Polyurethane Resin Modifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433500 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Polyurethane Resin Modifier Market Size

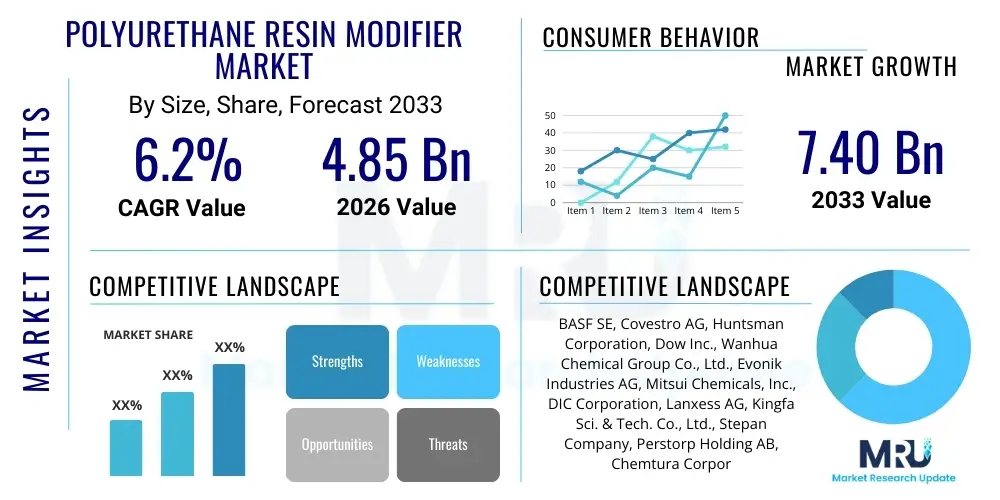

The Polyurethane Resin Modifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 7.40 Billion by the end of the forecast period in 2033. This significant expansion is fundamentally driven by the escalating demand for high-performance materials across crucial end-use sectors, particularly in infrastructure, construction, and automotive manufacturing. Polyurethane resin modifiers are vital components that enhance the mechanical, thermal, and chemical resistance properties of base polyurethane systems, allowing for customized material solutions tailored to specific industrial requirements. The shift towards durable, lightweight, and sustainable materials is a primary market accelerator, demanding innovative modifying agents that improve longevity and performance metrics.

Market expansion is also supported by increasing research and development activities focused on developing bio-based and sustainable modifiers. Regulatory pressure in regions such as Europe and North America mandates the reduction of Volatile Organic Compounds (VOCs) and the utilization of environmentally friendly formulations, compelling manufacturers to invest in novel modifiers that meet these stringent standards without compromising product efficacy. Furthermore, the rising adoption of polyurethane coatings, adhesives, and sealants (CAS) in emerging economies, fueled by rapid urbanization and infrastructural development projects, provides a robust foundation for market growth throughout the forecast period. The versatility and adaptability of modified polyurethane systems across various complex applications underscore the sustained high valuation and growth trajectory of this specialized chemical sector.

Polyurethane Resin Modifier Market introduction

Polyurethane Resin Modifiers are specialized chemical additives designed to significantly alter, enhance, or customize the physical and chemical attributes of primary polyurethane (PU) systems, including foams, coatings, elastomers, adhesives, and sealants. These modifiers, which include various polyols, chain extenders, cross-linkers, and nano-fillers, play a critical role in optimizing final product characteristics such as elasticity, hardness, tensile strength, abrasion resistance, fire retardancy, and UV stability. The fundamental principle is to fine-tune the polymerization process and resultant polymer structure to achieve properties specifically required by demanding end-use applications, ensuring superior performance and durability compared to unmodified resins.

Major applications of modified polyurethane resins span diverse high-value industries. In the automotive sector, modifiers are used to improve the durability and lightweight nature of interior components, seat cushions, and exterior protective coatings. The construction industry heavily relies on modified PU resins for high-performance insulation foams, durable roofing materials, and long-lasting sealants and adhesives, critical for energy efficiency and structural integrity. Furthermore, the electronics and aerospace industries utilize these modified systems for encapsulation, potting compounds, and specialized coatings requiring extreme temperature and chemical resistance. The primary benefit derived from these modifiers is the expansion of polyurethane's utility envelope, allowing it to compete effectively with traditional materials in highly regulated and harsh operating environments.

The market is primarily driven by the global imperative for resource efficiency and material optimization. Key driving factors include increasing government spending on infrastructure, the strong rebound in global vehicle production post-pandemic, and technological advancements enabling the commercialization of modifiers that improve processing speed and reduce manufacturing costs. Moreover, the inherent flexibility of polyurethane resin systems, combined with the precision offered by chemical modifiers, positions this market as essential to modern material science, facilitating innovations in flexible electronics, smart textiles, and advanced medical devices. The sustained demand for higher quality, longer-lasting products across the industrial spectrum guarantees continued innovation and market expansion for polyurethane resin modifiers.

Polyurethane Resin Modifier Market Executive Summary

The Polyurethane Resin Modifier Market is experiencing dynamic shifts, characterized by strong business trends centered on sustainability, technological specialization, and geographic diversification. A core trend involves the accelerated adoption of bio-based polyols and natural oil polyols (NOPs) as environmentally sound alternatives to traditional petrochemical derivatives, driven by corporate social responsibility mandates and consumer preference for green chemistry. This shift necessitates significant investment in R&D to maintain performance parity while ensuring ecological compliance. Furthermore, digitalization in manufacturing is prompting the development of modifiers optimized for enhanced cure rates and processability in automated, high-throughput production lines, increasing operational efficiency across coatings and adhesive manufacturing.

Regional trends indicate that the Asia Pacific (APAC) region dominates market consumption, primarily due to robust growth in the construction and manufacturing sectors in China, India, and Southeast Asian nations. This dominance is supported by favorable governmental policies promoting infrastructure development and rapid industrialization. Conversely, North America and Europe are market leaders in terms of technological innovation and high-value product differentiation, focusing intensely on specialized modifiers used in high-end applications like aerospace, medical devices, and electric vehicle (EV) battery encapsulation. Regulatory frameworks in these regions, particularly REACH in Europe, dictate product innovation, pushing manufacturers toward low-VOC and non-toxic formulations, creating a differentiated market for premium modifiers.

Segmentation trends highlight the increasing importance of functional additives, such as flame retardants and UV stabilizers, as end-use industries demand multi-functional performance from single material systems. In terms of application, the coatings segment maintains the largest market share, driven by protective and decorative requirements in automotive and architecture, followed closely by the adhesives and sealants segment, essential for structural bonding applications. The consistent rise in demand for flexible and rigid polyurethane foams, particularly in the insulation and furniture sectors, further solidifies the steady growth across all modifier segments, emphasizing the market's reliance on diverse additive types to customize final material properties efficiently.

AI Impact Analysis on Polyurethane Resin Modifier Market

Common user questions regarding AI's impact on the Polyurethane Resin Modifier Market frequently revolve around optimizing formulation speed, predicting material performance under specific conditions, and enhancing quality assurance processes. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can accelerate the notoriously lengthy R&D cycle of novel modifiers, asking whether AI can accurately predict the optimal ratio of components to achieve desired properties (e.g., tensile strength, flexibility, fire resistance) before physical synthesis. There is also significant concern and interest regarding the use of AI in streamlining complex supply chains, specifically predicting fluctuations in raw material costs (like isocyanates and polyether polyols) and optimizing inventory levels, ultimately leading to more predictable manufacturing costs and higher quality control. The key themes summarized from user queries focus on efficiency gains, predictive material science, and automation of quality management using computational tools.

The application of AI in this sector is revolutionizing how specialized chemical companies approach formulation science. AI algorithms, leveraging vast datasets from past experiments, molecular structures, and performance tests, can significantly reduce the number of physical iterations required to develop a new modifier. This predictive modeling capability allows manufacturers to efficiently screen thousands of potential component combinations, identifying the most promising candidates that meet stringent performance criteria and sustainability goals. For instance, ML models are increasingly deployed to model the correlation between modifier molecular structure and the viscoelastic properties of the resulting PU foam, dramatically cutting development time and resources.

Beyond R&D, AI enhances operational excellence throughout the production chain. In the manufacturing phase, AI-powered systems monitor reaction conditions in real-time, adjusting parameters such as temperature, pressure, and catalyst dosage to ensure consistent product quality and yield optimization. This capability is critical for high-volume, sensitive chemical synthesis processes inherent to producing polyurethane modifiers. Furthermore, the integration of AI in predictive maintenance protocols minimizes downtime of complex reactors and processing equipment. This holistic integration of AI, from initial molecular design to final quality control and logistical planning, solidifies its role as a fundamental driver of efficiency and innovation within the Polyurethane Resin Modifier Market.

- AI-driven Predictive Formulation: Accelerated R&D by predicting optimal modifier ratios and resultant polymer properties.

- Quality Control Automation: Real-time monitoring and adjustment of synthesis parameters for consistency and reduced batch variability.

- Supply Chain Optimization: ML algorithms forecast raw material price volatility and demand fluctuations, improving inventory management.

- Sustainable Material Discovery: AI screening identifies bio-based chemical candidates suitable for green modifier development.

- Process Efficiency Enhancement: Predictive maintenance schedules minimize equipment downtime and maximize production throughput.

DRO & Impact Forces Of Polyurethane Resin Modifier Market

The Polyurethane Resin Modifier Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping its future trajectory. A dominant driver is the unprecedented growth in the construction and infrastructure sectors globally, particularly in APAC and emerging markets, which necessitates high volumes of specialized coatings, insulation foams, and adhesives, all reliant on performance-enhancing modifiers. This is coupled with the continuous demand from the automotive industry, which requires lightweight yet durable modified PU systems to improve fuel efficiency and support the manufacturing requirements of electric vehicles. Technological advancements leading to the development of highly efficient and multi-functional modifiers further fuel market expansion, allowing customized solutions for extreme operational environments.

However, the market faces significant restraints that temper growth expectations. The most critical constraint is the inherent volatility in the pricing and supply chain of key raw materials, particularly crude oil derivatives used to manufacture polyols and isocyanates. These fluctuations directly impact the cost of production for modifiers, subsequently affecting the pricing structure of downstream products. Furthermore, increasingly stringent environmental regulations, especially those targeting VOC emissions and the disposal of petrochemical-based materials in developed regions, pose structural challenges, requiring costly modifications to manufacturing processes and substantial investment in compliance and sustainable alternatives.

Opportunities for market players are primarily concentrated in the realm of specialized product innovation and geographic expansion. The rising global focus on sustainability presents a major opportunity for companies pioneering the commercialization of bio-based, renewable, and environmentally friendly modifiers. Developing high-performance modifiers for niche applications, such as advanced fire-retardant systems for aerospace and high-durability coatings for maritime environments, offers premium market access. Furthermore, strategic capacity expansion in high-growth regions like Southeast Asia, coupled with targeted mergers and acquisitions, provides a pathway for increased market share and diversification, ensuring long-term profitability amidst regulatory and supply chain complexities.

Segmentation Analysis

The Polyurethane Resin Modifier Market is comprehensively segmented based on Type, Application, and End-Use Industry, allowing for a detailed understanding of market dynamics and specialized demand pockets. Segmentation by Type includes major chemical categories such as Polyols (which influence flexibility and hardness), Isocyanates (key curing agents), Chain Extenders (which control molecular weight and properties), and various Additives (like flame retardants, plasticizers, and UV stabilizers). This classification is crucial as the choice of modifier directly determines the final mechanical and chemical profile of the polyurethane system, catering to specific performance requirements ranging from rigid structural elements to flexible elastomeric parts. Understanding the demand drivers within each type segment is vital for manufacturers focusing on raw material production and specialized chemical synthesis.

- By Type:

- Polyols (Polyether Polyols, Polyester Polyols)

- Isocyanates (TDI, MDI)

- Chain Extenders and Cross-Linkers (Amines, Glycols)

- Functional Additives (Catalysts, Stabilizers, Nanomaterials, Plasticizers, Flame Retardants)

- By Application:

- Coatings

- Adhesives and Sealants (CAS)

- Elastomers

- Flexible and Rigid Foams

- Thermoplastic Polyurethanes (TPU)

- By End-Use Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Furniture and Bedding

- Electronics and Appliances

- Footwear and Textiles

- Aerospace and Marine

Value Chain Analysis For Polyurethane Resin Modifier Market

The value chain for the Polyurethane Resin Modifier Market initiates with upstream activities involving the procurement and production of basic petrochemical feedstock, primarily crude oil derivatives, which are processed into fundamental raw materials such as Propylene Oxide (PO), Ethylene Oxide (EO), and various aromatic amines. This upstream segment is highly concentrated, involving large petrochemical giants who supply these essential building blocks to modifier manufacturers. Efficiency and cost optimization at this stage are paramount, as raw material costs constitute a significant portion of the final product price. The manufacturing of the modifiers themselves constitutes the middle segment, where specialized chemical companies perform complex synthesis, compounding, and formulation processes to create specific polyols, performance additives, and specialized catalysts required to enhance PU resins.

The downstream segment involves the incorporation of these modifiers into final polyurethane systems. This phase includes the formulation of coatings, the production of rigid and flexible foams, and the compounding of elastomers used by end-user industries. Downstream manufacturers rely heavily on the consistent quality and specialized function provided by the modifiers to ensure their final products meet stringent industry standards, such as those governing structural integrity, fire safety, and environmental impact. The distribution channel structure is multi-faceted, utilizing both direct and indirect sales strategies. Direct sales are common for large-volume, highly customized orders, especially those supplied to major automotive or construction chemical producers, where technical support and specialized formulation assistance are required. Indirect channels, primarily utilizing regional distributors and chemical wholesalers, handle standardized, lower-volume products and ensure wide geographic reach, especially into smaller manufacturing operations globally.

Direct distribution offers tighter control over product delivery and technical service, building stronger partnerships between modifier producers and key integrators. Conversely, indirect distribution provides scalability and market penetration in fragmented regional markets. The competitive edge in distribution often lies in logistics efficiency, handling specialized chemical transportation requirements, and providing prompt technical advice. The overall profitability of the value chain is increasingly dependent on the ability of modifier producers to innovate using sustainable materials and maintain stable pricing amidst volatile upstream material costs, ultimately delivering customized performance solutions that justify a premium price point to the demanding end-use manufacturers.

Polyurethane Resin Modifier Market Potential Customers

The potential customers and primary end-users of Polyurethane Resin Modifiers are concentrated within high-value manufacturing and construction sectors that prioritize material performance, durability, and customization. The Construction and Infrastructure segment represents a cornerstone customer base, demanding modifiers for high-performance insulation foams (rigid PU foam) essential for energy efficiency in commercial and residential buildings, as well as durable coatings, roofing materials, and specialized joint sealants. These buyers require modifiers that enhance thermal stability, moisture resistance, and fire retardancy to comply with strict building codes and longevity expectations.

The Automotive and Transportation industry constitutes another critical group of potential customers. Manufacturers utilize modified PU resins extensively in vehicle components, including flexible foam for seating, interior trim parts, steering wheels, and high-abrasion-resistant coatings for chassis protection and body panels. With the ongoing global shift towards electric vehicles (EVs), there is rising demand for specialized modifiers used in potting and encapsulation compounds necessary for battery thermal management systems, demanding enhanced flame retardancy and thermal conductivity, thereby positioning EV battery manufacturers as rapidly emerging high-potential buyers.

Beyond these major sectors, significant consumption originates from the Furniture and Bedding industry (utilizing modifiers for viscoelastic and flexible foams), the Footwear and Textiles industry (relying on TPU modifiers for soles and performance wear), and the Electronics sector (where modified resins serve as crucial materials for encapsulation and protective coatings for sensitive electronic components). These diverse end-users collectively require modifiers that enable a wide spectrum of material properties, from extreme softness and flexibility to rigid, structurally supportive characteristics, confirming the broad market appeal and essential nature of these specialized chemical additives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 7.40 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group Co., Ltd., Evonik Industries AG, Mitsui Chemicals, Inc., DIC Corporation, Lanxess AG, Kingfa Sci. & Tech. Co., Ltd., Stepan Company, Perstorp Holding AB, Chemtura Corporation (now Lanxess), Lubrizol Corporation, Momentive Performance Materials Inc., Solvay S.A., Trelleborg AB, Tosoh Corporation, Shandong Dongda Chemical Industry Co., Ltd., Coim Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyurethane Resin Modifier Market Key Technology Landscape

The technological landscape of the Polyurethane Resin Modifier Market is rapidly evolving, driven primarily by the need for enhanced functionality, improved processability, and greater sustainability. A prominent technological development involves the incorporation of nanotechnology, utilizing specialized nanomaterials such as carbon nanotubes, nano-silica, and functionalized clay particles as modifiers. These nano-additives impart significant improvements in mechanical strength, abrasion resistance, and barrier properties (e.g., against moisture and gas permeation) at very low loading levels, drastically enhancing the performance profile of the final polyurethane resin system without compromising lightweight characteristics. This technology is particularly critical in high-specification applications like aerospace components and protective coatings where material integrity under extreme stress is essential.

Another major innovation focuses on sustainable and bio-based chemistry. This involves advanced synthetic routes for producing Polyurethane Resin Modifiers derived from renewable resources, such as natural oils (castor oil, soybean oil) and biomass fermentation products. The technological challenge lies in chemically modifying these natural polyols and isocyanates to achieve performance levels comparable to, or superior to, traditional petrochemical-based alternatives. Companies are investing heavily in catalysis technology and reaction engineering to achieve higher purity and consistent molecular structures in bio-based polyols, ensuring they can be reliably integrated into industrial-scale production of modified PU systems that comply with stringent environmental standards and consumer demand for green products.

Furthermore, significant technological progress is observed in the development of specialized curing agents and highly reactive cross-linkers that facilitate faster processing times (rapid cure systems). These advancements are crucial for sectors demanding high-speed manufacturing, such as continuous coating lines and automated adhesive dispensing systems. The implementation of latent catalysts and controlled-release additives ensures long pot life combined with rapid, on-demand curing, optimizing efficiency and reducing material waste on the factory floor. These technological leaps are fundamentally reshaping the modifier market by providing performance solutions that align with modern manufacturing demands for speed, precision, and environmental stewardship, thereby securing the market's relevance across diverse industrial applications.

Regional Highlights

The Polyurethane Resin Modifier Market exhibits substantial regional variation in terms of consumption, production capacity, and technological focus, reflecting differing industrial maturity and regulatory environments across the globe.

The Asia Pacific (APAC) region stands out as the primary market driver and largest consumer of polyurethane resin modifiers. This dominance is attributed to rapid and sustained growth in key end-use industries, including massive construction activities (residential, commercial, and infrastructure), expanding automotive manufacturing bases (especially in China and India), and burgeoning electronics production. Countries like China not only serve as major consumers but also as global production hubs for various raw materials and modified PU systems, supported by relatively lower manufacturing costs and increasing domestic technological prowess. The market here is characterized by high volume consumption and an accelerating shift towards implementing better quality standards, creating substantial growth opportunities for advanced modifier products.

North America and Europe represent mature markets defined by stringent environmental regulations and a strong emphasis on high-performance, specialized, and sustainable modifiers. In Europe, regulatory frameworks like REACH heavily influence product development, pushing companies towards bio-based polyols, low-VOC additives, and fire-retardant systems that avoid halogenated compounds. The regional market growth, while potentially slower in volume compared to APAC, is highly profitable, focusing on niche, high-value applications such as aerospace, medical implants, and premium automotive interiors. North America shows similar trends, with significant technological investment aimed at enhancing energy efficiency in building materials and supporting the rapid expansion of the Electric Vehicle sector, which demands specialized thermal management materials.

Latin America, and the Middle East and Africa (MEA), constitute emerging markets with promising growth potential. Latin America's market growth is tied to fluctuations in construction and mining sectors, demanding durable coatings and sealants. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in mega-infrastructure and diversification projects, driving demand for high-performance insulation foams and protective coatings suitable for extreme desert conditions. While these regions currently rely heavily on imports of advanced modifiers, increasing localization of manufacturing and infrastructural maturity are expected to bolster consumption rates over the forecast period, making them crucial areas for future expansion strategies.

- Asia Pacific (APAC): Dominates consumption driven by robust construction, infrastructure projects, and automotive production in China and India. Focus is on high-volume, general-purpose modifiers with improving quality standards.

- North America: Characterized by technological leadership, strong focus on sustainable and high-specification modifiers for EV battery components, construction insulation, and high-end consumer goods.

- Europe: Growth driven by stringent environmental compliance (low-VOC, bio-based), emphasizing modifiers for premium automotive, aerospace, and energy-efficient building applications.

- Latin America (LATAM): Growth tied to infrastructure development and industrial expansion, with increasing demand for resilient coatings and adhesives.

- Middle East & Africa (MEA): Emerging market growth fueled by government infrastructure investments, particularly in durable coatings and insulation materials designed for harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyurethane Resin Modifier Market.- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Wanhua Chemical Group Co., Ltd.

- Evonik Industries AG

- Mitsui Chemicals, Inc.

- DIC Corporation

- Lanxess AG

- Kingfa Sci. & Tech. Co., Ltd.

- Stepan Company

- Perstorp Holding AB

- Chemtura Corporation (now Lanxess)

- Lubrizol Corporation

- Momentive Performance Materials Inc.

- Solvay S.A.

- Trelleborg AB

- Tosoh Corporation

- Shandong Dongda Chemical Industry Co., Ltd.

- Coim Group

Frequently Asked Questions

Analyze common user questions about the Polyurethane Resin Modifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Polyurethane Resin Modifier?

The primary function of a Polyurethane Resin Modifier is to enhance or customize the physical and chemical properties of base polyurethane systems, improving aspects like mechanical strength, flexibility, thermal stability, adhesion, abrasion resistance, and chemical resistance for specific end-use applications.

Which application segment drives the largest demand for these modifiers?

The Coatings segment, encompassing protective and decorative finishes used extensively in automotive, construction, and industrial maintenance, currently accounts for the largest market share in terms of volume and value for polyurethane resin modifiers.

How are environmental regulations impacting the market for PU Resin Modifiers?

Environmental regulations, particularly in North America and Europe, are driving innovation towards sustainable, low-VOC (Volatile Organic Compound), and bio-based modifiers, compelling manufacturers to invest in natural oil polyols and non-toxic additives to ensure compliance and meet green market demand.

Which region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate due to accelerated urbanization, massive governmental infrastructure spending, and rapid expansion in manufacturing and automotive production bases, particularly in high-growth economies like China and India.

What role does nanotechnology play in the development of modern modifiers?

Nanotechnology is crucial for developing high-performance modifiers by incorporating nanomaterials (e.g., nano-silica, carbon nanotubes) to significantly boost mechanical performance, thermal resistance, and barrier properties of polyurethane resins at reduced material loading.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager