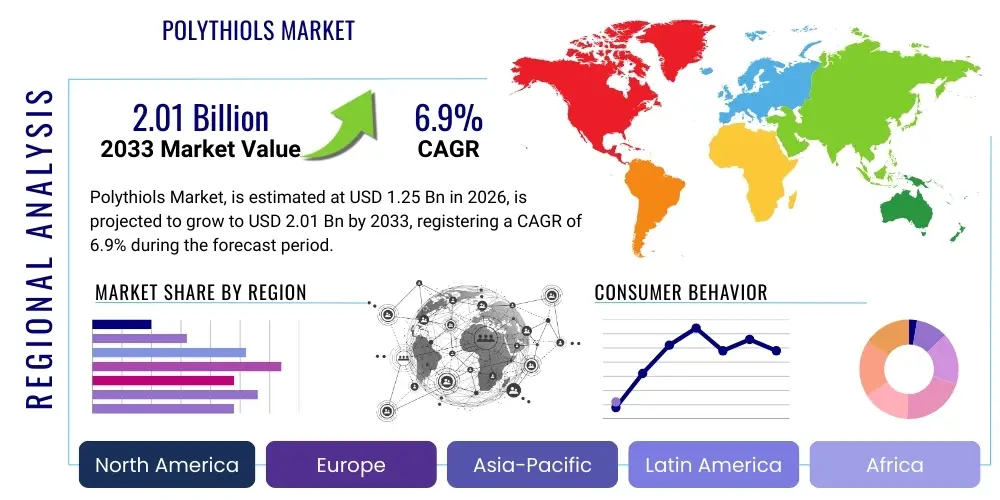

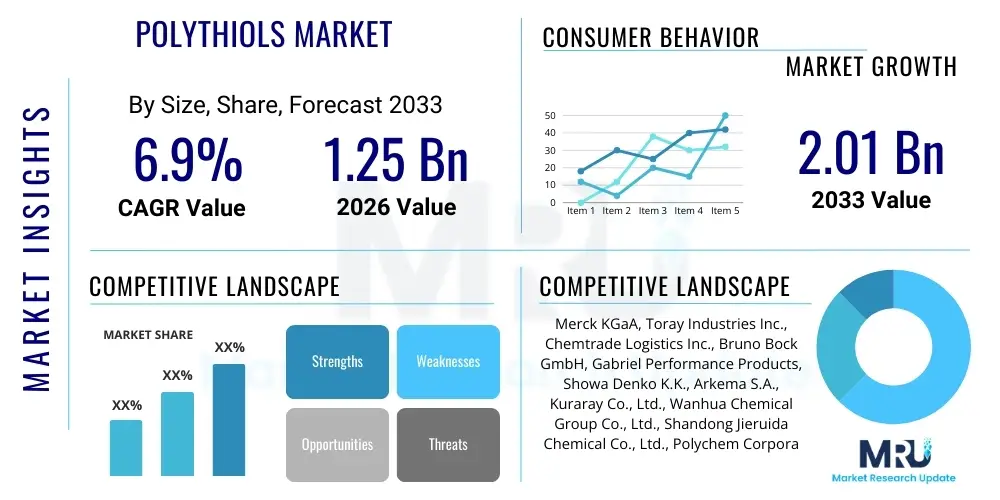

Polythiols Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436934 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Polythiols Market Size

The Polythiols Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.01 Billion by the end of the forecast period in 2033.

Polythiols Market introduction

Polythiols are specialized organic compounds containing two or more thiol functional groups (—SH). These materials are highly valued in industrial chemistry due to their unique reactivity, particularly their ability to undergo rapid curing reactions when combined with polyenes or epoxy resins, a process often referred to as thiol-ene or thiol-epoxy chemistry. This rapid curing capability, often achievable at room temperature or through UV radiation, makes polythiols indispensable components in high-performance sealants, adhesives, coatings, and specialized elastomers, particularly within demanding sectors such as aerospace and automotive manufacturing where precision and speed are crucial.

The core utility of polythiols stems from the high flexibility and low glass transition temperature (Tg) they impart to cured polymers, alongside exceptional resistance to thermal degradation, chemicals, and moisture. Major applications include UV-curable coatings for optical fibers and electronics, structural adhesives for lightweight composites in the transportation industry, and high-specification sealants used in infrastructure and construction. The increasing global focus on energy efficiency and lightweighting, particularly in electric vehicles (EVs) and commercial aircraft, further propels the demand for high-performance bonding and sealing agents derived from polythiols, replacing traditional, slower-curing systems.

Driving factors for market expansion include the burgeoning adoption of UV-curing technologies as an environmentally friendly alternative to solvent-based systems, and continuous innovation in synthesis methods leading to lower odor and greater molecular control. Furthermore, the rising need for high-reliability components in advanced electronics and medical devices, where polythiols offer superior barrier properties and biocompatibility (in specific formulations), establishes a firm foundation for sustained market growth. Research efforts focused on developing bio-based or renewable polythiols are also opening new avenues for commercialization, aligning with global sustainability mandates and attracting investment across the chemical value chain.

Polythiols Market Executive Summary

The Polythiols market is characterized by robust business trends driven primarily by the shift towards high-speed manufacturing processes and stringent performance requirements in end-use industries. Key market players are strategically focusing on vertical integration and geographical expansion, particularly into the Asia Pacific region, which exhibits high growth in construction and automotive production. Product innovation centers around minimizing the characteristic odor of thiols and developing advanced formulations for UV-LED curing systems, enhancing sustainability and reducing energy consumption in industrial applications. Mergers, acquisitions, and strategic partnerships, especially those aimed at securing upstream raw material supply or expanding distribution networks for specialized polythiols, are defining competitive dynamics, fostering both collaboration and intense rivalry among major manufacturers.

Regionally, the market dynamics are highly differentiated. North America and Europe currently represent mature markets, emphasizing high-value applications such as aerospace sealants, medical-grade adhesives, and sophisticated protective coatings, driven by strict regulatory frameworks regarding volatile organic compounds (VOCs). Conversely, Asia Pacific is emerging as the fastest-growing region, fueled by massive investments in infrastructure development, rapid expansion of the consumer electronics sector, and significant growth in electric vehicle manufacturing. These dynamics necessitate tailored supply chain solutions and localized production capacities to meet varied regional demands, often favoring manufacturers capable of scaling production rapidly while maintaining product quality consistency across diverse geographic locations.

Segment trends reveal a strong preference for liquid polythiols due to their ease of handling and formulation versatility in sealants and coatings. Application-wise, the adhesives and sealants segment maintains market dominance, benefiting from increased demand in structural bonding and flexible joint applications in modern construction and automotive assembly. Furthermore, the specialized coatings segment, particularly those utilized for electronic encapsulation and optical fiber protection, is exhibiting accelerated growth, supported by the ongoing digital transformation and the expansion of 5G infrastructure. End-use industries such as aerospace and defense, which require exceptional durability and resistance to harsh environments, continue to drive premium pricing and specialized product development within the polythiols sector.

AI Impact Analysis on Polythiols Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Polythiols Market often revolve around optimizing complex synthesis pathways, improving product consistency, and accelerating the discovery of novel thiol formulations with enhanced environmental profiles (low VOC, reduced odor). Users frequently question how AI and Machine Learning (ML) can predict the long-term performance and shelf-life of thiol-based sealants under various stress conditions, thereby reducing extensive physical testing cycles. Furthermore, significant interest exists regarding AI’s role in optimizing the supply chain for key precursors like pentaerythritol and trimethylolpropane, ensuring stable costs and availability, which are critical for maintaining competitive manufacturing margins. The underlying expectation is that AI integration will usher in an era of 'smart chemistry,' allowing manufacturers to customize polythiol properties rapidly for highly specific industrial applications, ultimately shortening the time-to-market for innovative products.

AI's primary influence is seen in the acceleration of materials informatics, enabling high-throughput screening of potential polythiol structures and their reactivity profiles. By utilizing algorithms trained on vast spectroscopic and reaction kinetic data, researchers can quickly narrow down promising molecular designs, significantly reducing the reliance on costly and time-consuming experimental trials. This computational advantage is particularly valuable in developing specialized, functionalized polythiols designed for next-generation applications, such as high-refractive-index materials for optics or advanced bio-compatible adhesives for medical implants, areas where precision in molecular engineering is paramount.

In manufacturing and quality control, AI-powered predictive maintenance and process optimization are revolutionizing polythiol production. ML models analyze sensor data from reactors—monitoring temperature, pressure, and catalyst efficiency—to predict and prevent deviations in polymerization, ensuring batch-to-batch consistency and minimizing waste. This shift from reactive to predictive quality management not only improves yield but also standardizes the complex synthesis processes involved in high-purity polythiol manufacturing, leading to cost efficiencies and enhanced reliability that are crucial for demanding aerospace and electronics customers.

- AI-driven materials informatics accelerates the discovery of novel, high-performance polythiol structures, optimizing functionality and synthesis cost.

- Machine Learning algorithms enhance process control in manufacturing, leading to improved batch consistency, yield maximization, and reduced production cycle times.

- Predictive modeling using AI assists in determining the long-term durability and performance characteristics of polythiol-based sealants and coatings, reducing reliance on slow physical aging tests.

- AI optimizes complex supply chain logistics for thiol precursors, improving inventory management and mitigating risks associated with raw material volatility.

- Robotics and automated synthesis platforms, guided by AI, enable high-throughput experimentation (HTE) for rapid formulation screening in UV-curable systems.

- AI facilitates the development of low-odor, bio-based polythiols by predicting suitable functionalization routes that adhere to green chemistry principles.

DRO & Impact Forces Of Polythiols Market

The Polythiols Market is dynamically shaped by a constellation of Drivers, Restraints, Opportunities, and external Impact Forces. The primary drivers revolve around the expanding applications of high-performance adhesives and sealants across automotive and aerospace sectors, necessitated by the imperative for lightweight, durable materials capable of resisting extreme operational environments. The increasing global adoption of UV and LED curing technologies, which heavily rely on thiol-ene chemistry for their fast, solvent-free operation, further accelerates market growth, especially in coating applications for floors, electronics, and graphic arts. Concurrently, the rising investment in infrastructure globally, particularly in developing economies, stimulates demand for corrosion-resistant protective coatings and flexible sealants where polythiols offer superior longevity compared to conventional materials, underpinning sustainable demand growth throughout the forecast period.

However, market expansion is significantly restrained by the inherent challenges associated with polythiols, chiefly their distinct and often strong odor profile, which complicates handling and application in non-industrial settings, despite ongoing efforts to develop low-odor variants. Furthermore, the volatility and price fluctuation of key petrochemical precursors, such as crude oil and certain specialty alcohols, introduce cost uncertainties that can pressure manufacturing margins and potentially slow down adoption, particularly in cost-sensitive applications. Regulatory complexities regarding the transportation and storage of certain thiol compounds also pose logistical hurdles for global distribution, requiring specialized infrastructure and compliance strategies that increase operational overheads for market players.

Significant opportunities lie in the development of renewable and bio-based polythiols derived from natural oils or terpenes, aligning with global green chemistry initiatives and attracting environmentally conscious customers. The expansion of 3D printing and additive manufacturing offers a nascent, yet potentially high-growth avenue, as polythiols are excellent candidates for high-speed, high-resolution photopolymer resins due to their rapid cure kinetics and tunable mechanical properties. External impact forces, such as stringent environmental regulations (e.g., REACH in Europe) pushing for low-VOC and solvent-free formulations, act as powerful catalysts for innovation, forcing companies to invest heavily in thiol-ene and thiol-epoxy systems. Economic cycles, especially those impacting construction and automotive production, exert cyclical pressure on demand, while technological advancements in UV-LED light sources continually lower the barrier for adopting thiol-based curing systems, solidifying their competitive advantage.

Segmentation Analysis

The Polythiols market segmentation offers a detailed view of its diverse application landscape, categorized primarily by Product Type, Application, and End-Use Industry. The Product Type segmentation distinguishes between liquid and solid forms, with liquid polythiols dominating due to their ease of incorporation into solvent-free formulations and versatile processing characteristics. Further differentiation within this category is based on functionality (mono-, di-, or multi-functional) and the backbone structure, such as aliphatic or aromatic polythiols, each offering distinct thermal and chemical resistance properties suitable for specialized markets.

The Application segment is broad, encompassing high-volume uses in sealants, adhesives, coatings, elastomers, and specialty chemicals. Adhesives and sealants remain the foundational market drivers, utilized extensively in construction, automotive assembly (particularly bonding disparate materials like carbon fiber to metal), and general industrial maintenance. Coatings represent the fastest-growing application area, fueled by the demand for highly durable, scratch-resistant, and UV-curable finishes in consumer electronics and protective industrial finishes. Elastomers, including specialty rubbers and encapsulants, utilize polythiols for improved flexibility and long-term chemical stability under harsh operating conditions.

Finally, the End-Use Industry segmentation highlights the sectors driving demand, led by automotive and transportation (for lightweight composites and structural bonding), aerospace and defense (requiring fuel tank sealants and protective coatings), construction (for flexible joint sealants and floor coatings), and electronics (for optical fiber coatings and encapsulation resins). The medical and dental sector is an emerging, high-value segment, leveraging the biocompatibility of select polythiol formulations for dental composites and surgical adhesives. Understanding these segmented demands is crucial for manufacturers to align their R&D efforts and marketing strategies with specific industry requirements.

- Product Type:

- Liquid Polythiols

- Solid Polythiols

- Functionalized Polythiols (e.g., Aliphatic, Aromatic)

- Application:

- Adhesives

- Sealants (e.g., Aircraft, Infrastructure)

- Coatings (e.g., UV-Curable, Protective)

- Elastomers and Specialty Rubbers

- Encapsulation Resins

- 3D Printing Resins

- End-Use Industry:

- Automotive and Transportation (including EV components)

- Aerospace and Defense

- Construction and Infrastructure

- Electronics and Electrical (OFC, Semiconductors)

- Medical and Dental

- Industrial Maintenance and Repair (MRO)

- Functionality:

- Di-functional Polythiols

- Tri-functional Polythiols

- Multi-functional Polythiols (>3 functionality)

Value Chain Analysis For Polythiols Market

The Polythiols market value chain commences with the upstream extraction and refinement of petrochemical feedstock, primarily propylene, which is crucial for synthesizing key intermediates such as glycols, polyols, and various sulfur compounds. These intermediates are then processed to create complex precursors like pentaerythritol tetrakis(3-mercaptopropionate) (PETMP) or trimethylolpropane tris(3-mercaptopropionate) (TMPMP), the foundational polythiol monomers. This upstream segment is characterized by high capital intensity and reliance on specialized chemical synthesis expertise, often controlled by major integrated chemical producers. Stability in precursor supply and quality control at this stage are paramount, directly influencing the performance characteristics and cost structure of the final polythiol product.

The midstream phase involves the specialized synthesis, purification, and formulation of the polythiols. Manufacturers differentiate themselves here through proprietary synthesis methods, achieving high purity levels, low odor, and specific molecular weight distributions required for demanding applications like aerospace sealants. Processing steps include distillation, functionalization, and mixing to create tailored products suitable for various curing mechanisms (thiol-ene, thiol-epoxy). Marketing and distribution channels then manage the flow from manufacturers to formulators or direct end-users. Direct distribution is common for highly specialized products sold to large aerospace or medical manufacturers, ensuring technical support and strict quality traceability.

The downstream sector is dominated by compounders and formulators who integrate polythiols with polyenes, catalysts, and additives to create final products such as UV-curable inks, structural adhesives, or encapsulants. These formulators serve the vast end-use industries—automotive, construction, electronics, and medical. Indirect distribution involves working through specialized chemical distributors and regional agents who provide logistical support and inventory management for smaller-to-medium-sized end-users. The final stage involves the application of the formulated product by end-users, where factors like ease of application, curing speed, and long-term performance dictate product preference and market acceptance, thereby providing crucial feedback loops to the upstream manufacturers for continuous product improvement.

Polythiols Market Potential Customers

The primary customers for polythiols are specialized formulators and compounders operating within the adhesives, sealants, and coatings industries, who utilize polythiols as critical reactive components to achieve specific material properties such as rapid cure, flexibility, and chemical resistance. These entities act as intermediaries, purchasing bulk polythiols and blending them into proprietary formulations tailored for specific industrial applications, such as specialized automotive body repair compounds or high-performance marine coatings. Large, integrated chemical companies that also possess formulation capabilities often act as both manufacturers and key customers, integrating the materials internally to produce complex polymers and specialized elastomer products for direct sale to high-reliability end-users.

Direct end-users constitute the second major customer group, particularly large multinational corporations in sectors where material performance is non-negotiable and technical specifications are highly restrictive. This includes aerospace OEMs (Original Equipment Manufacturers) demanding polysulfide-alternative sealants for fuel tanks and fuselages, defense contractors requiring robust encapsulants for sensitive electronic equipment, and leading electronics manufacturers utilizing polythiols for low-shrinkage, high-precision encapsulation of optical fibers and semiconductor components. These customers value product consistency, certification, and long-term supply agreements above price, driving demand for premium, high-purity polythiol grades.

Furthermore, the rapidly expanding sectors of electric vehicle (EV) battery manufacturing and advanced 3D printing represent emerging high-potential customer bases. EV manufacturers require flexible, durable sealing agents for battery packs that can withstand thermal cycling and vibration, areas where polythiol-based sealants excel due to their excellent adhesion and elasticity. In additive manufacturing, dental laboratories and medical device producers leverage polythiol-based resins for their superior cure speed and biocompatibility, allowing for the rapid creation of prototypes and finished medical-grade components, marking these specialized industries as critical targets for future market penetration and growth strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.01 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Toray Industries Inc., Chemtrade Logistics Inc., Bruno Bock GmbH, Gabriel Performance Products, Showa Denko K.K., Arkema S.A., Kuraray Co., Ltd., Wanhua Chemical Group Co., Ltd., Shandong Jieruida Chemical Co., Ltd., Polychem Corporation, Jiangxi Hongnuo Chemical Co., Ltd., LyondellBasell Industries N.V., Wacker Chemie AG, TCI Chemicals (India) Pvt. Ltd., Mitsubishi Chemical Corporation, Nippon Kayaku Co., Ltd., Coatex (Arkema Group), Sika AG, Henkel AG & Co. KGaA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polythiols Market Key Technology Landscape

The technological landscape of the Polythiols market is rapidly evolving, driven primarily by innovations aimed at enhancing product performance, improving sustainability, and overcoming the inherent challenges of thiol chemistry, particularly the odor. A key foundational technology is the esterification process used for synthesizing high-purity polythiols, such as TMPMP and PETMP, often involving complex reaction mechanisms utilizing phosphorus-based or acid catalysts. Recent advancements in this area focus on continuous flow chemistry and microreactor technology, which allow for tighter control over reaction parameters, resulting in materials with narrower molecular weight distribution, lower impurity levels, and consequently, reduced characteristic odor, which is critical for consumer acceptance in certain coatings and adhesives.

A major disruptive technology shaping the demand for polythiols is the proliferation of high-intensity UV-LED curing systems. Traditional UV curing relies on broadband mercury lamps, but the efficiency, lower energy consumption, and longer lifespan of UV-LEDs are making thiol-ene photopolymerization increasingly attractive. Polythiols are ideally suited for this due to the extremely rapid and efficient radical curing mechanism, which often allows formulators to achieve solvent-free, instant-curing systems. Technological focus is now shifting towards developing polythiol structures that are optimally sensitized to the specific wavelengths emitted by common commercial UV-LEDs (e.g., 365 nm or 395 nm), maximizing cure depth and speed in complex adhesive formulations.

Furthermore, significant research efforts are dedicated to the exploration and commercialization of bio-based polythiols, moving away from petrochemical dependence. This involves utilizing sustainable feedstocks derived from renewable resources like vegetable oils (e.g., soybean, castor oil) or waste streams, chemically functionalizing them to incorporate thiol groups. While still a nascent area, bio-based polythiols present a critical opportunity to address environmental regulations and consumer preference for green products, potentially opening new markets in specialized medical and cosmetic formulations. Technology in this domain requires breakthroughs in efficient, low-cost functionalization techniques that maintain the high reactivity and mechanical performance characteristic of petrochemical polythiols, ensuring they can be seamlessly integrated into existing industrial manufacturing processes without significant capital expenditure.

Regional Highlights

- North America: Dominance in Aerospace and High-Reliability Applications

North America holds a substantial share of the Polythiols market, driven by its robust aerospace and defense sectors, which demand high-specification sealants and adhesives capable of operating under extreme temperatures and resisting aviation fuels and hydraulic fluids. The region’s focus on electric vehicle (EV) manufacturing is generating significant demand for high-performance sealing materials necessary for battery packs and chassis bonding, promoting the adoption of advanced polythiol formulations due to their durability and flexibility. Furthermore, stringent environmental regulations in the U.S. and Canada regarding VOC emissions accelerate the shift towards solvent-free, UV-curable systems based on thiol-ene chemistry, positioning this region as a key adopter of technological innovation and high-purity products. Market maturity here encourages manufacturers to focus on value-added, specialized products rather than high-volume commodity goods, ensuring sustained profitability and competitive differentiation.

The presence of major electronics and optical fiber manufacturers also contributes significantly to demand, utilizing polythiol-based coatings for protection and encapsulation due to their superior optical clarity and low shrinkage upon curing. Investment in research and development, particularly in advanced materials science and additive manufacturing using thiol-based resins, remains high. Key market players leverage strong intellectual property protection and established supply chains to serve specialized industries, maintaining a competitive edge based on technical performance and compliance with industry-specific certifications, such as those required by military and aircraft governing bodies.

- Europe: Focus on Environmental Compliance and Automotive Coatings

Europe represents a mature but highly dynamic market, propelled by rigorous environmental legislation such as REACH, which mandates the reduction of hazardous substances and VOCs. This regulatory landscape strongly favors high-solids and 100% solids systems, where polythiols excel, especially in protective and architectural coatings. The thriving European automotive industry, particularly in Germany, France, and Italy, drives demand for polythiol-based structural adhesives and protective clearcoats, critical for reducing vehicle weight and improving crash resistance, aligning with EU mandates for fuel efficiency and safety. The ongoing shift toward lightweight composite materials requires specialized bonding agents where polythiol chemistry provides unmatched rapid curing capabilities.

Furthermore, European infrastructure and construction sectors utilize polythiol sealants for long-lasting performance in bridges, tunnels, and high-rise buildings, benefiting from their excellent weatherability and elastic recovery properties. The medical device industry, particularly in countries like Germany and Switzerland, is a significant consumer of specialized, biocompatible polythiols for advanced medical adhesives and dental restorative materials. The region's commitment to sustainability also fuels strong research into bio-based and renewable polythiol alternatives, supported by substantial public and private funding directed toward circular economy initiatives and green chemistry principles, fostering innovation beyond traditional petrochemical routes.

- Asia Pacific (APAC): Rapid Industrialization and Mass Consumption

The Asia Pacific region is the fastest-growing market for polythiols, characterized by massive investments in infrastructure, rapid urbanization, and exponential growth in manufacturing sectors, particularly in China, India, and Southeast Asia. The surging demand for automobiles, consumer electronics, and construction materials necessitates high volumes of adhesives, sealants, and coatings. Low-cost labor and favorable regulatory environments have attracted global manufacturing operations, leading to high consumption rates for general-purpose and specialized polythiols in various assembly applications, including appliance manufacturing and general industrial maintenance.

China, in particular, dominates the regional market, driven by its expansive electronics manufacturing base (requiring protective coatings for PCBs and displays) and substantial government-led infrastructure projects. The increasing need for corrosion control in maritime and industrial environments also boosts demand for high-performance protective coatings based on thiol chemistry. While price sensitivity remains a factor in certain high-volume segments, the growing focus on quality and product longevity, influenced by Western quality standards adopted by multinational companies operating in APAC, is gradually pushing demand toward higher-purity and more specialized polythiol grades, encouraging local manufacturers to upgrade their synthesis capabilities and compete on performance.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets and Infrastructure Focus

The LATAM and MEA regions represent emerging markets characterized by significant investments in energy infrastructure, petrochemical facilities, and civil construction projects. In the Middle East, large-scale construction projects and the need for durable coatings resistant to high temperatures, UV radiation, and harsh desert environments drive demand for specialty polythiol sealants and protective coatings. The region's reliance on oil and gas infrastructure also necessitates high-performance sealants for pipelines and storage tanks, where polythiols offer superior chemical resistance to hydrocarbons and solvents. Market growth, though sensitive to oil price fluctuations, is sustained by diversification efforts into non-oil sectors.

In Latin America, countries such as Brazil and Mexico, with strong automotive assembly plants and growing domestic construction sectors, are the main consumers. Market penetration is increasing as local manufacturers look to adopt more advanced, fast-curing chemistries to improve manufacturing efficiency and reduce reliance on imported formulated products. Logistical challenges and fragmented distribution networks necessitate partnerships between international polythiol suppliers and local distributors to effectively serve the diverse geographic landscape across both LATAM and MEA, focusing on key industrial hubs and major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polythiols Market.- Merck KGaA

- Toray Industries Inc.

- Chemtrade Logistics Inc.

- Bruno Bock GmbH

- Gabriel Performance Products (Acquired by Lanxess AG)

- Showa Denko K.K.

- Arkema S.A.

- Kuraray Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Shandong Jieruida Chemical Co., Ltd.

- Polychem Corporation

- Jiangxi Hongnuo Chemical Co., Ltd.

- LyondellBasell Industries N.V.

- Wacker Chemie AG

- TCI Chemicals (India) Pvt. Ltd.

- Mitsubishi Chemical Corporation

- Nippon Kayaku Co., Ltd.

- Coatex (Arkema Group)

- Sika AG

- Henkel AG & Co. KGaA

Frequently Asked Questions

Analyze common user questions about the Polythiols market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of polythiols in industrial applications?

Polythiols primarily function as reactive components in cross-linking systems, enabling rapid curing (polymerization) when combined with polyenes or epoxies, forming highly durable and flexible polymers used extensively in high-performance adhesives, sealants, and UV-curable coatings.

Which application segment drives the highest demand for polythiols?

The adhesives and sealants segment is currently the largest consumer of polythiols, particularly driven by requirements in the automotive, construction, and aerospace industries for structural bonding and flexible joints that demand superior chemical resistance and quick setting times.

How do environmental regulations impact the Polythiols Market?

Stringent environmental regulations, such as VOC limits in North America and Europe, significantly boost the demand for polythiols because they facilitate the formulation of solvent-free (100% solids) and low-VOC UV-curable systems, aligning with green chemistry mandates and sustainable manufacturing practices.

What technological advancement is most critical for future polythiol market growth?

The integration of UV-LED curing technology is most critical, as polythiols exhibit extremely rapid curing kinetics under LED wavelengths, driving their adoption in high-speed industrial coating and 3D printing applications by reducing energy consumption and processing time.

What is the main challenge facing polythiol manufacturers?

The persistent challenge is managing the characteristic odor associated with thiol compounds, which necessitates significant investment in advanced synthesis and purification technologies to develop low-odor variants that are acceptable for broader use in consumer-facing and specialized medical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager