Polyimide Foam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435011 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polyimide Foam Market Size

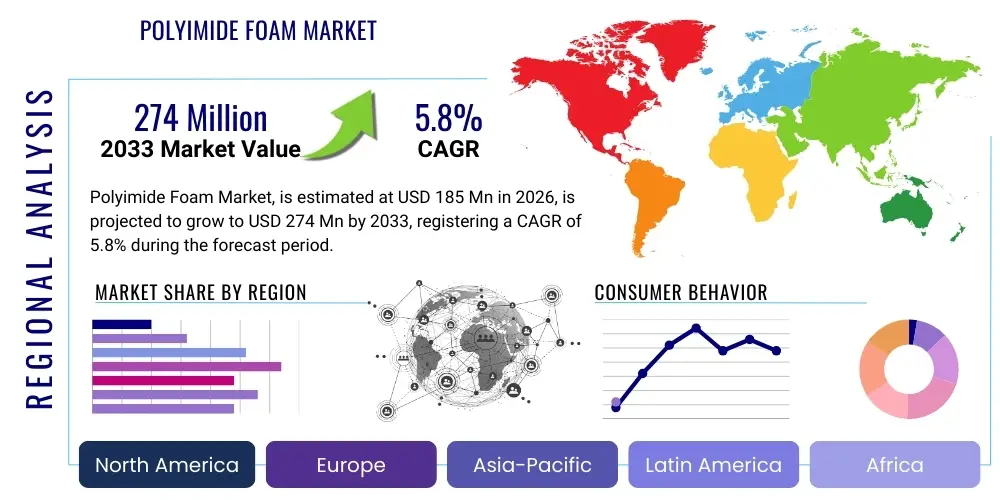

The Polyimide Foam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185 million in 2026 and is projected to reach USD 274 million by the end of the forecast period in 2033.

Polyimide Foam Market introduction

The Polyimide (PI) Foam Market encompasses the production and distribution of high-performance, lightweight cellular materials derived from polyimide polymers. Polyimide foam is critically important in demanding applications where traditional insulation or structural materials fail due to extreme temperature, fire risk, or weight constraints. These foams exhibit outstanding thermal stability, maintaining structural integrity and insulating properties across a wide temperature range, often from cryogenic levels up to 300°C. Their inherent flame retardancy, low smoke emission characteristics, and excellent acoustical insulation properties make them indispensable in industries adhering to stringent safety and performance regulations. Key applications span across aerospace (aircraft interiors, engine insulation, thermal protection systems), automotive (battery thermal management, sound dampening in high-end vehicles), and construction (fire barriers, specialized insulating panels).

The product is typically characterized by an open-cell structure, offering superior sound absorption coupled with very low thermal conductivity, which translates into highly efficient energy management solutions. The primary benefits driving market expansion include significant weight reduction compared to conventional materials, crucial for fuel efficiency in transportation sectors, and compliance with increasingly rigorous fire safety standards, especially within commercial aviation and high-speed rail. The manufacturing process often involves chemical foaming or solution/slurry foaming techniques, yielding materials with customizable density and mechanical strength profiles. Major drivers for market growth are the accelerating production rates in the aerospace sector, particularly for commercial aircraft requiring advanced cabin insulation, and the global push towards safer, lighter electric vehicle (EV) architectures where robust battery thermal management systems (BTMS) are essential.

Furthermore, the superior performance-to-weight ratio of polyimide foams positions them as strategic materials for next-generation defense applications and specialized industrial processes such, as clean room insulation or semiconductor manufacturing equipment. While the high cost of polyimide precursors and complex processing techniques present market restraints, continuous material science innovations aimed at reducing production costs and enhancing material flexibility are expected to generate substantial opportunities. The market's resilience is tied directly to sustained investment in infrastructure and transport sectors worldwide, prioritizing long-term durability and safety over initial material costs.

Polyimide Foam Market Executive Summary

The Polyimide Foam Market is undergoing transformative growth driven by heightened demand for lightweight, fire-resistant, and high-performance insulation solutions across specialized sectors. Current business trends indicate a strong focus on capacity expansion, particularly in regions experiencing robust growth in commercial aircraft manufacturing and electric vehicle battery production. Companies are heavily investing in proprietary foaming technologies, such as advanced solvent-free processes, to improve manufacturing efficiency, reduce lead times, and enhance the consistency of foam properties like cell size and porosity. Strategic collaborations between foam manufacturers and Tier 1 aerospace suppliers are becoming common, aimed at co-developing customized insulation kits that meet complex specification requirements for next-generation aircraft programs. Furthermore, the market is witnessing diversification into non-traditional segments, including high-end marine vessels and specialized industrial kilns, leveraging polyimide foam's superior thermal barrier capabilities.

Regionally, the market is dominated by North America and Asia Pacific (APAC). North America maintains its leadership primarily due to the presence of major aerospace and defense contractors, who are early adopters of high-specification polyimide foam for both civil and military platforms. The stringent fire safety regulations enforced by bodies like the FAA mandate the use of advanced, compliant materials in aircraft cabins, solidifying market demand. APAC, however, is emerging as the fastest-growing region, fueled by massive infrastructure projects, burgeoning domestic aerospace industries (notably in China and India), and the exponential growth of the electric vehicle market, particularly in China, which requires lightweight and safe BTMS solutions. Europe remains a significant contributor, driven by stringent energy efficiency targets and robust automotive manufacturing sectors focusing on premium and electric mobility.

Segment trends reveal that the Application segment of Aerospace and Defense holds the largest market share, commanding premium pricing due to regulatory requirements and mission-critical functionality. Within the Type segment, rigid polyimide foam, often utilized in structural applications and external thermal protection systems, is expected to exhibit faster growth due to advancements in composite integration and increased use in structural insulating panels. The demand for flexible polyimide foam remains steady, primarily for acoustic and thermal blankets within aircraft interiors and specialized piping insulation. The overarching trend across all segments is the increasing requirement for multi-functional materials that offer acoustic dampening, thermal management, and structural support simultaneously, pushing manufacturers toward material hybridization and composite solutions.

AI Impact Analysis on Polyimide Foam Market

Common user questions regarding AI's impact on the Polyimide Foam Market frequently revolve around how artificial intelligence can optimize the complex chemical synthesis and foaming processes, whether AI can accelerate the discovery of new, cost-effective polyimide precursors, and how predictive maintenance models can be applied to ensure the long-term performance and durability of foam integrated into critical systems like aircraft and EV batteries. Users are keen to understand if AI-driven simulation tools can reduce the extensive, costly physical testing required to meet aerospace fire safety certifications (e.g., FAR 25.853). The underlying themes are focused on leveraging AI and machine learning (ML) to overcome the primary market challenges of high manufacturing costs, process variability, and lengthy qualification cycles, ultimately transforming polyimide foam from a highly specialized niche material into a more accessible, scalable industrial product.

The application of AI in the Polyimide Foam Market centers on enhancing material property prediction, optimizing polymerization reaction kinetics, and improving quality control during the foaming stage. ML algorithms are being deployed to analyze vast datasets relating polymer formulation ratios, temperature profiles, and pressure variables against final foam characteristics such as density, cell structure uniformity, and mechanical strength. This predictive modeling capability significantly reduces the need for trial-and-error experimentation, accelerating the R&D cycle for customized foam variants required by specific end-users (e.g., foams optimized for thinner insulation layers in urban air mobility vehicles). Furthermore, Computer Vision systems integrated with AI are increasingly used in real-time inspection of manufactured foam sheets, identifying micro-defects invisible to human inspectors, thereby improving overall batch consistency and adherence to strict quality benchmarks.

AI's strategic impact extends beyond manufacturing optimization and into downstream applications. For instance, in Electric Vehicle Battery Thermal Management Systems (BTMS), AI algorithms analyze operational data (temperature, charge cycles, vibration) to predict insulation degradation or potential thermal runaway risks, ensuring the reliability and safety of the battery pack over its lifecycle. AI-powered finite element analysis (FEA) simulations allow engineers to virtually test how polyimide foam reacts under extreme mechanical and thermal stress conditions before physical prototypes are created. This integration of digital twins and predictive analytics shortens the time-to-market for complex insulating systems and reinforces the critical role of data science in developing next-generation high-performance polymer materials.

- AI-driven optimization of chemical precursor ratios and polymerization reaction parameters to achieve desired foam density and porosity.

- Machine learning models predicting thermal stability and flammability characteristics based on synthesis conditions, drastically reducing physical testing requirements for certification.

- Real-time quality control using computer vision and AI to detect manufacturing inconsistencies, ensuring uniformity in cell structure and overall product quality.

- Accelerated discovery of novel, lower-cost polyimide formulations through AI-powered material informatics and computational chemistry screening.

- Implementation of predictive maintenance models for integrated foam systems in aerospace and automotive applications to forecast material degradation and schedule timely replacement.

DRO & Impact Forces Of Polyimide Foam Market

The Polyimide Foam Market is fundamentally shaped by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces that dictate strategic direction and competitive intensity. The primary driver is the escalating global demand for lightweight materials in the aerospace industry, driven by fuel efficiency mandates and increased aircraft delivery rates, coupled with the critical requirement for superior thermal and fire insulation in Electric Vehicle (EV) battery packs to prevent thermal runaway. Conversely, the market is constrained by the relatively high initial cost of polyimide precursors and the complex, energy-intensive foaming processes, which limit large-scale commercial viability outside of high-value applications. Significant opportunities lie in developing next-generation flexible foams with enhanced mechanical resilience for use in specialized civil engineering projects and expanding applications in high-speed rail and marine safety systems. The market dynamics are heavily influenced by stringent governmental safety regulations (e.g., FAA, EASA fire standards), which act as a powerful external impact force, mandating the adoption of high-performance materials like polyimide foam despite its cost premium.

The high performance attributes of polyimide foam, specifically its exceptionally low flammability (UL94 V-0 or equivalent) and superior heat resistance compared to conventional materials like melamine or polyurethane foams, secure its position in high-specification markets. This intrinsic advantage is reinforced by secondary drivers, including the growing need for efficient noise reduction solutions in densely populated environments and luxury transport sectors, where PI foam’s acoustical properties are valuable. However, a major restraint is the limited number of suppliers capable of producing high-quality, uniform polyimide foam on an industrial scale, leading to supply chain rigidity and potential price volatility. Furthermore, the handling and processing difficulties associated with certain polyimide precursors require specialized equipment and expertise, contributing to the overall high capital expenditure needed for manufacturing.

Looking ahead, technological advancements in foaming chemistry, such as the development of water-blown systems or supercritical fluid processes, present clear opportunities to reduce environmental impact and manufacturing complexity, potentially lowering entry barriers and broadening application scope. The geopolitical focus on sustainable and green materials is also pushing R&D towards bio-based polyimides or materials with improved end-of-life recyclability, offering a long-term pathway for market expansion. The intense regulatory scrutiny following high-profile incidents involving material failure in transport systems serves as a constant and amplifying impact force, ensuring that performance and certification remain the non-negotiable criteria for market participation, thereby favoring established providers of certified polyimide foam products.

Segmentation Analysis

The Polyimide Foam Market is strategically segmented based on factors such as Type (Rigid Foam, Flexible Foam), Application (Aerospace & Defense, Automotive, Industrial, Construction), and geographical region. This segmentation provides a granular view of demand drivers and competitive landscapes across diverse end-user industries. Rigid Polyimide Foam, characterized by higher compressive strength and structural integrity, is predominantly utilized in external thermal protection systems, load-bearing insulation panels, and certain structural components within aircraft. Conversely, Flexible Polyimide Foam, known for its acoustic dampening and conformability, dominates interior applications such as cabin insulation blankets, pipe lagging, and specialized sound barriers in high-speed transit systems. The market structure reflects a strong correlation between material specifications and industry requirements, with aerospace demanding the highest quality and certification standards, while automotive is prioritizing solutions that optimize thermal management for electric vehicle batteries while minimizing weight penalties.

The Application segmentation highlights the critical dependency of the Polyimide Foam market on the highly cyclical yet high-value aerospace sector, which consumes significant volumes for fire-blocking materials, engine nacelle insulation, and cargo bay lining. The burgeoning automotive sector, particularly the Electric Vehicle (EV) segment, represents the most significant growth trajectory, driven by the mandate to ensure safety and performance stability across varied climatic conditions through advanced Battery Thermal Management Systems (BTMS). The Industrial segment encompasses specialized high-temperature processes, such as insulation for ovens, kilns, and chemical processing equipment, requiring the extreme temperature stability inherent to polyimide chemistry. The Construction segment utilizes PI foam primarily in high-specification public buildings and specialized infrastructure where extreme fire resistance is paramount, such as tunnels and high-rise fire barriers, capitalizing on its low-smoke and non-toxic combustion properties.

Geographic segmentation is pivotal, demonstrating localized differences in demand driven by manufacturing hubs and regulatory environments. For example, North America leads due to its expansive military and commercial aerospace production facilities, while Asia Pacific's growth is accelerating due to massive governmental support for EV production and infrastructure development. Understanding these segments is crucial for manufacturers to tailor product offerings—such as developing high-density, closed-cell foams for structural automotive applications or low-density, open-cell foams for acoustic aerospace requirements—optimizing production processes, and allocating marketing resources effectively across target industries and regions to maximize market penetration and profitability.

- By Type:

- Rigid Polyimide Foam

- Flexible Polyimide Foam

- By Application:

- Aerospace & Defense

- Automotive (focusing on EV Battery Thermal Management Systems)

- Industrial (Ovens, Cryogenics, Piping Insulation)

- Construction (Fire Barriers, High-performance Insulation Panels)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Polyimide Foam Market

The Polyimide Foam Value Chain commences with the Upstream Analysis, which focuses heavily on the procurement and synthesis of highly specialized chemical precursors. Key raw materials include various dianhydrides (such as PMDA, BPDA, or ODPA) and diamines (such as ODA or MDA). The performance and cost of the final foam product are highly dependent on the purity and stability of these monomers, which are often derived from complex petrochemical processes. Due to the specialized nature of these monomers, the upstream segment is characterized by a limited number of specialized chemical suppliers, leading to concentrated supply risks and high input costs. Manufacturers within the polyimide foam market must maintain robust supply chain relationships and potentially integrate backward to secure a stable and cost-effective supply of these critical high-performance chemical components, as any disruption directly impacts production capacity and pricing competitiveness.

The manufacturing stage involves polymerization, followed by the crucial foaming process, which can involve solvent-based or solvent-free techniques, or sometimes a chemical foaming method that dictates the physical properties (cell structure, density) of the final product. Significant value is added at this stage through proprietary technology and process optimization, which determine the foam's ability to meet stringent application specifications, particularly for fire resistance and thermal conductivity. The midstream involves converting the raw foam buns or blocks into semi-finished products—sheets, rolls, or customized shapes—that are ready for integration. Distribution channels are typically segmented into direct sales and indirect sales. Direct channels are utilized for large Original Equipment Manufacturers (OEMs) in aerospace and high-end automotive sectors, where customized sizes, specific certifications, and technical support require close collaboration between the manufacturer and the end-user. This direct engagement ensures strict quality control and customized logistical solutions tailored to complex assembly processes.

Downstream analysis involves the integration of the polyimide foam into final products by end-users. In the aerospace sector, the foam is often cut, layered, and bonded into thermal and acoustic blankets or structural components by Tier 1 suppliers before being integrated into the aircraft assembly line. For the automotive industry, the foam is often precision-cut and encased to form the thermal barrier and fire mitigation layer surrounding EV battery modules. Indirect distribution utilizes specialized industrial distributors and fabricators who handle inventory, cutting, shaping, and localized delivery to smaller industrial and construction clients. These indirect channels help manufacturers reach geographically dispersed markets and provide value-added services such as kitting and light assembly. The effectiveness of the value chain is ultimately measured by its ability to maintain high material quality and provide customized formats while managing the inherent high costs of raw material precursors and complex manufacturing, ensuring final product compliance with stringent industry standards.

Polyimide Foam Market Potential Customers

The Polyimide Foam Market targets highly specialized industrial sectors where safety, weight efficiency, and extreme temperature tolerance are paramount purchasing criteria, making typical procurement focused on performance specifications rather than just price. The primary potential customers are leading global Aerospace Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers, including companies such as Boeing, Airbus, Lockheed Martin, and Bombardier. These customers require polyimide foam for critical applications like aircraft cabin insulation (acoustic and fire blocking), engine nacelle thermal blankets, and insulating cryogenic storage tanks in space applications. The decision-makers in this segment are typically material engineers, procurement managers focused on compliance with FAA/EASA regulations, and project managers overseeing new aircraft programs that mandate lightweight, certified materials.

A rapidly expanding customer base is found within the Automotive industry, specifically manufacturers of Electric Vehicles (EVs) and high-performance Hybrid Electric Vehicles (HEVs). Companies such as Tesla, BMW, Volkswagen, and specialized battery pack integrators represent key buyers. For these customers, polyimide foam is essential for Battery Thermal Management Systems (BTMS), serving as a thermal barrier between individual battery cells or modules to prevent propagation of thermal runaway events, thereby enhancing vehicle safety and extending battery life. Customer requirements here are centered on thermal performance, resistance to vibrational stress, and the ability to integrate seamlessly into compact battery pack designs, often requiring specific die-cut geometries and flexible formats. Procurement decisions are heavily influenced by stringent automotive safety standards and the ongoing industry focus on maximizing energy density while ensuring absolute safety.

Beyond transportation, significant customers include specialized industrial insulation contractors and system integrators serving extreme environments. This includes manufacturers of high-temperature processing equipment (kilns, industrial ovens), cryogenics facilities needing low-density insulation for liquefied gas storage, and specialized construction firms focused on critical infrastructure like subway systems or long tunnels, where passive fire protection is a legislative necessity. These industrial end-users prioritize the foam's long-term durability, chemical resistance, and non-combustible characteristics. Procurement is often project-based, requiring materials that meet specific localized building codes or operational temperature envelopes, making technical consultancy and customized material testing key requirements provided by foam suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 274 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Aircell LLC, Evonik Industries AG, SABIC, Rogers Corporation, M.C. Gill Corporation, Ube Industries Ltd., SKC Inc., Toray Industries, Mitsubishi Chemical Corporation, Furukawa Electric Co., Ltd., BASF SE, Saint-Gobain, Zotefoams plc, Trelleborg AB, Huntsman Corporation, Kaneka Corporation, Boyd Corporation, Porex Corporation, Lydall, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyimide Foam Market Key Technology Landscape

The Polyimide Foam Market’s technological landscape is characterized by innovation across chemical synthesis, foaming methodology, and post-processing techniques aimed at optimizing performance and reducing production cost. The primary technological focus centers on proprietary foaming agents and process control systems. Traditional methods often involve the use of complex solvent systems (e.g., dimethylformamide) followed by high-temperature curing, which can be expensive and environmentally challenging. Consequently, a key technological advancement involves the shift toward solvent-free or water-blown foaming processes. These newer techniques utilize water or non-toxic agents that react with the polyimide precursors to generate volatile gases, creating the open-cell structure. Such innovations not only reduce the environmental footprint but also allow for higher throughput and potentially lower manufacturing capital investment, addressing a major restraint in the market.

Another crucial technological area is the advancement in controlling foam morphology, specifically cell size and uniformity. Techniques involving precise temperature gradient control during curing and advanced mechanical agitation (if used) are critical to producing foams that meet the stringent requirements for thermal conductivity and acoustic absorption in aerospace applications. For instance, achieving a highly uniform, ultra-fine cell structure is essential for maximizing insulation efficiency and minimizing weight. Furthermore, the development of flexible polyimide foams requires technological breakthroughs in modifying the polymer backbone chemistry—incorporating flexible segments or co-polymers during the synthesis phase—to maintain thermal stability while enhancing elasticity and resilience to bending or compression fatigue, which is necessary for blanket and flexible piping applications.

The technological landscape also includes advancements in composite integration and multi-layer material systems. Manufacturers are increasingly developing technologies to laminate polyimide foam with other materials, such as metallic foils (for enhanced radiation heat reflection) or fiber-reinforced composites (for structural rigidity). This technological integration focuses on creating multi-functional components, like fire-retardant structural panels for aircraft floors or lightweight enclosures for sensitive electronics. Specialized surface treatments and bonding agents are also being developed to ensure long-term adhesion and prevent delamination under extreme operational conditions, thereby expanding the potential application scope beyond simple insulation and into high-stress, load-bearing environments.

Regional Highlights

Market dynamics for polyimide foam exhibit significant geographical variation, dictated primarily by aerospace manufacturing concentration, electric vehicle adoption rates, and regional fire safety regulations.

- North America: This region holds the largest market share, anchored by the dominant presence of major aerospace and defense contractors (Boeing, Lockheed Martin) in the U.S. and Canada. Demand is driven by continuous investment in commercial aircraft production (especially wide-body jets requiring extensive thermal and acoustic insulation) and stringent Federal Aviation Administration (FAA) fire safety requirements, which mandate the use of certified, high-performance materials like PI foam in cabin interiors and cargo areas. The region is also a key hub for specialized industrial applications, including space exploration and high-temperature processing equipment, requiring premium insulation solutions.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, APAC’s acceleration is primarily attributed to rapidly expanding automotive manufacturing, particularly in China, Japan, and South Korea, which are leading the global transition to electric vehicles (EVs). The massive deployment of EVs necessitates vast volumes of polyimide foam for critical battery thermal management (BTMS) and fire mitigation systems. Furthermore, rising infrastructure development, including high-speed rail networks and ambitious domestic commercial aerospace programs (e.g., COMAC in China), fuels demand for certified, lightweight materials, making APAC a critical growth region for future investment and capacity expansion.

- Europe: This region maintains a strong position, driven by mature automotive manufacturing (high-end and luxury vehicles prioritizing acoustic insulation and lightweighting) and strict European Union (EU) mandates regarding energy efficiency in both construction and transport sectors. Countries like Germany and France are central to key market activities, leveraging their engineering expertise to integrate polyimide foam into complex systems, particularly in the rail industry (meeting stringent EN 45545 fire protection standards) and specialized marine vessels.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller market shares but are exhibiting promising growth, particularly in civil aviation expansion and strategic energy projects. MEA’s demand is linked to high-specification oil and gas infrastructure and specialized thermal insulation requirements in extreme desert environments. LATAM growth is expected to be modest but steady, tied to domestic industrial upgrades and regional aircraft fleet modernization programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyimide Foam Market.- Solvay S.A.

- Aircell LLC

- Evonik Industries AG

- SABIC

- Rogers Corporation

- M.C. Gill Corporation

- Ube Industries Ltd.

- SKC Inc.

- Toray Industries

- Mitsubishi Chemical Corporation

- Furukawa Electric Co., Ltd.

- BASF SE

- Saint-Gobain

- Zotefoams plc

- Trelleborg AB

- Huntsman Corporation

- Kaneka Corporation

- Boyd Corporation

- Porex Corporation

- Lydall, Inc.

Frequently Asked Questions

Analyze common user questions about the Polyimide Foam market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the Polyimide Foam Market growth?

The primary growth applications are aerospace and defense (for lightweight, fire-resistant acoustic and thermal insulation in aircraft interiors and engines) and the automotive sector, specifically for Battery Thermal Management Systems (BTMS) in electric vehicles to prevent thermal runaway and ensure safety.

How does polyimide foam compare to other insulation materials like melamine or polyurethane?

Polyimide foam offers significantly superior thermal stability and higher operating temperatures (up to 300°C) compared to melamine or polyurethane, combined with intrinsic flame retardancy (low smoke and toxicity), making it suitable for mission-critical, high-specification environments where safety standards are extremely stringent.

What are the main restraints hindering the broader adoption of polyimide foam?

The main restraints are the high cost of specialized polyimide chemical precursors (monomers) and the complexity of the manufacturing and foaming processes, which result in a higher unit price compared to conventional insulation materials, limiting its use primarily to high-value industrial and transportation applications.

Which region currently leads the Polyimide Foam Market and why?

North America leads the market due to the high concentration of major commercial and military aerospace and defense contractors, coupled with strict regulatory enforcement (FAA standards) that mandates the use of certified, high-performance fire-blocking and thermal insulation materials.

What role does technological innovation play in reducing polyimide foam costs?

Technological innovation is focused on developing solvent-free or water-blown foaming processes and optimizing polymerization kinetics using AI/ML. These advancements aim to simplify manufacturing complexity, reduce the reliance on expensive solvents, and improve material yield and consistency, thereby lowering overall production costs and making the material more scalable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager