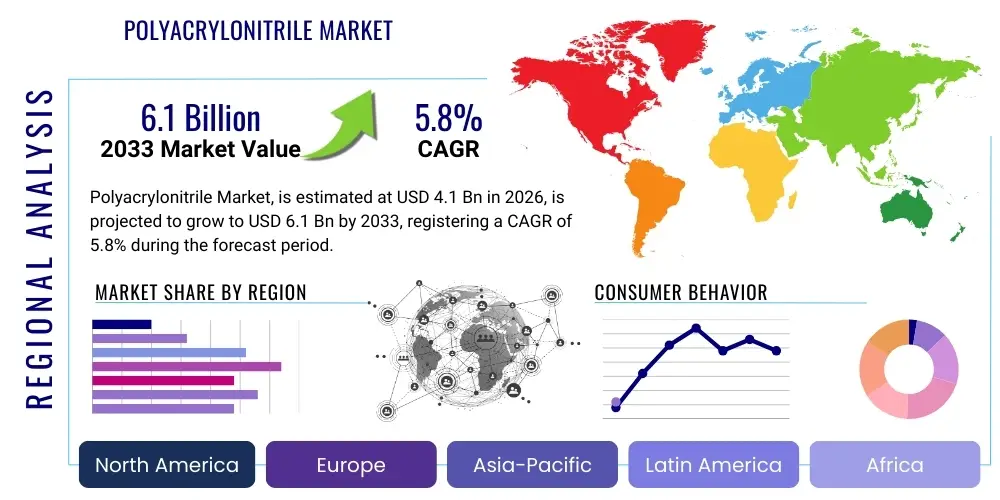

Polyacrylonitrile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435814 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Polyacrylonitrile Market Size

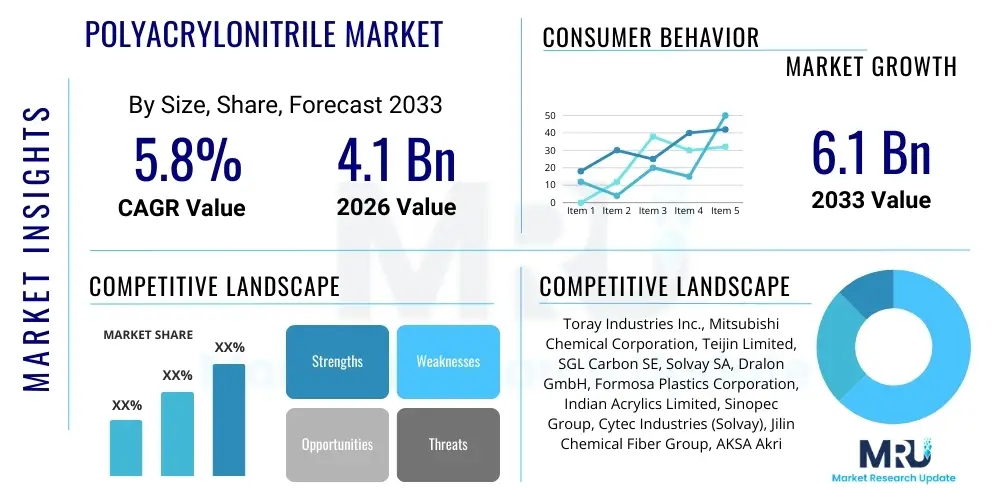

The Polyacrylonitrile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Polyacrylonitrile Market introduction

Polyacrylonitrile (PAN) is a semi-crystalline synthetic polymer resin characterized by its excellent thermal stability, chemical resistance, and tensile strength. It is principally utilized as the essential precursor material for over 90% of global carbon fiber production, making its market trajectory intrinsically linked to the high-performance composites sector. Beyond carbon fiber, PAN finds significant applications in textile fibers, often blended with natural fibers like wool or cotton to improve durability and dyeing characteristics, and in specialty applications such as filtration membranes, particularly those requiring high chemical and temperature resistance. The inherent versatility and superior mechanical properties of PAN fibers drive its adoption across strategic industries including aerospace, automotive, construction, and renewable energy.

The core benefits driving PAN market expansion include its high modulus of elasticity, lightweight nature when converted to carbon fiber, and resistance to UV degradation and most organic solvents. These characteristics are critical for reducing weight and enhancing fuel efficiency in transportation sectors, thereby aligning with global sustainability mandates. Furthermore, ongoing research focuses on improving PAN polymerization efficiency and reducing precursor production costs, which is paramount for achieving wider commercial viability of carbon fiber reinforced plastics (CFRPs) in mass-market applications. The increasing deployment of advanced filtration technologies, especially in water treatment and air purification, further solidifies the demand base for PAN-based hollow fiber membranes.

The primary driving factors for the Polyacrylonitrile market are centered on the burgeoning demand from the aerospace and defense industries for lightweight, high-strength materials, coupled with the mass electrification and structural optimization efforts within the automotive sector. Asia Pacific remains the powerhouse for both precursor manufacturing and downstream consumption, particularly due to rapid industrialization and governmental investment in advanced infrastructure projects. Furthermore, technological advancements in precursor spinning and stabilization processes, aiming to increase carbon yield and reduce energy consumption, continue to sustain market growth and enhance product differentiation among key manufacturers.

Polyacrylonitrile Market Executive Summary

The Polyacrylonitrile (PAN) market is experiencing robust expansion driven predominantly by escalating global demand for carbon fiber, especially within high-value sectors such as aerospace, defense, and wind energy infrastructure. Key business trends indicate a strategic shift towards capacity expansion in regions with readily available acrylonitrile feedstock and low manufacturing costs, primarily China and India, aiming to satisfy the massive composite materials demand. Furthermore, market players are intensely focused on developing eco-friendly and bio-based PAN precursors to address increasing regulatory scrutiny regarding environmental impact, presenting a significant area for innovation and competitive advantage.

Regionally, Asia Pacific maintains undisputed market leadership, fueled by extensive government subsidies supporting domestic carbon fiber production and high consumption rates in construction and automotive manufacturing. North America and Europe, while smaller in volume, command higher market value due to concentrated demand from specialized aerospace and luxury automotive segments, emphasizing premium-grade, ultra-high modulus PAN-based carbon fibers. The trend across all regions is towards vertical integration, where carbon fiber manufacturers seek to control the entire supply chain, from raw acrylonitrile sourcing to finalized PAN precursor production, ensuring quality control and stable supply amid volatile feedstock prices.

Segment trends reveal that the carbon fiber precursor application segment overwhelmingly dominates the market volume and revenue, reflecting its critical role in advanced manufacturing. Within textiles, the focus is shifting toward high-performance technical textiles, such as outdoor wear and fire-resistant materials, rather than commodity apparel. Geographically, while large-scale production facilities are localized in APAC, the intellectual property and high-end processing technologies largely reside in mature markets like Japan, the US, and Germany, influencing global pricing and technological standards. The membrane segment, although niche, is poised for accelerated growth due to stringent global water quality standards and industrial wastewater treatment mandates.

AI Impact Analysis on Polyacrylonitrile Market

User queries regarding AI's influence on the Polyacrylonitrile market frequently revolve around how artificial intelligence and machine learning (ML) can optimize complex, energy-intensive processes like polymerization, spinning, and stabilization of PAN precursors, thereby reducing manufacturing costs and improving material consistency. Key concerns include the adoption rate of predictive maintenance in highly specialized fiber lines and the use of generative AI models to simulate and discover novel PAN co-polymers with enhanced properties, such as lower cyclization temperatures or increased carbon yield. Users also express strong interest in how AI-driven supply chain transparency can mitigate risks associated with acrylonitrile feedstock price volatility and geopolitical disruptions, ensuring a stable and cost-effective supply chain for carbon fiber manufacturers globally.

- AI-driven optimization of polymerization kinetics, minimizing batch-to-batch variability and ensuring uniform molecular weight distribution crucial for high-quality carbon fiber.

- Predictive maintenance analytics applied to high-speed spinning lines and stabilization ovens, drastically reducing unexpected downtime and maximizing throughput efficiency.

- Machine Learning algorithms utilized for real-time quality control and defect detection during fiber spinning and drawing processes, enhancing product consistency above human capacity.

- Generative AI used in materials informatics to screen thousands of potential PAN co-polymer formulations, accelerating the discovery of precursors with superior thermo-oxidative stability.

- Optimization of energy consumption in the highly energy-intensive thermal stabilization phase through AI-managed heating profiles and environmental condition adjustments.

- Supply chain risk management using AI to forecast acrylonitrile feedstock price fluctuations and optimize inventory levels, minimizing procurement costs and securing material availability.

DRO & Impact Forces Of Polyacrylonitrile Market

The Polyacrylonitrile market dynamics are significantly shaped by the interplay of robust demand drivers, substantial operational restraints, and compelling strategic opportunities, all moderated by strong external impact forces. The primary driver is the accelerating penetration of carbon fiber composites in structural applications across aerospace and automotive sectors, mandated by stringent regulations requiring lower emissions and lighter vehicles. However, the high capital expenditure required for establishing PAN polymerization and spinning facilities, coupled with the volatility and environmental toxicity associated with acrylonitrile monomer production, acts as a substantial restraint. Opportunities primarily lie in developing cost-effective, continuous process technologies and exploring novel applications in emerging markets like hydrogen storage tanks and urban air mobility vehicles.

Key impact forces influencing the market include global crude oil pricing, which dictates the cost of propylene (a feedstock for acrylonitrile), leading to significant price fluctuations for PAN. Environmental regulations, particularly those concerning solvent recovery and monomer handling, necessitate high compliance costs, influencing manufacturing location strategies. Technological disruption in the form of alternative precursor materials, although currently small, poses a long-term threat. Furthermore, geopolitical stability plays a critical role, as major acrylonitrile production is concentrated in specific regions, making the supply chain vulnerable to trade disputes and logistical bottlenecks, thereby impacting global carbon fiber production capabilities.

The ongoing push for sustainable manufacturing represents both a restraint (due to compliance costs) and an opportunity (for bio-based PAN development). As industries globally commit to net-zero targets, the demand for lightweighting solutions will only intensify, cementing PAN’s role. However, achieving economies of scale large enough to make carbon fiber competitive with traditional materials like steel and aluminum remains the most crucial challenge, requiring sustained investment in processing innovation and market development. Successfully navigating these forces—leveraging innovation against cost and regulatory pressures—will determine the long-term competitive landscape of the PAN market.

Segmentation Analysis

The Polyacrylonitrile market is systematically segmented based on its primary application, which dictates the required polymer quality and end-use characteristics, and geographically, reflecting consumption patterns and manufacturing capacity. The market fundamentally separates into the carbon fiber precursor segment, demanding ultra-high purity and specific molecular characteristics, and the textile and filtration segments, which prioritize cost-effectiveness and specific fiber diameter/porosity, respectively. This segmentation allows manufacturers to tailor their production processes and material specifications precisely to the demanding requirements of aerospace-grade composites versus general-purpose apparel fibers or specialized membrane filters, optimizing value delivery across diverse industrial landscapes.

- By Application:

- Carbon Fiber Precursor

- Textiles and Fibers (Acrylic Fibers)

- Filtration Media (Hollow Fiber Membranes)

- Others (Cement Additives, Asphalt Modifiers)

- By Modality:

- Homopolymers

- Co-polymers (e.g., PAN/Methyl Acrylate)

- By End-Use Industry:

- Aerospace and Defense

- Automotive and Transportation

- Wind Energy (Turbine Blades)

- Construction and Infrastructure

- Water Treatment

- Textile and Apparel

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Polyacrylonitrile Market

The Polyacrylonitrile value chain is characterized by a high degree of integration between the upstream petrochemical industry and the specialized downstream carbon fiber manufacturing sector. Upstream analysis focuses on the production of the primary monomer, acrylonitrile (AN), which is typically derived from propylene and ammonia via the SOHIO process, making the PAN market highly sensitive to fluctuations in crude oil and natural gas prices. Key upstream players include major chemical and petrochemical companies that supply high-purity AN to polymer manufacturers. The midstream involves the polymerization of AN, often incorporating co-monomers to enhance processability and final fiber quality, followed by sophisticated wet or dry spinning techniques to form PAN precursor fibers.

Downstream operations are dominated by the conversion of PAN precursors into high-strength carbon fibers through stabilization, carbonization, and surface treatment processes, which are technologically demanding and energy-intensive. The primary consumers are manufacturers of composite components for aerospace, which require aerospace-grade carbon fiber (the most expensive and stringent requirement), followed by automotive and wind energy sectors, which utilize standard-modulus carbon fiber. The distribution channel for PAN products is dual: Direct sales are common for high-volume, highly technical precursors sold directly to integrated carbon fiber producers, while indirect channels utilizing specialty distributors are employed for textile fibers and membrane modules reaching smaller, dispersed end-users.

The trend towards vertical integration is highly prominent, especially in Asia, where major carbon fiber producers are increasingly acquiring or building their own PAN precursor manufacturing facilities to secure supply, control quality, and reduce the high costs associated with external procurement. This integration minimizes reliance on fluctuating external markets and ensures the precursor is tailored precisely to the manufacturer's specific carbonization process, which is critical for achieving optimal mechanical properties in the final composite part. This structure dictates that profitability often hinges on process efficiency and securing long-term, stable raw material contracts.

Polyacrylonitrile Market Potential Customers

The potential customer base for Polyacrylonitrile is segmented primarily by the form factor of the end product, ranging from precursor fibers to technical textiles and membranes. The largest and most lucrative customer segment comprises aerospace and defense contractors, along with high-performance automotive manufacturers, who consume PAN-based carbon fiber for critical structural components, prioritizing material performance, strength-to-weight ratio, and long-term durability over initial material cost. These customers demand the highest quality PAN precursors, often requiring specific co-polymer configurations to optimize the carbonization yield and minimize defects in their composite parts.

A rapidly expanding customer segment includes manufacturers of renewable energy infrastructure, specifically wind turbine blade producers. The increasing size and complexity of offshore and onshore wind blades necessitates vast quantities of structural carbon fiber to maintain stiffness while reducing mass, positioning these manufacturers as high-volume purchasers of standard modulus PAN precursors. Furthermore, the global construction and civil engineering sectors represent emerging potential, using carbon fiber for seismic retrofitting and strengthening aging infrastructure, seeking materials that offer superior fatigue resistance and longevity compared to traditional steel reinforcement.

In specialty applications, water and wastewater treatment facilities, along with industrial processing plants, are significant consumers of PAN-based filtration membranes due to their superior chemical resistance and high flow rates. Textile manufacturers, although representing a mature market, remain consistent buyers of acrylic fibers for outdoor, technical, and performance apparel where thermal insulation, moisture wicking, and low pilling characteristics are desired. Successful engagement with these customers requires a diverse portfolio capable of meeting the stringent specifications of aerospace while remaining cost-competitive for industrial and textile applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries Inc., Mitsubishi Chemical Corporation, Teijin Limited, SGL Carbon SE, Solvay SA, Dralon GmbH, Formosa Plastics Corporation, Indian Acrylics Limited, Sinopec Group, Cytec Industries (Solvay), Jilin Chemical Fiber Group, AKSA Akrilik Kimya Sanayii A.S., Taekwang Industrial Co. Ltd., Anhui Newman Textile Co., Ltd., China National Petroleum Corporation (CNPC), Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, Dow Inc., Reliance Industries Limited, Zhejiang Kaiman Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyacrylonitrile Market Key Technology Landscape

The technological evolution within the Polyacrylonitrile market is intensely focused on refining precursor fiber production to enhance the efficiency and reduce the cost of subsequent carbon fiber conversion. Current best practices involve advanced polymerization techniques, such as solution polymerization and precipitation polymerization, which are critical for controlling the molecular weight and narrow dispersity of the resulting polymer chain, crucial parameters for high-performance carbon fiber. Furthermore, the integration of specialized co-monomers, such as methyl acrylate or itaconic acid, remains a core technological focus. These co-monomers improve the fiber's thermal stability and decrease the required cyclization temperature during the energy-intensive stabilization step, leading to substantial energy savings and faster processing times for carbon fiber manufacturers.

Key innovations are also emerging in the spinning technology realm. While traditional wet spinning is widely used, particularly for high-modulus applications, dry-jet wet spinning is gaining traction as it offers a higher degree of control over the fiber structure and pore size distribution, critical for filtration membranes and uniform precursor preparation. The push for sustainability has spurred research into non-toxic solvents, seeking to replace traditional dimethylformamide (DMF) or dimethylacetamide (DMAc) with greener alternatives like ionic liquids or aqueous systems. This transition, while challenging due to process adjustments, promises compliance advantages and reduced environmental footprint, appealing strongly to European and North American regulators and customers.

A crucial area of ongoing research and development involves surface modification and stabilization technology for the PAN fibers. Advanced surface treatments and controlled oxidation processes are being deployed to optimize the chemical structure of the precursor before carbonization. These processes aim to increase the carbon yield—the amount of carbon fiber produced per unit mass of PAN precursor—thereby directly lowering the overall cost of carbon fiber production. Technologies utilizing plasma treatment or microwave heating are being explored as rapid, energy-efficient alternatives to traditional slow oven stabilization, promising a significant shift towards more cost-effective manufacturing methods capable of achieving economies of scale required for mass-market adoption.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant global market for Polyacrylonitrile, both in terms of production capacity and consumption, largely driven by Chinese and Indian manufacturers. China is the world's largest consumer and producer of both PAN precursor and subsequent carbon fiber, supported by significant government subsidies aimed at achieving self-sufficiency in high-performance composite materials for infrastructure, automotive electrification, and defense modernization. High demand from the textile sector and the rapid expansion of water treatment infrastructure further solidifies APAC's market leadership.

- North America: This region is characterized by high demand for specialized, premium-grade PAN precursor, primarily serving the mature aerospace and defense industries, particularly the United States. While manufacturing capacity is significant, the focus is less on volume and more on ultra-high modulus carbon fiber production, utilizing proprietary technology. Regulatory emphasis on lightweighting in the automotive industry provides a stable growth driver, encouraging localized precursor development tailored for automotive-grade composites.

- Europe: Europe maintains a strong market presence, driven by strict EU emissions regulations pushing automotive lightweighting and extensive investment in the massive offshore wind energy sector, which demands high-strength carbon fibers. Countries like Germany and the UK are centers for advanced materials research and downstream composite manufacturing. European manufacturers often lead the transition towards sustainable and bio-based PAN formulations to comply with stringent environmental standards and gain competitive advantage.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging markets for PAN. Growth in LAMEA is closely tied to infrastructure development, oil and gas sector demands (where carbon fiber is used for structural integrity and corrosion resistance), and increasing investment in localized water and sanitation projects, boosting demand for filtration membranes. Economic volatility and reliance on imports for high-grade precursors remain significant limiting factors, though domestic production is slowly being developed in economically stable nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyacrylonitrile Market.- Toray Industries Inc.

- Mitsubishi Chemical Corporation

- Teijin Limited

- SGL Carbon SE

- Solvay SA

- Dralon GmbH

- Formosa Plastics Corporation

- Indian Acrylics Limited

- Sinopec Group

- Jilin Chemical Fiber Group

- AKSA Akrilik Kimya Sanayii A.S.

- Taekwang Industrial Co. Ltd.

- Anhui Newman Textile Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Reliance Industries Limited

- Zhejiang Kaiman Chemical Co., Ltd.

- Toho Tenax Co., Ltd. (Teijin Group)

- Hyosung Advanced Materials

Frequently Asked Questions

Analyze common user questions about the Polyacrylonitrile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Polyacrylonitrile (PAN)?

The primary factor driving PAN demand is the escalating global requirement for carbon fiber, especially within high-performance applications such as aerospace, automotive lightweighting, and wind turbine blade manufacturing, as PAN serves as the essential precursor material.

How does the volatility of acrylonitrile feedstock affect the PAN market?

The cost of Polyacrylonitrile is highly sensitive to the price volatility of its primary raw material, acrylonitrile, which is derived from propylene. Fluctuations in crude oil and natural gas prices directly impact AN procurement, posing a significant challenge to the profitability and stable pricing of PAN fibers.

Which geographical region dominates the global PAN production and consumption?

The Asia Pacific (APAC) region, led predominantly by China, dominates both the production capacity and consumption of Polyacrylonitrile, supported by large-scale domestic investment in infrastructure, robust textile manufacturing, and governmental focus on building self-sufficient carbon fiber supply chains.

What technological innovations are impacting the cost reduction of PAN precursors?

Key technological innovations focus on improving polymerization techniques and utilizing co-monomers to lower the cyclization temperature required during the energy-intensive stabilization phase, thereby increasing the carbon yield and reducing the overall energy consumption and production cost of the final carbon fiber.

Beyond carbon fiber, what are the critical specialty applications for Polyacrylonitrile?

Critical specialty applications for PAN include high-efficiency hollow fiber membranes used extensively in water treatment and industrial filtration due to their superior chemical and thermal resistance, as well as use in specialty technical textiles and cement additives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Polyacrylonitrile (PAN) Market Size Report By Type (Acrylic Staple Fiber, Acrylic Tow, Acrylic Top), By Application (Filtration, Textiles, Precursors to carbon fiber, Outdoor, Fiber-reinforced concrete), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- CF and CFRP Market Statistics 2025 Analysis By Application (Aerospace, Automotive, Ship, Medical), By Type (Polyacrylonitrile Carbon Fiber, Pitch Based Carbon Fiber, Rayon Carbon Fiber, Thermosetting CFRP), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Anti-Static Floor Mats Market Statistics 2025 Analysis By Application (Household, Commercial, Industrial), By Type (PVC, Polyamide Fiber, Polyester Fiber, Polyacrylonitrile Fiber, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Carbon Fiber Reinforced Thermoplastic Resin Market Statistics 2025 Analysis By Application (Automotives, Electrical Appliances, Sporting Goods), By Type (Polyacrylonitrile (PAN)-based CFRTP, Pitch-based CFRTP), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Polyacrylonitrile Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Acrylic Staple Fiber, Acrylic Tow, Acrylic Top), By Application (Fіltrаtіоn, Техtіlеѕ, Рrесurѕоrѕ tо саrbоn fіbеr, Оutdооr, Fіbеr-rеіnfоrсеd соnсrеtе), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager