Polyurethane Enamelled Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436818 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Polyurethane Enamelled Wire Market Size

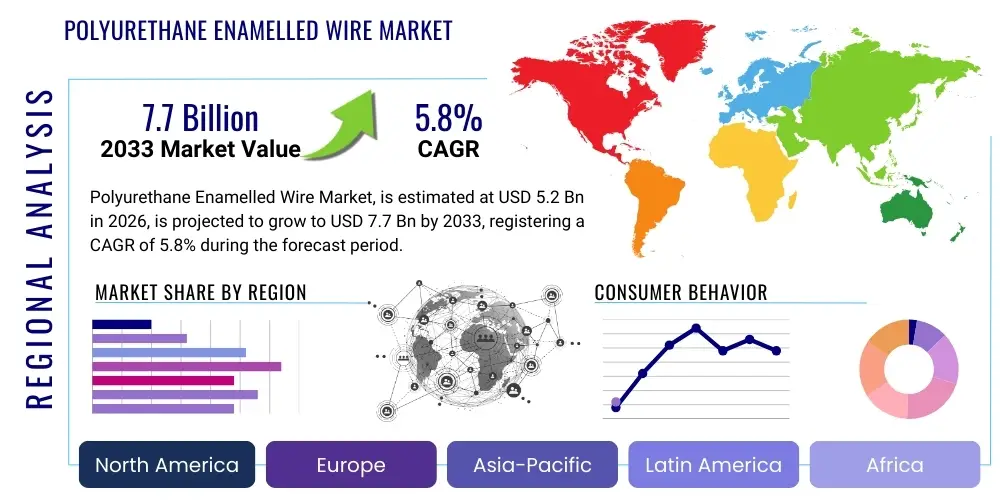

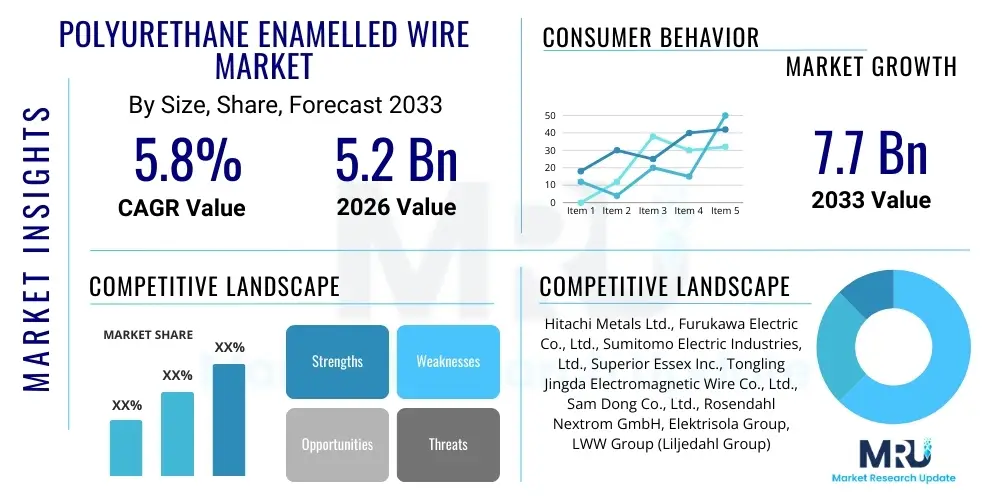

The Polyurethane Enamelled Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Polyurethane Enamelled Wire Market introduction

Polyurethane enamelled wire, often referred to as magnet wire or winding wire, is a specialized electrical conductor coated with a thin layer of polyurethane enamel insulation. This insulation provides excellent electrical properties, thermal stability, and, crucially, superior solderability without the prior removal of the insulation layer. This unique combination of characteristics makes polyurethane wire indispensable in applications requiring rapid assembly processes and high-density windings, such particularly prevalent in the manufacturing of miniaturized electronic components and intricate coil systems.

The product is fundamentally defined by its ability to maintain mechanical integrity and dielectric strength under operational stress, including high temperatures and voltage fluctuations. Major applications span across various critical sectors, including the automotive industry (e.g., sensors, small motors, solenoid valves), consumer electronics (e.g., speakers, headphones, chargers), and precision instruments (e.g., measuring devices, medical equipment). The ease of use, stemming from its direct solderability, significantly reduces manufacturing time and costs, offering a substantial benefit over conventional enamelled wires that require mechanical stripping or chemical treatment before termination.

Key driving factors accelerating the market growth include the global trend toward vehicle electrification and autonomous driving systems, both of which require high volumes of compact, high-performance electric motors and sensors. Furthermore, the relentless miniaturization in consumer electronics necessitates thinner, yet highly durable, winding wires. The shift towards renewable energy infrastructure, specifically in smart grid components and efficient transformers, also sustains robust demand for high-quality enamelled wires capable of operating reliably in varied environmental conditions, solidifying polyurethane wire’s position as a premium choice in precision electrical engineering.

Polyurethane Enamelled Wire Market Executive Summary

The Polyurethane Enamelled Wire Market is experiencing dynamic growth, driven primarily by technological advancements in high-efficiency electrical equipment and the pervasive global shift towards miniaturization across various end-use industries. Key business trends indicate a substantial emphasis on developing ultra-fine diameter wires (less than 0.1 mm) to meet the stringent requirements of micro-electronics and advanced sensor technology. Manufacturers are investing heavily in optimizing the enamelling process to ensure uniform coating thickness and enhance thermal resistance (e.g., increasing the thermal index from 130°C to 155°C), thereby catering to higher operating temperatures demanded by modern electric vehicle (EV) components and high-power density motors. Strategic alliances and mergers are becoming common as companies seek to secure stable supply chains for copper and integrate advanced process control systems to maintain product quality standardization across global facilities.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both consumption and production, spearheaded by robust manufacturing bases in China, South Korea, and Japan, particularly within the automotive electronics and consumer device sectors. North America and Europe demonstrate mature market characteristics, focusing on premium, specialized wires for high-reliability applications, such as aerospace, medical implants, and industrial automation where product performance and compliance with strict regulatory standards are paramount. Latin America and the Middle East & Africa are emerging markets, showing accelerated demand driven by infrastructure development projects, including smart grids and local assembly of electronic consumer goods, although they currently rely heavily on imports for specialized wire products.

Segment trends confirm that the finer diameter wires (0.1 mm to 0.5 mm) command the highest growth rate due to their critical role in audio equipment, miniature transformers, and charging coils. Application-wise, the automotive sector, specifically the production of sensors, actuators, and small DC motors for electric power steering and braking systems, remains the largest consumer, reflecting the massive ongoing investment in EV production globally. The segment dedicated to thermal ratings, particularly wires rated for 155°C (F Class) and higher, is expanding rapidly as engineers design systems that can dissipate heat more effectively and operate under more strenuous conditions, pushing the performance envelope beyond traditional polyurethane limitations.

AI Impact Analysis on Polyurethane Enamelled Wire Market

User inquiries regarding AI's influence in the Polyurethane Enamelled Wire Market center primarily on how advanced computation can revolutionize manufacturing precision, optimize material usage, and enhance quality control, specifically concerning coating uniformity and defect detection. Users are keen to understand how Machine Learning (ML) can predict coating thickness variations based on environmental factors (like humidity and temperature) during the enamelling process, thereby reducing waste and improving yields. Furthermore, there is significant interest in how AI-driven demand forecasting impacts supply chain management for key raw materials like copper rods and polyurethane resins. Another key thematic concern involves AI's role in the end-user markets, specifically how the proliferation of AI-driven electronics (e.g., high-performance computing, robotics) dictates new performance benchmarks, requiring polyurethane wires with higher thermal resistance and enhanced dielectric capabilities to manage increased power density.

- AI-driven optimization of the enamelling line to maintain precise coating thickness and minimize eccentricity, leading to superior quality control.

- Predictive maintenance using ML algorithms on winding equipment, reducing costly downtime and extending the lifespan of manufacturing assets.

- Enhanced supply chain resilience through AI forecasting of copper and chemical resin demand fluctuations, mitigating price volatility risks.

- Automation of complex winding processes in high-precision motor manufacturing, increasing efficiency and consistency in end-user applications.

- Simulation and design optimization of new polyurethane formulations using generative AI to achieve specific thermal and mechanical performance characteristics.

- AI-powered visual inspection systems for high-speed, non-destructive detection of minute pinholes or insulation flaws on the wire surface.

DRO & Impact Forces Of Polyurethane Enamelled Wire Market

The Polyurethane Enamelled Wire Market is significantly shaped by a powerful interplay of technological drivers and economic restraints, tempered by emerging market opportunities. The primary driver is the pervasive demand for miniaturization in electronic components, necessitating finer, high-performance wires that offer direct solderability, which polyurethane excels at providing. Simultaneously, stringent environmental regulations regarding the disposal of solvents and volatile organic compounds (VOCs) used in the enamelling process act as a substantial restraint, compelling manufacturers to invest in costlier, environmentally friendly coating technologies or shift towards water-based resins, which sometimes compromise performance characteristics. The dominant impact force is the fluctuating cost and availability of raw materials, particularly copper, which directly influences production costs and market pricing strategies. Opportunities are vast in the burgeoning electric vehicle (EV) sector and the global expansion of 5G infrastructure, both requiring massive quantities of specialized, high-temperature resistant polyurethane wire variants for motor windings and specialized inductors.

Drivers include the rapid adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), increasing the need for efficient windings in traction motors and charging systems. The continuous growth of the consumer electronics industry, particularly complex devices like smartwatches, hearing aids, and high-end audio systems, relies heavily on the compact nature and easy termination of polyurethane wire. Furthermore, advancements in specialized varnishes and insulation materials are allowing manufacturers to push the thermal boundaries of polyurethane enamel, making it suitable for previously inaccessible high-temperature applications, thus expanding its competitive range against polyesterimide and polyamide imide wires. These technological innovations ensure polyurethane remains a preferred material for high-volume, cost-sensitive, and fast-paced manufacturing environments.

However, the market faces headwinds from volatility in commodity prices, especially copper, which accounts for a significant portion of the final product cost, forcing constant price adjustments and inventory management challenges. Another critical restraint is the technical difficulty and capital investment required to manufacture ultra-fine wire diameters (sub-0.1 mm) with consistent quality and minimal defects. Furthermore, alternative insulation materials like polyesterimide are challenging polyurethane in specific high-thermal applications (>155°C), forcing polyurethane producers to continuously enhance their product formulation or risk losing specialized market share. Despite these challenges, the expanding global installed base of industrial automation and robotics presents a consistent long-term opportunity for polyurethane wire used in precision solenoid coils and sensors.

Segmentation Analysis

The Polyurethane Enamelled Wire Market is intricately segmented based on diameter, thermal class, and end-use application, providing detailed insight into targeted market demands and growth vectors. Segmentation by wire diameter is crucial as it directly relates to the level of precision required in manufacturing, distinguishing between heavy-duty industrial applications and ultra-fine electronic components. Thermal class segmentation reflects the operating environment requirements, with wires rated for 130°C and 155°C dominating, aligning with typical consumer and automotive electronics standards. Application segmentation reveals the market’s primary drivers, with automotive and consumer electronics consistently showing the strongest demand due to global trends in electrification and miniaturization. Analyzing these segments is essential for stakeholders to tailor production capabilities and marketing strategies effectively.

- By Diameter:

- Fine Diameter (Less than 0.1 mm)

- Medium Diameter (0.1 mm – 0.5 mm)

- Large Diameter (Greater than 0.5 mm)

- By Thermal Class:

- Class B (130°C)

- Class F (155°C)

- Class H (180°C - Modified Polyurethane/Polyesterimide blends)

- By Application:

- Automotive Electronics (Sensors, Solenoids, Small DC Motors)

- Consumer Electronics (Speakers, Headphones, Chargers, Inductors)

- Industrial Motors and Generators (Small Fractional Horsepower Motors)

- Transformers and Coils (Miniature and Medium Power Transformers)

- Instrumentation and Communication Equipment (Measuring Devices, Relays)

Value Chain Analysis For Polyurethane Enamelled Wire Market

The value chain for the Polyurethane Enamelled Wire Market commences with upstream analysis, focusing heavily on raw material suppliers. Key raw materials include high-purity electrolytic copper rod (the conductor core) and specialized chemical resins, primarily polyurethane-based lacquers, often dissolved in high-performance solvents. Copper rod processing involves drawing it down to the required fine gauge before it enters the enamelling stage. The quality and stable supply of these materials are paramount, as fluctuations in copper prices or resin quality directly impact the final wire's performance and cost structure. Chemical suppliers who can provide enhanced thermal-resistant or environmentally compliant (low-VOC) polyurethane resins hold significant leverage in the upstream segment, dictating innovation in insulation properties.

The midstream stage is dominated by the wire manufacturers, who perform the core processes of wire drawing, annealing, and continuous enamelling, where multiple layers of the polyurethane coating are applied and baked to achieve the precise insulation thickness and thermal index. This stage is capital intensive, requiring advanced drawing machinery and highly controlled baking ovens to ensure consistency and minimize pinholes or surface defects. Manufacturers focus intensely on achieving ISO and industry-specific certifications (like UL, NEMA) to guarantee product reliability. Distribution channels are typically a mix of direct sales to large Original Equipment Manufacturers (OEMs)—especially in the automotive and industrial sectors—and indirect sales through specialized industrial distributors who provide localized inventory, cutting services, and technical support to smaller component manufacturers (e.g., transformer winders, coil assemblers).

The downstream analysis centers on the end-users. Polyurethane enamelled wire is an essential input component for diverse industries, with component manufacturers being the direct buyers. These component manufacturers integrate the wire into devices like relays, motors, speakers, and transformers, which are then sold to final OEMs (e.g., Toyota, Samsung, Siemens). Direct sales are characterized by long-term contracts and highly customized product specifications, while indirect channels provide faster delivery and inventory convenience for standardized products. The increasing complexity and globalization of automotive and electronics supply chains necessitate robust logistical support and inventory management across the entire value chain, emphasizing the role of efficient and reliable distribution networks.

Polyurethane Enamelled Wire Market Potential Customers

Potential customers for Polyurethane Enamelled Wire are highly diversified across technology-intensive manufacturing sectors that require reliable, compact, and easily solderable electrical coils. The primary buyers are not the final product consumers but the intermediate component manufacturers and specialized assemblers. Key segments include automotive component suppliers, such as Tier 1 manufacturers specializing in sensors, electronic control units (ECUs), and small actuators (e.g., window motors, throttle body actuators, anti-lock braking solenoids). The drive toward vehicle lightweighting and electrification exponentially increases the demand from this sector, making it the most significant growth area for polyurethane wire consumption.

Another major customer base lies in the consumer electronics manufacturing segment. Companies producing audio equipment (e.g., voice coils for high-fidelity speakers and headphones), wireless charging coils, and miniature power supplies (adapters and chargers) are massive consumers of fine and ultra-fine diameter polyurethane wire due to its solderability and space-saving insulation properties. Furthermore, the industrial machinery sector, which produces small, fractional horsepower electric motors for robotics, CNC machines, and specialized industrial fans, represents a consistent and high-volume customer segment requiring standard thermal class wires for reliable long-term operation. The growth in smart home devices and IoT sensors further expands the customer pool requiring customized micro-coils.

In addition to these high-volume users, specialized industries like medical device manufacturing (e.g., MRI coils, miniaturized surgical tools, hearing aid components) and aerospace/defense (specialized relays and lightweight communication equipment) represent high-value customers. These buyers prioritize extremely tight tolerance manufacturing, high purity materials, and adherence to specialized quality standards, often requiring custom blends of polyurethane enamels designed for specific environmental resilience (e.g., vibration, extreme temperature cycling). The market research update table below provides essential market statistics and key data points relevant to strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd., Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., Superior Essex Inc., Tongling Jingda Electromagnetic Wire Co., Ltd., Sam Dong Co., Ltd., Rosendahl Nextrom GmbH, Elektrisola Group, LWW Group (Liljedahl Group), A. N. Deringer, Inc., Qingdao Hanhe Cable Co., Ltd., Tai-I Electric Wire & Cable Co., Ltd., REA Magnet Wire, Von Roll Holding AG, Fujikura Ltd., Zhaofeng Group, Shenyang Jinyuan Cable Group, Pioneer Industries, SWCC Showa Cable Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyurethane Enamelled Wire Market Key Technology Landscape

The manufacturing technology landscape for the Polyurethane Enamelled Wire Market is characterized by continuous process refinement aimed at increasing production speed, reducing energy consumption, and enhancing wire quality, especially for ultra-fine gauges. The core technology involves highly precise wire drawing and continuous horizontal or vertical enamelling lines. Modern drawing machines utilize diamond dies and sophisticated tension control systems to achieve diameters as fine as 0.01 mm without breakage, crucial for micro-electronics. The enamelling process employs high-efficiency thermal ovens with solvent recovery or catalytic converter systems to comply with increasingly strict environmental standards regarding VOC emissions. Closed-loop tension control, often integrated with laser micrometers, ensures highly consistent insulation thickness and minimal eccentricity along the entire length of the wire, optimizing the winding factor for end-user applications.

Material science innovation is equally vital, focusing on polyurethane resin formulations. Key technological advancements involve the incorporation of complex resin blends and nano-fillers to elevate the thermal index (up to 180°C), extending the wire's usability into high-stress applications previously dominated by polyimide or polyamideimide wires. This involves developing modified polyurethanes that offer superior resistance to hydrolytic degradation and chemical exposure, which is particularly important in oil-immersed transformers and automotive sensor environments. Furthermore, surface treatment technologies, such as plasma etching or specialized release agents, are being developed to improve the frictional characteristics of the wire, facilitating smoother, high-speed winding processes at the customer's manufacturing facility.

Automation and digitalization, central to the Industry 4.0 paradigm, are profoundly shaping the technological landscape. Modern production facilities integrate real-time monitoring and data analytics (enabled by AI/ML) across the entire production line—from copper drawing speed to oven temperature control and final inspection. This level of process control minimizes waste, predicts equipment failures (preventive maintenance), and allows manufacturers to trace quality parameters for every spool produced, meeting the rigorous traceability requirements of the automotive and aerospace industries. Investment in these high-precision, automated lines is essential for companies aiming to remain competitive, especially in high-volume production of the demanding fine-gauge wire segment.

Regional Highlights

- Asia Pacific (APAC): APAC commands the dominant market share, driven by its status as the global manufacturing hub for consumer electronics, automotive components, and industrial machinery. Countries like China, Japan, South Korea, and India host the largest production capacities for both enamelled wire and the end-use products. The rapid adoption of electric mobility and vast government investment in power grid expansion (smart grids, high-efficiency transformers) ensure APAC remains the fastest-growing and largest consuming region.

- North America: The market in North America is characterized by high demand for specialized, high-reliability polyurethane wires, particularly for aerospace, defense, and high-end medical equipment. While manufacturing volumes are lower than in APAC, the average selling price and focus on premium quality products (e.g., customized wires for high-frequency applications) remain high. The burgeoning EV manufacturing sector provides a strong, localized growth driver.

- Europe: Europe represents a mature market with stringent quality and environmental regulations. Demand is robust, stemming primarily from the sophisticated automotive industry (Germany, France, UK) and advanced industrial automation sectors. European manufacturers lead in the adoption of environmentally friendly, solvent-free enamelling processes, driving technological innovation in the formulation and application of low-VOC polyurethane resins.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth fueled by regional industrialization and investment in localized assembly plants for electronics and small appliances. Brazil and Mexico are key markets due to their automotive manufacturing bases and increasing domestic consumption of consumer goods, although much of the specialized wire is imported.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to infrastructure development projects, including regional power generation (transformers, distribution components) and nascent automotive manufacturing activities. Demand for polyurethane wire is increasing, but the market structure is heavily dependent on international trade and often prefers standard-grade products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Enamelled Wire Market.- Hitachi Metals Ltd.

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Superior Essex Inc.

- Tongling Jingda Electromagnetic Wire Co., Ltd.

- Sam Dong Co., Ltd.

- Rosendahl Nextrom GmbH

- Elektrisola Group

- LWW Group (Liljedahl Group)

- A. N. Deringer, Inc.

- Qingdao Hanhe Cable Co., Ltd.

- Tai-I Electric Wire & Cable Co., Ltd.

- REA Magnet Wire

- Von Roll Holding AG

- Fujikura Ltd.

- Zhaofeng Group

- Shenyang Jinyuan Cable Group

- Pioneer Industries

- SWCC Showa Cable Systems

- Precision Wire & Cable LLC

Frequently Asked Questions

Analyze common user questions about the Polyurethane Enamelled Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of polyurethane enamelled wire?

The primary technical advantage is its unique direct solderability, meaning the insulation melts away cleanly during the soldering process without requiring prior chemical stripping or mechanical removal, significantly accelerating manufacturing and assembly processes for small coils and components.

Which end-use application drives the highest demand growth for polyurethane wire?

The automotive electronics sector, particularly the rapid global transition to Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), drives the highest demand growth, as polyurethane wire is essential for sensors, solenoid valves, and compact motors requiring high reliability and ease of termination.

How does copper price volatility affect the polyurethane enamelled wire market?

Copper is the largest cost component of enamelled wire, often accounting for 70-80% of the material cost. Therefore, price volatility directly impacts manufacturers' profit margins, necessitates complex hedging strategies, and influences the final market pricing for wire products.

What is the key technological challenge in producing ultra-fine polyurethane wire?

The key technological challenge is maintaining precise, uniform insulation thickness and ensuring minimal defects (like pinholes) on wires less than 0.1 mm in diameter while achieving high production speeds, requiring specialized drawing equipment and advanced optical inspection systems.

How are environmental regulations impacting polyurethane wire manufacturing?

Environmental regulations, particularly concerning Volatile Organic Compounds (VOCs) used in solvents, force manufacturers to invest heavily in solvent recovery systems or transition towards more environmentally friendly water-based polyurethane enamels, affecting capital costs and process design globally.

This concludes the Polyurethane Enamelled Wire Market Insights Report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager