Polymers for implantable medical devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439583 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Polymers for implantable medical devices Market Size

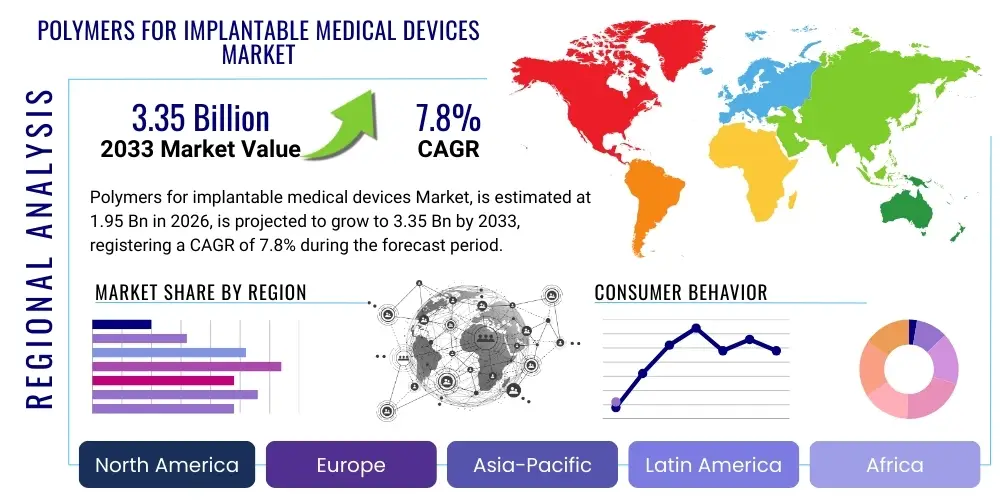

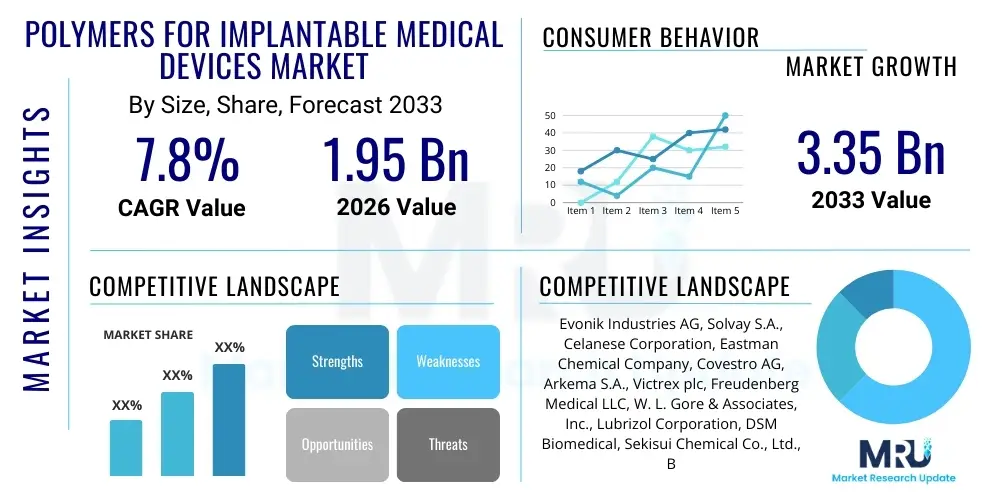

The Polymers for implantable medical devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.95 billion in 2026 and is projected to reach USD 3.35 billion by the end of the forecast period in 2033.

Polymers for implantable medical devices Market introduction

The Polymers for implantable medical devices market encompasses the design, development, manufacturing, and application of specialized polymeric materials engineered for long-term or short-term integration within the human body. These materials are meticulously selected for their unique properties, including biocompatibility, mechanical strength, chemical stability, and sometimes biodegradability, to ensure safety, efficacy, and functional integrity within complex biological environments. The inherent versatility of polymers allows for their use in a vast array of medical applications, from rigid orthopedic components to flexible cardiovascular stents and intricate drug delivery systems, forming the backbone of modern implantable medical technology. This market is profoundly influenced by advancements in material science, biomedical engineering, and clinical needs, constantly pushing the boundaries of what is possible in patient care and quality of life improvement.

Product descriptions within this market vary widely, covering a spectrum from inert, high-performance polymers like Polyetheretherketone (PEEK) used for spinal implants and joint replacements due to its bone-like modulus and excellent wear resistance, to bioresorbable polymers such as Polylactic Acid (PLA) and Polycaprolactone (PCL) that are designed to gradually degrade and be absorbed by the body, often used in drug delivery systems, tissue engineering scaffolds, and temporary fixation devices. Other key polymers include medical-grade silicones for reconstructive surgery and catheter components, polyurethanes for cardiovascular applications due to their elasticity and fatigue resistance, and ultra-high molecular weight polyethylene (UHMWPE) which remains a gold standard in articulating surfaces for joint prostheses. Each polymer type is chosen based on the specific physiological requirements of the implant, its intended lifespan, and the desired biological interaction.

Major applications for these polymers span critical areas of medicine, including orthopedic implants for joint replacement and spinal fusion, cardiovascular implants such as stents, grafts, and pacemaker leads, neurological devices like nerve repair conduits and dura mater replacements, dental implants, and various reconstructive and aesthetic surgical devices. The benefits derived from the use of polymers in these applications are extensive, encompassing enhanced patient comfort, reduced invasiveness, improved functional outcomes, and the potential for targeted drug release. Driving factors for market growth include the global aging population, the rising incidence of chronic diseases requiring surgical intervention, continuous technological advancements in polymer science, increasing demand for minimally invasive procedures, and a growing emphasis on personalized medicine, all contributing to a robust and expanding market landscape.

Polymers for implantable medical devices Market Executive Summary

The Polymers for implantable medical devices market is experiencing dynamic shifts driven by significant business trends, regional growth patterns, and evolving segmental preferences. Key business trends include a heightened focus on innovation in biodegradable and bioresorbable polymers, addressing the need for temporary implants that obviate secondary removal surgeries and offer scaffolding for tissue regeneration. There is also a strong emphasis on developing smart polymers capable of drug elution or responding to physiological stimuli, moving towards more active and therapeutic implant solutions. Furthermore, strategic collaborations and mergers and acquisitions among material suppliers and medical device manufacturers are increasingly prevalent, aimed at consolidating expertise, expanding product portfolios, and accelerating market penetration, particularly in high-growth application areas.

Regional trends indicate North America and Europe currently dominate the market due to advanced healthcare infrastructure, significant R&D investments, and a high prevalence of chronic diseases. However, the Asia Pacific (APAC) region is poised for the most rapid growth, fueled by rising healthcare expenditure, expanding medical tourism, increasing awareness of advanced medical treatments, and a large aging population. Countries like China, India, and Japan are becoming critical hubs for both manufacturing and consumption. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, driven by improving healthcare access and government initiatives to modernize medical facilities, creating new opportunities for market expansion and localized production capabilities.

Segmental trends reveal a robust demand across various polymer types and applications. In terms of material types, high-performance polymers like PEEK and UHMWPE continue to hold substantial market shares due to their proven long-term performance in orthopedic and spinal applications. However, biodegradable polymers are emerging as the fastest-growing segment, propelled by their utility in tissue engineering, drug delivery, and resorbable sutures, reflecting a shift towards more transient and biologically interactive implants. Application-wise, orthopedic implants consistently represent the largest segment, driven by the aging demographic and lifestyle-related bone and joint disorders. The cardiovascular segment is also experiencing significant growth, particularly with innovations in polymer-coated stents and advanced vascular grafts, while neurological and ophthalmic applications are showcasing steady, innovation-led expansion.

AI Impact Analysis on Polymers for implantable medical devices Market

Artificial intelligence (AI) is poised to revolutionize the Polymers for implantable medical devices market by accelerating material discovery, optimizing design processes, enhancing manufacturing efficiency, and facilitating personalized medicine. Common user questions often revolve around how AI can identify novel biocompatible polymers with specific properties, predict long-term implant performance, and streamline regulatory approval pathways. Users are keen to understand AI's role in reducing the time and cost associated with research and development, particularly for complex polymeric structures. There's significant interest in AI-driven predictive analytics for material degradation, patient-specific implant design tailored to individual anatomies and disease states, and the development of intelligent manufacturing systems that ensure high precision and quality control. The overarching expectation is that AI will foster a new era of highly customized, durable, and therapeutically effective implantable devices, while also addressing challenges related to material failure and host response.

- Accelerated Material Discovery and Optimization: AI algorithms, particularly machine learning models, can rapidly screen vast databases of chemical compounds and predict their properties, such as biocompatibility, mechanical strength, degradation rates, and host interaction, significantly reducing the experimental lead time for identifying new polymeric materials or optimizing existing ones for specific medical applications. This computational approach allows researchers to explore a much wider chemical space than traditional empirical methods, leading to novel polymer formulations faster.

- Predictive Modeling for Implant Performance and Longevity: AI can develop sophisticated predictive models based on real-world data from clinical trials and post-market surveillance. These models can forecast the long-term performance, wear rates, fatigue, and potential degradation pathways of polymeric implants under various physiological conditions, enabling designers to refine materials and designs for enhanced durability and reduced risk of failure. This contributes to better patient outcomes and reduces the need for revision surgeries.

- Personalized Implant Design and Manufacturing: AI-powered computational design tools can analyze patient-specific imaging data (e.g., MRI, CT scans) to generate highly customized implant geometries that perfectly match an individual's anatomy and biomechanical requirements. This personalization, often coupled with advanced manufacturing techniques like 3D printing, allows for the creation of implants that offer superior fit, function, and comfort, minimizing complications and improving rehabilitation success rates.

- Enhanced Smart Manufacturing and Quality Control: AI integration into manufacturing processes enables real-time monitoring and control of production parameters, optimizing extrusion, molding, or 3D printing processes for polymeric devices. Computer vision systems driven by AI can perform highly accurate quality checks, detecting minute defects that might be missed by human inspection, ensuring higher consistency, reduced waste, and adherence to stringent medical device standards.

- Improved Diagnostics and Post-Implantation Monitoring: AI can aid in analyzing sensor data from smart implants, providing continuous insights into the implant's status and the surrounding biological environment. This enables early detection of potential issues like infection, inflammation, or implant migration, allowing for timely intervention and improved patient management. AI-driven data analysis from wearables and other monitoring devices can also provide context for implant performance.

DRO & Impact Forces Of Polymers for implantable medical devices Market

The Polymers for implantable medical devices market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that shape its competitive landscape and future trajectory. Key drivers fueling market expansion include the global demographic shift towards an aging population, which inherently increases the incidence of age-related degenerative diseases requiring orthopedic, cardiovascular, and neurological implants. Concurrently, the rising prevalence of chronic conditions such as diabetes, obesity, and cardiovascular diseases necessitates a greater demand for implantable solutions. Technological advancements in polymer science, particularly the development of novel biocompatible, bioresorbable, and drug-eluting polymers, are expanding the functional capabilities and applications of medical devices, further stimulating market growth by enabling more effective and patient-friendly treatments.

However, several significant restraints challenge market growth. The high cost associated with research and development of new medical-grade polymers, coupled with the expensive and lengthy regulatory approval processes imposed by agencies like the FDA and EMA, creates substantial barriers to entry and innovation. Stringent regulatory requirements also add to manufacturing costs and complexities, limiting market access for smaller players. Furthermore, concerns regarding material limitations such as potential long-term degradation, mechanical fatigue, and host immune response reactions remain critical challenges that require continuous material science innovation. The complexity of ensuring absolute biocompatibility and avoiding adverse tissue reactions also acts as a restraint, necessitating rigorous testing and validation protocols for every new material and device combination.

Opportunities within this market are abundant and promising. The advent of personalized medicine opens new avenues for customized polymeric implants tailored to individual patient anatomies and needs, leveraging technologies like 3D printing and advanced imaging. The continuous development of biodegradable and smart polymers, which can elute drugs or guide tissue regeneration, offers substantial growth potential, addressing unmet clinical needs and reducing the burden of revision surgeries. Furthermore, emerging markets in Asia Pacific, Latin America, and the Middle East & Africa present significant untapped potential, driven by improving healthcare infrastructure, increasing disposable incomes, and a growing demand for advanced medical treatments. Strategic collaborations between polymer manufacturers, medical device companies, and research institutions are also creating synergies for accelerating innovation and market penetration.

The impact forces influencing the market are multifaceted. The intense competitive landscape among a limited number of specialized polymer suppliers and numerous medical device manufacturers drives continuous innovation but also puts pressure on pricing. The bargaining power of buyers, primarily hospitals and large healthcare systems, is substantial due as they purchase in large volumes, often negotiating for cost-effective solutions. The bargaining power of suppliers, particularly for specialized medical-grade raw materials, can be moderate to high, especially for proprietary compounds. The threat of substitutes, while limited for certain life-sustaining implants, exists from non-surgical interventions or alternative therapies, prompting continuous product differentiation. Finally, the threat of new entrants is relatively low due to high capital investment requirements, stringent regulatory hurdles, and the need for extensive clinical validation and established supplier relationships, consolidating market power among existing players.

Segmentation Analysis

The Polymers for implantable medical devices market is meticulously segmented to provide a granular understanding of its diverse components, allowing for targeted market strategies and a clear view of growth opportunities across various dimensions. This segmentation typically categorizes the market by the type of polymer used, the specific medical application, and the end-user setting where these devices are utilized. Each segment possesses distinct characteristics, growth drivers, and challenges, reflecting the varied requirements of medical procedures and patient demographics. Analyzing these segments helps stakeholders understand material preferences, technological advancements, and evolving clinical needs, enabling them to align their product development and market expansion efforts more effectively with prevailing trends and future demands.

- By Type:

- Polyethylene (UHMWPE, HDPE, LDPE)

- Polypropylene

- Polyvinyl Chloride (PVC)

- Silicone

- Polyetheretherketone (PEEK)

- Polylactic Acid (PLA)

- Polycaprolactone (PCL)

- Polydimethylsiloxane (PDMS)

- Polyurethane (PU)

- Polyether Block Amide (PEBA)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyvinylidene Fluoride (PVDF)

- Polysulfone (PSU)

- Polycarbonate (PC)

- Resorbable Polymers (PLA, PGA, PCL, PLGA)

- Other Polymers (e.g., Fluoropolymers, Hydrogels)

- By Application:

- Orthopedic Implants

- Joint Reconstruction (Hip, Knee, Shoulder)

- Spinal Implants

- Trauma Fixation Devices

- Dental Implants (Abutments, Restorations)

- Cardiovascular Implants

- Stents (Coronary, Peripheral)

- Catheters (Diagnostic, Interventional)

- Vascular Grafts

- Pacemaker Leads and Components

- Heart Valves

- Neurological Implants

- Dura Mater Grafts

- Nerve Repair Devices

- Cranial Fixation Devices

- Deep Brain Stimulation (DBS) Components

- Ophthalmic Implants

- Intraocular Lenses (IOLs)

- Glaucoma Drainage Devices

- Corneal Implants

- Plastic Surgery and Reconstructive Implants

- Breast Implants

- Facial Implants

- Tissue Expanders

- Drug Delivery Systems

- Implantable Drug Pumps

- Biodegradable Drug-Eluting Implants

- Tissue Engineering and Regenerative Medicine

- Scaffolds for Tissue Growth

- Wound Healing Devices

- Other Applications (e.g., Urological Implants, Gastrointestinal Implants)

- Orthopedic Implants

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (e.g., Orthopedic Clinics, Cardiology Clinics)

- Research and Academic Institutions

- Medical Device Manufacturers

Value Chain Analysis For Polymers for implantable medical devices Market

The value chain for the Polymers for implantable medical devices market is a complex ecosystem beginning with raw material extraction and culminating in the delivery of life-enhancing implants to patients. It typically starts with upstream analysis, which involves the sourcing and processing of specialized chemicals and monomers from basic chemical manufacturers. These raw materials, often petroleum-derived or bio-based, undergo rigorous purification and polymerization processes by specialized polymer producers to create medical-grade resins, films, or fibers. This initial stage demands high levels of quality control and compliance with strict purity standards, as even minor contaminants can compromise the biocompatibility and performance of the final implant. Innovations in upstream processes, such as the development of advanced synthesis techniques for novel biopolymers, are crucial for future market growth.

Midstream activities involve the conversion of these medical-grade polymers into specific components or finished medical devices. This stage is dominated by medical device manufacturers who perform precision molding, extrusion, machining, and assembly processes. Value-added services at this stage include surface modification, sterilization, and packaging to meet regulatory requirements and ensure product safety and efficacy. Design and engineering play a critical role here, translating clinical needs into functional implant designs and selecting appropriate polymers for optimal performance. The ability of manufacturers to integrate advanced manufacturing technologies like 3D printing for customized polymeric implants further enhances their position in the value chain, offering highly specialized solutions and differentiating their products in a competitive market.

Downstream analysis focuses on the distribution and end-use of the implantable medical devices. Once manufactured and sterilized, devices are transported through various distribution channels to reach healthcare providers. Direct channels involve medical device manufacturers selling directly to hospitals, ambulatory surgical centers (ASCs), and specialty clinics, often through their own sales forces or dedicated distributors. This approach allows for closer relationships with end-users, facilitating product training and technical support. Indirect channels involve third-party distributors, wholesalers, and group purchasing organizations (GPOs) that manage logistics, inventory, and sales to a broader network of healthcare facilities. The choice of distribution channel depends on factors such as market reach, cost-efficiency, and the complexity of the device, ensuring timely and effective delivery to the point of care. Post-market surveillance and continuous feedback from end-users are also vital downstream activities, informing future product improvements and regulatory compliance.

Polymers for implantable medical devices Market Potential Customers

The primary potential customers and end-users of polymers for implantable medical devices are diverse, spanning various segments of the healthcare industry, all seeking high-quality, biocompatible, and functionally robust materials to create safe and effective patient solutions. At the forefront are global and regional medical device manufacturers. These entities are the direct consumers of medical-grade polymers, utilizing them as raw materials to fabricate a vast array of implantable products, including orthopedic joints, cardiovascular stents, neurological electrodes, and ophthalmic lenses. Their demand is driven by the need for materials that meet stringent regulatory standards, offer specific mechanical properties, and demonstrate excellent long-term biocompatibility and performance within the human body. These manufacturers constantly seek innovative polymer solutions that can enhance device functionality, reduce costs, and improve patient outcomes.

Further down the chain, but intrinsically linked, are hospitals, ambulatory surgical centers (ASCs), and specialty clinics. While not directly purchasing raw polymers, these institutions are the ultimate end-users of the finished medical devices that incorporate these advanced polymeric materials. Their purchasing decisions for implantable devices are influenced by factors such as clinical efficacy, patient safety, cost-effectiveness, ease of use for surgeons, and the ability to integrate with existing medical procedures and technologies. Therefore, manufacturers of polymers must understand the clinical needs and economic pressures faced by these healthcare providers, ensuring that their materials contribute to devices that are well-received and widely adopted in clinical practice. The growing emphasis on value-based care further accentuates the demand for high-performance and cost-efficient implantable solutions.

Beyond clinical settings, research and academic institutions represent another significant segment of potential customers for polymers used in implantable medical devices. These institutions are often involved in fundamental research into new biomaterials, tissue engineering, drug delivery systems, and the development of next-generation implantable technologies. They require a steady supply of various medical-grade polymers for experimental purposes, prototyping, and preclinical testing. Their demand is characterized by a need for a wide range of polymer types, often in smaller quantities, to explore novel applications and material modifications. Collaborations between polymer suppliers and these research entities are crucial for fostering innovation, pushing the boundaries of material science, and ultimately translating scientific discoveries into commercially viable medical devices, thereby shaping the future landscape of the implantable medical device market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 billion |

| Market Forecast in 2033 | USD 3.35 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Solvay S.A., Celanese Corporation, Eastman Chemical Company, Covestro AG, Arkema S.A., Victrex plc, Freudenberg Medical LLC, W. L. Gore & Associates, Inc., Lubrizol Corporation, DSM Biomedical, Sekisui Chemical Co., Ltd., BASF SE, Ensinger GmbH, SABIC, Zeus Company Inc., Saint-Gobain, Purac Biomaterials (Corbion N.V.), Toray Industries, Inc., Biomerics LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polymers for implantable medical devices Market Key Technology Landscape

The Polymers for implantable medical devices market is characterized by a rapidly evolving technological landscape, driven by continuous innovation aimed at enhancing material performance, improving biocompatibility, and enabling new therapeutic functionalities. A pivotal technology is advanced polymer synthesis, which focuses on developing novel polymer architectures, controlled molecular weights, and specific functional groups to achieve desired mechanical, chemical, and biological properties. This includes the creation of custom copolymers, block copolymers, and star polymers that offer tailored degradation rates, improved elasticity, or enhanced surface characteristics for cell adhesion or drug loading. Furthermore, the development of biodegradable and bioresorbable polymers continues to be a major technological frontier, with ongoing research into materials like poly(lactic-co-glycolic acid) (PLGA), polycaprolactone (PCL), and various natural polymers, designed to resorb harmlessly in the body while supporting tissue regeneration.

Another transformative area is advanced manufacturing technologies, particularly 3D printing (additive manufacturing). Technologies like Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), and Binder Jetting are increasingly being adapted for medical-grade polymers. This enables the creation of highly complex, patient-specific implant geometries with intricate internal structures, such as porous scaffolds for tissue engineering or customized bone implants, which are impossible to achieve with traditional manufacturing methods. 3D printing also facilitates rapid prototyping and iterative design, significantly accelerating the development cycle for new devices. Alongside 3D printing, advanced injection molding and extrusion techniques are being refined to produce micro-scale components and multi-layered structures with enhanced precision and reproducibility, critical for devices like microcatheters and drug-eluting stents.

Surface modification technologies are also critical in optimizing the interaction between polymeric implants and biological tissues. Techniques such as plasma treatment, grafting of biomolecules, physical vapor deposition (PVD), and atomic layer deposition (ALD) are employed to alter the surface chemistry and topography of polymers without affecting their bulk properties. These modifications can enhance biocompatibility, reduce inflammation, prevent bacterial adhesion, or promote targeted cell growth, thereby improving integration and reducing the risk of implant failure. The integration of nanotechnology, such as incorporating nanoparticles or creating nanofiber scaffolds, is another emerging trend, offering novel approaches to modulate cellular responses, deliver drugs at a controlled rate, and mimic the extracellular matrix for superior tissue regeneration. The confluence of these technologies is enabling the creation of 'smart' implants that are not only structurally sound but also biologically active and responsive to physiological cues.

Regional Highlights

- North America: This region stands as a dominant force in the Polymers for implantable medical devices market, primarily due to its highly advanced healthcare infrastructure, significant investments in research and development, and the presence of major medical device manufacturers and polymer suppliers. The high prevalence of chronic diseases, an aging population, and a strong regulatory framework facilitating innovation contribute to a robust market. The United States, in particular, leads in adopting cutting-edge technologies and developing personalized medical devices, ensuring continued market growth.

- Europe: Europe represents another key market, driven by its aging demographic, well-established healthcare systems, and stringent quality standards for medical devices. Countries like Germany, France, and the UK are at the forefront of medical device innovation and polymer research. Favorable government policies and increasing healthcare expenditure, coupled with a focus on minimally invasive surgeries and advanced biomaterials, support a steady demand for high-performance polymeric implants across various applications.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, propelled by rapidly developing economies, improving healthcare access, and a burgeoning medical tourism sector. Increasing disposable incomes, a large and expanding patient pool, and growing awareness of advanced medical treatments are key drivers. Countries like China, India, Japan, and South Korea are significantly investing in healthcare infrastructure and R&D, positioning the region as a critical hub for both manufacturing and consumption of implantable medical devices.

- Latin America: This region is experiencing considerable growth in the polymers for implantable medical devices market, albeit from a smaller base. Factors such as improving economic conditions, expanding healthcare infrastructure, and increasing access to advanced medical technologies are contributing to market expansion. Governments are investing in modernizing healthcare facilities, leading to a rising demand for implantable devices, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA market is witnessing steady growth, largely driven by increasing government investments in healthcare infrastructure development and a rising prevalence of chronic diseases. Countries in the Gulf Cooperation Council (GCC) are particularly focused on enhancing their medical tourism capabilities and adopting advanced medical technologies, creating new opportunities for polymeric implant applications. However, market growth in some parts of Africa may be slower due to economic and political instability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polymers for implantable medical devices Market.- Evonik Industries AG

- Solvay S.A.

- Celanese Corporation

- Eastman Chemical Company

- Covestro AG

- Arkema S.A.

- Victrex plc

- Freudenberg Medical LLC

- W. L. Gore & Associates, Inc.

- Lubrizol Corporation

- DSM Biomedical

- Sekisui Chemical Co., Ltd.

- BASF SE

- Ensinger GmbH

- SABIC

- Zeus Company Inc.

- Saint-Gobain

- Purac Biomaterials (Corbion N.V.)

- Toray Industries, Inc.

- Biomerics LLC

Frequently Asked Questions

Analyze common user questions about the Polymers for implantable medical devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Polymers for implantable medical devices market?

The market's growth is primarily fueled by a global aging population, increasing prevalence of chronic diseases requiring surgical intervention, continuous technological advancements in polymer science leading to enhanced material properties, and a rising demand for minimally invasive procedures and personalized medical devices. Additionally, expanding healthcare infrastructure and increased healthcare expenditure in emerging economies significantly contribute to market expansion.

Which types of polymers are most commonly used in implantable medical devices, and why?

High-performance polymers like Polyetheretherketone (PEEK) are widely used for orthopedic and spinal implants due to their excellent mechanical strength, biocompatibility, and radiolucency. Ultra-high molecular weight polyethylene (UHMWPE) is preferred for articulating surfaces in joint replacements for its wear resistance. Silicones are crucial for reconstructive and flexible devices due to their biocompatibility and elasticity. Bioresorbable polymers such as Polylactic Acid (PLA) and Polycaprolactone (PCL) are gaining traction for drug delivery and tissue engineering due to their ability to degrade harmlessly within the body.

What are the key challenges faced by the Polymers for implantable medical devices market?

Significant challenges include the high cost and lengthy duration of research and development, stringent regulatory approval processes that increase time-to-market and compliance costs, and continuous concerns regarding material limitations such as long-term degradation, mechanical fatigue, and potential host immune responses. Maintaining absolute biocompatibility and ensuring the absence of adverse tissue reactions for new materials also presents a persistent challenge that requires extensive testing and validation.

How is AI impacting the development and application of polymers in implantable medical devices?

AI is profoundly impacting the market by accelerating the discovery of novel polymers through predictive modeling and high-throughput screening. It optimizes implant design by enabling personalized geometries based on patient-specific data, enhances manufacturing precision through smart quality control, and improves predictive analysis of implant performance and longevity. AI also aids in developing smart implants capable of real-time monitoring and advanced diagnostics, leading to more effective and safer devices.

What are the future trends and opportunities in the Polymers for implantable medical devices market?

Future trends include a strong focus on biodegradable and bioresorbable polymers for temporary implants and regenerative medicine, the development of smart polymers with drug-eluting or responsive capabilities, and the widespread adoption of 3D printing for personalized and complex implant geometries. Opportunities are vast in emerging markets due to improving healthcare infrastructure, and in advanced research areas like nanotechnology integration and tissue engineering, aiming for more integrated and therapeutically active implant solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager