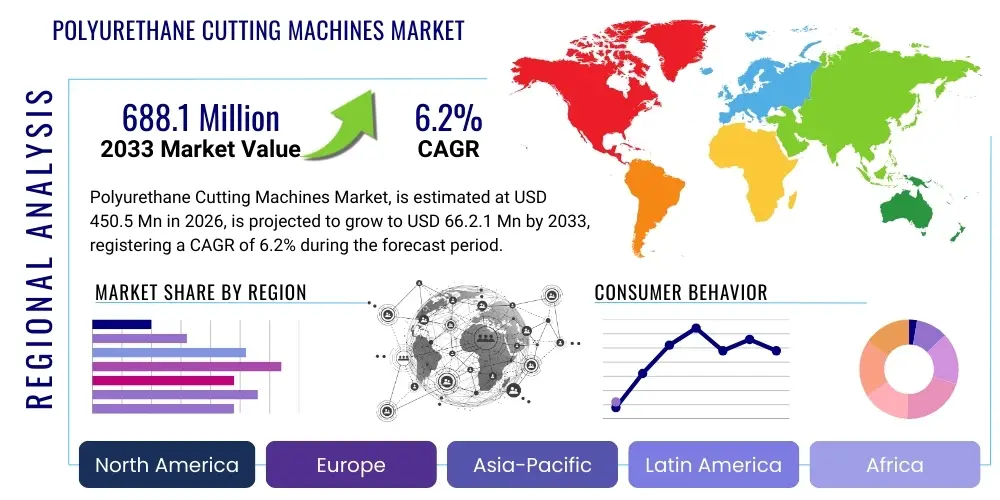

Polyurethane Cutting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438766 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Polyurethane Cutting Machines Market Size

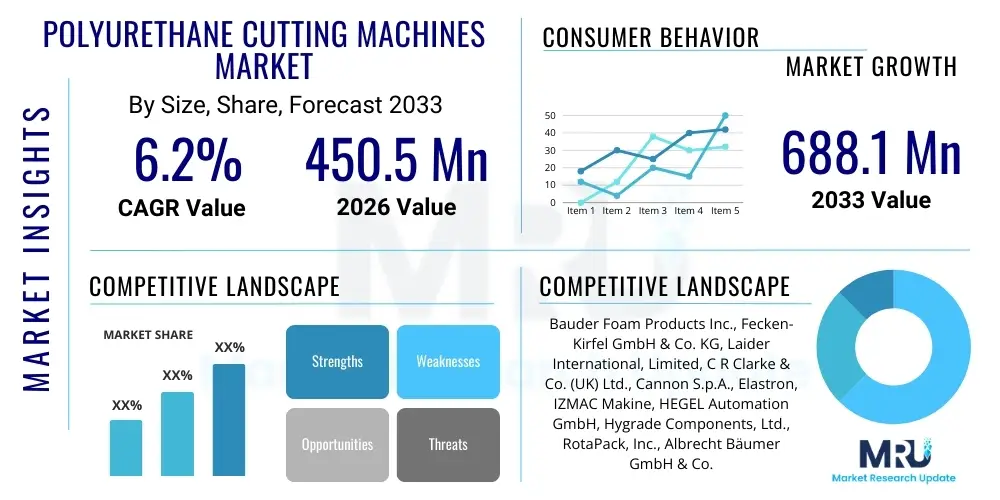

The Polyurethane Cutting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 688.1 Million by the end of the forecast period in 2033.

Polyurethane Cutting Machines Market introduction

The Polyurethane (PU) Cutting Machines Market encompasses specialized equipment designed for the precise and efficient processing of various polyurethane foam types, including flexible, rigid, and integral skin foams. These machines utilize advanced cutting technologies, such as Computer Numerical Control (CNC) contour cutting, oscillating blades, laser cutting, and waterjet technologies, to produce components for a diverse range of industries. The primary product scope covers machinery capable of handling high-volume production with exacting dimensional accuracy, crucial for applications ranging from intricate automotive seating components to large-scale insulation panels used in construction.

Major applications of these cutting systems span the automotive industry, particularly in interior components like seating, headliners, and sound dampening materials; the furniture sector for mattresses and upholstery foam; and the construction industry for thermal insulation and sealants. The increasing demand for lightweight, energy-efficient, and customized PU products directly fuels the need for sophisticated cutting solutions. These machines are essential for minimizing material waste, optimizing production cycles, and ensuring compliance with stringent quality standards required by end-user industries.

The key driving factors propelling the market include the robust growth in the global construction sector, particularly the focus on green building initiatives that mandate high-efficiency insulation; the continuous expansion of the automotive sector, demanding lighter and ergonomically designed foam components; and technological advancements in machine automation and robotics integration. Furthermore, the rising adoption of high-density and specialized PU foams necessitates cutting equipment capable of processing these difficult materials without compromising structural integrity or generating excessive heat.

Polyurethane Cutting Machines Market Executive Summary

The Polyurethane Cutting Machines Market is experiencing rapid evolution driven by the integration of Industry 4.0 principles, focusing heavily on enhanced automation and connectivity. Business trends indicate a strong shift toward highly flexible CNC contour cutting systems that can quickly adapt to varied batch sizes and complex geometric designs, thereby reducing downtime associated with manual tooling changes. Manufacturers are investing heavily in software solutions that offer integrated nesting algorithms to optimize material yield, a critical factor given the fluctuating raw material costs of polyurethane precursors. Strategic mergers, acquisitions, and technology licensing agreements are prevalent as companies seek to expand their geographical footprint and incorporate specialized technologies, such as advanced vision systems for defect detection during the cutting process.

Regionally, Asia Pacific (APAC) stands as the dominant market, primarily due to the massive scale of manufacturing in China, India, and Southeast Asian nations supporting the automotive, electronics, and furniture industries. This dominance is further amplified by significant infrastructure investments driving the demand for rigid PU insulation. North America and Europe, while mature, prioritize technological upgrades, focusing on fully automated robotic cutting cells and sustainable manufacturing practices. The introduction of stringent environmental regulations in these regions is accelerating the adoption of cleaner cutting technologies, such as waterjet, which eliminates the material damage associated with high-friction blade cutting.

Segment trends highlight the oscillating blade cutting machines segment maintaining a high market share due to its versatility and cost-effectiveness for processing flexible foams. However, the laser cutting segment is projected to exhibit the highest growth rate, fueled by the demand for precision cutting of micro-components and thin films used in electronic packaging and specialized medical devices. Automation level segmentation shows a clear preference for fully automatic systems over semi-automatic, driven by the need to reduce labor costs, improve process repeatability, and ensure operator safety in high-volume production environments. End-use trends confirm the automotive and furniture sectors as primary revenue generators, with construction showing substantial long-term growth potential spurred by global urbanization and energy efficiency mandates.

AI Impact Analysis on Polyurethane Cutting Machines Market

User inquiries regarding AI in polyurethane cutting primarily revolve around achieving higher levels of precision, predictive maintenance capabilities, and optimizing complex nesting patterns. Users are concerned about how AI-driven vision systems can compensate for the inherent material inconsistencies in foam, such as density variations or uneven surfaces, which typically challenge traditional CNC programs. Key expectations center on using machine learning algorithms to reduce material scrap by generating real-time, dynamic cutting paths based on instant analysis of foam block quality and shape, thereby maximizing yield and minimizing operational expenditure. There is also significant interest in using AI for anomaly detection in machine performance, moving beyond simple scheduled maintenance to true predictive failure prevention.

The application of Artificial Intelligence is fundamentally transforming the operational efficiency and quality control within the polyurethane cutting sector. AI-powered algorithms are utilized to analyze historical cutting data, machine telemetry, and material characteristics to fine-tune cutting parameters (speed, depth, blade oscillation frequency) autonomously. This results in unprecedented cutting precision and consistency, especially when dealing with highly specialized or viscoelastic foams that are temperature and pressure-sensitive. Furthermore, AI facilitates the rapid customization of production runs, allowing manufacturers to switch between different foam types and product geometries almost instantaneously, responding effectively to the trend of mass customization.

Another crucial impact lies in the realm of supply chain integration and energy efficiency. AI systems can link machine scheduling with inventory management and energy consumption models, ensuring that high-energy cutting operations are scheduled during off-peak utility hours where feasible, contributing to reduced carbon footprint and operational costs. For complex 3D contouring, AI-driven digital twinning creates a virtual simulation of the cutting process, allowing operators to test and optimize tool paths in a simulated environment before physical execution, significantly lowering the risk of expensive errors and material loss.

- AI-Driven Nesting Optimization: Maximizes material utilization by dynamically calculating complex 3D cutting paths, minimizing foam scrap.

- Predictive Maintenance: Uses machine learning on sensor data (vibration, heat, current draw) to forecast equipment failure, increasing uptime and reducing catastrophic breakdowns.

- Vision System Integration: AI enhances quality control by recognizing material defects or density variances in real-time and adjusting the cutting trajectory or speed accordingly.

- Automated Parameter Tuning: Machine learning algorithms automatically calibrate cutting speed, pressure, and blade geometry based on the specific type and rigidity of the PU foam being processed.

- Robotic Process Automation (RPA): AI guides robotic handling and loading/unloading operations, creating fully autonomous cutting cells and improving worker safety.

- Digital Twin Technology: Creates virtual replicas of the cutting process for risk-free path optimization and training, accelerating product development cycles.

DRO & Impact Forces Of Polyurethane Cutting Machines Market

The Polyurethane Cutting Machines Market is primarily driven by the expanding applications of technical foams in sectors requiring enhanced insulation, shock absorption, and lightweighting solutions. The automotive industry’s aggressive transition towards electric vehicles (EVs) necessitates specialized, lightweight PU components for battery thermal management and noise, vibration, and harshness (NVH) reduction, driving demand for precise cutting machinery. Simultaneously, the restraints on market growth include the significant initial capital investment required for high-precision CNC contour cutting systems and the high operational cost associated with specialized consumables, such as durable oscillating blades or ultra-high-pressure waterjet components. Furthermore, the volatility in the prices of petrochemical derivatives, which form the primary raw materials for polyurethane, introduces uncertainty in long-term manufacturing cost projections.

Key opportunities within the market arise from the increasing integration of robotics and multi-axis cutting capabilities, allowing for the creation of intricate, non-standard 3D shapes that were previously impossible or cost-prohibitive. Emerging markets in Southeast Asia and Latin America present substantial potential for growth as they rapidly industrialize their automotive and consumer goods manufacturing bases, leading to increased adoption of automated cutting equipment over traditional, less precise methods. Additionally, the development of eco-friendly and bio-based polyurethane foams creates a niche opportunity for manufacturers to develop cutting technologies specifically optimized for these novel material properties, catering to sustainability-conscious clients.

Impact forces currently shaping the market include the regulatory landscape, where tightening safety and environmental standards (e.g., limits on Volatile Organic Compounds or fire retardancy requirements) necessitate the use of specific PU formulations that demand specialized cutting techniques. Economic forces, particularly global supply chain disruptions, have put pressure on manufacturers to minimize waste and maximize efficiency, thereby increasing the importance of advanced nesting software integrated into cutting machines. Competitive intensity remains high, driven by technological leaps from European and Asian machine manufacturers vying for supremacy in accuracy and speed, compelling all market players to prioritize continuous innovation in software and hardware.

Segmentation Analysis

The Polyurethane Cutting Machines Market segmentation provides a granular view of market dynamics based on technology, automation level, and the diverse applications across major end-use industries. Understanding these segments is critical for manufacturers to tailor product development and market strategies, addressing the specific needs for precision, volume, and material type inherent in sectors like automotive seating, medical packaging, or aerospace components. The most significant differentiation occurs across the cutting technology segment, where the performance characteristics, capital expenditure, and operational costs vary widely, influencing end-user purchasing decisions.

The major segments reveal a market structure where traditional, high-throughput technologies like oscillating blade cutters dominate volume, while advanced systems such as 5-axis CNC cutters and laser systems command the premium segment focused on complex geometries and ultra-high precision. The regional segmentation underscores the varying adoption rates, with mature markets focusing on replacements and upgrades featuring higher automation, whereas developing economies are prioritizing investment in entry-level or mid-range automated systems to scale up capacity. This dual dynamic necessitates a flexible product portfolio for market leaders.

- By Cutting Technology

- CNC Contour Cutting Machines (5-Axis, Multi-Axis)

- Oscillating Blade Cutting Machines (Tangent Blade, Fixed Blade)

- Die Cutting Machines

- Laser Cutting Machines (CO2 Laser, Fiber Laser)

- Waterjet Cutting Machines (Abrasive and Pure Water)

- By Automation Level

- Fully Automatic

- Semi-Automatic

- Manual

- By End-Use Industry

- Automotive (Seating, Interiors, NVH Components)

- Furniture and Bedding (Mattresses, Upholstery)

- Construction (Insulation Panels, Sealing Foams)

- Packaging (Protective and Custom Packaging)

- Textile and Apparel

- Aerospace and Defense

- Medical and Healthcare

Value Chain Analysis For Polyurethane Cutting Machines Market

The value chain for Polyurethane Cutting Machines begins with upstream activities dominated by component suppliers providing critical parts such as high-precision servo motors, CNC controllers, industrial lasers/pumps, specialized oscillating blades, and robust structural steel. Key upstream challenges involve maintaining a stable supply chain for highly sensitive electronic components and ensuring the quality and durability of cutting consumables. The machine manufacturers (Tier 1 suppliers) focus intensely on R&D, software development (nesting optimization and CAD/CAM integration), and system assembly, aiming to differentiate their offerings through superior cutting speed, accuracy, and proprietary control software.

Downstream activities involve sales, distribution, and critical post-sales support, including installation, maintenance, and operator training. Distribution channels are typically complex, involving direct sales for large, custom-engineered systems to major corporations in the automotive and aerospace sectors, and indirect channels through regional distributors and specialized system integrators for standardized or smaller cutting equipment. System integrators play a vital role, often combining the core cutting machine with auxiliary equipment like conveying systems, handling robotics, and dust collection systems to deliver a complete, turn-key solution to the end-user.

The profitability across the value chain is concentrated at the machine manufacturing and software development stages, where intellectual property and technological complexity provide a competitive edge. Direct distribution channels offer higher margins but demand significant investment in regional service infrastructure, while indirect channels provide wider market access but involve margin sharing. The strong emphasis on continuous technical support and spare parts availability is crucial for long-term customer retention, given that machine downtime severely impacts the high-volume production schedules of major end-users.

Polyurethane Cutting Machines Market Potential Customers

The primary customers for Polyurethane Cutting Machines are manufacturers engaged in mass production and customization requiring precise foam processing. The automotive sector, encompassing major OEMs and their Tier 1 and Tier 2 suppliers, represents a critical customer base, purchasing complex 5-axis CNC cutters to manufacture seating components, interior trim, and crucial NVH insulation tailored to specific vehicle models, particularly electric vehicle battery enclosures requiring thermal stability.

Another significant segment comprises the furniture and bedding industries, including large mattress manufacturers and custom upholstery workshops. These customers predominantly utilize high-speed, fully automatic contour cutting systems and oscillating blade technology for efficiently slicing large foam blocks into consumer products like mattresses, pillows, and cushion inserts. Their purchasing criteria heavily emphasize throughput volume, reliability, and the ability to process diverse foam densities, from soft memory foam to highly resilient structural foams.

Furthermore, the construction and specialized packaging sectors constitute substantial potential buyers. Construction companies specializing in infrastructure and commercial insulation require large-format, robust cutting systems for rigid polyurethane foam panels used in roofing and exterior cladding. The packaging industry, especially providers of protective packaging for sensitive electronics and machinery, demands flexible and often modular cutting systems capable of handling low-volume, high-mix custom foam inserts with stringent shock absorption requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 688.1 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauder Foam Products Inc., Fecken-Kirfel GmbH & Co. KG, Laider International, Limited, C R Clarke & Co. (UK) Ltd., Cannon S.p.A., Elastron, IZMAC Makine, HEGEL Automation GmbH, Hygrade Components, Ltd., RotaPack, Inc., Albrecht Bäumer GmbH & Co. KG, Delta-ModTech, Zund Systemtechnik AG, Atom S.p.A., Consew Inc., Shrinath International, OMNI-TECH Inc., PUMOTIX, Inc., Sinotech Machinery Co., Ltd., ESCO Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyurethane Cutting Machines Market Key Technology Landscape

The technological landscape of polyurethane cutting is dominated by the evolution of Computer Numerical Control (CNC) systems, moving from basic 3-axis capabilities to sophisticated 5-axis and 6-axis robotic contour cutting machines. This shift enables manufacturers to process intricate 3D shapes and compound angles with a single setup, drastically reducing processing time and increasing geometric complexity potential. Key advancements include the adoption of non-contact measuring systems and real-time path correction software to counteract the inherent flexibility and compression of softer foam materials during the cutting operation, ensuring the final component dimensions match the digital design exactly.

Complementary cutting technologies, such as oscillating blade and waterjet cutting, are also undergoing significant innovation. Oscillating blade technology benefits from advanced materials science, resulting in longer-lasting, sharper blades and higher oscillation frequencies, leading to cleaner cuts on high-density and abrasive foams. Waterjet cutting, particularly for rigid, thin PU foams used in electronics or medical fields, is becoming more prevalent due to its ability to perform cold cutting, which eliminates the risk of thermal deformation or melting associated with friction-based methods. The implementation of ultra-high-pressure pumps and precision nozzles further enhances the accuracy and speed of waterjet systems.

A critical technology driver across all segments is the increasing standardization of open-architecture control platforms and proprietary CAD/CAM software tailored specifically for foam processing. These software suites feature integrated simulation capabilities and advanced nesting algorithms that maximize material yield, often achieving foam utilization rates exceeding 95%. Furthermore, machine connectivity (IoT integration) is essential, allowing for remote diagnostics, over-the-air software updates, and seamless data exchange with Enterprise Resource Planning (ERP) systems, thus positioning these machines as central components within smart factory environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to the concentration of automotive manufacturing (China, Japan, South Korea) and large-scale furniture production bases. Rapid urbanization in India and Southeast Asia drives massive demand for construction insulation materials, necessitating investment in high-throughput rigid foam cutting machines.

- North America: Characterized by high technological adoption and a strong focus on automation and quality. The region shows robust demand from the aerospace and medical sectors, requiring ultra-precise cutting (often utilizing laser and waterjet) for specialized, low-volume, high-value PU components.

- Europe: A mature market emphasizing sustainability, precision engineering, and adherence to strict safety standards. European manufacturers prioritize robotic cutting cells and systems integrated with AI for optimal material usage, catering heavily to the luxury automotive and high-efficiency building industries.

- Latin America (LATAM): Exhibits significant growth potential driven by industrial expansion in Brazil and Mexico, particularly in the automotive and packaging industries. The market is shifting from manual or semi-automatic methods toward mid-range CNC cutting solutions to improve production scalability.

- Middle East and Africa (MEA): Emerging market primarily driven by infrastructure development and large construction projects, boosting demand for rigid insulation cutting equipment. Adoption rates are moderate, focusing initially on cost-effective, durable machinery for foundational manufacturing needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Cutting Machines Market.- Albrecht Bäumer GmbH & Co. KG

- Fecken-Kirfel GmbH & Co. KG

- Cannon S.p.A.

- Zund Systemtechnik AG

- Atom S.p.A.

- Bauder Foam Products Inc.

- ESCO Group

- Laider International, Limited

- Delta-ModTech

- C R Clarke & Co. (UK) Ltd.

- PUMOTIX, Inc.

- HEGEL Automation GmbH

- IZMAC Makine

- Hygrade Components, Ltd.

- Sinotech Machinery Co., Ltd.

- Consew Inc.

- OMNI-TECH Inc.

- Shrinath International

- RotaPack, Inc.

- Elastron

Frequently Asked Questions

Analyze common user questions about the Polyurethane Cutting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between CNC Contour Cutting and Oscillating Blade Cutting for polyurethane?

CNC Contour Cutting offers superior complexity and precision for intricate 3D shapes, often utilizing 5-axis motion, making it ideal for automotive and aerospace components. Oscillating Blade Cutting is highly favored for speed and efficiency in processing large volumes of standard flexible foam slabs, such as those used in the bedding and furniture industries.

How is Industry 4.0 influencing the polyurethane cutting machine procurement process?

Industry 4.0, or smart manufacturing, drives procurement decisions toward machines with integrated IoT capabilities for remote monitoring, predictive maintenance, and seamless data integration with factory ERP systems. This shift prioritizes operational efficiency, uptime, and the ability to handle mass customization through flexible, interconnected production cells.

Which end-use industry contributes most significantly to the demand for polyurethane cutting machines?

The Automotive Industry, followed closely by the Furniture and Bedding sector, represents the largest contributors to market demand. Automotive requires high precision for complex interior safety components, seating, and NVH reduction, while the furniture sector drives high volume demand for efficient foam slab slicing and contouring.

Are waterjet or laser cutting technologies suitable for all types of polyurethane foam?

While highly precise, waterjet cutting is particularly suited for high-density, rigid foams or applications sensitive to thermal exposure, eliminating friction heat. Laser cutting is typically effective for very thin or specialized PU films and micro-components but can cause burning or melting in thicker, low-density flexible foams due to heat generation.

What factors are restraining the growth of the high-end automated cutting machine segment?

The primary restraint is the extremely high initial capital expenditure required for sophisticated, multi-axis CNC or robotic cutting systems. Additionally, the need for specialized software integration and highly skilled labor for operation and maintenance acts as a significant barrier to entry, particularly for smaller manufacturing entities.

The detailed analysis confirms that the Polyurethane Cutting Machines Market is fundamentally shaped by technological convergence, driven by the imperatives of precision manufacturing, material efficiency, and complete automation, ensuring the industry remains responsive to global demands for advanced polymeric components.

The integration of AI into process control and quality assurance represents the next major phase of technological evolution, promising to further minimize waste and maximize the utilization of high-cost foam materials, particularly in competitive markets like Asia Pacific. Manufacturers focusing on modular design, simplified user interfaces, and robust service networks are best positioned to capture market share across diverse geographical regions and end-use applications throughout the forecast period.

The increasing regulatory focus on energy efficiency and sustainability globally is simultaneously pushing innovation toward cleaner cutting methods, such as waterjet, and demanding greater accuracy to reduce waste, reinforcing the strategic importance of investing in cutting-edge polyurethane processing equipment for long-term competitive advantage in the global manufacturing landscape.

Further expansion into niche applications, such as specialized medical device components or acoustic insulation for emerging technologies, will depend heavily on the ability of machine manufacturers to deliver customized cutting solutions that handle novel, advanced foam formulations without compromising precision or throughput rates. Collaboration between foam material suppliers and equipment manufacturers will become increasingly essential to address these new material challenges effectively.

The market trajectory underscores the critical role of software sophistication; machines are increasingly purchased not just for their hardware capabilities but for their integrated nesting software and data analytics platforms, which provide measurable returns on investment by improving material yield and streamlining production workflow management.

The complexity and variety of polyurethane types—ranging from soft, open-cell flexible foams to dense, closed-cell rigid foams—mandate a flexible approach to machine design, ensuring that key players can offer a diverse portfolio of cutting mechanisms that meet specific material requirements while maintaining high levels of operational safety and energy efficiency. Global market leadership will continue to be defined by technological superiority and comprehensive after-sales service capabilities across major industrial hubs.

This market environment necessitates that vendors continuously update their product lines, incorporating advancements in sensor technology and machine tooling to stay ahead of competitive pressures. The lifecycle management of consumables, such as blades and nozzles, also plays a crucial role in operational cost reduction, making high-durability components a key selling point in procurement negotiations.

The overall market growth is intrinsically linked to the macroeconomic performance of key industrial consumers, particularly global automotive production figures and residential and commercial construction rates. Any sustained downturn in these sectors could temporarily restrain market growth, although the underlying trend towards automation and precision remains strong.

Focusing on the regional dynamics, the rapid technological catch-up observed in certain APAC economies is leading to intensified competition, pushing established European and North American firms to innovate faster, particularly in robotics and AI integration, ensuring their market offerings justify the premium pricing associated with superior engineering and advanced proprietary control systems.

The ongoing globalization of manufacturing supply chains means that end-users, such as major automotive companies, demand standardized equipment and service contracts across all their worldwide production facilities, providing an incentive for leading machine manufacturers to establish comprehensive global sales and support networks.

The strategic development of specialized cutting heads for handling composite materials, where polyurethane foam is often bonded to textiles, plastics, or metals, represents an important adjacent technological frontier. Machines capable of seamlessly processing these multi-layer structures without delamination or material damage command a premium in the market.

Looking ahead, the commitment to developing energy-efficient machines that reduce power consumption per cut piece will be a significant factor in addressing the rising energy costs faced by manufacturers globally, aligning technological innovation with pressing economic and environmental sustainability goals.

In summary, the polyurethane cutting machines market is characterized by high levels of automation, driven by the need for precision and efficiency in high-value component manufacturing across the automotive, construction, and furniture sectors, with AI and advanced CNC systems defining the future technological roadmap.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager