Polyurethane Idler Rollers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435226 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Polyurethane Idler Rollers Market Size

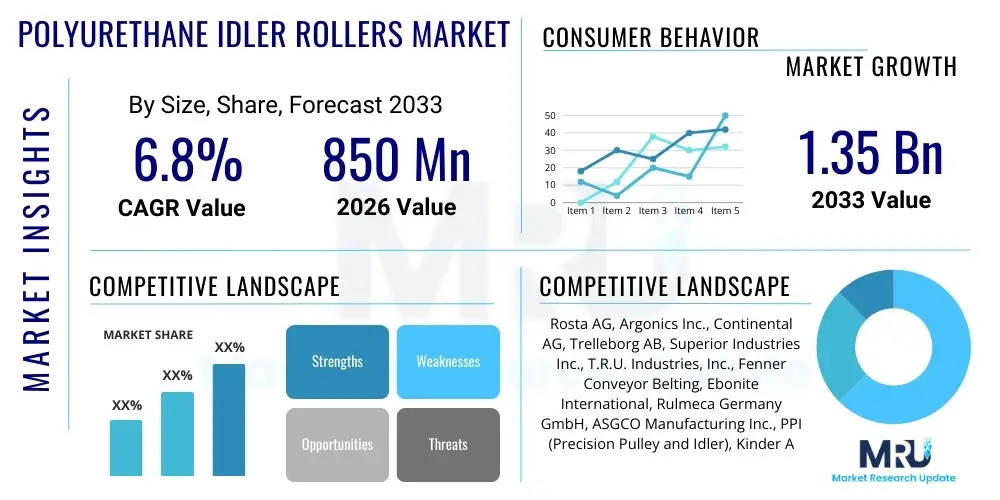

The Polyurethane Idler Rollers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1.35 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing automation across heavy industries such as mining, bulk material handling, and logistics, where high-performance components capable of withstanding severe operational stresses are paramount. Polyurethane’s inherent superior mechanical properties, including excellent abrasion resistance, high load-bearing capabilities, and superior chemical resilience compared to traditional materials like rubber or steel, solidify its indispensable role in modern conveyor and processing systems.

Market expansion is also significantly influenced by stringent operational safety standards and the industry’s persistent pursuit of minimizing maintenance downtime. Idler rollers are critical components in conveyor systems, ensuring the smooth and efficient transportation of materials. Failure of these components results in costly operational halts. Polyurethane idler rollers offer extended service life and reduced energy consumption due to their lighter weight and lower rolling resistance, directly addressing the core needs of industrial operators focused on efficiency and Total Cost of Ownership (TCO). The replacement cycle for traditional rollers migrating towards more durable polyurethane alternatives is a consistent revenue stream contributing to the forecasted growth.

Polyurethane Idler Rollers Market introduction

The Polyurethane Idler Rollers Market encompasses the manufacturing, distribution, and utilization of rollers constructed from polyurethane elastomers, specifically engineered for deployment in conveyor systems, processing machinery, and bulk material handling equipment. These rollers are designed to support and guide conveyor belts, absorb impact, and maintain belt alignment in demanding industrial environments. Polyurethane, recognized for its versatility and exceptional durability, provides a substantial improvement over conventional materials, exhibiting resistance to oils, chemicals, hydrolysis, and severe abrasive wear, which are common detractors in sectors like aggregates, chemicals, food processing, and automotive assembly. The product's enhanced lifespan translates directly into reduced operational expenditures and heightened productivity across various industrial applications, including heavy-duty mining conveyors, sensitive packaging lines, and specialized processing zones where non-marking properties are essential.

Major applications of polyurethane idler rollers span across industries requiring robust material conveyance. In the mining and construction sectors, they are crucial for handling abrasive ores and aggregates under heavy loads. In the logistics and warehousing domain, lighter-duty, non-marking polyurethane rollers ensure smooth package handling and sorting efficiency in automated systems. Furthermore, the food and beverage industry utilizes specialized FDA-approved polyurethane formulations for hygiene-sensitive processing lines. Key driving factors propelling market growth include the global surge in industrial automation adoption, particularly the expansion of high-speed conveyor systems, and the imperative for energy efficiency, which polyurethane rollers support by minimizing friction and operational drag. The increasing infrastructure development in emerging economies further amplifies the demand for durable material handling equipment.

Polyurethane Idler Rollers Market Executive Summary

The Polyurethane Idler Rollers Market is characterized by robust growth, propelled by sustained industrial digitalization and a pronounced shift towards material components offering superior longevity and reduced maintenance burden. Key business trends include vertical integration among major manufacturers to control raw material quality, particularly specialized polyol and isocyanate sourcing, and a strong focus on custom-engineered solutions tailored for specific industrial applications, such as high-temperature resistance or specialized anti-static requirements. Manufacturers are heavily investing in advanced casting and rotational molding technologies to ensure dimensional stability and concentricity, critical parameters for high-speed conveyor performance. Consolidation activities, particularly mergers and acquisitions targeting niche technology providers or strong regional distributors, are also shaping the competitive landscape, aiming to broaden global market reach and product portfolios.

Regionally, the Asia Pacific (APAC) continues to lead the market expansion, fueled by massive infrastructure projects, burgeoning manufacturing sectors in China, India, and Southeast Asian nations, and rapidly expanding e-commerce logistics networks requiring extensive material handling infrastructure. North America and Europe maintain significant market shares, characterized by demand for replacement components in mature industrial landscapes and strict compliance with safety and environmental regulations, pushing the adoption of high-efficiency, sustainable polyurethane compositions. Segment trends indicate a growing preference for high-impact absorption rollers within the mining segment and an increasing focus on lightweight, hygienic rollers in the food processing and pharmaceuticals sector, driving innovation in specialized coating technologies and material compliance. Overall, the market trajectory is strongly positive, underpinned by macroeconomic drivers favoring industrial efficiency and operational resilience.

AI Impact Analysis on Polyurethane Idler Rollers Market

Common user inquiries regarding AI's influence on the Polyurethane Idler Rollers Market frequently center on themes of predictive failure analysis, optimization of production processes, and the development of next-generation smart materials. Users are keenly interested in how Artificial Intelligence can utilize sensor data embedded near idler rolls (measuring vibration, temperature, and acoustic signatures) to predict component failure long before catastrophic breakdown occurs, thereby minimizing unscheduled downtime. Furthermore, there is significant curiosity about AI’s role in optimizing the complex chemical formulation and precise molding parameters necessary for achieving peak polyurethane performance characteristics, such as consistent durometer hardness and optimal adhesion to metal cores. Expectations revolve around AI-driven quality control ensuring zero-defect manufacturing and optimizing inventory management based on real-time operational demand and historical wear patterns across different geographic and industrial environments.

- AI facilitates Predictive Maintenance (PdM) programs by analyzing real-time vibration and temperature data from sensors installed near roller assemblies, significantly reducing unplanned conveyor stoppages.

- Optimized raw material blending and curing cycles using Machine Learning (ML) algorithms improve the consistency, durability, and performance characteristics (e.g., abrasion resistance) of the polyurethane elastomer.

- AI-powered visual inspection systems enhance quality control during manufacturing, automatically detecting microscopic defects and ensuring critical dimensional tolerances (concentricity, runout) are met.

- Enhanced supply chain management and demand forecasting for replacement rollers using ML models, optimizing stock levels based on predicted wear rates across diverse customer sites and operational loads.

- AI simulation tools accelerate the R&D cycle for novel polyurethane formulations, allowing engineers to virtually test material responses to extreme stress and environmental conditions.

DRO & Impact Forces Of Polyurethane Idler Rollers Market

The Polyurethane Idler Rollers Market is shaped by a confluence of accelerating drivers and persistent restraining factors, alongside compelling opportunities and profound impact forces. Key drivers include the global expansion of automated material handling systems, particularly in e-commerce fulfillment centers and bulk handling facilities, coupled with the inherent requirement for materials that offer superior wear characteristics and extend operational uptime. The restraint primarily stems from the higher initial capital expenditure associated with polyurethane rollers compared to standard rubber or PVC options, alongside the technical complexity involved in specialized molding and casting processes necessary to ensure flawless product quality. However, a significant opportunity lies in developing sustainable, bio-based polyurethane alternatives and integrating smart technologies (sensors and IoT capabilities) into rollers for real-time monitoring. The predominant impact forces include the increasing global emphasis on operational safety and environmental sustainability, mandating the use of durable, non-polluting components that reduce energy consumption and waste.

Drivers are strongly rooted in efficiency mandates across heavy industries. Mining operations, for instance, are increasingly moving towards high-capacity, high-speed conveyors where roller failure is catastrophic. Polyurethane's ability to handle high dynamic loads and severe abrasive attack makes it the preferred material solution, accelerating its adoption. Restraints also involve the challenge of specialized maintenance; while polyurethane rollers last longer, their repair or retreading requires specific expertise and equipment, sometimes leading end-users with limited technical resources to opt for easily replaceable, albeit less durable, alternatives. The global volatility in the price of key petrochemical feedstocks, such as toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), also poses a financial constraint for manufacturers, impacting final product pricing and market penetration strategies.

Opportunities are largely focused on technological differentiation. The development of segmented polyurethane rollers that allow for easy replacement of worn segments, rather than the entire roller, presents a strong value proposition for TCO reduction. Furthermore, penetrating niche markets, such as aerospace manufacturing where precision non-marking rollers are essential, offers high-margin growth avenues. The impact forces are continually pushing the market towards higher standards: global competition forces manufacturers to innovate rapidly, while regulatory scrutiny on industrial safety ensures that only the most reliable and robust components, like high-quality polyurethane idler rollers, gain long-term market acceptance, thereby setting a high barrier for new entrants.

Segmentation Analysis

The Polyurethane Idler Rollers Market is meticulously segmented based on key criteria including the type of application, the structural design, the end-use industry, and geographical region. This segmentation allows for precise market analysis and tailored strategic planning, recognizing the diverse demands placed upon these components across different industrial environments. By structural design, segments typically differentiate between flat idlers, V-return idlers, impact idlers (designed specifically to absorb high drop forces at loading zones), and troughing idlers, each serving a unique function in material handling. The material complexity and size of the rollers correlate directly with the pricing and performance attributes, necessitating distinct market strategies for each product category. Furthermore, the segmentation by end-use industry reflects the varying performance requirements, ranging from the need for high chemical resistance in the chemical processing sector to the necessity of non-contaminating, hygienic surfaces in the food and pharmaceutical industries.

- By Type:

- Troughing Idler Rollers (Standard, Heavy-Duty)

- Return Idler Rollers (Flat, V-Return)

- Impact Idler Rollers

- Self-Aligning/Training Idler Rollers

- Carrying/Flat Rollers

- By Application:

- Conveyor Systems

- Packaging Machinery

- Sorting and Distribution Systems

- Material Processing Equipment

- By End-Use Industry:

- Mining, Aggregates, and Cement

- Logistics, E-commerce, and Warehousing

- Food Processing and Beverages

- Automotive and Manufacturing

- Chemical and Pharmaceuticals

- By Manufacturing Process:

- Casting and Pouring

- Injection Molding

- Rotational Molding

Value Chain Analysis For Polyurethane Idler Rollers Market

The value chain for the Polyurethane Idler Rollers Market commences with upstream analysis, focusing heavily on the sourcing and compounding of crucial raw materials, primarily polyols (polyether and polyester types) and isocyanates (MDI/TDI). This initial stage is vital as the specific chemical structure of the prepolymer dictates the final properties of the roller, such as hardness (durometer), rebound, and thermal stability. Manufacturers often engage in strategic partnerships with petrochemical suppliers to ensure stable pricing and consistent quality of these raw inputs, which can be subject to high price volatility. Following raw material procurement, the chain moves through the intermediate process of polyurethane synthesis and specialized compounding, where additives (like UV stabilizers, anti-static agents, and colorants) are integrated to meet stringent application requirements. This preparation phase is crucial for achieving high-performance elastomers suitable for industrial roller applications.

The core manufacturing stage involves sophisticated techniques like precision casting, injection molding, or centrifugal casting onto prepared steel or aluminum cores, ensuring zero eccentricity and perfect balance, which are critical for high-speed operation. Quality control at this stage is intensive, involving non-destructive testing and dimensional inspection. Downstream analysis focuses on the distribution and end-user adoption. Distribution channels are varied, encompassing direct sales to large Original Equipment Manufacturers (OEMs) who integrate these rollers into new conveyor systems, and indirect sales through specialized industrial distributors and maintenance, repair, and overhaul (MRO) service providers who cater to the replacement market. Direct channels facilitate deep technical collaboration and customization, particularly for complex mining or automotive applications, while indirect channels provide the geographical reach necessary for servicing the fragmented MRO segment.

Effective value chain management hinges on maintaining traceability from the raw chemical batch to the final installed product, a necessity given the safety-critical nature of heavy industrial equipment. Optimization of the logistics segment, particularly for large, heavy rollers, is essential for minimizing transportation costs. Furthermore, after-market services, including technical support, installation guidance, and specialized roller retreading or repair services, represent a significant part of the downstream value proposition, fostering long-term customer relationships and securing recurring revenue streams. The competitive advantage often lies not just in the manufacturing quality but in the efficiency and speed of the distribution network and the technical competence of the service providers.

Polyurethane Idler Rollers Market Potential Customers

Potential customers for Polyurethane Idler Rollers are predominantly large-scale industrial operators and system integrators whose operational success depends heavily on the continuous, efficient movement of bulk or packaged materials. The primary end-users fall into sectors requiring high durability and minimal operational downtime under stressful conditions. This includes the global mining industry (coal, copper, iron ore), where idler rollers endure constant impact, abrasion from sharp materials, and harsh environmental exposure. Cement and aggregate producers also represent a core customer base due to the heavy-duty nature of their conveyance needs. These customers prioritize rollers with maximum impact absorption and resistance to wear, justifying the higher initial cost of polyurethane based on significantly reduced maintenance and replacement frequency, which drives down TCO over the equipment's lifespan.

A secondary, rapidly growing customer segment is the logistics, warehousing, and e-commerce fulfillment sector. These entities require rollers for high-speed sorting and distribution systems where precision, non-marking characteristics, and low noise levels are paramount. These customers demand consistent performance for high throughput, utilizing lighter-duty, high-precision polyurethane rollers that maintain gentle handling of packaged goods while minimizing energy consumption. Furthermore, specialized manufacturers, such as those in the automotive or tire industry, serve as important customers, requiring customized polyurethane rollers for specific processes like component transfer, painting, or tire curing, often necessitating specific chemical and temperature resistances tailored to their assembly lines. The purchasing decisions of these diversified customers are dictated by factors ranging from regulatory compliance and safety standards to raw productivity metrics and sustainability goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.35 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rosta AG, Argonics Inc., Continental AG, Trelleborg AB, Superior Industries Inc., T.R.U. Industries, Inc., Fenner Conveyor Belting, Ebonite International, Rulmeca Germany GmbH, ASGCO Manufacturing Inc., PPI (Precision Pulley and Idler), Kinder Australia, Maxam Tires, Polycorp Ltd., Vulkoprin n.v., Duraline, Belt Tech Industrial Inc., Rollers Inc., Conroy Elastomers Inc., Bando Chemical Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyurethane Idler Rollers Market Key Technology Landscape

The technological landscape of the Polyurethane Idler Rollers Market is defined by continuous innovation aimed at optimizing material performance, enhancing manufacturing precision, and integrating digitalization features. A critical area of advancement involves the chemistry of the polyurethane itself. Manufacturers are increasingly utilizing specialized polyether- or polyester-based formulations designed for specific extreme conditions, such as high-temperature environments (found in steel or cement plants) or applications requiring enhanced resistance to specific chemicals and hydrolysis. Advancements in dynamic curing systems and vacuum casting techniques are paramount to eliminate air entrapment and ensure uniform molecular cross-linking, resulting in a denser, defect-free elastomer layer that maximizes load-bearing capacity and abrasion resistance. The use of advanced computational fluid dynamics (CFD) modeling during the mold design process is also becoming standard to ensure optimal material flow and prevent internal stress points, which could lead to premature roller failure.

On the manufacturing front, the key technology lies in achieving and maintaining extremely tight tolerances for dimensional accuracy, especially concerning the Total Indicated Runout (TIR) and concentricity of the roller body relative to the bearing axis. Precision machining of the steel or aluminum cores, combined with highly controlled rotational molding or centrifugal casting processes, ensures that the rollers operate smoothly at high speeds without inducing excessive vibration or premature wear on the conveyor belt or bearings. Furthermore, the development of lightweight core materials, such as specialized composites or engineered plastics, encapsulated within the polyurethane shell, is a growing trend, aimed at reducing the overall weight of the idlers. This reduction directly translates to lower inertial resistance, significantly decreasing the power consumption required to drive the conveyor system, aligning with industry demands for energy efficiency.

The most transformative recent technological development involves the integration of smart technologies, moving polyurethane idler rollers from passive mechanical components to active data-generating assets. This includes embedding miniature IoT sensors (e.g., accelerometers, temperature probes) within the roller assembly, often non-invasively, to monitor operational health in real-time. These sensors communicate crucial data back to centralized maintenance systems, facilitating AI-driven predictive analytics that forecast potential failures based on subtle changes in vibration signatures or localized overheating. This technological leap provides end-users with unparalleled insight into conveyor health, drastically improving reliability, optimizing maintenance schedules, and solidifying the value proposition of premium polyurethane rollers over less sophisticated alternatives.

Regional Highlights

- Asia Pacific (APAC): The APAC region dominates the global market share and is projected to exhibit the highest growth rate, primarily driven by massive industrialization, rapid urbanization, and extensive infrastructure development across major economies like China, India, and Southeast Asia. Significant investment in mining, port operations, and the expansion of automated logistics and manufacturing facilities necessitate high volumes of durable idler rollers. The burgeoning e-commerce sector, demanding large-scale, high-speed automated warehouses, further accelerates the adoption of lightweight, precision polyurethane rollers in countries like Japan and South Korea.

- North America: This region is characterized by high replacement demand in mature industries and a strong focus on maximizing operational uptime. The adoption rate of high-performance polyurethane rollers is high, especially in resource extraction (oil sands, aggregates) and advanced manufacturing sectors. Regulatory pressure regarding worker safety and environmental impact drives the shift towards durable, low-maintenance components, justifying the investment in premium polyurethane solutions. Technological integration, particularly IoT and smart rollers for condition monitoring, is highly advanced here.

- Europe: The European market maintains a strong position, emphasizing quality, stringent adherence to CE safety standards, and environmental sustainability. There is significant demand from the automotive manufacturing sector, which requires specialized non-contaminating and highly reliable rollers for automated assembly lines. Innovation is focused on developing bio-based or recycled polyurethane formulations to comply with evolving circular economy initiatives, ensuring that material handling solutions are both efficient and environmentally responsible.

- Latin America (LATAM): Growth in LATAM is closely tied to the commodity super-cycle, particularly large-scale mining operations in Chile, Peru, and Brazil. These countries represent major consumers of heavy-duty impact and troughing idler rollers, where resistance to severe abrasion and high loads is non-negotiable. Political and economic stability can influence short-term investment cycles, but the underlying demand for reliable material handling in resource exports remains strong, favoring high-durability polyurethane products.

- Middle East and Africa (MEA): This region shows promising growth, fueled by investments in infrastructure projects, particularly port and logistics hubs in the UAE and Saudi Arabia, and continued expansion of mining activities in South Africa. The harsh desert climate in parts of the region necessitates polyurethane formulations with excellent UV and heat resistance, driving demand for specialized, high-specification products that can withstand extreme operational temperatures and high dust environments effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Idler Rollers Market.- Rosta AG

- Argonics Inc.

- Continental AG

- Trelleborg AB

- Superior Industries Inc.

- T.R.U. Industries, Inc.

- Fenner Conveyor Belting

- Ebonite International

- Rulmeca Germany GmbH

- ASGCO Manufacturing Inc.

- PPI (Precision Pulley and Idler)

- Kinder Australia

- Maxam Tires

- Polycorp Ltd.

- Vulkoprin n.v.

- Duraline

- Belt Tech Industrial Inc.

- Rollers Inc.

- Conroy Elastomers Inc.

- Bando Chemical Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Polyurethane Idler Rollers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific advantages do polyurethane idler rollers offer over conventional rubber rollers?

Polyurethane idler rollers offer superior abrasion and cut resistance, significantly higher load-bearing capacity, and excellent resistance to oils, solvents, and chemical degradation. This results in an extended service life—often three to five times longer than rubber—leading to drastically reduced maintenance costs and minimized conveyor downtime, making them highly cost-effective over the equipment's lifespan.

In which industries are high-impact absorption polyurethane idler rollers most essential?

High-impact absorption polyurethane idler rollers are critically essential in the mining, aggregates, and cement industries. These sectors involve handling large, heavy, and sharp bulk materials dropped onto the conveyor belt from height, requiring the polyurethane elastomer to absorb substantial kinetic energy to protect the conveyor structure and prevent damage to the belt itself, ensuring operational integrity.

How does the implementation of smart (IoT-enabled) polyurethane rollers improve conveyor system reliability?

Smart polyurethane rollers incorporate embedded sensors (IoT technology) that continuously monitor operational parameters such as vibration, temperature, and bearing health. By transmitting this real-time data to a centralized analysis platform, systems can use predictive algorithms to detect early signs of component wear or failure, enabling proactive maintenance scheduling and preventing catastrophic, unscheduled system shutdowns.

What are the primary factors driving the demand for polyurethane rollers in the logistics and e-commerce sector?

The demand is driven by the necessity for high-speed, high-throughput sorting systems that require non-marking, quiet, and extremely reliable components. Polyurethane rollers ensure smooth package transfer, reduce noise pollution in automated warehouses, and offer the dimensional precision required for accurate scanning and sorting operations, aligning perfectly with the demands of rapidly expanding e-commerce fulfillment centers.

Is the initial higher cost of polyurethane rollers justified for long-term industrial operations?

Yes, the higher initial capital outlay is typically justified by the superior Total Cost of Ownership (TCO). Polyurethane rollers reduce the frequency of replacement, minimize labor costs associated with maintenance and installation downtime, and contribute to lower energy consumption due to reduced rolling friction. These factors collectively deliver substantial long-term savings and improved operational efficiency, validating the premium pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager