Point of Sale (POS) System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433016 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Point of Sale (POS) System Market Size

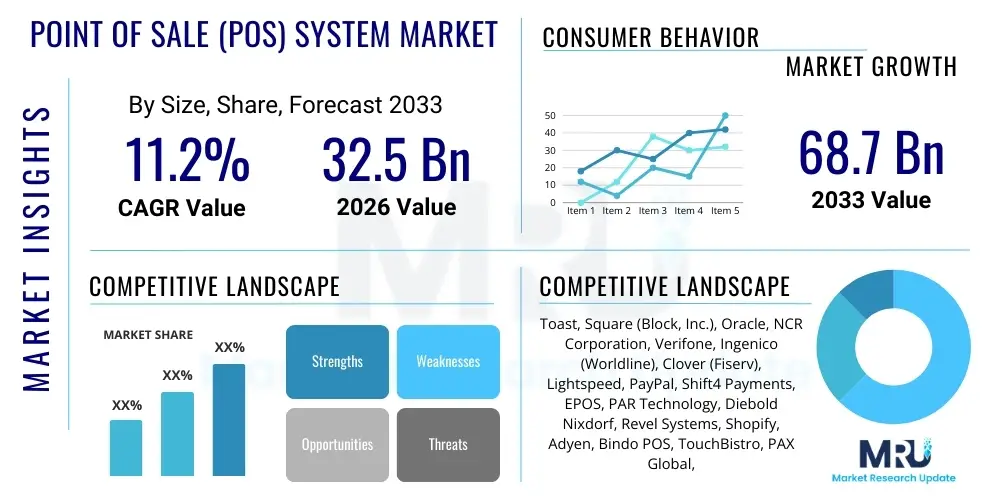

The Point of Sale (POS) System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at USD 32.5 Billion in 2026 and is projected to reach USD 68.7 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the global proliferation of digital payment methods, the increasing necessity for real-time inventory and customer relationship management (CRM) capabilities across retail and hospitality sectors, and the rapid adoption of cloud-based and mobile POS (mPOS) solutions that offer enhanced flexibility and lower operational costs compared to traditional systems. The shift towards integrated commerce platforms, unifying online and physical sales channels, further fuels this growth trajectory.

Point of Sale (POS) System Market introduction

The Point of Sale (POS) System Market encompasses the hardware and software solutions utilized by businesses to complete sales transactions. These systems function far beyond simple cash registers, integrating sophisticated capabilities such as inventory tracking, customer data analysis, employee management, and robust financial reporting. A modern POS solution typically includes a terminal or tablet (hardware), proprietary or cloud-based application software, and peripherals like barcode scanners, receipt printers, and payment card readers. The primary product goal is to streamline the checkout process, enhance operational efficiency, and provide crucial business intelligence necessary for strategic decision-making in highly competitive environments.

Major applications of POS systems span across diverse commercial sectors, with retail and hospitality representing the dominant end-users. In retail, POS systems are vital for managing vast inventories, processing omnichannel sales, and handling returns effectively. In hospitality (restaurants, cafes, hotels), specialized POS systems manage table orders, kitchen display systems (KDS) integration, reservation management, and payroll. The core benefits derived from implementing these systems include accelerated transaction speeds, reduced human error, comprehensive data security (especially for payment card industry compliance, or PCI DSS), and the ability to personalize customer interactions, thereby fostering loyalty and repeat business.

The market is currently being driven by several powerful macro and microeconomic factors. The increasing consumer preference for cashless transactions, including contactless payments and mobile wallets, necessitates upgraded, secure POS infrastructure. Furthermore, small and medium-sized enterprises (SMEs) are increasingly migrating from legacy systems to affordable, subscription-based cloud POS models, which lowers the barrier to entry for advanced functionality. Regulatory changes mandating digital invoicing and greater transparency in financial records also serve as significant driving factors compelling businesses worldwide to invest in sophisticated, compliant POS technology.

Point of Sale (POS) System Market Executive Summary

The global POS System Market is characterized by a significant transition from fixed, on-premise hardware to highly flexible, cloud-native software-as-a-service (SaaS) models, aligning with broader business trends favoring operational agility and scalable technology deployment. Business trends emphasize the merging of POS systems with comprehensive enterprise resource planning (ERP) suites and Customer Relationship Management (CRM) tools, creating unified commerce platforms that seamlessly manage transactions across physical stores, e-commerce sites, and mobile applications. The competitive landscape is intensely focused on innovation, particularly in mobile POS (mPOS) technology, catering to pop-up shops, delivery services, and queue-busting solutions. Vertical-specific POS solutions, tailored to the unique regulatory and operational needs of industries like healthcare, quick-service restaurants (QSR), and fine dining, are gaining increased traction.

Regional trends reveal that North America and Europe maintain technological leadership, driven by high penetration rates of advanced payment infrastructure and stringent data security regulations necessitating continuous system upgrades. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid urbanization, massive growth in the e-commerce sector, and the swift modernization of retail infrastructure in developing economies like India and China. Latin America and the Middle East & Africa (MEA) are seeing accelerated adoption, particularly in mPOS solutions, due to the need for cost-effective, decentralized payment acceptance in regions with high mobile connectivity and lower fixed infrastructure investment capacity. Government initiatives promoting financial inclusion and digital payments are central to regional POS market acceleration.

Segment trends highlight the dominance of the software component segment, which consistently generates higher recurring revenue through subscriptions and specialized modules (e.g., advanced analytics, loyalty programs). Among deployment types, the cloud segment is exhibiting superior growth rates compared to the on-premise model, primarily due to benefits such as remote accessibility, automatic updates, and reduced capital expenditure. Application-wise, the hospitality sector is aggressively adopting integrated POS solutions capable of managing complex food and beverage operations, while the retail sector demands highly scalable systems capable of supporting omnichannel strategies and enhanced customer experience features like self-checkout kiosks and integrated loyalty point redemption.

AI Impact Analysis on Point of Sale (POS) System Market

User inquiries concerning AI in the POS market center predominantly around automation, predictive capabilities, and enhanced security. Users frequently ask: "How can AI optimize inventory levels and reduce waste?" "What role does machine learning play in fraud detection during transactions?" and "Can AI personalize customer recommendations directly at the point of sale?" The prevailing themes suggest that businesses are looking to AI to transform POS from a simple transaction endpoint into a proactive intelligence hub. Key expectations include leveraging AI for demand forecasting based on historical sales data and external factors (weather, events), automating complex pricing strategies in real-time, and significantly improving operational efficiency through automated staff scheduling and predictive maintenance of hardware. Concerns often revolve around the cost of integration and ensuring data privacy as more sensitive customer and sales data are processed by sophisticated algorithms.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally redefining the utility and capability of modern POS systems. AI algorithms are now crucial for analyzing vast streams of transactional data to identify complex patterns indicative of internal shrinkage or external fraud, providing instantaneous alerts and significantly bolstering data security beyond traditional firewalls. Furthermore, AI enhances customer experience by processing historical purchase data to generate highly relevant, personalized product recommendations or promotional offers displayed on customer-facing screens during checkout, directly influencing conversion rates and average transaction value.

Beyond customer interactions and security, AI dramatically optimizes back-end operational processes. In the restaurant sector, ML models predict daily ingredient usage with high accuracy, minimizing food spoilage and optimizing procurement schedules. For retailers, predictive analytics driven by AI ensures optimal stock levels by anticipating seasonal shifts and sudden demand spikes, thereby preventing stockouts and improving inventory turnover ratio. This shift from reactive data viewing to proactive, predictive business intelligence powered by AI represents the most significant technological evolution currently shaping the POS ecosystem.

- AI-Powered Demand Forecasting: Utilizing historical and real-time data to predict product sales and optimize inventory stocking levels.

- Real-time Fraud Detection: ML algorithms analyzing transaction anomalies instantaneously to flag and prevent fraudulent activities at the terminal.

- Personalized Customer Engagement: AI generating targeted offers and recommendations displayed dynamically during the checkout process.

- Dynamic Pricing Optimization: Algorithms automatically adjusting prices based on competitor data, current stock, and time of day to maximize revenue.

- Automated Operational Management: Using AI to optimize labor scheduling based on predicted customer traffic and task load.

- Voice and Gesture Recognition: Future POS systems potentially leveraging AI for touchless ordering and transaction confirmation, particularly in hospitality.

DRO & Impact Forces Of Point of Sale (POS) System Market

The Point of Sale (POS) System Market is propelled by robust drivers, counterbalanced by inherent restraints, and presented with significant long-term opportunities, all influenced by dynamic impact forces. The primary driver is the accelerating global adoption of digital and contactless payments, necessitating compliant and modern POS hardware. Opportunities are concentrated in the rapid expansion of mobile POS (mPOS) solutions, offering low-cost entry points for small and micro-businesses, and the verticalization of software tailored specifically for niche industries (e.g., salons, gyms, specialized retail). However, restraints, such as high initial setup costs for integrated enterprise systems and persistent concerns regarding data breach vulnerability and regulatory compliance complexity (like GDPR or CCPA), temper growth rates.

Key impact forces shaping the market include technology diffusion, which sees cloud computing and application programming interface (API) integration standardizing advanced functionalities across various platforms, thereby lowering the cost of entry for new market players. Consumer behavioral shifts, specifically the expectation of seamless omnichannel experiences and personalized service, exert immense pressure on retailers to upgrade their transaction infrastructure. Furthermore, competitive intensity among vendors, driven by aggressive SaaS pricing models and continuous feature upgrades, keeps the market highly dynamic, forcing incumbent players to rapidly innovate their offerings to maintain market share against agile, specialized software providers.

The synergy between drivers (digitalization) and opportunities (mPOS, cloud) is creating a fertile environment for market growth, especially in emerging economies. The necessity for advanced data analytics to gain competitive advantage in inventory and customer management ensures that businesses increasingly view POS systems not as a cost center, but as a critical strategic asset. Successfully navigating the restraints, particularly mitigating security risks through advanced encryption and tokenization, remains paramount for vendors seeking long-term market sustainability and growth.

- Drivers:

- Increase in global digital and contactless payment acceptance.

- Growing demand for integrated inventory and employee management tools.

- Rising adoption of cloud-based POS solutions offering flexibility and lower TCO.

- Expansion of the organized retail and hospitality sectors globally.

- Restraints:

- High initial capital expenditure required for large enterprise POS deployments.

- Concerns regarding data security, privacy, and regulatory compliance (PCI DSS, GDPR).

- System integration complexities with existing legacy accounting and ERP systems.

- Opportunities:

- Proliferation of Mobile POS (mPOS) terminals in micro and small businesses.

- Development of industry-specific (verticalized) POS software solutions.

- Integration of AI, IoT, and blockchain technology for enhanced functionality and security.

- Growth of self-service technologies, including kiosks and unattended retail solutions.

- Impact Forces:

- Technological advancements in payment processing hardware (faster chips, biometric security).

- Shifting consumer expectations towards omnichannel and seamless experiences.

- Competitive pressure from agile SaaS providers disrupting legacy hardware models.

- Regulatory mandates requiring detailed digital transaction records and enhanced cybersecurity protocols.

Segmentation Analysis

The Point of Sale (POS) System Market is comprehensively segmented based on component, deployment type, end-use application, and organization size, reflecting the diverse needs of the global commercial ecosystem. Component segmentation differentiates between the physical hardware (terminals, scanners, printers), the software (operating system, application layer, backend management tools), and professional services (installation, maintenance, consulting). This structural differentiation is critical because modern market growth is largely concentrated in the recurring revenue generated by the software and service segments rather than one-time hardware sales.

Deployment type segmentation distinguishes between traditional on-premise systems, where data and software reside locally, and cloud-based (SaaS) systems, which offer remote access, centralized data storage, and subscription flexibility. The rapid adoption of cloud POS is a defining feature of the current market, favored by small and medium enterprises (SMEs) due to its scalability and reduced infrastructure investment. Application segmentation highlights the major vertical markets, with retail and hospitality being the most mature and demanding specific features, such as table management systems for restaurants or advanced planogram support for large retail chains.

Understanding these segmentations allows vendors to tailor their offerings effectively and provides critical insights for investors evaluating high-growth niches, such as mPOS hardware targeting mobile food vendors or highly customized cloud software designed for specialized niche retailers. The trend towards integrated 'Platform POS' solutions, which blur the lines between traditional segmentation by offering seamless bundles of hardware, proprietary cloud software, and specialized fintech services, is increasingly influencing the segmentation dynamics.

- By Component:

- Hardware (Terminals, Monitors, Payment Devices, Printers, Scanners, Kiosks)

- Software (Subscription/License, Operating System, Applications)

- Services (Consulting, Implementation, Maintenance, Managed Services)

- By Deployment Type:

- On-Premise POS

- Cloud-Based POS (SaaS)

- By End-use Application:

- Retail (Grocery Stores, Supermarkets, Specialty Stores, Drug Stores)

- Hospitality (Quick Service Restaurants (QSR), Fine Dining, Cafes, Hotels)

- Healthcare

- Entertainment

- Transportation

- Others (Government, Education)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Point of Sale (POS) System Market

The POS system market value chain begins with upstream activities dominated by hardware manufacturers and software developers. Upstream analysis involves the procurement and assembly of physical components such as microprocessors, specialized displays, and secure payment chips (EMV, NFC). Key technological inputs include securing intellectual property rights for proprietary operating systems and developing robust API layers that enable connectivity with third-party applications (e.g., accounting software, loyalty programs). The efficiency and cost-effectiveness in this stage heavily influence the final product pricing and security features, particularly concerning the complexity of Payment Card Industry (PCI) compliance embedded in the hardware and core software.

The midstream of the value chain focuses on manufacturing, integration, and distribution. System integrators play a crucial role in combining hardware from various specialized vendors (e.g., payment terminals from Verifone, touch screens from others) with the chosen POS application software. The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Large enterprises often utilize direct sales teams for customized, high-value contracts, while SMEs are predominantly served through indirect channels, including certified resellers, value-added resellers (VARs), and major e-commerce platforms, particularly for standardized mPOS hardware.

Downstream analysis centers on end-user deployment, service provision, and ongoing support. Post-installation services, including training, technical support, and critical software updates, constitute a significant portion of the recurring revenue stream, especially in the SaaS model. The distribution channels must ensure seamless delivery and localized support, which is paramount given the mission-critical nature of POS systems in commerce. The shift towards cloud-based systems has minimized the need for physical installers but increased the reliance on digital distribution and robust, centralized data center infrastructure managed by the vendor or platform partner.

Point of Sale (POS) System Market Potential Customers

Potential customers for Point of Sale (POS) systems are virtually any entity involved in the exchange of goods or services for payment, requiring a mechanism to record, manage, and report these transactions accurately. The primary end-users fall within the Retail and Hospitality sectors, ranging from independent coffee shops requiring basic mobile terminals to multinational grocery chains needing sophisticated, networked enterprise systems capable of handling thousands of transactions per hour across geographically dispersed locations. Furthermore, as digital transformation penetrates public services, government agencies and educational institutions requiring efficient fee collection and inventory tracking also represent a growing customer base.

The key differentiator among potential buyers is their organization size and complexity of operation. Small and medium enterprises (SMEs) prioritize low total cost of ownership (TCO), ease of use, and quick deployment, making them ideal buyers for plug-and-play mPOS and cloud-based subscription services. Conversely, large enterprises require highly customizable, robust, on-premise or hybrid solutions that can integrate deeply with existing legacy ERP systems, demanding advanced security features, redundancy, and centralized control over thousands of terminals.

Beyond traditional retail, the rise of niche service industries—such as healthcare (clinic billing), fitness centers (membership management), and home services contractors—is expanding the potential customer pool. These segments increasingly require tailored POS solutions that can handle specialized payment types (e.g., insurance claims, recurring memberships) alongside standard retail transactions. The evolving needs of these potential customers drive continuous specialization and feature enrichment within the POS market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 32.5 Billion |

| Market Forecast in 2033 | USD 68.7 Billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toast, Square (Block, Inc.), Oracle, NCR Corporation, Verifone, Ingenico (Worldline), Clover (Fiserv), Lightspeed, PayPal, Shift4 Payments, EPOS, PAR Technology, Diebold Nixdorf, Revel Systems, Shopify, Adyen, Bindo POS, TouchBistro, PAX Global, Castles Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Point of Sale (POS) System Market Key Technology Landscape

The technological landscape of the POS System Market is defined by convergence, integration, and security innovation, moving far beyond legacy closed systems. Cloud computing remains the foundational technology, enabling Software-as-a-Service (SaaS) delivery models that provide remote access, automatic updates, and centralized data management, significantly lowering the total cost of ownership and enhancing system scalability. This shift facilitates the rapid adoption of mobile POS (mPOS) solutions, which utilize smartphones or tablets equipped with compact card readers (enabled by technologies like Bluetooth and Near Field Communication, or NFC) to facilitate transactions anywhere, meeting the demands of high mobility and decentralized operations.

Furthermore, the reliance on advanced security protocols is paramount, driven by stringent regulatory requirements such as PCI DSS. Key security technologies include end-to-end encryption (E2EE) and tokenization, which replace sensitive cardholder data with non-sensitive identifiers (tokens) during the payment process, drastically reducing the risk exposure in case of a data breach. The integration of biometric authentication technologies, such as fingerprint or facial recognition, is also emerging, particularly in systems used for employee login and high-value transaction authorization, adding an extra layer of security and reducing internal theft risks.

Future growth will be increasingly dictated by the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, inventory optimization, and advanced fraud detection. Additionally, Internet of Things (IoT) connectivity is crucial, allowing POS terminals to communicate seamlessly with smart peripheral devices, self-checkout kiosks, and backend inventory sensors, fostering a cohesive and highly automated retail environment. The development of robust Application Programming Interfaces (APIs) is also fundamental, enabling seamless integration with crucial third-party services like e-commerce platforms, advanced payroll processors, and enterprise resource planning (ERP) systems, turning the POS into the central commerce operating system.

Regional Highlights

- North America: This region dominates the global POS market in terms of technology adoption and market value, primarily due to the mandatory migration to EMV (Europay, Mastercard, and Visa) chip technology, high consumer readiness for digital wallets, and the robust presence of leading POS software and hardware providers (e.g., Square, Toast, NCR). The market here is highly mature, characterized by rapid replacement cycles for modernizing legacy systems and extensive adoption of cloud-based POS platforms across both large retail chains and dynamic hospitality groups, focusing heavily on integrated analytics and security compliance.

- Europe: Europe is a highly fragmented yet technologically advanced market, driven by strict regulatory mandates like GDPR, which necessitates highly secure and compliant systems, and widespread adoption of contactless payment methods. Western European countries exhibit high market penetration, with a strong focus on self-service technologies and mobile payment integration. The deployment of mPOS is particularly strong in smaller retail and food services across Southern and Eastern Europe, where cost-efficiency and payment mobility are critical competitive factors.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth over the forecast period, driven by rapidly increasing internet penetration, massive consumer bases adopting mobile commerce, and governmental initiatives promoting cashless economies (e.g., India, Southeast Asia). China and India are major growth engines, characterized by fierce competition among domestic and international vendors offering cost-effective, mPOS-centric solutions. The rapid expansion of organized retail chains and QSRs across the region is fundamentally accelerating the demand for scalable, cloud-enabled POS infrastructure.

- Latin America: This region is experiencing high growth in mPOS adoption due to the need for financial inclusion and payment acceptance in previously underserved micro-markets. High inflation and economic volatility sometimes restrain large-scale fixed investment, pushing businesses toward flexible, lower-cost mobile solutions. Brazil and Mexico lead the region in adopting modern payment infrastructure, supported by favorable government regulations aimed at digitizing commerce and reducing reliance on cash transactions.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the GCC (Gulf Cooperation Council) countries, driven by mega-events, infrastructure development, and strong government push for smart retail and tourism initiatives. Africa, particularly South Africa and Nigeria, is seeing significant uptake of mPOS and low-cost terminals, primarily addressing challenges related to scattered infrastructure and low banking penetration by enabling mobile-first transaction capabilities for SMEs and independent merchants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Point of Sale (POS) System Market.- Toast

- Square (Block, Inc.)

- Oracle Corporation

- NCR Corporation

- Verifone

- Ingenico (Worldline)

- Clover (Fiserv)

- Lightspeed Commerce Inc.

- PayPal Holdings Inc.

- Shift4 Payments

- EPOS Systems

- PAR Technology Corporation

- Diebold Nixdorf, Incorporated

- Revel Systems

- Shopify Inc.

- Adyen N.V.

- Bindo POS

- TouchBistro

- PAX Global Technology Limited

- Castles Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Point of Sale (POS) System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant technological trend shaping the future of POS systems?

The most significant technological trend is the transition to fully integrated, cloud-based Platform POS solutions leveraging AI and Machine Learning. These platforms move beyond simple transaction processing to offer predictive analytics for inventory management, personalized customer engagement, and integrated financial services, transforming the system into a core business intelligence hub rather than just a checkout terminal.

What is the primary difference between on-premise and cloud-based POS systems?

On-premise POS systems store data and software locally, requiring significant upfront capital investment and manual maintenance. Cloud-based (SaaS) systems host data remotely on vendor servers, offering lower initial cost, automatic updates, superior scalability, and the flexibility of remote access, making them highly favored by Small and Medium Enterprises (SMEs).

How does Mobile POS (mPOS) contribute to market growth?

mPOS systems utilize mobile devices (smartphones/tablets) with external card readers, drastically lowering the barrier to entry for micro-merchants and enabling flexible payment acceptance for delivery services, pop-up shops, and busy restaurants needing queue-busting capabilities. This innovation is key to accelerating market penetration in emerging economies and dynamic service sectors.

What are the main security concerns associated with POS systems?

The main security concerns revolve around data breaches, specifically the exposure of sensitive cardholder information during transmission or storage. To mitigate this, modern POS systems employ advanced security measures like end-to-end encryption (E2EE), tokenization, and strict adherence to Payment Card Industry Data Security Standards (PCI DSS) compliance protocols.

Which industry segment is the largest end-user of POS technology?

The Retail industry, encompassing supermarkets, specialty stores, and general merchandise outlets, traditionally represents the largest end-user segment for POS technology. However, the Hospitality sector, particularly Quick Service Restaurants (QSR) and fine dining establishments, is rapidly accelerating its adoption of specialized, feature-rich POS solutions.

How is omnichannel commerce affecting POS system requirements?

Omnichannel commerce necessitates that POS systems act as unified commerce hubs, seamlessly synchronizing inventory, pricing, and customer data across all sales channels (in-store, online, mobile apps). This requires robust API integration capabilities and real-time data flow between the physical terminal and the e-commerce backend to ensure a cohesive customer experience.

What role does IoT play in modern POS deployments?

IoT (Internet of Things) connects the POS system with various smart peripherals and sensors, such as inventory tracking sensors, smart scales, and automated self-checkout kiosks. This connectivity enables higher levels of automation, improved operational efficiency, and better real-time data visibility across the entire retail floor and supply chain.

Are regulatory standards impacting vendor innovation in the POS market?

Yes, regulatory standards, such as EMV mandates for chip technology, GDPR (data privacy), and local digital invoicing laws, significantly impact vendor innovation. These mandates force vendors to continuously upgrade software and hardware to meet evolving compliance requirements, often leading to the integration of enhanced security features and improved data management tools.

What is the forecast growth outlook for POS software versus hardware?

While hardware demand remains essential for payment acceptance, the software component, especially cloud-based SaaS, is forecasted to experience superior growth rates and generate higher recurring revenue. The market value is increasingly shifting towards the intelligence and efficiency provided by the software application rather than the physical terminal itself.

How do POS systems support employee management?

Modern POS systems integrate labor management features, including clock-in/clock-out functionality, performance tracking, commission calculation, and automated scheduling based on predicted demand (often powered by AI). This streamlines payroll processes, ensures labor compliance, and helps optimize staffing levels to match customer traffic.

Which region offers the most significant untapped potential for POS growth?

The Asia Pacific (APAC) region offers the most significant untapped potential, driven by the massive scale of its consumer market, rapid digitalization efforts in countries like India and Indonesia, and the increasing modernization of both formal and informal retail sectors adopting mPOS solutions.

What benefits do independent retailers gain from adopting cloud POS?

Independent retailers benefit significantly from cloud POS due to low upfront costs, automatic software updates, the ability to manage the business remotely via mobile devices, and seamless integration with third-party accounting and e-commerce platforms, offering enterprise-level functionality without the need for dedicated IT infrastructure.

How are advanced POS systems utilized for customer relationship management (CRM)?

Advanced POS systems integrate CRM capabilities by capturing customer purchase history, preference data, and loyalty program participation directly at the point of transaction. This data allows businesses to execute targeted marketing campaigns, reward repeat customers, and personalize interactions, thereby enhancing retention and lifetime value.

What is the competitive landscape like in the POS market?

The competitive landscape is highly fragmented and intense, featuring large legacy hardware providers (e.g., NCR, Oracle), specialized global payment technology companies (e.g., Ingenico, Verifone), and agile, rapidly growing cloud-native software platforms (e.g., Toast, Square). Competition is centered on vertical specialization, subscription pricing, and integrated fintech services.

Can POS systems integrate with blockchain technology?

While still emerging, some advanced systems are exploring integration with blockchain technology primarily for enhanced supply chain transparency (tracking product origin), secure storage of loyalty points, and facilitating decentralized, secure cross-border payment processing, offering a high degree of immutability and trust in transaction records.

What factors are driving the replacement of legacy POS systems?

The primary factors driving replacement are the inability of legacy systems to support modern payment methods (NFC, digital wallets), lack of necessary security compliance (PCI DSS updates), absence of cloud connectivity for remote management, and the crucial need for integrated omnichannel capabilities and sophisticated data analytics tools.

How do POS solutions address the needs of the Quick Service Restaurant (QSR) sector?

QSR-specific POS solutions feature expedited order entry workflows, kitchen display system (KDS) integration, drive-thru management tools, integration with third-party food delivery apps (e.g., Uber Eats, DoorDash), and robust reporting focused on speed of service and peak-hour efficiency optimization.

What impact does urbanization have on POS market growth?

Urbanization drives the expansion of organized retail, shopping centers, and standardized food service chains in concentrated geographic areas. This concentration increases the demand for centralized, interconnected POS networks and integrated systems capable of managing complex, high-volume transactions, particularly in developing urban centers.

What is meant by the "Platform POS" concept?

The Platform POS concept refers to systems that serve as a comprehensive operating hub for a business, consolidating POS functionality with payments, banking, lending, payroll, marketing, and inventory management into a single, cohesive software environment, often blurring the line between a POS provider and a financial technology service.

How important are APIs for modern POS functionality?

APIs (Application Programming Interfaces) are critically important, acting as the foundation for modern POS flexibility. They allow the core POS system to communicate and exchange data seamlessly with a wide range of essential third-party business applications, enabling businesses to customize their tech stack without being locked into a single vendor's proprietary ecosystem.

What is the role of self-service kiosks in the POS market?

Self-service kiosks allow customers to place orders and process payments independently, reducing labor costs and improving customer experience by speeding up transaction times. They are particularly prevalent in QSRs, cinemas, and large retail environments, representing a key area of POS hardware innovation focused on automation.

How does the market cater to the needs of the specialized retail segment (e.g., beauty salons)?

Specialized retail segments require tailored POS software that integrates functions specific to their operations, such as appointment scheduling, membership management, employee commission tracking, and detailed client history records, transforming the POS terminal into a comprehensive management system for their niche industry.

What is the typical lifecycle of POS hardware?

The typical lifecycle of POS hardware is generally 5 to 7 years. However, this cycle is shortening in technologically advanced markets due to the continuous introduction of new payment standards (e.g., contactless mandates) and the necessity to replace legacy systems that cannot handle the requirements of modern cloud-based software and security protocols.

What are the implications of subscription models (SaaS) on vendor revenue?

Subscription models shift vendor revenue from one-time hardware sales to consistent, recurring revenue streams. This model provides greater financial stability for vendors, encourages continuous software development and feature updates, and allows businesses to manage POS costs as operational expenditure (OpEx) rather than capital expenditure (CapEx).

How are POS systems being utilized in the healthcare sector?

In healthcare, POS systems are used for streamlined patient payment processing (co-pays, deductibles), inventory management for pharmaceuticals and supplies, and integration with electronic health record (EHR) systems. Security and compliance with regulations like HIPAA are the highest priorities in this application segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager