Polyester Forming Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435214 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Polyester Forming Fabric Market Size

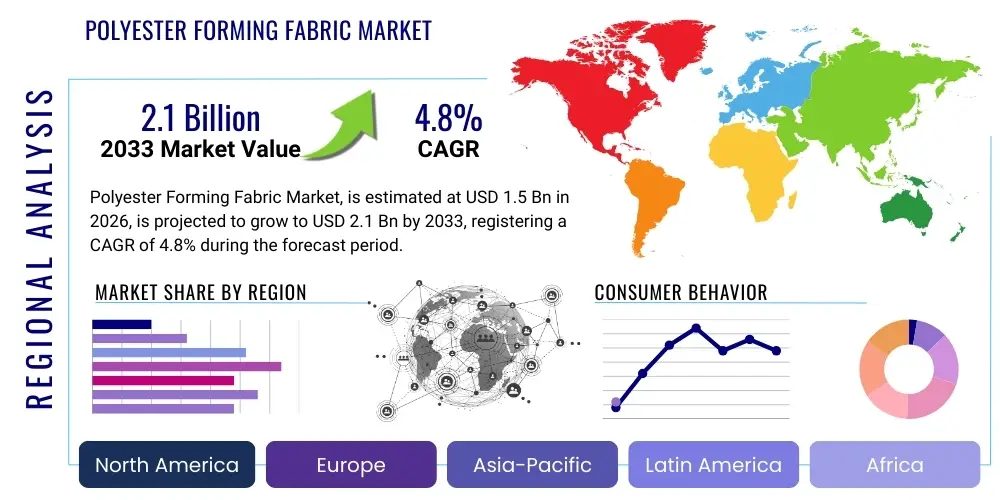

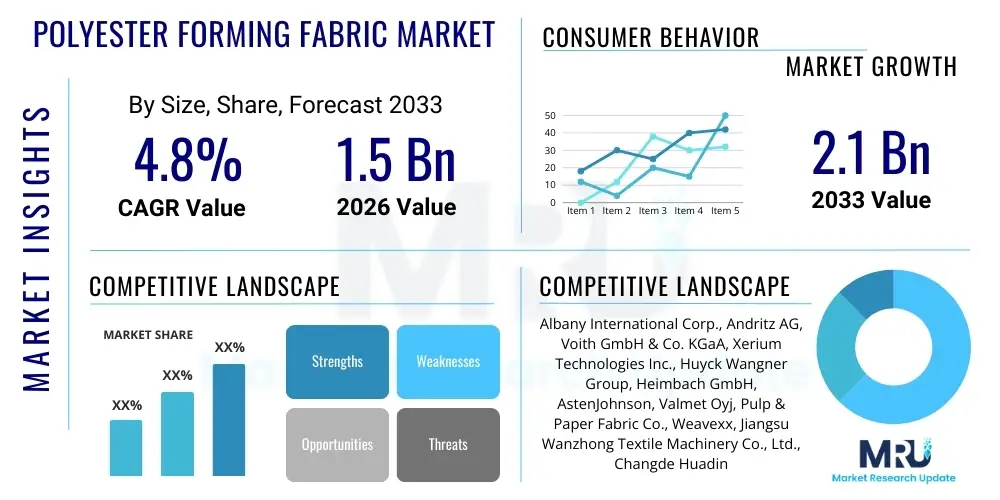

The Polyester Forming Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Polyester Forming Fabric Market introduction

The Polyester Forming Fabric Market encompasses the specialized technical textiles used in the forming section of paper, board, and pulp machines. These fabrics are integral components, responsible for the initial dewatering of the paper stock (slurry) while transporting the nascent paper web. Constructed predominantly from high-strength polyester monofilaments or multifilaments, forming fabrics are designed to offer specific drainage characteristics, high dimensional stability, resistance to abrasion, and excellent mechanical strength. Their structure, which can range from single-layer designs to complex triple-layer or SSB (Sheet Support Binder) weaves, significantly influences the paper quality, machine runnability, and overall operational efficiency of the paper mill.

The primary application of polyester forming fabrics lies in the production of various paper grades, including packaging materials, printing and writing paper, newsprint, and specialty grades. The inherent benefits of using polyester, such as longevity, chemical resistance, and ease of cleaning, make these fabrics superior to traditional metal mesh. Market growth is fundamentally driven by the rising global demand for packaging materials, particularly corrugated board and containerboard, which necessitates continuous improvements in high-speed papermaking technology and fabric durability. Furthermore, the relentless focus on maximizing machine speed and minimizing unscheduled downtime fuels innovation in fabric design, aiming for optimal sheet formation and rapid water removal.

Key technological advancements are centered on developing finer mesh counts, multi-layer structures, and specialized surface treatments to enhance drainage and reduce wire mark. These improvements address the increasing complexity of raw materials used in papermaking, such as recycled fibers, which require highly robust and efficient forming media. The overall objective is to provide a uniform and stable platform for web formation, critical for achieving high-quality finished paper products while simultaneously reducing energy consumption associated with dewatering processes. The performance of these fabrics directly impacts the economic viability and environmental footprint of paper manufacturing operations globally.

Polyester Forming Fabric Market Executive Summary

The Polyester Forming Fabric Market is exhibiting robust growth, propelled primarily by the expansion of the global packaging industry and the continuous optimization of paper machine efficiency across major manufacturing regions, especially Asia Pacific. Business trends indicate a strong shift towards complex multi-layer fabrics, such as triple-layer and SSB designs, which offer superior drainage capacity, enhanced sheet support, and extended service life compared to older single-layer structures. Key industry players are focusing on strategic mergers, acquisitions, and technology licensing to consolidate market share and integrate specialized weaving and heat-setting technologies, ensuring fabrics can withstand the increasingly high speeds and demanding operational environments of modern paper machines.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, driven by massive investments in new paper production capacity, particularly in China and India, catering to the growing domestic and export markets for packaging and hygienic paper products. North America and Europe, while mature, demonstrate stable demand fueled by the need for advanced, high-performance fabrics that support energy efficiency initiatives and accommodate high recycled fiber content. Segment trends show that the packaging paper and board application segment is the fastest growing, reflecting the e-commerce boom. Furthermore, the SSB forming fabric type is gaining substantial traction due to its superior fine-tuning capabilities related to filtration, drainage, and fabric stability.

The market faces concurrent challenges, including fluctuating raw material (polyester resin) prices and the necessity for significant capital investment in highly specialized manufacturing equipment. However, opportunities abound in developing markets and through the integration of advanced materials science, such as incorporating specialized polymer blends for enhanced resistance to chemical degradation and microbial fouling. Overall, the market remains competitive, characterized by high barriers to entry due to the proprietary weaving patterns and heat-treatment processes required to produce high-specification technical fabrics crucial for modern, high-speed papermaking.

AI Impact Analysis on Polyester Forming Fabric Market

User inquiries regarding AI's impact on the Polyester Forming Fabric Market frequently center on predictive maintenance, optimization of weaving and finishing processes, and the development of 'smart' fabrics capable of real-time monitoring. Users are concerned about how AI-driven predictive analytics can reduce unscheduled downtime associated with fabric wear and tear, and whether machine learning algorithms can refine fabric specifications (like permeability and mesh density) based on specific paper grade requirements and changing operational variables. The key themes revolve around efficiency gains, quality consistency, and the potential for AI to move the industry from reactive maintenance schedules to proactive, data-informed operational strategies, ultimately demanding higher data compatibility standards from fabric suppliers.

- AI-driven Predictive Maintenance: Algorithms analyze fabric sensor data (if embedded or external monitoring) to predict the end-of-life cycle, minimizing unexpected failures and optimizing replacement schedules.

- Process Optimization in Manufacturing: Machine learning refines complex weaving and heat-setting parameters to achieve precise fabric properties, ensuring better batch consistency and reducing material waste.

- Real-Time Drainage Control: AI systems integrate data from forming section sensors (vacuum levels, water removal rates) to dynamically adjust machine parameters, maximizing dewatering efficiency based on current fabric condition and fiber furnish.

- Automated Quality Inspection: Computer vision and AI enhance quality control during fabric production, detecting microscopic defects that affect sheet formation and fabric longevity.

- Simulation and Design Optimization: AI models simulate fluid dynamics and wear patterns on new fabric designs, dramatically accelerating the research and development cycle for next-generation products.

- Inventory and Supply Chain Forecasting: AI improves the accuracy of demand forecasting for specialized fabric types required by different paper mills, leading to better inventory management and shortened lead times.

DRO & Impact Forces Of Polyester Forming Fabric Market

The market dynamics are governed by a balance of significant drivers, structural restraints, and emergent opportunities, which collectively determine the market's trajectory and competitive landscape. The primary driver is the pervasive demand for high-quality packaging materials globally, spurred by e-commerce proliferation, necessitating paper mills to adopt faster and more efficient machinery that demands highly durable and advanced forming fabrics. Concurrently, strict quality mandates for printing paper and high-end board products require fabrics capable of providing superior sheet formation and minimal wire marking. These factors combine to create a constant need for technological upgrades in the forming fabric sector, particularly towards multi-layer and specialty structures.

However, the market faces structural restraints, chiefly the volatility of raw material costs, particularly the price fluctuations of polyethylene terephthalate (PET) resin, which directly impacts manufacturing costs and profit margins. Furthermore, the specialized nature of the product requires substantial capital expenditure for weaving and finishing equipment, posing high barriers to entry for new competitors. The cyclical nature of the pulp and paper industry, linked to global economic health, also presents a restraint, as major machine upgrade cycles can be postponed during economic downturns, temporarily dampening demand for premium fabrics.

Opportunities for growth are concentrated in emerging economies, where rapid industrialization is leading to new capacity additions and the phasing out of older, less efficient paper machines, creating significant demand for modern forming fabrics. Additionally, the increasing global focus on sustainability drives the demand for fabrics that can efficiently handle highly recycled fiber furnishes, which are inherently more abrasive and challenging to dewater. The impact forces indicate that technological advancement (specifically the shift to SSB fabrics and smart monitoring) exerts the strongest positive influence, pushing market value higher despite the intermittent cost pressures from raw materials and the cyclical demand from mature markets.

Segmentation Analysis

The Polyester Forming Fabric Market is meticulously segmented based on fabric type, application, material composition, and machine speed, allowing manufacturers to tailor products precisely to the diverse needs of the global paper industry. The segmentation by Type is critical, differentiating between single-layer fabrics (used primarily in slower, older machines or for specific paper grades), double-layer fabrics (offering improved drainage and fiber support), and advanced triple-layer and Sheet Support Binder (SSB) fabrics, which dominate the high-speed paper machine sector due to their superior stability, drainage homogeneity, and longevity. Segmentation by Application highlights the varied demands of different paper end-products, with packaging paper and board representing the largest and fastest-growing segment globally, followed by printing and writing paper, which maintains a stable demand for high-quality surface finish fabrics.

- By Type

- Single Layer

- Double Layer

- Triple Layer

- SSB Forming Fabric

- By Application

- Printing & Writing Paper

- Packaging Paper & Board (Containerboard, Corrugated Medium, Folding Boxboard)

- Newsprint

- Specialty Paper (Tissue, Filter Paper, Release Liner)

- By Material

- Polyester Monofilament

- Polyester Multifilament

- By Machine Speed

- Low Speed (Below 800 m/min)

- Medium Speed (800 – 1200 m/min)

- High Speed (Above 1200 m/min)

Value Chain Analysis For Polyester Forming Fabric Market

The value chain for the Polyester Forming Fabric Market is characterized by high integration and specialization, starting from raw material procurement and extending to post-sales technical service at the paper mill. The upstream segment involves the production of high-grade polyester chips, which are then extruded into specific diameter monofilaments or multifilaments—this stage is crucial as the quality, polymer grade, and precise diameter of the filaments dictate the final fabric performance. Key suppliers in the upstream market are often large chemical companies that specialize in high-tenacity, low-shrinkage PET resins. The middle segment, manufacturing, is dominated by a few large, vertically integrated technical textile companies that utilize proprietary weaving, seaming, and crucial heat-setting processes to achieve the exacting permeability, dimensional stability, and wear resistance required for high-speed operation. This manufacturing stage represents the highest value addition due to the specialized intellectual property involved.

Downstream analysis focuses on the distribution and end-users. Distribution channels are predominantly direct, involving close collaboration between the forming fabric manufacturer and the paper mill’s technical and maintenance teams. Due to the custom-made nature of high-performance fabrics, standard indirect sales through general industrial distributors are uncommon. Direct distribution ensures accurate measurement, timely installation, and ongoing technical support, which is critical for optimizing fabric lifespan and machine efficiency. The end-users are paper and pulp manufacturers globally, segmented by the type and speed of their paper machines, which dictate the specific fabric specifications required.

The direct sales model is paramount in this industry because fabric performance is highly dependent on specific machine geometry and operational parameters. Fabric manufacturers invest heavily in technical service teams that analyze machine performance, diagnose issues (like barring or uneven drainage), and recommend optimal fabric design changes. This comprehensive support structure ensures customer loyalty and acts as a key competitive differentiator, particularly for complex SSB and triple-layer fabrics. The indirect channel, while limited, might involve local agents facilitating initial sales in geographically dispersed emerging markets, though technical service almost always remains the responsibility of the OEM (Original Equipment Manufacturer) of the fabric.

Polyester Forming Fabric Market Potential Customers

The primary customers in the Polyester Forming Fabric Market are major operators within the global pulp and paper industry, encompassing integrated pulp mills and non-integrated paper and board producers. These customers can be categorized based on the products they manufacture and the technological sophistication of their paper machines. Highly demanding customers operate ultra-high-speed machines (over 1,500 m/min) producing lightweight containerboard, newsprint, and high-quality tissue paper, requiring the most advanced, high-stability SSB fabrics to maintain high throughput and quality. Mid-range speed machines, common in printing and writing paper production, require fabrics balanced for drainage and surface finish.

Specific end-user groups include multinational paper conglomerates that manage multiple mills across various continents, requiring standardized global fabric specifications and robust supply chains. Another crucial customer segment is the rapidly expanding group of packaging paper producers in Asia, focusing on kraftliner and fluting production to meet the demands of global e-commerce and logistics sectors. These buyers prioritize longevity, tear resistance, and cost-effectiveness in their fabric choices. Ultimately, the purchasing decision is highly technical, involving maintenance managers, production engineers, and procurement specialists who assess fabric suppliers based on proven runnability, documented lifespan increases, and the quality of the technical support provided.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albany International Corp., Andritz AG, Voith GmbH & Co. KGaA, Xerium Technologies Inc., Huyck Wangner Group, Heimbach GmbH, AstenJohnson, Valmet Oyj, Pulp & Paper Fabric Co., Weavexx, Jiangsu Wanzhong Textile Machinery Co., Ltd., Changde Huading Forming Fabric Co., Ltd., Shanghai Chengshuo Industrial Co., Ltd., William Kenyon & Sons Ltd., Haining Xinxiang Textile Machinery Co., Ltd., Dalian Shengli Screen Co., Ltd., Kadant Inc., CHENGDU QINGYANG PAPER MAKING MACHINERY CO., LTD., FELTS & FABRICS (INDIA) LTD., Vaaibhav Laxmi Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyester Forming Fabric Market Key Technology Landscape

The Polyester Forming Fabric Market is defined by continuous advancements in weaving, heat treatment, and polymer science, essential for meeting the demands of modern high-speed papermaking. The most critical technological development is the pervasive adoption of Sheet Support Binder (SSB) forming fabric technology. SSB fabrics feature complex three-layer designs: a top layer optimized for uniform sheet formation and minimal wire mark, a bottom layer optimized for wear resistance and machine stability, and a robust binder layer connecting the two. This structure allows independent optimization of the wear-side and the sheet-side, drastically improving both fabric longevity and paper quality, making them indispensable for machines operating above 1200 meters per minute.

In addition to structural complexity, manufacturing technologies involving high-precision weaving looms and advanced heat-setting processes are paramount. Modern looms enable the creation of extremely fine mesh counts and precise drainage channels, ensuring rapid and uniform water removal. The heat-setting process, performed under tension and controlled temperature, is crucial for dimensional stability, locking the weave structure in place to prevent stretching and distortion during operation. Suppliers are also heavily investing in specialized polymer blends and coatings that enhance resistance to hydrolytic degradation, microbial attack (bio-fouling), and abrasive wear caused by mineral fillers and recycled fibers, thereby maximizing the operating life between fabric changes.

A burgeoning technological area is the integration of "smart" features into forming fabrics. Although still niche, research is focusing on embedding microscopic sensors or conductive elements within the fabric structure. These features would allow real-time monitoring of fabric tension, permeability, wear rate, and drainage performance, feeding crucial operational data back to the paper machine's control system. This technology promises to revolutionize predictive maintenance and operational optimization, moving the industry towards Industry 4.0 standards. The convergence of textile engineering, polymer science, and digital monitoring systems is the central theme of technological innovation in this market.

Regional Highlights

Geographically, the Polyester Forming Fabric Market displays distinct growth patterns and maturity levels across major global regions. The Asia Pacific (APAC) region stands as the undisputed powerhouse and fastest-growing market globally. This dominance is attributed to large-scale capacity additions, particularly in China and India, driven by surging domestic consumption of packaging and tissue paper, coupled with robust export markets. APAC manufacturers are rapidly adopting high-speed paper machines, generating immense demand for technologically advanced SSB and triple-layer fabrics capable of managing high throughput efficiently. The competitive environment in APAC is characterized by the presence of large global suppliers competing fiercely with rapidly expanding local manufacturers.

North America and Europe represent mature markets characterized by stable demand focused on replacement cycles and technological upgrades aimed at sustainability and operational efficiency. In these regions, the emphasis is heavily placed on premium fabrics that reduce energy consumption during dewatering and provide exceptional stability to handle high percentages of recycled and low-quality fiber furnish. Fabric longevity and the ability to minimize wire mark for high-quality printing and specialty papers remain critical purchasing criteria. European demand is further stimulated by stringent environmental regulations, pushing mills to optimize every part of the papermaking process.

Latin America and the Middle East & Africa (MEA) regions offer specialized growth opportunities. Latin America, particularly Brazil and Chile, with strong wood pulp resources, drives demand for fabrics used in market pulp drying and containerboard production. The MEA region, while smaller, is experiencing steady growth, fueled by urbanization and rising hygiene standards, stimulating investment in tissue and packaging production capacity, thereby increasing the need for modern forming fabrics. These regions often prioritize cost-effectiveness alongside durability, leading to varied demand across single, double, and triple-layer fabric segments.

- Asia Pacific (APAC): Market leader and fastest-growing region, driven by massive expansions in packaging and tissue sectors (China, India). High demand for SSB fabrics supporting ultra-high-speed machines.

- North America: Mature market prioritizing high-performance, durable fabrics for energy efficiency and high recycled content usage. Stable demand driven by replacement cycles and technological mandates.

- Europe: Stable growth focused on quality (printing and specialty paper) and sustainability requirements. Strong uptake of advanced multi-layer fabrics and integrated services.

- Latin America: Focused growth in countries with strong pulp and paper industries (Brazil, Mexico). Key applications include containerboard and market pulp production.

- Middle East & Africa (MEA): Emerging market growth tied to increasing urbanization and domestic capacity development, particularly in tissue and lightweight packaging grades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyester Forming Fabric Market.- Albany International Corp.

- Andritz AG

- Voith GmbH & Co. KGaA

- Xerium Technologies Inc. (Andritz Fabrics and Rolls Inc.)

- Huyck Wangner Group

- Heimbach GmbH

- AstenJohnson

- Valmet Oyj

- Pulp & Paper Fabric Co.

- Weavexx (Part of Andritz)

- Jiangsu Wanzhong Textile Machinery Co., Ltd.

- Changde Huading Forming Fabric Co., Ltd.

- Shanghai Chengshuo Industrial Co., Ltd.

- William Kenyon & Sons Ltd.

- Haining Xinxiang Textile Machinery Co., Ltd.

- Dalian Shengli Screen Co., Ltd.

- Kadant Inc.

- CHENGDU QINGYANG PAPER MAKING MACHINERY CO., LTD.

- FELTS & FABRICS (INDIA) LTD.

- Vaaibhav Laxmi Industries

- Schoeller Technocell GmbH

- P. H. F. Fabrics Ltd.

Frequently Asked Questions

Analyze common user questions about the Polyester Forming Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a polyester forming fabric in the paper industry?

The primary function is to serve as the conveyor belt in the forming section of a paper machine, facilitating the initial rapid drainage of water from the fiber slurry while simultaneously supporting and transporting the nascent paper web for subsequent processing.

How do SSB (Sheet Support Binder) forming fabrics differ from traditional single-layer fabrics?

SSB fabrics feature a triple-layer structure, allowing the top (sheet-side) surface to be optimized for superior sheet formation and low wire mark, while the bottom (machine-side) layer is optimized independently for high wear resistance and stability, significantly enhancing both paper quality and fabric lifespan compared to single-layer designs.

Which application segment drives the highest demand in the current market?

The Packaging Paper & Board segment, including containerboard, corrugated medium, and folding boxboard, drives the highest demand globally due to the exponential growth of e-commerce and logistics sectors, which require rapid, high-volume production using advanced forming media.

What are the key technical challenges in producing high-speed polyester forming fabrics?

Key challenges include achieving and maintaining perfect dimensional stability under extreme tension, ensuring precise permeability for uniform drainage at high speeds, and developing specialized treatments to resist abrasion and bio-fouling caused by recycled fiber furnishes and water chemistry.

How is technological innovation impacting the competitive landscape?

Innovation is leading to market consolidation, as companies capable of manufacturing complex multi-layer and SSB structures, often utilizing proprietary weaving and heat-setting IP, gain competitive advantages over those supplying standard fabrics. Future competition will increasingly involve smart fabrics and technical service capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager