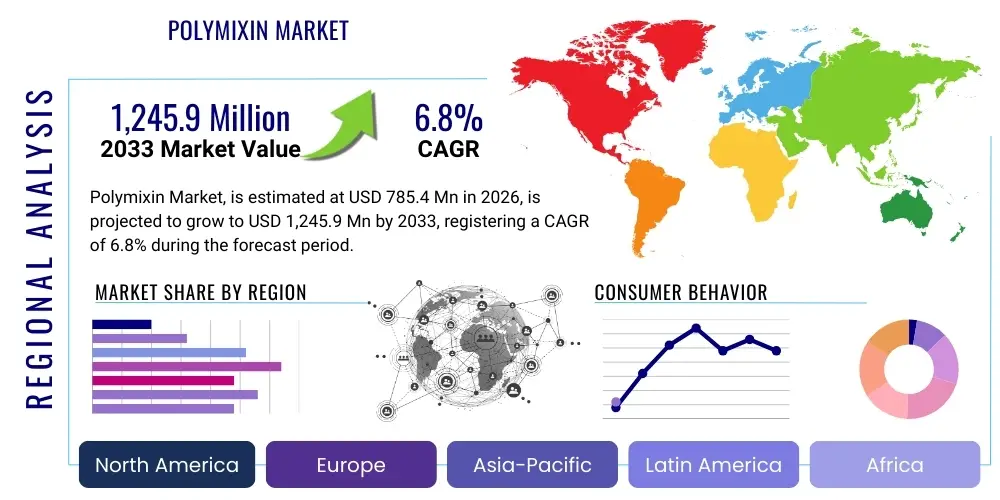

Polymixin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438277 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Polymixin Market Size

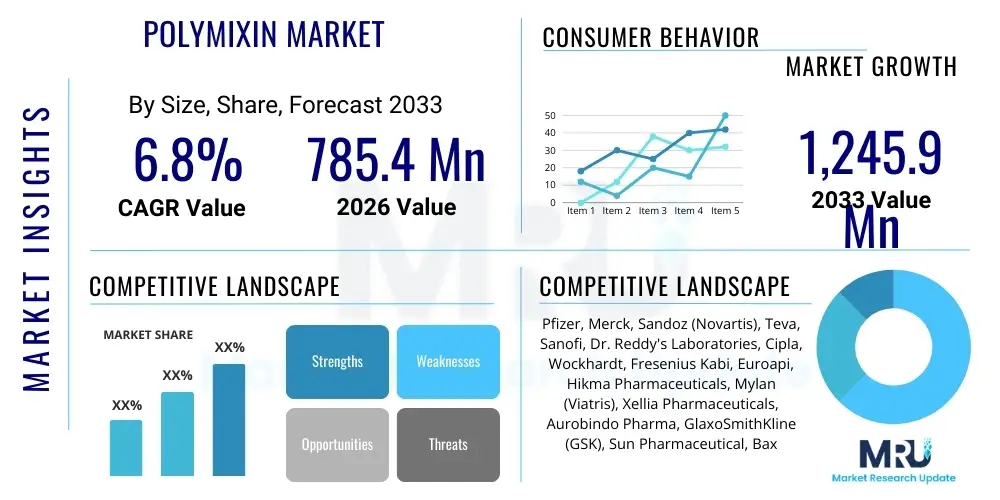

The Polymixin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,245.9 Million by the end of the forecast period in 2033.

Polymixin Market introduction

The Polymixin Market centers on a class of polypeptide antibiotics crucial for combating Gram-negative bacterial infections, particularly those demonstrating extensive drug resistance (XDR) or pan-drug resistance (PDR). Polymixins, primarily Polymixin B and Colistin (Polymixin E), function by disrupting the bacterial outer membrane, leading to cell death. These drugs, despite known nephrotoxicity and neurotoxicity concerns, have experienced a significant resurgence in clinical utility due to the alarming global rise of multidrug-resistant (MDR) organisms like Carbapenem-resistant Enterobacteriaceae (CRE) and Acinetobacter baumannii. The market growth is inherently tied to hospital infection rates, stewardship programs, and the continuous failure of newer generation antibiotics to effectively manage these critical threats.

Major applications of Polymixins span across treating critical infections such as hospital-acquired pneumonia (HAP), ventilator-associated pneumonia (VAP), complicated urinary tract infections (cUTI), and bloodstream infections (BSI) in intensive care units (ICUs). The primary benefit of these antibiotics lies in their proven efficacy as a last-resort option, often used in combination therapy to maximize bactericidal effect and minimize resistance development. Driving factors include the lack of novel antibiotics entering the pipeline that can effectively replace Polymixins for these specific resistant strains, increasing awareness among clinicians regarding MDR management protocols, and substantial government and institutional funding directed towards tackling antimicrobial resistance (AMR) globally, which often necessitates stockpiling or prioritizing the availability of these older, yet highly effective, agents.

Polymixin Market Executive Summary

The Polymixin market is poised for robust expansion driven by critical clinical needs stemming from rising global antimicrobial resistance (AMR). Business trends indicate a strategic focus on improving drug safety profiles, particularly through advanced formulation development and drug delivery systems aimed at minimizing nephrotoxicity, which remains the primary constraint on broader usage. Key pharmaceutical manufacturers are increasingly engaging in licensing agreements and focused R&D efforts to enhance the manufacturing purity of Polymixin derivatives, ensuring consistent potency and reduced side-effect burden. Furthermore, the market exhibits consolidation, as specialty pharmaceutical companies capable of navigating complex regulatory pathways for older antibiotics gain market share, emphasizing high-quality generic production and supply chain reliability crucial for critical care settings.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, largely due to high prevalence rates of Gram-negative resistance (e.g., MCR-1 carrying strains) in populous nations like India and China, coupled with expanding healthcare infrastructure and rising antibiotic consumption. North America and Europe, while mature, remain dominant in terms of revenue, driven by stringent regulatory frameworks ensuring quality and established protocols for combination therapy use in advanced ICUs. Segment trends show Polymixin B maintaining a slight lead over Colistin, especially where toxicity concerns prioritize newer, purified forms of B. The hospital segment dominates application usage, reflecting the drugs' primary role in treating severe, nosocomial infections. Overall, the market trajectory is structurally resilient, anchored by the unmet medical need posed by 'superbugs' and the essential nature of Polymixins in global public health preparedness against AMR.

AI Impact Analysis on Polymixin Market

Common user questions regarding AI's impact on the Polymixin market frequently revolve around AI's capacity to revolutionize drug discovery for novel analogues, optimize existing Polymixin dosing regimens to minimize toxicity, and enhance antimicrobial stewardship programs (ASP). Users are keenly interested in whether AI can accelerate the identification of non-toxic Polymixin derivatives or combinations that bypass the existing mechanisms of renal injury. There is also significant anticipation regarding AI algorithms improving clinical outcomes by predicting individual patient responses to standard Polymixin therapy based on extensive clinical data sets, thereby moving from generalized guidelines to personalized medicine approaches. The summarized key themes indicate strong user expectation that AI will primarily serve as a risk mitigation and optimization tool, addressing the core limitations—toxicity and dosing variability—that currently hinder the optimal deployment of these life-saving antibiotics.

The application of Artificial Intelligence (AI) and Machine Learning (ML) models is expected to introduce transformative efficiencies across the Polymixin value chain, primarily targeting the optimization of usage protocols and the discovery of safer alternatives. In clinical practice, AI systems can process real-time patient data, including renal function markers, infection severity scores, and pharmacokinetics, to recommend highly individualized Polymixin dosing, thereby keeping the drug concentration within the therapeutic window while minimizing the risk of acute kidney injury (AKI). This capability is critical because the narrow therapeutic index of Polymixins currently necessitates highly complex and manual adjustments, which AI can automate and refine with greater precision, significantly improving patient safety and treatment efficacy, leading to broader clinical adoption where toxicity risks are managed effectively.

Furthermore, AI-driven computational biology is being deployed in preclinical research to screen vast chemical libraries and predict the activity and toxicity profiles of new Polymixin-like molecules or synergistic drug combinations. This accelerates the laborious and costly process of traditional antibiotic R&D. By analyzing genomic data of resistant pathogens and the structural characteristics of Polymixins, AI can help researchers identify mutations in target bacteria (like MCR-1) and rapidly design counter-strategies. The ability of generative AI to propose synthetic pathways for novel, less nephrotoxic analogues holds the potential to sustain the long-term viability of this drug class, shifting the market focus from merely managing resistance to developing safer, next-generation agents based on the Polymixin scaffold. This technological integration is crucial for addressing the increasing complexity of clinical resistance patterns.

- AI drives personalized dosing algorithms, optimizing Polymixin concentration to reduce nephrotoxicity risks in real-time patient monitoring.

- Machine Learning enhances antimicrobial stewardship by analyzing resistance patterns and recommending appropriate combination therapies, reducing unnecessary Polymixin use.

- Computational modeling accelerates the discovery of novel, less toxic Polymixin analogues by predicting structural activity relationships (SAR).

- AI improves manufacturing quality control by analyzing spectroscopic data for purity, ensuring consistency in bulk drug production, which is crucial for safety.

- Predictive analytics tools forecast outbreaks of specific Gram-negative resistant strains (e.g., CRE), guiding inventory and supply chain preparedness for Polymixin stocks.

DRO & Impact Forces Of Polymixin Market

The Polymixin market dynamics are complexly governed by a critical balance of therapeutic necessity and inherent drug toxicity, encapsulated by significant drivers, restraints, and opportunities. The overwhelming driver is the relentless increase in global antimicrobial resistance (AMR), particularly against last-line Carbapenems, which forces clinicians to revert to Polymixins as the only viable treatment option for certain life-threatening infections. This necessity creates structural demand largely immune to conventional market pressures. However, the market faces significant restraint due to the recognized risk of dose-dependent nephrotoxicity and neurotoxicity associated with both Polymixin B and Colistin, necessitating cautious usage, extensive monitoring, and restrictions on outpatient use, thus limiting the potential patient pool compared to less toxic antibiotics.

Opportunities in the market primarily reside in the development of next-generation formulations, such as liposomal or encapsulated Polymixins, designed to improve the therapeutic index by reducing systemic toxicity while maintaining efficacy at the site of infection. Additionally, R&D focused on synergistic combination therapies—pairing Polymixins with other agents to lower the effective required dose—presents a major avenue for market expansion and safer use. The impact forces dictating market behavior include regulatory scrutiny, which mandates rigorous post-market surveillance and reporting of adverse events, and public health policies that increasingly prioritize dedicated funding for drugs combatting critical priority pathogens, often including Polymixins. The cyclical nature of antibiotic discovery, where new classes fail and old ones return, ensures that Polymixins retain their irreplaceable niche as a critical impact force sustaining the market.

Furthermore, the economic burden of treating drug-resistant infections amplifies the perceived value of Polymixins, despite their age and toxicity profile. Hospitals often face extended patient stays, complex treatment regimens, and higher mortality rates when resistant pathogens are involved, making the successful deployment of Polymixins economically advantageous compared to treating protracted complications. Restraints also include manufacturing challenges; the fermentation and purification processes for these polypeptide antibiotics are intricate, leading to potential variability in product quality and supply chain instability, which discourages new entrants and concentrates production among specialized generic manufacturers. Successfully mitigating these production risks through improved synthetic biology techniques offers a significant opportunity to stabilize global supply and pricing.

Segmentation Analysis

The Polymixin market segmentation provides a granular view of therapeutic adoption based on drug type, primary application settings, and route of administration, reflecting the drug’s specialized role in critical care. Segmentation by Type, including Polymixin B and Polymixin E (Colistin), is crucial because clinical guidelines often differentiate between their usage profiles based on pharmacokinetics, availability of intravenous vs. inhaled formulations, and relative toxicity concerns, driving distinct market shares. The Application segment highlights the dominance of tertiary care settings where resistance is rampant, particularly in ICUs.

The segmentation structure is highly informative regarding procurement and distribution channels. The Route of Administration segment, distinguishing between intravenous (IV), intrathecal, and topical/inhalation, directly correlates with infection type and severity. IV administration constitutes the largest segment, addressing systemic, life-threatening infections. Topical or inhaled uses, while smaller, are vital for treating localized infections like pneumonia or external wounds caused by resistant pathogens. Analyzing these segments helps stakeholders understand where resources should be focused, from clinical education on proper administration techniques to manufacturing prioritization based on demand for high-purity IV formulations necessary for systemic use.

- Type:

- Polymixin B

- Polymixin E (Colistin)

- Application:

- Hospital-Acquired Infections (HAP, VAP, BSI)

- Clinical Settings (Outpatient specialty treatment)

- Others (e.g., Veterinary applications, compounding)

- Route of Administration:

- Intravenous (IV)

- Inhaled/Nebulized

- Topical and Ophthalmic

- Intrathecal/Intraventricular

- Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Polymixin Market

The Value Chain for the Polymixin market is concentrated and complex, beginning with the upstream sourcing of raw materials, which are typically derived from bacterial fermentation processes using specific strains of Bacillus polymyxa. This initial stage, involving microbiological culture and extraction, is technically demanding and highly sensitive to external variables, requiring specialized facilities to ensure yield and purity, particularly concerning endotoxin levels. The synthesis and rigorous purification of the active pharmaceutical ingredient (API), Colistin methanesulfonate (CMS) or Polymixin B sulfate, represent the highest value-addition step due to the necessity of meeting stringent pharmacopoeial standards for clinical injection, addressing the potential for inherent impurities to contribute to toxicity.

The downstream analysis involves formulation, packaging, and distribution, primarily targeting hospital and critical care settings. Due to their last-resort status, Polymixins largely bypass standard retail channels, moving directly through specialized hospital supply chains and institutional purchasing agreements. Direct channels, involving large pharmaceutical wholesalers supplying major hospital systems and government stockpiles, are dominant, ensuring rapid access during infection surges. Indirect channels, such as specialty distributors serving smaller clinics or compounding pharmacies, play a lesser but important role. The distribution system requires robust cold chain management and tracking, essential for maintaining drug stability and preventing counterfeiting, particularly in high-demand regions.

Furthermore, the market's value proposition is significantly enhanced by post-market clinical support and education. Because Polymixins require specialized dosing, monitoring, and combination strategy knowledge, manufacturers often invest in educational programs for intensivists, infectious disease specialists, and clinical pharmacists. This intellectual capital—the knowledge and guidelines surrounding safe and effective use—is a critical component of the downstream value proposition. Upstream sourcing constraints, coupled with the specialized knowledge required for both manufacturing and clinical administration, create high barriers to entry, reinforcing the position of established, quality-focused pharmaceutical entities.

Polymixin Market Potential Customers

The primary end-users and buyers of Polymixin antibiotics are institutional healthcare facilities, with acute care hospitals and specialized critical care units being the largest consumers globally. Specifically, Intensive Care Units (ICUs), respiratory therapy departments (for inhaled Colistin), and infectious disease wards are core customer segments, as these environments manage the highest concentration of patients suffering from severe, drug-resistant Gram-negative infections such as multi-drug resistant P. aeruginosa, K. pneumoniae, and A. baumannii. The purchasing decisions within this segment are often centralized, driven by Pharmacy and Therapeutics (P&T) committees, and influenced heavily by local epidemiology data on resistance patterns and institutional antimicrobial stewardship guidelines, prioritizing supply reliability and product purity.

Secondary, yet significant, customer segments include government health organizations and public health agencies responsible for national public health preparedness and managing antimicrobial resistance crises. Many governments maintain strategic national stockpiles of last-resort antibiotics, including Polymixins, recognizing their essential nature for bioterrorism response or large-scale infection outbreaks. This segment provides stable, high-volume demand, often secured through long-term contracts. Additionally, specialty outpatient clinics and home healthcare services dealing with chronic, complicated infections, such as cystic fibrosis patients requiring inhaled Colistin, represent niche but growing customer bases. The increasing prevalence of resistance dictates that any healthcare setting dealing with immunocompromised patients is a potential customer for Polymixins.

Finally, research institutions and compounding pharmacies also constitute important, albeit smaller, customer groups. Academic medical centers utilize Polymixins for clinical trials evaluating novel combination therapies or new administration routes. Compounding pharmacies require Polymixin APIs to formulate customized dosages or unique topical preparations not commercially available. The crucial characteristic demanded by all these buyers is not just the drug itself, but comprehensive product documentation and assurance of low endotoxin levels and high purity, given the inherent risks associated with systemic administration in critically ill patients, thereby placing extreme emphasis on supplier reputation and quality control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,245.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer, Merck, Sandoz (Novartis), Teva, Sanofi, Dr. Reddy's Laboratories, Cipla, Wockhardt, Fresenius Kabi, Euroapi, Hikma Pharmaceuticals, Mylan (Viatris), Xellia Pharmaceuticals, Aurobindo Pharma, GlaxoSmithKline (GSK), Sun Pharmaceutical, Baxter International, Abbott Laboratories, Zydus Lifesciences, Bristol Myers Squibb |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polymixin Market Key Technology Landscape

The technological landscape surrounding the Polymixin market is primarily focused on enhancing safety, efficacy, and optimizing manufacturing efficiency, rather than entirely novel antibiotic discovery. A critical area is advanced drug formulation technology. Liposomal encapsulation and polymeric nanoparticle carriers represent key breakthroughs aimed at shielding the drug until it reaches the infected tissue, thereby reducing systemic exposure and mitigating the notorious dose-limiting nephrotoxicity. These advanced delivery systems are computationally intensive in their design and require highly specialized sterile manufacturing processes, marking a significant technological shift from traditional bulk drug compounding and leading to premium pricing for the resulting products, justifying the investment through improved patient outcomes and reduced side effects.

In manufacturing, the focus is on synthetic biology and fermentation optimization. Given that Polymixins are naturally derived polypeptides, utilizing genetically modified bacterial strains (e.g., enhanced B. polymyxa) in the fermentation process allows for higher yields and, crucially, reduced levels of specific, highly toxic impurities that are difficult to separate during downstream purification. This technological refinement directly impacts the final product quality and consistency, a major concern for regulatory bodies worldwide. Furthermore, continuous flow chemistry and advanced chromatography techniques are being applied to achieve ultra-high purity Polymixin B sulfate and Colistin Methanesulfonate (CMS), essential for ensuring clinical safety when administered intravenously in high-dose regimens required for treating life-threatening infections in critical care settings.

Beyond drug formulation and API production, technology is heavily integrated into clinical practice via therapeutic drug monitoring (TDM) and rapid diagnostic tests. Sophisticated mass spectrometry-based TDM assays allow clinical pharmacists to precisely measure Polymixin concentrations in patient plasma, enabling quick, informed adjustments to individualized dosing regimens—a practice critical for managing the drug's narrow therapeutic window and mitigating the risk of acute kidney injury. Concurrently, advancements in molecular diagnostics, such as PCR and next-generation sequencing, enable the rapid identification of specific resistance genes (like MCR-1 or NDM-1) that might necessitate Polymixin use, ensuring that the antibiotic is used only when absolutely necessary, thereby supporting global antimicrobial stewardship efforts and extending the effectiveness of this crucial last-resort drug class.

Regional Highlights

- North America (United States and Canada): North America represents a mature, high-value segment characterized by advanced critical care infrastructure, high spending on personalized medicine, and rigorous antimicrobial stewardship programs (ASPs). The U.S. market is driven by high prevalence of resistant nosocomial infections, necessitating the frequent use of Polymixins, often in combination with novel beta-lactamase inhibitors. Regulatory agencies, particularly the FDA, maintain strict quality standards, promoting the use of purified, high-quality generic and branded Polymixin formulations. Investment in clinical trials for safer analogues and new combination protocols is significant here, contributing substantially to global R&D. The major regional challenge remains balancing clinical effectiveness against the economic burden and high risk of nephrotoxicity associated with Polymixin use, driving demand for TDM technology integration.

- Europe (Germany, UK, France, Italy, Spain): The European market is highly fragmented but unified under the strong influence of the European Medicines Agency (EMA) and national health technology assessment (HTA) bodies. While resistance patterns vary, Southern and Eastern Europe generally exhibit higher rates of Gram-negative resistance, leading to elevated Polymixin consumption. The UK and Nordic countries focus heavily on stringent ASPs, potentially limiting overall volume but driving demand for high-quality, pure Colistin for specific patient groups like cystic fibrosis patients using inhaled formulations. Germany, with its robust pharmaceutical manufacturing base, often serves as a key production hub for high-ppurity APIs used across the continent. Pricing and reimbursement policies, which vary significantly by country, critically affect market accessibility and procurement strategies for hospitals, favoring tenders for bulk generic supply.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the most dynamic and fastest-growing market, primarily due to the vast population, rapidly developing healthcare infrastructure, and critically high endemic rates of multidrug-resistant organisms carrying resistance mechanisms such as MCR-1 (Colistin resistance gene) and Carbapenemase genes. India and China are both major consumers and manufacturers of Polymixin APIs and finished products, leading to aggressive pricing and significant generic competition. The sheer volume of antibiotic usage, coupled with less stringent initial regulatory oversight compared to the West, accelerates the spread of resistance, paradoxically increasing the reliance on last-resort drugs like Polymixins. Japan and South Korea, however, operate with stringent regulatory standards, focusing on optimized use and quality imports. The growth here is explosive, driven by the critical need to manage rapidly expanding infection burdens in tertiary care.

- Latin America (Brazil, Mexico): The market in Latin America is characterized by high levels of government procurement and significant challenges in managing antibiotic resistance due to often inconsistent public health investment and prescription controls. Polymixins are crucial in Brazil, which reports significant incidence of Carbapenem-resistant isolates in hospital settings. Market access is often determined by public tenders and the capabilities of local pharmaceutical distributors to maintain stable supply chains despite logistical complexities. Pricing sensitivity is high, favoring cost-effective generic formulations, though there is a growing demand for advanced, less-toxic intravenous formulations in private hospitals catering to higher socioeconomic strata.

- Middle East and Africa (MEA): MEA presents a market scenario defined by significant heterogeneity. The Gulf Cooperation Council (GCC) countries possess highly developed, well-funded healthcare systems that follow European and North American treatment guidelines, demanding high-quality, branded Polymixins and TDM capabilities. Conversely, many African nations face substantial supply chain hurdles and limited access, though the necessity is high due to pervasive resistant infections. The market is primarily supported by international aid organizations and government purchasing focused on managing critical hospital-acquired infections, often relying on essential medicines lists that include Polymixins. Regulatory harmonization efforts across the region are gradually improving, which is stabilizing procurement processes and quality assurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polymixin Market.- Pfizer Inc.

- Merck & Co., Inc.

- Sandoz (A Novartis Division)

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Wockhardt Ltd.

- Fresenius Kabi AG

- Euroapi S.A.

- Hikma Pharmaceuticals PLC

- Mylan (Viatris Inc.)

- Xellia Pharmaceuticals (A Novo Holdings Company)

- Aurobindo Pharma Limited

- GlaxoSmithKline (GSK)

- Sun Pharmaceutical Industries Ltd.

- Baxter International Inc.

- Abbott Laboratories

- Zydus Lifesciences Limited

- Bristol Myers Squibb (BMS)

Frequently Asked Questions

Analyze common user questions about the Polymixin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Polymixin market?

The primary driver is the critical global surge in multidrug-resistant (MDR) Gram-negative bacteria, such as CRE and MDR Acinetobacter, which have exhausted therapeutic options, positioning Polymixins (Polymixin B and Colistin) as essential last-resort antibiotics for treating life-threatening hospital infections.

What is the main safety concern limiting the wider use of Polymixins?

The chief safety concern is dose-dependent nephrotoxicity (kidney damage) and, to a lesser extent, neurotoxicity. These risks necessitate frequent therapeutic drug monitoring (TDM), customized dosing regimens, and careful patient selection, thereby restraining routine usage.

How is technology impacting the efficacy and safety of Polymixins?

Technology is enhancing safety through advanced drug delivery systems like liposomal encapsulation, which reduces systemic toxicity. Furthermore, sophisticated AI-driven therapeutic drug monitoring (TDM) and rapid molecular diagnostics are optimizing dosing and ensuring the targeted use of these antibiotics, improving clinical outcomes.

Which geographical region exhibits the fastest growth in Polymixin consumption?

The Asia Pacific (APAC) region, particularly nations like India and China, demonstrates the fastest market growth. This is attributed to the high prevalence of endemic drug resistance, expanding healthcare access, and the high volume of hospital-acquired infections requiring last-line treatment.

What are the key opportunities for market stakeholders in the Polymixin sector?

Key opportunities lie in developing improved, less-toxic analogues and novel combination therapies that allow for reduced dosage requirements. Furthermore, securing stable supply chains and investing in high-purity API manufacturing processes offer competitive advantages due to high clinical demand for reliable, safe products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager