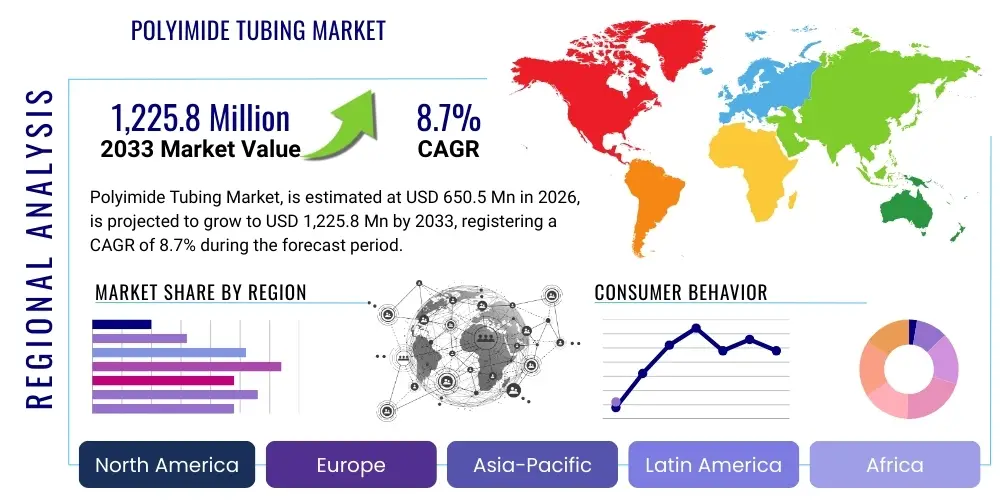

Polyimide Tubing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438270 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polyimide Tubing Market Size

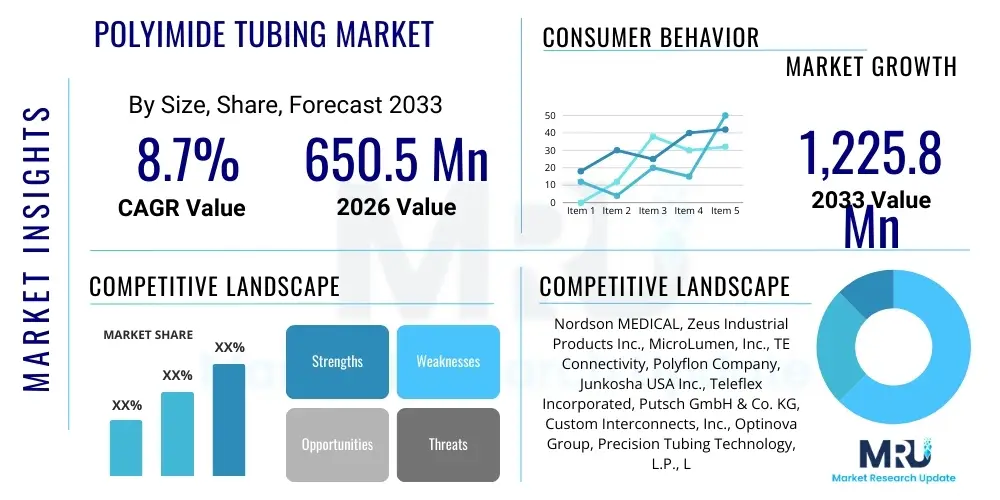

The Polyimide Tubing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 650.5 Million in 2026 and is projected to reach USD 1,225.8 Million by the end of the forecast period in 2033.

Polyimide Tubing Market introduction

The Polyimide Tubing Market encompasses specialized polymer products known for their superior thermal, electrical, and mechanical properties, making them indispensable in highly demanding environments. Polyimide (PI) is an exceptional high-performance polymer characterized by an unparalleled thermal stability, often retaining mechanical strength and dimensional stability at temperatures exceeding 250°C, alongside superb resistance to radiation and chemicals. This unique combination of attributes positions PI tubing as a critical component in sectors requiring reliable performance under extreme conditions, such as high vacuum, cryogenic temperatures, or aggressive chemical exposure. The product line includes thin-wall, standard-wall, and heavy-wall configurations, tailored for specific needs like micro-catheterization or electrical insulation.

The primary applications driving the consumption of polyimide tubing are concentrated within the medical device industry, particularly for advanced neurovascular and cardiovascular catheters, where flexibility, biocompatibility, and high pushability are mandatory. Furthermore, the aerospace and defense sectors utilize PI tubing extensively for wire harnessing, protective sleeving, and lightweight structural elements due to its resistance to jet fuel, lubricants, and wide thermal fluctuations experienced during flight and space exploration. In the electronics domain, these tubings are vital for insulating sensitive circuitry in demanding applications, including satellites and advanced semiconductor manufacturing equipment. The product's key benefits—low outgassing, high dielectric strength, and minimal weight—reinforce its selection over conventional materials like PTFE or FEP in mission-critical systems.

Major market driving factors include the rapid global increase in minimally invasive surgical procedures, which rely heavily on ultra-thin and precise catheter tubing manufactured from polyimide. Technological advancements in flexible electronics and the ongoing trend toward miniaturization across various industries further solidify the demand base. Additionally, substantial government and private investments in space exploration missions and the burgeoning deployment of 5G telecommunication infrastructure, which requires high-reliability electrical components, are accelerating market expansion. The continuous innovation in polyimide formulations and processing techniques, particularly regarding enhanced lubricity and tighter tolerances, ensures that PI tubing remains the material of choice for next-generation, high-specification products.

Polyimide Tubing Market Executive Summary

The Polyimide Tubing Market is characterized by robust growth underpinned by irreversible trends toward miniaturization and high-performance requirements across critical end-use sectors. Business trends indicate a strong focus on strategic mergers, acquisitions, and collaborations aimed at vertical integration, particularly among specialized manufacturers seeking to control the entire value chain from polymer synthesis to final product fabrication. Key players are heavily investing in expanding their manufacturing capabilities, especially for micro-diameter tubing used in complex medical devices, alongside developing proprietary surface treatment technologies to improve lubricity and biocompatibility. The regulatory landscape, especially concerning FDA and ISO certifications for medical-grade materials, significantly influences market entry and product commercialization strategies, leading to higher barriers for new entrants but stable profitability for established compliance leaders.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive investments in medical infrastructure, rapidly expanding electronics manufacturing hubs in countries like China, South Korea, and Taiwan, and rising defense spending. North America maintains market leadership in terms of technology adoption and revenue share, primarily due to the dominant presence of leading aerospace and medical device original equipment manufacturers (OEMs) and stringent quality requirements in the US. Europe, benefiting from strong regulatory support for sustainable and high-quality medical device manufacturing (especially in Germany and Switzerland), continues to exhibit stable growth, focusing on specialized, high-margin applications within industrial and fiber optic communication sectors.

Segmentation trends reveal that the medical application segment holds the largest market share, directly correlated with the global increase in chronic diseases and the resulting demand for sophisticated, minimally invasive surgical tools. Within the product type segmentation, thin-wall tubing is experiencing accelerated growth rates, reflecting the industry's need for maximum lumen size relative to external diameter in catheter applications. Furthermore, the aerospace and defense segment remains a crucial consumer, particularly for customized, radiation-resistant polyimide tubes and sleeves required for cabling insulation in harsh environments. Innovations in composite materials, where polyimide tubing acts as a reinforcement or protective layer, are opening new, high-value avenues across all major segments, enhancing structural integrity while maintaining thermal stability.

AI Impact Analysis on Polyimide Tubing Market

Common user questions regarding AI's influence on the Polyimide Tubing Market typically revolve around enhancing manufacturing precision, optimizing raw material usage, accelerating material discovery, and improving supply chain resilience. Users are keen to understand how AI-driven predictive modeling can eliminate defects in the complex extrusion and drawing processes required for high-tolerance tubing, especially micro-diameter medical grades. Furthermore, inquiries focus on leveraging machine learning algorithms to analyze extensive performance data to expedite the qualification of new polyimide formulations for highly specialized applications like deep-sea or space missions. The overarching user expectation is that AI will primarily contribute to higher quality standards, faster turnaround times, and significant cost reductions through automated process control and yield optimization.

AI's adoption in the Polyimide Tubing sector is principally focused on improving the intricate steps of manufacturing and quality assurance, which are critical given the stringent requirements of end-user industries. Machine vision systems powered by deep learning are being deployed for real-time defect detection, inspecting tubing for minute flaws (such as wall thickness inconsistency or surface irregularities) that are undetectable by human operators at high production speeds. This significantly enhances compliance with ISO and FDA standards. Simultaneously, AI-driven process optimization uses multivariate data analysis (temperature, pressure, resin flow rate) to predict and proactively adjust extrusion parameters, ensuring consistent physical properties—like tensile strength and burst pressure—across entire production batches, thereby minimizing waste of expensive polyimide resin.

- AI-driven predictive maintenance schedules for sophisticated extrusion equipment, minimizing unplanned downtime and maximizing asset utilization.

- Machine learning algorithms optimizing polymer blending ratios and curing profiles to achieve specific mechanical and thermal properties for custom orders.

- Automated visual inspection using computer vision to ensure micro-diameter precision and identify microscopic surface defects in real-time.

- Enhanced supply chain forecasting and logistics management based on AI, improving inventory control of high-cost raw materials and accelerating global distribution.

- Generative AI assisting R&D teams in simulating the performance of novel polyimide derivatives under extreme operational conditions, reducing physical prototyping cycles.

DRO & Impact Forces Of Polyimide Tubing Market

The dynamics of the Polyimide Tubing Market are strongly influenced by a robust set of driving factors (D), inherent constraints (R), compelling opportunities (O), and external impact forces. The primary drivers stem from the global surge in demand for minimally invasive medical devices and the continuous need for high-performance, lightweight materials in the expansive aerospace sector, particularly for advanced communication and wiring solutions. Opportunities are emerging prominently from the development of advanced 5G and 6G infrastructure, which demands extremely reliable dielectric materials, and the increased governmental and private funding allocated to complex space exploration programs, requiring radiation-resistant cabling solutions. These positive market accelerators are, however, counterbalanced by significant challenges, notably the exceedingly high cost of polyimide resins and the technical complexity associated with manufacturing ultra-fine, high-tolerance tubing structures.

Impact forces acting on the market are predominantly technological and regulatory. Technological advancements in additive manufacturing (3D printing of high-temperature polymers) pose a potential disruption, offering customized geometries, though currently lacking the required micro-tolerance and seamless finish of traditional extruded tubing. Regulatory pressures, particularly the stricter enforcement of medical device regulations (such as MDR in Europe) and environmental mandates concerning solvent usage in polyimide processing, necessitate ongoing research and investment in compliance and sustainable manufacturing techniques. Furthermore, geopolitical tensions affecting global supply chains for specialized chemical precursors remain an external force influencing stability and raw material pricing, particularly sensitive to regional manufacturing capacity concentration.

- Drivers (D): Expansion of global minimally invasive surgery markets; Escalating demand for lightweight and high-temperature resistant materials in Aerospace and Defense; Miniaturization trend in electronics and fiber optics.

- Restraints (R): High initial cost of polyimide resins and specialized processing equipment; Technical difficulties in maintaining tight dimensional tolerances for micro-diameter tubing; Potential substitution by alternative high-performance polymers (e.g., PEEK) in less extreme environments.

- Opportunities (O): Growing adoption in electric vehicles (EVs) for battery management systems and wiring harnesses; Commercialization of advanced 5G and satellite communication networks; Development of enhanced polyimide nanocomposites offering superior mechanical properties.

- Impact Forces: Stringent regulatory standards (FDA, ISO 13485) impacting market entry and product qualification; Geopolitical volatility affecting supply of critical chemical precursors; Continuous innovation in manufacturing technologies (precision extrusion, laser ablation).

Segmentation Analysis

The Polyimide Tubing Market is comprehensively segmented based on product type, application, and end-use industry, providing granular insights into demand patterns and growth vectors. The segmentation by product type typically differentiates based on wall thickness and mechanical robustness, addressing varied requirements from highly flexible, thin-walled structures for navigating vasculature to heavy-walled, rigid tubes for structural electrical insulation. Application segmentation highlights the critical functions these tubes perform, ranging from protecting fiber optic cables to acting as delivery conduits in surgical procedures. This layered analytical approach is essential for manufacturers to tailor their production capabilities and marketing efforts toward the highest-growth, highest-margin segments, acknowledging the differing regulatory and performance benchmarks inherent to each sector, particularly the stringent requirements of the medical and aerospace industries which dominate consumption.

The predominant segmentation factor remains the application area, where the medical segment stands out due to the mandatory requirement for polyimide’s biocompatibility, excellent lubricity (often enhanced via coatings), and ability to withstand gamma sterilization without degradation. Within the electronics and electrical segment, segmentation focuses heavily on electrical resistance, dielectric strength, and thermal resilience, especially for high-voltage insulation in automotive battery packs and aerospace cabling. The increasing complexity of modern machinery and the perpetual push towards smaller components ensure that highly specialized sub-segments, such as those focusing on micro-bore tubing (inner diameters less than 0.010 inches), command premium pricing and drive specialized innovation in extrusion techniques.

- By Type:

- Thin Wall Tubing (Used extensively for catheter shafts and minimal profile components)

- Standard Wall Tubing (Common in electrical insulation and general industrial sleeving)

- Heavy Wall Tubing (Utilized for structural integrity, high-pressure applications, and robust protective sleeving)

- Custom/Micro-Bore Tubing

- By Application/End-Use Industry:

- Medical (Cardiovascular, Neurovascular, Urology, Endoscopy, Drug Delivery Systems)

- Aerospace and Defense (Wire Harnessing, Protective Sleeving, Insulation, Sensor Components)

- Electrical and Electronics (Fiber Optic Buffers, High-Temperature Wire Insulation, Semiconductor Processing Equipment)

- Automotive (EV Battery Systems Insulation, Sensor Protection)

- Industrial and Others (Chemical Processing, Scientific Instrumentation)

- By Form:

- Coiled Tubing

- Straight Tubing

- Multi-lumen Tubing

Value Chain Analysis For Polyimide Tubing Market

The value chain for the Polyimide Tubing Market is structured around highly specialized chemical synthesis, precision manufacturing, and intensive distribution channels tailored to specific end-user demands. Upstream activities are dominated by a limited number of high-performance polymer manufacturers specializing in polyimide resins (precursors such as PMDA and ODA), requiring significant chemical expertise and capital investment. The quality and purity of these raw materials directly dictate the performance characteristics of the final tubing, establishing the raw material cost as a major component of the final product price. Due to the proprietary nature of polyimide synthesis and the high barriers to entry, suppliers often wield considerable bargaining power, influencing market pricing and material availability.

Midstream activities involve the highly precise process of tubing fabrication, including extrusion, drawing, and post-processing techniques such as laser ablation for precise hole drilling or custom cutting, and surface treatments like etching or coating (e.g., PTFE lining for enhanced lubricity). This stage requires specialized, clean-room environments and advanced equipment capable of maintaining sub-micron tolerances, particularly for medical applications. Manufacturing specialization is common; some firms focus exclusively on thin-wall medical tubes, while others specialize in large-diameter industrial sleeves. Distribution channels are highly critical for maintaining product integrity and fast delivery of mission-critical components.

Downstream activities are characterized by the integration of the tubing into complex end products by OEMs. Distribution channels typically involve both direct sales (for large volume contracts with major aerospace or medical device manufacturers) and indirect specialized distributors. Indirect channels, particularly distributors with technical expertise in handling high-performance polymers, are crucial for reaching smaller, specialized engineering firms or R&D labs. The primary value addition at this stage is customization and technical support, ensuring the tubing integrates seamlessly into sophisticated systems like cardiac catheters or aircraft wiring harnesses, emphasizing the need for robust quality control documentation and traceability.

Polyimide Tubing Market Potential Customers

The Polyimide Tubing Market targets a diverse yet highly specialized customer base, primarily comprising Original Equipment Manufacturers (OEMs) operating within regulated and high-performance sectors. The largest customer segment consists of medical device manufacturers who utilize polyimide tubing as the backbone of neurovascular, peripheral vascular, and cardiovascular catheters, demanding absolute precision, biocompatibility, and consistent mechanical properties. These buyers place paramount importance on material qualification, regulatory compliance (FDA clearance), and sustained supply chain reliability, often entering into long-term strategic purchasing agreements with preferred suppliers to ensure material constancy and access to proprietary formulations.

Another major segment includes aerospace and defense prime contractors and Tier 1 suppliers. These customers purchase polyimide tubing for wire and cable insulation, lightweight fluid delivery systems, and protective sleeving in aircraft, spacecraft, and satellite systems. Their purchasing decisions are driven by specifications related to extreme temperature resistance, radiation tolerance, low outgassing characteristics in vacuum environments, and strict adherence to military and aerospace material specifications (e.g., specific UL ratings or military standards). The automotive industry, specifically manufacturers of high-performance and electric vehicles (EVs), is rapidly emerging as a key customer, primarily sourcing PI tubing for insulating sensitive battery management systems and high-voltage wiring harnesses that operate under demanding thermal cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.5 Million |

| Market Forecast in 2033 | USD 1,225.8 Million |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson MEDICAL, Zeus Industrial Products Inc., MicroLumen, Inc., TE Connectivity, Polyflon Company, Junkosha USA Inc., Teleflex Incorporated, Putsch GmbH & Co. KG, Custom Interconnects, Inc., Optinova Group, Precision Tubing Technology, L.P., L. Gore & Associates, Inc., Insulation Plastics, LLC, Specialty Silicone Products, Inc., Saint-Gobain Performance Plastics, Vention Medical, A.P. Technology, Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyimide Tubing Market Key Technology Landscape

The Polyimide Tubing Market is defined by sophisticated manufacturing technologies essential for achieving the necessary high precision and performance characteristics. The primary technology employed is high-precision extrusion, often utilizing Ram Extrusion or Melt Extrusion techniques, specifically modified to handle the high melting temperatures and viscous nature of polyimide resins. Achieving extremely thin walls (down to 0.0005 inches) and maintaining tight tolerance control (often +/- 0.0005 inches) requires continuous innovation in die design, temperature control systems, and automated monitoring. Furthermore, advancements focus on incorporating specialized additives into the resin, such as carbon nanotubes or inorganic fillers, to enhance mechanical strength, conductivity, or radiation shielding properties, pushing the boundaries of material performance for demanding applications.

Post-processing technologies are equally crucial and highly specialized. Laser ablation and laser cutting technologies are frequently used to create micro-scale features, such as intricate tip geometries, multiple side holes, or specific window cuts in medical tubing, with unparalleled accuracy. Surface treatment technologies, particularly chemical etching and plasma treatment, are vital for enhancing adhesion for subsequent coating layers (e.g., hydrophilic coatings for lubricity) or improving bonding to other materials used in composite assemblies. The push for multi-lumen tubing, used to simultaneously deliver fluids, house wires, and provide structural support, drives innovation in co-extrusion and braiding techniques, ensuring distinct channels are separated by thin, structurally sound polyimide webs.

Furthermore, technology adoption includes advanced analytical and quality control methodologies. Non-contact measurement systems, often based on optical or ultrasonic sensors, provide continuous dimensional verification during the extrusion process, facilitating real-time feedback loop adjustments and ensuring zero-defect production runs. The integration of advanced computer-aided design (CAD) and simulation software allows manufacturers to predict tubing behavior under bending, torsion, and pressure, optimizing material usage and structural design before physical prototyping. This holistic technological approach ensures that polyimide tubing products consistently meet the evolving, highly stringent performance specifications of the medical and aerospace industries, maintaining polyimide’s competitive edge over lower-performing commodity plastics.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share in terms of revenue, primarily driven by a mature and highly innovative medical device industry and the presence of major aerospace and defense contractors. Stringent regulatory standards set by the FDA necessitate high-quality, traceable polyimide products, favoring established domestic manufacturers and leading to premium pricing. The region is a hub for R&D in micro-catheter technology and next-generation surgical tools, ensuring sustained high demand for thin-wall and micro-bore PI tubing. Significant investment in defense modernization programs further cements the region's dominance in high-specification, military-grade polyimide insulation.

- Europe: Europe represents a stable and high-value market, characterized by strong technological capabilities in Germany, Switzerland, and Ireland, particularly within the medical and precision industrial sectors. European manufacturers often specialize in high-margin applications, such as advanced fiber optic communication components and specialized scientific equipment. The implementation of the Medical Device Regulation (MDR) has increased the complexity of market entry but has simultaneously reinforced the demand for highly reliable and compliant materials like polyimide, favoring established supply chains and premium quality offerings across key European economies.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is fueled by booming electronics manufacturing sectors, particularly in China and South Korea, which require large volumes of PI tubing for insulation and protection in consumer electronics and industrial machinery. Rapid expansion of healthcare infrastructure and increasing affordability of complex medical procedures in countries like India and China are accelerating the adoption of advanced polyimide catheters. Furthermore, substantial government investment in indigenous aerospace and defense capabilities across the region contributes significantly to the increasing consumption of high-performance PI tubing materials.

- Latin America (LATAM): The LATAM market is currently characterized by moderate growth, primarily driven by the modernization of healthcare systems and increasing foreign investment in localized manufacturing facilities, particularly in Brazil and Mexico. Demand for polyimide tubing is largely focused on importing finished medical devices and sophisticated electronic components, but local demand for general industrial sleeving is slowly expanding. Market growth relies heavily on improving economic stability and reducing reliance on costly imports of high-end raw materials and complex finished tubing products.

- Middle East and Africa (MEA): The MEA market accounts for the smallest share globally but demonstrates potential, driven by oil and gas operations and increasing investment in high-tech infrastructure, particularly in the UAE and Saudi Arabia. Polyimide tubing is valued for its performance in high-temperature industrial environments and corrosive chemical processing facilities. The medical segment is growing, albeit from a low base, spurred by governmental initiatives aimed at upgrading public health facilities and acquiring advanced surgical equipment, slowly increasing the need for imported, high-quality polyimide-based devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyimide Tubing Market.- Nordson MEDICAL

- Zeus Industrial Products Inc.

- MicroLumen, Inc.

- TE Connectivity

- Polyflon Company

- Junkosha USA Inc.

- Teleflex Incorporated

- Putsch GmbH & Co. KG

- Custom Interconnects, Inc.

- Optinova Group

- Precision Tubing Technology, L.P.

- L. Gore & Associates, Inc.

- Insulation Plastics, LLC

- Specialty Silicone Products, Inc.

- Saint-Gobain Performance Plastics

- Vention Medical

- A.P. Technology, Co. Ltd.

- Hitachi Chemical Company, Ltd. (Showa Denko Materials)

- New England Wire Technologies Corporation

- Bal Seal Engineering, Inc.

Frequently Asked Questions

Analyze common user questions about the Polyimide Tubing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of polyimide tubing over alternatives like PTFE or PEEK?

Polyimide (PI) tubing offers superior performance primarily due to its extreme thermal stability (operating at higher continuous temperatures, often over 250°C), exceptional dielectric strength, and high tensile strength allowing for thinner walls and smaller diameters, critical for catheter and aerospace applications.

Which end-use industry is the largest consumer of polyimide tubing globally?

The Medical Device industry is the dominant consumer segment, leveraging PI tubing for its biocompatibility, flexibility, and precise wall thickness control required in complex cardiovascular and neurovascular catheters for minimally invasive surgical procedures.

How does the high cost of polyimide resin impact market adoption?

The high raw material cost necessitates that polyimide tubing is generally restricted to mission-critical, high-performance applications (aerospace, advanced medical) where its unique properties are indispensable. However, cost pressures are driving manufacturers towards process optimization and waste reduction strategies.

What major technological advancement is currently influencing polyimide tubing manufacturing?

The market is increasingly influenced by advanced laser ablation and etching techniques, which enable manufacturers to create extremely precise, micro-scale features (such as holes or flares) on the tubing walls post-extrusion, significantly enhancing the functionality of complex medical delivery systems.

Why is Asia Pacific (APAC) projected to be the fastest-growing region for this market?

APAC's accelerated growth is driven by massive governmental investment in advanced medical infrastructure, rapid expansion of domestic aerospace and defense capabilities, and the region's status as a global hub for high-volume electronics manufacturing requiring high-reliability insulation materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Polyimide Tubing Market Statistics 2025 Analysis By Application (Medical, Electronic, Others), By Type (Seamless Tubing, Spiral Wound Tubing), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Polyimide Tubing for Electronic Application Market Statistics 2025 Analysis By Application (.), By Type (ID), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Polyimide Tubing Market Statistics 2025 Analysis By Application (Medical, Electronic), By Type (Seamless Tubing, Spiral Wound Tubing), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager