Poloxamer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435264 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Poloxamer Market Size

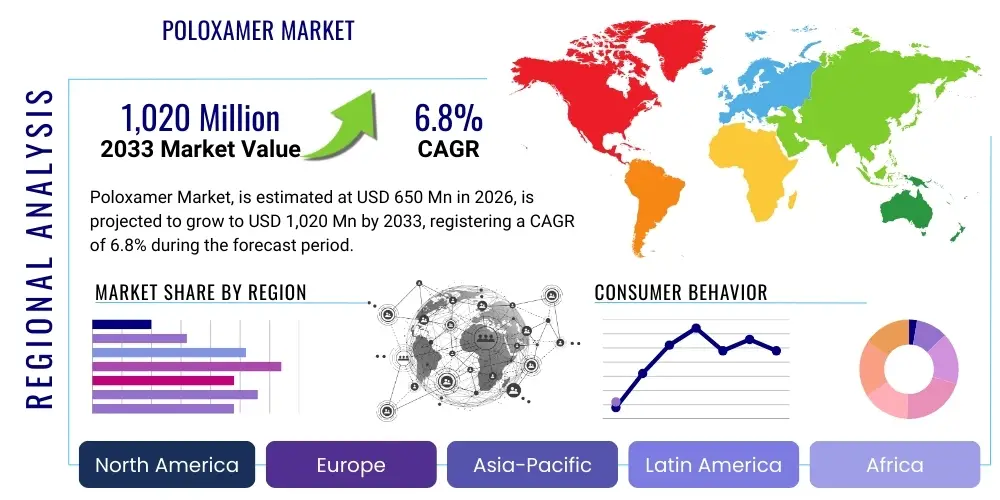

The Poloxamer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Poloxamer Market introduction

Poloxamers, also commercially known as Pluronics, represent a class of non-ionic triblock copolymers composed of a central hydrophobic block of polyoxypropylene (PPO) flanked by two hydrophilic blocks of polyoxyethylene (PEO). Their unique amphiphilic structure enables them to act effectively as surfactants, emulsifiers, and dispersants, making them indispensable components across multiple industries, particularly pharmaceuticals and cosmetics. The critical characteristic driving their market adoption is their concentration-dependent self-assembly behavior, forming micelles above a certain concentration, which is vital for solubilizing poorly water-soluble drugs and stabilizing emulsions.

The primary applications of Poloxamers span complex pharmaceutical formulations, including solid dosage forms, injectable suspensions, and topical preparations. In drug delivery, they are leveraged for their ability to improve bioavailability, control release kinetics, and enhance drug solubility, particularly for lipophilic Active Pharmaceutical Ingredients (APIs). Beyond therapeutics, they are widely used in personal care products like shampoos, creams, and gels due to their non-irritating nature and effective stabilizing properties. Their utility extends into industrial processing as antifoaming agents and dispersants in chemical synthesis.

Major benefits derived from Poloxamer usage include low toxicity, biocompatibility, thermal gelling properties (especially Poloxamer 407), and ease of synthesis and modification. The market is fundamentally driven by the escalating demand for advanced drug delivery systems, particularly in oncology and chronic disease management, where enhanced efficacy and reduced side effects are paramount. Furthermore, the burgeoning growth in the premium cosmetics sector, demanding high-stability and high-performance excipients, further fuels the consumption of high-grade Poloxamers globally.

Poloxamer Market Executive Summary

The Poloxamer market demonstrates robust expansion, primarily fueled by innovations in the pharmaceutical sector, focusing heavily on controlled and targeted drug delivery systems. Business trends indicate a shift towards specialized, high-purity Poloxamer grades, such as those used in biopharmaceuticals and advanced cell culture media, necessitating stricter quality control and enhanced manufacturing capabilities among key market players. Consolidation of suppliers specializing in pharmaceutical-grade excipients and strategic partnerships between manufacturers and large pharmaceutical companies characterize the current competitive landscape, ensuring stable supply chains and accelerated product development cycles. The integration of continuous flow manufacturing techniques is also gaining traction, aiming to reduce production costs and improve consistency.

Regionally, Asia Pacific (APAC) is poised for the fastest growth, attributed to the rapidly expanding generic drug manufacturing base, increasing healthcare expenditure, and surging demand for personal care products, particularly in India and China. North America and Europe, while mature, remain dominant markets due to high levels of research and development (R&D) activities, presence of major biotechnology hubs, and stringent regulatory environments that favor established, well-characterized excipients like Poloxamers. The regulatory harmonization across regions, facilitated by bodies such as the FDA and EMA, further encourages global market penetration for Poloxamer manufacturers adhering to Good Manufacturing Practices (GMP).

Segment trends highlight the dominance of Poloxamer 407 due to its superior thermoreversible gelling properties, making it essential for injectable depot formulations and ocular drug delivery. The drug delivery application segment maintains the largest market share, driven by the shift from conventional oral dosage forms to specialized parenteral and topical systems. There is a noticeable trend towards micro- and nano-encapsulation techniques utilizing Poloxamers to overcome solubility and stability challenges associated with novel drug compounds. Furthermore, the cosmetics segment shows sustained growth, particularly demanding grades optimized for sensitive skin formulations and enhanced sensorial attributes.

AI Impact Analysis on Poloxamer Market

Common user questions regarding AI's impact on the Poloxamer market often center on its ability to accelerate novel formulation discovery, optimize manufacturing processes, and predict excipient performance in complex biological systems. Users are keenly interested in how machine learning (ML) algorithms can be used to model the self-assembly of Poloxamer micelles, determine optimal concentration thresholds for specific APIs, and predict stability under various environmental conditions, thereby significantly reducing the time and cost associated with traditional R&D formulation screening. There is also substantial inquiry into AI-driven supply chain management, ensuring predictive maintenance for high-volume Poloxamer synthesis reactors, and optimizing inventory based on real-time pharmaceutical production demand, addressing key concerns about supply reliability and cost efficiency in a highly regulated industry.

AI and machine learning tools are beginning to revolutionize the preclinical phase of drug development where Poloxamers are utilized. By employing predictive modeling, researchers can simulate the interaction between Poloxamer molecules and newly synthesized APIs, identifying the most effective solubilization or stabilization strategies without extensive laboratory trials. This predictive capability is crucial for identifying optimal molecular weight ratios and concentrations of PEO and PPO blocks required to achieve desired release profiles in controlled drug delivery systems. The application of AI ensures better batch-to-batch consistency in synthesis by monitoring reactor parameters in real-time, leading to superior quality pharmaceutical-grade Poloxamers.

Furthermore, AI-powered quality assurance systems are enhancing regulatory compliance throughout the Poloxamer supply chain. These systems can analyze vast datasets from spectral analysis (e.g., NMR, GPC) and rheological testing, automatically flagging subtle deviations that might impact the excipient's performance in a final drug product. This heightened level of precision and quality control minimizes waste, reduces the risk of costly formulation failures, and streamlines the path to regulatory approval. As Poloxamers become increasingly integrated into complex biotechnology products, AI offers the precision required to manage the nuanced requirements of these high-value applications.

- AI-driven formulation modeling significantly reduces the lead time for selecting optimal Poloxamer grades for new APIs.

- Predictive analytics optimizes reactor synthesis parameters, ensuring high purity and reducing manufacturing variability (batch-to-batch consistency).

- Machine learning enhances quality control by rapidly analyzing complex characterization data (rheology, micelle formation).

- AI aids in simulating Poloxamer performance in biological environments, predicting drug release kinetics and targeting efficiency.

- Integration of AI in supply chain logistics optimizes inventory, reducing buffer stocks and ensuring timely delivery of specialized grades.

DRO & Impact Forces Of Poloxamer Market

The Poloxamer market dynamics are shaped by strong drivers stemming from pharmaceutical innovation, counterbalanced by regulatory and cost-related restraints, while opportunities emerge through technological advancements in biotechnology and material science. The primary driving force is the expanding application of Poloxamers as highly effective solubilizing agents for the growing pipeline of poorly water-soluble drugs (BCS Class II and IV compounds), coupled with their inherent biocompatibility, which is crucial for injectable and implantable formulations. Restraints largely involve the complexities of scaling up synthesis of ultra-high purity, pharmaceutical-grade materials and the strict, time-consuming regulatory scrutiny excipients face before market approval. The industry sees significant opportunities in leveraging Poloxamers in next-generation therapies, such as gene delivery vectors and advanced wound healing hydrogels, which demand unique amphiphilic polymer properties.

Drivers: The increasing prevalence of chronic diseases globally mandates continuous research into more effective and patient-compliant drug delivery methods, directly boosting Poloxamer demand. As controlled release mechanisms become standard in therapeutic areas like diabetes and oncology, the unique thermo-responsive and micelle-forming properties of Poloxamers (especially Poloxamer 407) make them irreplaceable components for creating stable, long-acting depot injections and advanced oral dosage forms. Furthermore, the growing demand within the sophisticated personal care and cosmetic industry for mild, highly functional emulsifiers and thickeners reinforces market growth, particularly in high-growth economies where consumer spending on premium products is rising. This pharmaceutical and cosmetic dual-pull ensures consistent upward trajectory for high-purity Poloxamer grades.

Restraints: Despite their utility, the Poloxamer market faces limitations, primarily related to the cost structure of specialized grades and the competitive threat from alternative polymeric excipients. Manufacturing pharmaceutical-grade Poloxamers requires stringent adherence to cGMP standards, leading to higher operational expenditures and consequently high final product pricing, which can be a barrier for generic drug manufacturers operating under tight cost constraints. Additionally, regulatory bodies require extensive toxicological and stability data for excipients used in novel delivery systems, leading to prolonged development timelines and significant investment risk. Furthermore, the availability of substitutes, such as PEG derivatives and other non-ionic surfactants, occasionally poses competitive pricing pressure, particularly in non-pharmaceutical applications.

Opportunities: Significant untapped opportunities exist in the burgeoning fields of biotechnology, nanomedicine, and regenerative medicine. Poloxamers are being extensively researched for their potential role in targeted drug delivery, where they can modify the surface of liposomes and nanoparticles to evade the reticuloendothelial system (RES) and improve tumor accumulation. The development of advanced injectable hydrogels for tissue engineering, combining Poloxamer’s thermo-gelling properties with bioactive materials, represents a high-value niche market. Moreover, expanding R&D focused on producing specialized, stimuli-responsive Poloxamer derivatives (e.g., pH-sensitive or light-sensitive variations) opens avenues for highly precise therapeutic interventions, driving future innovation and premiumization of the product portfolio.

Impact Forces: The impact forces governing the Poloxamer market are predominantly influenced by shifts in global regulatory standards for pharmaceutical excipients and the pace of innovation in drug solubilization technology. Strict adherence to pharmacopeial standards (USP, EP, JP) acts as a powerful barrier to entry, favoring established manufacturers. Technological impact forces, driven by nanotechnology, mandate continuous improvements in Poloxamer purity and molecular weight precision to ensure optimal performance in nanocarriers. Economic stability, particularly the investment capacity of major pharmaceutical firms in outsourcing high-quality excipient synthesis, directly affects demand. Furthermore, growing sustainability concerns exert pressure on manufacturers to adopt greener synthesis routes and ensure eco-friendly disposal of production waste, influencing long-term operational strategies and material selection.

Segmentation Analysis

The Poloxamer market is comprehensively segmented based on Type, Application, and Region, reflecting the diverse utility and varying purity requirements across end-use industries. Segmentation by Type is crucial as the functional properties—such as micelle formation, viscosity, and thermo-reversibility—are highly dependent on the specific molecular weight and the ratio of PEO to PPO blocks, leading to distinct commercial grades like Poloxamer 188 and 407, which cater to different formulation needs. Application-based segmentation highlights the pharmaceutical industry's dominance, yet also acknowledges the substantial and growing consumption in the cosmetics and industrial sectors, each requiring unique quality and regulatory profiles.

Further granularity in segmentation reveals underlying market dynamics. Within the Application segment, sub-categories like specialized injectables, ocular delivery, and transdermal patches demand the highest quality Poloxamers and command premium pricing, driving innovation towards high-specification products. The regional segmentation is vital for understanding differences in regulatory adoption and manufacturing capacity, with APAC rapidly growing as a manufacturing hub, contrasting with North America's strength in advanced pharmaceutical R&D and high-value product consumption. These segmentations collectively provide a structured view of market opportunities, pricing strategies, and competitive positioning across the global landscape.

The ongoing trend towards personalized medicine and complex biological therapeutics continues to intensify the need for tailored excipients. This necessitates manufacturers to broaden their portfolio to include functionalized Poloxamers designed for specific targeting or release mechanisms. The interaction between segments is pronounced, for instance, the demand for Poloxamer 407 (Type) is heavily influenced by the injectable depot formulations (Application), while manufacturing requirements are guided by stringent regulatory oversight (Regional Dynamics, particularly in the US and EU). Understanding these interconnected segments is fundamental for strategic market entry and forecasting future growth areas within this specialized chemical market.

- Type

- Poloxamer 188 (Pluronic F68)

- Poloxamer 407 (Pluronic F127)

- Poloxamer 237 (Pluronic F87)

- Other Types (e.g., Poloxamer 338, 124, 184)

- Application

- Drug Delivery Systems

- Oral Drug Delivery

- Parenteral Drug Delivery (Injectables, Implants)

- Topical and Transdermal Delivery

- Ocular and Nasal Delivery

- Cosmetics & Personal Care

- Creams, Lotions, and Gels

- Shampoos and Conditioners

- Industrial Processing

- Antifoaming Agents

- Dispersants and Emulsifiers

- Medical Devices and Diagnostics

- Drug Delivery Systems

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Poloxamer Market

The Poloxamer market value chain initiates with the procurement and processing of key raw materials, namely ethylene oxide (EO) and propylene oxide (PO), which are petrochemical derivatives. Upstream activities involve specialized chemical manufacturers that synthesize the PEO and PPO block components and subsequently perform the copolymerization reaction under controlled conditions to produce various Poloxamer grades. Due to the stringent purity requirements, particularly for pharmaceutical applications, raw material quality and efficient, precise block polymerization are critical determinants of the final product's market value. These raw material suppliers and intermediate manufacturers often operate globally, focusing on economies of scale and consistent adherence to ISO and GMP standards.

Midstream activities encompass the purification, standardization, and final finishing of the Poloxamer product. This stage is crucial for ensuring the specific physical properties (e.g., HLB value, molecular weight distribution) required by end-users. Manufacturers specializing in pharmaceutical excipients dedicate significant resources to advanced purification technologies to remove impurities and unwanted byproducts. Finished Poloxamers are then packaged, often in sterile conditions, and labeled according to pharmacopeial specifications. Regulatory approval and quality certification are intrinsic parts of this stage, adding substantial value and establishing the market credibility of the manufacturer.

Downstream analysis focuses on distribution channels and end-user consumption. Poloxamers are distributed through both direct sales channels, primarily to large pharmaceutical companies or contract manufacturing organizations (CMOs) requiring bulk quantities and customized grades, and indirect channels involving specialized chemical distributors or agents. These distributors manage inventory, provide technical support, and service smaller cosmetic manufacturers and research laboratories. End-users—including drug formulators, cosmetic brand owners, and medical device developers—incorporate Poloxamers into their final products. The high demand from the specialized drug delivery segment drives premium pricing and innovation throughout the entire value chain, emphasizing rapid transport and secure storage to maintain product integrity.

Poloxamer Market Potential Customers

The primary potential customers and end-users of Poloxamers are entities heavily invested in product formulation where solubilization, stabilization, or viscosity modification is paramount, primarily spanning the healthcare and consumer goods sectors. Large multinational pharmaceutical companies are the biggest volume consumers, particularly their R&D divisions and manufacturing units focused on developing novel dosage forms for biopharmaceuticals, generic injectables, and long-acting therapeutics. Contract Development and Manufacturing Organizations (CDMOs) also represent a crucial customer segment, as they require high-quality excipients in bulk to service various pharmaceutical clients efficiently.

Beyond pharmaceuticals, the cosmetics and personal care industry constitutes a rapidly growing customer base. Manufacturers of premium skin care, hair care, and oral hygiene products utilize Poloxamers as gentle, effective surfactants and emulsifiers that enhance product feel and stability. This segment often prioritizes specific grades optimized for dermal compatibility and low irritation potential. Furthermore, research institutions and university laboratories involved in drug formulation research, polymer science, and biomedical engineering are consistent buyers, typically ordering smaller, high-purity experimental quantities.

A specialized, yet high-value, customer group includes manufacturers of medical devices and in-vitro diagnostics. Poloxamers are used in surface coatings to improve biocompatibility of implants, catheter lubrication, and as components in diagnostic assays due to their anti-fouling characteristics. The common requirement across all these potential customers is the need for highly characterized, consistent, and regulatory-compliant material, favoring suppliers who can provide extensive quality documentation and reliable supply chain logistics tailored to strict industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Croda International Plc, Clariant AG, Dow Chemical Company, Solvay S.A., Spectrum Chemical Mfg. Corp., Merck KGaA, Sandoz (Novartis), Sigma-Aldrich (Merck), Abitec Corporation, Gelest Inc., Lubrizol Corporation, Vantage Specialty Chemicals, Gattefosse, Evonik Industries AG, PKL Chemicals Pvt. Ltd., Kolb Distribution Ltd., Stepan Company, Sino-Lion USA, Inc., Seppic S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Poloxamer Market Key Technology Landscape

The underlying technological landscape of the Poloxamer market is rooted in precision polymer synthesis and advanced purification methods designed to meet escalating regulatory and functional demands. The core technology involves the anionic polymerization of ethylene oxide (EO) and propylene oxide (PO) to form the tri-block copolymer structure. Recent technological advancements focus on optimizing reaction conditions, such as temperature, pressure, and catalyst selection, to achieve extremely narrow polydispersity indices (PDI) and precise molecular weight control. This precision is non-negotiable for pharmaceutical-grade Poloxamers, as small variations in PDI can drastically affect micellization behavior, drug loading capacity, and stability in biological systems, which is critical for complex nanomedicines.

A significant technological focus is directed towards the development of novel Poloxamer derivatives and functionalization techniques. Researchers are utilizing conjugation chemistry to attach targeting ligands (e.g., antibodies, peptides) to the PEO block of the Poloxamer. This enables the resulting polymer-drug conjugate or surface-modified nanoparticle to achieve targeted delivery, enhancing therapeutic efficacy and minimizing off-target toxicity. This customization requires sophisticated analytical technologies, such as High-Performance Liquid Chromatography (HPLC) coupled with advanced detectors and Nuclear Magnetic Resonance (NMR) spectroscopy, to thoroughly characterize the modified polymer structure and confirm purity before application in clinical trials.

Furthermore, technology related to formulation processing is equally important. Techniques like solvent evaporation, high-pressure homogenization, and microfluidics are employed to efficiently incorporate Poloxamers into drug carriers (liposomes, polymeric nanoparticles) or specialized delivery vehicles (thermo-gelling implants). The successful incorporation of Poloxamers relies on understanding and exploiting their thermo-responsive rheological properties, particularly the sol-gel transition, which is crucial for liquid injectable formulations that solidify in situ. Manufacturers are investing in closed-loop automated synthesis systems utilizing Process Analytical Technology (PAT) to ensure real-time monitoring and control, thereby guaranteeing compliance and quality consistency at high volumes.

Regional Highlights

Regional dynamics heavily influence the Poloxamer market, driven by varying healthcare spending, regulatory stringency, and local manufacturing capabilities. North America, comprising the United States and Canada, currently holds a dominant share in terms of value, primarily due to the vast concentration of leading pharmaceutical and biotechnology companies and substantial R&D investment in advanced drug delivery systems, particularly in oncology and chronic disease management. The region's stringent regulatory framework (FDA approval) mandates the use of highly characterized, GMP-compliant excipients, thereby sustaining demand for premium Poloxamer grades. Furthermore, the robust cosmetic and personal care market, characterized by high consumer willingness to pay for high-performance products, contributes significantly to regional consumption.

Europe represents another key market, characterized by a strong presence of established chemical manufacturers and a robust generics industry, particularly in Germany, France, and Switzerland. The European market benefits from collaborative research initiatives between academia and industry focused on biomaterials and nanomedicine, driving the demand for specialized Poloxamers for novel drug carriers and tissue engineering applications. Regulatory oversight by the European Medicines Agency (EMA) ensures high-quality standards, similar to North America. Western European countries are also major consumers of high-end cosmetic and dermatological products, where Poloxamers are valued for their mildness and functionality as non-ionic surfactants.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion is fueled by the tremendous growth of the generic drug manufacturing sector in India and China, increasing governmental focus on healthcare infrastructure development, and rising domestic consumption of personal care products. Lower operating costs and favorable investment policies are attracting global excipient manufacturers to establish production facilities in this region. While price sensitivity remains a factor in the generic segment, the rapid adoption of Western-style formulations and the increasing sophistication of local pharmaceutical companies are steadily driving up the demand for high-purity Poloxamers.

Latin America (LA) and the Middle East & Africa (MEA) currently hold smaller, but strategically important, market shares. In LA, market growth is gradually accelerating, driven by increasing foreign investment in local drug manufacturing and improving access to specialized medicines. Countries like Brazil and Mexico are key growth nodes. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in local pharmaceutical manufacturing and cosmetic product formulation to reduce reliance on imports. Oil-rich nations are improving healthcare infrastructure and establishing regulatory frameworks that necessitate the use of quality excipients. These emerging markets represent crucial future growth opportunities for manufacturers capable of navigating complex local regulatory environments and distribution logistics, often requiring smaller, specialized shipments.

- North America: Dominant market share driven by advanced biopharma R&D, high regulatory standards, and strong demand for premium drug delivery systems (injectables, nanocarriers).

- Europe: Mature market focused on research collaboration, robust generics manufacturing, and significant utilization in specialized cosmetic and dermatological preparations.

- Asia Pacific (APAC): Fastest growing region, fueled by expanding generic drug production in China and India, increasing healthcare spending, and rising consumer demand for functional personal care products.

- Latin America & MEA: Emerging markets with accelerating growth potential driven by investments in local pharmaceutical manufacturing and improving healthcare access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Poloxamer Market.- BASF SE

- Croda International Plc

- Clariant AG

- Dow Chemical Company

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- Merck KGaA

- Sandoz (Novartis)

- Sigma-Aldrich (Merck)

- Abitec Corporation

- Gelest Inc.

- Lubrizol Corporation

- Vantage Specialty Chemicals

- Gattefosse

- Evonik Industries AG

- PKL Chemicals Pvt. Ltd.

- Kolb Distribution Ltd.

- Stepan Company

- Sino-Lion USA, Inc.

- Seppic S.A.

Frequently Asked Questions

Analyze common user questions about the Poloxamer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Poloxamers, and why are they preferred over other surfactants?

Poloxamers are primarily used in Drug Delivery Systems (e.g., solubilizers for poorly water-soluble APIs, thermo-gelling injectable depots) and Cosmetics (emulsifiers, stabilizers). They are preferred due to their excellent biocompatibility, low toxicity, non-ionic nature, and ability to form micelles and reversible hydrogels (especially Poloxamer 407), which are crucial properties for pharmaceutical formulation and sustained release.

How does the Poloxamer 407 segment dominate the market?

Poloxamer 407 (Pluronic F127) dominates the market due to its unique thermo-reversible gelling property. It exists as a liquid at low temperatures but transitions rapidly into a stable gel at body temperature, making it indispensable for long-acting injectable and implantable formulations, ocular gels, and advanced wound dressings, commanding a higher price point and demand in high-value medical applications.

What are the key regulatory challenges impacting Poloxamer market growth?

The primary regulatory challenge is the stringent requirement for characterization and purity, particularly for injectable and novel drug applications. Manufacturers must strictly adhere to current Good Manufacturing Practices (cGMP) and pharmacopeial standards (USP/EP/JP), requiring significant investment in quality assurance and toxicology studies, which can slow down new product development and increase costs.

Which region offers the most significant growth opportunity for Poloxamer manufacturers?

The Asia Pacific (APAC) region offers the most significant growth opportunity. This is driven by the rapid expansion of generic drug manufacturing bases in China and India, coupled with increasing governmental and private investment in local pharmaceutical R&D and consumer demand for sophisticated cosmetic products, creating substantial volume opportunities.

How is nanotechnology influencing the demand for specialized Poloxamer grades?

Nanotechnology, particularly in areas like liposomes and polymeric nanoparticles, relies heavily on Poloxamers for surface modification and stabilization. Poloxamers enhance stability, prevent aggregation, and facilitate targeting by minimizing uptake by the reticuloendothelial system (RES), thus driving demand for ultra-high-purity, low-polydispersity grades essential for effective nanocarrier formulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager