Polycarbodiimides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432615 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Polycarbodiimides Market Size

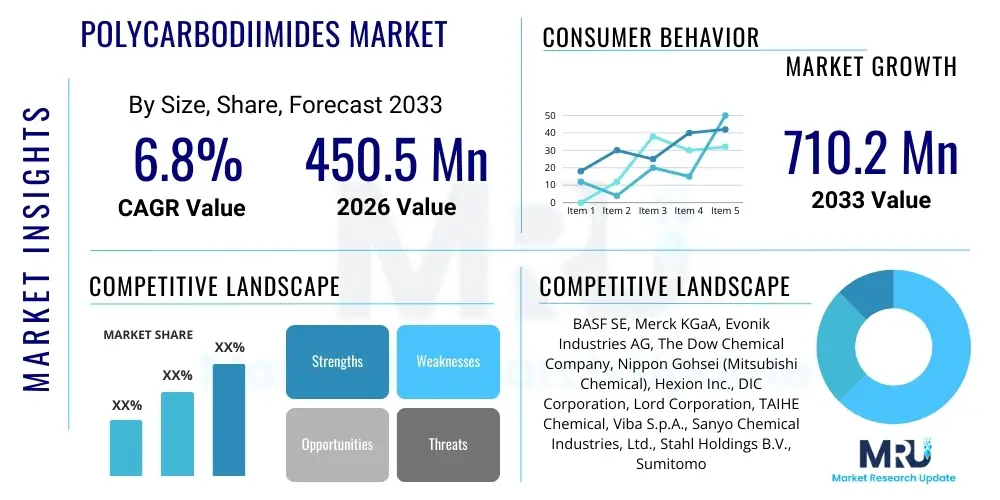

The Polycarbodiimides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for high-performance polyurethane systems, particularly in the automotive, construction, and electronics sectors, where superior hydrolysis resistance and longevity are critical performance indicators. Polycarbodiimides serve as essential chemical stabilizers, preventing degradation in moisture-sensitive applications, thereby ensuring product reliability and extending the service life of end materials. The market size reflects the increasing industrial shift towards advanced materials capable of enduring harsh operational environments.

Polycarbodiimides Market introduction

Polycarbodiimides (PCDIs) are a class of specialty chemical compounds characterized by the presence of multiple carbodiimide functional groups (-N=C=N-) within their molecular structure. These compounds function primarily as highly effective anti-hydrolysis agents and cross-linking additives, crucial for enhancing the stability and physical properties of polymers, particularly polyurethane (PU) and polyester-based materials. Their fundamental mechanism involves scavenging detrimental acidic species and moisture, which typically lead to the premature degradation of these polymers, thus ensuring long-term performance integrity in demanding applications such as automotive interiors, protective coatings, and synthetic leather.

The product range encompasses various forms, including solvent-based, water-based dispersions, and non-solvent liquid types, catering to diverse formulation requirements across different industrial processes. Major applications span high-performance coatings and paints, where they improve resistance to weathering and chemicals; adhesives and sealants, where they provide superior bond strength and durability; and elastomers and foams, where they prevent degradation and maintain dimensional stability. The intrinsic benefit of PCDIs lies in their ability to significantly extend the lifespan of materials exposed to heat, humidity, and chemical stress, making them indispensable components in modern material science formulations.

Driving factors propelling the market include stringent regulatory requirements mandating longer product lifetimes and reduced waste in sectors like automotive and construction, alongside the continuous innovation in polyurethane chemistry demanding more resilient stabilizers. Furthermore, the global trend towards waterborne and environmentally friendly coating systems is favoring specialized water-dispersible polycarbodiimides, positioning them as key enablers for sustainable material development. Their superior efficacy in comparison to conventional stabilizers solidifies their critical role in the advanced materials supply chain.

Polycarbodiimides Market Executive Summary

The Polycarbodiimides Market is poised for significant expansion, fueled by robust business trends centered on material longevity and sustainability. Key business dynamics include increasing capital expenditure in R&D aimed at developing bio-based and non-isocyanate polyurethanes (NIPUs), where polycarbodiimides often play a critical cross-linking or stabilizing role. The market is witnessing consolidation among major chemical manufacturers seeking to integrate advanced specialty additives into their polymer portfolios, enhancing competitive differentiation. Furthermore, the accelerating adoption of electric vehicles (EVs) drives demand for highly durable, lightweight interior and battery materials stabilized by PCDIs, securing a strong growth trajectory through the forecast period.

Geographically, Asia Pacific (APAC) stands out as the dominant and fastest-growing region, primarily due to the expansive manufacturing base for automotive components, electronics, and construction chemicals in countries such as China, India, and South Korea. Europe maintains a strong presence, driven by strict environmental regulations favoring advanced, low-VOC polycarbodiimide formulations and high-end industrial coatings. North America exhibits steady growth, particularly in specialized defense and aerospace applications requiring exceptional material stability and performance characteristics. The emphasis across all regions is shifting towards local manufacturing capabilities to mitigate supply chain vulnerabilities exposed in recent years.

Segment trends highlight the dominance of the solvent-based segment, although the water-based segment is projected to register the highest CAGR, aligned with global sustainability mandates and the transition away from high-VOC systems. Application-wise, coatings and adhesives remain the primary consumers, yet the increasing use of polycarbodiimides in functional films and high-performance elastomers for industrial machinery and infrastructure is diversifying revenue streams. End-use trend analysis confirms that the automotive industry, demanding superior hydrolysis resistance for interior components, constitutes the largest segment, closely followed by the construction sector utilizing stabilized materials for roofing and flooring applications.

AI Impact Analysis on Polycarbodiimides Market

User queries regarding the impact of Artificial Intelligence (AI) on the Polycarbodiimides Market frequently revolve around optimizing synthesis processes, predicting material performance under specific environmental stresses, and accelerating the discovery of novel carbodiimide structures with enhanced functionalities. Common concerns include how AI can reduce the time-to-market for new stabilizer formulations and whether machine learning algorithms can accurately model the complex hydrolytic degradation pathways of polyurethane systems stabilized by PCDIs. Users are particularly interested in AI's role in computational chemistry, aiming to screen thousands of potential catalyst and reactant combinations virtually before laboratory synthesis, thereby drastically cutting R&D costs and increasing the efficiency of specialty chemical manufacturing. The expectation is that AI will streamline quality control and improve supply chain resilience by forecasting demand fluctuations and optimizing logistics for these specialized additives, ultimately leading to higher purity and more consistent product output.

- AI-driven Predictive Modeling: Enhancing the accuracy of simulating long-term material stability and hydrolysis resistance of PU formulations containing PCDIs.

- Optimized Synthesis Routes: Using machine learning to identify the most efficient temperature, pressure, and catalyst conditions for polycarbodiimide manufacturing, improving yield and purity.

- Accelerated Material Discovery: Employing computational chemistry (AI/ML) to design and screen novel polycarbodiimide oligomers tailored for specific polymer matrices and end-use environments.

- Quality Control Automation: Implementing AI vision systems and data analytics for real-time monitoring of batch consistency and contaminant detection in specialty chemical production.

- Supply Chain Optimization: Utilizing AI algorithms for demand forecasting and inventory management of raw materials (diisocyanates, catalysts) and finished PCDI products, reducing waste and lead times.

DRO & Impact Forces Of Polycarbodiimides Market

The Polycarbodiimides Market dynamics are shaped by a strong interplay of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces. The primary drivers include the inherent need for enhanced durability in polymer systems, especially polyurethanes, coupled with the global trend towards high-performance coatings that require longevity and resistance to harsh environmental factors such as humidity and chemical exposure. Simultaneously, the restraints revolve around the relatively higher cost of polycarbodiimides compared to conventional stabilizers and the complexity associated with their incorporation into certain existing industrial formulations, necessitating specialized technical expertise. However, significant opportunities arise from the rapidly expanding waterborne coatings segment, where specialized PCDI dispersions are essential, and the emerging market for non-isocyanate polyurethane (NIPU) chemistry, offering new avenues for PCDI cross-linking functionality, ensuring resilience against market volatility.

The impact forces are substantial, particularly concerning regulatory pressures. Environmental regulations, especially in Europe and North America, demanding reduced Volatile Organic Compounds (VOCs) and favoring sustainable, water-based solutions, strongly favor the adoption of advanced water-dispersible polycarbodiimides, accelerating market penetration. Conversely, the fluctuating cost and availability of key raw materials, such as specific types of diisocyanates required for synthesis, present a moderate restraining force, potentially impacting profitability margins for manufacturers. The technological impact force is high, as continuous R&D focuses on developing multi-functional polycarbodiimides that offer not just anti-hydrolysis properties but also improved adhesion or fire retardancy, significantly expanding their application spectrum beyond traditional PU stabilization. This combination of strong regulatory tailwinds and technological advancement outweighs the cost constraints, driving overall market momentum.

The global shift toward lightweighting in the automotive and aerospace industries is a crucial driving factor, as polyurethanes and advanced elastomers stabilized by PCDIs are integral components in achieving weight reduction without compromising structural integrity or long-term performance. This performance enhancement justifies the premium pricing of these stabilizers. The long-term opportunities in emerging economies, specifically in infrastructure development and manufacturing growth, ensure a steady increase in demand for durable construction materials and protective coatings, guaranteeing continued high impact forces favoring market expansion throughout the forecast period.

Segmentation Analysis

The Polycarbodiimides Market is comprehensively segmented based on its physical form (Type), intended use (Application), and the ultimate purchasing industry (End-Use Industry). This granular segmentation is essential for understanding market structure and identifying niche growth areas. The market analysis reveals that the Type segmentation is currently dominated by solvent-based PCDIs due to their historical prevalence and effectiveness in specific industrial processes, although water-based formulations are rapidly gaining market share due to increasing environmental scrutiny. Application segmentation highlights the critical role of PCDIs in high-performance coatings, serving as essential cross-linkers and hydrolysis protectors in demanding environments. End-use segmentation confirms the automotive sector as the dominant consumer, leveraging PCDIs for durable interior materials and protective films, showcasing a clear link between material resilience needs and market uptake across specific verticals.

- By Type:

- Solvent-based Polycarbodiimides

- Water-based Polycarbodiimide Dispersions

- Non-solvent Liquid Polycarbodiimides

- Powder Polycarbodiimides

- By Application:

- Coatings and Paints (Protective, Industrial, Automotive Refinish)

- Adhesives and Sealants (Structural and Non-Structural)

- Elastomers and Foams (TPU, Synthetic Leather)

- Films and Fibers (Packaging, Textiles)

- Others (Inks, Resins)

- By End-Use Industry:

- Automotive (Interior, Exterior, Components)

- Construction (Roofing, Flooring, Insulation)

- Electronics (Potting Compounds, Encapsulation)

- Packaging (Flexible Packaging, Food Contact Materials)

- Textiles and Leather

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Polycarbodiimides Market

The value chain for the Polycarbodiimides Market begins with upstream activities involving the sourcing and refining of key raw materials, predominantly various types of diisocyanates (such as MDI, TDI, and specific aromatic or aliphatic diisocyanates) and functional additives used in the polymerization process. These raw materials, often petroleum-derived, are synthesized into polycarbodiimide oligomers or polymers through complex chemical reactions, typically involving catalysts and specialized reactors. Upstream analysis focuses on ensuring stable raw material supply, managing volatility in isocyanate pricing, and maintaining high purity standards, as slight variations can significantly impact the performance characteristics of the final PCDI product, which is a key technical challenge in this segment of specialty chemicals.

The core manufacturing stage involves the proprietary synthesis of PCDIs, followed by processing into various marketable forms, such as solvent solutions, aqueous dispersions, or powders. Distribution channels play a vital role in connecting manufacturers to end-users, given the specialized nature of the product. Direct distribution is common for large-volume industrial purchasers, particularly major polyurethane system houses or Tier 1 automotive suppliers, where precise technical support and customized formulations are required. Indirect distribution leverages regional chemical distributors and specialized agents who maintain localized warehousing and manage smaller orders for various coatings and adhesives formulators, ensuring broad market access and minimizing logistical complexities for international manufacturers.

Downstream activities center on the incorporation of polycarbodiimides into finished product formulations, such as performance coatings, structural adhesives, or thermoplastic polyurethanes (TPU). The final step involves the end-use application within industries like automotive manufacturing (for anti-hydrolysis applications in seating or dashboards), construction (for durable roofing membranes), or electronics (for protective encapsulation). Success in the downstream market is highly dependent on effective technical support provided by PCDI suppliers, enabling customers to optimize formulation parameters and maximize the stabilizing benefits of the additive, making technical consulting a critical value-added component of the entire chain.

Polycarbodiimides Market Potential Customers

The potential customers for polycarbodiimides are diverse, primarily comprising businesses that utilize polyurethane, polyester, and other hydrolytically sensitive polymers in their final products, where failure due to moisture or heat degradation is unacceptable. The primary buyers are large chemical formulators specializing in industrial coatings and protective paints, particularly those targeting automotive Original Equipment Manufacturers (OEMs) and construction infrastructure projects. These customers seek PCDIs to extend the warranty period and functional lifespan of their products, making performance enhancement the paramount purchasing criterion. Furthermore, manufacturers of flexible packaging and synthetic leather requiring improved durability and anti-aging properties are significant buyers, often purchasing water-based dispersions to align with stricter environmental standards.

Another major segment of end-users includes Tier 1 and Tier 2 suppliers in the automotive sector, who incorporate PCDIs directly into polyurethane foam, thermoplastic polyurethane (TPU) components, and various elastomers used in vehicle interiors and engine bay applications. These buyers require material stability under extreme temperatures and high humidity, which polycarbodiimides effectively provide. The electronics industry also represents a growing customer base, utilizing PCDIs in encapsulants, sealants, and potting compounds to protect sensitive circuitry from moisture ingress and ensure long-term functionality of devices under varying climatic conditions.

In essence, the core buyer profile consists of sophisticated industrial organizations that prioritize material durability, regulatory compliance (especially concerning VOC emissions and product longevity), and advanced chemical stability. The purchasing decision often involves a lengthy qualification process, emphasizing long-term supplier relationships and demanding suppliers who can guarantee product consistency and provide comprehensive technical service regarding optimal dosage and compatibility with complex polymer matrices. These end-users are investing in quality to minimize field failures and associated liability costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Merck KGaA, Evonik Industries AG, The Dow Chemical Company, Nippon Gohsei (Mitsubishi Chemical), Hexion Inc., DIC Corporation, Lord Corporation, TAIHE Chemical, Viba S.p.A., Sanyo Chemical Industries, Ltd., Stahl Holdings B.V., Sumitomo Chemical Co., Ltd., Wanhua Chemical Group Co., Ltd., Covestro AG, Lanxess AG, Songwon Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polycarbodiimides Market Key Technology Landscape

The technological landscape of the Polycarbodiimides Market is defined by continuous innovation focused on improving functionality, environmental compliance, and cost-effectiveness. A central technological trend is the shift from traditional solvent-based formulations to highly stable aqueous polycarbodiimide dispersions (PCDs). Developing these water-based systems requires advanced emulsification and stabilization technology to ensure particle size uniformity and long shelf life, which is crucial for their effective integration into low-VOC coatings and adhesive systems now preferred by regulators and consumers worldwide. Manufacturers are heavily investing in proprietary polymerization techniques that yield PCDIs with tailored molecular weights and architecture, allowing for specific reactivity profiles optimized for different polymer matrices, such as thermoplastic polyurethanes (TPUs) or polyester polyols.

Another significant area of technological focus involves the development of multi-functional polycarbodiimides. These next-generation products are designed not only to act as anti-hydrolysis agents but also to incorporate features such as latent cross-linking capabilities or improved compatibility with non-polar resins. For instance, research is being conducted on PCDIs that can cure at lower temperatures or those that offer integrated UV stability, reducing the need for multiple separate additives in a single formulation. This multi-functional approach enhances the value proposition of PCDIs, simplifying formulation processes for end-users and improving overall material performance in complex applications like high-end exterior coatings and structural bonding applications required in the aerospace industry, demanding material specifications that are exceptionally robust and reliable.

Furthermore, process technology, including continuous manufacturing rather than traditional batch processing, is gaining traction to improve efficiency and reduce the cost structure of high-purity PCDI production. The use of advanced analytical techniques, such as High-Performance Liquid Chromatography (HPLC) and Nuclear Magnetic Resonance (NMR), is vital for quality assurance, ensuring the high functional group concentration and low residual monomer content critical for performance and safety compliance. The convergence of computational chemistry and material informatics is also becoming crucial, allowing researchers to predict and fine-tune the chemical structure of new PCDI molecules with superior hydrolytic stability and targeted reactivity before committing to expensive and time-consuming laboratory synthesis, thereby accelerating the pace of technological innovation in this specialized field.

Regional Highlights

Regional dynamics play a pivotal role in shaping the Polycarbodiimides Market, reflecting differing regulatory environments, industrial output levels, and technological adoption rates across the globe. Asia Pacific (APAC) stands out as the undisputed leader in both consumption volume and growth rate. This dominance is attributed to the presence of large and rapidly expanding manufacturing hubs in China, India, Japan, and South Korea, particularly for automotive production, electronics assembly, and large-scale infrastructure development. The massive production capacity for synthetic leather and footwear in countries like China further solidifies APAC's position, as these industries rely heavily on stabilized PU materials. Investment in coatings and adhesive manufacturing facilities across Southeast Asia also contributes significantly to the escalating regional demand for anti-hydrolysis agents.

Europe represents a mature yet high-value market, characterized by stringent environmental regulations, notably the REACH regulation, which pushes manufacturers toward sophisticated, low-VOC, water-based polycarbodiimide solutions. Countries like Germany, Italy, and France, with strong automotive and high-performance industrial coatings sectors, drive consumption. The regional focus on sustainability and circular economy principles also favors PCDIs that contribute to product longevity, reducing material replacement frequency. North America demonstrates stable demand, driven by specialized applications in aerospace, defense, and high-specification construction projects, where material reliability under extreme environmental conditions is non-negotiable, and quality assurance demands the highest performance stabilizers available in the market.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for polycarbodiimides, though their market share remains comparatively smaller. LATAM growth is primarily tied to expanding automotive manufacturing (Mexico, Brazil) and construction activities. MEA demand is increasingly linked to investments in petrochemical infrastructure and protective coatings required for oil and gas facilities, necessitating materials that withstand high temperatures and harsh corrosive environments. While these regions offer substantial future potential, market penetration is currently hampered by slower regulatory modernization and reliance on imported specialty chemicals, indicating that infrastructure development and industrial maturation will be key determinants of future PCDI market expansion in these territories.

- Asia Pacific (APAC): Dominant market share and highest CAGR, driven by vast manufacturing bases in automotive, electronics, and construction, particularly in China and India.

- Europe: Mature market focused on high-performance, low-VOC water-based PCDIs due to stringent regulatory frameworks like REACH, strong consumption in German and Italian automotive sectors.

- North America: Steady growth concentrated in specialized high-reliability applications such as aerospace, defense, and high-specification industrial coatings and sealants.

- Latin America (LATAM): Emerging demand linked to manufacturing growth in Brazil and Mexico, focusing on local protective coating and automotive production needs.

- Middle East and Africa (MEA): Growth driven by infrastructure projects and the necessity for robust protective coatings in the oil, gas, and petrochemical industries to combat extreme climate and corrosion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polycarbodiimides Market.- BASF SE

- Merck KGaA

- Evonik Industries AG

- The Dow Chemical Company

- Nippon Gohsei (Mitsubishi Chemical)

- Hexion Inc.

- DIC Corporation

- Lord Corporation

- TAIHE Chemical

- Viba S.p.A.

- Sanyo Chemical Industries, Ltd.

- Stahl Holdings B.V.

- Sumitomo Chemical Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Covestro AG

- Lanxess AG

- Songwon Industrial Co., Ltd.

- King Industries, Inc.

- Mitsui Chemicals, Inc.

- Carbochem Inc.

Frequently Asked Questions

Analyze common user questions about the Polycarbodiimides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of polycarbodiimides in polymer systems?

Polycarbodiimides primarily function as anti-hydrolysis agents, scavenging moisture and carboxylic acids to stabilize polymers, especially polyurethanes and polyesters, thereby preventing degradation and extending the material's service life in humid or hot environments.

Which application segment drives the highest demand for polycarbodiimides?

The Coatings and Paints application segment is the largest consumer of polycarbodiimides. They are critical for cross-linking waterborne systems and providing superior chemical and weather resistance in industrial, protective, and automotive coatings.

How do polycarbodiimides contribute to sustainability?

PCDIs contribute to sustainability by enabling the use of low-VOC waterborne systems and significantly increasing the longevity and durability of end products (like automotive components and infrastructure materials), which reduces replacement frequency and waste generation.

Which geographical region shows the fastest growth in the Polycarbodiimides Market?

Asia Pacific (APAC), particularly China and India, exhibits the fastest market growth, driven by rapid industrialization, burgeoning automotive manufacturing, and high demand for durable construction materials and electronics protection.

What is the key difference between solvent-based and water-based polycarbodiimides?

The key difference lies in the carrier medium and environmental profile. Solvent-based PCDIs offer high efficacy in traditional systems, while water-based dispersions (PCDs) are crucial for modern, environmentally compliant, low-VOC formulations, aligning with global regulatory trends.

Are Polycarbodiimides compatible with non-isocyanate polyurethane systems?

Yes, polycarbodiimides are highly compatible with Non-Isocyanate Polyurethane (NIPU) systems. They are increasingly utilized as essential cross-linking or stabilizing agents in NIPU chemistry, which represents a significant technological opportunity for the market as the industry seeks safer alternatives to traditional isocyanates.

What are the typical end-use requirements driving the adoption of PCDIs in the Automotive industry?

The automotive industry requires PCDIs primarily for enhancing the hydrolysis resistance of interior components (foams, synthetic leather, adhesives) and under-the-hood elastomers, ensuring materials maintain structural integrity and appearance despite exposure to heat and humidity over the vehicle's lifespan.

How does the cost of raw materials impact the profitability of Polycarbodiimide manufacturers?

The synthesis of polycarbodiimides relies heavily on specialized diisocyanates, whose prices can fluctuate due to upstream petrochemical market volatility. These raw material costs represent a significant operational expense, directly impacting profit margins and necessitating strong supply chain management and forward contracting for manufacturers.

What is the role of R&D in maintaining a competitive edge in this market?

R&D is critical for developing proprietary formulations, particularly water-based dispersions with improved shelf stability and tailored reactivity profiles. Companies focusing on specialized, multi-functional PCDIs that address niche performance gaps maintain a significant competitive and pricing advantage over commodity producers.

How is the Polycarbodiimides Market affected by fluctuating global oil prices?

Since key precursor chemicals (diisocyanates) are derived from petroleum feedstock, fluctuating global oil prices directly influence the cost structure of polycarbodiimides. High oil prices generally lead to increased production costs, potentially restraining market growth or necessitating price adjustments for the specialty additive.

What specific materials are stabilized most effectively by Polycarbodiimides?

Polycarbodiimides are most effective at stabilizing polymers that contain ester groups or urethane linkages that are susceptible to hydrolysis. This primarily includes polyester polyols, polyurethane (PU) elastomers, PU foams, and certain types of polyester resins used in coatings and adhesives.

Do Polycarbodiimides have any function beyond anti-hydrolysis stabilization?

Yes, beyond anti-hydrolysis, polycarbodiimides can also act as cross-linking agents, particularly in waterborne coatings and NIPU systems, enhancing the hardness, chemical resistance, and solvent resistance of the final cured polymer matrix.

What regulations are driving the adoption of water-based Polycarbodiimides in Europe?

The European Union's REACH regulation and national legislation focused on reducing Volatile Organic Compound (VOC) emissions are the primary drivers, necessitating a shift towards waterborne coating systems where stable PCDI dispersions are required to maintain product performance without harmful solvents.

How is the electronics industry utilizing polycarbodiimides?

The electronics industry uses PCDIs in encapsulants, potting compounds, and protective conformal coatings to shield sensitive electronic components and printed circuit boards from moisture, humidity, and heat, ensuring the long-term reliability and functionality of electronic devices.

What is the estimated Compound Annual Growth Rate (CAGR) for the Polycarbodiimides Market?

The Polycarbodiimides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, reflecting sustained high demand from automotive and construction industries for durable materials.

What are the barriers to entry for new players in the Polycarbodiimides Market?

Barriers to entry are high, mainly due to the specialized synthesis chemistry required, high capital investment in production facilities, the need for robust IP protection (patents on proprietary formulations), and the lengthy qualification process demanded by large industrial customers.

In what way does Artificial Intelligence influence Polycarbodiimides R&D?

AI, through predictive modeling and computational chemistry, influences R&D by accelerating the design and screening of novel PCDI molecular structures, optimizing synthesis conditions for purity, and accurately forecasting material performance under varied operational stress conditions.

Which type of PCDI formulation is expected to grow the fastest during the forecast period?

Water-based Polycarbodiimide Dispersions are anticipated to exhibit the fastest growth rate, driven by the global imperative to transition to environmentally compliant, low-VOC coating and adhesive formulations across major industries.

How do Polycarbodiimides compare to other anti-hydrolysis agents?

Polycarbodiimides are generally considered superior to many conventional anti-hydrolysis agents due to their high reactivity with carboxylic acids and moisture, offering greater efficiency, lower required dosage, and broader compatibility across various demanding polymer systems, particularly polyurethane.

What role do polycarbodiimides play in flexible packaging materials?

In flexible packaging, PCDIs are used in lamination adhesives to improve the durability and bond strength, especially for food contact applications, by enhancing the adhesive's resistance to moisture and heat sterilization processes, thus extending shelf life.

How crucial is technical support in the distribution channel for PCDIs?

Technical support is extremely crucial. Due to the specialized nature of PCDIs and their precise interaction with complex polymer systems, manufacturers must provide extensive technical guidance to end-users on optimal dosage, mixing, and compatibility to achieve desired performance outcomes.

What is the significance of the Non-solvent Liquid Polycarbodiimides segment?

Non-solvent liquid PCDIs are significant for applications requiring 100% solid content, offering maximum performance with zero VOCs. They are typically used in high-build protective coatings and sealants where regulatory constraints necessitate the elimination of all volatile components.

How do Polycarbodiimides enhance the performance of synthetic leather?

PCDIs are integrated into synthetic leather production, especially PU-based types, to prevent hydrolysis of the polymer structure, which causes cracking and stickiness over time, thereby significantly improving the material's durability, feel, and lifespan, particularly in automotive interiors.

What impact does the trend of electric vehicles have on PCDI demand?

The shift towards Electric Vehicles (EVs) drives high demand for PCDIs, as these stabilizers are essential for lightweight, high-performance battery encapsulation, durable interior components, and specialized thermal management systems that require excellent long-term material stability under rigorous conditions.

What is the estimated market size of the Polycarbodiimides Market in 2033?

The Polycarbodiimides Market is projected to reach an estimated value of USD 710.2 Million by the end of the forecast period in 2033, reflecting substantial value generation from high-performance material stabilization requirements globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager