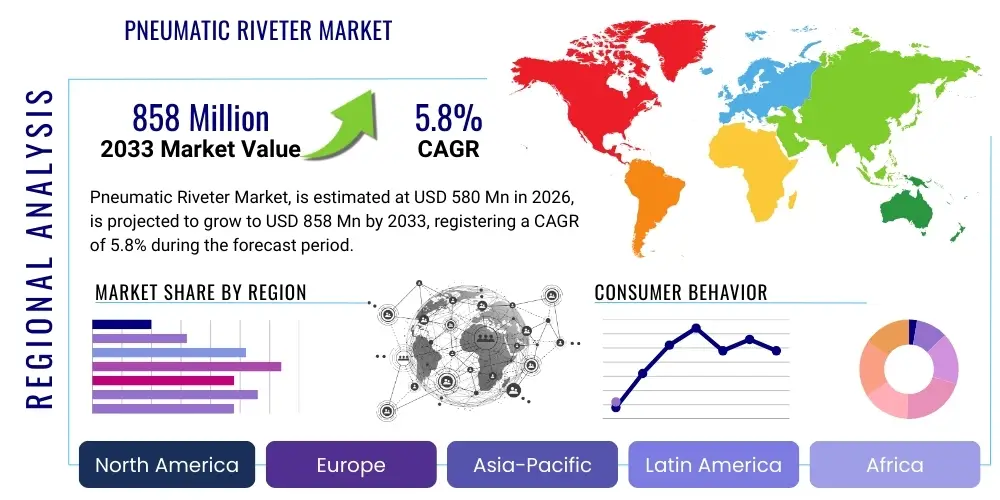

Pneumatic Riveter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435792 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pneumatic Riveter Market Size

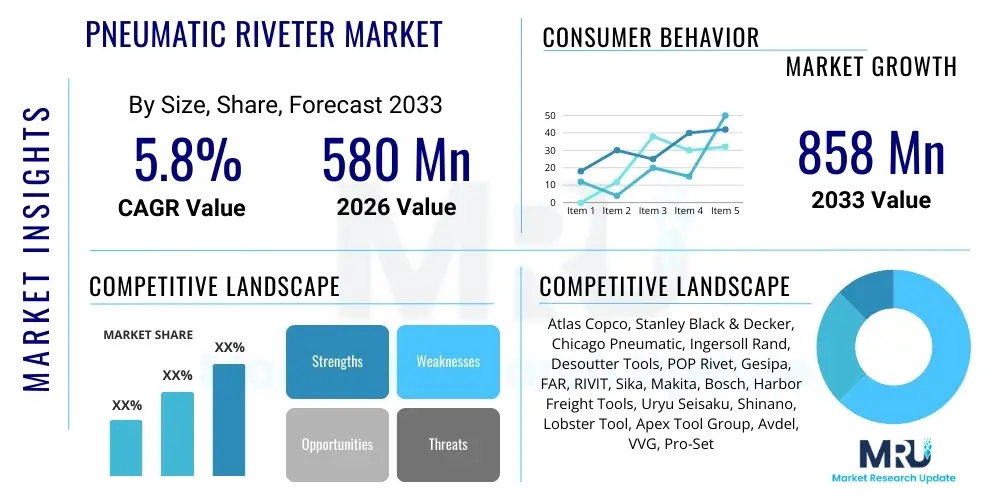

The Pneumatic Riveter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 858 Million by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the ongoing global emphasis on high-speed assembly processes, particularly within the automotive, aerospace, and heavy machinery sectors, where reliable and high-strength fastening is paramount. The precision and repetitive nature offered by pneumatic systems make them indispensable tools in modern manufacturing lines striving for both efficiency and defect reduction, driving sustained demand across industrialized regions.

Pneumatic Riveter Market introduction

The Pneumatic Riveter Market encompasses the manufacturing, distribution, and utilization of compressed air-powered tools designed to insert and set rivets for permanent joining of two or more materials. These tools range from small, handheld pistol-grip models used in workshops to large, stationary, automated units integrated into complex assembly lines. The product description emphasizes high power-to-weight ratios, operational efficiency, and durability, distinguishing them from hydraulic or manual alternatives. Major applications span structural integrity demanding industries, including aircraft fuselages, automotive chassis construction, railway carriages, and large-scale industrial fabrication, where their ability to deliver consistent, high-impact force is critical for joint strength and safety compliance. Key benefits include enhanced productivity due to rapid cycling times, reduced operator fatigue compared to manual methods, and superior consistency in the quality of the set rivet, which minimizes rework and scrap rates in high-volume production environments. Driving factors for market growth include the rising global production of vehicles, increasing investment in defense and commercial aerospace programs requiring precision fastening, and the continuous trend toward factory automation seeking robust, repeatable fastening solutions for structural components.

Pneumatic Riveter Market Executive Summary

The Pneumatic Riveter Market exhibits robust business trends driven by industrial automation, particularly the integration of robotic riveting cells in high-stakes industries like aerospace and defense, where the consistency of pneumatic power is essential for maintaining structural integrity. Manufacturers are focusing on developing lighter, more ergonomic tools incorporating advanced noise reduction and vibration dampening technologies to comply with stricter occupational health and safety standards while maximizing operator comfort and productivity. A significant trend involves the incorporation of smart features, such as integrated sensors and data logging capabilities, enabling real-time process monitoring and predictive maintenance, transitioning the market towards Industry 4.0 readiness. This digital transformation is reshaping business models, favoring providers who offer holistic solutions combining hardware efficiency with software intelligence.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, propelled by the rapid expansion of the manufacturing bases in China, India, and Southeast Asian nations, alongside massive investments in infrastructure development and automotive production capacity. North America and Europe maintain strong market shares, characterized by demand for high-end, specialized riveting systems, particularly within their established aerospace and high-performance automotive sectors, focusing heavily on advanced materials like carbon fiber reinforced plastics (CFRPs) and specialized alloys requiring nuanced fastening techniques. These developed markets prioritize operational precision and traceability, often favoring automated or semi-automated stationary pneumatic riveting units over purely handheld options.

Segment trends reveal that the automated/stationary pneumatic riveting segment is experiencing the fastest growth, largely due to its integration into flexible manufacturing systems and the necessity for high-throughput, zero-defect assembly lines, especially for blind riveting applications in thin-sheet metal structures. By application, the aerospace segment commands a premium due to stringent regulatory requirements and the need for highly reliable, precision tools capable of handling complex fastener geometries and materials. However, general manufacturing and construction segments contribute the largest volume of sales, driven by the continuous demand for durable and cost-effective handheld tools used in fabrication shops and site work.

AI Impact Analysis on Pneumatic Riveter Market

Common user questions regarding AI's impact on the Pneumatic Riveter Market often revolve around how AI enhances the automation of the riveting process, concerns over job displacement, and the feasibility of integrating intelligent monitoring systems into existing pneumatic equipment infrastructure. Users frequently inquire about AI's role in optimizing fastener placement patterns, predicting tool failure based on acoustic or vibration data analysis, and ensuring quality control (QC) through real-time image recognition of set rivets. The consensus theme is a desire for "smarter" pneumatic tools that maintain the core benefits of air power—reliability and strength—while introducing decision-making capabilities that reduce human error and increase throughput consistency. This transformation signifies a shift from simple mechanical power delivery to an integrated cyber-physical system, where AI acts as the supervisory layer ensuring operational excellence and material integrity.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze pneumatic tool performance data (air pressure consumption, cycle time variation, vibration signatures) to predict maintenance needs, minimizing unplanned downtime in critical production environments.

- Automated Quality Control (AQC): Integrating vision systems and AI recognition models to instantly verify proper rivet seating, head formation, and material deformation after setting, significantly reducing the reliance on manual inspection and enhancing traceability records.

- Robotic Path Optimization: Employing AI to optimize the riveting sequence and tool movement in automated cells, ensuring the fastest, most efficient path while avoiding collisions and maximizing material integrity during complex assembly tasks (e.g., aircraft wing assembly).

- Process Parameter Optimization: Using AI to dynamically adjust air pressure, stroke length, and speed based on real-time feedback regarding material thickness and rivet specifications, ensuring optimal fastening strength and consistency across varied batch production.

- Ergonomic Design Simulation: AI assisting in simulating operator interaction with handheld pneumatic riveters, optimizing weight distribution and grip design based on predictive fatigue modeling, leading to enhanced safety and productivity standards.

DRO & Impact Forces Of Pneumatic Riveter Market

The Pneumatic Riveter Market is dynamically influenced by a specific set of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's impact forces. A primary driver is the accelerating trend of industrial automation globally, especially within high-volume manufacturing sectors like automotive assembly, which demand consistent, high-speed fastening solutions that pneumatic systems inherently provide with superior energy density and control compared to pure electrical systems in high-impact applications. Furthermore, the burgeoning commercial and military aerospace industries require extremely high standards of structural integrity, often mandating the use of pneumatic squeeze riveters and specialized blind riveting tools for critical components, thereby providing a resilient base for market expansion. This is coupled with ongoing regulatory pressures in developed economies favoring safer, more ergonomic tools, prompting manufacturers to invest in vibration reduction and noise mitigation features that enhance the appeal of modern pneumatic offerings.

However, the market faces significant restraints, chiefly the operational costs associated with maintaining a centralized compressed air infrastructure, including the energy consumption required for air compression, filtration, and drying, which can be substantial compared to localized electric tool operation. Additionally, the increasing maturity and performance improvements of battery-powered riveting tools (often referred to as 'electric riveters') present a strong competitive threat, particularly in construction and field repair applications where portability and independence from air lines are paramount. Furthermore, specialized training is often required for operators to correctly adjust and maintain pneumatic tool settings for optimal rivet setting quality, presenting an overhead cost that discourages smaller fabrication shops from rapid adoption of advanced pneumatic systems over simpler fastening methods.

Opportunities for growth lie prominently in emerging economies, where rapid industrialization and infrastructural development are creating massive greenfield demand for reliable industrial tooling across construction, railway, and general fabrication sectors. Technological opportunities are focused on integrating Internet of Things (IoT) capabilities into pneumatic tools for real-time performance monitoring and remote diagnostics, aligning products with Industry 4.0 smart factory mandates. Moreover, the development of lightweight, composite materials in industries like automotive necessitates new precision pneumatic riveting solutions capable of setting delicate or complex fasteners without compromising the structural integrity of the surrounding composite material, opening niche markets for specialized, high-precision pneumatic tools.

Segmentation Analysis

The Pneumatic Riveter Market is extensively segmented based on key functional attributes, operational mechanics, end-user applications, and the capacity of the tool to handle different rivet types, providing a detailed framework for understanding market dynamics and targeted product development. Analyzing these segments reveals varying growth trajectories and demand centers. For instance, segmentation by type separates high-volume, repetitive industrial assembly tools (Stationary/Automated) from versatile, field-use equipment (Handheld), reflecting distinct end-user needs regarding mobility versus throughput. Application-based segmentation dictates product specifications, with aerospace tools requiring ultra-high precision and certification, contrasting sharply with the robustness and durability required of tools used in heavy construction or general manufacturing environments.

- By Type: Handheld Pneumatic Riveters, Stationary/Automated Pneumatic Riveters (including robotic end-effectors).

- By Riveting Mechanism: Pneumatic Pulling Riveters (for blind rivets), Pneumatic Squeeze Riveters (for solid rivets), Pneumatic Hammer Riveters.

- By Application: Aerospace and Defense, Automotive (OEM and aftermarket), Construction and Infrastructure, General Manufacturing and Fabrication, Shipbuilding and Marine.

- By Rivet Material Capability: Aluminum Rivets, Steel/Stainless Steel Rivets, Specialized Alloy Rivets (e.g., Titanium, Monel).

- By Distribution Channel: Direct Sales (OEMs), Indirect Sales (Distributors, Retailers, Online).

Value Chain Analysis For Pneumatic Riveter Market

The Value Chain for the Pneumatic Riveter Market commences with upstream activities centered on the procurement and processing of core raw materials, predominantly high-grade steel alloys, specialized plastics, and precision mechanical components such as motors, air valves, and ergonomic housing materials. This stage is crucial as the durability and operational lifespan of the pneumatic tool heavily depend on the quality and metallurgy of these inputs. Manufacturers, typically large industrial tool corporations, then engage in design, specialized machining, and assembly, focusing intensely on internal mechanisms that optimize the air-to-force conversion, resulting in high-performance, consistent riveting action while adhering to stringent global manufacturing standards and intellectual property rights concerning proprietary air motor and shock absorption technologies. Key differentiating factors at the manufacturing stage include patented designs for noise reduction and minimizing vibration exposure for the operator, adding significant value.

The downstream analysis focuses on market penetration and end-user engagement. For highly technical and customized tools, particularly those integrated into automated assembly lines (e.g., automotive OEMs or aerospace primary production), the distribution channel often relies on direct sales and specialized engineering support. These direct relationships involve significant pre-sales consultation, custom tooling development, and post-sales maintenance contracts. Conversely, for standardized, handheld pneumatic riveters used in general manufacturing or maintenance, the distribution strategy leverages large industrial distributors, specialized tool retailers, and increasingly, efficient e-commerce platforms, offering broad geographic reach and inventory immediacy, thereby optimizing delivery logistics and inventory holding costs for end-users.

Direct distribution ensures maximum control over the product positioning, pricing, and service quality, which is vital for complex, high-margin, automated solutions requiring installation and calibration expertise. Indirect distribution, leveraging established third-party networks, is essential for achieving high-volume sales of general-purpose tools, benefiting from the distributor's existing customer base and logistical infrastructure. The efficiency of this distribution network, coupled with rapid aftermarket support (spare parts and maintenance), is a critical component of the value chain, directly impacting customer loyalty and the total cost of ownership for the end-user, thereby sustaining market competitiveness. Strong emphasis on supply chain transparency and ethical sourcing is also becoming a requisite value-add throughout the chain.

Pneumatic Riveter Market Potential Customers

Potential customers for the Pneumatic Riveter Market span a diverse range of capital-intensive industries characterized by the consistent need for robust, reliable, and permanent material joining solutions, placing paramount importance on structural integrity and production throughput. The primary buyers are large manufacturing entities in the transportation sector, encompassing major automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers who use pneumatic riveting extensively for chassis, body panels, and structural sub-assemblies. The aerospace and defense sector represents a highly lucrative segment, as they require certified, high-precision pneumatic squeeze riveters and specialized pull riveters for critical components like wing spars, fuselage sections, and military hardware, where fastening failure is unacceptable, driving demand for premium, highly traceable tools. These customers prioritize consistency, certification documentation, and long-term service agreements over initial tool cost.

A second major segment comprises the construction and infrastructure sectors, including heavy machinery manufacturers (e.g., mining equipment, cranes) and large-scale metal fabrication facilities (e.g., bridge building, industrial piping). These end-users demand durable, powerful handheld pneumatic hammer and squeeze riveters capable of handling large-diameter, hard steel rivets in harsh, non-controlled environments. Utility and railway companies also form a steady customer base, utilizing these tools for maintenance and repair of rolling stock and fixed track infrastructure, where reliability under heavy use is a key purchasing criterion. Furthermore, general manufacturing, encompassing HVAC production, appliance assembly, and various metal workshops, utilizes the widest array of pneumatic riveters, focusing on cost-effectiveness, ease of use, and versatility to accommodate different job sizes and rivet types, driving volume sales for general-purpose pneumatic models distributed through industrial supply houses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 858 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Stanley Black & Decker, Chicago Pneumatic, Ingersoll Rand, Desoutter Tools, POP Rivet, Gesipa, FAR, RIVIT, Sika, Makita, Bosch, Harbor Freight Tools, Uryu Seisaku, Shinano, Lobster Tool, Apex Tool Group, Avdel, VVG, Pro-Set |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Riveter Market Key Technology Landscape

The technological landscape of the Pneumatic Riveter Market is characterized by continuous evolution aimed at enhancing precision, ergonomics, and integration capabilities, rather than revolutionary changes to the core air motor principle. A key focus area is the advancement in pneumatic motor efficiency, utilizing sophisticated valve designs and lighter piston materials to maximize the power-to-weight ratio while simultaneously reducing air consumption per cycle, making the tools more economical to run and improving sustainability metrics in high-volume operations. Furthermore, the development of advanced dampening systems, incorporating proprietary elastomer and mechanical designs, is crucial for mitigating vibration and noise levels, directly addressing the strict occupational health and safety regulations prevalent in developed markets and significantly improving operator comfort and reducing the risk of conditions like hand-arm vibration syndrome (HAVS). This ergonomic engineering is essential for sustaining competitiveness against quieter electric tool alternatives.

Another major technological driver is the integration of process monitoring and control systems, aligning pneumatic riveting tools with Industry 4.0 principles. Modern pneumatic riveters, especially automated ones, are increasingly equipped with embedded sensors that track operational parameters such as applied force, air pressure stability, cycle time, and tool temperature. This collected data is processed by onboard microcontrollers or fed back to a centralized manufacturing execution system (MES), allowing for real-time quality assurance and predictive failure analysis. This capability ensures that every rivet set meets predefined quality standards and allows manufacturers to maintain comprehensive digital records for traceability, which is critical in aerospace and regulated industries, transforming the tool from a simple power device into an intelligent data node within the assembly ecosystem.

The material handling and tooling interface also represent a significant area of innovation, particularly in specialized applications. Technologies related to automated rivet feeding systems have become highly sophisticated, ensuring rapid, reliable delivery of rivets to the tool nose, minimizing cycle pauses, and enabling high-speed automation. For squeeze riveting applications, advancements in yoke and die material science and design are critical, allowing tools to maintain alignment and apply consistent pressure even when setting complex or oversized solid rivets in challenging geometries. This ongoing refinement of the tooling interface and the implementation of sophisticated force feedback mechanisms are vital for ensuring the integrity of the material joint, especially when dealing with advanced, non-metallic composite materials that require extremely delicate handling to prevent delamination or stress cracking during the fastening process.

Regional Highlights

- North America (NA): This region is a mature market characterized by extremely high demand from the aerospace and defense sectors, where reliability and certification are paramount. Key growth is concentrated in the production of high-precision, automated pneumatic riveting systems designed for specialized material handling and compliance with strict FAA regulations. The U.S. remains the dominant consumer, driven by major aircraft manufacturers and robust automotive assembly plants focused on high-speed, high-quality production.

- Europe: Europe represents a highly industrialized market with significant emphasis on ergonomic design, noise reduction, and energy efficiency, largely influenced by stringent EU safety standards. Germany and the UK lead in consumption, driven by their sophisticated automotive and manufacturing sectors. The market sees strong uptake of advanced, portable pneumatic tools that integrate IoT monitoring capabilities to comply with evolving smart factory initiatives and quality traceability demands.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive infrastructure development and the rapid expansion of manufacturing capabilities, particularly in China, India, and South Korea. This region demands a large volume of cost-effective, durable handheld pneumatic riveters for general fabrication and construction, alongside burgeoning demand for automated riveting solutions in new automotive and defense production facilities being established throughout the region.

- Latin America (LA): The market in Latin America is characterized by growth tied to fluctuating investment in automotive manufacturing and mining equipment maintenance, driving steady demand for mid-range pneumatic tools. Brazil and Mexico are the primary markets, utilizing pneumatic riveters heavily in industrial repair and maintenance operations, often requiring robust tools capable of operating effectively in varied environmental conditions.

- Middle East and Africa (MEA): Growth in MEA is primarily project-based, linked to large-scale investments in oil and gas infrastructure, shipbuilding, and emerging aerospace maintenance facilities. Demand is specialized, requiring heavy-duty pneumatic tools for structural applications, with procurement decisions often influenced by international engineering standards followed by multinational contractors operating within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Riveter Market.- Atlas Copco

- Stanley Black & Decker

- Chicago Pneumatic

- Ingersoll Rand

- Desoutter Tools

- POP Rivet (a Stanley Black & Decker brand)

- Gesipa (a SFS Group brand)

- FAR

- RIVIT

- Sika

- Makita

- Bosch

- Harbor Freight Tools

- Uryu Seisaku

- Shinano

- Lobster Tool

- Apex Tool Group

- Avdel (a Stanley Black & Decker brand)

- VVG

- Pro-Set

Frequently Asked Questions

Analyze common user questions about the Pneumatic Riveter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of pneumatic riveters over electric or hydraulic models?

Pneumatic riveters offer superior power-to-weight ratios, delivering higher impact force and consistent repeatability crucial for setting large, solid, or structural rivets rapidly. They are generally more durable and require less complex maintenance on the motor assembly, leading to prolonged operational lifespan in high-duty cycle industrial environments compared to battery-powered or fully hydraulic alternatives. Their inherent air-powered nature also makes them safe for use in potentially explosive atmospheres where electric sparks are a hazard.

How is Industry 4.0 influencing the future design and use of pneumatic riveting equipment?

Industry 4.0 drives the integration of smart features, including IoT sensors for real-time performance monitoring, data logging for full fastening traceability, and connectivity to manufacturing execution systems (MES). Future designs focus on precision control of air pressure and force application using advanced electronic valves, enabling automated quality verification and predictive maintenance scheduling, transitioning them into smart cyber-physical tools.

Which application segment holds the highest growth potential for high-end pneumatic riveting systems?

The Aerospace and Defense segment holds the highest growth potential for high-end pneumatic riveting systems, specifically precision squeeze riveters and automated robotic end-effectors. This growth is driven by increasing global aircraft production and stringent regulatory requirements that mandate absolute consistency and high joint integrity, necessitating premium, certified pneumatic tools capable of handling specialized alloys and complex assembly geometries with documented precision.

What are the main ergonomic concerns addressed by modern pneumatic riveter technology?

Modern pneumatic riveters are engineered to address Hand-Arm Vibration Syndrome (HAVS) and acoustic noise exposure. Manufacturers utilize advanced dampening materials, isolation techniques, and optimized internal mechanisms to significantly reduce tool vibration and sound output. Additionally, ergonomic design focuses on optimal tool balance, lighter composite housing materials, and user-friendly grip profiles to minimize operator fatigue and enhance workplace safety compliance, maintaining productivity over long shifts.

What is the competitive landscape regarding pneumatic tools versus battery-powered riveting tools in the market?

The competitive landscape shows pneumatic tools dominating fixed, high-volume production lines where unlimited power and consistency are critical. However, battery-powered tools are aggressively gaining market share in field service, MRO (Maintenance, Repair, and Operations), and construction, driven by superior portability and freedom from air lines. Pneumatic manufacturers counter this by focusing on high-precision automation and maximizing operational torque and speed which remains superior in high-demand structural riveting applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager