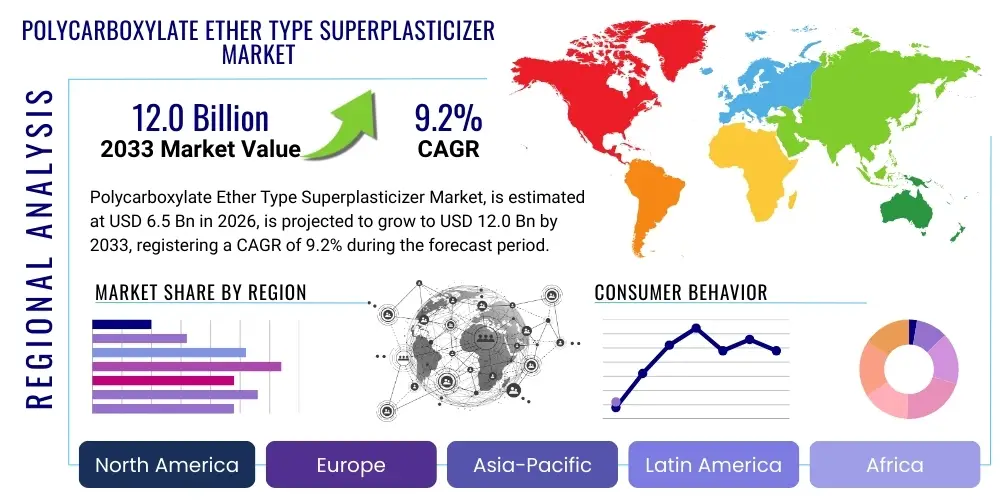

Polycarboxylate Ether Type Superplasticizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434867 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Polycarboxylate Ether Type Superplasticizer Market Size

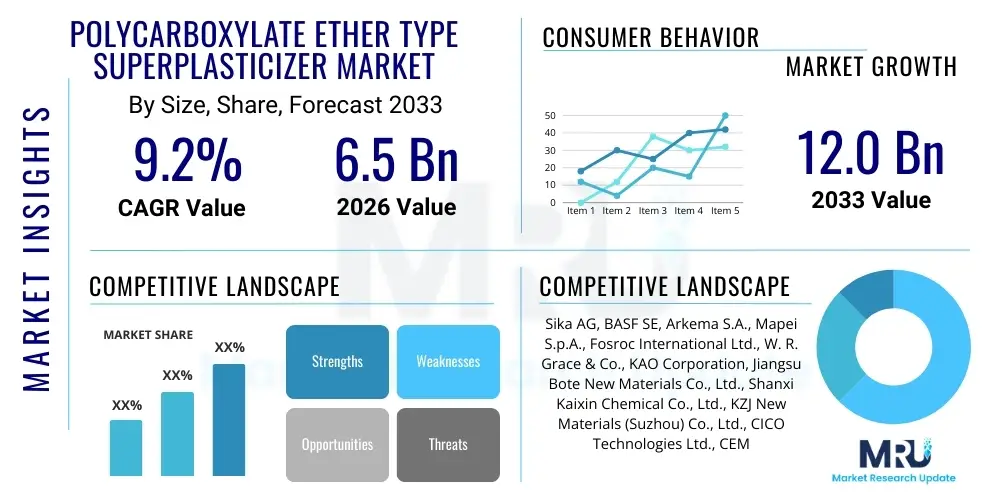

The Polycarboxylate Ether Type Superplasticizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 6.5 billion in 2026 and is projected to reach USD 12.0 billion by the end of the forecast period in 2033.

Polycarboxylate Ether Type Superplasticizer Market introduction

The Polycarboxylate Ether (PCE) Type Superplasticizer Market encompasses the production and distribution of advanced chemical admixtures crucial for modern concrete technology. PCE superplasticizers are high-performance water-reducing agents designed to significantly improve the workability and rheology of concrete without compromising its compressive strength. Unlike traditional lignosulfonates or naphthalene formaldehyde condensates, PCEs employ a unique molecular structure, typically a backbone polymer with polyoxyethylene side chains, which provides enhanced steric hindrance and electrostatic repulsion effects, resulting in superior dispersion of cement particles and exceptional slump retention.

The primary product characteristic driving market demand is the capability of PCEs to achieve extremely high water reduction ratios, often exceeding 30%, which is essential for producing high-strength, high-performance, and self-consolidating concrete (SCC). These characteristics are increasingly vital in large-scale infrastructure projects, complex architectural designs, and applications requiring durable, long-lasting concrete structures. The benefits derived from using PCEs include faster construction cycles due to quicker setting times, reduced permeability leading to enhanced durability against chemical attack, and lower overall material costs when accounting for improved efficiency and longevity of the structure.

Major applications of PCE superplasticizers span across various sectors, dominated by ready-mix concrete production, precast concrete manufacturing, and large-scale infrastructure development such as bridges, dams, high-rise buildings, and tunnels. Driving factors for market expansion include accelerating urbanization trends globally, particularly in Asia Pacific, the necessity for repair and rehabilitation of aging infrastructure in developed economies, and stringent environmental regulations promoting the use of sustainable construction materials, where PCEs enable the incorporation of supplementary cementitious materials (SCMs) while maintaining performance standards.

Polycarboxylate Ether Type Superplasticizer Market Executive Summary

The Polycarboxylate Ether Type Superplasticizer market exhibits robust growth driven by global infrastructural investments and the persistent demand for high-performance concrete solutions that reduce resource consumption and enhance structural integrity. Business trends indicate a strong move toward customizing PCE formulations to address specific regional climate conditions and specialized concrete requirements, such as extremely low water-to-cement ratios or enhanced temperature stability during mass concreting. Key industry players are focusing on backward integration to secure raw material supply, primarily involving ethylene oxide and acrylic acid derivatives, while simultaneously investing heavily in research and development to create bio-based and low-VOC (Volatile Organic Compound) superplasticizer alternatives, aligning with global sustainability mandates and green building certification standards.

Regional trends highlight the Asia Pacific region, led by China and India, as the foremost growth engine due to unprecedented levels of construction activity in residential, commercial, and transportation infrastructure sectors. North America and Europe, while mature markets, demonstrate growth primarily through the adoption of premium, specialized PCE products for repair work and high-specification projects like data centers and energy facilities, emphasizing longevity and minimal lifecycle maintenance. Regulatory environments in these regions strongly favor performance-enhancing admixtures that reduce carbon footprints associated with cement production, further stimulating market penetration of highly efficient PCE formulations.

Segmentation trends reveal that the liquid form of PCE superplasticizers remains dominant due to ease of handling, dosage accuracy, and seamless integration into automated concrete batching plants. However, the powder segment is projected to experience faster growth, particularly for precast concrete applications and dry-mix mortars, driven by the advantages of longer shelf life and reduced shipping costs. The application segment growth is overwhelmingly concentrated in ready-mix concrete, followed closely by infrastructure projects which demand concrete with advanced rheological properties to meet stringent construction deadlines and durability specifications, ensuring the market's continued upward trajectory across the forecast period.

AI Impact Analysis on Polycarboxylate Ether Type Superplasticizer Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Polycarboxylate Ether (PCE) Superplasticizer market frequently revolve around optimization, quality control, and predictive performance modeling. Common themes include how AI can optimize PCE dosage rates in real-time based on varying ambient conditions and material quality (cement composition, aggregate moisture), whether machine learning algorithms can predict the long-term performance and durability of concrete mixes incorporating PCEs, and the potential for AI-driven formulation design to accelerate the development of new, high-efficiency superplasticizers. Users are keen to understand if AI can minimize human error in batching processes and ensure consistent concrete quality across large, complex construction projects, ultimately seeking data-driven confirmation that AI integration enhances material efficiency and reduces operational waste, leading to substantial cost savings and superior structural outcomes.

- AI-driven optimization algorithms enable real-time adjustment of PCE dosages, minimizing overdosing and ensuring optimal concrete workability despite variations in raw material quality and environmental temperature.

- Predictive modeling using machine learning helps in forecasting the long-term durability and structural performance of PCE-modified concrete, enhancing quality assurance in critical infrastructure projects.

- AI facilitates rapid screening and simulation of thousands of polymer structures, accelerating the research and development cycle for novel, high-performance PCE chemical formulations and raw material sourcing strategies.

- Integration of AI with automated batching systems improves supply chain management and inventory control for superplasticizers, reducing operational downtime and logistics costs.

- AI platforms analyze sensor data from concrete placement and curing processes, providing proactive insights into potential setting issues or slump loss risks related to PCE interactions.

DRO & Impact Forces Of Polycarboxylate Ether Type Superplasticizer Market

The Polycarboxylate Ether Superplasticizer market growth is fundamentally propelled by Drivers such as global infrastructure modernization and the rising demand for sophisticated construction materials capable of meeting enhanced durability and sustainability criteria. Restraints primarily involve the substantial volatility and price sensitivity associated with key petrochemical raw materials, including ethylene oxide and acrylic acid, which directly impacts production costs and profit margins for manufacturers. Opportunities are abundant in emerging markets and through the development of niche, high-value applications, such as specialized repair mortars and 3D printing concrete formulations. The combined influence of these factors, alongside stringent environmental regulations acting as key Impact Forces, shapes the competitive landscape, pushing manufacturers toward efficiency and innovation to maintain market relevance.

A primary driver is the accelerating trend toward high-rise construction and massive infrastructural undertakings, particularly in Asia, which inherently require high-strength, self-consolidating concrete (SCC) that is impractical to produce without advanced PCE superplasticizers. Furthermore, the global mandate to reduce CO2 emissions necessitates the use of high volumes of supplementary cementitious materials (SCMs) like fly ash and slag, which demand highly effective dispersants like PCEs to maintain the desired fluidity and setting characteristics. This systemic shift toward green concrete mixtures solidifies the essential role of PCEs in sustainable construction practices, guaranteeing sustained demand.

Conversely, the reliance on petroleum-derived precursors exposes the PCE industry to significant supply chain risks and cost fluctuations, which acts as a persistent restraint, particularly for smaller market participants. The opportunity for market differentiation lies in the development of tailor-made solutions for specific applications, such as high-temperature environments or marine structures, and through geographical expansion into underserved regions in Africa and Latin America. The most significant impact force is regulatory pressure, particularly in developed economies, which favors admixtures that contribute positively to LEED certifications and local environmental standards, thereby incentivizing investment in product purity and performance standardization among key industry players.

- Drivers: Rapid global urbanization and large-scale government investment in infrastructure projects, increasing adoption of High-Performance Concrete (HPC) and Self-Consolidating Concrete (SCC), and the necessity to reduce water consumption in concrete production for environmental compliance.

- Restraints: High volatility and dependence on petrochemical raw material prices (ethylene oxide, acrylic acid), and potential quality inconsistencies in PCE products manufactured by smaller, localized firms leading to distrust among major construction groups.

- Opportunity: Expansion into developing economies with substantial infrastructure deficits, increasing use of PCE in specialized applications like 3D printing concrete and oil well cementing, and development of cost-effective, bio-based PCE alternatives.

- Impact Forces: Strict governmental regulations promoting sustainable building materials and reduced cement consumption, competitive pressure forcing continuous innovation in molecular design for enhanced water reduction, and the increasing sophistication of construction demands requiring specialized admixture blends.

Segmentation Analysis

The Polycarboxylate Ether Type Superplasticizer market is segmented primarily based on physical form (Liquid and Powder), application (Ready-Mix Concrete, Precast Concrete, High-Performance Concrete), and end-use sector (Residential, Commercial, and Infrastructure). The segmentation structure is critical for strategic planning, as it reveals differential growth rates and pricing sensitivities across various product types and user groups. The liquid segment currently holds the dominant market share due to its ease of integration into existing large-scale concrete batching plants, offering consistent dosing and minimal preparation time, which is essential for high-volume ready-mix operations globally.

However, the powder segment, although smaller, is gaining momentum, especially in emerging markets and specialized applications such as dry-mix mortars, grouts, and certain precast operations where logistics and shelf-life extension are paramount. The application segmentation demonstrates the centrality of ready-mix concrete, which represents the largest consumer base, utilizing PCEs to manage slump retention over long transit distances. The high-performance concrete segment, while smaller in volume, drives innovation and commands premium pricing, reflecting its deployment in technically demanding projects like nuclear facilities and long-span bridges.

Further analysis of the end-use sector confirms that the infrastructure category, encompassing roads, bridges, dams, and ports, is the most consistent and substantial consumer of high-quality PCEs, owing to strict durability requirements and substantial governmental funding allocated to these projects. The residential and commercial sectors exhibit high cyclicality but represent significant consumption points during periods of building booms, particularly requiring PCEs for high-rise construction to facilitate pumping and placement efficiency. Understanding these granular segment dynamics is vital for manufacturers to tailor production capacity, marketing efforts, and distribution networks effectively.

- By Type:

- Liquid

- Powder

- By Application:

- Ready-Mix Concrete

- Precast Concrete

- High-Performance Concrete (HPC)

- Self-Consolidating Concrete (SCC)

- Other Applications (Mortars, Grouts, Shotcrete)

- By End-Use Sector:

- Residential

- Commercial

- Infrastructure (Roads, Bridges, Tunnels, Airports)

- Industrial (Factories, Warehouses, Energy Plants)

Value Chain Analysis For Polycarboxylate Ether Type Superplasticizer Market

The value chain for the Polycarboxylate Ether Superplasticizer market begins with the upstream sourcing of crucial petrochemical raw materials, primarily involving monomers like ethylene oxide, acrylic acid, methacrylic acid, and maleic anhydride. The consistency and cost stability of these inputs are paramount, as they determine the final cost structure of the PCE polymer. Key chemical manufacturers often integrate partially backward to secure stable monomer supplies or rely on long-term procurement contracts with major petrochemical producers. The complexity arises during the polymerization process, where specialized reaction techniques are employed to graft the side chains onto the polymer backbone, which is a highly technical and proprietary step defining the performance characteristics of the resulting superplasticizer.

The midstream stage involves the chemical synthesis and formulation by specialist admixture companies. These companies focus intensely on product development, blending the synthesized PCE polymers with other concrete admixtures (such as air entrainers or set retarders) to create tailored solutions for specific construction needs. Distribution channels are highly varied; large multinational producers typically utilize a direct sales model for major ready-mix and precast concrete corporations, offering technical support and customized logistical solutions. Conversely, smaller construction sites and localized projects often rely on indirect distribution through specialized construction chemical distributors, regional traders, and hardware stores.

Downstream analysis highlights the immediate end-users: concrete producers (ready-mix and precast) and major construction companies. Direct engagement with these buyers is crucial for feedback loops regarding product performance in the field. The demand dynamics are heavily influenced by the pace of infrastructure spending and commercial real estate development. The value chain is characterized by a high need for technical expertise throughout, particularly in dosage calibration and compatibility testing with different cement types, making technical service a non-negotiable component of the overall market offering and a key factor in competitive differentiation.

Polycarboxylate Ether Type Superplasticizer Market Potential Customers

The primary customer base for Polycarboxylate Ether Type Superplasticizers consists overwhelmingly of entities involved in the production and placement of concrete, where performance, consistency, and durability are critical requirements. Ready-mix concrete producers represent the largest and most frequent buyers, utilizing PCEs on a daily basis to ensure that concrete remains workable during transport from the batching plant to diverse construction sites, often maintaining slump retention for hours. These buyers prioritize cost-effectiveness, reliability of supply, and standardized technical support to minimize potential variations in their final product quality.

The second major cohort comprises precast concrete manufacturers who produce high-volume standardized components such as beams, pipes, blocks, and railway sleepers. For these customers, PCEs are essential for achieving high early strength necessary for rapid demolding and high-quality surface finishes, simultaneously reducing the energy required for steam curing. Their procurement decisions focus heavily on specialized PCE formulations that accelerate the setting time under controlled factory conditions, thereby increasing throughput and operational efficiency, making them sensitive to performance consistency rather than just volume pricing.

Furthermore, large engineering, procurement, and construction (EPC) firms, particularly those involved in high-specification public infrastructure (dams, bridges, subways) and specialized industrial projects (LNG tanks, nuclear power plants), represent key, high-value potential customers. While they may not directly purchase the PCE, they dictate its specification to their concrete suppliers, emphasizing ultra-high performance, long-term durability against harsh environmental conditions (e.g., chloride attack), and adherence to strict regulatory standards. These projects demand the most advanced and customized PCE solutions, often requiring extensive site trials and technical collaboration between the PCE manufacturer and the EPC contractor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, BASF SE, Arkema S.A., Mapei S.p.A., Fosroc International Ltd., W. R. Grace & Co., KAO Corporation, Jiangsu Bote New Materials Co., Ltd., Shanxi Kaixin Chemical Co., Ltd., KZJ New Materials (Suzhou) Co., Ltd., CICO Technologies Ltd., CEMEX S.A.B. de C.V., CHRYSO SAS, Kingfa SCI. & TEC. Co., Ltd., Muhu Bauchemie, GCP Applied Technologies, Bostik (Arkema Group), Flowcrete Group Ltd., Dairen Chemical Corp., Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polycarboxylate Ether Type Superplasticizer Market Key Technology Landscape

The core technology surrounding the Polycarboxylate Ether market is centered on advanced polymer chemistry, specifically focusing on controlled free-radical polymerization techniques used to synthesize the comb-like polymer structure. The efficiency of a PCE superplasticizer is inherently linked to its molecular architecture, particularly the length and density of the polyoxyethylene (POE) side chains relative to the main polymer backbone (often polyacrylic acid). Technological advancements involve refining these synthetic routes to achieve a narrower molecular weight distribution and precisely controlled charge density, which directly translates into superior dispersion capabilities and enhanced slump retention across different cement types and ambient temperatures, providing a crucial competitive edge in highly demanding concrete applications.

Current technological innovations are heavily invested in developing bespoke PCE molecules tailored for specific functional requirements, moving beyond generic water reduction. This includes technologies for high-early-strength PCEs for precast operations, anti-washout PCEs for underwater concreting, and high-flow retention PCEs designed for regions with high ambient temperatures or long transport times. Furthermore, the integration of digital tools and analytics in the R&D process allows manufacturers to rapidly correlate molecular structure with concrete performance characteristics, utilizing high-throughput experimentation to minimize time-to-market for novel formulations and address the increasing market demand for specialty admixtures that solve complex construction challenges.

A significant trend in the technology landscape is the exploration of sustainable and environmentally friendly synthesis methods. This involves investigating bio-based monomers derived from renewable sources to replace traditional petrochemical inputs, aiming to reduce the overall carbon footprint of the admixture production process. Additionally, advanced mixing and blending technologies are being deployed at the batching plant level, ensuring optimal dispersion and homogeneous integration of liquid and powder PCEs into the concrete matrix, thereby maximizing the efficiency of the superplasticizer and reducing waste. This holistic technological approach ensures that PCEs remain at the forefront of concrete chemical innovation.

Regional Highlights

The regional dynamics of the Polycarboxylate Ether Type Superplasticizer market are highly differentiated, reflecting varying levels of infrastructural maturity, regulatory environments, and construction activity. Asia Pacific (APAC) stands out as the dominant and fastest-growing region globally. This explosive growth is directly attributed to massive governmental spending on new infrastructure, rapid urbanization, and a continuous housing development boom, particularly in key economies like China, India, and Southeast Asian nations. The region’s need for large volumes of durable, cost-effective concrete ensures sustained demand for PCEs in both standard ready-mix and high-rise construction.

North America and Europe represent mature markets characterized by steady, moderate growth primarily fueled by the replacement and refurbishment of aging infrastructure rather than greenfield projects. These regions prioritize performance over volume, driving demand for premium, specialized PCE formulations that comply with stringent environmental standards and provide enhanced durability for long-term structural integrity. Regulatory mandates regarding reduced cement consumption and carbon emissions further solidify the reliance on high-efficiency superplasticizers in these advanced economies.

Latin America and the Middle East & Africa (MEA) are emerging regions that promise significant future opportunities. MEA, particularly the GCC countries, is witnessing massive investments in iconic architectural projects, tourism infrastructure, and energy facilities, all of which require high-performance, temperature-stable concrete facilitated by PCEs. Latin America, though characterized by economic volatility, offers substantial untapped potential, especially in Brazil and Mexico, as construction standards gradually improve and the adoption of modern concrete technology gains traction.

- Asia Pacific (APAC): Dominates the global market volume due to high population density, unprecedented levels of infrastructure development (e.g., high-speed rail, smart cities), and rapidly increasing residential construction.

- North America: Focused on adopting specialized, high-durability PCE solutions for rehabilitation projects, driven by rigorous standards for structural longevity and increasing preference for sustainable green concrete mixes.

- Europe: Characterized by strong regulatory support for low-carbon construction practices, leading to high penetration rates of advanced PCEs that facilitate the use of high volumes of supplementary cementitious materials (SCMs).

- Middle East & Africa (MEA): High growth potential driven by large-scale commercial and industrial construction projects, requiring PCEs specifically formulated to manage concrete workability under extreme high-temperature conditions.

- Latin America: Emerging market growth driven by expanding housing and municipal infrastructure projects, focusing on improving concrete quality and efficiency in major economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polycarboxylate Ether Type Superplasticizer Market.- Sika AG

- BASF SE

- Arkema S.A.

- Mapei S.p.A.

- Fosroc International Ltd.

- W. R. Grace & Co.

- KAO Corporation

- Jiangsu Bote New Materials Co., Ltd.

- Shanxi Kaixin Chemical Co., Ltd.

- KZJ New Materials (Suzhou) Co., Ltd.

- CICO Technologies Ltd.

- CEMEX S.A.B. de C.V.

- CHRYSO SAS

- Kingfa SCI. & TEC. Co., Ltd.

- Muhu Bauchemie

- GCP Applied Technologies

- Bostik (Arkema Group)

- Flowcrete Group Ltd.

- Dairen Chemical Corp.

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Polycarboxylate Ether Type Superplasticizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Polycarboxylate Ether (PCE) superplasticizers over traditional admixtures?

PCE superplasticizers utilize a unique comb-like molecular structure that provides superior steric hindrance and electrostatic repulsion. This allows for significantly higher water reduction (often exceeding 30%) and exceptional slump retention without negative effects on concrete strength, making them ideal for high-performance and self-consolidating concrete.

How does the volatility of raw material prices affect the PCE market?

The PCE market is highly dependent on petrochemical derivatives such as ethylene oxide and acrylic acid. Price volatility in these upstream raw materials directly impacts the production costs and profit margins of PCE manufacturers, often leading to fluctuations in end-product pricing for concrete producers.

Which application segment drives the highest volume demand for PCE superplasticizers globally?

The Ready-Mix Concrete segment is the largest volume consumer globally. PCEs are essential in this segment to maintain the concrete's workability and flowability (slump retention) during long-distance transportation from the central batching plant to various construction sites.

Is the Polycarboxylate Ether market adopting sustainable or bio-based chemical formulations?

Yes, driven by environmental regulations and market demand for green building materials, manufacturers are actively investing in R&D to develop bio-based PCE monomers derived from renewable sources, aiming to reduce the reliance on petrochemicals and lower the overall carbon footprint of the admixture.

Which geographic region is projected to experience the fastest growth rate for PCE consumption?

Asia Pacific (APAC), particularly driven by massive infrastructure investments in countries like China and India, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to high volumes of residential, commercial, and governmental construction projects.

What role does molecular architecture play in PCE superplasticizer performance?

Molecular architecture is the defining factor; the length and density of the polyethylene oxide side chains dictate the degree of steric repulsion, which in turn controls water reduction efficiency and slump retention time. Optimized structures are key to tailor products for specific temperature or strength requirements.

How do PCEs support the use of Supplementary Cementitious Materials (SCMs)?

PCEs are crucial for SCM integration (like fly ash or slag) because these materials typically increase the water demand of the mix. PCEs effectively disperse both cement and SCM particles, allowing high SCM loading while maintaining necessary workability and preventing early stiffening, thereby supporting sustainable low-carbon concrete mixes.

What challenges exist in standardizing PCE products across different markets?

Standardization is challenging due to local variations in cement chemistry, aggregate characteristics, and climate conditions. A PCE formulation effective in one region may require significant recalibration in another, necessitating customized blending and extensive local technical support from manufacturers.

How does the shift toward 3D printing in construction influence PCE demand?

3D printing requires highly specialized, rapid-setting concrete with precise rheological properties—specifically, controlled yield stress and excellent buildability. PCEs are vital components in these formulations, enabling the necessary flow and quick structural development required for additive manufacturing techniques.

What is the difference in logistics between liquid and powder PCE forms?

Liquid PCE is preferred for large, continuous batching operations due to easy integration and pumping. Powder PCE offers advantages in logistics by reducing shipping weight and volume, extending shelf life significantly, making it ideal for export, remote sites, or integration into dry-mix mortar products.

What is the most critical restraint facing PCE market expansion in mature economies?

In mature economies, the market faces slower expansion due to the high cost of specialized PCEs compared to conventional admixtures, and the slower pace of new construction, shifting the focus towards specialized high-margin applications like repair and highly durable concrete rather than high volume growth.

How do strict environmental regulations act as an opportunity for the PCE market?

Regulations demanding lower CO2 emissions and material efficiency push the construction industry to reduce cement consumption. PCEs, by enabling greater water reduction and the incorporation of more SCMs, directly facilitate these reductions, positioning them as essential enablers of regulatory compliance and green building certifications.

Explain the concept of 'slump retention' and why it is crucial for ready-mix concrete using PCEs.

Slump retention refers to the ability of concrete to maintain its workability and flow (measured by the slump test) over an extended period. For ready-mix concrete, PCEs must maintain high slump retention during transit, preventing premature stiffening, thus ensuring the concrete can be successfully pumped and placed upon arrival at the construction site.

What are the typical end-users classified under the Infrastructure segment?

The Infrastructure segment includes projects such as public transportation (roads, bridges, tunnels, rail systems), water management systems (dams, reservoirs), power generation facilities, and specialized marine structures like ports and offshore platforms, all requiring highly durable concrete.

How does competition affect R&D investment in the PCE industry?

Intense global competition, especially from Asian manufacturers, forces leading players to continually invest in R&D to create novel, higher-performance PCE molecules that offer distinct advantages (e.g., enhanced thermal stability, specific interaction with diverse cements), thereby justifying premium pricing and maintaining market share.

What is the role of technical service in the PCE value chain?

Technical service is critical. Manufacturers must provide expertise in dosage optimization, field testing, and troubleshooting, as improper use of PCEs can severely affect concrete performance. Technical support ensures correct product integration and builds long-term trust with concrete producers.

Can Artificial Intelligence (AI) predict the optimal PCE dosage for a specific concrete mix?

Yes, AI and machine learning algorithms are increasingly used to analyze historical batch data, material inputs, and environmental conditions to predict the exact optimal PCE dosage required to achieve target workability and strength, minimizing material waste and ensuring product consistency.

What are the major raw material inputs required for the synthesis of PCE polymers?

The key petrochemical raw materials include primary monomers such as ethylene oxide, which is used to form the polyoxyethylene side chains, and acrylic acid or methacrylic acid, which form the main polymer backbone structure.

In which application area are PCEs most crucial for achieving high early strength?

PCEs are most crucial for high early strength in Precast Concrete manufacturing. Achieving high strength quickly allows for rapid demolding of elements, significantly increasing the productivity and throughput of the precasting plant.

How does the use of PCE superplasticizers contribute to reducing concrete permeability?

By enabling significant water reduction, PCEs allow for a much lower water-to-cement ratio (W/C). A lower W/C ratio results in a denser microstructure with fewer capillary pores, which dramatically reduces concrete permeability, enhancing resistance to freeze-thaw cycles and chemical penetration.

What differentiates the high-performance concrete segment from standard concrete applications?

High-Performance Concrete (HPC) requires specific long-term properties beyond standard strength, such as exceptional durability, low permeability, and high resistance to chemical attack. PCEs are mandatory for HPC as they are the only admixture class capable of achieving the necessary ultra-low water-to-cement ratios required for these properties.

Why is the powder form of PCE gaining popularity in certain markets?

The powder form is favored in regions with logistical challenges or for specialized dry-mix products because it offers a significantly longer and more stable shelf life compared to liquid versions, reduces transport weight, and simplifies handling in areas without advanced liquid dosing systems.

How does the complexity of urban projects influence PCE market demand?

Complex urban projects, such as deep basement construction and dense high-rise structures, require concrete to be pumped over long vertical or horizontal distances. PCEs ensure the concrete remains pumpable and flows easily into complex formwork without segregation, directly enabling these technically challenging builds.

What are the main risks associated with overdosing PCE superplasticizers?

Overdosing PCEs can lead to severe issues, including excessive segregation of aggregate, prolonged setting times, bleeding, and potential difficulty in finishing the concrete surface. This necessitates precise dosing control, often managed through automated batching and AI systems.

In which region are specialized PCEs for extreme high-temperature applications most demanded?

The Middle East (part of MEA) has the highest demand for PCEs specially formulated to maintain slump retention and control setting time under extreme desert heat conditions, mitigating the rapid evaporation and premature stiffening typical of high ambient temperatures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager