Pneumatic Rollers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435551 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pneumatic Rollers Market Size

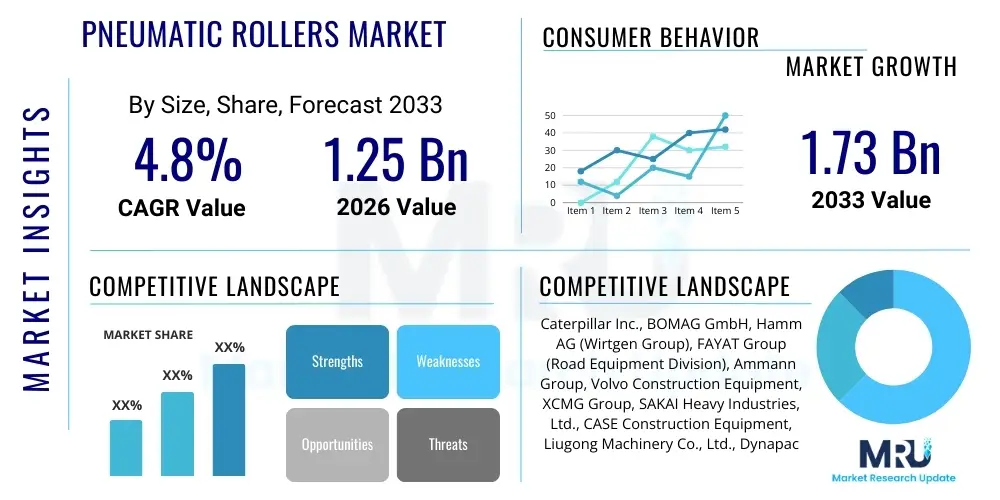

The Pneumatic Rollers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at 1.25 Billion USD in 2026 and is projected to reach 1.73 Billion USD by the end of the forecast period in 2033.

Pneumatic Rollers Market introduction

The Pneumatic Rollers Market encompasses the manufacturing, distribution, and utilization of compaction equipment characterized by multiple smooth, pneumatic rubber tires arranged in staggered rows. These machines are fundamentally designed to achieve density and smoothness in road construction, airfield pavement projects, and various civil engineering applications. Unlike vibratory or static steel drum rollers, pneumatic tired rollers rely primarily on kneading action, vertical pressure, and uniform ground contact pressure provided by the flexible tires to compact asphalt layers, stabilized soils, and other unbound granular materials. This kneading effect minimizes the risk of aggregate crushing while ensuring superior density uniformity, particularly critical in intermediate and finish rolling stages of hot mix asphalt (HMA) pavement construction. The operational effectiveness of pneumatic rollers is directly tied to adjustable tire pressure, ballast weight, and consistent rolling speed, allowing operators to fine-tune compaction parameters according to material specifications and ambient temperature conditions.

The primary applications driving the demand for pneumatic rollers are centered around large-scale infrastructure development and maintenance activities globally. Major end-users include government highway departments, private construction companies specializing in commercial and residential road projects, and contractors involved in specialized industrial paving. Pneumatic rollers excel in compacting binder and surface courses of asphalt pavement where a tight, sealed surface texture is required, improving durability and resistance to water penetration. Furthermore, these machines are highly effective in compacting fine-grained or cohesive soils on subgrades and embankments, utilizing the manipulative effect of the tires to achieve high density without generating excessive vibration that might destabilize surrounding structures or utilities. Their versatility in handling diverse material types—from granular bases to fine asphalt mixes—makes them indispensable tools in modern construction fleets.

Key driving factors propelling the market growth include the increasing global emphasis on resilient and long-lasting infrastructure, necessitating higher quality compaction standards. Government investments in transport infrastructure, particularly in developing economies across Asia Pacific and Latin America, are consistently fueling the demand for reliable compaction equipment. Additionally, technological advancements such as the integration of intelligent compaction (IC) systems, which provide real-time compaction measurements and GPS-guided control, enhance operational efficiency and document quality assurance, further validating the use of modern pneumatic rollers. The inherent benefits, including reduced surface cracking, superior material interlock, and adaptability to complex geometries, ensure that pneumatic rollers maintain a crucial position alongside vibratory technology in the comprehensive compaction equipment landscape, sustaining market momentum.

Pneumatic Rollers Market Executive Summary

The Pneumatic Rollers Market is characterized by robust growth underpinned by significant shifts toward advanced technologies and stricter quality control protocols in civil engineering. Current business trends indicate a strong market preference for hydrostatic drive systems, which offer smoother acceleration, precise speed control, and enhanced maneuverability compared to traditional mechanical drives, contributing directly to higher compaction uniformity. Manufacturers are increasingly focusing on developing models with modular ballast systems, allowing contractors to easily adjust operating weight for optimum performance across varied soil and pavement conditions, thereby maximizing fleet utilization. The competitive landscape is intensely focused on integrating telematics and IoT capabilities, enabling remote diagnostics, predictive maintenance scheduling, and fuel efficiency monitoring, transforming how construction equipment fleets are managed and optimized on job sites globally. Furthermore, sustainability is emerging as a key trend, with some companies exploring hybrid power options or engines designed to meet stringent Tier 4 Final/Stage V emission standards, addressing environmental regulatory pressures.

Regionally, the Asia Pacific (APAC) market is expected to dominate growth due to massive investments in urban and rural connectivity projects, particularly in China, India, and Southeast Asian nations where infrastructure backlogs are significant. North America and Europe maintain a mature market status, focusing primarily on equipment replacement cycles, the adoption of premium, high-tech IC-enabled rollers, and rigorous pavement preservation programs that require specialized compaction techniques. The Latin American and Middle East & Africa (MEA) regions present substantial opportunities, driven by rapid urbanization and the initiation of large-scale oil, gas, and mining related infrastructure development, requiring durable compaction solutions suitable for diverse geographical and climatic challenges. These regional dynamics highlight a bifurcated demand pattern: emerging markets prioritizing capacity and affordability, while developed markets emphasize automation, efficiency, and data integration.

Segment trends reveal that the 10-20 Ton capacity segment holds the largest market share, predominantly favored for intermediate and finish rolling in high-volume highway projects due to their optimal balance of weight, tire configuration, and operating efficiency. However, the light-duty segment (under 10 tons) is experiencing increasing demand for utility work, municipal paving, and smaller repair jobs where size and precision are paramount. In terms of technology, the shift towards intelligent compaction systems, including density gauges and temperature sensors integrated with GPS mapping, is the most transformative trend, enabling evidence-based compaction and reducing the dependency on trial-and-error methods. This focus on verifiable quality assurance is setting new benchmarks for procurement specifications across both governmental and private sector infrastructure contracts, ensuring the long-term viability of the pneumatic roller segment in the overall construction equipment industry.

AI Impact Analysis on Pneumatic Rollers Market

User queries regarding the impact of AI on pneumatic rollers often center on how automation can replace manual operation, the potential for achieving autonomous compaction, and the role of machine learning in optimizing compaction parameters for heterogeneous materials. Key themes emerging from this analysis include concerns about predictive maintenance accuracy, the ability of AI algorithms to interpret real-time soil or asphalt conditions, and how data generated by Intelligent Compaction (IC) systems will be utilized for process improvement across multiple job sites. Users are keen to understand if AI can virtually eliminate human error in achieving target densities and smoothness, thereby reducing material waste and premature pavement failure. The consensus expectation is that while full autonomy might be distant, AI-driven prescriptive analytics will significantly enhance decision-making, moving beyond simple data logging to suggesting optimal passes, speeds, and pressure adjustments dynamically.

- AI facilitates real-time prescriptive analytics, optimizing roller pass patterns and speeds based on instantaneous material stiffness readings (e.g., using Continuous Compaction Control (CCC)).

- Machine learning algorithms enhance predictive maintenance schedules by analyzing vibration data, tire wear rates, and hydraulic pressure fluctuations, minimizing unexpected downtime.

- AI-enabled quality control systems use pattern recognition to identify inconsistencies or weak spots in compacted layers that might be missed by human operators or standard IC systems.

- Development of autonomous or semi-autonomous compaction fleets, leveraging GPS and sensor fusion, reducing labor costs and improving site safety in high-risk areas.

- Optimization of fuel consumption and operational efficiency by utilizing AI to manage hydrostatic drive power output relative to required compaction force and material resistance.

DRO & Impact Forces Of Pneumatic Rollers Market

The Pneumatic Rollers Market is principally driven by surging global infrastructure spending, particularly concerning highway expansion and rehabilitation projects that necessitate high-quality pavement compaction. Restraints primarily involve the high initial capital investment required for heavy equipment and the inherent sensitivity of pneumatic roller performance to operator skill and precise control over tire pressure settings. However, significant opportunities exist through the integration of advanced intelligent compaction technology, which addresses the skill gap and provides verifiable quality assurance, aligning with global standards for durable pavement construction. The market is subject to intense competitive rivalry, stemming from both established global manufacturers and emerging regional players, complemented by the substantial bargaining power of large construction corporations that often purchase fleets based on long-term reliability and total cost of ownership (TCO). This dynamic is further influenced by supplier stability and the regulatory framework surrounding engine emissions and noise pollution, which dictate the technical complexity and ultimate price point of new machinery.

Driving Forces (Drivers)

One of the foremost drivers is the increasing regulatory mandate for achieving high-density, void-free asphalt layers to enhance pavement lifespan and reduce long-term maintenance costs. Pneumatic rollers, through their unique kneading action, are exceptionally suited for sealing the asphalt surface and achieving optimal density in the intermediate stages of HMA paving, directly supporting these regulatory requirements. Furthermore, rapid urbanization globally is accelerating the need for continuous construction and rehabilitation of urban roads and municipal infrastructure, where the maneuverability and controlled compaction offered by mid-sized pneumatic rollers are highly valued. The global construction boom, particularly evident in the Belt and Road Initiative and similar multinational infrastructure programs, provides a sustained and large-scale demand environment.

Restraining Factors (Restraints)

A significant restraint on market expansion is the high initial acquisition cost, especially for high-capacity models equipped with sophisticated IC technology and advanced hydrostatic systems. This cost barrier can deter smaller and regional contractors from adopting the latest models. Moreover, the performance variability associated with pneumatic rollers, heavily dependent on the operator's ability to maintain the correct ballast and tire pressure relative to the material temperature and composition, presents a technical challenge. If not properly calibrated, the resulting compaction can be inconsistent, leading to performance disputes. The cyclical nature of the construction industry, prone to economic fluctuations and delays in government infrastructure funding, also imposes short-term market instability.

Opportunities

The primary opportunity lies in the burgeoning market for equipment leasing and rental services, which lowers the barrier to entry for smaller contractors and allows companies to rapidly scale their fleet for peak project demands without large capital outlays. The demand for retrofitting older equipment with modern telemetry and Intelligent Compaction (IC) technologies represents another significant revenue stream. Furthermore, specialization in environmentally friendly pneumatic rollers, such as those optimized for low-emission or alternative fuels, provides a competitive edge in environmentally conscious markets, notably in Scandinavia and Western Europe where green building standards are stringent. The growth of specialized compaction segments, such as compacting landfill liners or specialized foundation preparation, opens niche high-value markets.

Impact Forces (Porter's Five Forces Analysis Summary)

The intensity of competitive rivalry is high, driven by market consolidation and technological differentiation. Key players invest heavily in R&D to enhance roller performance, often competing on total cost of ownership (TCO) and aftermarket support quality. The threat of new entrants is moderate; while manufacturing heavy equipment requires substantial capital and established distribution networks (a high barrier), specialized component manufacturers (e.g., for IC sensors or hydrostatic pumps) can indirectly influence the market. The bargaining power of buyers is high, especially for large fleet operators who command volume discounts and specific customization. The bargaining power of suppliers is moderate to high, particularly concerning specialized components like advanced engine components (meeting Tier 4/Stage V standards) and high-quality, durable tires, which are critical to performance. The threat of substitutes is moderate; while vibratory rollers dominate certain applications (e.g., granular bases), pneumatic rollers remain irreplaceable for achieving specific surface finishes and density uniformity in asphalt and cohesive soils, limiting substitution risk in their core applications.

Segmentation Analysis

The Pneumatic Rollers Market is strategically segmented based on factors such as operating weight, drive mechanism, and primary application, reflecting the diverse needs of the global construction and infrastructure sector. Operating weight is a critical parameter, defining the machine's primary role, ranging from small utility work (under 10 tons) to major highway construction (over 20 tons). The segmentation by drive mechanism—hydrostatic versus mechanical—highlights the ongoing technological shift towards precision and efficiency. Furthermore, differentiating the market based on application areas, such as asphalt compaction, soil stabilization, and material handling, provides a granular view of demand patterns across different end-user industries. This structured approach allows manufacturers to tailor product specifications and marketing strategies to specific regional and operational requirements, ensuring optimal product-market fit across the entire construction value chain.

- By Operating Weight:

- Light Duty (Under 10 Tons)

- Medium Duty (10 – 20 Tons)

- Heavy Duty (Above 20 Tons)

- By Drive Mechanism:

- Hydrostatic Drive

- Mechanical Drive

- By End-User Application:

- Road and Highway Construction

- Airfield and Port Infrastructure

- Municipal Roads and Utility Paving

- Commercial and Residential Construction

- Soil Stabilization and Base Compaction

- By Tire Configuration:

- Four Front / Three Rear (7-wheel)

- Four Front / Four Rear (8-wheel)

- Five Front / Five Rear (10-wheel)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Rental and Used Equipment)

Value Chain Analysis For Pneumatic Rollers Market

The value chain for the pneumatic rollers market begins with the Upstream Analysis, which involves the sourcing and processing of core raw materials such as high-grade steel plates for frames and drums, advanced hydraulic components, specialized rubber compounds for tires, and sophisticated electronic control units (ECUs). Key upstream suppliers include steel producers, engine manufacturers (e.g., complying with Tier 4 emission standards), and hydraulic system specialists (pumps, motors, valves). Maintaining stable relationships with reliable, quality-certified suppliers is paramount, as the durability and performance of the final machine are heavily dependent on the integrity of these foundational components. Cost management in the upstream segment, particularly concerning global steel and fuel price volatility, significantly impacts the final price of the pneumatic roller.

The manufacturing stage (Midstream) involves component assembly, welding, painting, system integration (installing engines, drives, and control systems), and rigorous quality testing. Manufacturers often leverage advanced robotic welding and assembly lines to ensure precision and throughput. Following manufacturing, the Distribution Channel plays a critical role. Direct sales occur mainly for large government tenders or key accounts, where manufacturers interface directly with the buyer, offering extensive customization and integrated support packages. Indirect channels, primarily relying on authorized dealer networks, are essential for reaching smaller regional contractors and providing localized sales, parts inventory, maintenance services, and financing options. These dealers often handle the crucial post-sale support, including warranty service and operator training, which directly influences customer satisfaction and repeat business.

The Downstream Analysis focuses on the end-use applications and the ongoing equipment lifecycle management. Once deployed, pneumatic rollers are utilized by construction companies, road contractors, and infrastructure developers. Demand in the downstream market is influenced by project timelines, seasonality, and regulatory quality standards. Aftermarket services—including parts replacement, periodic maintenance, and technological upgrades (e.g., adding IC modules)—constitute a significant and stable revenue stream throughout the machine’s operational life. The disposal or resale (used equipment market) forms the final stage, highlighting the importance of durable design for high residual value. The integration of digital technologies (telematics, IoT) across the entire value chain is enhancing efficiency, predictability, and asset optimization from the initial design phase through to final deployment on the job site.

Pneumatic Rollers Market Potential Customers

The primary customer base for pneumatic rollers consists of entities engaged in large-scale infrastructure development and maintenance that require precise, non-vibratory compaction for surface finishing or specific material types. Leading customers include large, multinational Engineering, Procurement, and Construction (EPC) companies that manage complex highway and airport projects, demanding reliable, high-capacity rollers with intelligent compaction capabilities. These major contractors prioritize equipment uptime, comprehensive service agreements, and compliance with stringent public works specifications, often dictating the adoption of the latest technology standards. Furthermore, regional and local paving contractors form the bulk of the market, typically purchasing mid-sized rollers for municipal street repairs, parking lots, and residential development paving, where maneuverability and versatility across different mix types are critical purchasing factors.

Secondary, yet significant, customers include government transportation and public works agencies, particularly in regions where these bodies directly manage or heavily influence the procurement process for construction equipment used in state-funded projects. These governmental entities are often early adopters of technologies that enhance quality assurance, such as integrated IC systems, as they aim to maximize the lifespan of public infrastructure assets. Moreover, specialized industry sectors, such as mining operations that require the construction of large haul roads or landfill management companies needing specific compaction for liner materials and daily cover, represent lucrative niche markets where the kneading action of pneumatic rollers offers distinct operational advantages over vibratory counterparts.

Finally, equipment rental and leasing companies are increasingly influential potential customers. These firms purchase large fleets of standardized and well-maintained pneumatic rollers to cater to smaller contractors or companies that prefer not to bear the burden of ownership. Rental companies focus heavily on machine durability, ease of maintenance, high utilization rates, and features that support remote monitoring and asset tracking (telematics). Their procurement decisions drive standardization across the market, offering manufacturers a large, consolidated purchasing channel. Therefore, targeting both direct end-users and the intermediary rental sector is essential for market penetration and sustained volume growth across all geographical segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.25 Billion USD |

| Market Forecast in 2033 | 1.73 Billion USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., BOMAG GmbH, Hamm AG (Wirtgen Group), FAYAT Group (Road Equipment Division), Ammann Group, Volvo Construction Equipment, XCMG Group, SAKAI Heavy Industries, Ltd., CASE Construction Equipment, Liugong Machinery Co., Ltd., Dynapac (Fayat Group), Wacker Neuson SE, Doosan Infracore (now Hyundai Doosan Infracore), Shantui Construction Machinery Co., Ltd., ASTEC Industries, Inc., MBW, Inc., Multiquip Inc., Leeboy, Inc., Gomaco Corporation, Mauldin Paving Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pneumatic Rollers Market Key Technology Landscape

The technological evolution in the pneumatic rollers market is primarily focused on enhancing precision, optimizing compaction results, and improving operator comfort and safety. The most significant technological advancement is the widespread adoption of Intelligent Compaction (IC) systems. These systems integrate GPS positioning, real-time measurement of compaction parameters (such as asphalt temperature and roller passes), and stiffness monitoring (e.g., Compaction Meter Value or CMV for soil). IC technology allows contractors to map the compacted area, verify coverage uniformity, and ensure that target density and temperature ranges are met across the entire job site. This shift from qualitative to quantitative compaction assessment is revolutionizing quality control, drastically reducing the risk of pavement failure due to under-compaction, and providing verifiable data required by modern infrastructure agencies.

Furthermore, modern pneumatic rollers are increasingly reliant on sophisticated Hydrostatic Drive Systems. Unlike older mechanical transmissions, hydrostatic systems use hydraulic fluid to power the wheels, offering infinitely variable speed control, smoother starting and stopping, and superior gradeability. This smooth operation is crucial for achieving a defect-free surface finish on delicate asphalt mixtures, preventing bumps and material displacement. Advancements in engine technology, specifically the implementation of engines complying with global emission standards such as EPA Tier 4 Final and EU Stage V, necessitate complex after-treatment systems (like Selective Catalytic Reduction or SCR) and electronic engine management, which contribute to improved fuel efficiency and reduced environmental footprint, though at a higher initial capital cost.

Beyond drive and control, the focus on operator ergonomics and digital integration is paramount. Contemporary designs feature advanced cabins with improved vibration dampening, intuitive digital displays providing real-time data on tire pressure (centralized inflation systems are a key feature), and integrated telematics. Telematics allow fleet managers to monitor machine location, operational status, maintenance alerts, and overall performance metrics remotely. This capability supports predictive maintenance strategies, enhances asset security, and provides valuable utilization data necessary for optimizing fleet size and deployment. Continuous development in specialized pneumatic tires designed for longer life, better heat resistance, and enhanced traction further defines the competitive technology landscape, ensuring optimal material contact and energy transfer during the compaction process.

Regional Highlights

The dynamics of the Pneumatic Rollers Market vary significantly across major geographical regions, influenced by localized infrastructure policies, technological readiness, and economic growth rates. Each region contributes distinctly to the global demand landscape.

- Asia Pacific (APAC): This region is the largest and fastest-growing market for pneumatic rollers, driven by massive public and private sector investments in foundational infrastructure, including ambitious highway networks, high-speed rail corridors, and urbanization projects in countries like India, China, and Indonesia. Demand is high across all weight segments, with a growing focus on adopting medium-to-heavy duty models that integrate modern compaction technology to meet rising quality standards.

- North America: Characterized by a mature market with high replacement demand, North America places a premium on advanced features such as Intelligent Compaction (IC) systems, sophisticated telematics, and stringent emission compliance (Tier 4 Final). The market is sustained by consistent road rehabilitation programs and significant governmental funding for highway preservation, demanding highly efficient, fuel-optimized equipment.

- Europe: The European market is highly regulated, emphasizing sustainability and low emissions (Stage V). Demand is focused on high-specification, reliable machines, particularly medium-duty hydrostatic rollers used for pavement repair and maintenance in densely populated urban areas. Western European countries exhibit high penetration of IC technology, while Central and Eastern Europe are increasing investments in modernizing their equipment fleets.

- Latin America: This region presents significant growth potential, fueled by the development of oil and gas infrastructure, port facilities, and improved road connectivity in key economies like Brazil, Mexico, and Chile. The market often seeks robust, reliable, and cost-effective mechanical and hydrostatic rollers, although the adoption of basic telemetry systems is starting to gain traction in major projects.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC nations (Saudi Arabia, UAE) due to large-scale urban development projects, mega-city construction, and energy-related infrastructure. These projects require heavy-duty rollers capable of operating efficiently under extreme heat conditions. Africa’s burgeoning demand is linked to economic development and international aid focused on rural road connectivity and large civil works programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pneumatic Rollers Market.- Caterpillar Inc.

- BOMAG GmbH

- Hamm AG (Wirtgen Group)

- FAYAT Group (Road Equipment Division)

- Ammann Group

- Volvo Construction Equipment

- XCMG Group

- SAKAI Heavy Industries, Ltd.

- CASE Construction Equipment

- Liugong Machinery Co., Ltd.

- Dynapac (Fayat Group)

- Wacker Neuson SE

- JCB (Joseph Cyril Bamford Excavators Ltd.)

- Shantui Construction Machinery Co., Ltd.

- ASTEC Industries, Inc.

- MBW, Inc.

- Multiquip Inc.

- Mauldin Paving Products

- LeeBoy, Inc.

- Wirtgen GmbH (Wirtgen Group)

Frequently Asked Questions

Analyze common user questions about the Pneumatic Rollers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of pneumatic tired rollers compared to vibratory rollers?

Pneumatic rollers utilize kneading and vertical pressure via flexible rubber tires to achieve density, primarily used for finishing asphalt pavements and compacting fine-grained or cohesive soils. Vibratory rollers, conversely, use dynamic force (vibration) and are typically preferred for compacting granular materials and base courses.

How does Intelligent Compaction (IC) technology benefit pneumatic roller operations?

IC systems integrate GPS, temperature sensors, and stiffness meters to provide real-time compaction data, allowing operators to ensure uniform density and coverage, reduce unnecessary passes, and provide verifiable quality assurance documentation for the compacted layer.

Which market segment dominates the pneumatic rollers industry in terms of weight capacity?

The Medium Duty segment (10–20 Tons) generally holds the largest market share, as this weight class offers the versatility and power necessary for intermediate and finish rolling on most major highway and commercial pavement projects globally.

What major factors are driving the growth of the Pneumatic Rollers Market in the Asia Pacific region?

Market growth in APAC is primarily driven by substantial government investment in large-scale infrastructure projects, including highway expansion and urban road network development, necessitating high volumes of reliable compaction equipment.

What are the key advantages of hydrostatic drive systems in modern pneumatic rollers?

Hydrostatic drives offer superior advantages in maneuverability, infinitely variable speed control, and smoother reversing capabilities, which are crucial for minimizing surface defects and ensuring high-quality, uniform compaction results, especially on asphalt surfaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager