Polytene Casting Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431369 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Polytene Casting Film Market Size

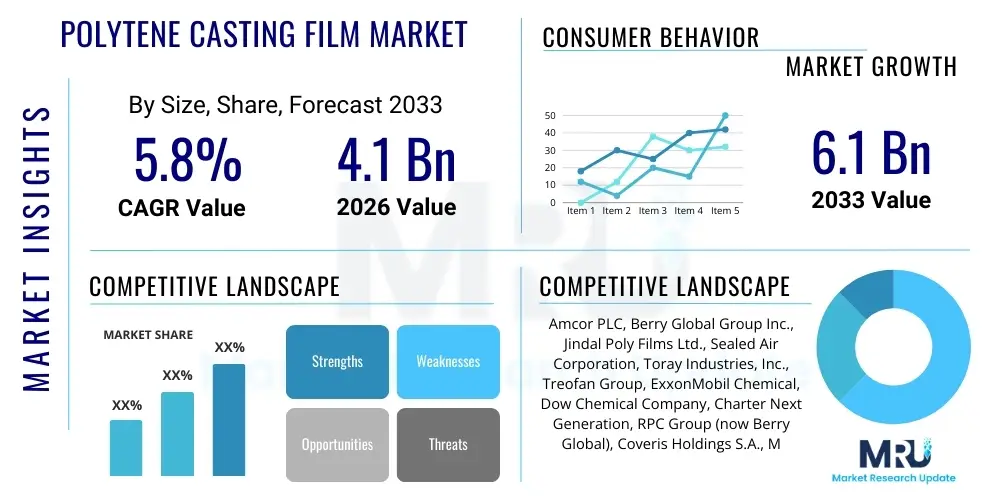

The Polytene Casting Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Polytene Casting Film Market introduction

Polytene casting film, often referred to simply as cast polyethylene (PE) film, is a high-performance polymeric material produced through the casting extrusion process. This manufacturing method involves melting polyolefin resins, primarily various grades of polyethylene (such as LDPE, LLDPE, and HDPE), and extruding them through a flat die onto a chilled roller, which rapidly cools the molten polymer into a thin, highly transparent, and uniform film. The distinctive characteristics of cast films, including superior tear resistance, high gloss, excellent clarity, and controlled thickness variability, make them indispensable across a wide spectrum of industrial and consumer applications. These films possess enhanced mechanical properties compared to blown films, offering high stiffness and better heat sealing characteristics, which are critical for high-speed automated packaging lines. The versatility in material formulation allows manufacturers to tailor barrier properties, slip characteristics, and anti-static features to meet specific end-user requirements, particularly in demanding sectors like food packaging and hygiene products.

The primary applications of polytene casting films are concentrated in the flexible packaging industry, where they are utilized for stretch wrap, industrial liners, lidding films, and multilayer laminations requiring strong barrier and sealing attributes. Furthermore, their application extends significantly into the medical and hygiene sector, including back sheets for diapers and sanitary napkins, and sterile packaging for medical devices due to their clean processing and purity. The core benefits derived from using polytene casting films include high throughput manufacturing efficiency, superior optical clarity crucial for branding and product visibility, and excellent dimensional stability under various temperature conditions. These attributes facilitate their use in sophisticated converting processes such as printing and metallization, increasing the overall aesthetic and functional value of the final packaged product. The inherent flexibility and low-cost nature of polyethylene polymers further solidify their dominant position in the materials market, driving continuous adoption across emerging economies that prioritize cost-effective packaging solutions.

Driving factors underpinning the sustained growth of the Polytene Casting Film Market include the rapidly expanding demand for flexible packaging solutions as alternatives to rigid containers, driven by convenience, reduced material usage, and lower transportation costs. The global shift toward e-commerce and smaller household sizes necessitates high-barrier, durable, and aesthetically pleasing packaging formats, precisely where cast films excel. Technological advancements in co-extrusion capabilities, allowing for the creation of multi-layer films with tailored performance characteristics—such as incorporating EVOH for enhanced oxygen barrier or specialty sealants—are significantly expanding the addressable market. Regulatory impetus promoting lightweight and recyclable packaging materials also favors polytene films, provided they align with circular economy initiatives, pushing manufacturers toward incorporating post-consumer recycled (PCR) content and developing mono-material structures that simplify the recycling process. This confluence of consumer preference, manufacturing efficiency, and regulatory compliance ensures a robust growth trajectory for the market.

Polytene Casting Film Market Executive Summary

The Polytene Casting Film Market is characterized by intense technological competition centered on enhancing film performance characteristics, particularly related to sustainability and advanced barrier functions. Business trends indicate a strong move towards vertical integration, where resin producers are increasingly investing in film conversion capabilities to secure supply chains and capitalize on higher-margin specialty film production. Key market participants are focusing their R&D efforts on developing high-performance cast films utilizing metallocene polyethylene (mPE) and other specialty copolymers, which offer superior tensile strength and puncture resistance with reduced film thickness. Furthermore, strategic mergers and acquisitions are prevalent, driven by the need to expand geographic footprint, acquire proprietary co-extrusion technology, and consolidate market share in highly fragmented regional segments. The optimization of manufacturing processes through Industry 4.0 principles, including predictive maintenance and real-time quality control, represents a crucial business strategy aimed at minimizing waste and maximizing energy efficiency, which is paramount given rising utility costs.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, fueled by massive population growth, escalating urbanization, and the corresponding surge in the consumption of packaged food and personal care products, particularly in India, China, and Southeast Asian nations. North America and Europe, while mature markets, are leading the innovation curve, particularly regarding sustainability mandates. European companies are heavily invested in developing circular economy solutions, including films designed for chemical recycling and films with high PCR content, responding directly to stringent EU directives. Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth hubs, driven by increasing foreign direct investment in manufacturing infrastructure and the gradual replacement of traditional, less efficient packaging formats with modern, flexible cast film solutions. Infrastructure development, coupled with localized demand for specialty agricultural films and construction barriers, provides diverse avenues for regional market penetration.

Segmentation trends highlight the increasing demand for high-barrier cast films (often used in conjunction with other barrier layers) within the food and beverage packaging segment, crucial for extending shelf life and reducing food waste. This trend is closely followed by the booming hygiene segment, where cast films act as non-woven back sheets, requiring specific breathability and liquid management characteristics. By material type, Linear Low-Density Polyethylene (LLDPE) remains the primary segment due to its exceptional stretch and puncture resistance, making it ideal for stretch wrap and heavy-duty bags. However, Metallocene Polyethylene (mPE) films are gaining traction rapidly, especially in high-end applications, owing to their superior strength-to-thickness ratio, allowing for source reduction and further material efficiency. Manufacturers are increasingly segmenting their offerings based on functionality, moving away from commodity films towards specialized, tailored solutions for niche markets such as medical sterilization wrap and advanced protective laminations, which command premium pricing and higher margins.

AI Impact Analysis on Polytene Casting Film Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Polytene Casting Film Market generally revolve around enhancing operational efficiency, improving product quality consistency, and accelerating material innovation cycles. Users frequently ask how AI can optimize the complex parameters of the cast film extrusion process—such as temperature profiling, cooling roll speed, and melt pressure—to achieve perfect film thickness uniformity and minimize defects like gels or fish eyes. A significant concern is the ability of machine learning models to accurately predict equipment failure (predictive maintenance) for high-value assets like extruders and winders, thus reducing costly downtime. Furthermore, there is considerable interest in AI’s capability to analyze vast material databases and simulation results to fast-track the development of new polymer blends, especially those incorporating bio-based or recycled content, without compromising the functional integrity required for demanding applications like high-barrier food packaging. The core expectation is that AI integration will translate directly into higher yield, reduced material consumption, and a significant competitive advantage through superior process control.

The immediate impact of AI is most visible in quality assurance and process optimization. AI-driven vision systems are increasingly deployed post-extrusion to scan the film surface in real-time at high line speeds, identifying and classifying micro-defects with precision far exceeding human capability. These systems not only detect defects but also correlate them with specific upstream processing variables, enabling immediate, automated adjustments to the extrusion line. This closed-loop control mechanism drastically reduces scrap rates and ensures product specifications are met consistently, which is critical for specialty films where dimensional tolerance is extremely tight. By modeling the relationship between resin input characteristics (e.g., Melt Flow Index, density) and output film properties (e.g., tensile strength, clarity), AI algorithms help production managers select the optimal feedstock blends, maximizing the utilization of less expensive or recycled materials while maintaining required performance levels. This smart material handling is crucial for improving cost competitiveness.

Looking forward, AI’s influence will expand into strategic areas such as supply chain resilience and demand forecasting. Machine learning models can analyze complex market variables, including commodity resin price fluctuations, geopolitical risks, and seasonal shifts in end-user consumption (e.g., peak holiday packaging demand), to generate highly accurate forecasts. This capability allows film manufacturers to optimize inventory levels of raw materials and finished goods, mitigating the risks associated with volatile polymer pricing and logistical bottlenecks. For researchers, Generative AI tools are starting to assist in the molecular design of novel polyolefins and additives, rapidly screening millions of potential formulations in a virtual environment. This dramatically shortens the R&D timeline for next-generation cast films that require advanced properties like enhanced oxygen scavenging or specialized release characteristics, marking a paradigm shift from traditional, slow empirical testing methods towards data-driven innovation in polymer science.

- AI-driven real-time quality control enhances film uniformity and defect detection.

- Predictive maintenance minimizes operational downtime and extends equipment lifespan.

- Machine Learning optimizes extrusion parameters (temperature, pressure) for energy savings.

- AI accelerates R&D for sustainable and advanced polymer blend formulation.

- Enhanced supply chain forecasting reduces inventory costs and mitigates resin price volatility.

DRO & Impact Forces Of Polytene Casting Film Market

The dynamic equilibrium of the Polytene Casting Film Market is governed by powerful Drivers, inherent Restraints, strategic Opportunities, which collectively determine the overall Impact Forces shaping the industry's trajectory. Key drivers include the exponential growth in the flexible packaging sector, particularly the rapid expansion of the food and beverage industry globally, necessitating high-performance, cost-effective barrier films. Coupled with this is the continuous trend of film down-gauging, enabled by technological advancements in resins like mPE, allowing manufacturers to achieve required mechanical strength with less material, aligning with sustainability goals and reducing per-unit cost. The rising adoption of e-commerce also fuels demand for protective secondary packaging, often utilizing cast stretch films. However, restraints such as the volatility of crude oil prices, which directly impact polyethylene resin costs, introduce significant uncertainty and margin pressure for film converters. Furthermore, stringent regulatory scrutiny concerning plastic waste and the resulting pushback against single-use plastics in developed economies pose a significant challenge, requiring substantial investment in infrastructure for circular material streams.

Opportunities for market expansion are fundamentally linked to innovation in sustainable solutions and penetration into niche, high-value applications. The urgent need for recyclable packaging structures creates immense opportunity for developing monomaterial (all-polyethylene) laminates using cast film components, effectively replacing non-recyclable multi-material constructions. The integration of bio-based polyethylene (Bio-PE) offers a pathway to reduce the carbon footprint, attracting environmentally conscious brand owners. Moreover, the medical and pharmaceutical packaging sectors present a highly lucrative opportunity, demanding specialty films with superior sterilization compatibility (e.g., gamma irradiation resistance) and meticulous cleanroom standards. The emergence of sophisticated co-extrusion technologies allows for the simultaneous processing of up to 11 or more layers, enabling manufacturers to integrate highly functional additives and barrier resins seamlessly, thereby commanding premium pricing and expanding product diversification beyond commoditized offerings.

The collective Impact Force is predominantly positive and growth-oriented, driven by the indispensable nature of polytene films in modern commerce and the strong momentum towards technical substitution. While the negative force of environmental regulation exerts pressure, it simultaneously forces innovation towards higher-value, sustainable solutions, which ultimately contributes to market maturity and technological advancement. The necessity for advanced barrier properties to reduce global food waste provides a strong, inelastic driver for specialty cast films. The primary challenge remains the delicate balance between maintaining cost competitiveness, which favors commodity film production in APAC, and investing heavily in next-generation, sustainable film technology required by Western markets. Companies that successfully navigate resin price volatility through smart procurement and leverage advanced co-extrusion to offer tailored, sustainable solutions will capture disproportionate market share, solidifying the market’s ongoing transition towards specialization and value-added product lines.

Segmentation Analysis

The Polytene Casting Film Market is comprehensively segmented based on material type, film structure, application area, and end-use industry, reflecting the diverse functional requirements of global consumers. This detailed segmentation is crucial for understanding specific growth pockets and technological preferences. The material segmentation primarily focuses on the type of polyethylene used, encompassing Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), and specialty polymers like Metallocene Polyethylene (mPE). LLDPE dominates due to its superior toughness and stretch characteristics, essential for pallet wrap and industrial packaging. Application segmentation focuses on differentiating between major uses such as stretch films, lidding films, hygienic back sheets, and release liners, each requiring unique process parameters and formulation characteristics to meet performance specifications.

A key axis of segmentation is the end-use industry, which includes Food & Beverage, Hygiene & Personal Care, Medical & Pharmaceutical, Agriculture, and Industrial Packaging. The Food & Beverage sector, driven by increasing packaged food consumption and the need for extended shelf life, accounts for the largest market share, requiring films with excellent optical properties and customizable barrier capabilities. The Hygiene sector is rapidly growing, demanding highly specialized, often breathable, cast films for back sheets in disposable products. Furthermore, the segmentation by film structure, distinguishing between mono-layer, three-layer, five-layer, and multi-layer (seven or nine-layer) films, provides insight into the technological complexity and value-added nature of the product. Advanced multi-layer films, created via co-extrusion, enable the integration of diverse functional layers, such as sealants, tie layers, and barrier resins, to achieve complex performance profiles.

Analyzing these segments reveals critical market dynamics. The shift towards thinner gauge films across all application areas underscores the impact of mPE resins, which allow for source reduction without compromising strength. The highest growth rate is anticipated in the multi-layer film segment, particularly those designed for high-barrier food packaging, driven by the global imperative to reduce food spoilage. Geographically, while volume production remains centralized in Asia Pacific, the demand for specialty, high-specification medical and pharmaceutical grade cast films is strongest in North America and Western Europe, commanding premium pricing. Strategic market participants focus on vertical integration, controlling both resin production and conversion, to optimize cost structures and maintain quality consistency across these diverse, highly regulated segments.

- By Material Type:

- Linear Low-Density Polyethylene (LLDPE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Metallocene Polyethylene (mPE)

- Blends and Copolymers

- By Film Structure:

- Mono-layer Films

- Co-extruded Films (3-layer, 5-layer, 7-layer, 9-layer and above)

- By Application:

- Stretch Film/Pallet Wrap

- Lidding Film

- Hygiene Back Sheets

- Medical & Pharmaceutical Packaging Films

- Release Liners

- Industrial Liners and Bags

- By End-Use Industry:

- Food & Beverage (Meat, Dairy, Fresh Produce, Snacks)

- Hygiene & Personal Care (Diapers, Sanitary Products)

- Medical & Pharmaceutical (Sterile Packaging, Device Wrap)

- Industrial & Consumer Goods

- Agriculture (Greenhouse Films, Silage Wrap)

Value Chain Analysis For Polytene Casting Film Market

The value chain of the Polytene Casting Film Market is intricate, starting with upstream raw material supply and culminating in downstream distribution and final consumption. The upstream segment is dominated by major petrochemical companies and resin manufacturers who produce the primary polyethylene feedstocks (LDPE, LLDPE, HDPE, and specialty mPE resins). This segment is capital-intensive and highly sensitive to global crude oil prices, dictating the cost structure for the entire chain. Suppliers of additives, such as slip agents, anti-block agents, UV stabilizers, and colorants, also form a crucial part of the upstream activities, providing essential compounds that enhance the functional properties of the final film. The bargaining power of resin suppliers is significant, particularly during periods of tight supply, necessitating robust contract negotiations and strategic sourcing by film manufacturers to maintain competitive pricing.

The core processing stage involves film manufacturers (converters) who employ high-speed cast extrusion lines. These companies transform polymer resins into finished rolls of film, applying advanced techniques such as co-extrusion to create multi-layer films with complex barrier and sealing properties. Quality control, process optimization, and investment in cutting-edge machinery define the competitiveness at this stage. Following conversion, the distribution channel plays a critical role. Direct sales channels are often used for large volume, customized orders supplied directly to major brand owners (e.g., multinational food companies or hygiene product manufacturers). Indirect distribution involves working with specialized packaging distributors, brokers, and wholesalers who serve smaller end-users, manage inventory, and provide localized technical support and converting services (such as slitting and rewinding).

The downstream segment consists of the end-use industries, including packaging firms, food processors, medical device manufacturers, and consumer product companies. These entities utilize the cast films for their final product applications, often involving further processes like printing, laminating, or forming. Their demand specifications (e.g., sealing temperature, oxygen transmission rate, puncture resistance) drive the technological requirements upstream. The growing emphasis on sustainability means that brand owners are increasingly demanding films optimized for recycling, influencing both the material selection (mono-material focus) and the production process. Efficient logistics and a streamlined distribution network are vital to ensure timely delivery of large volumes of film, particularly to high-speed automated packaging lines where delays can result in substantial operational costs. The overall health of the value chain is increasingly dependent on close collaboration between resin producers and end-users to innovate sustainable solutions.

Polytene Casting Film Market Potential Customers

The primary customer base for Polytene Casting Films spans diverse high-volume manufacturing sectors, fundamentally defined by the need for cost-effective, high-performance flexible barriers and protective materials. Large multinational food and beverage corporations constitute the most significant segment. These companies require cast films for automated packaging processes for products ranging from dairy, fresh meat, and frozen foods to snacks and baked goods. They prioritize films offering superior seal integrity, controlled oxygen and moisture vapor transmission rates (OTR and MVTR), and high clarity for consumer appeal. Their purchasing decisions are heavily influenced by the film manufacturer's ability to provide consistent quality, global supply capabilities, and verifiable sustainability credentials, often demanding films incorporating specific percentages of PCR or bio-based content to meet corporate ESG targets.

Another major customer demographic is the Hygiene and Personal Care industry, dominated by producers of disposable hygiene products such as diapers, sanitary napkins, and adult incontinence products. For this segment, polytene cast films function as the back sheet material, requiring specific properties such as soft touch, high tear resistance, and, crucially, controlled breathability (microporous films) to ensure user comfort while managing fluid containment. These buyers seek reliable, high-volume suppliers capable of meeting stringent health and safety standards and providing films with low migration properties. The medical and pharmaceutical sector represents a high-value, albeit smaller, customer segment. Medical device and drug manufacturers utilize cast films for sterile packaging applications (e.g., peelable pouches and protective wraps), where film purity, consistent sterilization resistance (e.g., to EtO or gamma radiation), and traceability are non-negotiable requirements, necessitating specialized cleanroom manufacturing standards from the film suppliers.

Beyond these specialized sectors, the Industrial and Commercial segment represents a foundational customer group, primarily utilizing commodity cast films for large-scale protective applications, notably in logistics and construction. This includes purchasers of stretch film used for securing pallet loads during transit, large industrial liners, and protective coverings. These buyers are highly cost-sensitive and focus primarily on mechanical performance indicators such as yield, stretch percentage, and puncture resistance. Finally, packaging converters and printers serve as intermediate customers, purchasing plain or base films and adding value through high-definition printing, lamination with other materials (like aluminum or paper), or specialized coatings. Their purchasing decisions are driven by the film’s suitability for conversion, requiring excellent surface tension and dimensional stability to run smoothly on complex printing and laminating machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor PLC, Berry Global Group Inc., Jindal Poly Films Ltd., Sealed Air Corporation, Toray Industries, Inc., Treofan Group, ExxonMobil Chemical, Dow Chemical Company, Charter Next Generation, RPC Group (now Berry Global), Coveris Holdings S.A., Mondi Group, TC Transcontinental, Polyplex Corporation Ltd., FSPG Hi-Tech Co., Ltd., Klöckner Pentaplast, Wipak Group, Taghleef Industries (Ti), Innovia Films, Mitsubishi Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polytene Casting Film Market Key Technology Landscape

The technological landscape of the Polytene Casting Film Market is dominated by advanced extrusion systems, with a significant emphasis on co-extrusion capabilities. Cast film extrusion differs from blown film primarily in the cooling process, utilizing a chilled roll stack which enables faster line speeds, superior film clarity, and precise gauge control (thickness uniformity), typically less than 3% variation. Modern cast lines are highly automated, employing sophisticated controls to manage melt temperature, die gap settings, edge pinning, and winding tension in real-time. The shift toward higher-output, multi-layer extrusion lines (7, 9, or 11 layers) is a core technological trend, allowing manufacturers to combine various resins—such as LLDPE for bulk strength, metallocene for sealant layers, and specialty barrier polymers like EVOH or nylon—into a single, high-performance structure. This technological convergence enables the creation of highly specialized films for oxygen-sensitive products, essential for extending the shelf life of packaged goods.

Another crucial technological advancement is the incorporation of sophisticated winding systems that can handle thin-gauge, high-slip films without causing surface defects or telescoping. Precision slitting and winding technologies ensure that the film rolls meet the exacting standards required for subsequent high-speed converting processes, such as lamination and printing. Furthermore, in response to sustainability drivers, film manufacturers are increasingly implementing solventless lamination processes and exploring innovative recycling technologies. The development of mono-material polyolefin structures is perhaps the most defining technological challenge; producers are engineering all-PE films that mimic the performance of traditional mixed-material laminates, ensuring the final package is readily recyclable within existing PE recycling streams. This involves meticulous engineering of the PE resin blend at each layer to achieve the necessary heat resistance, barrier properties, and stiffness.

The deployment of Industry 4.0 principles, including integrated sensors, Big Data analytics, and machine learning, constitutes a strategic technological focus for leading players. These digital technologies enable continuous monitoring of process parameters, optimizing energy consumption per kilogram of film produced, and facilitating predictive maintenance regimes that minimize unplanned downtime. The innovation in specialty film coating technology is also expanding the market; for instance, applying ultra-thin, vacuum-deposited barrier coatings (like Aluminum Oxide or Silicon Oxide) onto cast PE films to provide ultra-high barrier properties suitable for pharmaceutical applications, while maintaining transparency and flexibility. This continuous pursuit of enhanced functionality, material efficiency (down-gauging), and process automation defines the competitive edge in the highly mechanized polytene casting film manufacturing environment.

Regional Highlights

The global Polytene Casting Film Market exhibits significant regional disparities in terms of production capacity, consumption patterns, and technological maturity, primarily segmented across Asia Pacific (APAC), North America, Europe, Latin America, and the Middle East and Africa (MEA).Asia Pacific (APAC): APAC is undeniably the powerhouse of the global polytene casting film market, driving both volume production and consumption. The region’s dominance is attributed to rapid economic expansion, massive urbanization, and a burgeoning middle class, particularly in China, India, and Southeast Asian nations. The tremendous growth in organized retail and the local manufacturing of fast-moving consumer goods (FMCG) necessitate colossal quantities of cost-effective, flexible packaging materials. While APAC excels in high-volume, commodity film production, there is a rapidly increasing demand for specialty cast films, especially high-barrier and hygienic grades, as consumer disposable income rises and food safety regulations tighten across the region. Governmental initiatives aimed at improving manufacturing efficiency and investing in modern extrusion technology further support localized production capabilities, although competition remains fierce and margins are often tighter than in Western markets.

North America: North America represents a mature, high-value market characterized by robust demand for technically advanced cast films, especially those used in medical, pharmaceutical, and high-barrier food applications. The market is driven by sophisticated consumer demands, stringent food safety standards, and a strong push toward sustainable packaging solutions, including films containing high percentages of Post-Consumer Recycled (PCR) content. Innovation in co-extrusion technology and specialty resin usage is centralized here. Major players focus on providing tailored, value-added films, often achieving premium pricing due to superior performance characteristics such as enhanced seal strength and sterilization capability. The logistical packaging segment, particularly industrial stretch wrap, remains a large, steady consumer of LLDPE cast film, benefitting from the region's expansive supply chain infrastructure.

Europe: The European market is the global leader in sustainability-driven innovation within the cast film sector. Demand is heavily influenced by strict EU directives targeting plastic waste reduction and circular economy mandates. This regulatory environment has forced manufacturers to prioritize monomaterial film development (all-PE constructions), recyclability, and the integration of bio-based polymers. While growth rates might be lower than in APAC, the value generated per unit of film is high, focusing on specialty applications in hygiene, high-barrier laminates, and advanced agricultural films. Western European countries, particularly Germany and Italy, host several key equipment manufacturers and film converters known for precision engineering and high-quality production standards. Strategic investment is concentrated on chemical recycling infrastructure to ensure the long-term viability of polytene films in the region.

- Asia Pacific: Dominant market share and fastest growth, driven by packaging and hygiene sectors in China and India.

- North America: Focus on high-barrier, medical-grade films and adoption of PCR content to meet brand sustainability pledges.

- Europe: Pioneer in sustainable, monomaterial cast film structures and heavily regulated by circular economy mandates.

- Latin America (LATAM): Emerging market with increasing demand for packaged goods; localized production is growing to offset high import costs.

- Middle East and Africa (MEA): Growth driven by infrastructure projects, agricultural films, and increasing reliance on packaged food in rapidly urbanizing Gulf and African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polytene Casting Film Market.- Amcor PLC

- Berry Global Group Inc.

- Jindal Poly Films Ltd.

- Sealed Air Corporation

- Toray Industries, Inc.

- Treofan Group

- ExxonMobil Chemical

- Dow Chemical Company

- Charter Next Generation

- Mondi Group

- TC Transcontinental

- Polyplex Corporation Ltd.

- FSPG Hi-Tech Co., Ltd.

- Klöckner Pentaplast

- Wipak Group

- Taghleef Industries (Ti)

- Innovia Films

- Mitsubishi Chemical Corporation

- Coveris Holdings S.A.

- Huhtamaki Oyj

Frequently Asked Questions

Analyze common user questions about the Polytene Casting Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between Polytene Casting Film and Blown Film?

Polytene casting film is produced by extruding molten polymer onto a chilled roll (chill roll casting), leading to rapid cooling. This results in superior clarity, higher gloss, and better gauge uniformity compared to blown film, which is extruded upward through a circular die and cooled by air, making blown film generally tougher but optically less clear.

Which end-use industry drives the highest demand for specialized Polytene Casting Films?

The Food and Beverage industry drives the highest demand, particularly for specialized multi-layer cast films offering advanced barrier properties (oxygen and moisture) essential for extending the shelf life of perishable items such as processed meats, cheese, and fresh produce.

How is the Polytene Casting Film Market responding to global sustainability pressures?

The market is responding by developing monomaterial (all-polyethylene) cast film structures that are fully recyclable, increasing the incorporation of Post-Consumer Recycled (PCR) content, and investing in bio-based polymer feedstock alternatives to reduce reliance on virgin fossil fuels.

What role does Metallocene Polyethylene (mPE) play in the current market technology landscape?

mPE is critical for film down-gauging. Due to its narrow molecular weight distribution, mPE offers exceptional strength, puncture resistance, and sealing properties at thinner gauges compared to traditional LLDPE, enabling material source reduction and cost optimization across high-performance applications.

Is the Asian Pacific region primarily focused on commodity or specialty Polytene Cast Films?

While APAC remains the largest producer of commodity cast films for general packaging volume, the rapid growth in its organized food, medical, and hygiene sectors is accelerating the shift towards significant local production and increasing consumption of high-specification, specialty multi-layer cast films.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager