Police Body Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434032 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Police Body Cameras Market Size

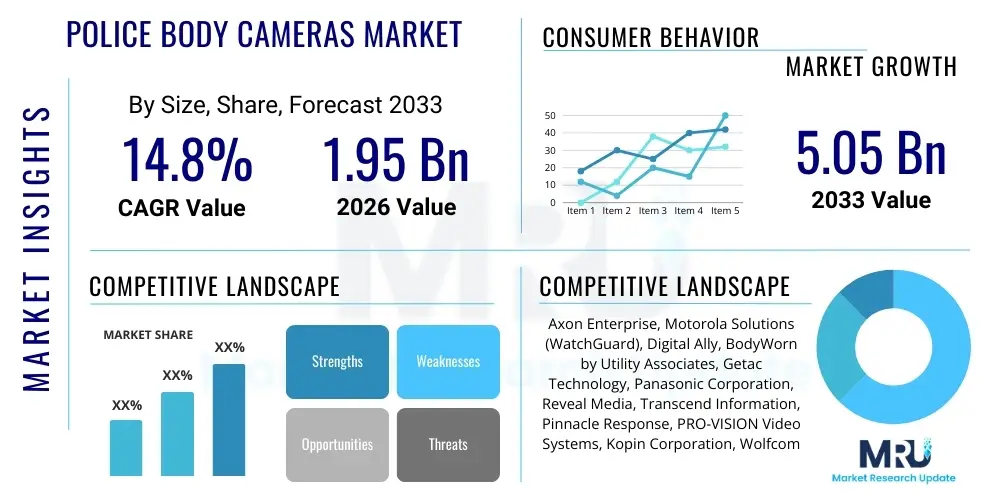

The Police Body Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 5.05 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing governmental mandates for law enforcement transparency and accountability across developed and developing nations, coupled with continuous advancements in video capture technology, data management, and artificial intelligence integration.

Police Body Cameras Market introduction

The Police Body Cameras Market encompasses the sale of wearable video recording devices utilized by law enforcement and public safety personnel to document interactions with the public and capture evidence. These devices, typically lightweight and affixed to an officer's uniform, record high-definition audio and video data, providing an objective, unbiased account of events transpiring during patrols, traffic stops, and critical incidents. The primary objective of deploying these devices is enhancing transparency, reducing instances of excessive force, protecting officers against false accusations, and gathering crucial forensic evidence for legal proceedings.

The product ecosystem involves not only the physical camera units but also sophisticated back-end components, including secure data storage solutions (both cloud-based and on-premise), advanced Digital Evidence Management (DEM) software, and accompanying accessories such as docking stations and encryption systems. Major applications span traffic enforcement, criminal investigations, patrol duty, and search and rescue operations, making them indispensable tools for modernizing police operations. The integration of live-streaming capabilities further enhances operational safety and situational awareness for command centers, providing real-time oversight of critical scenarios.

Key benefits derived from the widespread adoption of body-worn cameras (BWCs) include increased police accountability, a statistically documented reduction in citizen complaints, improved evidential quality leading to higher conviction rates, and enhanced public trust in law enforcement agencies. Driving factors stimulating market growth are predominantly regulatory requirements mandating their use, technological miniaturization allowing for better battery life and higher resolution, and substantial investment in smart policing initiatives funded by government budgets aimed at public safety modernization. Furthermore, heightened media attention and public demand for police reform continue to accelerate deployment schedules globally.

Police Body Cameras Market Executive Summary

The Police Body Cameras Market is experiencing dynamic growth, characterized by strong governmental support and technological innovation focused on maximizing data utility and minimizing storage friction. Current business trends indicate a significant shift towards subscription-based software services (Software-as-a-Service or SaaS models) over outright hardware purchasing, driven by the need for seamless software updates, secure cloud storage, and predictive analytics tools embedded within the Digital Evidence Management (DEM) platforms. Key market players are heavily investing in developing integrated ecosystems where cameras, dashcams, and automated license plate recognition (ALPR) systems communicate seamlessly, creating a unified evidence collection matrix, thereby consolidating vendor dominance through extensive service contracts rather than solely relying on hardware sales.

Regional trends highlight North America as the most dominant market, propelled by proactive federal and state legislation, high adoption rates among major urban police forces, and substantial budgetary allocations specifically earmarked for transparency technologies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rapidly modernizing law enforcement agencies in countries like India and China seeking to adopt advanced surveillance and monitoring solutions to manage large populations and combat rising crime rates. Europe maintains steady growth, focusing heavily on regulatory compliance related to data privacy (GDPR implications) which dictates specialized encryption and data handling features for BWC usage, influencing product design towards stricter security protocols.

Segment trends underscore the increasing preference for advanced models featuring live-streaming capabilities and integrated GPS tracking over basic recording-only devices, reflecting the demand for real-time situational awareness during emergencies. From a component perspective, the software and data storage segment is forecast to witness the highest growth, overshadowing the hardware component growth, as agencies struggle to manage the exponentially increasing volume of captured video data. Furthermore, end-user segmentation shows that municipal and metropolitan police departments remain the largest purchasers, while specialized units such as transit police and customs enforcement are adopting these technologies for niche application requirements, broadening the overall market reach beyond traditional patrolling duties.

AI Impact Analysis on Police Body Cameras Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Police Body Cameras Market center primarily on how AI can transition BWCs from simple recording tools into proactive, intelligent security assets. Common questions revolve around the efficacy of automated video analysis for identifying criminal behavior, the potential for bias and privacy infringements stemming from facial recognition technology, and the capabilities of predictive policing algorithms utilizing BWC data feeds. The general expectation is that AI will drastically reduce the manual workload associated with evidence review, improve incident response times through automated flagging of critical events, and ultimately enhance officer safety through immediate threat detection. Users are keenly interested in the balance between operational efficiency provided by AI and the necessary ethical safeguards required to maintain public trust.

AI's primary influence lies in post-incident data processing and triage. Given that a single officer can generate terabytes of video data annually, manual review is impractical. AI-powered Digital Evidence Management (DEM) systems utilize machine learning algorithms to automatically categorize, redact (to protect victim privacy or minors), transcribe, and index video footage based on predefined criteria, such as detecting weapons, vehicle types, specific actions (e.g., foot chases, use of force), or audio cues (e.g., gunshots, aggressive language). This automation dramatically accelerates the investigation timeline, allowing prosecutors and internal affairs to swiftly locate and utilize pertinent segments of video evidence, thereby streamlining the judicial process and internal accountability mechanisms.

Looking forward, the deployment of edge computing directly within body cameras is a crucial technological trajectory driven by AI integration. This allows for real-time, on-device analysis of video streams, enabling immediate alerts to officers regarding potential threats or predetermined high-risk scenarios without relying on constant cloud connectivity. Ethical concerns, particularly those surrounding biometric data processing like facial recognition, remain a significant regulatory hurdle, pushing developers to focus on less invasive AI applications, such as object detection and context-aware recording activation (e.g., automatically starting recording based on sudden movements or proximity to a known threat location), ensuring compliance with evolving privacy legislation while maximizing officer utility.

- AI-powered redaction minimizes manual hours required to prepare evidence for public release or court submission, significantly accelerating workflow.

- Real-time threat detection (weapons, aggressive actions) using on-device AI enhances immediate officer situational awareness and safety.

- Automated indexing and categorization of video data based on incident type streamline Digital Evidence Management (DEM) and retrieval processes.

- Predictive analytics leveraging BWC data helps identify potential crime hotspots and optimize resource deployment strategy.

- Machine learning algorithms improve transcription accuracy for audio recordings captured during dynamic incidents.

DRO & Impact Forces Of Police Body Cameras Market

The market dynamics of Police Body Cameras are shaped by powerful Drivers, significant Restraints, and transformative Opportunities, collectively known as DRO, creating potent Impact Forces. Key drivers include increasing governmental mandates for police transparency, a direct response to rising public demand for accountability, which forces jurisdictions globally to invest in these verifiable recording technologies. This mandate is often accompanied by dedicated funding programs, ensuring consistent market uptake. Simultaneously, the persistent technological advancements in battery efficiency, resolution (4K recording becoming standard), and secure wireless data transmission continue to improve the viability and operational reliability of BWC systems, making them more attractive and indispensable for modern policing, thereby accelerating adoption rates across varying organizational sizes.

Restraints primarily revolve around the operational costs associated with data management and profound concerns regarding privacy and data security. The exponential volume of high-definition video data necessitates massive investment in secure cloud storage and robust DEM infrastructure, placing significant financial strain on smaller police departments. Furthermore, civil liberties organizations often raise serious concerns about the potential misuse of BWC footage, especially when integrated with advanced features like facial recognition, leading to legislative delays and regulatory limitations in several high-growth regions. Managing the complexity of secure data handling, redacting sensitive information in compliance with privacy laws (e.g., protecting bystanders' identities), and the inherent legal costs associated with footage requests and litigation act as structural inhibitors to rapid, unfettered market expansion.

Opportunities for growth are concentrated in the integration of Artificial Intelligence for automation and the expansion into non-traditional security sectors. The capacity for AI to automate the labor-intensive tasks of evidence tagging and retrieval unlocks substantial operational efficiencies, offering a compelling Return on Investment (ROI) for agencies struggling with backlogs. Geographically, penetration into emerging markets in the Middle East and Africa (MEA) and specific high-density urban areas in APAC presents vast, untapped growth potential as these regions prioritize national security and public order modernization. The core impact force driving the market is the irreversible societal and political shift toward documenting and verifying interactions between citizens and the state, cementing BWCs as essential components of democratic governance infrastructure.

Segmentation Analysis

The Police Body Cameras Market segmentation provides a comprehensive view of the diverse product offerings and application landscapes driving market demand. Segmentation is fundamentally structured around the operational capabilities of the device (Type), the core technological infrastructure required (Component), and the distinct organizational needs of the users (End-User). This multi-layered analysis enables stakeholders, from manufacturers to government procurement agencies, to identify specific market needs and tailor solutions, recognizing that the demands of a small, rural police force differ significantly from those of a large metropolitan department or a specialized military unit. The complexity inherent in data security, device longevity, and integration capacity mandates specialized product designs within each segment.

Based on Type, the market is differentiated primarily by the ability to transmit data. Basic 'Recording Only' models serve smaller, budget-conscious agencies focusing solely on incident documentation, relying on post-shift docking for data upload. In contrast, 'Recording and Live Streaming' models represent the high-growth segment, preferred by larger organizations seeking real-time situational awareness and command control during dynamic events. The Component segmentation highlights the shift from hardware focus to software and storage, where secure, scalable Digital Evidence Management (DEM) systems and proprietary operating software command increasing market share due to their critical role in data integrity and legal compliance, thus demanding higher subscription revenues.

Furthermore, End-User segmentation reveals that municipal and city Police Departments remain the foundation of demand due to legislative mandates, but diversification is occurring. Military Police, Special Operations Forces, and Private Security firms are increasingly adopting ruggedized BWCs for documentation, training, and operational oversight in high-stakes environments. This cross-sector adoption, driven by the proven success of transparency initiatives within civil policing, introduces requirements for enhanced durability, advanced encryption standards suitable for classified environments, and specialized mounting solutions that cater to tactical gear, broadening the scope of necessary technological development within the market.

- By Type:

- Recording Only (Stand-Alone)

- Recording and Live Streaming (Connected/Real-Time)

- By Component:

- Hardware (Camera Units, Batteries, Mounting Kits)

- Software (Digital Evidence Management Systems - DEMS, Analytics Software)

- Storage (Cloud Storage, On-Premise Storage, Hybrid Solutions)

- Accessories (Docking Stations, Controllers, Cables)

- By End-User:

- Police Departments (Municipal and State)

- Federal Law Enforcement Agencies

- Special Operations/Military Police

- Private Security and Transit Authorities

- Customs and Border Protection

Value Chain Analysis For Police Body Cameras Market

The Value Chain for the Police Body Cameras Market begins with upstream activities focused on sophisticated electronic component sourcing, notably high-resolution sensors, miniature computing modules, and secure memory chips. Key upstream suppliers include specialized manufacturers of durable plastic casings, lithium-ion battery technology providers, and semiconductor firms supplying advanced processors suitable for real-time video encoding and edge AI capabilities. Manufacturing itself involves meticulous assembly, rigorous quality control, and ensuring compliance with military-grade standards for ruggedness and environmental resistance (e.g., IP ratings), defining the initial hardware cost and reliability profile of the final product. Specialized expertise in secure firmware development is also critical at this stage to prevent unauthorized access or tampering with recorded data.

The distribution channel is predominantly characterized by a direct-to-government sales model, supplemented by specialized, authorized resellers who manage regional procurement tenders. Major manufacturers like Axon and Motorola often engage directly with large municipal police departments and federal agencies through long-term procurement contracts that bundle hardware, proprietary software licensing, and cloud storage services into a single subscription package. Indirect channels, involving smaller distributors, typically serve medium-to-small police forces and ancillary markets such as private security or university police. The complexity of post-sale service—which includes secure cloud hosting, technical support for DEMS integration, and officer training—necessitates a highly specialized and controlled distribution network, prioritizing long-term service agreements over one-time hardware sales.

Downstream activities are dominated by system integration, data security management, and end-user training. Once deployed, the true value is derived from the seamless operation of the Digital Evidence Management System (DEMS), which dictates how data is uploaded, stored, accessed, and shared securely. This phase requires ongoing technological support to manage firmware updates, integrate the BWC ecosystem with existing police IT infrastructure, and comply with evolving legal requirements regarding evidence integrity (chain of custody). Therefore, the downstream value, primarily captured through software subscriptions and service contracts, often represents a greater financial opportunity over the product lifecycle than the initial hardware sale, driving vendor business models towards comprehensive ecosystem solutions.

Police Body Cameras Market Potential Customers

The primary customers, or end-users/buyers, in the Police Body Cameras Market are municipal and state Police Departments globally, driven by stringent legislative mandates and public pressure for transparency following high-profile incidents involving officer conduct. These organizations require robust, reliable cameras that offer secure, encrypted recording capabilities, coupled with highly scalable cloud or on-premise storage solutions capable of handling massive data volumes generated daily. Purchasing decisions are heavily influenced by the vendor's ability to provide a complete, integrated ecosystem—including hardware, docking stations, and proprietary Digital Evidence Management Software (DEMS)—that simplifies the workflow from capture to evidence storage and retrieval, ensuring compliance with legal standards and minimal IT burden.

A rapidly expanding customer segment includes specialized governmental agencies beyond traditional policing. This encompasses Federal Law Enforcement agencies, such as the FBI or Homeland Security, requiring advanced features like enhanced encryption and integration with sophisticated tactical communication systems. Furthermore, transit security authorities, border patrol units, and even certain military police formations are adopting these devices for operational documentation, recognizing the utility of irrefutable video evidence in maintaining accountability and facilitating after-action reviews. These specialized users often prioritize ruggedized designs that can withstand extreme environmental conditions and possess enhanced battery life suitable for extended operational periods in remote or challenging locations.

Emerging potential customers include large-scale private security organizations and hospital security teams, particularly those operating in high-traffic, high-risk environments like major stadiums, corporate campuses, or metropolitan healthcare facilities. While not governed by the same public transparency mandates as police forces, these groups utilize BWCs primarily for liability protection, personnel safety, and operational training. Their purchasing criteria often emphasize affordability, ease of use, and simple, secure data export capabilities, leading to demand for more accessible, less computationally intensive solutions compared to the enterprise-level systems procured by major municipal police forces, thereby broadening the accessible market segments for BWC manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 5.05 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axon Enterprise, Motorola Solutions (WatchGuard), Digital Ally, BodyWorn by Utility Associates, Getac Technology, Panasonic Corporation, Reveal Media, Transcend Information, Pinnacle Response, PRO-VISION Video Systems, Kopin Corporation, Wolfcom Enterprises, Safety Vision, Blackhawk, E-Band Communications, L3Harris Technologies, Patriot One Technologies, Cradlepoint, Safariland, Aetina Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Police Body Cameras Market Key Technology Landscape

The technological landscape of the Police Body Cameras Market is rapidly evolving beyond simple video capture, emphasizing enhanced data security, real-time connectivity, and miniaturization. Current technological advancements focus heavily on improving video resolution, with 1080p and 4K capabilities becoming standard to ensure evidential clarity, coupled with advanced low-light optimization sensors essential for nighttime operations. A critical development is the implementation of AES 256-bit encryption both at rest (on the device storage) and in transit (during data upload), ensuring the chain of custody remains legally sound and tamper-proof from the moment of capture, addressing one of the most vital legal requirements for forensic evidence integrity. Furthermore, increased battery efficiency is a consistent development focus, aiming to support 12-hour or longer shifts with continuous recording capacity.

Connectivity solutions are driving the market's evolution towards real-time utility. Many contemporary BWC models feature integrated 4G/5G capabilities, allowing for live video streaming back to command centers during critical incidents, significantly improving dispatchers' situational awareness and enabling immediate tactical support. This connectivity is seamlessly linked to sophisticated Digital Evidence Management Systems (DEMS) that leverage cloud computing for secure, scalable storage. These DEMS platforms are increasingly incorporating features like automated file tagging, case management integration, and precise GPS location mapping, turning raw video data into actionable intelligence assets. These integrated systems reduce the risk of data loss and simplify compliance procedures for law enforcement agencies facing strict data retention and disclosure regulations.

The most significant emerging technology is the deployment of Artificial Intelligence (AI) and Machine Learning (ML), often facilitated by edge computing. Processing capabilities are being built directly into the camera units (edge processing) to allow for instantaneous analysis, such as detecting weapons, flagging excessive force, or recognizing specific vehicle license plates without requiring immediate data transfer to a central server. This enables features like context-aware recording activation, where the camera starts recording automatically based on sensor inputs (e.g., foot speed, drawing a weapon), improving consistency. Future technological growth is heavily geared towards utilizing augmented reality (AR) overlays and enhanced sensor fusion (integrating audio, GPS, and biometric data) to create a comprehensive, multi-modal record of officer interactions, further solidifying the evidential value of BWC footage.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market segment, driven primarily by government mandates, high levels of public scrutiny regarding police conduct, and substantial federal and state funding allocated for police transparency programs. High adoption rates are supported by robust technological infrastructure for 4G/5G connectivity and established regulatory frameworks for digital evidence handling. Major vendors, including Axon and Motorola Solutions, maintain significant market share dominance through comprehensive ecosystem offerings encompassing hardware, cloud storage, and predictive analytics software.

- Europe: The European market demonstrates steady growth, highly influenced by the European Union’s stringent data protection regulations, especially the General Data Protection Regulation (GDPR). This necessitates BWC systems with advanced anonymization features and on-device encryption capabilities, shifting market focus toward privacy-by-design solutions. Key adopters include the UK, France, and Germany, where pilot programs have expanded into widespread deployment, often focusing on balancing security requirements with civilian data privacy rights.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid governmental investments in smart city infrastructure and police modernization initiatives in countries such as China, India, and Australia. The massive scale of population management and increasing focus on counter-terrorism and internal security drives demand for live-streaming capabilities and highly centralized, scalable Digital Evidence Management Systems (DEMS) suitable for handling large-scale data volumes generated by extensive metropolitan police forces.

- Latin America (LATAM): Growth in LATAM is driven by efforts to combat high crime rates and reduce corruption within law enforcement agencies, particularly in Brazil and Mexico. Market penetration is accelerating, often supported by international aid and loans aimed at police professionalization. Challenges remain related to infrastructure constraints, including limited internet connectivity in rural areas, leading to continued reliance on recording-only models or specialized BWC units with enhanced local storage capacity.

- Middle East and Africa (MEA): The MEA region is witnessing growing BWC adoption, primarily concentrated in high-income Gulf Cooperation Council (GCC) countries focusing on national security and establishing advanced monitoring capabilities for public safety. Market expansion is currently slower in parts of Africa due to budgetary constraints, though demand exists for affordable, ruggedized solutions for border control and internal security forces, positioning the region as a long-term growth opportunity driven by infrastructural development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Police Body Cameras Market.- Axon Enterprise, Inc. (Global Leader in BWC and DEMS)

- Motorola Solutions, Inc. (Via WatchGuard/V300 product line)

- Digital Ally, Inc.

- BodyWorn by Utility Associates, Inc.

- Getac Technology Corporation

- Panasonic Corporation

- Reveal Media Ltd.

- Transcend Information, Inc.

- Pinnacle Response Ltd.

- PRO-VISION Video Systems

- Kopin Corporation

- Wolfcom Enterprises

- Safety Vision, LLC

- Blackhawk (Part of Vista Outdoor)

- E-Band Communications, LLC

- L3Harris Technologies, Inc.

- Patriot One Technologies Inc.

- Cradlepoint, Inc. (A subsidiary of Ericsson)

- Safariland, LLC

- Aetina Corporation

Frequently Asked Questions

What are the primary factors driving the adoption of Police Body Cameras?

The primary drivers include mandatory government legislation promoting law enforcement transparency, significant public pressure for accountability following high-profile incidents, and technological improvements such as enhanced battery life, high-definition recording, and secure cloud-based Digital Evidence Management Systems (DEMS) which simplify evidence handling and storage for police agencies.

How is Artificial Intelligence (AI) transforming the utility of Police Body Cameras?

AI is transforming BWCs by automating labor-intensive tasks such as video redaction for privacy compliance, real-time threat detection via edge computing, and automatic indexing and categorization of footage. This significantly reduces manual review time, enhances evidence integrity, and facilitates quicker investigations by streamlining the identification of key incident moments.

What is the largest restraint facing the growth of the BWC market?

The largest restraint is the substantial ongoing cost associated with secure data storage and management. High-resolution footage generates enormous data volumes, demanding continuous investment in scalable cloud infrastructure, strict encryption protocols, and sophisticated Digital Evidence Management Systems (DEMS), often posing budgetary challenges for smaller police departments.

Which segment is expected to show the fastest growth rate in the forecast period?

The Software and Storage segment, particularly cloud-based Digital Evidence Management Systems (DEMS) and analytical software, is expected to exhibit the fastest growth. This acceleration is driven by the industry shift towards subscription-based service models necessary to securely manage and process the exponentially growing volume of video data generated by hardware deployments globally.

How does the deployment of Police Body Cameras impact police accountability and citizen complaints?

Studies consistently indicate that the deployment of BWCs leads to improved police accountability by providing objective documentation of interactions. This often results in a measurable reduction in both documented incidents of officer use-of-force and the overall number of citizen complaints against officers, fostering greater public trust and procedural legitimacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager