Pocket Door Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437112 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pocket Door Market Size

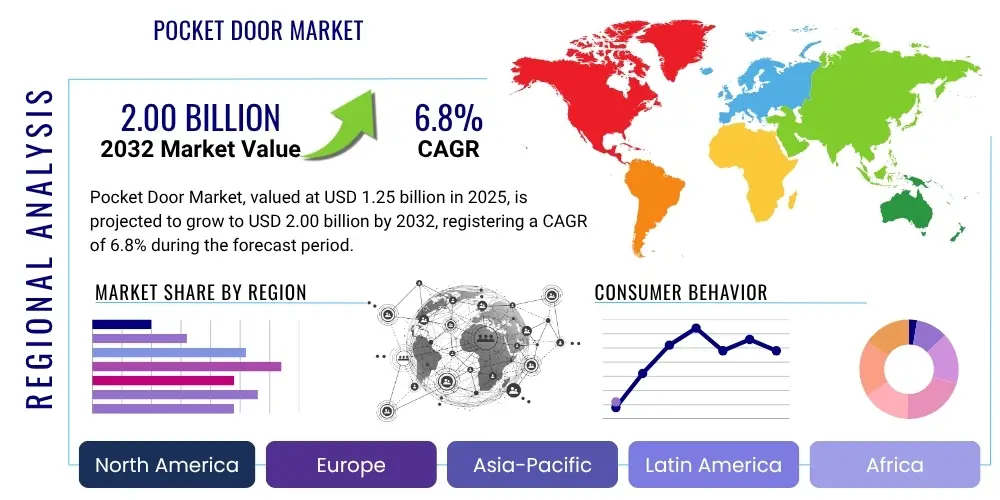

The Pocket Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.95 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global demand for space-saving architectural solutions, particularly within the residential construction and renovation sectors. The shift toward compact urban living environments, coupled with aesthetic preferences for seamless, minimalist interior designs, establishes a robust foundation for market growth. Furthermore, continuous product innovation, including the integration of soft-close mechanisms and smart automation, is enhancing the functionality and appeal of pocket door systems, contributing significantly to their market penetration across various geographies.

The valuation reflects a positive market sentiment stemming from high adoption rates in both new construction and retrofitting projects. Specifically, commercial applications such as healthcare facilities and hospitality sectors are increasingly utilizing pocket doors due to their accessibility benefits and ability to maximize usable floor space in corridors and patient rooms. Market proliferation is also supported by advancements in hardware quality, making installation more straightforward and increasing the durability and longevity of the door systems, thereby addressing previous concerns regarding maintenance complexity. Regulatory mandates promoting accessible design, particularly in North America and Europe, further bolster the demand profile, ensuring sustained revenue generation throughout the forecast period.

Pocket Door Market introduction

The Pocket Door Market encompasses the manufacturing, distribution, and installation of specialized door systems designed to slide horizontally into a cavity within the adjacent wall. These doors, which include the door panel, frame kit (or jamb kit), and high-quality track and roller hardware, are essential space-saving alternatives to traditional hinged doors. They offer aesthetic benefits by providing clean lines and maximizing usable floor space, making them highly desirable in urban apartments, small homes, and commercial settings where spatial efficiency is paramount. The product range spans materials from wood and glass to metal and composite constructions, catering to diverse design requirements and budgets. Pocket doors are fundamentally differentiated by their operational mechanism, which completely recesses the door when open, offering an unimpeded passage.

Major applications for pocket door systems include residential interiors, particularly bathrooms, closets, and laundry rooms, where maximizing every square foot is critical. In the commercial sector, they are extensively used in healthcare facilities (hospitals and clinics), hospitality venues (hotels), and corporate offices, valued for improving accessibility, reducing physical obstructions, and enhancing the flow of movement. Key benefits driving adoption include superior space utilization, enhanced aesthetic integration into modern minimalist designs, and improved accessibility for individuals with mobility limitations—especially when paired with automation or low-effort opening hardware. Furthermore, the capacity of pocket doors to act as effective room dividers without requiring swing clearance positions them as a versatile solution in open-plan living and working environments, contributing to their expanding market footprint.

Driving factors for the market expansion include the global urbanization trend leading to smaller average housing sizes, stimulating the demand for space-efficient interior solutions. The robust growth in the residential renovation and remodeling market, particularly post-pandemic, has increased consumer spending on high-value interior fixtures that enhance both functionality and property aesthetics. Technological advancements in hardware, such as sophisticated soft-close/soft-open mechanisms and durable, silent roller systems, have significantly mitigated historical challenges associated with pocket door functionality and maintenance. This increased reliability, combined with regulatory support for accessible building standards (ADA compliance in the US, for instance), collectively serves as powerful propulsion for continuous market development across all major geographies, ensuring their sustained preference over traditional door formats in specialized applications.

Pocket Door Market Executive Summary

The Pocket Door Market is characterized by stable growth, primarily fueled by global construction buoyancy and an intensified focus on optimizing interior spaces. Current business trends indicate a strong shift towards premium hardware components and sophisticated automation systems, moving pocket doors beyond basic functionality into the realm of architectural features. Key manufacturers are concentrating on lightweight, durable materials like aluminum tracks and engineered wood panels, alongside modular frame kits that simplify installation for contractors, addressing one of the major historical barriers to adoption. Furthermore, sustainability is becoming a critical competitive factor, with market players increasingly offering products made from recycled or sustainable materials and focusing on energy efficiency, particularly for exterior pocket door systems, though the core market remains highly centered on interior applications.

Regional trends highlight North America and Europe as mature markets demanding high-quality, customized, and automated solutions, with robust activity in the remodeling sector driving growth. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, massive infrastructure development, and a booming residential construction industry, especially in emerging economies like India and China, where maximizing small dwelling spaces is a priority. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, driven by increased foreign investment in commercial real estate and hospitality projects. These regional disparities necessitate tailored market entry strategies focusing on either premium innovation (in mature markets) or cost-effective, high-volume solutions (in developing markets).

Segment trends reveal that the hardware segment, encompassing tracks, rollers, and soft-close mechanisms, remains the most critical component, influencing performance and consumer satisfaction. In terms of operation, manual pocket doors still hold the largest market share due to cost-effectiveness, but the automated and soft-close segments are exhibiting the highest CAGRs, driven by increased affordability and demand for convenience and accessibility. The residential segment continues to dominate the application landscape, yet the commercial segment, particularly healthcare, is seeing accelerated adoption due to regulatory requirements emphasizing barrier-free design. Future segment expansion is expected in fire-rated and acoustic-dampening pocket door systems, fulfilling specialized needs in commercial and luxury residential builds.

AI Impact Analysis on Pocket Door Market

Common user questions regarding AI's impact on the Pocket Door Market primarily revolve around how artificial intelligence can simplify the highly complex installation process, enhance product customization and design, and improve supply chain efficiency for specialized components. Users are particularly interested in AI-powered tools for accurately calculating wall cavity dimensions and hardware tolerances, which currently require skilled labor, minimizing the risk of misalignment and operational failure. Furthermore, there is significant interest in AI driving predictive maintenance systems for automated pocket doors used in high-traffic commercial environments. Key themes emerging from this user analysis include the expectation that AI should lead to cost reduction, faster project turnaround, and superior product longevity and functionality, especially concerning smooth, silent operation over extended periods.

AI is beginning to influence the Pocket Door Market by optimizing the entire product lifecycle, starting from the design phase. Generative design algorithms can rapidly produce thousands of optimized frame and track designs based on constraints like material cost, weight, acoustic requirements, and spatial dimensions, offering engineers solutions that maximize structural integrity while minimizing material usage. In manufacturing, AI-driven quality control systems, utilizing computer vision, can inspect roller assemblies and track precision with sub-millimeter accuracy, ensuring that all components meet stringent operational standards necessary for silent and smooth movement. This level of precision is vital for consumer satisfaction and reducing warranty claims associated with common pocket door hardware failures.

The supply chain and installation process are also beneficiaries of AI integration. Machine learning models are being deployed to forecast demand for specific door sizes and hardware types regionally, ensuring better inventory management and reducing lead times for customized orders. For installation, augmented reality (AR) applications powered by AI provide real-time guidance to contractors, superimposing digital installation instructions onto the physical wall structure. This significantly lowers the skills barrier required for complex installations and ensures dimensional accuracy, a crucial step for achieving perfect recessing and operation. Ultimately, AI’s primary contribution is enhancing precision, optimizing design, and democratizing the installation process, leading to higher-quality, more reliable pocket door systems accessible to a broader contractor base.

- AI-driven Generative Design optimizes frame and track structures for minimal material use and maximum rigidity.

- Machine Learning enhances demand forecasting for specialized hardware components, improving supply chain responsiveness.

- Computer Vision systems conduct high-precision quality checks on track alignment and roller assemblies during manufacturing.

- AI-powered Augmented Reality (AR) tools guide contractors through complex installation procedures, ensuring dimensional accuracy.

- Predictive maintenance algorithms monitor automated pocket door hardware in commercial settings, preventing operational downtime.

DRO & Impact Forces Of Pocket Door Market

The Pocket Door Market is primarily driven by powerful trends emphasizing architectural efficiency and aesthetic integration, while simultaneously navigating constraints related to installation complexity and perceived higher initial costs compared to traditional hinged doors. Opportunities are abundant in the smart home and automation sectors, coupled with untapped potential in emerging economies undergoing rapid urbanization. The interplay of these forces—Drivers, Restraints, and Opportunities (DRO)—shapes the market landscape, creating significant impact forces that determine profitability and market expansion trajectories for key players.

Key drivers include the global push for maximized usable space, especially in urban residential development, where pocket doors provide superior spatial utility. The rising consumer preference for minimalist and modern interior aesthetics strongly favors the clean lines and concealed nature of these systems. Furthermore, regulatory support and increasing awareness regarding universal design and accessibility standards (e.g., ADA, DDA) mandate the use of barrier-free door solutions in public and increasingly, residential buildings, providing a non-discretionary driver for adoption. The continuous evolution of high-quality, durable hardware, specifically tracks, runners, and soft-close mechanisms, has significantly enhanced product reliability, addressing past performance issues and increasing contractor confidence.

Conversely, restraints persist, notably the complexity and high labor cost associated with installation, requiring specialized framing and wall modification, which can deter budget-sensitive builders. There is also a persistent perception that maintenance or repair of hardware embedded within a wall cavity is difficult or disruptive, though modern removable track systems are mitigating this concern. Opportunities lie prominently in technological innovation, particularly the integration of Internet of Things (IoT) connectivity for automated operation, enabling seamless control via smart home platforms. Geographic expansion into high-growth APAC markets and the specialized demands arising from segments like acoustic and fire-rated door systems present substantial avenues for strategic growth and revenue diversification.

Segmentation Analysis

The Pocket Door Market is extensively segmented based on material, operating mechanism, application, and end-user, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for manufacturers to tailor product development, pricing strategies, and distribution channels. The structure of the market reflects a dynamic balance between cost-effective, standard solutions and high-end, customized, and automated systems. Segmentation by material is critical as it dictates durability, weight, and aesthetic appeal, ranging from traditional wood and engineered wood to lightweight aluminum and glass options, often influencing the choice between residential and commercial use cases.

By operating mechanism, the market is divided into Manual, Soft-Close/Soft-Open, and Automated systems. While manual doors dominate in terms of volume due to their low cost and simplicity, the Soft-Close segment is experiencing rapid growth, reflecting consumer demand for enhanced safety and premium functionality. The Automated segment, although currently smaller, is pivotal in commercial and high-end residential projects, especially those focused on accessibility and smart integration. Segmentation by application clearly distinguishes between new construction and renovation, with renovation activity often driving demand for modular, easy-to-install pocket frame kits suitable for existing wall structures.

The core segments demonstrate distinct growth trajectories. For instance, the commercial application segment, driven by the expanding healthcare and hospitality industries, demands heavy-duty, highly durable hardware and specialized fire-rated solutions. In contrast, the residential segment prioritizes aesthetics, quiet operation, and compatibility with standard interior design materials. Regional segmentation further highlights variations in product preference, with North America favoring sophisticated, integrated hardware and Europe focusing on highly engineered, space-saving designs compliant with stringent safety and acoustic regulations, solidifying the importance of a detailed, multi-dimensional segmentation approach for strategic market assessment.

- By Material:

- Wood (Solid Wood, Engineered Wood)

- Glass (Clear, Frosted, Tempered)

- Aluminum

- Composite Materials

- By Operating Mechanism:

- Manual Operation

- Soft-Close/Soft-Open

- Automated/Motorized

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Healthcare, Hospitality, Corporate Offices, Retail)

- By End-User:

- New Construction

- Renovation and Remodeling

Value Chain Analysis For Pocket Door Market

The value chain of the Pocket Door Market begins with upstream activities involving the sourcing and processing of raw materials, primarily focusing on metals (aluminum, steel) for tracks and hardware, and wood or engineered wood for door panels and frames. Key upstream suppliers include metal processors, specialized hardware component manufacturers (rollers, bearings), and lumber mills. Success at this stage relies heavily on ensuring high-quality, precision-engineered hardware, as the performance and longevity of a pocket door system are critically dependent on the track and roller mechanisms. Maintaining robust relationships with specialized hardware suppliers capable of meeting tight tolerances and high durability standards is essential for all pocket door manufacturers.

Midstream activities involve the design, manufacturing, and assembly of the pocket door systems. Manufacturers typically focus on producing either complete door kits (including pre-assembled frames and hardware) or specialized component kits (track systems and rollers) sold separately to door slab producers. Differentiation at this stage is achieved through proprietary frame designs that enhance rigidity, simplify installation (e.g., quick-mount systems), and allow for easier future maintenance access. Quality control systems focusing on track straightness and operational smoothness are crucial. Marketing and branding efforts, especially targeting architects, interior designers, and professional contractors, also form a critical part of the midstream value proposition, educating the market on the benefits of modern pocket door systems.

Downstream distribution channels are diverse, encompassing direct sales to large commercial contractors, partnerships with big-box retailers (Home Depot, Lowe's), specialized building material distributors, and online e-commerce platforms. The complexity of the product means professional installation is often required, making contractors and specialized installers the most important downstream point of influence. Direct sales channels are often used for high-value commercial projects requiring customization, while indirect channels via distributors handle standard residential volumes. Effective logistics and inventory management, particularly for bulky door frames and tracks, are necessary to ensure timely delivery to decentralized construction sites, ultimately connecting the engineered product to the end-user buyer.

Pocket Door Market Potential Customers

The primary end-users and buyers of pocket door systems span both the residential and commercial sectors, each driven by distinct needs related to space optimization, aesthetic design, and regulatory compliance. Residential buyers, including homeowners, property developers, and residential builders, represent the largest volume segment. For single-family homes and luxury apartments, pocket doors are purchased to enhance interior aesthetics, maximize space in secondary rooms (pantries, laundry rooms), and create flexible layouts in open-plan living areas. Developers of multi-family housing prioritize the cost-effectiveness of space saving provided by pocket doors, especially in dense urban developments where floor area command premium prices, leading to strong bulk purchasing of standard frame kits and hardware.

The commercial sector comprises high-value customers with complex functional requirements. Healthcare facilities, such as hospitals, elderly care homes, and clinics, are significant buyers, driven by the absolute necessity for accessible, barrier-free design (compliance with ADA and similar standards) and the operational efficiency gained by eliminating door swing obstruction in high-traffic corridors and patient rooms. Hospitality venues, including upscale hotels and resorts, utilize pocket doors to maximize space in compact suites and deliver a seamless, high-end aesthetic in bathroom and closet entrances, often demanding automated or soft-close systems for enhanced guest experience and reduced noise transmission between rooms.

Furthermore, institutional clients (educational buildings, government offices) and the corporate real estate sector are increasing their adoption. Corporate offices use pocket doors for conference rooms and executive offices to create flexible meeting spaces that can be quickly partitioned or opened up, favoring solutions that offer superior acoustic privacy. Specialized customers also include renovators and remodelers who are constantly seeking space-saving solutions for existing structures, often opting for modular, retrofit pocket door frame kits that minimize the complexity of wall modification. This broad base of potential customers, spanning from individual homeowners to large institutional procurement departments, highlights the versatile utility and growing necessity of pocket door solutions in modern architecture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Hardware, Kason Hardware, Cavity Sliders Ltd (CS For Doors), Eclisse, Hafele, Stanley Black & Decker, Birtley Group, P C Henderson, Raydoor, AD Systems, Specified Technologies Inc. (STI), Saheco, Dormakaba, Henderson, Richards-Wilcox. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pocket Door Market Key Technology Landscape

The technological landscape of the Pocket Door Market is centered around three core areas: advanced hardware precision, integration of automation and smart controls, and material innovation focused on lightweight durability. Precision-engineered hardware, specifically the track and roller systems, remains the single most critical technological component. Modern systems utilize high-grade aluminum extruded tracks for optimal straightness and low-friction polymer or steel ball-bearing rollers. Innovations here focus on achieving completely silent operation, extremely high load capacities (essential for heavy glass or custom wood doors), and, most critically, easy-access removable tracks that allow for maintenance without tearing into the wall structure, directly addressing a primary historical concern of pocket door functionality.

Automation technology is rapidly maturing, transforming the user experience, particularly in commercial and high-end residential settings. Key developments include electromagnetic soft-close and soft-open mechanisms that control the final centimeters of door travel, eliminating slamming and finger trapping hazards, thereby increasing safety. For high-traffic commercial applications, low-voltage motorized systems integrate seamlessly with access control systems and safety sensors (e.g., infrared beams) to provide touchless, smooth operation. The integration of these motorized systems into wider Building Management Systems (BMS) allows for centralized control and diagnostics, providing crucial data on usage cycles and performance metrics.

Further technological advancements include improvements in frame kit design and material science. Manufacturers are leveraging modular, quick-assembly galvanized steel or high-density plastic frame kits that offer superior rigidity and easier installation compared to traditional wood framing. This modularity reduces installation time and ensures dimensional stability, mitigating issues of warping or settling over time. Additionally, the development of fire-rated (up to 90 minutes) and specialized acoustic pocket door systems, utilizing proprietary seals and core materials, allows for their application in highly regulated environments like hospitals and luxury high-rise residential buildings, significantly expanding their overall market potential and functionality beyond basic space division.

Regional Highlights

Regional dynamics play a significant role in shaping the Pocket Door Market, primarily driven by varying construction standards, urbanization rates, and consumer disposable income allocated towards home improvement. North America, comprising the United States and Canada, represents a mature but highly innovative market. The region’s growth is strongly supported by the robust residential remodeling sector and stringent regulatory requirements for accessibility (ADA compliance), making pocket doors a necessity in many new commercial and multi-family structures. Demand here focuses heavily on high-end hardware, automated features, and large, custom-sized door panels. The region benefits from strong penetration of established hardware specialists who continuously introduce patented, easy-to-install frame technologies that appeal directly to the contractor base, simplifying the installation process and reducing labor costs, which is a key barrier elsewhere.

Europe stands as another major market, characterized by smaller living spaces, high population density, and a strong preference for aesthetic quality and energy efficiency. Countries like Germany, the UK, and Italy show significant adoption. European consumers prioritize highly engineered, durable hardware, and there is a high demand for solutions that offer superior acoustic insulation, crucial for dense residential blocks. The focus here is often on complete system solutions, including sophisticated frame kits and specialty fire-rated doors necessary to comply with strict European building codes (Eurocodes). The market is slightly fragmented, featuring strong local manufacturers who emphasize customization and superior integration into diverse architectural styles, from historical preservation to contemporary minimalist design.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is a direct consequence of soaring urbanization rates, massive government investment in infrastructure, and the consequential boom in the residential and commercial construction sectors, particularly in China, India, and Southeast Asia. Pocket doors are highly valued here as they provide essential space savings in rapidly expanding, high-density metropolitan areas. While the market initially focuses on cost-effective, high-volume standard manual systems, increasing disposable incomes and the rise of luxury residential projects are starting to accelerate demand for automated and visually appealing glass pocket door systems. The growing middle class and the rapid adoption of modern building techniques ensure that APAC will be the primary driver of global volume growth, though infrastructure challenges and variable quality control remain factors influencing local market penetration.

- North America: High demand driven by remodeling, ADA compliance, and preference for automated, sophisticated hardware systems.

- Europe: Focus on highly engineered, acoustic, and fire-rated solutions due to stringent regulatory standards and compact urban living.

- Asia Pacific (APAC): Fastest-growing market fueled by high urbanization, large-scale residential construction, and critical need for space optimization in dense cities.

- Latin America: Emerging market growth supported by increasing commercial real estate investment, particularly in hospitality and corporate segments.

- Middle East & Africa (MEA): Growth tied to mega-projects in commercial and luxury residential sectors, emphasizing aesthetics and custom glass door systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pocket Door Market.- Johnson Hardware

- Kason Hardware

- Cavity Sliders Ltd (CS For Doors)

- Eclisse

- Hafele

- Stanley Black & Decker

- Birtley Group

- P C Henderson

- Raydoor

- AD Systems

- Specified Technologies Inc. (STI)

- Saheco

- Dormakaba

- Henderson

- Richards-Wilcox

- Sliding Door Company

- Hawa Sliding Solutions AG

- Klein Europe

- Coastal Pocket Door Hardware

- Allegion

Frequently Asked Questions

Analyze common user questions about the Pocket Door market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of installing a pocket door system?

The primary benefits are superior space maximization, as they require zero swing clearance, leading to greater usable floor space. They also offer a modern, clean aesthetic by disappearing completely into the wall, supporting minimalist design trends, and significantly improving accessibility.

Is maintenance or repair difficult for pocket doors once installed within the wall cavity?

Historically, repair was difficult, but modern systems utilize removable tracks and proprietary hardware that allow for servicing or replacement of rollers and track components without requiring the destruction of the surrounding wall structure, significantly easing future maintenance.

Which application segment shows the highest growth potential for pocket doors?

The Commercial Application segment, particularly within the healthcare and hospitality sectors, exhibits the highest growth potential due to regulatory mandates for universal design, the need for space-efficient patient rooms, and the increasing demand for high-end, automated solutions in hotels.

What is the current technological focus in pocket door hardware innovation?

Current technological focus centers on precision engineering for silent, durable operation, the seamless integration of soft-close/soft-open mechanisms for safety, and the development of modular, quick-assembly frame kits that reduce installation complexity and labor time for contractors.

How is the Pocket Door Market segmented by operating mechanism?

The market is segmented into Manual Operation (largest volume share), Soft-Close/Soft-Open systems (highest growth rate due to enhanced safety and convenience), and fully Automated/Motorized systems, primarily used in commercial and luxury accessible applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager