Polyps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440207 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Polyps Market Size

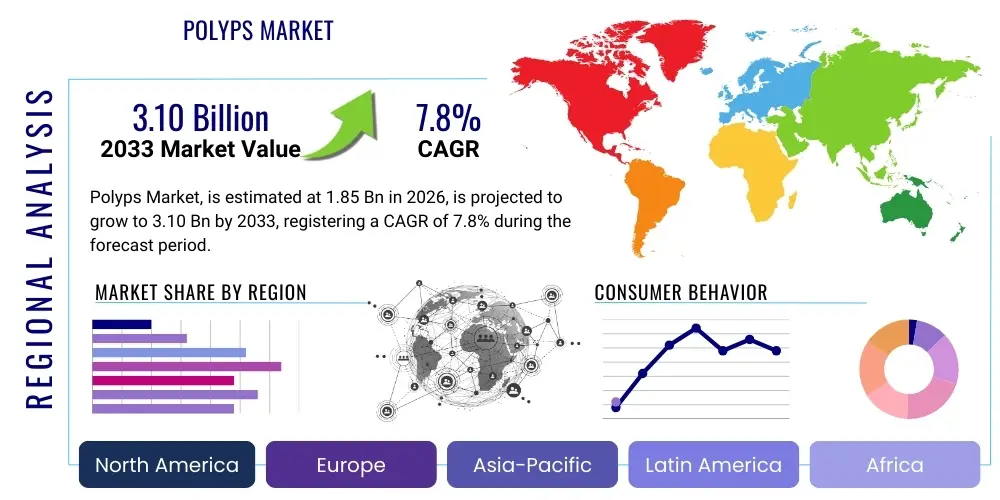

The Polyps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.10 Billion by the end of the forecast period in 2033.

Polyps Market introduction

Polyps are abnormal tissue growths that can form on the mucous membranes of various organs within the body, most commonly found in the colon, nasal passages, uterus, and stomach. While many polyps are benign, certain types, particularly in the colon, carry a significant risk of malignancy if left untreated. Early detection and removal are paramount for preventing progression to cancer and improving patient prognoses. The polyps market encompasses a wide array of diagnostic tools, therapeutic interventions, and monitoring solutions designed to identify, characterize, and manage these growths effectively.

The product landscape within the polyps market includes advanced endoscopic systems, biopsy devices, imaging technologies such as CT and MRI scans, and various surgical instruments used for polypectomy procedures. Additionally, pharmacological treatments for symptom management and prevention of recurrence, particularly for nasal and uterine polyps, contribute to the market's breadth. Innovations in minimally invasive techniques and enhanced visualization capabilities are continuously shaping the offerings, making procedures safer and more accessible for patients.

Major applications of polyps management span across gastroenterology, otolaryngology, gynecology, and urology, reflecting the diverse anatomical locations where polyps can manifest. The primary benefits driving market growth include the early detection of precancerous lesions, leading to improved cancer prevention rates, reduced morbidity and mortality, and enhanced quality of life for affected individuals. Key driving factors contributing to this growth include a globally aging population, which is more susceptible to polyp formation, increasing incidence of lifestyle-related diseases, and a heightened emphasis on preventive healthcare and early screening programs facilitated by public health initiatives and technological advancements.

Polyps Market Executive Summary

The polyps market is experiencing robust growth driven by several key business trends, including the increasing adoption of advanced diagnostic technologies and a shift towards minimally invasive treatment modalities. Healthcare providers are increasingly investing in high-definition endoscopes, AI-powered image analysis tools, and sophisticated polypectomy devices to enhance diagnostic accuracy and therapeutic efficacy. Furthermore, there is a growing focus on personalized screening protocols and targeted therapies, reflecting a broader trend in precision medicine aimed at optimizing patient outcomes and reducing healthcare costs associated with advanced disease.

Regionally, the market exhibits diverse growth patterns. Developed regions such as North America and Europe currently hold significant market shares due to well-established healthcare infrastructures, high healthcare expenditure, and widespread awareness regarding screening programs. However, the Asia Pacific region is poised for substantial growth, propelled by expanding healthcare access, rising disposable incomes, increasing prevalence of risk factors, and government initiatives promoting early disease detection. Latin America, the Middle East, and Africa are also emerging as promising markets, albeit with challenges related to infrastructure and affordability, but presenting long-term opportunities for market players.

Segment-wise, the market sees dynamic trends across different polyp types, diagnostic methods, and treatment approaches. Colorectal polyps continue to dominate due to their high prevalence and strong link to colorectal cancer, driving demand for colonoscopy and related therapeutic interventions. The diagnostic segment is witnessing innovations in non-invasive screening methods like stool-based DNA tests, aiming to improve patient compliance. In treatment, endoscopic polypectomy remains the gold standard, but newer ablation techniques and improved instrument designs are gaining traction, reflecting the industry's commitment to less invasive and more effective patient care.

AI Impact Analysis on Polyps Market

User questions related to the impact of AI on the polyps market frequently center around its potential to revolutionize diagnosis, treatment planning, and personalized patient management. There is significant interest in how AI algorithms can improve the accuracy and efficiency of polyp detection during endoscopic procedures, reducing missed lesions and inter-observer variability. Users are also keen to understand AI's role in risk stratification, predicting polyp recurrence, and aiding in the development of novel therapeutic strategies. Concerns often revolve around data privacy, regulatory approvals, and the integration challenges within existing clinical workflows, alongside the need for robust validation studies to ensure reliability and trust in AI-driven solutions.

The anticipation is that AI will not only augment human capabilities but also drive greater accessibility to expert-level diagnostics in underserved areas. Expectations are high for AI to streamline administrative tasks, optimize resource allocation in screening programs, and enable more data-driven decision-making throughout the patient journey. However, the ethical implications of autonomous AI systems in medical diagnosis and the potential for algorithmic bias in diverse patient populations remain critical discussion points among stakeholders, requiring careful consideration as AI technologies mature and become more integrated into clinical practice.

- Enhanced Diagnostic Accuracy: AI algorithms can analyze endoscopic images and pathology slides with high precision, identifying polyps and classifying their types more accurately than human eyes alone, reducing missed lesions.

- Automated Polyp Detection and Characterization: Real-time AI tools integrated into endoscopes can highlight suspicious areas, calculate polyp size, and provide probability scores for malignancy, assisting endoscopists during procedures.

- Personalized Risk Assessment: AI can process vast amounts of patient data, including genetic predispositions, lifestyle factors, and medical history, to predict an individual's risk of polyp formation and recurrence, enabling tailored screening protocols.

- Optimized Treatment Planning: AI can aid in selecting the most appropriate treatment strategy by evaluating polyp characteristics, patient comorbidities, and historical treatment outcomes, leading to more effective and personalized interventions.

- Drug Discovery and Development: AI can accelerate the identification of new therapeutic targets and drug candidates for polyps that are not amenable to surgical removal or for preventing recurrence, by analyzing molecular data and predicting drug efficacy.

- Workflow Efficiency: AI tools can automate documentation, generate reports, and prioritize patient cases for follow-up, significantly improving clinical workflow efficiency and reducing the administrative burden on healthcare professionals.

- Educational and Training Support: AI-powered simulators and training modules can help medical trainees improve their polyp detection and removal skills, providing objective feedback and standardized learning experiences.

DRO & Impact Forces Of Polyps Market

The polyps market is significantly driven by the escalating global prevalence of chronic diseases and conditions known to predispose individuals to polyp formation, such as inflammatory bowel disease and obesity. The demographic shift towards an aging population worldwide is another primary driver, as the risk of developing polyps, particularly colorectal polyps, increases substantially with age. Furthermore, continuous advancements in diagnostic technologies, including high-definition endoscopy and non-invasive screening methods, coupled with growing public awareness campaigns and government-backed screening programs, are propelling market expansion by facilitating earlier detection and intervention.

However, the market faces several restraints that could impede its growth. The high cost associated with advanced diagnostic procedures, specialized endoscopic equipment, and therapeutic interventions remains a significant barrier, especially in developing economies with constrained healthcare budgets. A lack of adequate awareness regarding the importance of early screening and the potential risks of untreated polyps in certain regions also limits market penetration. Moreover, the inherent risks associated with invasive endoscopic procedures, such as perforation or bleeding, although rare, contribute to patient apprehension and can impact compliance with recommended screening guidelines.

Opportunities within the polyps market are abundant and include the robust development of novel therapeutic agents for polyp management, particularly for those that are difficult to access or remove surgically. The increasing integration of artificial intelligence and machine learning into diagnostic imaging and predictive analytics offers substantial avenues for innovation and improved outcomes. Expansion into emerging markets, where healthcare infrastructure is improving and awareness is rising, presents untapped potential for market players. Furthermore, the growing emphasis on personalized medicine approaches, tailored to an individual's genetic profile and specific polyp characteristics, is expected to unlock new treatment paradigms and enhance patient care. These opportunities, combined with the underlying impact forces of technological innovation, healthcare policy evolution, and demographic shifts, will continue to shape the trajectory and competitiveness of the polyps market.

Segmentation Analysis

The polyps market is comprehensively segmented to provide granular insights into its diverse components, covering various aspects from the type of polyp and its anatomical location to the diagnostic methodologies employed, the treatment interventions available, and the end-user facilities utilizing these solutions. This segmentation helps to understand the specific dynamics and growth drivers within each sub-market, enabling stakeholders to identify niche opportunities and tailor strategies effectively. The complexity of polyp manifestation across different organ systems necessitates a multi-faceted approach to market analysis and product development.

- Type:

- Colorectal Polyps

- Nasal Polyps

- Uterine Polyps

- Gastric Polyps

- Bladder Polyps

- Vocal Cord Polyps

- Others (e.g., small intestine polyps, ear polyps)

- Diagnosis:

- Endoscopy

- Colonoscopy

- Gastroscopy

- Hysteroscopy

- Nasal Endoscopy

- Laryngoscopy

- Cystoscopy

- Biopsy

- Imaging

- CT Scan

- MRI

- Ultrasound

- Virtual Colonoscopy (CT Colonography)

- Stool-based Tests

- Fecal Immunochemical Test (FIT)

- Stool DNA Test (sDNA)

- Blood Tests (e.g., tumor markers for screening support)

- Genetic Testing

- Endoscopy

- Treatment:

- Polypectomy

- Endoscopic Polypectomy

- Surgical Polypectomy (Open/Laparoscopic)

- Medications

- Corticosteroids

- NSAIDs

- Antihistamines

- Biologics

- Ablation Techniques (e.g., radiofrequency ablation, cryoablation)

- Surveillance and Monitoring

- Other Therapeutic Interventions

- Polypectomy

- End-User:

- Hospitals

- Specialty Clinics (e.g., Gastroenterology Clinics, ENT Clinics, Gynecology Clinics)

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Academic & Research Institutions

- Contract Research Organizations (CROs)

Value Chain Analysis For Polyps Market

The value chain for the polyps market commences with extensive upstream activities encompassing research and development (R&D) by pharmaceutical and medical device companies. This stage involves the discovery of new diagnostic biomarkers, the design and engineering of advanced endoscopic instruments, and the development of novel therapeutic drugs or non-invasive screening technologies. Key players in this phase include academic institutions, biotech startups, and large R&D divisions of established healthcare corporations, focusing on innovation to address unmet clinical needs and improve patient outcomes.

Following R&D, the value chain progresses to manufacturing, where raw materials are transformed into finished products, including endoscopes, biopsy forceps, polypectomy snares, and pharmaceutical formulations. This segment is characterized by stringent quality control, regulatory compliance, and economies of scale. Downstream activities primarily involve distribution channels, which include a complex network of wholesalers, distributors, and direct sales forces responsible for delivering products to end-users such as hospitals, specialty clinics, and diagnostic centers globally. These channels manage logistics, inventory, and often provide technical support and training.

The distribution network is a critical component, bridging manufacturers and the healthcare providers who perform polyp diagnosis and treatment. Direct distribution involves manufacturers selling directly to large hospital networks or purchasing organizations, fostering closer relationships and often providing tailored solutions. Indirect distribution utilizes third-party distributors who have extensive reach into diverse markets, particularly beneficial for smaller manufacturers or those targeting wider geographic coverage. The entire value chain is supported by post-sales services, maintenance, and ongoing research into product improvement and new application areas, ensuring sustained market presence and technological advancement in the polyps management landscape.

Polyps Market Potential Customers

The primary potential customers and end-users of products and services within the polyps market are diverse healthcare entities and professionals dedicated to patient care and medical research. Hospitals, particularly those with well-equipped gastroenterology, otolaryngology, and gynecology departments, represent a significant customer segment. These institutions require a wide range of diagnostic and therapeutic devices, including high-definition endoscopes, polypectomy instruments, and pathology services for tissue analysis, due to the high volume of patients undergoing screening and treatment for various polyp types.

Specialty clinics, such as dedicated gastroenterology centers, ENT clinics, and women's health clinics, also constitute a crucial customer base. These outpatient facilities often focus on specific types of polyps and minimally invasive procedures, driving demand for specialized equipment and consumables. Ambulatory Surgical Centers (ASCs) are increasingly becoming preferred venues for less complex polypectomy procedures, seeking cost-effective and efficient solutions for patient care. Diagnostic centers, offering advanced imaging and laboratory services, are key buyers of screening tests and biopsy analysis tools, supporting the early detection efforts across the healthcare continuum.

Beyond direct patient care facilities, academic and research institutions are significant potential customers, primarily for cutting-edge diagnostic technologies, research-grade instruments, and advanced analytical tools. They drive innovation, validate new techniques, and contribute to the understanding of polyp pathogenesis and treatment efficacy. Additionally, pharmaceutical companies and Contract Research Organizations (CROs) engaging in drug discovery for polyp-related conditions or prevention strategies also represent an indirect but vital customer segment, influencing the development and adoption of novel pharmaceutical interventions within the broader polyps market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Boston Scientific, Ethicon (Johnson & Johnson), Olympus Corporation, Fujifilm Holdings Corporation, Karl Storz SE & Co. KG, Stryker Corporation, Cook Medical LLC, Pentax Medical (HOYA Corporation), Richard Wolf GmbH, CONMED Corporation, B. Braun Melsungen AG, ERBE Elektromedizin GmbH, Endomed Systems GmbH, US Endoscopy (STERIS plc), Ambu A/S, Exact Sciences Corporation, Guardant Health, Inc., F. Hoffmann-La Roche AG, Siemens Healthineers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyps Market Key Technology Landscape

The polyps market is significantly influenced by a dynamic and rapidly evolving technology landscape, primarily centered around enhancing diagnostic precision, improving therapeutic outcomes, and enabling less invasive patient interventions. A cornerstone of this landscape is advanced endoscopic imaging, featuring high-definition (HD) and ultra-high-definition (UHD) endoscopes equipped with narrow-band imaging (NBI) or i-SCAN technologies. These innovations allow for superior visualization of mucosal patterns and vascular structures, significantly aiding in the early detection and characterization of polyps, differentiating between benign and potentially malignant lesions with greater accuracy.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms represents another pivotal technological advancement. AI-powered diagnostic platforms are increasingly being employed to analyze endoscopic images in real-time, providing automated polyp detection, size estimation, and histological prediction. This not only enhances diagnostic efficiency and reduces operator fatigue but also helps to minimize the rate of missed polyps, thereby improving the overall effectiveness of screening programs and ensuring timely intervention. Predictive analytics, driven by AI, is also emerging to identify patients at higher risk of polyp recurrence or malignant transformation.

Furthermore, the development of minimally invasive surgical tools and advanced polypectomy devices continues to shape the treatment landscape. These include electrosurgical units with precise cutting and coagulation capabilities, specialized snares for various polyp sizes and locations, and endoscopic submucosal dissection (ESD) and endoscopic mucosal resection (EMR) techniques for larger or more complex polyps. Complementing these are genetic screening technologies and molecular diagnostics, which are becoming crucial for risk stratification and personalized treatment approaches, allowing for more targeted interventions based on an individual’s genetic predisposition and the molecular characteristics of their polyps, thereby driving the market towards more precise and effective patient management strategies.

Regional Highlights

- North America: This region holds a dominant share in the polyps market, primarily driven by a robust healthcare infrastructure, high awareness regarding early screening and diagnosis, significant healthcare expenditure, and the early adoption of advanced medical technologies. The presence of key market players and a high prevalence of colorectal polyps, combined with favorable reimbursement policies, further contribute to market growth in the United States and Canada.

- Europe: The European market is characterized by an aging population highly susceptible to polyp formation and well-established screening programs, particularly for colorectal cancer. Countries like Germany, the UK, and France are at the forefront of adopting advanced endoscopic techniques and innovative diagnostic solutions. Government initiatives to promote preventative healthcare and advancements in medical research also significantly support market expansion.

- Asia Pacific (APAC): Expected to witness the highest growth rate, the APAC region is driven by improving healthcare access, rising disposable incomes, and increasing awareness about health conditions in populous countries like China and India. The growing prevalence of lifestyle-related diseases, coupled with substantial investments in healthcare infrastructure and medical tourism, presents immense opportunities for market players to expand their presence.

- Latin America: The market in Latin America is progressively growing, fueled by increasing government spending on healthcare, improving economic conditions, and rising health awareness among the population. While challenges such as limited access to advanced technologies in some areas persist, ongoing efforts to modernize healthcare systems and medical device penetration create a fertile ground for market expansion.

- Middle East and Africa (MEA): This region shows steady growth, influenced by improving healthcare facilities, increasing foreign investments in the healthcare sector, and a rising focus on medical tourism, particularly in the GCC countries. However, disparities in healthcare access and technological adoption across the diverse nations within MEA mean that growth is often concentrated in economically stronger countries, with potential for broader expansion as healthcare infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyps Market.- Medtronic plc

- Boston Scientific Corporation

- Ethicon (Johnson & Johnson Services, Inc.)

- Olympus Corporation

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- Stryker Corporation

- Cook Medical LLC

- Pentax Medical (HOYA Corporation)

- Richard Wolf GmbH

- CONMED Corporation

- B. Braun Melsungen AG

- ERBE Elektromedizin GmbH

- Endomed Systems GmbH

- US Endoscopy (STERIS plc)

- Ambu A/S

- Exact Sciences Corporation

- Guardant Health, Inc.

- F. Hoffmann-La Roche AG

- Siemens Healthineers AG

Frequently Asked Questions

What are polyps and why is early detection important?

Polyps are abnormal tissue growths typically found on mucous membranes, most commonly in the colon, nose, or uterus. Early detection is critical because certain types of polyps, particularly colorectal polyps, can be precancerous and may develop into cancer if not removed. Timely identification and treatment significantly reduce the risk of malignancy and improve patient outcomes, making screening programs vital for public health.

What are the main methods for diagnosing polyps?

The primary diagnostic methods for polyps include endoscopy (such as colonoscopy, gastroscopy, or hysteroscopy) for direct visualization and biopsy collection, which allows for histological examination. Other important methods involve imaging techniques like CT scans or MRI for assessing size and location, and non-invasive stool-based tests (e.g., FIT, sDNA) for initial screening, particularly for colorectal polyps, guiding further diagnostic steps.

What treatment options are available for polyps?

Treatment for polyps largely depends on their type, size, location, and potential for malignancy. The most common therapeutic approach is polypectomy, which involves the endoscopic or surgical removal of the polyp. In some cases, particularly for nasal or uterine polyps, medication such as corticosteroids or NSAIDs may be used to reduce inflammation and shrink the polyps. Advanced techniques like endoscopic mucosal resection (EMR) or submucosal dissection (ESD) are employed for larger or more complex lesions.

How is artificial intelligence impacting the polyps market?

Artificial intelligence is profoundly impacting the polyps market by enhancing diagnostic accuracy and efficiency. AI algorithms can provide real-time assistance during endoscopic procedures for automated polyp detection, characterization, and even malignancy prediction. This technology helps reduce diagnostic errors, streamline workflows, and supports personalized risk assessment for patients, ultimately leading to earlier and more precise interventions and contributing significantly to advanced patient care and improved screening outcomes.

What factors are driving the growth of the polyps market?

The polyps market is primarily driven by several key factors: an increasing global prevalence of chronic diseases and conditions that predispose individuals to polyp formation; a growing aging population, which is more susceptible to polyps; continuous advancements in diagnostic and therapeutic technologies, including high-definition endoscopy and AI integration; and rising public awareness coupled with expanding screening programs aimed at early detection and prevention of cancer. These elements collectively contribute to a robust demand for polyps management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager