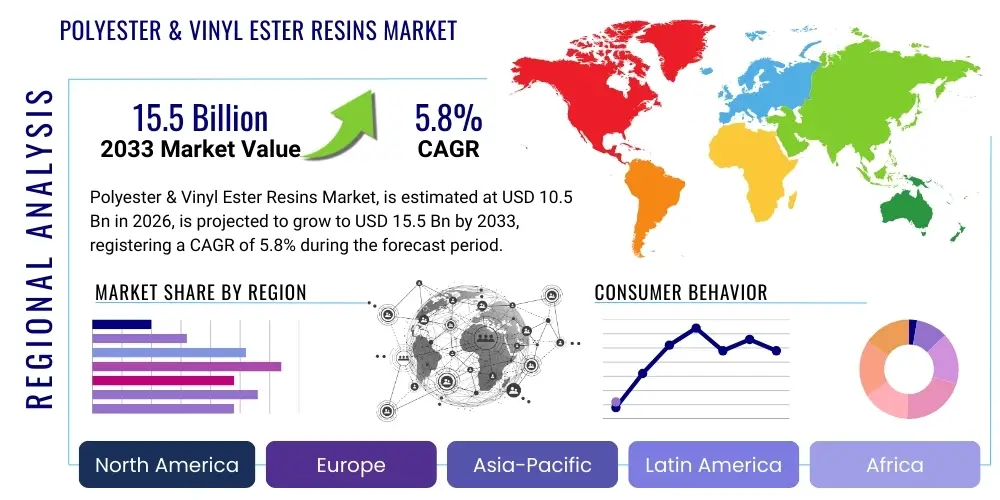

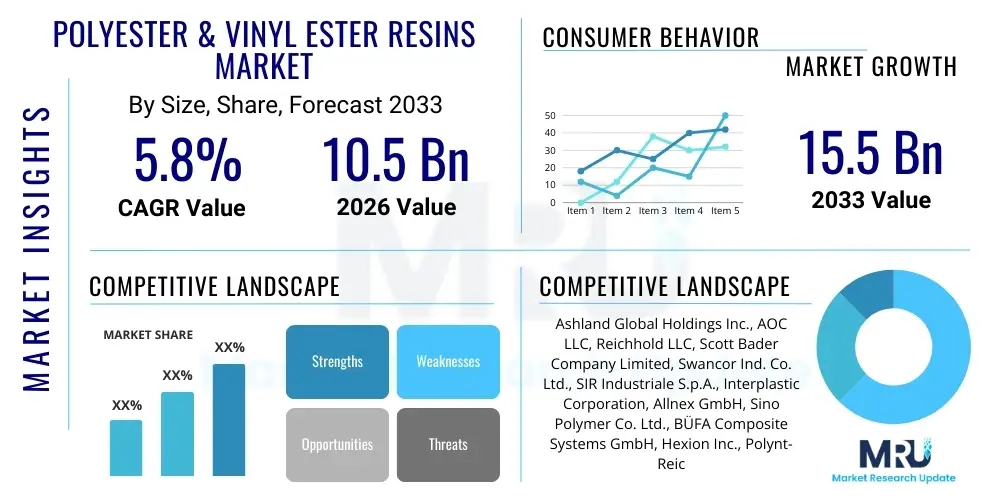

Polyester & Vinyl Ester Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435409 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Polyester & Vinyl Ester Resins Market Size

The Polyester & Vinyl Ester Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033.

Polyester & Vinyl Ester Resins Market introduction

The Polyester and Vinyl Ester Resins Market encompasses the production, distribution, and application of thermosetting resins widely utilized as matrices in fiber-reinforced composite materials. Polyester resins, particularly Unsaturated Polyester Resins (UPR), are derived from the polycondensation of saturated and unsaturated dicarboxylic acids with diols, offering excellent moldability, mechanical strength, and cost-effectiveness. Vinyl ester resins (VERs), on the other hand, are produced by reacting epoxy resins with an unsaturated monocarboxylic acid, primarily offering superior resistance to corrosion, harsh chemicals, and high temperatures compared to standard polyesters, positioning them as high-performance materials in demanding environments.

Major applications for these resins span critical infrastructure sectors. UPRs are heavily utilized in the building and construction industry for paneling, roofing, and architectural components, as well as in the transportation sector for automotive body parts and marine applications (boats and yachts) due to their lightweight properties and structural integrity. Vinyl ester resins are indispensable in chemical processing, oil and gas, and wastewater treatment infrastructure, where their high chemical resistance protects pipes, tanks, and scrubber systems from degradation. The primary benefit these resins offer is their ability to form robust, lightweight composites when combined with reinforcing fibers like glass or carbon fiber, replacing traditional materials such as steel and concrete in structural applications.

Driving factors for market expansion include the increasing demand for lightweight materials in the aerospace and automotive industries aimed at enhancing fuel efficiency and reducing emissions. Furthermore, stringent environmental regulations requiring enhanced corrosion resistance in industrial infrastructure, particularly for chemical storage and fluid transport, boost the adoption of high-performance vinyl ester resins. The growth of renewable energy sectors, such as wind turbine manufacturing, which relies heavily on UPR for large blade construction, also provides substantial momentum. Simultaneously, continuous innovation in resin formulations, focusing on reduced volatile organic compound (VOC) emissions and enhanced fire retardancy, supports market acceptance in developed economies.

Polyester & Vinyl Ester Resins Market Executive Summary

The global Polyester & Vinyl Ester Resins market is characterized by robust business trends driven by sustainability initiatives and infrastructure development spending, particularly in emerging economies. Key business trends involve vertical integration among resin manufacturers and composite producers to secure supply chains and optimize production costs. The market is witnessing a shift towards specialized, low-styrene emission resins to comply with health and safety standards, impacting manufacturing processes and product formulation globally. Regional trends show that Asia Pacific dominates the market due fueled by massive infrastructural projects and burgeoning manufacturing bases in China and India. North America and Europe, while mature, exhibit strong demand for high-performance vinyl ester resins in corrosion-resistant industrial applications and for advanced composites in the automotive sector, focusing heavily on weight reduction and compliance with end-of-life vehicle directives.

Segmentation trends indicate that the Unsaturated Polyester Resins (UPR) segment retains the largest volume share due to its cost-effectiveness and versatility across construction, marine, and electrical applications. However, the Vinyl Ester Resins (VER) segment is projected to grow at a faster CAGR, driven by its superior chemical resistance which makes it mandatory for critical infrastructure like high-pressure pipes, storage tanks in the chemical processing industry (CPI), and demanding corrosion-control systems. Within end-use industries, the building & construction sector remains the primary consumer, although the transportation sector, particularly electric vehicle (EV) component manufacturing, is emerging as the fastest-growing application segment, requiring resins with optimized structural properties and faster curing cycles. The market structure remains highly competitive, necessitating continuous investment in research and development to introduce specialized resin grades that meet specific performance criteria such as fire resistance and low viscosity for infusion processes.

Overall market dynamics suggest a favorable outlook, underscored by the imperative for durable and maintenance-free infrastructure globally. While volatility in raw material pricing, particularly styrene and key acids, poses a restraint, the technological advancements in bio-based resins and the development of resins compatible with automated manufacturing techniques (like robotic winding and pultrusion) offer significant growth opportunities. Stakeholders are focused on optimizing supply logistics and improving the shelf life and reactivity of these thermosets. The long-term growth trajectory is intrinsically linked to global industrial output and the replacement cycles of aging infrastructure, especially in the water/wastewater management and chemical processing industries where chemical resistance is paramount.

AI Impact Analysis on Polyester & Vinyl Ester Resins Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Polyester & Vinyl Ester Resins Market commonly center on predictive maintenance, optimization of complex manufacturing processes, and accelerated material discovery. Users seek to understand how AI algorithms can reduce batch-to-batch variability in resin synthesis, which is critical for consistent composite performance. Concerns frequently revolve around the initial investment required for integrating AI-driven sensors and data infrastructure in traditional chemical plants, and the expertise needed to manage complex predictive models for polymerization kinetics and quality control. Expectations are high regarding AI’s ability to model the long-term degradation of composite structures made from these resins, allowing for predictive failure analysis, thereby enhancing product reliability and safety in applications like pressurized piping systems and structural bridge components.

- AI-driven optimization of polymerization kinetics, reducing reaction time and energy consumption during resin manufacturing.

- Predictive quality control utilizing machine vision and sensor data to monitor viscosity and curing profiles, minimizing batch variability.

- Enhanced R&D via AI modeling to rapidly screen and design novel resin formulations with specific performance characteristics (e.g., higher temperature resistance, bio-content).

- Optimization of composite manufacturing processes (pultrusion, filament winding) by predicting fiber orientation and resin flow characteristics.

- Implementation of digital twins for critical infrastructure (tanks, pipes) using AI to monitor structural health and predict maintenance requirements for VER composites.

DRO & Impact Forces Of Polyester & Vinyl Ester Resins Market

The market for Polyester & Vinyl Ester Resins is driven primarily by the strong global demand for lightweight, high-strength materials, particularly in the transportation and wind energy sectors, alongside significant investments in corrosion-resistant infrastructure, especially in developing economies. Conversely, the market faces key restraints including the volatility of raw material prices (styrene, epoxy derivatives), which directly impacts manufacturing costs and profit margins, and increasing regulatory scrutiny regarding styrene emissions and VOC content, particularly in North America and Europe. Opportunities are abundant in the field of bio-based or partially bio-derived resins, which address sustainability concerns and open new consumer segments, as well as the rapid expansion of manufacturing processes like 3D printing and automated composite manufacturing which demand specialized resin grades with unique curing characteristics. These internal market dynamics, coupled with external factors such as global industrial output and infrastructure spending cycles, exert significant impact forces on pricing, supply chain resilience, and technological adoption rates within the industry.

Segmentation Analysis

The Polyester & Vinyl Ester Resins market is broadly segmented based on resin type, end-use industry, and reinforcement material, providing a multi-dimensional view of consumption patterns and growth pockets. Unsaturated Polyester Resins (UPR) dominate the market due to their favorable cost-to-performance ratio, serving high-volume applications such as construction and general fabrication. However, the Vinyl Ester Resins (VER) segment, offering superior chemical and thermal resistance, is witnessing accelerated growth as industrial standards for performance in corrosive environments become stricter, driving adoption in specialized industrial applications. The end-use segmentation reveals that while construction remains the foundation, the automotive and aerospace composite sector is poised for rapid expansion, driven by the global imperative for lighter vehicles and efficient, high-performance materials. Analyzing these segments helps stakeholders tailor their product portfolio to capitalize on high-growth areas while maintaining competitiveness in established markets.

- By Resin Type:

- Unsaturated Polyester Resins (UPR)

- Vinyl Ester Resins (VER)

- By End-Use Industry:

- Building & Construction

- Marine

- Transportation (Automotive, Aerospace, Rail)

- Pipes & Tanks

- Electrical & Electronics

- Wind Energy

- Others (Sporting Goods, Consumer Products)

- By Reinforcement Material:

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Natural Fibers

- By Manufacturing Process:

- Lay-up (Hand Lay-up, Spray Lay-up)

- Pultrusion

- Filament Winding

- Resin Transfer Molding (RTM)

- Injection Molding

Value Chain Analysis For Polyester & Vinyl Ester Resins Market

The value chain for Polyester & Vinyl Ester Resins starts with upstream activities involving the procurement and processing of key raw materials, including bulk petrochemical derivatives such as styrene, maleic anhydride, phthalic anhydride, glycols, and bisphenol A (BPA) epoxy resins. Price volatility and supply chain stability for these chemical precursors are critical factors impacting the final resin cost and availability. Major chemical manufacturers and refineries supply these materials to resin producers. The core manufacturing stage involves complex polymerization processes and formulation techniques, where specialized additives, initiators, and stabilizers are incorporated to achieve desired curing profiles, viscosity, and final mechanical properties, representing the highest value addition point in the chain.

Midstream activities involve the distribution of the synthesized resins, often categorized as liquid thermoset polymers, through both direct sales channels to large composite manufacturers and indirect distribution networks involving specialized chemical distributors. These distributors play a crucial role in providing logistical support, smaller batch sizes, and technical service to regional, smaller composite fabricators. Downstream activities involve the utilization of these resins by composite part manufacturers, who employ various techniques—including pultrusion for pipes, filament winding for tanks, and vacuum infusion for large marine parts—to produce final composite structures. This stage is highly dependent on the fabrication expertise and the specific quality control standards required by the end-use industry, such as adherence to DNV GL or ASTM standards.

Direct sales are prevalent for large volume contracts, typically serving Tier 1 automotive suppliers, major wind turbine blade manufacturers, and global piping corporations, ensuring customized product delivery and long-term technical support. Indirect channels, via specialized chemical stockists and regional distributors, facilitate market penetration into fragmented sectors like small-scale construction and customized manufacturing. Understanding this dual distribution structure is essential for market players to optimize inventory management and reduce lead times for both standard UPR grades and high-performance VER variants, ultimately connecting the primary chemical supply with the highly diverse demands of the final composite consumers.

Polyester & Vinyl Ester Resins Market Potential Customers

Potential customers for Polyester & Vinyl Ester Resins are diverse and span several heavy industry sectors, characterized by their need for materials offering a balance of structural integrity, low weight, chemical inertness, and durability. The primary end-users include major composite manufacturers specializing in fiberglass reinforced plastic (FRP) products. In the infrastructure sector, municipal water authorities and large industrial plants are key buyers, demanding VER for constructing corrosion-resistant wastewater treatment tanks, chemical processing vessels, and underground utility pipes, where resistance to aggressive chemical agents is non-negotiable. Furthermore, shipbuilding yards and marine repair facilities constitute a significant customer base, relying heavily on UPR for boat hulls, decks, and marine structural components due to its resistance to moisture and its ease of repair.

The transportation industry represents a rapidly expanding customer segment, encompassing automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers who seek lightweight composites for electric vehicle battery enclosures, interior structures, and external body panels to achieve vehicle mass reduction targets. Similarly, the wind energy sector is a major consumer, with turbine manufacturers requiring vast quantities of UPR for the fabrication of increasingly large rotor blades, demanding materials that possess excellent fatigue resistance and stiffness. These customers typically require resins customized for specific manufacturing processes (e.g., infusion grades with controlled viscosity) and specific performance criteria (e.g., enhanced fire retardancy for construction or stringent dimensional stability for aerospace).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashland Global Holdings Inc., AOC LLC, Reichhold LLC, Scott Bader Company Limited, Swancor Ind. Co. Ltd., SIR Industriale S.p.A., Interplastic Corporation, Allnex GmbH, Sino Polymer Co. Ltd., BÜFA Composite Systems GmbH, Hexion Inc., Polynt-Reichhold Group, DIC Corporation, BASF SE, Mitsubishi Chemical Corporation, Dow Inc., Tianhe Resin Co., Ltd., Changzhou Huari, Jiangsu Huayang Resin, Wuxi Huada. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyester & Vinyl Ester Resins Market Key Technology Landscape

The technological landscape in the Polyester & Vinyl Ester Resins market is centered on enhancing material performance, reducing environmental impact, and enabling advanced composite fabrication techniques. Significant research is focused on developing low-VOC and styrene-free resin formulations to meet stringent environmental regulations, utilizing technologies such as methyl methacrylate (MMA) or other reactive diluents to replace styrene. This shift necessitates reformulation of curing agents and initiator systems to maintain optimal processing times and mechanical properties. Furthermore, the development of fire-retardant resins, often achieved through the incorporation of phosphorus- or halogen-based additives, is crucial for applications in construction and transportation where fire safety standards (e.g., FAR 25.853, EN 45545) are mandatory, driving innovation in flame-retardant resin chemistry and testing protocols.

A key technological focus involves tailoring resin viscosity and reactivity profiles for advanced manufacturing methods. For instance, low-viscosity resins are being engineered specifically for infusion processes (like Vacuum Assisted Resin Transfer Molding – VARTM) used in large component manufacturing (e.g., wind blades), ensuring full fiber wet-out without defects. Conversely, fast-curing, highly thixotropic resins are optimized for high-speed processes like pultrusion and RTM, crucial for automotive high-volume applications where cycle time reduction is paramount. The integration of nanotechnology, utilizing carbon nanotubes or graphene into the resin matrix, represents an emerging technology aimed at improving structural properties such as interlaminar shear strength and electrical conductivity without significantly compromising processability or increasing viscosity dramatically.

The increasing adoption of smart manufacturing and automation is driving the need for resins with consistently tight specification tolerances. This includes the implementation of real-time monitoring of resin characteristics during production and application. Bio-based chemistry also forms a growing part of the technology roadmap, focusing on replacing petroleum-derived constituents with bio-renewable alternatives such as bio-glycols and bio-derived unsaturated acids. While currently occupying a niche, these bio-resins are projected to gain market share as corporate sustainability goals become more aggressive, demanding new methods for scaling production while maintaining performance parity with traditional thermoset systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by massive infrastructure investments in China, India, and Southeast Asian nations. The region’s dominance is supported by its expansive manufacturing base for automotive parts, consumer goods, and the establishment of numerous chemical processing and power generation plants requiring corrosion-resistant materials. China, in particular, drives high-volume UPR consumption in construction and marine fabrication, while specialized VER adoption is rising in rapidly industrializing economies for environmental protection systems and chemical storage.

- North America: This region is characterized by high demand for performance-driven composite materials, especially in the oil and gas (e.g., fiberglass reinforced pipe – FRP), transportation, and aerospace sectors. Strict regulatory frameworks regarding material safety and environmental impact drive the adoption of low-VOC and high-performance vinyl ester resins. The regional market growth is stable, underpinned by constant innovation in composite manufacturing technologies, including advanced RTM and pultrusion techniques for automotive lightweighting initiatives.

- Europe: Europe exhibits strong maturity and innovation, focusing heavily on sustainability and circular economy principles. Key drivers include the wind energy sector (especially offshore wind) and the automotive industry’s push towards electric vehicles and composite structures. European markets prioritize certified, fire-retardant UPR for construction and VER for industrial applications, adhering strictly to REACH regulations and promoting the development and adoption of bio-based resins.

- Latin America (LATAM): Growth in LATAM is sporadic but promising, tied closely to major infrastructure projects in countries like Brazil and Mexico, particularly in water treatment, mining, and oil exploration. Market penetration relies heavily on imports and regional distribution partnerships, with UPR being the primary volume driver in construction and regional marine sectors due to cost considerations.

- Middle East and Africa (MEA): This region shows significant potential, primarily driven by massive petrochemical and infrastructure developments, particularly in Saudi Arabia and the UAE. There is high demand for high-performance vinyl ester resins and specialized pipe-grade UPR to withstand harsh environmental conditions, including high temperatures and corrosive environments associated with oil refining and desalination plants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyester & Vinyl Ester Resins Market.- Ashland Global Holdings Inc.

- AOC LLC

- Reichhold LLC

- Scott Bader Company Limited

- Swancor Ind. Co. Ltd.

- SIR Industriale S.p.A.

- Interplastic Corporation

- Allnex GmbH

- Sino Polymer Co. Ltd.

- BÜFA Composite Systems GmbH

- Hexion Inc.

- Polynt-Reichhold Group

- DIC Corporation

- BASF SE

- Mitsubishi Chemical Corporation

- Dow Inc.

- Tianhe Resin Co., Ltd.

- Changzhou Huari

- Jiangsu Huayang Resin

- Wuxi Huada

Frequently Asked Questions

Analyze common user questions about the Polyester & Vinyl Ester Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in performance between Polyester (UPR) and Vinyl Ester Resins (VER)?

UPR offers good mechanical strength and cost-effectiveness suitable for general construction and marine uses, while VER provides significantly superior resistance to chemical attack, moisture absorption, and thermal degradation, making it essential for chemical processing and industrial piping applications.

Which industry segment drives the highest current volume consumption of these resins?

The Building & Construction industry currently drives the highest volume consumption of polyester resins globally, utilizing them extensively in panels, structural components, and architectural features due to their durability and moldability.

What are the main drivers of the shift towards specialized, low-VOC resin formulations?

The primary driver is the need to comply with increasingly strict environmental regulations, particularly in North America and Europe, aimed at reducing volatile organic compound (VOC) emissions, especially styrene, to enhance workplace safety and minimize ecological impact.

How does the volatility of styrene prices affect the profitability of resin manufacturers?

Styrene is a critical raw material and its price volatility directly impacts the cost of Unsaturated Polyester Resins (UPR). Manufacturers often face margin pressure and must strategically manage inventory or incorporate price hedging mechanisms to mitigate these fluctuations.

What is the role of these resins in the rapidly growing wind energy sector?

Polyester resins (specifically UPR) are crucial in the wind energy sector as the matrix material for manufacturing large, structurally critical rotor blades, offering the necessary combination of lightweight properties, stiffness, fatigue resistance, and ease of mass production via infusion processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager