Police and Law Enforcement Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436043 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Police and Law Enforcement Equipment Market Size

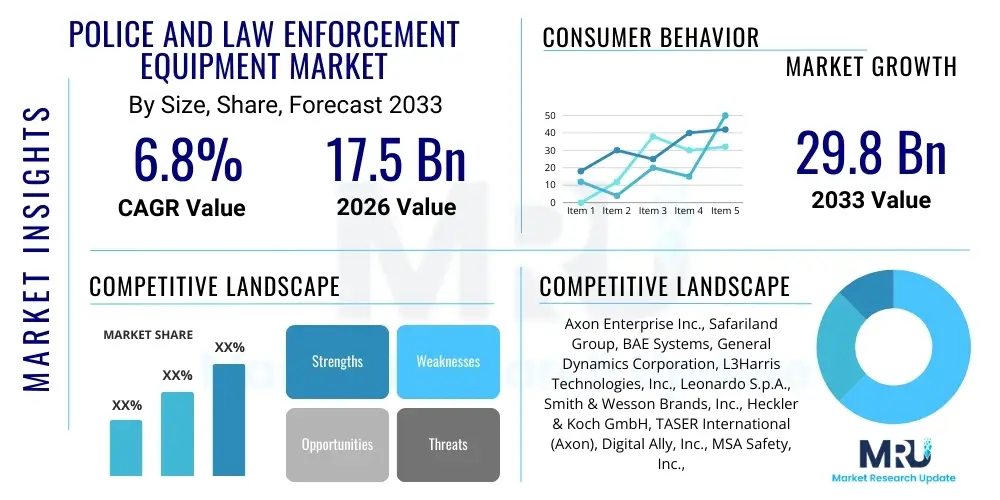

The Police and Law Enforcement Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by increasing global security concerns, rising governmental investments in modernizing police forces, and the rapid integration of advanced technologies such as artificial intelligence and IoT into operational equipment.

Police and Law Enforcement Equipment Market introduction

The Police and Law Enforcement Equipment Market encompasses a broad spectrum of products and systems designed to enhance the safety, efficiency, and operational capabilities of law enforcement agencies, police departments, and associated security organizations worldwide. These essential tools range from traditional components like firearms, ammunition, and protective ballistic gear to sophisticated technological solutions, including body-worn cameras (BWCs), advanced surveillance systems, digital forensics tools, and communication infrastructure. The fundamental purpose of this equipment is to ensure officer safety, improve response times, gather credible evidence, and manage public order effectively, thereby supporting the core mission of maintaining rule of law and protecting citizens.

Major applications for this equipment span across routine police patrols, specialized tactical operations (such as SWAT teams and counter-terrorism units), correctional facilities management, and border security enforcement. The product descriptions emphasize durability, reliability, interoperability, and increasingly, non-lethal capabilities to minimize collateral damage and enhance de-escalation tactics. Benefits derived from deploying modern equipment include enhanced transparency and accountability through digital documentation, superior situational awareness provided by connected devices, and optimized resource allocation achieved through data analytics and predictive policing tools. The shift towards less-lethal options and smart equipment represents a significant evolutionary step in law enforcement practices.

Key driving factors accelerating market growth include escalating cross-border criminal activities, the persistent threat of domestic and international terrorism, and increased public demand for police accountability and transparency, which mandates the use of recording devices. Furthermore, governments across developed and developing economies are committing substantial budget allocations to replace aging equipment and adopt next-generation technologies that promise greater operational effectiveness and data security. The modernization drive, coupled with technological advancements in sensors, AI, and robotics, ensures a dynamic and expanding market landscape for specialized law enforcement gear.

Police and Law Enforcement Equipment Market Executive Summary

The Police and Law Enforcement Equipment Market is experiencing robust growth driven by converging global security priorities and technological innovation. Business trends indicate a strong market shift towards digital and connected equipment, specifically body-worn cameras, intelligent vehicle systems, and advanced communication networks (e.g., LTE/5G private networks). Major industry players are focusing on strategic partnerships, mergers, and acquisitions to integrate specialized AI and data analytics capabilities into their product portfolios, enabling predictive maintenance, enhanced decision-making tools, and improved facial recognition technologies. Furthermore, there is a pronounced emphasis on designing modular and interoperable systems that can seamlessly integrate with existing departmental infrastructure, maximizing utility and minimizing overhaul costs.

Regionally, North America maintains market dominance due to high governmental spending on defense and internal security, coupled with early adoption of high-cost, advanced technology like drone surveillance and digital evidence management systems. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid modernization of law enforcement agencies in countries like China, India, and South Korea, responding to increasing urbanization, complex policing challenges, and large-scale infrastructure projects requiring specialized security oversight. European markets are characterized by stringent regulatory frameworks concerning privacy, driving demand for GDPR-compliant data storage and anonymization features in surveillance equipment.

Segment trends highlight the significant growth trajectory of the Non-Lethal Weapons and Surveillance Systems segments. Non-lethal technologies, including conducted energy devices and sophisticated chemical agents, are gaining traction as agencies seek methods to de-escalate situations without resorting to lethal force, satisfying public and political demands for restraint. Simultaneously, the surveillance segment, encompassing advanced CCTV, aerial drones, and mobile surveillance units with real-time analytics, is expanding rapidly, becoming indispensable for critical infrastructure protection and large-event security management. The protective gear segment, particularly lightweight, high-performance ballistic materials, also sees continuous innovation driven by ergonomic requirements and advanced threat protection specifications.

AI Impact Analysis on Police and Law Enforcement Equipment Market

User queries regarding AI's impact on law enforcement equipment primarily revolve around three core themes: operational efficiency gains, ethical implications (bias, privacy, and accountability), and the long-term feasibility of autonomous systems. Users frequently ask about the accuracy of AI-driven facial recognition in body-worn cameras, the effectiveness of predictive policing algorithms in resource allocation, and how AI integration will influence budget planning and required officer training. There is a general expectation that AI will dramatically transform data analysis—moving from reactive reporting to proactive intervention—but this enthusiasm is tempered by serious concerns about algorithmic bias leading to disproportionate enforcement and the need for clear legislative guidelines governing autonomous police technologies.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally redefining the capabilities and utility of law enforcement equipment, shifting the focus from passive tools to intelligent, decision-support systems. AI is being embedded in surveillance infrastructure (CCTV and drones) to provide automated threat detection, object tracking, and behavioral anomaly identification in real-time. This drastically reduces the labor-intensive nature of monitoring activities and provides actionable intelligence faster, directly influencing operational response strategies. For instance, AI algorithms can process vast amounts of body camera footage to quickly identify key events or suspects, thereby accelerating post-incident review and evidence collection processes.

Beyond surveillance, AI drives predictive policing models, optimizing patrol routes and resource deployment based on complex crime patterns and historical data analysis, moving law enforcement toward a more preventative posture. Furthermore, within digital forensics and evidence management, AI tools enhance the efficiency of processing large data sets, including mobile phone extractions and computer hard drives, identifying critical links and patterns that human analysts might miss. However, the deployment of these sophisticated AI tools necessitates significant investment in high-performance computing infrastructure and specialized training for police personnel to ensure ethical usage and minimize the risk of algorithmic error or misuse.

- AI-driven real-time video analytics for suspect identification and situational awareness enhancement.

- Predictive policing models optimizing patrol allocation and crime prevention strategies.

- Automated digital evidence processing and classification for faster investigations.

- Integration of machine learning into forensic tools to enhance data extraction and analysis.

- Development of autonomous patrol and surveillance drones equipped with AI navigation and detection capabilities.

- Enhancement of communication systems with AI-powered language processing for transcription and immediate translation during emergency response.

- Creation of specialized training simulations using virtual reality (VR) and AI feedback loops for scenario-based officer training.

DRO & Impact Forces Of Police and Law Enforcement Equipment Market

The market is predominantly driven by increasing global threats, including terrorism and organized crime, which necessitate continuous investment in sophisticated security apparatus. Restraints largely center on budgetary constraints faced by municipal police departments and heightened public scrutiny regarding surveillance and privacy violations, leading to regulatory limitations on certain technologies. Opportunities lie in the rapid proliferation of smart city initiatives requiring integrated law enforcement infrastructure and the burgeoning demand for non-lethal equipment and advanced data security solutions. These factors create a complex environment where technological innovation must be balanced with fiscal responsibility and strict adherence to ethical and legal frameworks.

Drivers: The modernization mandate is a crucial driver, as older equipment lacks the digital integration and safety features required for modern policing. Furthermore, political instability and rising geopolitical tensions globally compel governments to prioritize internal security spending, directly boosting procurement of advanced equipment, especially protective gear and cyber defense tools. The widespread adoption of digitalization also necessitates investment in equipment capable of generating, storing, and analyzing digital evidence, such as ruggedized tablets, digital radios, and secure cloud storage solutions, ensuring end-to-end data integrity in the investigative process.

Restraints: Significant restraints include the high initial cost associated with cutting-edge equipment, particularly sophisticated AI systems and specialized robotics, which often exceeds the budgets of smaller police jurisdictions. Additionally, public backlash and political resistance concerning data privacy and potential surveillance overreach impede the smooth adoption of technologies like centralized facial recognition databases or expansive drone programs. The complex procurement processes within governmental agencies, characterized by lengthy tender cycles and bureaucratic hurdles, also slow down the pace of market penetration for new technologies.

Opportunities: The major opportunities reside in the development and deployment of non-lethal and de-escalation equipment, which aligns with modern policing philosophies focused on community engagement and minimal force usage. The advent of IoT and 5G connectivity opens up opportunities for highly integrated, real-time command, control, communications, and computer (C4) systems, enhancing interoperability between various agencies. Furthermore, specialized training and simulation equipment utilizing AR/VR technologies offer a lucrative niche, addressing the critical need for advanced, safe, and realistic training environments for law enforcement personnel globally.

Segmentation Analysis

The Police and Law Enforcement Equipment market is segmented based on the type of equipment, specific application areas, and underlying technology deployed. This segmentation provides a granular view of market dynamics, revealing varying growth rates across specialized product categories. Equipment types differentiate between defensive (protective gear, non-lethal weapons) and offensive (lethal weapons, ammunition), while technology segregation highlights the shift towards smart, connected systems. Understanding these segments is vital for stakeholders to allocate resources toward high-growth areas, particularly those capitalizing on digital transformation and operational efficiency enhancements within police forces.

- By Equipment Type:

- Lethal Weapons (Firearms, Rifles, Shotguns)

- Ammunition and Cartridges

- Non-Lethal Weapons (Tasers, Pepper Spray, Water Cannons, Tear Gas)

- Communication Systems (TETRA/P25 Radios, Mobile Data Terminals, 5G-Enabled Devices)

- Surveillance Systems (Body-Worn Cameras, Vehicle-Mounted Cameras, CCTV, Drones)

- Protective Gear (Ballistic Vests, Helmets, Riot Gear, Gas Masks)

- Vehicle Equipment (Intelligent Patrol Vehicles, Ruggedized Computing)

- By Application:

- Police and Patrol Forces

- Special Weapons and Tactics (SWAT) Teams

- Border Patrol and Coast Guard

- Correctional Facilities and Prisons

- Traffic Enforcement

- By Technology:

- Conventional Equipment

- Smart and Connected Devices (IoT, Sensors)

- AI and Analytics Software

- Biometrics and Identity Management Systems

- By End-User:

- Governmental Agencies

- Private Security Firms

Value Chain Analysis For Police and Law Enforcement Equipment Market

The value chain for the Police and Law Enforcement Equipment market begins with sophisticated upstream activities involving raw material sourcing and the manufacturing of specialized components, such as high-grade polymers, advanced metals for firearms, and specialized electronics for surveillance devices. Upstream supply integrity is paramount, often requiring suppliers to meet rigorous quality standards and regulatory compliance mandates, especially for sensitive components like ammunition primers or ballistic plate materials. Key component manufacturers, often operating under strict export controls, provide specialized sensors, communication chips, and proprietary software crucial for integrated smart equipment.

The midstream section involves Original Equipment Manufacturers (OEMs) who assemble, integrate, and test the final products. This stage is characterized by significant R&D investment focused on miniaturization, enhanced durability, cybersecurity, and interoperability across different police systems. Distribution channels are highly controlled and segmented, relying heavily on specialized governmental procurement agencies, licensed distributors, and direct sales teams. Due to the sensitive nature of the products, indirect channels often require high levels of certification and security clearance. The direct sales model is prevalent for large, strategic contracts involving complex integrated systems or proprietary technology transfers to national defense ministries or major police departments.

Downstream activities include deployment, maintenance, and training services. Once equipment is sold, comprehensive training programs are essential to ensure effective and safe utilization, especially for non-lethal weapons and complex AI surveillance systems. Aftermarket services, including repairs, upgrades, and scheduled maintenance, represent a stable revenue stream, extending the lifecycle of high-cost assets like armored vehicles and specialized robotics. The value chain concludes with the end-users—law enforcement agencies—who provide critical feedback that drives future product improvements and adherence to evolving field requirements and regulatory landscapes.

Police and Law Enforcement Equipment Market Potential Customers

The primary customers in the Police and Law Enforcement Equipment market are governmental entities responsible for maintaining internal security and public order. This includes federal, state, and local police departments, which have constant, foundational demand for standard equipment like uniforms, patrol vehicles, firearms, and communication gear. However, the most significant growth in purchasing power comes from specialized government bodies such as national SWAT and tactical units, border control agencies, and federal investigative bureaus (e.g., FBI equivalents). These specialized units require high-end, customized equipment, including advanced robotics, specialized breaching tools, precision weaponry, and encrypted tactical communication platforms, driving higher average transaction values.

Correctional facilities and prison systems represent another critical segment of end-users, requiring equipment focused on perimeter security, internal surveillance (including contraband detection systems), and control mechanisms for managing inmate populations. Their procurement needs are distinct, prioritizing high-security monitoring tools, specialized restraint devices, and communication jammers. Furthermore, in many jurisdictions, public transportation security authorities, airport police, and critical infrastructure protection units (power grids, water treatment plants) also act as key buyers, investing heavily in sophisticated surveillance and access control systems often overlapping with standard law enforcement technologies.

While governmental agencies dominate, the emergence of highly sophisticated private security firms, particularly those contracted to protect large corporate campuses, critical national assets, or high-net-worth individuals, forms a growing customer base. These private entities often demand equipment comparable to governmental standards, particularly in areas like advanced CCTV monitoring, anti-drone technology, and high-quality protective ballistic gear. They are often less constrained by bureaucratic procurement processes, allowing for faster adoption of new technologies, providing manufacturers with an important, albeit secondary, market for rapid product validation and sales growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axon Enterprise Inc., Safariland Group, BAE Systems, General Dynamics Corporation, L3Harris Technologies, Inc., Leonardo S.p.A., Smith & Wesson Brands, Inc., Heckler & Koch GmbH, TASER International (Axon), Digital Ally, Inc., MSA Safety, Inc., Thales Group, Motorola Solutions, Inc., FLIR Systems (Teledyne FLIR), Zebra Technologies Corporation, Beretta Holding S.A., Q-Florescence, Cobham Advanced Electronic Solutions, Point Blank Enterprises, Inc., Viken Detection. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Police and Law Enforcement Equipment Market Key Technology Landscape

The technological landscape of the Police and Law Enforcement Equipment market is rapidly evolving, moving beyond analog systems toward highly digitized, interconnected platforms. A primary technological focus is the seamless integration of Internet of Things (IoT) sensors and connectivity into traditional gear. Body-worn cameras, smart uniforms, and patrol vehicles are now interconnected data collection points, feeding vast amounts of real-time operational data back to centralized command centers. This shift allows for enhanced situational awareness, immediate data sharing between deployed units, and a complete, verifiable chain of custody for digital evidence, significantly improving post-incident review capabilities and overall operational transparency.

Another dominant technology trend is the incorporation of advanced non-lethal capabilities and remote operation systems. This includes sophisticated conducted energy weapons with refined aiming mechanics and data logging, as well as the increasing deployment of unmanned aerial vehicles (UAVs) and ground robotics. UAVs equipped with high-resolution thermal and optical cameras are used for surveillance, search and rescue, and perimeter security, reducing risk to human officers. These platforms increasingly rely on AI for autonomous navigation and pattern recognition, enabling efficient coverage of large or hazardous areas without direct human piloting.

Furthermore, cybersecurity and secure communication technology remain paramount. Given the sensitive nature of law enforcement data—including criminal records, intelligence reports, and digital evidence—all communication systems (P25, TETRA, and emerging 5G tactical networks) must feature state-of-the-art encryption and anti-tamper safeguards. Biometric technology, including fingerprint, iris, and facial recognition, is also being integrated into field devices for rapid identification checks and secure access control to sensitive equipment or facilities, ensuring that only authorized personnel can handle restricted data and assets.

Regional Highlights

North America currently holds the largest market share, driven primarily by the United States’ significant expenditure on federal, state, and local law enforcement agencies, often focusing on high-tech solutions like drone technology, sophisticated surveillance systems, and robust digital forensics capabilities. The region benefits from a well-established industrial base for defense and security manufacturing and a culture of early adoption of advanced policing tools, though recent legislative scrutiny regarding privacy is influencing procurement toward accountable, transparent technologies like highly secure body-worn cameras.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to escalating internal security challenges, rapid urbanization, and substantial governmental modernization programs in densely populated nations. Countries such as China and India are making massive investments in large-scale surveillance infrastructure (Safe City projects) utilizing AI-driven CCTV networks and identity management systems. The need to police vast populations and secure critical infrastructure fuels demand for communication equipment and predictive analytics software.

Europe represents a mature market with high demand for interoperable, standards-compliant equipment, largely dictated by pan-European security initiatives and stringent data protection laws (GDPR). Emphasis is placed on advanced non-lethal solutions and highly secure, encrypted communication technologies (TETRA networks) to ensure seamless cooperation across national borders. The Middle East and Africa (MEA) region shows accelerating growth, driven by elevated security threats, geopolitical instability, and high defense budgets among key Gulf Cooperation Council (GCC) countries, focusing procurement on counter-terrorism gear, border security equipment, and specialized ballistic protection.

- North America (Dominant Market): Characterized by high R&D spending, early adoption of AI analytics, and strong demand for tactical gear and digital evidence management solutions. Key growth segment: Integrated vehicle systems and robotics.

- Asia Pacific (Fastest Growth): Fueled by mass infrastructure security projects, rapid police force modernization, and large-scale deployment of surveillance technologies, particularly in China and India. Key growth segment: Biometric and AI surveillance.

- Europe: Focused on regulatory compliance (GDPR), demanding interoperable communication systems (TETRA), advanced non-lethal weapons, and cyber resilience solutions. Key growth segment: Secure digital evidence management.

- Latin America: Market growth driven by efforts to combat organized crime and drug trafficking, increasing demand for communication upgrades, body armor, and forensic tools.

- Middle East & Africa (MEA): Growth attributed to high defense and internal security budgets, driven by regional conflicts and critical infrastructure protection needs. Strong demand for counter-terrorism equipment and border surveillance technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Police and Law Enforcement Equipment Market.- Axon Enterprise Inc.

- Safariland Group

- BAE Systems

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Smith & Wesson Brands, Inc.

- Heckler & Koch GmbH

- Digital Ally, Inc.

- MSA Safety, Inc.

- Thales Group

- Motorola Solutions, Inc.

- Teledyne FLIR (formerly FLIR Systems)

- Zebra Technologies Corporation

- Beretta Holding S.A.

- Q-Florescence

- Cobham Advanced Electronic Solutions

- Point Blank Enterprises, Inc.

- Viken Detection

- Northrop Grumman Corporation

Frequently Asked Questions

Analyze common user questions about the Police and Law Enforcement Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Police and Law Enforcement Equipment Market?

The Police and Law Enforcement Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2026–2033), reaching an estimated value of USD 29.8 Billion by 2033, driven by modernization and technological upgrades.

Which technology segment is expected to show the fastest growth in the law enforcement equipment sector?

The Smart and Connected Devices segment, specifically integrated AI and analytics software combined with body-worn cameras and drone systems, is projected to experience the highest growth, fueled by the global demand for real-time situational awareness and digital accountability tools.

How are non-lethal weapons influencing procurement trends in the market?

Non-lethal weapons, such as advanced conducted energy devices and specialized chemical agents, are critically influencing procurement by enabling de-escalation tactics and meeting public and political demands for minimizing the use of deadly force, leading to substantial investment in this category globally.

Which geographical region holds the largest market share for law enforcement equipment?

North America currently accounts for the largest market share, primarily due to high domestic security budgets in the United States, significant investment in tactical operations gear, and advanced adoption of digital and network-centric policing solutions across federal and state agencies.

What are the key restraints affecting the adoption of new law enforcement technology?

Key restraints include the substantial initial capital expenditure required for sophisticated technology (like robotics and AI platforms), intense public scrutiny and regulatory hurdles regarding data privacy and surveillance overreach, and the complex, often protracted, governmental procurement cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager