Polyquaternium-10 Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434127 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polyquaternium-10 Market Size

The Polyquaternium-10 Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.0 Million by the end of the forecast period in 2033.

Polyquaternium-10 Market introduction

The Polyquaternium-10 market encompasses the production, distribution, and utilization of this specific quaternary ammonium polymer, derived from hydroxyethyl cellulose (HEC). This chemical compound serves as a highly effective conditioning agent, recognized for its exceptional cationic charge density which allows it to readily adhere to negatively charged surfaces like hair keratin and skin epidermis. Its primary function is to provide lubricity, static control, improved wet and dry combability, and enhanced texture in cosmetic formulations. Due to its superior performance compared to non-ionic or amphoteric conditioning agents, Polyquaternium-10 is indispensable in high-quality personal care products.

The product is commercially available in various grades, differentiated mainly by molecular weight and nitrogen content, allowing manufacturers to tailor the conditioning performance and viscosity profile of their end products. Major applications span across shampoos, conditioners, hair styling gels, body washes, facial cleansers, and moisturizing lotions. The robust demand is underpinned by global consumer trends favoring premium, multifunctional personal care solutions that address issues such as hair damage, frizz control, and scalp health. Furthermore, its efficacy in clear formulations without causing significant haze makes it a preferred choice for aesthetically demanding products.

Key driving factors accelerating market expansion include the burgeoning demand for specialized hair care treatments, particularly in emerging economies characterized by increasing disposable incomes and greater awareness of cosmetic ingredients. Regulatory acceptance in major jurisdictions, coupled with continuous innovation by cosmetic giants to launch new product lines utilizing advanced conditioning polymers, further cements its market position. The compound offers significant benefits, including reducing friction during combing, retaining moisture, and mitigating the abrasive effects of surfactants, thus securing its long-term viability within the cosmetics industry value chain.

Polyquaternium-10 Market Executive Summary

The Polyquaternium-10 market demonstrates stable growth, primarily fueled by sustained demand within the personal care sector, particularly high-end hair conditioning and specialty skin cleansing products. Business trends indicate a strategic focus among manufacturers on expanding production capacity in Asia Pacific to capitalize on lower operational costs and proximity to the fastest-growing consumer bases. Mergers and acquisitions focusing on backward integration, securing stable cellulose feedstock supply, and intellectual property surrounding high-performance grades are critical business strategies being observed. Furthermore, sustainability initiatives are prompting some market players to explore bio-based alternatives or more environmentally benign synthesis routes for cellulose modification, though Polyquaternium-10 remains the benchmark standard.

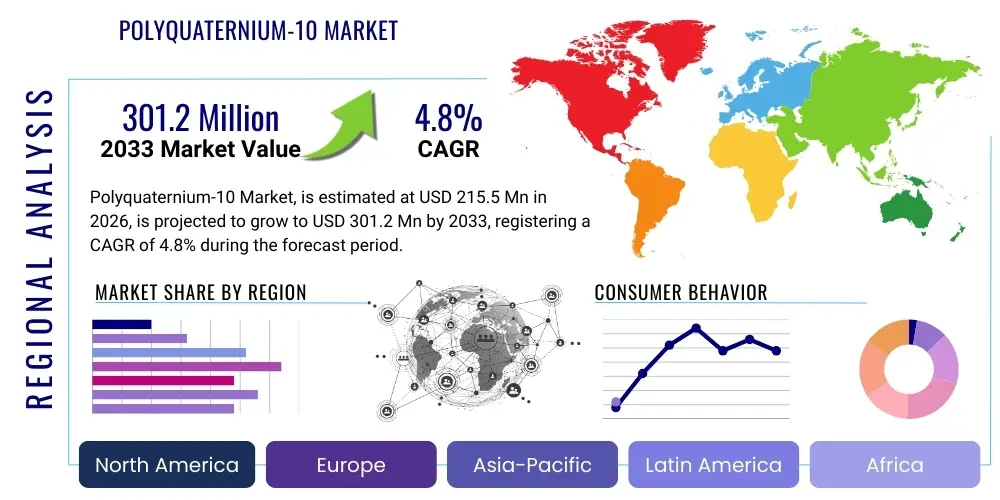

Regionally, Asia Pacific currently dominates the market share, driven by massive manufacturing hubs in China and India, alongside strong consumer markets in Japan and South Korea known for their advanced cosmetic industry. North America and Europe represent mature markets characterized by stringent regulatory environments but high per capita spending on premium cosmetic formulations, necessitating consistent quality and traceable supply chains. The Middle East and Africa (MEA) and Latin America are emerging regional markets, showcasing rapid adoption rates of specialized hair care products previously confined to developed economies, presenting significant untapped growth opportunities for market penetration.

Segmentation trends highlight the dominance of the hair care segment, which utilizes the polymer extensively in shampoos and rinse-off conditioners due to its effective deposition on hair fibers. Within product types, high-molecular-weight Polyquaternium-10 grades are gaining traction for applications requiring superior viscosity modification and intensive conditioning effects, such as hair masks and leave-in treatments. The increasing shift towards direct-to-consumer (DTC) brands and e-commerce platforms is influencing distribution trends, demanding specialized packaging and smaller batch sizes, while simultaneously increasing brand visibility and ingredient transparency requirements, impacting marketing strategies across all segments.

AI Impact Analysis on Polyquaternium-10 Market

Users frequently inquire how Artificial Intelligence (AI) can optimize the chemical synthesis process, enhance product formulation efficiency, and predict consumer preferences for conditioning agents like Polyquaternium-10. Key themes revolve around AI’s role in material science discovery, predicting the interaction of Polyquaternium-10 grades with complex surfactant systems, and optimizing deposition rates on hair substrates. Concerns often focus on the upfront investment required for integrating AI and machine learning (ML) models into traditional chemical manufacturing operations and quality control procedures. Expectations center on AI significantly accelerating the R&D cycle for new cosmetic ingredients, helping formulators select the optimal polymer grade based on targeted performance metrics (e.g., frizz reduction, texture enhancement), and creating personalized consumer products that dynamically adjust Polyquaternium-10 concentration based on specific hair and skin biometric data.

- AI-driven Predictive Formulation: Utilizing ML algorithms to model the complex rheological behavior of Polyquaternium-10 in multi-component cosmetic systems, minimizing formulation trial-and-error.

- Optimized Manufacturing Processes: Implementing AI to monitor reaction kinetics during cellulose etherification and quaternization, ensuring maximum yield, purity, and batch consistency.

- Supply Chain Forecasting: AI-powered analytics predicting feedstock (HEC) demand fluctuations and optimizing inventory management for timely Polyquaternium-10 delivery to global cosmetic manufacturers.

- Personalized Product Development: Leveraging AI and consumer data to recommend optimal Polyquaternium-10 concentrations or molecular weight grades for highly customized hair and skin treatments.

- Quality Control Enhancement: Using computer vision and machine learning for automated inspection and defect detection in large-scale polymer production, ensuring strict adherence to purity standards.

DRO & Impact Forces Of Polyquaternium-10 Market

The Polyquaternium-10 market is influenced by a dynamic interplay of driving factors (D), restraints (R), and opportunities (O), which collectively define the impact forces shaping its trajectory. A key driver is the relentless growth of the global personal care market, particularly the premium segment, where consumers are willing to pay more for proven, high-performance ingredients that offer tangible conditioning benefits. Additionally, increasing consumer awareness regarding hair health and the rising prevalence of chemically treated hair necessitate the use of effective conditioning polymers to mitigate damage. These drivers exert a strong positive impact force, continually increasing the baseline demand for the polymer.

However, the market faces significant restraints. The primary challenge stems from the increasing scrutiny of synthetic polymers and the subsequent demand for natural or bio-derived alternatives, which presents competitive pressure from ingredients like guar hydroxypropyltrimonium chloride. Furthermore, the synthesis process of Polyquaternium-10, while established, relies on petroleum-derived intermediates (for some components of the quaternization agents), leading to price volatility linked to crude oil markets. Stringent regulatory guidelines in regions like the European Union regarding the safety and environmental fate of cosmetic ingredients also impose constraints on product development and market entry, acting as strong counter-forces.

Despite these restraints, substantial opportunities exist. The expanding application scope beyond traditional hair care into specialized dermatological products and high-performance textiles presents new avenues for market penetration. Furthermore, research focused on developing novel, low-irritation grades of Polyquaternium-10 with enhanced biodegradability can mitigate environmental concerns and capitalize on the green chemistry movement. The rapid urbanization and improved economic conditions in Asia and Latin America translate directly into higher consumption of value-added cosmetic products, providing lucrative geographic expansion opportunities that amplify the market's potential growth trajectory and serve as powerful impact forces for innovation and capacity investment.

Segmentation Analysis

The Polyquaternium-10 market is systematically segmented based on various criteria including product type, application, and end-use formulation, allowing for a granular understanding of consumer behavior and technological preferences. The classification by product type typically focuses on molecular weight and degree of substitution, which directly influence performance attributes such as viscosity, film formation capabilities, and overall conditioning efficacy. Application segmentation clearly delineates the polymer’s usage across major personal care categories, with hair care being the most dominant segment, followed by skin care and other niche applications. Analyzing these segments helps stakeholders refine their production focus, optimize distribution channels, and tailor marketing efforts to specific demographic and functional requirements across the global market.

- By Product Type:

- High Molecular Weight Polyquaternium-10

- Low Molecular Weight Polyquaternium-10

- By Application:

- Shampoos

- Conditioners (Rinse-off and Leave-in)

- Hair Styling Products (Gels, Mousse)

- Body Washes and Liquid Soaps

- Skin Creams and Lotions

- Others (Dermatological formulations, Specialty Cleaners)

- By End-Use Formulation:

- Rinse-Off Products

- Leave-On Products

- By Grade:

- Cosmetic Grade

- Industrial Grade

Value Chain Analysis For Polyquaternium-10 Market

The value chain for Polyquaternium-10 begins with the upstream sourcing and processing of raw materials, primarily wood pulp or cotton linters, which yield purified cellulose. This cellulose is then chemically modified, typically via etherification, to produce hydroxyethyl cellulose (HEC). The HEC then undergoes a critical quaternization step using quaternary ammonium compounds (like N, N-dimethyl aminoethyl chloride), converting the non-ionic HEC into the cationic polymer, Polyquaternium-10. Upstream analysis highlights that the cost and availability of high-purity cellulose and the efficiency of the etherification/quaternization reaction are major factors influencing the final production cost and margin of the finished polymer, necessitating robust relationships with chemical suppliers and stringent quality control during synthesis.

The midstream phase involves specialized chemical manufacturers who synthesize the polymer, followed by purification, drying, grinding, and blending to meet specific customer requirements related to molecular weight and charge density. Distribution channels play a vital role in connecting these manufacturers to thousands of cosmetic formulators globally. Distribution largely operates through indirect channels, involving specialized chemical distributors who provide inventory management, technical support, and small-batch supplies to medium and small-sized cosmetic companies. Direct sales are typically reserved for large, multinational cosmetic corporations that purchase in bulk and require highly customized grades or long-term supply agreements, fostering efficiency in scale.

The downstream segment encompasses the usage of Polyquaternium-10 by end-users—cosmetic manufacturers—who incorporate it into various formulations (shampoos, conditioners, lotions). The final point in the chain is the consumer market, where product efficacy and perceived value drive demand back up the chain. Efficient logistics and warehousing are critical, as the material must be stored under specific conditions to maintain its performance characteristics. Optimization throughout the value chain focuses on reducing waste in synthesis, securing stable supply of specialty chemical precursors, and enhancing technical support to aid downstream formulators in achieving desired conditioning results with minimal dosage.

Polyquaternium-10 Market Potential Customers

The primary potential customers and buyers of Polyquaternium-10 are large multinational Fast-Moving Consumer Goods (FMCG) corporations specializing in personal care, beauty, and hygiene products. These major players, including giants in the cosmetic industry, utilize enormous volumes of Polyquaternium-10 for their globally marketed shampoo, conditioner, and styling product lines, valuing ingredients that provide consistent performance and excellent cost-in-use ratios. These buyers typically demand high-purity, standardized grades, often procured through direct, long-term contractual agreements to ensure supply stability and favorable pricing. Their purchasing decisions are heavily influenced by regulatory compliance, technical specifications, and the supplier's ability to provide detailed documentation on efficacy and safety profiles.

A secondary, yet rapidly expanding, customer segment consists of smaller, niche, and indie beauty brands. These companies often focus on specialized segments such as natural, organic, or personalized hair care, requiring smaller quantities but demanding specific technical support for formulation in complex or minimalist ingredient systems. They predominantly purchase through indirect distribution channels, relying on chemical distributors for flexible logistics, technical guidance, and access to samples. This segment is characterized by rapid innovation cycles and a focus on transparency, pushing suppliers to provide more sustainable or natural-sounding variations of conditioning polymers.

Additionally, pharmaceutical and dermatological companies represent potential customers, utilizing high-purity grades of Polyquaternium-10 in therapeutic skin treatments or medical devices where its film-forming and lubricating properties are essential. Furthermore, chemical contract manufacturers and private label formulators who produce finished goods for various brands represent another significant buyer category. Their demand is project-based and highly sensitive to cost, requiring suppliers to offer competitive pricing and flexible ordering mechanisms. The purchasing criteria across all segments are converging on sustainability credentials and traceability, beyond just functional performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashland, Dow Chemical Company, TRI-K Industries, KCI, Akzo Nobel (Nouryon), SNF Group, Sino Lion USA, Guangzhou Tinci Materials Technology Co., Ltd., BASF SE, Croda International Plc, Kao Corporation, Lubrizol Corporation, Clariant AG, Solvay SA, Evonik Industries AG, Guangzhou Sunway Chemical Co., Ltd., Spec-Chem Industry Inc., Shanghai Peakchem Corporation, Hangzhou Bayee Chemical Co., Ltd., Shanghai Rich Chemicals Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyquaternium-10 Market Key Technology Landscape

The core technology landscape surrounding the Polyquaternium-10 market centers on advanced cellulose chemistry and optimization of the quaternization reaction. The fundamental synthesis involves reacting hydroxyethyl cellulose (HEC) with a quaternary ammonium reagent under controlled conditions, typically in an alkaline medium. Technological innovation is primarily focused on process engineering to enhance reaction yield, improve polymer uniformity, and precisely control the final molecular weight distribution and degree of cationic substitution. Techniques involving continuous flow chemistry and micro-reactor technology are being explored to achieve higher efficiency and repeatability, reducing energy consumption and waste generation during large-scale manufacturing operations.

Current technological efforts are also directed toward modifying the HEC backbone to create specialty grades of Polyquaternium-10 that offer unique functionalities. This includes developing lower-irritation grades suitable for sensitive skin formulations and grades optimized for enhanced biodegradability to address environmental concerns associated with synthetic polymers. Manufacturers are utilizing advanced analytical techniques, such as Gel Permeation Chromatography (GPC) and Nuclear Magnetic Resonance (NMR) spectroscopy, to accurately characterize the polymer structure and ensure batch-to-batch consistency, which is crucial for maintaining performance in highly sensitive cosmetic formulations.

Furthermore, technology related to formulation science significantly impacts the market. Research into combining Polyquaternium-10 with various surfactants, emulsifiers, and silicones aims to prevent complex coacervate formation, which can lead to product instability or haze. Encapsulation technologies are also being investigated to improve the targeted delivery and deposition of the polymer onto the hair shaft or skin epidermis, maximizing conditioning benefits while minimizing required concentration. These technological advancements ensure that Polyquaternium-10 remains a high-performance, cost-effective conditioning standard despite competitive pressures from newer, often more expensive, alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Polyquaternium-10 market, primarily due to robust manufacturing capabilities in China and India, coupled with massive consumer bases in these nations and sophisticated cosmetic markets in South Korea and Japan. Increased disposable income and a cultural emphasis on beauty and self-care drive high consumption of performance hair care products. Market growth is further stimulated by the proliferation of local cosmetic brands and the continuous establishment of international production facilities in the region.

- North America: North America represents a mature, high-value market characterized by early adoption of premium and specialized personal care formulations. The demand here is driven by high consumer spending, a strong focus on natural and sustainable ingredients, and stringent quality requirements. Polyquaternium-10 utilization is concentrated in high-performance hair repair, color protection, and anti-frizz product lines, where its superior conditioning ability justifies its inclusion.

- Europe: The European market is highly regulated, necessitating strict adherence to REACH and cosmetic directives. Growth is steady, primarily concentrated in Western European countries (Germany, France, UK), focusing on innovation in 'free-from' and environmentally conscious formulations. While there is pressure to use biodegradable alternatives, Polyquaternium-10 maintains market share due to its established efficacy, particularly in professional salon-grade products.

- Latin America (LATAM): LATAM exhibits significant potential, fueled by large populations, increasing urbanization, and a strong cultural affinity for hair care products. Brazil and Mexico are pivotal markets, showcasing a high frequency of hair washing and styling, directly translating to high demand for conditioning agents. The region’s growth trajectory is characterized by rising middle-class consumption and greater accessibility to international beauty brands.

- Middle East and Africa (MEA): The MEA market is rapidly emerging, supported by economic diversification and increasing Western influence on consumer habits. The unique climate conditions often necessitate specific hair and skin treatments, driving demand for moisturizing and static-control ingredients like Polyquaternium-10. Market development is concentrated in the Gulf Cooperation Council (GCC) countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyquaternium-10 Market.- Ashland

- Dow Chemical Company

- TRI-K Industries

- KCI

- Nouryon (formerly Akzo Nobel)

- SNF Group

- Sino Lion USA

- Guangzhou Tinci Materials Technology Co., Ltd.

- BASF SE

- Croda International Plc

- Kao Corporation

- Lubrizol Corporation

- Clariant AG

- Solvay SA

- Evonik Industries AG

- Guangzhou Sunway Chemical Co., Ltd.

- Spec-Chem Industry Inc.

- Shanghai Peakchem Corporation

- Hangzhou Bayee Chemical Co., Ltd.

- Shanghai Rich Chemicals Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Polyquaternium-10 market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Polyquaternium-10 in cosmetic formulations?

Polyquaternium-10 serves predominantly as a cationic conditioning polymer. Its strong positive charge enables it to neutralize the negative charges on damaged hair and skin surfaces, resulting in significantly improved wet and dry combability, reduced static electricity (anti-frizz), and enhanced overall hair texture and manageability.

How does the molecular weight of Polyquaternium-10 impact its performance?

Lower molecular weight grades of Polyquaternium-10 typically offer better clarity in formulations and deposit less build-up, favoring daily shampoos and light conditioners. Conversely, high molecular weight grades provide superior viscosity enhancement and intensive conditioning, making them ideal for deep conditioning masks and leave-in treatments where maximal deposition is desired.

What major regulatory factors affect the use and market growth of Polyquaternium-10?

The major factors include compliance with global chemical inventories and cosmetic safety regulations, particularly REACH in Europe and similar governmental bodies globally. Formulators must ensure the specific grade meets requirements regarding purity, impurity limits, and usage concentration as defined by local cosmetic regulators to maintain market access.

Which application segment drives the highest demand for Polyquaternium-10?

The hair care segment, specifically the formulation of shampoos and rinse-off conditioners, generates the highest volume demand for Polyquaternium-10. Its exceptional ability to mitigate the drying and stripping effects of surfactants while providing immediate detangling benefits makes it an essential ingredient in these mass-market products.

Is Polyquaternium-10 considered a sustainable or natural ingredient?

Polyquaternium-10 is derived from cellulose (a natural source), but it is chemically modified through quaternization, making it classified as a synthetic, bio-derived polymer. While research focuses on improving its biodegradability, it faces competitive pressure from fully natural alternatives derived from guar or other plant sources in the burgeoning clean beauty sector.

What are the key raw materials used in the synthesis of Polyquaternium-10?

The primary raw materials are highly purified cellulose (often from wood pulp or cotton linters), which is first converted into hydroxyethyl cellulose (HEC). This HEC is then reacted with quaternizing agents, typically derivatives of N, N-dimethyl aminoethyl chloride, to introduce the cationic sites necessary for its conditioning function.

How do competitive conditioning agents compare to Polyquaternium-10?

Polyquaternium-10 is often compared to Polyquaternium-7 and Guar Hydroxypropyltrimonium Chloride. Polyquaternium-10 generally offers a superior balance of conditioning, ease of use in clear formulations, and low irritation profile. Guar derivatives are favored for natural formulations but can sometimes offer less consistent conditioning depending on the formulation environment.

What role does the degree of cationic substitution play in polymer efficacy?

The degree of cationic substitution (nitrogen content) directly correlates with the polymer’s conditioning efficacy. A higher degree of substitution means a greater positive charge density, leading to stronger electrostatic attraction to the hair surface, resulting in better static control and deposition efficiency in rinse-off applications.

What is the significance of the shift toward leave-on formulations for Polyquaternium-10?

The shift towards leave-on products (e.g., serums, detangling sprays) is significant because these products allow the polymer to remain on the hair for extended periods, maximizing moisturizing, anti-frizz, and heat protection benefits. This trend demands grades of Polyquaternium-10 that are non-tacky and provide superior film formation without stiffness or residue.

How is geopolitical stability impacting the Polyquaternium-10 supply chain?

Geopolitical stability primarily affects the price and availability of key feedstocks, particularly the petroleum-derived reagents used in the quaternization process. Disruptions in global shipping routes or trade tariffs targeting major manufacturing regions (like China) can lead to volatility and increased inventory costs for downstream formulators globally.

What technological advancements are optimizing the manufacturing process for Polyquaternium-10?

Key technological advancements include the utilization of continuous processing techniques and advanced process control systems (APCS) to ensure highly uniform molecular weight distribution and consistent degree of substitution across batches. This optimizes yield, reduces side product formation, and enhances the economic viability of production at scale.

In which market segment is high molecular weight Polyquaternium-10 most prevalent?

High molecular weight Polyquaternium-10 is most prevalent in intensive conditioning treatments, hair masks, and products requiring significant viscosity modification, as these grades offer stronger film-forming properties and more substantial deposition, providing deeper, long-lasting conditioning effects.

How does the increasing trend of waterless beauty impact Polyquaternium-10 demand?

The waterless beauty trend creates a dual impact. While traditional liquid shampoos (high PQ-10 usage) might decline, the polymer remains crucial for solid formats (shampoo bars) where its conditioning properties must be delivered in a highly concentrated, anhydrous base, requiring specialized, often highly pure, grades.

What strategic role do chemical distributors play in the Polyquaternium-10 value chain?

Chemical distributors are crucial indirect channel partners, especially for small and medium-sized enterprises (SMEs). They manage inventory, provide logistical flexibility for small orders, offer technical formulation support, and bridge the gap between large manufacturers and diverse end-users across different geographical regions.

What are the key challenges faced by new entrants in the Polyquaternium-10 manufacturing market?

New entrants face significant challenges, including the high capital investment required for establishing efficient synthesis facilities, stringent quality control standards demanded by major cosmetic houses, and difficulties in competing with established players who possess proprietary technology and secure, low-cost raw material supply chains.

How does Polyquaternium-10 contribute to color retention in hair care?

Polyquaternium-10 contributes to color retention by conditioning the hair fiber, smoothing the cuticle, and forming a protective film. This action helps reduce the leakage of artificial color molecules during washing and minimizes the physical damage that causes color fading due to porosity increase.

What is the current perception of Polyquaternium-10 among clean beauty consumers?

While generally considered safe, Polyquaternium-10 sometimes faces negative scrutiny from 'clean beauty' advocates due to its synthetic modification and non-biodegradability profile compared to some natural polymers. However, its origin from cellulose gives it an edge over purely petroleum-derived synthetic ingredients, creating a nuanced perception.

Which region shows the highest growth rate for consumption of Polyquaternium-10?

The Asia Pacific region consistently exhibits the highest growth rate in consumption, driven by market expansion in populous countries like China and India, where rising disposable incomes fuel demand for quality, premium hair and skin care products.

What impact does Polyquaternium-10 have on skin care formulations?

In skin care, Polyquaternium-10 functions as a gentle conditioning agent, improving the tactile feel of cleansers and body washes, reducing the potential harshness of surfactants, and leaving a soft, non-tacky feel on the skin after rinsing, contributing to superior skin hydration.

How is AI specifically being utilized to enhance the formulation of Polyquaternium-10 containing products?

AI is used to run computational fluid dynamics and predictive modeling to anticipate how different grades of Polyquaternium-10 interact with complex surfactant and rheology modifier systems. This optimizes viscosity stability, deposition efficiency, and clarity, drastically cutting down physical laboratory testing time.

Why is the control of nitrogen content critical in Polyquaternium-10 manufacturing?

Nitrogen content directly corresponds to the degree of cationic substitution and charge density of the polymer. Precise control over this variable is critical because it dictates the level of conditioning performance and the potential for incompatibilities with other ingredients in the final cosmetic formulation.

What is the competitive threat posed by bio-based conditioning agents to Polyquaternium-10?

Bio-based agents, such as specialized cationic guar gums and certain proteins, pose a competitive threat, especially in markets favoring 'natural' labeling. However, Polyquaternium-10 generally offers more stable performance and greater flexibility in clear formulations, thus maintaining a strong position despite the sustainability shift.

How does raw material price volatility affect manufacturer margins?

Raw material price volatility, particularly concerning the precursors for HEC and the quaternizing agents, compresses the profit margins of Polyquaternium-10 manufacturers. Companies mitigate this by securing long-term supply contracts and implementing efficiency improvements in their synthesis processes.

What safety assessments govern the use of Polyquaternium-10 in consumer products?

Safety assessments are governed by bodies like the Cosmetic Ingredient Review (CIR) Expert Panel and similar agencies globally. Polyquaternium-10 is generally recognized as safe (GRAS) for use in cosmetics when formulated correctly, with assessments focusing on its non-irritant and non-sensitizing properties.

In which emerging regions is Polyquaternium-10 adoption accelerating most rapidly?

Adoption is accelerating most rapidly in Latin America, particularly Brazil and Mexico, and in specific parts of Southeast Asia, fueled by increasing consumer access to modern retail, greater brand variety, and a rising focus on hair care maintenance routines.

Describe the major difference between rinse-off and leave-on formulations regarding Polyquaternium-10 usage.

In rinse-off products (shampoos), Polyquaternium-10 must deposit quickly despite the short contact time. In leave-on products, the polymer must provide long-lasting sensory benefits without causing build-up, tackiness, or stiffness, often requiring lower concentrations of high-purity grades.

What strategic move are key players undertaking to secure a competitive advantage?

Key players are strategically focusing on backward integration to control the supply of cellulose derivatives, investing heavily in proprietary synthesis technologies to optimize grade performance, and establishing robust regulatory support teams to navigate complex global compliance requirements.

How is the packaging industry impacting the delivery and usage of Polyquaternium-10?

The packaging industry influences demand through the development of eco-friendly and concentrated product formats (like refill pouches or solid bars). This requires Polyquaternium-10 grades that maintain stability and functionality under highly concentrated or anhydrous conditions, aligning with sustainable packaging trends.

What specific benefit does Polyquaternium-10 offer to hair that has undergone chemical treatments?

For chemically treated (dyed, bleached, permed) hair, Polyquaternium-10 is vital because it targets and repairs the most damaged, negatively charged areas of the hair shaft. This process smooths the cuticle, restoring shine, sealing in moisture, and significantly reducing breakage and frizz caused by chemical stress.

How are environmental concerns regarding polymer biodegradability addressed by manufacturers?

Manufacturers are addressing biodegradability concerns by researching modifications to the polymer backbone to introduce cleavable linkages, thereby enhancing the polymer’s environmental fate without compromising its conditioning performance, though these advanced grades are typically more costly.

What is coacervate formation, and why is it important in Polyquaternium-10 formulations?

Coacervate formation is the creation of a dense, conditioning layer formed when the cationic polymer (PQ-10) interacts with anionic surfactants in shampoo. This layer effectively deposits the conditioning agent onto the hair shaft during rinsing, a crucial mechanism for performance in rinse-off applications; formulators must carefully control this interaction for optimal deposition.

How does the shift towards direct-to-consumer (DTC) brands affect Polyquaternium-10 sales?

DTC brands emphasize ingredient transparency and rapid product launch cycles. This pushes Polyquaternium-10 suppliers to provide excellent technical data, simplified product documentation, and flexible supply options tailored to the smaller batch sizes and fast turnaround times characteristic of the DTC model.

What are the limitations of using Polyquaternium-10 in ultra-natural cosmetic lines?

The primary limitations are its non-biodegradable status (in the traditional sense) and its chemical modification, which disqualifies it from certain "all-natural" or "100% organic" certification schemes, forcing formulators in this niche to seek alternative, fully plant-based conditioning solutions.

How do global economic slowdowns typically impact the Polyquaternium-10 market?

During economic slowdowns, while the mass-market consumption of basic hygiene products remains stable, consumers often trade down from premium, specialized hair treatments to more affordable alternatives. This can slow the growth of higher-priced, high-performance Polyquaternium-10 grades, shifting demand towards cost-effective standard grades.

Which end-use formulation segment, rinse-off or leave-on, is expected to show faster growth?

The leave-on segment (including serums, creams, and finishing sprays) is generally expected to show faster growth. This trend reflects increasing consumer focus on specialized daily hair protection, styling, and restorative treatments that necessitate a continuous conditioning effect.

What are the technical challenges in formulating Polyquaternium-10 into clear hair gels?

Formulating clear gels is challenging because Polyquaternium-10 can sometimes cause cloudiness or haze when interacting with certain gelling agents or salts. Achieving clarity requires using specific, high-purity grades and careful pH and solvent control to maintain the aesthetic integrity of the final product.

How important is intellectual property protection in the Polyquaternium-10 market?

Intellectual property is critical, primarily related to novel synthesis methods that yield unique molecular weight distributions or optimized degrees of substitution, providing superior performance or cost-efficiency that allows manufacturers to differentiate their specialized Polyquaternium-10 grades in a highly competitive market.

Why is the market for skin creams and lotions a secondary opportunity for Polyquaternium-10?

While primarily used in hair care, Polyquaternium-10 is valuable in skin care as it reduces the harsh feel of body washes and acts as a moisturizer film-former. It is a secondary opportunity because other established ingredients dominate high-volume moisturizing products, but its use is growing in specialized sensitive skin cleansers.

What differentiates industrial grade Polyquaternium-10 from cosmetic grade?

Cosmetic grade Polyquaternium-10 must adhere to extremely strict purity standards concerning heavy metals and microbial content, and must be validated for skin and eye safety. Industrial grades, used in applications like water treatment or textiles, typically have lower purity requirements and different performance metrics related to adhesion or flocculation.

How does the availability of high-purity cellulose feedstock influence market pricing?

Cellulose feedstock availability is a major cost factor. Tight supply or increased demand from other industries (like textiles or paper) can drive up HEC prices, consequently increasing the manufacturing cost and final market price of Polyquaternium-10, impacting the margins across the value chain.

What demographic shifts are boosting Polyquaternium-10 consumption in emerging markets?

Key demographic shifts include the growth of the urban middle class, increased female participation in the workforce, and greater access to media promoting professional beauty standards. These factors directly translate to higher per capita expenditure on specialized, high-quality hair maintenance products.

How is digital transformation impacting the marketing and sales of Polyquaternium-10?

Digital transformation enables manufacturers to utilize e-commerce platforms and digital specification sheets, making technical data and product samples more accessible to formulators globally. It also facilitates direct communication between technical support teams and end-users, accelerating the adoption cycle for new grades.

What are the technical benefits of combining Polyquaternium-10 with silicones?

Combining Polyquaternium-10 with silicones creates a synergistic effect where the polymer aids in the uniform deposition of the silicone oil onto the hair shaft. This enhances shine, softness, and conditioning far beyond what either ingredient can achieve alone, optimizing the final product performance.

How do seasonal variations affect the demand pattern for Polyquaternium-10?

Demand often peaks during summer months, especially in humid or dry climates, due to increased consumer need for anti-frizz and static control products (styling gels, intensive conditioners) that leverage the superior moisturizing and charge-neutralizing properties of Polyquaternium-10.

What is the role of certification bodies in validating the quality of Polyquaternium-10?

Certification bodies ensure compliance with Good Manufacturing Practices (GMP) and provide external validation of quality management systems. Certifications regarding ISO standards and specific regional cosmetic standards are crucial for building trust and securing long-term contracts with major cosmetic manufacturers.

Why is the low-irritation profile of certain Polyquaternium-10 grades increasingly important?

Low-irritation grades are increasingly important due to the rising consumer demand for products suitable for sensitive skin and scalps. Manufacturers are developing grades with lower residual impurities and optimized molecular structures to minimize irritation potential, making them suitable for baby care and sensitive dermatological formulations.

How are mergers and acquisitions influencing the competitive landscape?

M&A activities are leading to consolidation, allowing major players (like Ashland, Dow, BASF) to expand their portfolio, secure specialized proprietary technologies, and achieve greater economies of scale in production, raising the barrier to entry for smaller competitors.

What impact does the growth of personalized beauty have on Polyquaternium-10 usage?

Personalized beauty requires precise formulation adjustments based on individual needs. This translates to increased demand for suppliers offering a wide range of specific PQ-10 grades (varying molecular weights/charges) that can be algorithmically selected and incorporated into bespoke cosmetic solutions.

What are the key differences in formulation requirements between Asia Pacific and Western markets?

APAC markets often prioritize lightweight, non-greasy textures and high foam stability, while Western markets might focus more heavily on intensive repair, volume, and robust color protection. These differences necessitate slight variations in the chosen grade and concentration of Polyquaternium-10.

How does the shift towards sulfate-free shampoos affect Polyquaternium-10 performance?

Sulfate-free shampoos often use milder, non-anionic surfactants, which can sometimes reduce the efficiency of coacervate formation needed for deposition. Formulators must counteract this by using higher charge density Polyquaternium-10 grades or specific polymer blends to maintain comparable conditioning performance.

What technical considerations are crucial when selecting Polyquaternium-10 for hair styling products?

In styling products (gels, mousses), the polymer must provide sufficient holding power and film formation without imparting excessive tackiness or flaking upon drying. Low molecular weight grades that offer flexibility and clarity are often preferred over high-MW variants for this application.

Why is supply chain traceability becoming increasingly important for cosmetic buyers?

Traceability is critical due to growing consumer and regulatory pressure regarding ethical sourcing and ingredient safety. Cosmetic buyers require verified documentation proving the origin of raw materials (like cellulose) and confirming ethical and sustainable practices throughout the Polyquaternium-10 synthesis chain.

What is the primary barrier to entry for Polyquaternium-10 manufacturers in the European market?

The primary barrier is adherence to the European Union's comprehensive and rigorous REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations, which require extensive toxicological and environmental fate data for all chemical substances imported or manufactured within the EU.

How do changes in consumer hair washing frequency influence product consumption?

Increasing consumer tendencies towards daily or high-frequency hair

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager