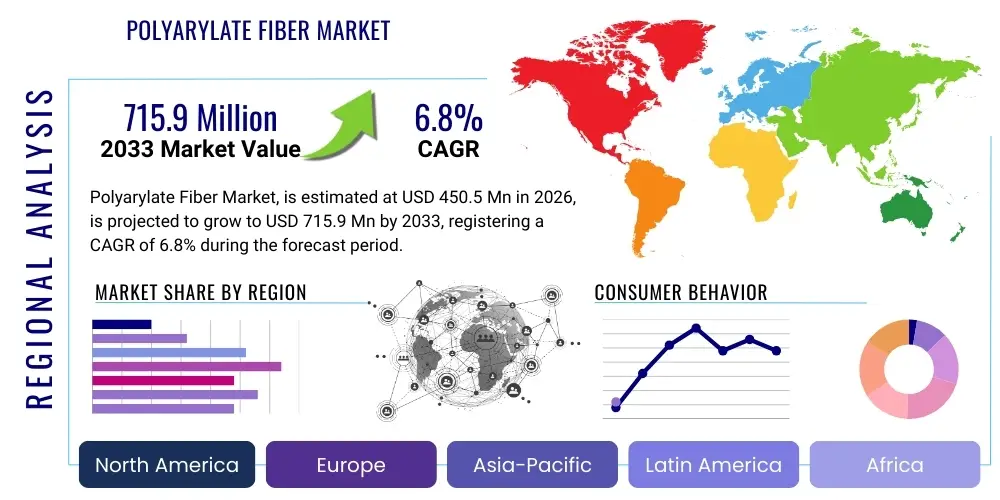

Polyarylate Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438784 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Polyarylate Fiber Market Size

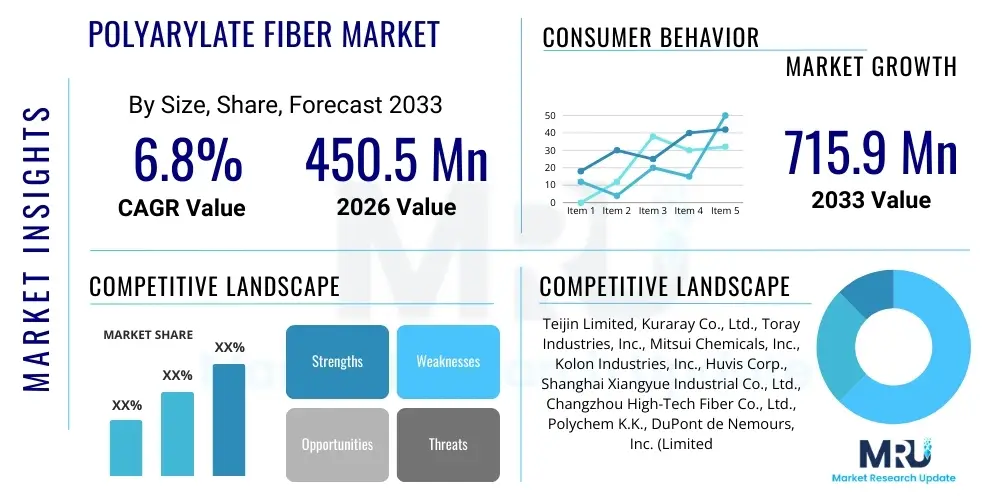

The Polyarylate Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.9 Million by the end of the forecast period in 2033.

Polyarylate Fiber Market introduction

Polyarylate fibers, often known commercially as high-performance synthetic fibers, represent a class of aromatic polyesters characterized by exceptional thermal stability, chemical resistance, and mechanical strength. These advanced materials are synthesized through the polymerization of dicarboxylic acids and dihydric phenols, resulting in a polymer backbone that is highly rigid and resistant to degradation under extreme conditions. The primary structure of polyarylates lends itself to applications where conventional polymer fibers fail, such as in high-temperature filtration, flame-retardant protective apparel, and complex composite structures. The market introduction of these fibers was driven by the increasing demand from industries—particularly aerospace, automotive, and industrial filtration—for materials that offer a superior balance of lightweight properties and robustness.

The product description highlights polyarylate fibers' distinct advantages over commodity fibers, including their inherent non-flammability, low smoke generation upon combustion, and excellent dimensional stability across a broad temperature spectrum, typically retaining structural integrity above 200°C. Major applications span structural components in high-performance vehicles, insulation materials in electrical systems, and critical protective gear for military and firefighting personnel. The unique combination of tenacity, abrasion resistance, and dielectric properties further solidifies their role in specialized engineering segments where material failure poses significant safety or operational risks. This performance profile ensures a steady, premium demand.

Key benefits driving market adoption include enhanced safety, extended product lifespan in harsh environments, and reduced maintenance costs associated with material failure. Driving factors for market growth primarily involve stringent governmental regulations regarding fire safety and personal protective equipment (PPE) standards, particularly in developed economies. Furthermore, the continuous lightweighting trend within the automotive and aerospace sectors, aiming to improve fuel efficiency and reduce emissions, creates sustained opportunities for polyarylate fibers in composite reinforcement and interior components. Technological advancements in polymerization and spinning techniques are also contributing to reduced production costs and broader application feasibility, thereby accelerating market penetration.

Polyarylate Fiber Market Executive Summary

The Polyarylate Fiber Market is experiencing robust growth fueled by intensifying regulatory pressure for high-performance protective materials and rapid expansion in sophisticated industrial filtration markets, particularly in Asia Pacific. Business trends indicate a strong focus on strategic partnerships and backward integration by key manufacturers to secure consistent raw material supply and optimize production efficiency, driven by the volatile pricing of precursors. Innovation is concentrated on developing next-generation polyarylate blends that offer improved chemical resistance and hydrolytic stability for demanding environments like chemical processing and marine applications. Furthermore, sustainability initiatives are prompting manufacturers to explore bio-based alternatives and recycling methods to reduce the environmental footprint associated with synthetic fiber production.

Regional trends reveal that Asia Pacific (APAC) currently dominates the market share due to rapid industrialization, burgeoning construction activities, and substantial investments in the automotive and electrical sectors, especially in China, Japan, and South Korea. North America and Europe, while representing mature markets, exhibit high demand for premium, specialized grades of polyarylate fibers utilized in stringent aerospace and military applications, driven by robust R&D spending and established regulatory frameworks. The demand growth in Latin America and the Middle East & Africa (MEA) is accelerating, albeit from a lower base, largely attributed to infrastructure development projects and increasing adoption of industrial safety standards across various emerging economies.

Segment trends underscore the dominance of the Filament Yarn segment, attributed to its extensive use in weaving high-strength textiles for structural applications and technical fabrics. By application, the Protective Clothing segment maintains a significant share, mandated by occupational safety laws globally, while the Filtration segment is poised for the fastest growth, driven by the need for high-efficiency particulate air (HEPA) filters and hot gas filtration systems in industrial processes like cement and steel manufacturing. Moreover, the composites segment is witnessing steady uptake as polyarylate fibers prove effective in reinforcing lightweight structural parts, offering a competitive edge against traditional materials like fiberglass in specialized applications.

AI Impact Analysis on Polyarylate Fiber Market

Common user inquiries concerning AI's influence on the Polyarylate Fiber Market revolve around optimizing polymerization processes, predicting material performance under stress, and automating quality control during spinning and weaving. Users are keenly interested in how machine learning can accelerate the discovery of novel polyarylate formulations, particularly those with enhanced thermal stability or reduced environmental impact. Key concerns include the high implementation cost of AI-driven manufacturing systems and the requisite skills gap in integrating complex predictive modeling into traditional chemical and textile manufacturing environments. Overall expectations are high, anticipating that AI will significantly reduce defects, minimize material waste, and potentially lower the prohibitive cost of these high-performance fibers through process optimization and predictive maintenance strategies.

- AI-driven optimization of polymerization kinetics, enhancing yield and purity.

- Machine learning models for predicting fiber degradation rates under extreme conditions (thermal, chemical).

- Automated visual inspection and defect detection (Quality Control) during the spinning and weaving stages.

- AI-enabled supply chain management for precursor chemicals, reducing inventory costs and lead times.

- Development of novel polyarylate copolymer structures using generative AI for material discovery.

- Predictive maintenance for specialized spinning machinery, minimizing downtime and operational expenditure.

DRO & Impact Forces Of Polyarylate Fiber Market

The market is predominantly driven by increasing global mandates for worker safety and protection against fire hazards, particularly in high-risk industries, alongside the sustained demand for lightweight, high-temperature resistant materials in advanced manufacturing sectors like aerospace and electric vehicles. However, the market faces significant restraints, chiefly stemming from the high initial capital expenditure required for sophisticated polymerization and specialized spinning equipment, coupled with the volatile pricing and limited availability of crucial raw material precursors. Opportunities are emerging through the adoption of polyarylate fibers in niche high-growth sectors such as battery separator materials for electric vehicles (EVs) and advanced infrastructure protection against seismic events or extreme weather.

Impact forces currently shaping the market dynamics include the stringent regulatory environment (Political and Legal Forces), which mandates the use of non-flammable and heat-resistant textiles in public infrastructure and occupational settings. Furthermore, intense competition from substitute materials like aramid, PBO, and carbon fibers (Competitive Forces) pressures manufacturers to continuously innovate and optimize cost structures. Technological advancements in continuous spinning processes and surface modification techniques (Technological Forces) are crucial for enhancing the functional performance of polyarylate fibers, making them suitable for increasingly complex applications. Finally, the growing consumer and industrial focus on product longevity and sustainability (Social and Environmental Forces) is indirectly favoring polyarylate fibers due to their exceptional durability and reduced need for frequent replacement.

The primary driver remains the indispensable nature of polyarylate fibers in applications requiring superior thermal and dimensional stability that commodity fibers cannot provide, ensuring they command a premium price point and maintain relevance in critical infrastructure and safety markets. The challenge lies in balancing the high input costs against the necessity for competitive pricing, especially in emerging industrial applications. Strategic investment in recycling technologies and bio-based precursors could mitigate the raw material volatility restraint and unlock substantial long-term market potential by appealing to sustainability-conscious end-users, thus transforming a restraint into a long-term opportunity for differentiated products.

Segmentation Analysis

The Polyarylate Fiber Market is meticulously segmented based on product type, application, and end-use industry, reflecting the diverse requirements and functional specifications across various vertical markets. Analyzing these segments provides crucial insights into growth pockets and technology adoption rates. The market structure is highly dependent on the ability of manufacturers to produce specific grades of fiber—such as staple fiber versus filament yarn—tailored precisely for the intended end-use, whether it involves structural reinforcement, high-temperature filtration, or incorporation into protective apparel designed for extreme environments. Understanding segment dynamics is essential for strategic planning and resource allocation in this highly specialized high-performance material market.

- By Product Type:

- Staple Fiber

- Filament Yarn

- Spunbond/Meltblown Non-Wovens

- By Application:

- Protective Clothing (Fire Retardant Apparel, Military Gear)

- Filtration (Hot Gas Filtration, Liquid Filtration, HEPA Filters)

- Composites and Reinforcement (Aerospace Composites, Automotive Parts)

- Electrical Insulation and Dielectrics

- Others (Ropes, Cables, Specialty Textiles)

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Oil & Gas

- Chemical & Petrochemical

- Manufacturing & Industrial (Cement, Steel)

- Healthcare and Medical

Value Chain Analysis For Polyarylate Fiber Market

The value chain for the Polyarylate Fiber Market begins with the upstream procurement and synthesis of specialized chemical monomers, primarily aromatic dicarboxylic acids and dihydric phenols, which require complex chemical processing and are often proprietary to a few specialized suppliers. This upstream phase is characterized by high production costs and stringent quality control, as the purity of precursors directly influences the thermal and mechanical properties of the final polyarylate fiber. Manufacturers who integrate backward often gain significant cost advantages and greater control over product specifications, mitigating risks associated with supply chain bottlenecks and quality variance.

The midstream process involves the complex polymerization reaction followed by sophisticated extrusion and spinning technologies, converting the polymer resin into either staple fibers or continuous filament yarns. This stage demands high technological expertise and specialized equipment, acting as a significant barrier to entry for new market participants. Downstream activities involve converting these specialized fibers into technical textiles, non-woven fabrics, or composite prepregs. Conversion processes are specialized, requiring specific weaving, knitting, or coating techniques to meet the performance requirements of end-user applications, such as weaving high-density fabrics for protective clothing or bonding fibers for hot gas filtration membranes.

Distribution channels for polyarylate fibers are typically highly specialized, dominated by direct sales models for large-volume end-users (like major aerospace or defense contractors) due to the necessity for detailed technical consultation and customized specification adherence. Indirect distribution involves working with niche distributors who possess specialized knowledge of technical textiles or composite materials, servicing smaller manufacturers and specialized fabricators. Due to the high-performance nature and premium price point of polyarylate fibers, the emphasis is placed on technical support, application engineering, and maintaining robust quality documentation throughout the entire supply and distribution network.

Polyarylate Fiber Market Potential Customers

Potential customers for polyarylate fibers are predominantly institutional buyers and manufacturers operating in high-risk or high-specification environments where material failure is unacceptable. Key end-users include Personal Protective Equipment (PPE) manufacturers who require fabrics with inherent flame resistance and excellent heat stability for first responders, military personnel, and industrial workers exposed to high thermal loads. Another critical customer group comprises aerospace and automotive component manufacturers focused on lightweighting and improving the thermal performance of critical engine, interior, or structural parts, where polyarylates serve as ideal reinforcement or insulation materials.

Furthermore, the manufacturing and heavy industry sectors, specifically cement, steel, and power generation plants, represent significant buyers for polyarylate-based filtration media. These industries mandate durable filter bags capable of operating continuously at elevated temperatures to comply with stringent environmental emission regulations. Specialized electrical and electronics companies also purchase these fibers for advanced insulation purposes in motors, transformers, and circuit boards, leveraging their superior dielectric properties and dimensional stability under heat, ensuring long-term reliability of electrical systems. These buyers prioritize product certification, documented performance data, and the ability of the fiber to withstand extreme operating parameters over purely cost considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teijin Limited, Kuraray Co., Ltd., Toray Industries, Inc., Mitsui Chemicals, Inc., Kolon Industries, Inc., Huvis Corp., Shanghai Xiangyue Industrial Co., Ltd., Changzhou High-Tech Fiber Co., Ltd., Polychem K.K., DuPont de Nemours, Inc. (Limited capacity/specialty grades), Solvay S.A., Indorama Ventures PCL, Sinopec Yizheng Chemical Fibre Co., Ltd., Tomen Corporation, Nippon Kayaku Co., Ltd., Toyobo Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyarylate Fiber Market Key Technology Landscape

The technology landscape for the Polyarylate Fiber Market is highly sophisticated, focusing predominantly on optimizing polymerization techniques and enhancing fiber spinning processes to achieve superior material properties and cost-effectiveness. The core technology involves the synthesis of high molecular weight polyarylates via processes like melt polymerization or solution polymerization, often utilizing specialized catalysts and precise temperature control to ensure uniformity and prevent degradation. Recent technological shifts emphasize continuous processes over batch methods, aiming to increase yield, reduce energy consumption, and ensure consistent quality, which is critical for meeting aerospace and medical standards.

A significant technological focus is placed on advanced spinning methods, primarily dry spinning or wet spinning, which allow for the manipulation of the fiber's internal structure and surface morphology. For instance, techniques like high-speed spinning are employed to achieve high tenacity and specific crystalline orientations crucial for structural reinforcement applications. Furthermore, post-spinning treatments, including thermal setting, stretching, and surface modification (e.g., plasma treatment or chemical functionalization), are becoming increasingly vital. These treatments enhance adhesion to matrix materials in composites, improve dye uptake, or boost filtration efficiency by controlling pore size distribution.

Looking ahead, innovation is directed towards developing environmentally friendlier processes, such as solvent-free spinning methods, and incorporating nanotechnology to create functionalized polyarylate fibers. Research into polyarylate nanofibers, produced via electrospinning, is gaining traction due to their potential in highly specialized filtration and advanced medical textiles. Furthermore, material science research is exploring copolymerization strategies to introduce specific functional groups, improving the hydrolytic stability of the fibers, thus expanding their usability in moisture-rich industrial environments and opening up new market avenues in demanding marine and chemical handling applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by massive infrastructure investments, rapid urbanization, and mandatory adoption of safety standards in manufacturing powerhouses like China, India, and Southeast Asia. The region benefits from large-scale production capacities and intense industrial activity requiring high-temperature filtration and protective clothing. Japan and South Korea remain key centers for technological innovation and high-end automotive and electronics applications utilizing advanced polyarylate composites.

- North America: This region is characterized by high demand for premium-grade polyarylate fibers, primarily in the stringent aerospace, defense, and high-specification electrical insulation sectors. Regulatory mandates from bodies like the FAA and OSHA drive stable demand for specialized materials. The US market dominates regional consumption, focusing heavily on R&D and advanced composite manufacturing for next-generation aircraft and military equipment.

- Europe: Europe maintains a strong market position, highly influenced by rigorous EU environmental and occupational safety directives (e.g., REACH regulations). Key drivers include the robust automotive sector, which uses polyarylates for noise reduction, thermal management, and lightweight structural components, and the extensive industrial base requiring high-efficiency hot gas filtration to meet environmental targets. Germany, France, and the UK are primary consumers.

- Latin America (LATAM): Growth in LATAM is emerging, spurred by increased investments in the oil and gas sector and mining industries, leading to greater adoption of industrial protective clothing. Market penetration is accelerating as regulatory compliance and safety awareness improve, particularly in Brazil and Mexico, though high import reliance and economic instability occasionally constrain large-scale adoption.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the expansion of the petrochemical and construction sectors. High-temperature and chemical-resistant applications are crucial in the demanding environments of the Gulf Cooperation Council (GCC) countries. Defense spending in certain nations also contributes significantly to the demand for high-performance protective gear and specialized military textiles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyarylate Fiber Market.- Teijin Limited

- Kuraray Co., Ltd.

- Toray Industries, Inc.

- Mitsui Chemicals, Inc.

- Kolon Industries, Inc.

- Huvis Corp.

- Shanghai Xiangyue Industrial Co., Ltd.

- Changzhou High-Tech Fiber Co., Ltd.

- Polychem K.K.

- DuPont de Nemours, Inc.

- Solvay S.A.

- Indorama Ventures PCL

- Sinopec Yizheng Chemical Fibre Co., Ltd.

- Tomen Corporation

- Nippon Kayaku Co., Ltd.

- Toyobo Co., Ltd.

- Mitsubishi Chemical Corporation

- Unitika Ltd.

- Lenzing AG (Specialty Fibers Division)

- Daicel Corporation

Frequently Asked Questions

Analyze common user questions about the Polyarylate Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of polyarylate fibers over conventional high-performance fibers like aramids?

Polyarylate fibers offer superior inherent thermal stability and resistance to high temperatures (often exceeding 200°C) without significant degradation, coupled with excellent resistance to UV radiation and hydrolysis. While aramids excel in high tenacity, polyarylates often exhibit better dimensional stability and lower smoke generation in fire conditions, making them ideal for high-specification insulation and filtration applications.

Which end-use industry contributes most significantly to the demand for polyarylate fibers?

The protective clothing and personal protective equipment (PPE) sector currently constitutes the largest application segment, driven by global governmental mandates for worker safety, particularly in industries involving fire hazards, high heat, and chemical exposure (e.g., firefighting, military, and heavy manufacturing sectors).

What are the main market restraints impacting the broader adoption of polyarylate fibers?

The primary restraint is the high manufacturing cost associated with polyarylate production, stemming from complex polymerization processes and the high cost of specialized aromatic precursor chemicals. This cost premium limits widespread adoption in price-sensitive applications where standard polymer fibers or less expensive high-performance alternatives are adequate.

How is the Polyarylate Fiber Market segmented by product type, and which segment is witnessing the highest growth?

The market is segmented into Staple Fiber, Filament Yarn, and Non-Wovens. While Filament Yarn holds a large market share due to its use in technical textiles, the Non-Wovens segment, particularly for hot gas filtration and specialty insulation, is projected to witness the highest compound annual growth rate (CAGR) driven by increasing industrial environmental regulations.

Which geographical region leads the global Polyarylate Fiber Market in terms of consumption and production?

Asia Pacific (APAC), particularly driven by industrial expansion in China, Japan, and South Korea, currently leads the market in both production capacity and consumption. This dominance is attributed to robust growth in the automotive, industrial filtration, and general manufacturing sectors requiring high-performance materials.

The continuous innovation within the polyarylate fiber domain is centered on achieving a delicate balance between ultra-high performance and increased cost-efficiency, ensuring the material remains competitive against established alternatives like aramid and carbon fibers. Future market growth hinges on successful technological scaling and the ability to penetrate emerging, high-specification applications such as advanced battery components for sustainable electric mobility solutions. This market, therefore, remains strategically vital for industries demanding uncompromising material performance in harsh environments.

The development of specialized grades, particularly those designed for enhanced chemical stability against aggressive solvents and acids, represents a key avenue for market differentiation. Manufacturers are investing heavily in compounding techniques that allow polyarylates to be blended with other high-performance polymers or additives to create tailored solutions. This includes efforts to improve processability for complex manufacturing techniques like resin transfer molding (RTM) used in aerospace component fabrication, thereby widening the scope of polyarylate applicability beyond traditional textile uses and solidifying its position within the advanced materials ecosystem. Such efforts are crucial for sustaining the 6.8% CAGR projected through 2033.

Furthermore, the impact of global supply chain resilience, exacerbated by recent geopolitical tensions, highlights the importance of localized or regionalized production capabilities for precursor materials. Companies that can demonstrate robust, vertically integrated supply chains for key monomers will secure a significant competitive advantage, mitigating price fluctuations and ensuring reliable delivery to critical end-use markets such as defense and specialized industrial manufacturing. The strategic importance of polyarylate fibers in safety-critical applications necessitates this focus on supply chain stability and high-quality control standards throughout the production lifecycle.

The analysis of the Polyarylate Fiber Market clearly indicates a migration toward applications where the fiber acts as an enabler of advanced technology, rather than merely a substitute for traditional materials. This is evident in the burgeoning EV battery market, where polyarylates offer superior thermal runaway protection and stability compared to standard polymers, fulfilling a critical safety function. Similarly, in telecommunications, the use of polyarylates in high-specification cables and optical fibers leverages their low dielectric constant and mechanical durability. This shift towards "enabling applications" secures the market's premium pricing structure and ensures sustained investment in next-generation material science and process engineering.

In summary, while navigating challenges related to cost and raw material sourcing, the market benefits from powerful, non-negotiable drivers rooted in global safety regulations and the relentless pursuit of performance optimization in high-tech sectors. The synergistic relationship between material science innovation (e.g., enhanced surface modification) and demand from high-growth industries (e.g., filtration and EV) dictates the market’s positive trajectory and its continued relevance in the advanced synthetic fiber landscape, affirming the projected market valuation exceeding USD 700 Million by the end of the forecast period in 2033. The focus on intellectual property surrounding proprietary polymerization and spinning technology will remain a defining feature of the competitive landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager