Polyimide and Imide Polymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435631 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polyimide and Imide Polymer Market Size

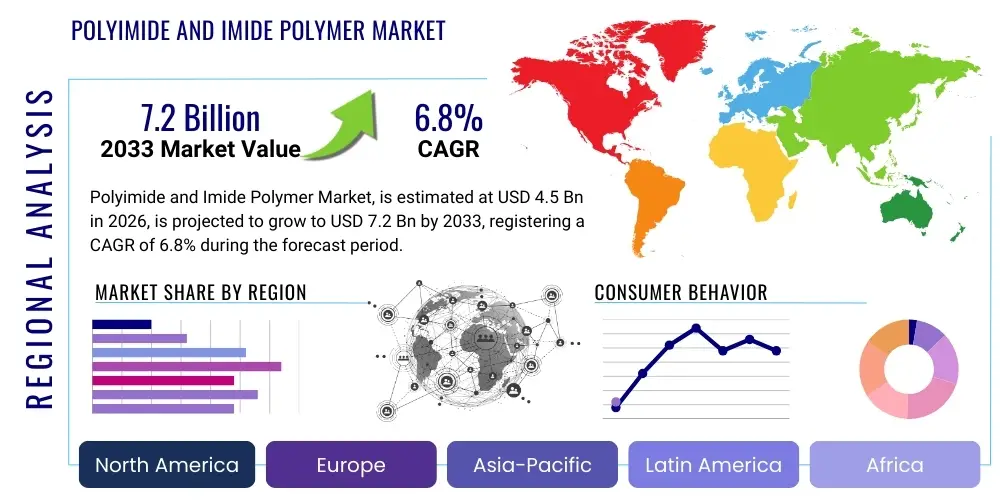

The Polyimide and Imide Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Polyimide and Imide Polymer Market introduction

The Polyimide (PI) and Imide Polymer Market encompasses high-performance engineering thermoplastics characterized by exceptional thermal stability, mechanical strength, and chemical resistance. Polyimides are synthesized through the polycondensation reaction of dianhydrides and diamines, resulting in materials possessing imide rings within their polymer backbone. These characteristics make them indispensable in demanding environments where traditional plastics fail, particularly within the aerospace, electronics, and automotive industries. Products derived from these polymers include films, coatings, composites, fibers, and molded parts, serving critical functions such as insulation, stress absorption, and structural integrity in extreme conditions.

Major applications driving the demand for polyimides include flexible printed circuit boards (FPCBs) in consumer electronics, protective coatings for aircraft components, and high-temperature seals and gaskets in engines. Their superior dielectric properties and low coefficient of thermal expansion (CTE) are crucial for advanced semiconductor manufacturing and 5G telecommunication infrastructure. The increasing miniaturization of electronic devices and the imperative for lightweight, fuel-efficient designs in transportation sectors further solidify the market position of polyimide and imide polymers.

The primary benefits of utilizing these specialized polymers revolve around their operational longevity and performance reliability under continuous high temperatures (often exceeding 250°C), superior dimensional stability, and intrinsic flame retardancy. Driving factors include escalating global demand for flexible electronics, stringent regulatory requirements favoring lightweight materials in aerospace and automotive industries for fuel efficiency, and technological advancements in synthesis methods enabling customized polymer properties for specific high-end applications like deep-sea exploration equipment and medical devices.

Polyimide and Imide Polymer Market Executive Summary

The Polyimide and Imide Polymer Market is experiencing robust expansion, primarily fueled by rapid technological adoption in the Asia Pacific electronics sector and stringent performance demands from global aerospace and defense industries. Business trends show a strong shift towards developing customized, soluble polyimides and polyetherimide (PEI) variants that offer enhanced processing ease without compromising high-performance characteristics. Key strategic activities include mergers, acquisitions, and extensive research and development focused on bio-based and recycled polyimides to address sustainability concerns. Furthermore, manufacturers are investing heavily in advanced film casting and lamination technologies to cater to the flexible display and battery markets.

Regional trends highlight the Asia Pacific (APAC) as the dominant market, driven by the concentration of FPCB manufacturing and semiconductor fabrication facilities in countries such as China, South Korea, and Taiwan. North America and Europe maintain significant market shares due to high spending in the aerospace, defense, and specialized medical device industries, which require ultra-high-performance grades of polyimides. Latin America and the Middle East and Africa (MEA) are emerging as growth regions, spurred by infrastructure development and increasing adoption of advanced materials in automotive production and energy exploration projects, although currently representing smaller segments.

Segment trends underscore the dominance of the Films & Sheets segment due to pervasive use in electronic insulation and flexible circuits. However, the Molding Materials segment is projected to exhibit the highest growth rate, driven by demand for lightweight components in electric vehicles (EVs) and high-temperature connectors. By application, the Electronics sector remains the largest consumer, while the Automotive and Transportation segment is poised for accelerated growth, reflecting the global transition to electric mobility and the need for heat-resistant power electronics casings and insulation components.

AI Impact Analysis on Polyimide and Imide Polymer Market

User queries regarding AI's impact on the Polyimide and Imide Polymer market often center on three key themes: optimization of complex polymer synthesis and materials discovery, predictive quality control during high-temperature manufacturing processes, and the role of polyimides in next-generation AI hardware (like flexible sensors and heat sinks for GPUs). Users are concerned about how AI can accelerate the development cycle for novel PI structures with optimized dielectric constants for 5G/6G applications, and whether machine learning (ML) models can predict long-term material degradation and performance under extreme operational conditions, thereby reducing expensive physical testing. Expectations are high that AI will lead to customized material design tailored precisely to end-user specifications, particularly in additive manufacturing (3D printing) of polyimide parts.

- Optimization of Synthesis Routes: AI and machine learning algorithms are utilized to model complex chemical reaction pathways, predicting optimal solvent systems and process parameters for high-yield polyimide production, reducing experimental time by up to 40%.

- Advanced Materials Informatics: AI accelerates the discovery of novel polyimide structures with enhanced performance characteristics (e.g., lower CTE or higher glass transition temperature (Tg)) necessary for advanced semiconductor packaging and quantum computing components.

- Predictive Maintenance and Quality Control: AI-driven sensor systems monitor critical manufacturing parameters (temperature, pressure, viscosity) during film casting and polymerization, allowing for real-time fault detection and ensuring uniformity and high quality of ultra-thin polyimide films.

- Additive Manufacturing (AM) Integration: AI algorithms optimize the slicing and deposition processes for 3D printing of polyimide and polyetherimide parts, ensuring structural integrity and isotropic mechanical properties in the final printed component.

- Enhanced Electronic Application Performance: AI contributes indirectly by driving demand for PI films as substrate materials for flexible electronics, specialized sensors, and heat dissipation solutions in high-performance computing units (data centers, edge devices).

DRO & Impact Forces Of Polyimide and Imide Polymer Market

The Polyimide and Imide Polymer market dynamics are predominantly influenced by strong drivers related to global technological progression, counterbalanced by significant constraints regarding high production costs and complexity. Opportunities exist in emerging application domains such as electric vehicle battery technology and medical implants, while the impact forces shape competitive dynamics through regulatory compliance and intellectual property landscapes. Specifically, the escalating demand for thermal management solutions in high-density electronics and the continued growth of the commercial aerospace industry serve as powerful drivers, mandating materials that withstand increasingly harsh operational parameters. Conversely, the necessity for multi-stage synthesis, specialized handling equipment, and the limited availability of high-purity precursor materials contribute substantially to the high cost of polyimides compared to alternative engineering plastics like PEEK or LCP, restraining broader market adoption in cost-sensitive applications.

Key restraining factors also include challenges associated with processing certain types of polyimides, particularly the infusible, insoluble varieties, which require specialized techniques like sintering or direct forming, increasing manufacturing complexity. Furthermore, environmental and regulatory pressures regarding the solvents used in polyimide synthesis (such as NMP or DMAc) compel manufacturers to invest in environmentally benign alternatives or solvent recovery systems, adding to operational expenditure. Despite these hurdles, substantial opportunities are present in developing specialized polyimide derivatives for emerging fields. For instance, the demand for flexible, high-temperature wire insulation in nuclear and conventional power generation, alongside the need for robust encapsulation materials for next-generation solid-state batteries, presents significant avenues for market expansion.

Impact forces dictate the velocity and direction of market growth. Technological innovation acts as a primary accelerating force, enabling the creation of new PI variants (e.g., photodefinable polyimides) essential for advanced microelectronics fabrication. The rapid pace of miniaturization and increasing heat load in consumer electronics (smartphones, wearables) necessitates continuous material refinement. Moreover, the competitive landscape is intensely shaped by intellectual property; companies holding patents for specific synthesis methods or high-performance formulations maintain significant market leverage. Economic impact forces, such as fluctuating prices of precursors (like BTDA, PMDA), also influence profit margins and pricing strategies across the value chain, forcing manufacturers to optimize supply chain resilience and global sourcing strategies to maintain competitiveness.

Segmentation Analysis

The Polyimide and Imide Polymer Market is comprehensively segmented based on its product form, key application areas, and end-use industries, providing a granular view of market dynamics and growth potential across various dimensions. Segmentation by form highlights the dominance of films and sheets, vital for flexible electronics, but also captures significant revenue generated by molding materials, varnishes, and fibers. The chemical segmentation typically differentiates between pure polyimides, which offer the highest thermal performance, and polyetherimides (PEI), which provide a balance of performance and processability. Understanding these segments is crucial for manufacturers to align production capabilities with sector-specific demand patterns.

- By Product Form:

- Films & Sheets (e.g., Kapton film)

- Molding Materials (e.g., Vespel, melt-processible PI)

- Fibers & Filaments

- Coatings & Varnishes

- Adhesives

- By Application:

- Electronic Insulation

- Flexible Printed Circuits (FPCBs)

- Mechanical Parts (Bushings, Bearings, Seals)

- Composites (Matrix Resins)

- Filter Media

- By End-Use Industry:

- Electronics & Electrical

- Aerospace & Defense

- Automotive & Transportation (including Electric Vehicles)

- Medical

- Industrial (Heavy Machinery, Energy)

Value Chain Analysis For Polyimide and Imide Polymer Market

The value chain for the Polyimide and Imide Polymer market begins with the upstream segment, which involves the synthesis and supply of high-purity monomer precursors. Key raw materials include various dianhydrides (e.g., Pyromellitic Dianhydride (PMDA), Biphenyltetracarboxylic Dianhydride (BPDA)) and aromatic diamines (e.g., 4,4'-Oxydianiline (ODA)). The complexity of synthesizing these monomers in high purity directly influences the final polymer cost and performance. Specialized chemical companies dominate this initial stage, which requires strict quality control, as impurities can drastically compromise the polymer’s dielectric and thermal characteristics. Significant investment is needed in R&D to develop novel, cost-effective precursors and sustainable, bio-based alternatives.

The midstream stage involves the core manufacturing process, where polymerization takes place. Leading polymer manufacturers convert the precursors into finished polyimide products such as films, resins, and molded components. This stage includes complex processes like melt polymerization, solution casting (for films), and compression molding. High operational expenditure is associated with maintaining cleanroom environments, specialized high-temperature reactors, and advanced processing machinery. The distribution channel subsequently handles the movement of these specialty polymers. Direct distribution is common for high-volume or highly customized orders, especially those supplied to major aerospace or electronics OEMs, ensuring technical support and strict quality traceability. Indirect distribution utilizes specialized distributors and agents, particularly in fragmented markets or for smaller-volume standard products like polyimide tapes and varnishes, providing wider market penetration.

The downstream analysis focuses on the integration and utilization of polyimide products by end-use industries. Major downstream sectors include semiconductor packaging, flexible display manufacturing, and aircraft component production. These industries often require materials tailored to specific thickness, flexibility, or dielectric properties. For instance, manufacturers of FPCBs are major buyers of polyimide films, laminating them with copper foil. The demand pull from this downstream segment dictates innovation in precursor chemistry and processing technology. The entire value chain is characterized by strong vertical integration by large chemical manufacturers aiming to control quality from monomer to final product, thereby mitigating supply chain risks and maximizing profit margins.

Polyimide and Imide Polymer Market Potential Customers

Potential customers for polyimide and imide polymers are predominantly large-scale industrial consumers requiring materials that exhibit superior performance beyond the capabilities of standard engineering plastics, driven by applications involving extreme heat, aggressive chemicals, or demanding electrical insulation requirements. These buyers typically operate in sectors where product failure due to material fatigue or thermal breakdown is catastrophic, such as defense systems or mission-critical electronic devices. End-users often possess sophisticated engineering and material testing capabilities, enabling them to validate and specify precise polymer grades (e.g., specific molecular weights or fill compositions) required for their components, thereby forming long-term contractual relationships with specialized polymer suppliers.

The primary groups of buyers include electronics manufacturers needing high-performance substrates for flexible displays and advanced semiconductor packaging (interposers), and the aerospace industry, which uses polyimides for structural composites, thermal blankets, and engine seals due to their low density and high service temperature capabilities. Furthermore, the rapidly growing electric vehicle (EV) sector is becoming a major consumer, utilizing polyimide films for insulation between battery cells and within power electronics modules (inverters and converters) where heat management is critical for safety and efficiency. These buyers prioritize product consistency, regulatory compliance (e.g., UL ratings, aerospace standards), and the supplier's capacity for technological co-development to meet future performance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Kaneka Corporation, PI Advanced Materials, Ube Industries, Mitsui Chemicals, Evonik Industries, Saint-Gobain, Solvay, Kolon Industries, Asahi Kasei, LBT Co., Ltd., Changzhou Sunlight, Skypolymer Co., Ltd., Taimide Technology, SABIC, Kuraray Co., Ltd., Toray Industries, Mitsubishi Chemical, Lenzing AG, Hongseok Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyimide and Imide Polymer Market Key Technology Landscape

The technology landscape governing the Polyimide and Imide Polymer market is highly advanced, centered on optimizing the thermal, mechanical, and electrical properties of these polymers while improving their processability and sustainability profile. A critical technological focus is on enhancing the film casting process, particularly for ultra-thin (less than 10 micrometers) polyimide films required for foldable and rollable electronic displays. Advancements here involve specialized solution polymerization techniques and precision coating and curing methods that ensure exceptional dimensional stability, minimal surface defects, and uniform thickness across large manufacturing batches. Furthermore, the development of fluorinated polyimides represents a key innovation, offering lower dielectric constants crucial for high-frequency signal transmission in 5G and future telecommunication networks, mitigating signal loss at high speeds.

Another pivotal technological area involves the synthesis of soluble polyimides, often achieved through chemical modifications such as incorporating bulky side groups or kink structures into the polymer backbone, which disrupts chain packing. This enhanced solubility allows for processing using conventional solvent casting methods (like spin coating or spray coating) in electronic fabrication, significantly broadening their application potential beyond traditional aerospace uses. This move towards processability is vital for rapid prototyping and mass customization. Concurrently, the use of nanotechnology, specifically incorporating carbon nanotubes (CNTs) or graphene into the polyimide matrix, is being explored to create composites with dramatically improved mechanical strength, thermal conductivity, and electrostatic discharge (ESD) protection, addressing demands from the high-reliability industrial sector.

The manufacturing technology for molded polyimide parts, such as those used in precision mechanical applications (bearings, seals), is also evolving. Technologies like Vespel machining and high-temperature injection molding of melt-processible polyimides (like PEI and specific thermoplastic PIs) are being refined to achieve tighter tolerances and complex geometries. Furthermore, the integration of polyimides into additive manufacturing (3D printing) requires specialized high-temperature sintering and selective laser melting (SLM) equipment capable of handling the high melting points and maintaining the structural integrity of the imide bonds, thereby opening avenues for rapid, customized tooling and functional components in harsh environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for polyimide and imide polymers globally, primarily driven by its undisputed dominance in electronics manufacturing. Countries like China, South Korea, Japan, and Taiwan host the largest global facilities for semiconductor fabrication, flexible printed circuit board (FPCB) production, and flat panel display manufacturing, all of which rely heavily on polyimide films (like Kapton) as critical substrates and insulators. The rapid expansion of 5G infrastructure and the massive scale of EV battery production in the region further amplify demand, creating a sustained need for high volumes of thermally and dielectrically optimized polyimide materials.

- North America: The North American market holds a commanding position in the high-value, low-volume segment, predominantly anchored by the aerospace, defense, and specialized medical device industries. The stringent regulatory requirements and high-performance specifications demanded by NASA, Boeing, Lockheed Martin, and specialized medical device manufacturers necessitate the use of premium, custom-formulated polyimides and composites for structural components, extreme-temperature insulation, and radiation-resistant materials. Investment in advanced manufacturing techniques, including polyimide 3D printing, is robust.

- Europe: Europe represents a mature market characterized by strong innovation in the automotive sector (especially in EV power electronics and lightweighting initiatives) and significant research in high-performance industrial filtration (using PI fibers like P84). Strict environmental regulations (e.g., REACH) push manufacturers toward developing more sustainable and halogen-free polyimide formulations. Germany, France, and the UK are key consumers, driven by precision engineering applications and the renovation of aging industrial infrastructure requiring durable, high-temperature components.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. Growth is driven by increasing foreign investment in automotive assembly plants (LATAM) and significant expenditures on oil, gas, and energy infrastructure (MEA), which requires polyimide coatings, seals, and high-temperature cable insulation for harsh operational environments. While smaller in volume, the market penetration rate in these regions is expected to accelerate as industrialization and reliance on sophisticated materials increase, particularly in high-temperature well logging and drilling operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyimide and Imide Polymer Market.- DuPont

- Kaneka Corporation

- PI Advanced Materials

- Ube Industries

- Mitsui Chemicals

- Evonik Industries

- Saint-Gobain

- Solvay

- Kolon Industries

- Asahi Kasei

- LBT Co., Ltd.

- Changzhou Sunlight

- Skypolymer Co., Ltd.

- Taimide Technology

- SABIC

- Kuraray Co., Ltd.

- Toray Industries

- Mitsubishi Chemical

- Lenzing AG

- Hongseok Chemical

Frequently Asked Questions

Analyze common user questions about the Polyimide and Imide Polymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the polyimide market growth?

The primary drivers include the escalating demand for ultra-high-temperature resistant materials in the aerospace sector, the mass adoption of flexible printed circuit boards (FPCBs) in consumer electronics, and the necessity for superior thermal management and electrical insulation components within the rapidly expanding electric vehicle (EV) battery and power electronics market.

How do polyimides contribute to the electric vehicle (EV) industry?

Polyimides are crucial for EV performance and safety, serving as essential dielectric films for insulating individual battery cells and modules, and as high-temperature molding materials for connectors, seals, and heat sinks within the motor and inverter systems, ensuring reliability under intense thermal cycling.

What is the difference between polyimide (PI) and polyetherimide (PEI)?

Polyimide (PI) generally refers to thermosetting or highly insoluble thermoplastic polymers offering superior thermal resistance (often above 300°C Tg). Polyetherimide (PEI) is a melt-processible, amorphous thermoplastic known commercially as Ultem, which offers a balance of high heat resistance (typically lower than pure PI) and excellent mechanical properties, making it easier and cheaper to process using standard injection molding techniques.

Which geographic region dominates the demand for polyimide polymers?

The Asia Pacific (APAC) region dominates the global demand for polyimide polymers. This leadership is driven by the region's massive manufacturing base for electronics, semiconductors, and flexible displays, which are the largest consumers of polyimide films and coatings globally.

What technological challenges currently restrain the wider adoption of polyimides?

Key technological restraints include the high synthesis cost of high-purity precursors, the processing difficulty associated with insoluble polyimides (requiring specialized high-temperature methods), and the need for significant investment in R&D to develop sustainable, solvent-free manufacturing routes to comply with increasingly strict environmental regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager