Polyanionic Cellulose Polymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432165 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polyanionic Cellulose Polymer Market Size

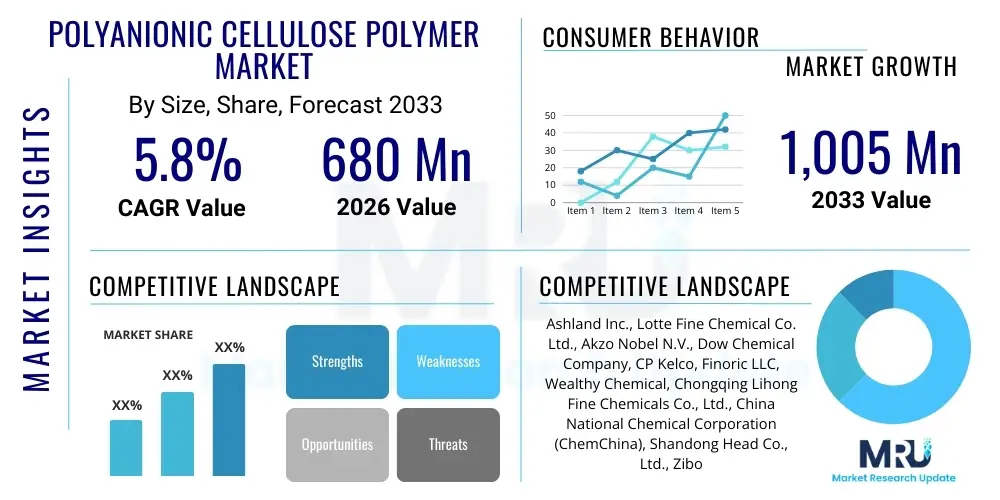

The Polyanionic Cellulose Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 680 Million in 2026 and is projected to reach USD 1,005 Million by the end of the forecast period in 2033.

Polyanionic Cellulose Polymer Market introduction

Polyanionic Cellulose (PAC) is a water-soluble polymer derived from natural cellulose, specifically designed to function as an efficient viscosifier, protective colloid, and fluid loss reducer across a myriad of industrial applications. Its chemical structure grants it excellent stability under high temperatures and high salinity conditions, making it indispensable in environments where conventional polymers fail. The market expansion is fundamentally driven by the robust demand from the oil and gas sector, where PAC is a critical component in formulating drilling fluids, specifically for optimizing rheological properties and minimizing water loss into formations, thereby ensuring borehole stability and improving drilling efficiency in complex geological settings.

The product is typically classified based on its purity and viscosity grade, offering tailored solutions for specialized uses. For instance, high-viscosity PAC is predominantly utilized in drilling operations, while medium-to-low viscosity grades find extensive use in non-drilling applications such such as textiles, paper processing, detergents, and food products (though less common than CMC, certain high-purity PAC grades are suitable). Its primary function in these auxiliary industries is to serve as a binder, thickener, or stabilizer. The inherent benefits of PAC, including its non-toxic nature, biodegradability, and superior performance characteristics compared to other synthetic and natural thickeners under extreme conditions, cement its position as a preferred polymer in high-performance industrial processes.

Major applications driving the current market trajectory include horizontal and directional drilling activities, which require superior fluid control and stability. The ongoing global exploration activities for unconventional gas and oil reserves, particularly in deep-water and high-pressure/high-temperature (HPHT) environments, directly necessitate the use of high-quality PAC to maintain drilling fluid integrity. Furthermore, increasing urbanization and subsequent growth in the construction sector are contributing factors, as PAC is also employed in construction materials like plaster and cement mixtures for enhanced water retention and workability, providing multiple avenues for sustained market expansion beyond the petroleum industry.

Polyanionic Cellulose Polymer Market Executive Summary

The Polyanionic Cellulose Polymer market is characterized by mature technological processes in production coupled with high demand elasticity linked predominantly to global crude oil and natural gas exploration expenditures. Current business trends indicate a critical focus on developing superior quality PAC grades, specifically High-Purity PAC (PAC-HV and PAC-LV), which exhibit enhanced thermal stability and salt tolerance essential for deep-sea and shale drilling projects. Key manufacturers are investing heavily in capacity expansion and backward integration strategies to secure raw material supplies (refined cellulose), thereby optimizing production costs and maintaining competitive pricing in a largely consolidated market structure. Supply chain resilience, particularly regarding logistics and storage, remains a central theme due to the fluctuating nature of oil exploration activities and subsequent demand volatility.

Regionally, the market dynamics are heavily skewed towards regions with intense oil and gas extraction activities. The North American market, driven by shale gas exploration in the Permian Basin and other unconventional resources, commands the largest share, showcasing robust demand for specialized PAC products used in hydraulic fracturing fluids. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by expanding energy demands in China, India, and Southeast Asia, coupled with substantial growth in non-oilfield applications such as textile sizing and paper manufacturing. European growth, while steady, is increasingly focused on high-specification, environmentally friendly PAC derivatives that align with stringent regional environmental regulations, particularly concerning wastewater discharge and biodegradable inputs.

Segmentation analysis reveals that the High Viscosity (HV) grade dominates the market by revenue due to its indispensable role in rheology control during drilling operations, commanding premium pricing and consistent demand from major service providers. Conversely, the Low Viscosity (LV) grade is projected to register faster volume growth, driven by its diverse use across general industrial sectors, including ceramics, paint thickening, and standardized industrial drilling muds where high fluid retention capability is prioritized over extreme viscosity enhancement. The application segment remains dominated by Oilfield Chemicals, reflecting the fundamental dependency of the PAC market on global energy exploration capital expenditure and the continuous need for reliable fluid loss control agents in complex reservoir engineering.

AI Impact Analysis on Polyanionic Cellulose Polymer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Polyanionic Cellulose Polymer market primarily focus on three interconnected themes: optimization of complex synthesis processes, predictive demand forecasting in volatile energy markets, and enhancing material performance through simulation. Users frequently ask how AI can reduce the variability in PAC production purity and viscosity, which is critical for oilfield performance. Furthermore, there is significant interest in using machine learning (ML) algorithms to analyze drilling data in real-time to predict optimal PAC concentration needed for specific geological formations (AEO focus: 'Optimizing PAC dosage using AI'). This shift towards data-driven formulation promises reduced material wastage, cost efficiency for service companies, and potentially opens avenues for designing 'smart' PAC derivatives with optimized molecular weights and substitution levels based on deep learning models simulating downhole conditions. The core expectation is that AI will move PAC manufacturing and deployment from empirical testing to predictive optimization.

- AI optimizes PAC synthesis parameters (temperature, reaction time, reagent ratios) to ensure consistent high purity and specific viscosity profiles, minimizing batch-to-batch variation.

- Machine Learning (ML) algorithms are utilized for predictive maintenance of drilling fluid systems, forecasting the required PAC consumption based on real-time lithological data and wellbore conditions, thus reducing inventory costs.

- AI-driven simulation tools accelerate the R&D process for novel, high-temperature/high-salinity resistant PAC grades by rapidly screening chemical structures and predicting performance characteristics without extensive lab work.

- Demand forecasting models leverage macroeconomic indicators, oil price volatility, and regional drilling rig counts to provide accurate predictions of future PAC consumption, improving supply chain efficiency and pricing strategies for manufacturers.

- Robotic Process Automation (RPA) powered by AI enhances quality control in manufacturing plants by automatically inspecting finished PAC products for particle size distribution and contamination, ensuring adherence to strict API specifications.

DRO & Impact Forces Of Polyanionic Cellulose Polymer Market

The dynamics of the Polyanionic Cellulose Polymer market are heavily influenced by a combination of inherent advantages and external economic pressures. Key drivers include the necessity for effective fluid loss control in advanced drilling techniques, particularly horizontal and deep-water operations where high pressure and temperature necessitate superior polymer stability. Restraints largely stem from the volatile nature of crude oil prices, which directly impacts upstream capital expenditure and subsequently suppresses the demand for drilling fluid additives. Opportunities lie predominantly in expanding non-oilfield applications, especially in high-growth industrial sectors like construction chemicals and specialized personal care products, alongside the development of bio-based and highly biodegradable PAC derivatives that meet rising global sustainability standards. These forces collectively dictate market momentum and investment direction.

The primary impact forces acting upon the PAC market include the global transition toward renewable energy sources, which, while gradual, poses a long-term threat to sustained oil and gas exploration budgets, thereby capping the growth potential from the core application segment. Conversely, regulatory mandates in key regions demanding enhanced environmental safety and biodegradable inputs are acting as a catalyst for innovation, pushing manufacturers to develop advanced PAC grades that are both highly functional and environmentally benign. Technological advancements in drilling automation and efficiency also affect the market; as drilling times decrease, the overall volume of drilling fluid additives consumed per well might drop, necessitating a shift toward premium, high-performance additives that provide unparalleled efficiency and stability over generic alternatives.

Furthermore, competition from substitute products, particularly Carboxymethyl Cellulose (CMC) and various synthetic polyacrylates, presents a continuous challenge, forcing PAC manufacturers to clearly articulate and demonstrate the superior performance benefits of PAC under extreme conditions. The intensity of competition among existing suppliers, mainly concentrated in Asia, drives aggressive pricing strategies and necessitates operational excellence to maintain profit margins. The bargaining power of major oilfield service companies (buyers) is exceptionally high due to their scale and volume purchasing, requiring PAC suppliers to maintain strict quality control (API specifications) and offer customized logistics solutions to secure large, multi-year supply contracts.

Segmentation Analysis

The Polyanionic Cellulose (PAC) Polymer market is fundamentally segmented based on factors such as grade type (viscosity), the purity level, and the end-use application, each reflecting distinct performance requirements and pricing structures. High Viscosity (HV) and Low Viscosity (LV) PAC grades form the backbone of the product segmentation. The HV grade is formulated to impart high shear-thinning viscosity to water-based drilling muds, crucial for hole cleaning and suspension of weighting agents (barite). In contrast, the LV grade primarily functions as an excellent filtration control agent, minimizing fluid loss into permeable formations while having a lesser impact on overall mud viscosity. The strategic combination of these grades allows drilling engineers to finely tune the rheological profile of the drilling fluid tailored to specific geological challenges, maximizing operational safety and drilling rates.

Purity segmentation, often categorized into technical grade and refined/premium grade, also plays a critical role. Technical grade PAC is generally used in less demanding industrial applications or basic shallow drilling operations. The refined or premium grade, characterized by very low levels of impurities and high active polymer content, strictly adheres to API standards (American Petroleum Institute) and is mandatory for deep-water, HPHT, and complex directional wells where polymer stability is paramount. The increasing complexity of global oil and gas exploration is continually shifting demand toward these higher-purity, more expensive grades, thereby improving the market's overall revenue realization per unit volume despite potential fluctuations in total volume consumed.

Application-wise, the market heavily relies on the Oilfield Chemicals sector, which drives bulk demand. However, the diversification into secondary applications provides resilience against cyclical downturns in the energy sector. These secondary segments, including construction, ceramics, textiles, and paper, value PAC for its excellent water retention, binding capabilities, and chemical stability. For instance, in the textile industry, PAC is used as a sizing agent, providing strength and smoothness to yarn during weaving. Ongoing technological advancements focus on cross-linking modifications and grafting techniques to further enhance the PAC polymer's performance characteristics, opening new avenues in specialized sectors like geothermal energy drilling and environmental remediation.

- By Grade:

- High Viscosity (HV) PAC

- Low Viscosity (LV) PAC

- By Purity:

- Technical Grade

- Refined Grade (Premium/API Compliant)

- By Application:

- Oilfield Chemicals (Drilling, Completion, Workover Fluids, Hydraulic Fracturing)

- Textile Industry

- Detergents and Cleaning Agents

- Paper Industry

- Construction and Building Materials

- Ceramics and Other Industrial Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Polyanionic Cellulose Polymer Market

The Polyanionic Cellulose polymer value chain commences with the sourcing of refined cellulose, typically derived from wood pulp or cotton linters, which constitutes the primary raw material input. This upstream segment is dominated by specialized pulp and paper manufacturers who must ensure high-quality, consistent cellulose feedstock. The subsequent manufacturing phase involves the etherification of cellulose with monochloroacetic acid (MCA) or similar reagents in an alkaline medium to produce PAC. This phase is capital-intensive and requires stringent quality control to achieve specific degrees of substitution (DS) and polymerization necessary for high-performance end-use in oilfields. Efficiency in this manufacturing step is crucial for cost management.

The midstream involves processing, drying, grinding, and packaging the PAC product, often tailored to meet specific client specifications (e.g., granular size, hydration rate). Distribution channels are highly specialized, utilizing both direct sales models for major oilfield service companies (OFS providers like Schlumberger or Halliburton) and indirect channels involving chemical distributors and regional traders who handle smaller volumes for non-oilfield industrial applications. The complexity of handling bulk chemical logistics and maintaining stable inventory necessitates robust supply chain management capabilities, especially when delivering to remote drilling locations globally.

Downstream utilization is dominated by the Oilfield Chemicals sector, where PAC is formulated into drilling muds and specialized completion fluids. The end-users, encompassing exploration and production (E&P) companies, rely heavily on the performance and consistency of PAC to ensure the technical success and cost-efficiency of their drilling programs. Direct sales ensure tight control over product performance communication and customization, while indirect distribution allows market penetration into diverse industrial sectors globally, broadening the overall demand base. Optimization across the entire chain is focused on reducing lead times, enhancing product purity, and minimizing transportation costs to maintain competitive leverage.

Polyanionic Cellulose Polymer Market Potential Customers

The primary and most significant purchasers and end-users of Polyanionic Cellulose polymers are global oilfield service companies (OFS) and major independent and national oil companies (NOCs) responsible for drilling and well intervention. These customers require massive volumes of high-specification, API-compliant PAC (refined grade) for formulating water-based drilling muds, crucial for fluid loss prevention and rheology stabilization in complex, high-cost wells, including deep-water and unconventional shale operations. Their purchasing decisions are driven by strict performance criteria, consistency, and compliance with API 13A standards.

Secondary, yet rapidly expanding, customer segments include textile manufacturers, particularly those in Asia Pacific, who utilize PAC as a highly effective sizing agent to prepare warp yarns for weaving, increasing the strength and reducing breakage rates. Detergent and cleaning agent formulators purchase PAC for its anti-redeposition properties in laundry products. Furthermore, construction chemical companies utilize PAC as a water retainer and thickener in cement mortars, plasters, and tile adhesives, seeking to improve workability and curing properties. These diverse industrial buyers typically purchase lower-viscosity or technical-grade PAC, prioritizing cost-effectiveness alongside satisfactory functional performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680 Million |

| Market Forecast in 2033 | USD 1,005 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashland Inc., Lotte Fine Chemical Co. Ltd., Akzo Nobel N.V., Dow Chemical Company, CP Kelco, Finoric LLC, Wealthy Chemical, Chongqing Lihong Fine Chemicals Co., Ltd., China National Chemical Corporation (ChemChina), Shandong Head Co., Ltd., Zibo Wuyue Chemical Co., Ltd., Maverick Applied Science, Shijiazhuang Guangshun Chemical, Spectrum Chemical Mfg. Corp., Sinofloc Chemical Ltd., Yixing Tongtai Chemical Co., Ltd., Hebei Jinchang Chemical, Shanghai Luyuan Chemical, Tethys Oil. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyanionic Cellulose Polymer Market Key Technology Landscape

The technological landscape of the Polyanionic Cellulose polymer market is characterized by process optimization aimed at achieving higher purity levels and precise control over substitution degrees and molecular weight distribution. Modern manufacturing techniques increasingly employ automated, closed-loop reactor systems to control the critical etherification reaction, which uses monochloroacetic acid to functionalize the cellulose backbone. This precise control is essential for creating high-performance PAC grades that meet stringent API 13A specifications, particularly regarding filter loss characteristics and thermal stability required for deep drilling environments. Advanced drying technologies, such as spray drying or fluidized bed drying, are utilized to ensure uniform particle size and rapid hydration rates when the polymer is introduced into drilling fluids, enhancing efficiency at the wellsite.

Innovation is also heavily focused on the post-synthesis modification of PAC structures. Research and development efforts are concentrated on developing modified PAC polymers through grafting or cross-linking techniques using novel reagents. These modifications aim to enhance resistance to severe operational conditions, such as extremely high salinity (saturated brine muds) and temperatures exceeding 350°F, where conventional PAC tends to degrade rapidly. Successful implementation of these advanced derivatives allows E&P companies to utilize water-based mud systems in challenging reservoirs that previously mandated more expensive, environmentally complex oil-based muds, creating a technological competitive advantage for the suppliers.

Furthermore, sustainability is driving technological evolution. Manufacturers are exploring the use of more environmentally friendly cellulose sources and developing production methods that minimize the use of harsh solvents and reduce wastewater output. The incorporation of nanotechnology and micro-encapsulation techniques is an emerging trend. For example, micro-encapsulated PAC could offer delayed release mechanisms, allowing the polymer to remain inactive until specific temperature or pressure conditions are met downhole, thereby maximizing its lifespan and effectiveness in complex multi-stage drilling or fracturing operations. This focus on green chemistry and controlled delivery is vital for future market relevance and adherence to evolving global environmental standards, particularly in sensitive offshore drilling areas.

Regional Highlights

North America currently holds the dominant position in the Polyanionic Cellulose Polymer market, primarily driven by the continuous and intense unconventional oil and gas exploration activities, particularly shale plays across the United States and Canada. The region’s extensive reliance on hydraulic fracturing and horizontal drilling necessitates massive volumes of high-performance fluid loss additives to ensure borehole stability and optimize completion processes. Regulatory frameworks, while generally stringent, still permit extensive drilling operations, sustaining a high level of demand for refined-grade PAC. Investment in advanced drilling technologies and the presence of major oilfield service providers in this region further solidify its leading market share, requiring local suppliers to maintain large inventories and highly specialized production capabilities tailored to the demanding conditions of US onshore basins.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment throughout the forecast period. This rapid growth is attributable not only to rising energy demands and modest increases in exploration activities in countries like China, Indonesia, and Malaysia but, more significantly, to the burgeoning industrial sectors. Countries such as India and China have massive textile, paper, and construction industries that rely heavily on PAC for its thickening and binding properties. The combination of industrial manufacturing expansion and infrastructural development, particularly in large developing economies, ensures a diversified and accelerating demand base, mitigating the reliance solely on the cyclical oil and gas sector. Furthermore, increased investment in natural gas projects across Southeast Asia contributes materially to PAC consumption.

Europe and the Middle East & Africa (MEA) regions represent established but distinct market profiles. The European market, while constrained by limited domestic drilling and highly protective environmental legislation, maintains a steady demand for high-specification PAC grades used in industrial processes and for specialized offshore North Sea operations. The focus here is increasingly on biodegradable and sustainable polymer solutions. Conversely, the MEA region, particularly the GCC countries (Saudi Arabia, UAE, Kuwait), represents a critical hub for high-volume, conventional, and increasingly complex drilling projects. The significant capital expenditure deployed by national oil companies to maintain production capacity and explore new deep reservoirs ensures consistent, high-volume demand for API-grade PAC, making the region crucial for bulk suppliers, although geopolitical risks can introduce demand volatility.

- North America (Dominant Market): High consumption driven by extensive unconventional drilling (shale gas, oil sands) and hydraulic fracturing activities requiring specialized, high-purity PAC for fluid loss control and rheology modification under extreme shear conditions.

- Asia Pacific (Fastest Growth): Rapid expansion fueled by burgeoning industrial applications (textiles, paper, construction chemicals) and increasing but localized oil and gas exploration, particularly in coastal and offshore areas of Southeast Asia and China.

- Middle East and Africa (MEA): Large-volume market sustained by massive national oil company investments in conventional and deep-reservoir drilling projects, particularly in Saudi Arabia, UAE, and offshore West Africa, focusing on consistent supply of API-compliant grades.

- Europe: Mature market with strict environmental regulations; demand is focused on high-specification, sustainable PAC derivatives for specialized industrial uses and limited, highly regulated offshore drilling in the North Sea.

- Latin America (LATAM): Growth tied to national energy policies, specifically new offshore projects in Brazil (pre-salt) and ongoing activities in Mexico and Argentina, driving episodic but substantial demand peaks for high-performance drilling additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyanionic Cellulose Polymer Market.- Ashland Inc.

- Lotte Fine Chemical Co. Ltd.

- Akzo Nobel N.V.

- Dow Chemical Company

- CP Kelco

- Finoric LLC

- Wealthy Chemical

- Chongqing Lihong Fine Chemicals Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Shandong Head Co., Ltd.

- Zibo Wuyue Chemical Co., Ltd.

- Maverick Applied Science

- Shijiazhuang Guangshun Chemical

- Spectrum Chemical Mfg. Corp.

- Sinofloc Chemical Ltd.

- Yixing Tongtai Chemical Co., Ltd.

- Hebei Jinchang Chemical

- Shanghai Luyuan Chemical

- Tethys Oil

Frequently Asked Questions

Analyze common user questions about the Polyanionic Cellulose polymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Polyanionic Cellulose (PAC) and its primary function in drilling operations?

Polyanionic Cellulose (PAC) is a water-soluble cellulose ether polymer primarily used in water-based drilling fluids. Its chief function is to reduce fluid loss (filtration control) and modify rheology (viscosity and suspension) of the drilling mud, ensuring borehole stability and efficient cleaning, particularly in high-temperature and high-salinity environments.

How is the PAC market segmented by product grade?

The PAC market is broadly segmented into High Viscosity (HV) grade, which is used mainly for enhancing the mud's viscosity and suspension capability, and Low Viscosity (LV) grade, which is primarily focused on achieving superior fluid loss control without excessively increasing mud thickness.

Which geographical region represents the largest consumer of PAC polymers?

North America currently represents the largest consumer of Polyanionic Cellulose polymers, a dominance driven by extensive unconventional oil and gas exploration, particularly in the Permian Basin and other active shale plays that require consistent use of specialized drilling fluid additives.

What are the main substitutes for Polyanionic Cellulose in industrial applications?

The main substitutes for PAC include Carboxymethyl Cellulose (CMC), various synthetic polyacrylates, starch derivatives, and Xanthan Gum. While CMC is often competitive in non-oilfield uses, PAC is preferred for applications requiring superior stability under extreme temperature and high salt conditions.

How does the volatility of crude oil prices affect the PAC market?

The volatility of crude oil prices is a major restraint on the PAC market. When oil prices drop, exploration and production (E&P) companies reduce capital expenditure, leading to fewer drilling projects and a corresponding decrease in demand for essential drilling fluid additives like PAC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager