Polyimide Plastic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437101 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Polyimide Plastic Market Size

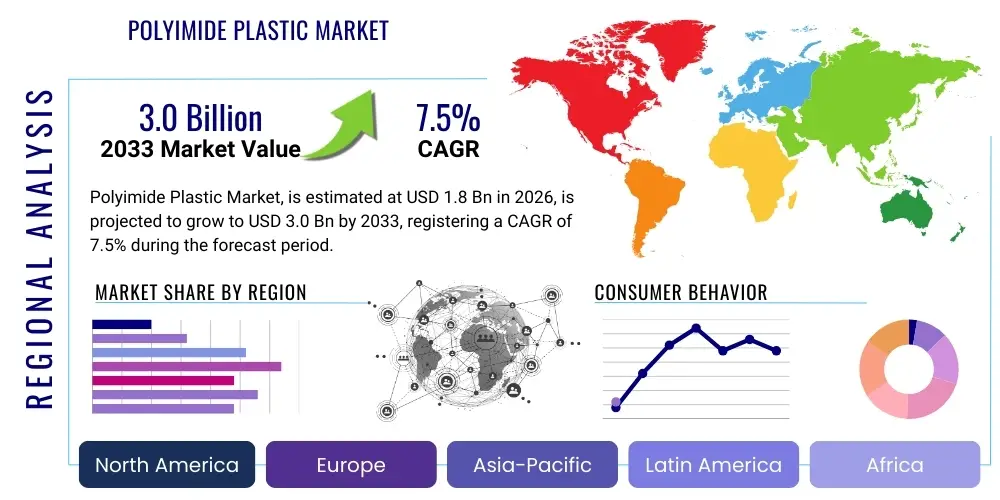

The Polyimide Plastic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033.

Polyimide Plastic Market introduction

The Polyimide Plastic Market encompasses high-performance polymers characterized by exceptional thermal stability, mechanical strength, and chemical resistance, making them indispensable in demanding environments across numerous industries. Polyimides are synthetic polymers containing imide rings in their main chain, typically synthesized through the polycondensation reaction of diamines and dianhydrides. These materials excel where traditional plastics fail, particularly when subjected to extreme temperatures, radiation, or harsh chemical agents. Key product forms include films (Kapton), varnishes, fibers, molded parts, and foams, each catering to specialized functional requirements within end-use sectors like electronics, aerospace, and automotive manufacturing. The unique combination of high glass transition temperature and low coefficient of thermal expansion positions polyimides as crucial enabling materials for miniaturization and high-reliability applications, such as flexible printed circuit boards (FPCBs) and high-temperature wire insulation.

Major applications of polyimide plastics are concentrated in the electronics sector, driven by the persistent demand for flexible and durable insulating materials in smartphones, tablets, and advanced display technologies. In aerospace and defense, polyimides are used extensively for structural components, thermal blankets, and insulation systems due to their superior performance-to-weight ratio and ability to withstand cryogenic and ultra-high-temperature conditions encountered during space exploration and high-speed flight. Furthermore, the automotive industry increasingly adopts polyimide components, primarily in under-the-hood applications like engine parts and transmission components, where operational temperatures are rapidly increasing due to stricter efficiency and emission standards. This broadening application base underscores polyimide plastics’ role as a key material science solution for modern engineering challenges requiring robust material integrity.

The market growth is fundamentally driven by technological advancements in semiconductor manufacturing, requiring ultra-pure and thermally stable materials for wafer processing and packaging. The shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) further fuels demand, as polyimides offer excellent dielectric insulation and thermal management capabilities critical for battery systems and power electronics. Additionally, favorable regulatory environments promoting lightweight and fuel-efficient transportation solutions incentivize the substitution of metallic parts with advanced high-performance polymers like polyimides. The continued investment in advanced manufacturing techniques, such as 3D printing of polyimide parts, also contributes significantly to market expansion by offering customized, complex geometries with minimized waste and faster prototyping cycles.

Polyimide Plastic Market Executive Summary

The Polyimide Plastic Market demonstrates robust business trends characterized by intense focus on developing specialty grades offering enhanced properties such as low dielectric constant (LDC) and improved processability, crucial for next-generation 5G and 6G telecommunication infrastructure. Strategic collaborations between material suppliers and aerospace/defense contractors are shaping innovation, leading to specialized polyimide formulations optimized for high radiation resistance and extreme mechanical stress. Vertically integrated business models, where manufacturers control both the monomer synthesis and final product fabrication (e.g., film extrusion), are gaining prominence, ensuring supply chain resilience and cost optimization. Furthermore, sustainability is becoming a key market differentiator, prompting research into bio-based polyimides and improved recycling methods for polyimide waste, aligning market strategies with global environmental goals and consumer demand for responsible manufacturing practices.

Regionally, Asia Pacific (APAC) dominates the polyimide plastic market, primarily driven by the massive concentration of electronics manufacturing hubs in countries like China, South Korea, Japan, and Taiwan. The rapid expansion of semiconductor production capacities and the burgeoning flexible display market in this region necessitate high volumes of polyimide films and coatings. North America and Europe maintain significant market shares, characterized by high-value applications in the aerospace, medical devices, and specialized industrial machinery sectors, often prioritizing advanced materials for stringent performance requirements rather than sheer volume. Growth in these developed regions is propelled by governmental and private investments in electric vehicle technology and advanced industrial automation, utilizing polyimides for durable and lightweight components.

Segmentation trends indicate that the film segment (including specialized films like polyimide flexible laminates and coverslays) remains the largest revenue contributor due to its critical role in FPCBs and thermal insulation across consumer electronics. However, the molded parts and shapes segment is experiencing the fastest growth, driven by increasing adoption in demanding friction and wear applications, replacing traditional metals or lower-performance engineering plastics in compressors, pumps, and engine components. In terms of application, the electronics segment retains supremacy, but the transportation (aerospace and automotive) sector exhibits exceptional potential for future expansion, especially as regulatory pressures mandate improved fuel efficiency and operational longevity in critical systems. These segment dynamics reflect the material's adaptability and growing acceptance beyond traditional electronic insulation uses.

AI Impact Analysis on Polyimide Plastic Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Polyimide Plastic Market frequently revolve around optimizing material discovery processes, enhancing quality control during film manufacturing, and predicting material performance under novel operating conditions. Users are keenly interested in how AI can accelerate the development of new polyimide formulations with tailored properties, such as specific dielectric constants or ultra-low coefficients of thermal expansion, crucial for advanced microelectronics. Concerns also center on leveraging machine learning models to analyze complex manufacturing data, identify subtle process deviations, and minimize defects, thereby improving yield rates in high-precision product lines like flexible displays and aerospace composites. The consensus expectation is that AI will primarily serve as an optimization tool, dramatically reducing R&D cycles and elevating manufacturing efficiency across the polyimide value chain, transitioning from purely experimental material science to data-driven material engineering.

AI's application extends profoundly into predictive maintenance and operational efficiency within polyimide production facilities. By analyzing real-time sensor data from reactors, extruders, and curing ovens, AI algorithms can predict equipment failures, optimize energy consumption, and fine-tune processing parameters, which is particularly complex given the high-temperature requirements of polyimide synthesis and curing. This level of optimization not only lowers operational costs but also ensures batch-to-batch consistency, a paramount factor in high-reliability applications like space-grade insulation and medical implants. Furthermore, AI is critical for simulating the long-term performance and degradation mechanisms of polyimide components in harsh environments, reducing the need for lengthy and expensive physical testing protocols, thereby accelerating time-to-market for novel polyimide products.

The integration of Generative AI (GAI) is poised to revolutionize polyimide design by quickly iterating through thousands of potential monomer combinations and predicting the resultant polymer properties before any laboratory synthesis. This capability allows material scientists to quickly narrow down viable chemical pathways for specific applications, such as polyimides suitable for high-frequency millimeter-wave applications in 5G and 6G technology, or those offering superior chemical resistance to new generations of industrial solvents. The data generated through these AI simulations becomes proprietary knowledge, providing a significant competitive advantage to firms that successfully integrate sophisticated computational material science into their R&D strategy, pushing the boundaries of what polyimide chemistry can achieve in high-stakes engineering disciplines.

- AI optimizes polyimide synthesis pathways, reducing R&D time for new formulations by analyzing historical reaction data and predicting optimal processing conditions.

- Machine learning models enhance manufacturing yield by detecting subtle defects in polyimide films and coatings during high-speed production, ensuring superior quality control.

- Predictive analytics driven by AI minimizes machine downtime in polyimide production lines by forecasting equipment maintenance needs, reducing operational expenditure.

- Generative AI enables simulation-driven material design, allowing researchers to predict properties (e.g., dielectric constant, thermal expansion) of hypothetical polyimides, tailoring materials for specific extreme applications.

- AI assists in standardizing the complex characterization data of polyimides, creating comprehensive, searchable material databases essential for aerospace and defense material qualification processes.

DRO & Impact Forces Of Polyimide Plastic Market

The Polyimide Plastic Market is significantly influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO) that collectively shape its growth trajectory and competitive landscape. The primary driving force is the escalating demand from the electronics sector, particularly the rapid proliferation of flexible displays and advanced packaging technologies that critically rely on the high thermal and mechanical performance of polyimide films. Additionally, stringent safety and performance standards in the aerospace and automotive industries necessitate the use of lightweight, flame-retardant, and thermally stable materials, which polyimides readily provide. These drivers create a compelling need for high-performance polymers capable of surviving increasing operational demands. The market dynamics are further complicated by the high cost of polyimide monomers and complex, energy-intensive synthesis processes, which act as a key restraint, particularly for adoption in high-volume, cost-sensitive applications.

Key impact forces operating within the market include competitive pressures from emerging high-performance materials such as PEEK (Polyetheretherketone) and PTFE (Polytetrafluoroethylene) in specific industrial and automotive segments, which offer varying balances of cost and performance. Furthermore, fluctuating raw material prices, particularly for precursors like Pyromellitic Dianhydride (PMDA) and Biphenyltetracarboxylic Dianhydride (BPDA), introduce volatility into the production costs of polyimides, affecting profitability margins. Regulatory requirements, especially those concerning solvent use during film casting and environmental disposal of spent materials, also exert significant influence, pushing manufacturers towards more environmentally friendly production methods, such as solvent-free synthesis routes and development of water-soluble polyimides.

Opportunities for market expansion are substantial, primarily driven by the increasing global investment in 5G and future telecommunication networks, requiring polyimides with ultra-low dielectric loss properties to support high-frequency transmission. The burgeoning market for electric vehicles offers a fertile ground for polyimide adoption in battery insulation, motor components, and charging infrastructure due to the critical need for superior thermal management and electrical isolation in high-voltage systems. Moreover, advancements in additive manufacturing (3D printing) technologies capable of processing high-temperature polymers are opening new avenues for complex polyimide parts production, catering to niche, customized applications in medical and specialized industrial tooling, effectively bypassing traditional, costly molding constraints and expanding the material's accessibility to smaller volume production runs.

Segmentation Analysis

The Polyimide Plastic Market segmentation provides a granular view of market dynamics based on product form, application, and end-use industry, reflecting the diverse utility of polyimide materials across the global economy. The market is primarily categorized into four main product types: films and sheets, molded parts and shapes, coatings and varnishes, and composites, each serving distinct functional requirements. Films and sheets constitute the largest segment due to their indispensable role in flexible electronics and thermal insulation. Applications are largely segmented into electronics, automotive, aerospace, medical, and industrial sectors, with electronics maintaining the leading position globally due to the ongoing miniaturization trend and the demand for high-reliability components. Understanding these segments is crucial for strategic planning, allowing market players to focus R&D and manufacturing capacity towards high-growth areas, particularly those linked to sustainable energy and advanced communication technologies, which are highly reliant on high-performance polymer solutions.

The differentiation in segments is driven by the specific properties required by the end-users. For instance, the aerospace industry demands polyimide composites for lightweight structural elements where mechanical strength and thermal resistance are prioritized, whereas the medical sector primarily uses molded polyimide components for surgical tools and diagnostic equipment that require excellent biocompatibility and high-temperature sterilization tolerance. The coatings and varnishes segment, while smaller in volume than films, provides vital protective layers for wiring, magnet wires, and printed circuit boards, offering superior dielectric strength and abrasion resistance. The complexity of polyimide chemistry allows manufacturers to tailor the polymer structure to meet the precise requirements of each specific end-use, creating a highly specialized and value-added market ecosystem that favors technical expertise and innovation over simple bulk production.

Regional consumption patterns also influence segmentation; for example, North America and Europe show a higher proportional uptake of polyimide composites and molded parts due to large aerospace and industrial machinery manufacturing bases, whereas Asia Pacific overwhelmingly dominates the polyimide film segment driven by consumer electronics production. Future segmentation growth is projected to be strongest in the composites and specialty molded parts used in electric mobility solutions and high-performance computing, where the thermal management capabilities of polyimides are paramount. This continuous evolution of application requirements ensures that manufacturers must maintain a flexible production portfolio capable of delivering diverse product forms and chemical compositions to remain competitive and capture emerging market opportunities across various high-tech fields globally.

- By Product Form:

- Films and Sheets (e.g., Polyimide Film, Flexible Laminates)

- Molded Parts and Shapes (e.g., Machined Components, Bearings, Seals)

- Coatings and Varnishes (e.g., Insulating Enamels, Adhesives)

- Fibers and Filaments (e.g., Fire-Resistant Fabrics)

- Composites (e.g., Polyimide Matrix Composites)

- By Application:

- Insulation Materials (Wire & Cable Insulation, Slot Liners)

- Flexible Printed Circuit Boards (FPCBs)

- Adhesives and Tapes

- Friction and Wear Parts (Bushings, Bearings)

- Semiconductor Packaging and Wafer Handling

- By End-Use Industry:

- Electronics and Electrical (Consumer Electronics, Displays, Semiconductors)

- Aerospace and Defense (Structural Components, Thermal Blankets)

- Automotive and Transportation (Under-the-Hood Components, EV/HEV Batteries)

- Medical (Surgical Tools, Diagnostic Equipment)

- Industrial (Machinery, Pumps, Compressors)

Value Chain Analysis For Polyimide Plastic Market

The value chain of the Polyimide Plastic Market is complex and highly specialized, beginning with the upstream sourcing of key chemical precursors and extending through specialized synthesis, conversion processes, and finally, distribution to niche industrial end-users. The upstream segment involves the production of high-purity diamines (such as 4,4'-oxydianiline, ODA) and dianhydrides (such as Pyromellitic Dianhydride, PMDA). The purity of these monomers is critical as it directly impacts the thermal stability and final electrical properties of the resulting polyimide polymer. Due to the limited number of suppliers capable of producing these specialized, high-purity precursors at an industrial scale, the upstream segment is concentrated, often involving long-term strategic contracts between chemical producers and polyimide manufacturers. This concentration provides significant leverage to precursor suppliers, making input cost management a major strategic concern for polymer producers.

The midstream stage involves the polyimide manufacturing process itself, encompassing polycondensation reactions, often yielding polyamic acid intermediates, followed by various conversion processes like casting, molding, sintering, or extrusion to form final product shapes such as films, sheets, or powders. This stage requires substantial capital investment in specialized, high-temperature processing equipment and demanding cleanroom environments, particularly for electronic-grade films. Conversion complexity varies significantly; for instance, producing ultra-thin, defect-free polyimide film demands stringent process control, proprietary solvent systems, and deep technological expertise. Firms often employ integrated operations, controlling both the polymerization and the film conversion, to safeguard proprietary technologies and ensure product consistency necessary for high-reliability applications like flexible displays and aerospace composites.

The downstream distribution channel is highly specialized, relying on both direct sales and indirect distributors tailored to specific end-use industries. Direct distribution is prevalent for high-volume customers in the aerospace and large electronics manufacturing sectors, enabling tight quality control and customized technical support. Indirect distribution, leveraging specialized chemical and plastics distributors, serves smaller industrial consumers and maintenance, repair, and overhaul (MRO) markets, providing localized inventory and logistical support. The critical element downstream is the application engineering expertise offered by the manufacturer or distributor, helping end-users select the correct polyimide grade and form factor for complex technical applications, effectively acting as technical consultants rather than simple commodity sellers. This technical support is vital in sectors such as medical devices and defense, where material failure carries high risks and regulatory scrutiny.

Polyimide Plastic Market Potential Customers

The potential customer base for the Polyimide Plastic Market is diverse, spanning multiple high-technology and mission-critical industries where material performance under extreme conditions is non-negotiable. Primary buyers are large multinational corporations operating within the Electronics and Electrical industries, including semiconductor fabrication companies (fabs), flexible display manufacturers, and producers of high-performance wire and cable. These customers purchase polyimide films and varnishes for critical functions such as thermal insulation, dielectric separation in microprocessors, and substrates for flexible printed circuit boards (FPCBs). The purchasing decision for these entities is heavily influenced by factors such as material purity, thermal stability ratings, dielectric properties, and proven reliability in high-cycle, high-heat environments, often necessitating long qualification cycles for new suppliers or grades.

Another significant segment of potential customers includes Original Equipment Manufacturers (OEMs) in the Aerospace and Defense sector. Companies specializing in aircraft manufacturing, satellite systems, and military hardware procure polyimide molded parts, composites, and films for lightweight structural elements, thermal management solutions (e.g., external thermal blankets), and high-temperature fluid seals. For aerospace buyers, compliance with strict regulatory standards (e.g., FAA, military specifications), superior flame retardancy, low outgassing characteristics, and resistance to radiation and extreme temperature fluctuations are paramount. These customers often require specialized, low-volume, high-value customized polyimide solutions, making technical partnership and certification track records crucial for securing contracts.

Furthermore, the rapidly expanding Automotive and Transportation industry, particularly OEMs focused on Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), represents a burgeoning customer segment. These buyers utilize polyimides for battery insulation materials, motor component slot liners, transmission seals, and sensor encapsulation, seeking materials that can withstand the severe thermal cycling and high voltage associated with EV powertrains. Secondary customers include medical device manufacturers purchasing polyimide materials for sterilizable surgical tools, catheter components, and diagnostic equipment requiring biocompatibility and high-frequency signal transmission capabilities. The purchasing criteria for these customers prioritize material certification, supply consistency, and the supplier's capacity for innovation in adapting polyimides to meet rapidly evolving performance demands across these highly technical domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Solvay, Kaneka Corporation, Mitsui Chemicals, Ube Industries, Kolon Industries, Taimide Technology, L.P.S. Chemical, SKC Inc., Evonik Industries, Saint-Gobain, SABIC, Kuraray, DIC Corporation, PI Advanced Materials, Shanghai Huajing Resin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyimide Plastic Market Key Technology Landscape

The key technology landscape of the Polyimide Plastic Market is defined by continuous innovation aimed at overcoming traditional processing limitations, improving material properties for highly demanding applications, and enhancing sustainability. A core technological area is the development of next-generation polyimide formulations, specifically those engineered for 5G and future high-frequency applications. This involves molecular design modifications to achieve ultra-low dielectric constants (Dk) and low dissipation factors (Df), crucial for minimizing signal loss in high-speed data transmission. Manufacturers are investing heavily in synthesizing novel monomer combinations that result in polymers with lower moisture absorption and excellent dimensional stability across broad temperature ranges. Another significant technological push is towards solution-processable polyimides, which allow for easier application methods, such as spin coating or spray coating, circumventing the challenges associated with traditional film casting, thus facilitating integration into complex microelectronic fabrication processes.

In terms of manufacturing processes, advancements in additive manufacturing (AM) techniques capable of handling high-temperature polyimide materials are revolutionizing the production of complex geometries. Technologies like Selective Laser Sintering (SLS) and high-temperature Fused Deposition Modeling (FDM) are being refined to process polyimide powders and filaments, enabling rapid prototyping and the production of end-use functional parts for aerospace and high-performance industrial machinery. These AM processes offer distinct advantages in customization, reducing material waste, and allowing for the integration of features that are impossible to achieve through traditional compression molding or machining. Furthermore, the industry is increasingly adopting continuous processing technologies, moving away from batch synthesis, which improves overall yield consistency and reduces the per-unit cost of specialized polyimide materials, crucial for meeting the rising demand from the high-volume electronics sector.

Sustainability-focused technological development is also gaining traction, driven by environmental regulations and corporate responsibility goals. Research is focused on developing bio-based polyimides derived from sustainable feedstocks, reducing reliance on petroleum-based monomers. Concurrently, efforts are concentrated on solvent-free polyimide synthesis methods, utilizing melt polymerization or solid-state polycondensation, to eliminate the use of hazardous organic solvents typically employed in traditional polyamic acid solution processes. Finally, surface modification technologies, such as plasma treatment and chemical vapor deposition (CVD), are being deployed post-synthesis to enhance the adhesion, wear resistance, or biocompatibility of polyimide surfaces, enabling their use in increasingly diverse and challenging applications, including advanced medical implants and extreme friction environments within industrial compressors.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for polyimide plastics, primarily due to its established and rapidly expanding semiconductor and consumer electronics manufacturing base. Countries like China, South Korea, Japan, and Taiwan are major producers and consumers of polyimide films used in FPCBs, flexible OLED displays, and high-density interconnect applications. Government initiatives supporting local electronics and EV manufacturing further fuel demand. The region benefits from lower labor costs and significant investments in developing domestic production capacities for specialized polyimide precursors, aiming to reduce reliance on Western suppliers. APAC’s growth is characterized by high volume consumption and intense price competition, particularly in the standard film grades.

- North America: North America represents a mature, high-value market, driven predominantly by the robust aerospace, defense, and specialized medical device industries. Polyimide usage here is focused on extreme performance requirements, including high-temperature resistance, radiation shielding, and lightweight composites for satellite and aircraft components. The expansion of electric vehicle R&D and manufacturing also contributes significantly, with polyimides being integral to battery management systems and advanced thermal runaway protection solutions. Stringent regulatory standards and long qualification cycles characterize this region, favoring suppliers with proven track records and strong technical support capabilities.

- Europe: Europe exhibits strong demand for polyimides in the automotive, industrial machinery, and energy sectors. The continent's ambitious climate goals and push for sustainable transportation accelerate the adoption of polyimides in electric mobility for insulation and lightweighting purposes. Germany, France, and the UK are key contributors, focusing on polyimide use in precision engineering, high-reliability seals, and friction parts for machinery operating under elevated temperatures. Regulatory pressures, especially REACH, are pushing innovation towards more sustainable polyimide synthesis and handling procedures, creating opportunities for bio-based and solvent-free polyimide solutions.

- Latin America (LATAM): The LATAM market is nascent but growing, primarily driven by investments in regional electrical infrastructure and modest automotive manufacturing activities, particularly in Brazil and Mexico. Demand is often met through imports, focusing mainly on standard polyimide grades for electrical insulation and minor industrial applications. Economic stability and localized manufacturing investment are key factors that will accelerate future polyimide adoption in this region.

- Middle East and Africa (MEA): MEA presents specialized demand stemming from the region's strong focus on oil and gas exploration, where polyimides are essential for high-temperature downhole tools, wireline insulation, and sealing components that must resist corrosive chemical environments and extreme heat. The region’s nascent but growing diversification efforts into aerospace and defense also generate niche demand for high-performance polyimide composites and films. Growth is highly dependent on capital expenditure cycles in the energy and infrastructure sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyimide Plastic Market.- DuPont de Nemours, Inc.

- Solvay S.A.

- Kaneka Corporation

- Mitsui Chemicals, Inc.

- Ube Industries, Ltd.

- Kolon Industries, Inc.

- Taimide Technology Co., Ltd.

- L.P.S. Chemical Co., Ltd.

- SKC Inc.

- Evonik Industries AG

- Saint-Gobain S.A.

- SABIC (Saudi Basic Industries Corporation)

- Kuraray Co., Ltd.

- DIC Corporation

- PI Advanced Materials Co., Ltd.

- Krempel Group

- Jiangsu Zhongtian Technology Co., Ltd.

- Chem-Tronics, Inc.

- Toray Industries, Inc.

- Shanghai Huajing Resin Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Polyimide Plastic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of polyimide plastics over standard engineering polymers?

Polyimide plastics offer superior thermal stability, maintaining structural integrity and electrical properties at continuous operating temperatures often exceeding 260°C. They also exhibit excellent mechanical strength, high dielectric strength, and exceptional resistance to chemicals and radiation, making them ideal for extreme environments where materials like PET or nylon would fail.

Which end-use industry is the largest consumer of polyimide plastic films globally?

The Electronics and Electrical industry is the largest consumer, primarily utilizing polyimide films for flexible printed circuit boards (FPCBs), thermal insulation in high-density electronic devices, and advanced semiconductor packaging due to the material's unparalleled thermal and electrical reliability.

How is the growth of the electric vehicle (EV) sector impacting the polyimide plastic market?

The EV sector significantly boosts demand for polyimides, which are crucial for high-voltage battery insulation, motor component slot liners, and power electronics encapsulation. Polyimides provide the required lightweight solution combined with superior thermal management capabilities to ensure the safety and longevity of EV components.

What are the main technical restraints affecting the wider adoption of polyimide materials?

The primary technical restraints include the high synthesis cost of specialized polyimide monomers (e.g., dianhydrides), the complex and energy-intensive processing required (like high-temperature curing), and the limited melt processability of many high-performance grades, which restricts their use in high-volume, cost-sensitive consumer applications.

What role does Asia Pacific play in the global polyimide plastic supply chain?

Asia Pacific is the key global manufacturing hub, dominating both production capacity and consumption, especially for polyimide films. The region houses major semiconductor and flexible display fabrication facilities, driving high demand for FPCB substrates and specialized thermal management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager