Polysilazane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434584 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polysilazane Market Size

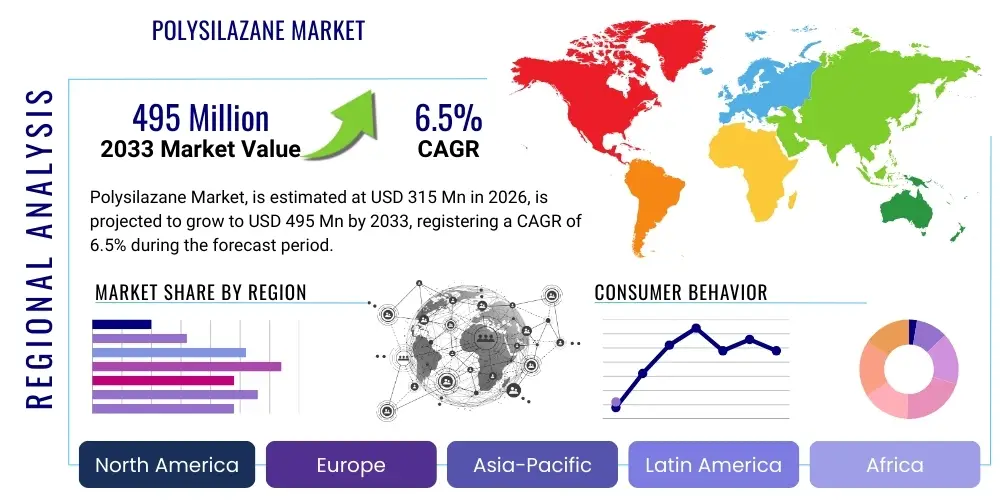

The Polysilazane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 315 Million in 2026 and is projected to reach USD 495 Million by the end of the forecast period in 2033.

Polysilazane Market introduction

Polysilazanes represent a specialized class of inorganic polymers characterized by repeating silicon and nitrogen atoms in their backbone structure. These advanced materials are highly valued for their exceptional thermal stability, chemical resistance, excellent barrier properties, and capacity to convert into high-performance ceramics (SiCN or SiN) upon pyrolysis. The unique properties inherent to the Si-N-Si bond enable Polysilazanes to serve as crucial precursors for ceramic matrix composites (CMCs) and as high-durability coatings, particularly in demanding industrial and aerospace environments. Market expansion is fundamentally driven by the increasing demand for lightweight, high-temperature resistant materials across critical end-use sectors, including specialized automotive coatings and robust electronic encapsulation.

The core application areas for Polysilazanes span protective coatings, where they offer superior anti-corrosion and scratch-resistant attributes, and as binders or matrices in high-performance materials. Their efficacy as ceramic precursors, especially through the liquid-phase processing of Polymer-Derived Ceramics (PDCs), is accelerating adoption in the aerospace and defense industries, where components must withstand extreme thermal and mechanical stresses. Furthermore, the development of modified polysilazanes, such as those incorporating organic functionalities, has broadened their applicability, allowing for room-temperature curing and integration into mainstream protective coating systems, thereby significantly expanding their commercial footprint beyond niche high-end applications.

Key driving factors propelling the Polysilazane market include stringent regulations mandating improved energy efficiency and component longevity in vehicles and aircraft, necessitating materials that can operate reliably under harsh conditions. The rising sophistication of electronic devices also requires better protective barriers against moisture and contaminants, a requirement effectively met by polysilazane-based thin films. Technological advancements in synthesis methods, aimed at reducing production costs and improving consistency, are further lowering adoption barriers and fueling market growth across Asia Pacific, North America, and Europe.

Polysilazane Market Executive Summary

The global Polysilazane market is witnessing robust growth, primarily fueled by technological maturation in Polymer-Derived Ceramics (PDCs) and intensified demand for high-performance coatings in the automotive and aerospace sectors. Business trends indicate a strong focus on strategic partnerships between polysilazane manufacturers and application specialists to develop customized formulations tailored for specific end-use requirements, such as enhanced flexibility or UV stability in coatings. Furthermore, market players are heavily investing in capacity expansion and research focused on sustainable, lower-toxicity synthesis routes to align with global environmental mandates. The shift towards lightweighting in transportation continues to be a primary commercial driver, cementing polysilazanes’ role as indispensable materials for future mobility solutions and specialized defense applications.

Segment trends reveal that the Coatings application segment holds the dominant market share, attributed to the widespread adoption of Perhydropolysilazane (PHPS) and Modified Polysilazane (MPS) systems offering unparalleled durability and resistance to harsh environmental factors. Within the product type segmentation, Modified Polysilazane is projected to exhibit the fastest CAGR, driven by its versatility and applicability in room-temperature curing systems, which streamlines industrial application processes. The Automotive and Aerospace & Defense end-user segments collectively account for a significant portion of the demand, necessitated by the need for superior thermal insulation, abrasion resistance, and extended operational lifecycles of critical components.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to rapid industrialization, burgeoning automotive manufacturing hubs, and increasing investment in advanced materials research in countries like China, Japan, and South Korea. North America and Europe, characterized by mature aerospace and defense industries and stringent regulatory frameworks regarding material performance and safety, maintain significant market shares, focusing particularly on high-value applications such as ceramic matrix composites (CMCs) for jet engines and advanced protective systems for complex machinery. The market dynamic is generally favorable, underpinned by sustained innovation in material science and expanding commercial realization of polysilazane technology beyond laboratory scale.

AI Impact Analysis on Polysilazane Market

Users frequently inquire about how artificial intelligence (AI) can accelerate the discovery of novel polysilazane compositions, reduce manufacturing variability, and optimize application methods such as curing profiles and film thickness uniformity. Key concerns often revolve around whether AI can effectively model the complex pyrolysis conversion process of polysilazanes into ceramics, predict material failure under extreme conditions, and streamline the regulatory approval process for new formulations. The overarching expectation is that AI will minimize the intensive, time-consuming experimental cycles traditionally required in polymer chemistry, leading to faster commercialization and performance improvements, thereby addressing the high cost and complexity associated with producing and utilizing these advanced materials.

AI’s influence is anticipated to revolutionize the R&D pipeline for polysilazanes, moving material science towards a data-driven paradigm. Machine learning algorithms are now being deployed to analyze vast datasets relating to precursor synthesis parameters, formulation components, and resulting material performance characteristics (e.g., thermal stability, viscosity, conversion yield). This analytical capability allows researchers to predict the properties of untested formulations with higher accuracy, accelerating the identification of optimal molecular structures for specific applications, such as high-k dielectrics or ultra-hard coatings, substantially reducing the reliance on traditional trial-and-error experimentation and decreasing time-to-market for innovative products.

In manufacturing and quality control, AI systems are integrating with process monitoring equipment to ensure real-time optimization of polysilazane synthesis, polymerization, and purification processes. Computer vision and predictive maintenance models are being used to monitor reactor conditions, detect impurities, and predict equipment failure, thereby enhancing product consistency and maximizing operational uptime. Furthermore, in the application phase, AI can optimize spray coating patterns, analyze curing kinetics via sensor data, and ensure defect detection in coatings or composite preforms, ensuring that the high value of polysilazane materials is fully realized through flawless end-product integration and performance predictability.

- AI-driven simulation and modeling accelerates the discovery of new polysilazane compositions and optimal molecular weight distributions.

- Machine learning optimizes industrial synthesis parameters, improving batch consistency and reducing production costs.

- Predictive analytics enhances quality control by monitoring purity levels and detecting process anomalies in real-time during manufacturing.

- AI models simulate the complex conversion kinetics during pyrolysis for Polymer-Derived Ceramics (PDCs), optimizing final ceramic properties.

- Advanced image processing algorithms detect minute flaws and inconsistencies in applied polysilazane coatings, improving quality assurance.

- Natural Language Processing (NLP) assists in synthesizing global research literature, accelerating innovation scouting and competitive intelligence.

DRO & Impact Forces Of Polysilazane Market

The Polysilazane market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define its trajectory and impact forces. The primary drivers include the stringent performance requirements in specialized industries, necessitating materials with superior thermal, oxidative, and mechanical resistance far exceeding conventional organic polymers. Specifically, the expanding use of CMCs in hot sections of gas turbines and the demand for permanent, maintenance-free protective coatings on infrastructure and vehicles provide sustained market impetus. Technological improvements that lead to easier application, such as solvent-free or water-based formulations, are also positively impacting adoption rates across diverse industrial user bases, making polysilazanes increasingly competitive against traditional high-performance materials like epoxies or polyurethanes.

However, significant restraints temper the market's growth potential. The high initial cost of polysilazane precursors, resulting from complex, multi-step synthesis procedures and specialized handling requirements, remains a major barrier, particularly for price-sensitive bulk applications. Furthermore, challenges related to scalability and consistency in high-volume production, coupled with the necessity for highly controlled environments for some polymerization and curing processes, limit wider commercial adoption. The toxicity concerns associated with certain organo-functionalized polysilazane precursors and regulatory scrutiny over solvent usage in formulations necessitate continuous R&D investment to develop safer, environmentally benign alternatives, adding to operational complexity.

Opportunities for market expansion are substantial, particularly in the emerging fields of solid-state batteries, where polysilazanes can function as protective separators or binders, leveraging their high ionic conductivity and stability. The development of specialized hybrid polysilazane systems, combining the benefits of organic flexibility and inorganic hardness, opens new avenues in flexible electronics and advanced packaging solutions. Furthermore, increasing investment in infrastructure rehabilitation globally presents a long-term opportunity for polysilazane coatings to be used for durable, anti-graffiti, and corrosion-resistant treatments for bridges, pipelines, and public transport infrastructure, ensuring the market's enduring relevance in advanced materials science.

Segmentation Analysis

The Polysilazane market is critically segmented based on product type, application, and end-user industry, enabling precise market analysis tailored to specific material requirements and industry utilization patterns. Product segmentation primarily differentiates between Perhydropolysilazane (PHPS) and Modified Polysilazane (MPS), reflecting variations in molecular structure, handling characteristics, and ultimate performance attributes. PHPS, known for converting to near-pure silica or SiN ceramics, dominates high-temperature applications, whereas MPS offers flexibility in formulation (e.g., organic modifications) to achieve room-temperature curing and improved adhesion for general protective coatings. This distinction is crucial as it dictates the suitability of the material for demanding aerospace use versus broad industrial coating needs.

Application segmentation highlights the primary commercial outlets, with Coatings commanding the largest share due to widespread use in anti-corrosion and scratch-resistant finishes for automotive and marine sectors. The Ceramic Matrix Composites (CMCs) segment is highly specialized but drives significant value, particularly in the aerospace and defense sectors, utilizing polysilazanes as preceramic binders for fabricating lightweight, ultra-high-temperature resistant components. The Binders/Adhesives and Electronics segments represent specialized, high-growth niche markets, where the material’s unique dielectric and barrier properties are exploited for advanced component manufacturing and encapsulation.

End-user segmentation clearly defines the ultimate consumers of polysilazane-based solutions. The Automotive industry is the largest consumer, driven by external protective coatings and internal engine component protection. Aerospace & Defense utilizes these materials extensively for CMCs and thermal barrier coatings. The Electronics sector leverages polysilazanes for hermetic sealing, passivation layers, and dielectric applications in advanced semiconductor manufacturing. The Construction and Industrial sectors utilize them for high-durability infrastructure protection and specialized industrial equipment coatings, demonstrating the broad cross-industry utility of these high-performance inorganic polymers.

- By Type:

- Perhydropolysilazane (PHPS)

- Modified Polysilazane (MPS)

- By Application:

- Coatings (e.g., Anti-corrosion, Scratch-resistant)

- Ceramic Matrix Composites (CMCs)

- Binders and Adhesives

- Electronics (Dielectrics, Encapsulation)

- Others (e.g., Fibers, Membranes)

- By End-User:

- Automotive

- Aerospace and Defense

- Electronics and Semiconductor

- Construction and Infrastructure

- Industrial Manufacturing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Polysilazane Market

The Polysilazane market value chain begins with the sourcing of specialized raw materials, primarily organosilanes and ammonia or amines, which constitute the upstream activities. Key suppliers focus on ensuring the high purity and consistency of these precursors, as slight variations can drastically affect the polymerization yield and the final material properties. The subsequent synthesis phase, involving complex ammonolysis or dehydrogenative coupling reactions, is the most crucial step, characterized by high intellectual property barriers and specialized chemical engineering expertise. This manufacturing stage converts basic silane precursors into linear or branched polysilazane polymers, tailored for specific applications, representing the highest value-addition point in the chain due to the technological complexity involved.

Moving downstream, the synthesized base polymers are formulated into marketable products such as liquid coatings, preceramic polymers for infiltration, or binders. This formulation step involves incorporating catalysts, solvents, stabilizers, and functional additives to optimize viscosity, cure time, adhesion, and shelf life, transforming the raw polymer into an application-ready product. Direct distribution channels are often preferred for highly specialized applications like aerospace CMCs, where direct technical support and quality assurance traceability are paramount. However, for broader coating applications targeting automotive and industrial maintenance, manufacturers increasingly utilize indirect channels, including specialized chemical distributors and professional coating applicators, who provide regional inventory and local technical services to end-users.

The distribution network plays a critical role in delivering the formulated product to the end-user. Due to the sensitivity of some polysilazane products (e.g., reactivity to moisture/air), transportation and storage often require specialized, moisture-free conditions, adding logistical complexity and cost. Direct sales teams handle large B2B relationships with major end-users (like OEMs in aerospace), providing tailored technical solutions. Indirect channels, consisting of authorized regional distributors and integrators, are vital for servicing smaller enterprises and for market penetration into geographically diverse industrial segments. The efficiency of this downstream logistics network significantly impacts the overall adoption rate and accessibility of polysilazane technology across global markets, demanding robust inventory management and specialized chemical handling procedures.

Polysilazane Market Potential Customers

Potential customers for polysilazane products are concentrated in industries requiring materials capable of surviving extreme thermal, chemical, and mechanical stress environments. The Automotive sector represents a critical customer base, utilizing polysilazanes extensively for high-durability clear coats that protect vehicle paint from environmental damage, chemical etching, and micro-scratches. Furthermore, high-temperature formulations are increasingly employed for protecting engine components, exhaust systems, and brake parts, where they provide thermal insulation and corrosion resistance, contributing to extended component lifetime and improved vehicle performance efficiency. Automotive OEMs and aftermarket detailing/coating service providers are central buyers, seeking materials that offer certified longevity and superior aesthetic retention.

The Aerospace and Defense industry constitutes a highly lucrative, albeit demanding, customer segment. Key buyers include manufacturers of gas turbines, rocket components, and military aircraft, where Polysilazanes are indispensable as precursors for high-strength, lightweight Ceramic Matrix Composites (CMCs) used in hot sections of jet engines and specialized thermal protection systems. These customers prioritize thermal stability, reliability, and specific material certifications (e.g., military standards). The necessity for lighter materials that maintain strength at extreme operational temperatures drives persistent demand and justifies the high cost associated with these advanced polymer-derived ceramic solutions, making defense contractors and commercial aircraft engine manufacturers essential clients.

Beyond transportation, the Electronics and Semiconductor industry represents a growing customer segment, utilizing polysilazanes for crucial dielectric layers, hermetic sealing, and protective passivation films on delicate circuitry. Customers such as semiconductor fabrication plants (fabs) and advanced electronics manufacturers require materials that offer exceptional barrier properties against moisture and oxygen, high dielectric strength, and uniformity in ultra-thin film deposition. The unique capability of polysilazanes to cure into dense, stable inorganic layers at relatively low temperatures makes them ideal for sensitive electronic component processing, positioning companies involved in advanced memory, displays, and high-frequency communication devices as key purchasers looking for next-generation material solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 315 Million |

| Market Forecast in 2033 | USD 495 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Clariant AG, AzkoNobel N.V., Advanced Chemical Technologies, Semichem Co., Ltd., Wacker Chemie AG, BASF SE, Shin-Etsu Chemical Co., Ltd., KiON Specialty Polymers, Inc., KCC Corporation, Evonik Industries AG, Momentive Performance Materials Inc., Gelest Inc., Dow Inc., Nippon Shikizai, The 3M Company, FUSO CHEMICAL CO., LTD., Hexcel Corporation, Toray Industries, Inc., Mitsubishi Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polysilazane Market Key Technology Landscape

The technology landscape for the Polysilazane market is centered on optimizing synthesis routes, improving material processability, and developing advanced curing mechanisms to suit diverse application methods. Historically, the synthesis of polysilazanes relied heavily on ammonolysis of chlorosilanes, which is effective but often yields a high-purity product (PHPS) that is extremely moisture-sensitive, requiring specialized handling. Contemporary technological advancements are focusing on dehydrogenative coupling and dehydrocoupling polymerization techniques, which offer better control over molecular weight, branching, and functionalization. This control is crucial for tailoring the polymer’s viscosity and thermal behavior, prerequisites for advanced applications like Resin Transfer Molding (RTM) in CMC fabrication or ultra-thin film deposition in electronics.

A significant area of technological focus is the modification of the base polymer structure to create Modified Polysilazanes (MPS). These modifications often involve incorporating organic groups (organo-polysilazanes) to reduce reactivity to ambient moisture, improve adhesion to organic substrates, and facilitate room-temperature curing (RT-curing). The shift from high-temperature thermal curing to UV-curing or ambient moisture-curing technologies is critical for expanding polysilazanes into commercial coating sectors, as it significantly lowers the energy requirements and capital investment for end-users. These innovations address key restraints related to application complexity and cost, making the material competitive against traditional two-component coating systems in high-volume industrial settings.

In application technologies, the landscape is evolving toward precision deposition methods. For the electronics industry, chemical vapor deposition (CVD) techniques utilizing volatile polysilazane precursors are being perfected to create highly uniform, dense dielectric or passivation layers at the nanoscale. Conversely, for large-area coating applications in automotive and construction, advancements in spray technology and self-leveling formulations ensure optimal film thickness uniformity and minimal surface defects. Furthermore, in the realm of ceramic conversion, researchers are continually refining the Pyrolysis, Infiltration, and Pyrolysis (PIP) process for CMCs, focusing on maximizing ceramic yield and reducing shrinkage and crack formation during the high-temperature conversion of the liquid polysilazane precursor into a robust ceramic matrix.

Regional Highlights

The global Polysilazane market exhibits distinct regional dynamics driven by local industrial concentration, regulatory frameworks, and technological adoption rates. Asia Pacific (APAC) currently dominates the market in terms of volume and is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This aggressive growth is underpinned by the region’s massive manufacturing base, particularly in China and South Korea, which are leading global producers of automotive components, electronics, and specialty chemicals. Rapid urbanization and the resultant demand for durable infrastructure coatings, alongside significant governmental investment in advanced materials research, solidify APAC's position as the primary engine for polysilazane demand expansion.

North America maintains a strong leadership position in terms of value, primarily due to the established and highly demanding Aerospace and Defense industry located predominantly in the United States. Key demand drivers include the ongoing military and commercial aircraft modernization programs that necessitate high volumes of Ceramic Matrix Composites (CMCs) for engine hot sections. Furthermore, stringent environmental and safety regulations imposed by bodies like the EPA drive the adoption of high-performance, long-lasting protective coatings for oil and gas infrastructure and complex industrial machinery, where polysilazane formulations provide certified, extended asset protection against corrosion and wear.

Europe represents a mature market characterized by a robust, innovation-focused automotive sector, particularly in Germany and Italy, which demands premium protective coatings for both OEM finishes and high-end aftermarket detailing. Additionally, European research institutions are heavily involved in advanced material development, often focusing on low-solvent or water-based polysilazane formulations to comply with strict EU chemical regulations (REACH). This regulatory pressure, combined with sustained demand from the region's strong industrial manufacturing base for durable, thermally resistant components, ensures stable, high-value demand for both pure and modified polysilazane systems across the continent.

- Asia Pacific (APAC): Fastest growing region; driven by mass production in automotive and electronics sectors in China, Japan, and South Korea; large investments in industrial infrastructure and specialized coatings.

- North America: Market leader in value; dominated by demand from the Aerospace and Defense industry for CMCs and high-temperature material applications; stringent performance requirements in oil & gas exploration.

- Europe: Mature market with stable, high-value growth; significant adoption in premium automotive coatings and compliance-driven development of environmentally friendly polysilazane formulations.

- Latin America (LATAM): Emerging market primarily driven by infrastructure projects and automotive manufacturing growth in Brazil and Mexico; increasing need for anti-corrosion solutions in harsh environments.

- Middle East & Africa (MEA): Growing demand focused on the energy sector (pipelines, refineries) for specialized anti-corrosion and high-temperature coatings, particularly in Saudi Arabia and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polysilazane Market.- Merck KGaA

- Wacker Chemie AG

- Clariant AG

- Shin-Etsu Chemical Co., Ltd.

- Advanced Chemical Technologies

- KiON Specialty Polymers, Inc.

- Semichem Co., Ltd.

- KCC Corporation

- AzkoNobel N.V.

- Evonik Industries AG

- Momentive Performance Materials Inc.

- Gelest Inc.

- BASF SE

- Dow Inc.

- Nippon Shikizai

- The 3M Company

- FUSO CHEMICAL CO., LTD.

- Hexcel Corporation

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Polysilazane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Polysilazane primarily used for in the industrial sector?

Polysilazane is primarily used as a precursor for ultra-high-performance ceramic materials (SiCN, SiN) and as a crucial component in advanced protective coatings, offering superior resistance to abrasion, corrosion, heat, and chemicals in the automotive, aerospace, and industrial manufacturing sectors.

How is the Polysilazane market segmented by product type?

The market is broadly segmented into Perhydropolysilazane (PHPS), characterized by its high purity and suitability for extreme thermal applications, and Modified Polysilazane (MPS), which includes organic functionalities for improved room-temperature curing, flexibility, and compatibility with various substrates.

What are the main drivers accelerating the adoption of Polysilazane materials?

Key drivers include the global trend toward lightweighting in transportation, the necessity for Ceramic Matrix Composites (CMCs) in high-temperature aerospace components, and sustained demand for extremely durable, long-life protective coatings on infrastructure and vehicles.

Why is the high cost of Polysilazane considered a market restraint?

The high cost stems from the complex, multi-step chemical synthesis processes required to achieve the desired purity and molecular structure, coupled with the specialized handling necessary for moisture-sensitive precursors, which limits its adoption in highly price-sensitive bulk applications.

Which geographic region is expected to show the fastest growth in the Polysilazane market?

The Asia Pacific (APAC) region is projected to experience the fastest growth due to rapid industrial expansion, high-volume production in the automotive and electronics industries, and increasing investment in advanced materials across key economic hubs like China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager