Polygon Scanning Mirror Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434560 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Polygon Scanning Mirror Market Size

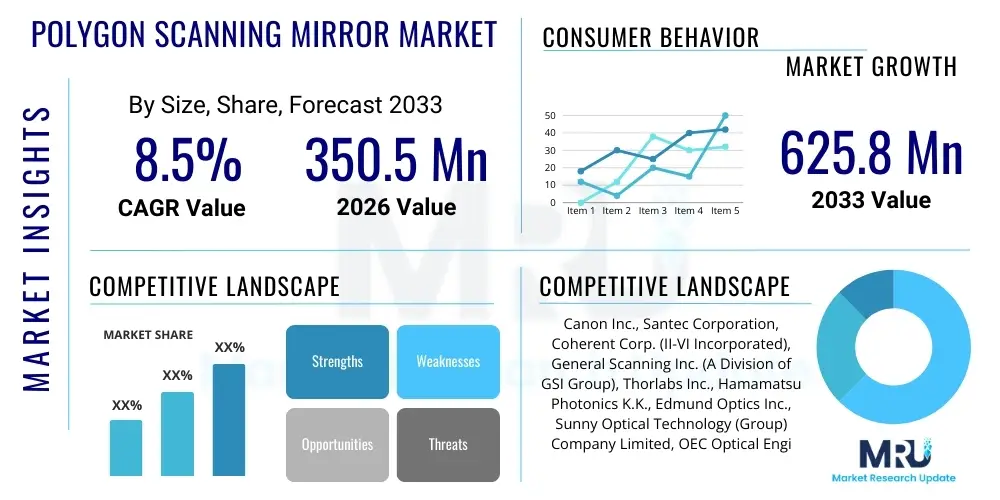

The Polygon Scanning Mirror Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 625.8 Million by the end of the forecast period in 2033. This robust expansion is fueled by the escalating adoption of high-speed laser processing systems across manufacturing sectors, particularly electronics and automotive, which require extremely fast and accurate beam positioning mechanisms. The increasing complexity of quality inspection systems, especially in semiconductor fabrication, further drives the demand for ultra-precise polygon scanners capable of microscopic resolution scanning at industry-leading velocities. Technological advancements focused on reducing rotational jitter and improving bearing longevity are instrumental in sustaining this market trajectory, ensuring that polygon scanners remain the preferred choice for demanding applications over alternative scanning technologies.

Polygon Scanning Mirror Market introduction

The Polygon Scanning Mirror Market encompasses the global trade and utilization of multi-faceted rotating mirrors engineered for the dynamic deflection and modulation of laser beams. These sophisticated optical components are foundational to various high-speed optical scanning applications, delivering superior linearity and speed compared to galvanometer mirrors or MEMS-based systems in specific contexts. Polygon mirrors function by rotating at extremely high velocities, often exceeding 50,000 revolutions per minute (RPM), allowing incident laser light to be rapidly swept across a target plane, a capability essential for maximizing throughput in industrial environments. Key performance indicators for these devices include the number of facets, the optical flatness of the reflective surfaces, the synchronization accuracy of the driving motor, and the overall stability against thermal and vibrational loads, directly correlating with the quality and resolution of the resulting scan pattern.

Major applications for polygon scanning mirrors span several critical high-tech sectors, including high-resolution laser printing, advanced material processing, medical diagnostics (such as Optical Coherence Tomography or OCT), security screening, and, most prominently, Light Detection and Ranging (LiDAR) systems used in autonomous navigation and robotics. The inherent robustness and scalability of polygon scanning mechanisms make them invaluable in environments requiring continuous, high-duty cycle operation. Furthermore, the rising adoption of additive manufacturing techniques and the need for precision laser ablation in microelectronics drive continuous innovation in mirror fabrication materials and motor control algorithms, seeking to minimize pyramidal error and maximize effective scan angle without compromising beam quality. The utility of these mirrors lies not just in speed, but in their ability to handle high-power lasers efficiently, minimizing thermal distortion.

The market benefits significantly from several driving factors, including the global proliferation of fiber and solid-state lasers demanding high-speed modulation for data handling and marking, the mandate for faster medical imaging techniques reducing patient time, and the explosion of 3D sensing technology, especially in infrastructure mapping and autonomous vehicle development. The precision offered by polygon scanners, coupled with enhanced durability and reduced maintenance requirements compared to older mechanical scanning systems, solidifies their market position. Continuous improvements in air-bearing and magnetic-bearing motor technologies have notably extended the operational lifespan and reduced the acoustic noise signature of these devices, making them suitable for sensitive laboratory and clinical settings, further broadening their applicability and market reach globally.

Polygon Scanning Mirror Market Executive Summary

The Polygon Scanning Mirror Market is characterized by vigorous growth, primarily driven by rapid advancements in laser-based technologies and the commercialization of high-performance LiDAR systems. Business trends indicate a strategic shift towards integrated scanning modules that combine the polygon mirror, motor, control electronics, and auxiliary optics into compact, ready-to-deploy units, significantly simplifying system integration for OEMs in the automotive and industrial automation sectors. Key market players are investing heavily in improving manufacturing tolerance to achieve sub-arcsecond accuracy in facet angles, a crucial metric for high-end digital imaging and metrology. Furthermore, strategic partnerships between mirror manufacturers and laser system integrators are becoming prevalent, aiming to co-develop optimized solutions for emerging applications like high-speed flexible display manufacturing and complex semiconductor inspection, ensuring that product development aligns directly with stringent industrial requirements.

Regionally, the Asia Pacific (APAC) area dominates the market both in terms of production capacity and consumption, fueled by the massive presence of electronics manufacturing, sophisticated medical device production hubs in countries like Japan and South Korea, and the burgeoning electric vehicle (EV) and autonomous driving markets in China. North America and Europe maintain strong footholds, focusing on high-value niche segments such as aerospace defense systems utilizing laser tracking and advanced research applications requiring ultra-precise scanning capabilities. Regional trends suggest an accelerated demand for military-grade and ruggedized polygon scanners capable of operating reliably in extreme environmental conditions. Manufacturers are also adapting their supply chains to navigate geopolitical complexities, leading to increased localized production capabilities to enhance resilience and reduce lead times for major end-user clusters.

Segment trends reveal that the highest growth is concentrated in scanners optimized for LiDAR and 3D sensing, where the shift from traditional mechanical LiDAR to solid-state or semi-solid-state designs often incorporates polygon mechanisms to achieve wide field-of-view (FoV) coverage at high frame rates. In terms of technology, air-bearing polygon motors are gaining traction over ball-bearing motors in high-reliability applications, despite their higher initial cost, due to their superior rotational stability and virtually limitless operational lifespan under controlled conditions. The material segment is also witnessing a shift, with increasing utilization of lightweight materials like aluminum alloys and even specialized polymers coated for high reflectivity in lower power, weight-sensitive portable devices, driving market segmentation based on operational frequency and laser power handling capability.

AI Impact Analysis on Polygon Scanning Mirror Market

User queries regarding AI's influence predominantly center on whether Artificial Intelligence (AI) and Machine Learning (ML) will directly replace the function of polygon mirrors or whether they will enhance the performance of polygon-based systems. Key concerns revolve around the integration of AI-driven control loops for real-time error correction and the optimization of scanning patterns in complex environments, such as autonomous navigation or intricate surgical robotics. Users are also keen to understand how AI-enhanced data processing of high-volume scan data generated by ultra-fast polygon scanners affects downstream applications, particularly in defect detection and volumetric reconstruction. The general expectation is that AI will not render polygon mirrors obsolete but will serve as an indispensable tool for maximizing their precision, stability, and efficiency within broader optical systems.

AI’s primary impact on the Polygon Scanning Mirror Market is centered on enhancing operational efficiency and extending system capabilities far beyond traditional control methods. By applying machine learning algorithms to sensor feedback, AI can predict and compensate for minor mechanical drifts, thermal expansion effects, and rotational jitter in real-time, thereby maintaining or improving the scan fidelity under varying operating conditions. This capability is critical in maintaining the tight angular tolerances required in lithography and high-end metrology. Furthermore, in dynamic applications like robot vision or autonomous navigation, AI controls can dynamically adjust the polygon rotation speed or the mirror tilt (if integrated with a secondary mechanism) to focus computational resources on areas of interest, significantly optimizing data acquisition efficiency and reducing overall latency in decision-making processes.

In the manufacturing domain, AI is revolutionizing quality control for polygon mirror production itself. High-resolution optical inspection of reflective facets to detect minute surface imperfections or pyramidal errors can be automated using deep learning models, drastically increasing inspection throughput and consistency compared to human-led inspection. Predictive maintenance, another critical AI application, utilizes sensor data from the polygon motor (temperature, vibration, current draw) to forecast potential component failure, allowing for scheduled replacement and minimizing costly unplanned downtime in 24/7 industrial operations. This integration of AI across the lifecycle—from manufacturing quality assurance to in-field performance optimization—cementing polygon mirrors' viability in next-generation smart factories and critical infrastructure.

- AI-driven real-time compensation for rotational non-linearity and motor jitter, improving scan accuracy.

- Enhanced predictive maintenance routines based on ML models analyzing motor performance data.

- Optimization of data sampling strategies in LiDAR systems, utilizing AI to dynamically prioritize scan regions.

- Accelerated and automated quality control inspection of mirror facets during the manufacturing process.

- Integration of polygon scan data with computer vision algorithms for faster, more reliable defect detection.

DRO & Impact Forces Of Polygon Scanning Mirror Market

The market dynamics of polygon scanning mirrors are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces shaping its trajectory. Key drivers include the overwhelming demand from the automotive sector for high-resolution, long-range LiDAR, where polygon scanners offer a proven, scalable mechanism for beam steering. The accelerating adoption of advanced laser marking, micro-machining, and 3D printing technologies across diverse manufacturing sectors further propels demand, as these processes fundamentally rely on high-speed beam manipulation. Simultaneously, continuous technological refinement leading to smaller, lighter, and more energy-efficient scanning units broadens their appeal for portable and unmanned aerial vehicle (UAV) applications, fostering market expansion into new operational domains.

Despite strong underlying demand, several restraining factors challenge the market's seamless growth. High manufacturing complexity and the stringent requirement for ultra-high precision in facet angle tolerances contribute significantly to the overall unit cost, making polygon scanners less accessible for certain budget-sensitive applications compared to less performant alternatives like galvanometer mirrors. Furthermore, system integration challenges, specifically managing the high rotational speeds and the need for complex, highly synchronized control electronics to ensure precise scan line positioning, pose technical hurdles for new market entrants. Competition from emerging solid-state beam steering technologies, particularly Optical Phased Arrays (OPAs) and certain MEMS mirror configurations, presents a long-term threat, especially if these alternatives can match the field-of-view and power handling capabilities of polygon systems while reducing cost and size.

Opportunities for exponential growth exist through the strategic targeting of nascent high-potential applications. The increasing deployment of advanced robotics in logistics and manufacturing, which require sophisticated 3D vision systems, offers a fertile ground for polygon scanner integration. Moreover, the development of specialized, low-cost polymer-based polygon mirrors for consumer electronics and affordable medical devices could open entirely new volume markets, shifting the focus from high-precision industrial niche applications to mass-market appeal. Strategic investments in bearing technology—moving definitively toward robust, zero-maintenance magnetic or air bearings—represent a key opportunity to mitigate reliability concerns and secure market dominance in critical, mission-critical systems. Successfully navigating the high cost of precision manufacturing while exploiting these new application frontiers is crucial for maximizing future revenue streams and mitigating competitive pressures from rival scanning technologies.

Segmentation Analysis

The Polygon Scanning Mirror Market is comprehensively segmented based on several critical dimensions, including the type of bearing utilized, the number of facets, the laser power handling capability, and the primary application area. Understanding these segments is vital for stakeholders to accurately gauge market concentration and tailor product development strategies toward specific end-user needs. The most fundamental segmentation relies on bearing technology, distinguishing between traditional ball-bearing units, which are cost-effective but limited in lifespan and speed, and advanced air-bearing or magnetic-bearing units, which offer superior stability, speed, and durability, often at a premium price point. This segmentation reflects the trade-off between cost and performance demanded by various industries, ranging from high-volume, low-cost desktop printers to high-reliability, long-lifetime industrial metrology systems.

Further granular segmentation is driven by application, with major categories including LiDAR and 3D Scanning, Laser Material Processing, Biomedical Imaging, and Digital Printing/Display Systems. The requirements within the LiDAR segment, for example, emphasize angular resolution and resistance to environmental factors, necessitating highly specialized mirrors and motor designs. Conversely, material processing applications prioritize high laser damage threshold and thermal stability of the mirror coating, as they deal with significantly higher incident power levels. The number of facets on the polygon directly dictates the scan efficiency and the complexity of the optical system; mirrors with more facets achieve faster repetition rates, crucial for high-throughput scanning, while fewer facets might be used in specialized systems requiring highly detailed, slower scans over a smaller angular range.

The analysis of these segments highlights significant differential growth rates. While digital printing represents a mature, stable segment, the LiDAR and 3D scanning segments are experiencing exponential growth due to rapid developments in autonomous mobility and industrial automation. Manufacturers are strategically positioning their portfolios to capitalize on the increasing demand for high-facet, high-speed, air-bearing scanners specifically tailored for automotive-grade operating temperatures and vibration profiles. Successful market penetration increasingly requires offering customized solutions that integrate seamlessly with specific laser wavelengths, divergence characteristics, and environmental specifications of the end-user application, moving away from standardized, off-the-shelf components.

- By Bearing Type:

- Ball Bearing

- Air Bearing (Aerodynamic Bearing)

- Magnetic Bearing

- By Number of Facets:

- < 10 Facets

- 10 to 20 Facets

- > 20 Facets

- By Application:

- LiDAR and 3D Sensing (Automotive, Industrial Robotics)

- Laser Material Processing (Cutting, Welding, Marking)

- Biomedical and Scientific Imaging (OCT, Confocal Microscopy)

- Digital Printing and Display Systems

- Inspection and Metrology

- By End-User Industry:

- Automotive

- Electronics and Semiconductor

- Aerospace and Defense

- Healthcare

- Industrial Manufacturing

Value Chain Analysis For Polygon Scanning Mirror Market

The value chain for the Polygon Scanning Mirror Market begins with upstream activities focused on the procurement and processing of highly specialized raw materials and precision components. This includes ultra-pure aluminum alloys, specialized substrates for mirror manufacturing, and advanced motor components (such as magnetic coils and high-precision shafts). Precision machining and coating services form a critical early stage, as the optical quality, flatness, and facet angles must be achieved with nanometer-level accuracy. Key upstream suppliers include material providers for aerospace-grade metals and specialized vacuum coating houses responsible for applying high-reflectivity, high-laser-damage-threshold dielectric or metallic coatings tailored to specific laser wavelengths. The stability and availability of these highly specialized materials directly influence production costs and final product quality, necessitating strong supplier relationships.

Midstream activities involve the core manufacturing and assembly of the polygon scanner system. This includes the ultra-precision machining of the polygon drum, dynamic balancing to ensure stability at high rotation speeds, and the integration of the mirror with the motor and electronic drive system. The value added at this stage is immense, encompassing proprietary motor control algorithms that minimize jitter and ensure constant velocity, along with the precise alignment of the optical and mechanical components. Manufacturers often specialize in either the motor technology (e.g., air bearings) or the optical precision (e.g., large-format mirrors), leading to a highly specialized competitive landscape. Rigorous quality assurance, including interferometric testing of facet flatness and high-speed vibration analysis, ensures the final product meets the stringent operational specifications required by end-users.

Downstream activities involve distribution, system integration, and end-user application. Distribution channels are typically dual: direct sales to large OEMs (like major automotive LiDAR manufacturers or industrial laser companies) and indirect sales through specialized technical distributors and integrators who add value by incorporating the polygon scanner into complex, multi-component laser systems. The end-user, such as a robotic manufacturer or a medical imaging lab, purchases the integrated system. Direct channels allow for close technical collaboration and customization, which is crucial in high-end markets, while indirect channels provide wider geographical reach. Aftermarket services, including recalibration, maintenance contracts, and specialized repair for high-precision components, form the final, crucial link in the value chain, extending the operational life and perceived value of these sophisticated optical devices.

Polygon Scanning Mirror Market Potential Customers

Potential customers for polygon scanning mirrors represent a diverse spectrum of high-technology industries where high-speed, accurate beam steering is a non-negotiable requirement. The primary cohort of end-users are Original Equipment Manufacturers (OEMs) specializing in advanced 3D sensing and LiDAR systems, particularly those targeting autonomous vehicles (Level 3 and above) and industrial automation robotics. These customers require polygon scanners capable of generating dense point clouds at high frame rates over long distances, prioritizing ruggedness, reliability, and automotive-grade certification. The escalating investment in EV and autonomous technology ensures that this segment remains the largest and fastest-growing customer base for high-performance air-bearing polygon scanners, driving standardization toward smaller, more robust integrated modules.

Another significant customer segment is composed of manufacturers of high-throughput industrial laser systems, including companies involved in precision cutting, welding, micro-ablation, and marking of materials like polymers, metals, and composite fabrics. These customers often prioritize mirrors with high laser damage thresholds and excellent thermal stability, typically requiring specialized metallic or enhanced dielectric coatings suitable for kilowatt-level laser power. The increasing shift towards flexible manufacturing and the need for personalized product customization are driving demand for dynamic beam delivery systems, making the polygon mirror an indispensable component in modern industrial processing lines, particularly in the electronics and semiconductor industries for wafer inspection and repair.

Finally, the medical and scientific community represents a vital, albeit specialized, customer base. Biomedical OEMs, particularly those developing advanced imaging modalities like Fourier-domain Optical Coherence Tomography (FD-OCT) and high-speed confocal microscopy, require extremely high rotational stability and repeatability to achieve micron-level resolution in real-time. Research institutions and university laboratories also procure polygon scanners for experimental setups involving rapid spectral analysis, atmospheric sensing, and high-energy physics applications. These customers often demand highly customized, low-volume solutions with extreme precision specifications, favoring manufacturers known for their optical engineering expertise and willingness to engage in co-development projects for cutting-edge scientific instrumentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 625.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Inc., Santec Corporation, Coherent Corp. (II-VI Incorporated), General Scanning Inc. (A Division of GSI Group), Thorlabs Inc., Hamamatsu Photonics K.K., Edmund Optics Inc., Sunny Optical Technology (Group) Company Limited, OEC Optical Engineering Co. Ltd., Scanlab GmbH, Precision Optical Engineering (POE), TOPTICA Photonics AG, ALIO Industries, Konica Minolta Inc., Newport Corporation (A MKS Instruments Brand), A.P.I. Technologies (Advanced Photonix Inc.), Mitsubishi Electric Corporation, Nikon Corporation, P&P Optica, Sumitomo Heavy Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polygon Scanning Mirror Market Key Technology Landscape

The technological landscape of the Polygon Scanning Mirror Market is defined by continuous innovation focused on three primary areas: maximizing rotational speed and stability, minimizing optical aberrations, and improving the durability of the motor drive system. Central to rotational stability are advanced bearing technologies. While traditional ball bearings remain cost-effective, they suffer from inherent friction, noise, and limited lifespan, often restricting their use to lower-end or non-critical applications. Conversely, the transition to high-performance, maintenance-free air bearings and magnetic bearings represents the pinnacle of current technology. Air bearings utilize a thin cushion of pressurized air to support the rotating drum, virtually eliminating mechanical contact and allowing speeds up to 100,000 RPM with minimal rotational jitter, crucial for high-resolution imaging and metrology systems requiring highly stable scan lines over extended periods of continuous operation. Magnetic bearings, while often more complex and costly, provide the highest speed capability and are entirely impervious to dust contamination, making them ideal for ultra-clean environments like semiconductor manufacturing.

Optical design and material science also play a pivotal role. Current trends favor the utilization of high-stiffness, lightweight substrate materials, such as single-crystal silicon or specialized low-thermal-expansion glass ceramics, which are then highly polished and coated. This selection minimizes inertial load, allowing for faster acceleration and deceleration, and reduces thermally induced distortion when exposed to high-power lasers. The precision of the facet manufacturing process is paramount; techniques like diamond turning and sophisticated post-polishing are employed to maintain pyramidal errors (the deviation of the facet angle from the axis of rotation) to sub-arcsecond levels. Advancements in durable, multi-layer dielectric coatings optimized for specific wavelengths (e.g., 905 nm or 1550 nm for LiDAR, or UV wavelengths for material processing) ensure high reflectivity and longevity against laser-induced damage, which is a major concern in industrial laser applications.

Furthermore, the electronic control systems driving the polygon motor are becoming significantly more sophisticated. The integration of high-resolution rotary encoders and sophisticated Position Sensor Interface (PSI) technologies allows for highly accurate synchronization and speed control, essential for maintaining the linearity and repeatability of the scan across the entire operational window. Microprocessor-based Field-Programmable Gate Array (FPGA) controllers are increasingly used to implement real-time compensation algorithms that correct for manufacturing imperfections and operational variances, further enhancing system performance. This convergence of ultra-precise mechanics, advanced material science, and intelligent control electronics positions polygon scanning mirrors as highly sophisticated sub-systems, driving performance breakthroughs in areas like frequency-modulated continuous-wave (FMCW) LiDAR where extremely stable, high-speed beam movement is required for accurate distance and velocity measurements.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Application

The Asia Pacific region, led by China, Japan, South Korea, and Taiwan, is the undisputed powerhouse of the Polygon Scanning Mirror Market. This dominance stems from the massive installed base of high-volume electronics manufacturing, including display fabrication and semiconductor production, both of which rely heavily on high-speed laser inspection and processing systems. China's aggressive push into Electric Vehicles (EVs) and the domestic development of autonomous driving technology have made it the single largest market for LiDAR-grade polygon scanners. Japanese and South Korean firms maintain a global lead in high-precision, low-jitter scanners primarily utilized in advanced medical diagnostics (OCT) and high-fidelity printing. The sheer scale of industrial automation adoption and the favorable government policies supporting the transition to high-tech manufacturing continue to solidify APAC's leading position, driving both supply-side innovation and demand-side volume.

The region is characterized by intense price competition in the lower-to-mid-range segments, particularly for digital printing applications, but maintains significant demand for premium air-bearing systems required for semiconductor wafer inspection and advanced industrial marking. Investment in R&D within major APAC economies focuses heavily on miniaturization and thermal management solutions to enable the integration of polygon scanners into smaller form factors, such as drones and consumer-grade 3D scanners. Supply chain resilience, following recent global disruptions, has prompted localized sourcing initiatives, further stimulating the regional manufacturing ecosystem and ensuring sustained growth throughout the forecast period. The high population density and rapid infrastructure development across Southeast Asia also contribute to robust demand for aerial and terrestrial mapping services utilizing polygon-based LiDAR systems.

Japan remains a key center for technological breakthroughs, particularly in the motor control and bearing precision aspects of polygon scanner design. Companies originating here often set the global standard for rotational stability and long-term reliability. South Korea is rapidly expanding its capacity for manufacturing specialized optical components for next-generation consumer electronics, requiring polygon scanners for advanced display inspection and fabrication processes. Ultimately, the APAC market segment is expected to outpace global growth rates, driven by the intersecting demands of automotive technology, consumer electronics, and large-scale industrial automation upgrades across the mainland Asian economies.

- North America: Innovation and High-Value Applications

North America holds a strategic position in the market, driven by heavy investment in defense, aerospace, advanced research, and the thriving autonomous vehicle development ecosystem centered in the United States. Demand here is characterized by a requirement for highly customized, high-specification polygon scanners capable of operating reliably under extreme conditions, often used in laser targeting systems, atmospheric monitoring, and high-power directed energy applications. The region is home to major technology innovators and system integrators who prioritize cutting-edge performance and proprietary optical coatings, willing to absorb higher costs for superior technical specifications, particularly in terms of angular precision and laser damage threshold.

The concentration of top-tier universities and national laboratories in the US and Canada sustains continuous demand for polygon mirrors in scientific instrumentation, including specialized astronomical imaging and quantum optics experiments. Furthermore, the strong presence of major cloud computing providers and logistics automation companies fuels the need for sophisticated industrial robotics and 3D mapping solutions in warehouses and distribution centers. North American companies are often at the forefront of integrating AI and machine learning into the control systems of polygon scanners to maximize performance and extend operational life through predictive maintenance protocols, setting new standards for intelligent optical systems.

The competitive landscape is dominated by niche players offering highly specialized, vertically integrated solutions, contrasting with the high-volume manufacturing focus often seen in APAC. Regulatory environments pertaining to autonomous vehicle deployment and aerial surveying also stimulate regional market growth. The ongoing consolidation and strategic acquisition of smaller, specialized optics firms by large industrial conglomerates underscores the strategic importance of high-precision scanning technology within the broader aerospace and industrial control markets in this region. This focus on high-margin, technologically advanced solutions ensures steady, high-quality revenue streams for manufacturers operating within North America.

- Europe: Industrial Automation and Medical Devices

Europe represents a mature and technologically sophisticated market, primarily driven by Germany's robust industrial automation sector (Industry 4.0), the UK's aerospace and defense initiatives, and strong healthcare markets across Western Europe. European manufacturers are significant consumers of polygon scanners for high-speed laser processing systems used in automotive component manufacturing and high-precision machinery construction. The emphasis on high-quality, long-life industrial equipment translates into a preference for premium air-bearing and magnetic-bearing polygon mirrors, emphasizing longevity and minimal maintenance requirements in automated production lines.

The region also maintains a strong focus on advanced medical device manufacturing, particularly in ophthalmic surgery equipment and sophisticated diagnostic tools like OCT, requiring ultra-stable, high-speed scanning capabilities. Strict regulatory standards, such as those imposed by the European Medicines Agency (EMA), necessitate components that offer exceptionally high repeatability and reliability, reinforcing the market for precision-engineered polygon scanners. Furthermore, governmental and private sector investments in infrastructure monitoring and construction mapping utilizing mobile and airborne LiDAR solutions contribute substantially to regional market growth in the geo-spatial segment.

Sustainability and energy efficiency are increasingly important factors influencing component selection in Europe, favoring compact and power-efficient polygon scanner designs. Local manufacturers are concentrating efforts on developing robust solutions that integrate seamlessly with standardized industrial communication protocols, furthering the market penetration within smart factory environments. While the overall volume may be lower than in APAC, the value per unit in the European market remains high, reflecting the stringent quality and performance requirements mandated by advanced European industrial and medical end-users.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polygon Scanning Mirror Market.- Canon Inc.

- Santec Corporation

- Coherent Corp. (II-VI Incorporated)

- General Scanning Inc. (A Division of GSI Group)

- Thorlabs Inc.

- Hamamatsu Photonics K.K.

- Edmund Optics Inc.

- Sunny Optical Technology (Group) Company Limited

- OEC Optical Engineering Co. Ltd.

- Scanlab GmbH

- Precision Optical Engineering (POE)

- TOPTICA Photonics AG

- ALIO Industries

- Konica Minolta Inc.

- Newport Corporation (A MKS Instruments Brand)

- A.P.I. Technologies (Advanced Photonix Inc.)

- Mitsubishi Electric Corporation

- Nikon Corporation

- P&P Optica

- Sumitomo Heavy Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Polygon Scanning Mirror market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of polygon scanning mirrors over galvanometer scanners?

The primary advantage of polygon scanning mirrors is their capacity for significantly higher scanning speeds and scan rates, enabling ultra-high-speed data acquisition or material processing. Polygon mirrors maintain highly linear scan velocity across the field of view, unlike galvanometers, which must constantly accelerate and decelerate, making polygons ideal for continuous, high-throughput applications like LiDAR and high-resolution digital printing.

How does the choice of bearing type impact the performance and lifespan of a polygon scanner?

The bearing type fundamentally determines speed, lifespan, and rotational stability. Ball bearings are lower cost but limit rotational speed and require maintenance. Air bearings (aerodynamic) and magnetic bearings eliminate mechanical contact, offering superior speeds (up to 100,000+ RPM), negligible jitter, and virtually unlimited operational lifespan, making them mandatory for high-precision, mission-critical industrial and automotive LiDAR applications.

Which industry segment is driving the highest demand for polygon scanning mirrors currently?

The LiDAR and 3D Sensing segment, particularly within the autonomous vehicle and industrial robotics sectors, is currently driving the highest demand. Polygon scanners provide the necessary speed and wide field-of-view coverage crucial for generating the dense, real-time point cloud data required for safe autonomous navigation and advanced industrial inspection systems.

What is the significance of the pyramidal error in polygon mirror manufacturing?

Pyramidal error refers to the angular deviation of a mirror facet from the ideal parallel plane of rotation. Minimizing pyramidal error is critical because it directly influences the vertical scan line position and overall scan linearity. High-precision applications, such as laser metrology and semiconductor inspection, require pyramidal error to be minimized to sub-arcsecond levels to ensure image fidelity and measurement accuracy.

Are solid-state scanning technologies expected to replace polygon mirrors entirely in the future?

While solid-state technologies (like MEMS and OPAs) are advancing rapidly and are gaining traction in compact, low-power applications, they currently struggle to match the high power handling capacity, wide field-of-view, and superior speed of polygon mirrors. Polygon scanners are expected to retain dominance in high-performance, high-power, and large-area scanning industrial and long-range automotive LiDAR systems for the foreseeable future due to their proven scalability and robustness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager