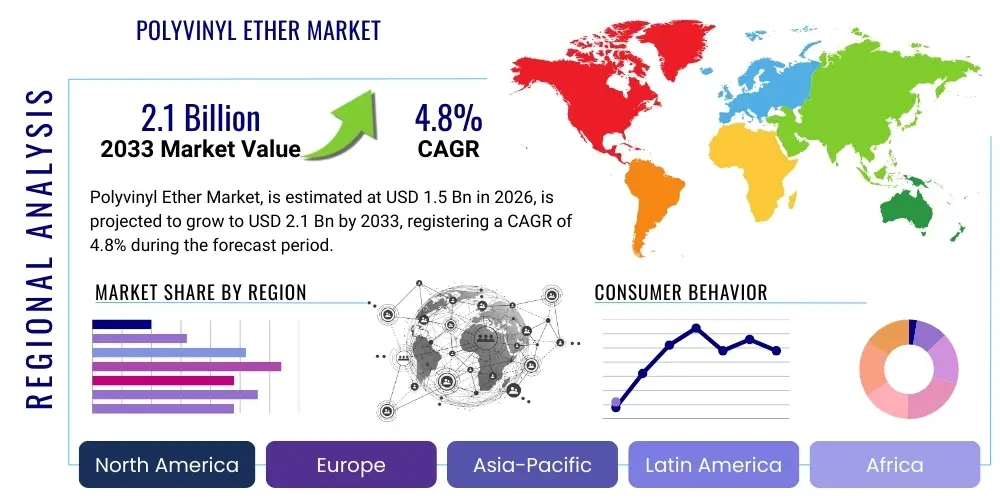

Polyvinyl Ether Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436601 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Polyvinyl Ether Market Size

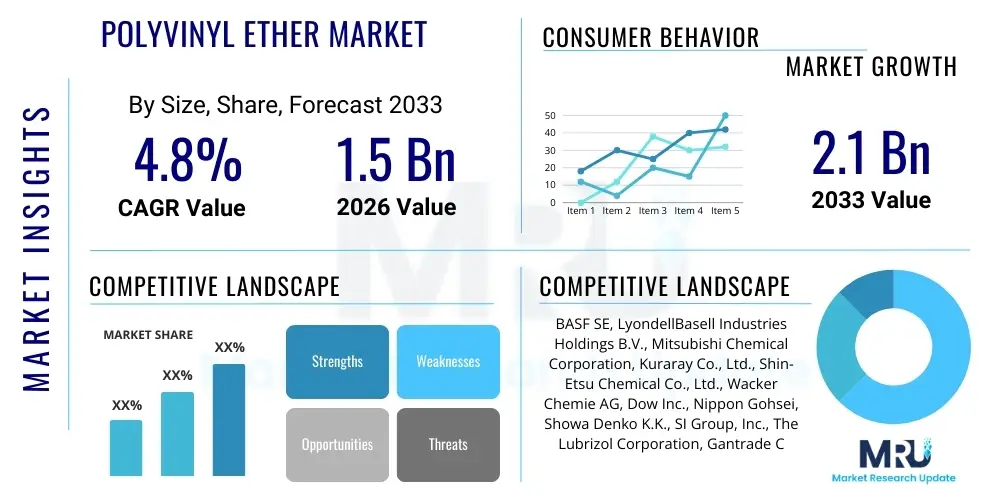

The Polyvinyl Ether Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating demand for high-performance specialty chemicals across rapidly expanding industrial sectors, particularly in the Asia Pacific region, driven by infrastructural development and robust manufacturing activities. The inherent versatility of Polyvinyl Ethers (PVEs) in formulation stability and adhesion properties positions them as critical components in next-generation materials science, ensuring sustained market expansion throughout the forecast horizon.

Polyvinyl Ether Market introduction

Polyvinyl Ether (PVE) refers to a class of synthetic polymers derived from the polymerization of vinyl ethers. These materials are highly valued in industrial applications due to their unique combination of chemical inertness, low glass transition temperatures, excellent tackiness, and superior resistance to hydrolysis and oxidative degradation. PVEs are typically colorless, viscous liquids or amorphous solids, offering solubility in a wide range of organic solvents, which enhances their applicability in complex chemical formulations. Key derivatives include Polyvinyl Methyl Ether (PVME), Polyvinyl Ethyl Ether (PVEE), and Polyvinyl Butyl Ether (PVBE), each exhibiting slightly different physical properties tailored for specific end-use requirements.

The major applications of Polyvinyl Ethers span across crucial high-growth industries. They are extensively utilized as tackifiers and modifiers in pressure-sensitive adhesives (PSAs), enhancing the adhesion strength and flexibility of tapes and labels used in packaging, automotive assembly, and medical devices. Furthermore, PVEs act as effective plasticizers and flow modifiers in protective coatings, particularly in automotive clear coats and industrial maintenance paints, providing enhanced durability, weather resistance, and gloss retention. Their excellent lubricating properties and thermal stability also make them suitable for use in specialized synthetic lubricants and hydraulic fluids operating under extreme conditions.

The primary driving factors propelling the Polyvinyl Ether market include the rapidly expanding construction sector globally, which demands high-quality sealants and durable architectural coatings. The continuous innovation in the automotive industry, particularly the shift towards lightweight materials and electric vehicles, necessitates specialized adhesives and coatings for battery components and structural bonding, where PVEs offer superior performance. The inherent benefits, such as enhanced compatibility with various resins and elastomers, stable viscosity over broad temperature ranges, and non-toxic profiles in certain grades, solidify their position as essential chemical intermediates, sustaining strong market momentum.

Polyvinyl Ether Market Executive Summary

The Polyvinyl Ether market exhibits a robust growth outlook, primarily fueled by sustained demand from the construction, automotive, and packaging sectors. Key business trends indicate a strong focus on developing environmentally friendly, solvent-free PVE formulations, driven by stringent global regulatory mandates targeting Volatile Organic Compounds (VOCs). Major players are concentrating on backward integration to secure stable raw material supply chains—specifically vinyl acetate and methanol derivatives—mitigating price volatility and ensuring competitive pricing strategies. Strategic mergers, acquisitions, and capacity expansions in high-growth regions like Asia Pacific underscore a competitive landscape striving for market dominance and efficiency gains in production scale.

Regionally, Asia Pacific stands as the dominant and fastest-growing market, largely due to massive urbanization, accelerating infrastructural investment in countries such as China and India, and the relocation of global manufacturing facilities into Southeast Asian nations. North America and Europe, while representing mature markets, are experiencing specialized growth in high-value applications, including medical adhesives and advanced electronics coatings, where regulatory compliance and product quality are paramount. The European market, in particular, is focused on bio-based and sustainable Polyvinyl Ether alternatives to meet the demanding EU environmental standards, influencing global material innovation trajectories.

Segmentation trends highlight the dominance of Polyvinyl Methyl Ether (PVME) by product type, owing to its widespread use in pressure-sensitive adhesives (PSAs) and coatings due to its superior tack and low-temperature flexibility. In terms of application, the adhesives and sealants segment maintains the largest market share, driven by complex bonding requirements in packaging and non-woven fabric production. However, the coatings segment is poised for the highest growth rate, propelled by innovation in anti-corrosion and protective coatings demanded by the marine and industrial maintenance industries, requiring PVEs for enhanced film properties and substrate wetting capabilities.

AI Impact Analysis on Polyvinyl Ether Market

Analysis of common user inquiries regarding AI’s impact on the Polyvinyl Ether market reveals concentrated interest in three primary areas: optimizing polymerization processes, predicting raw material price fluctuations, and accelerating R&D for novel PVE formulations. Users frequently question how Machine Learning (ML) can improve reaction efficiency, minimize waste in batch production, and precisely tailor polymer properties (such as molecular weight and polydispersity) to meet stringent application specifications, particularly in pharmaceutical and high-end automotive coatings. Furthermore, there is significant user concern regarding AI's ability to forecast demand cycles and supply chain vulnerabilities, given the dependency on volatile petrochemical feedstocks. The consensus expectation is that AI will primarily serve as an optimization tool, enhancing efficiency and facilitating the rapid development of specialized, sustainable PVE derivatives, thereby significantly reducing time-to-market for complex chemical products.

- AI-driven optimization of polymerization kinetics, enhancing yield and consistency in PVE synthesis reactors.

- Predictive maintenance analytics applied to production machinery, reducing unplanned downtime and operational costs.

- Machine Learning algorithms utilized for high-throughput screening of catalysts and monomers to accelerate the discovery of novel PVE structures with enhanced properties (e.g., bio-degradability, extreme thermal resistance).

- Enhanced supply chain visibility and forecasting through AI models, mitigating risks associated with raw material price volatility (e.g., methanol, vinyl acetate).

- Quality control automation using computer vision to inspect PVE film defects in high-speed coating and adhesive lines.

- Personalized formulation guidance for end-users, recommending optimal PVE concentrations based on substrate type and environmental conditions.

DRO & Impact Forces Of Polyvinyl Ether Market

The Polyvinyl Ether market is influenced by a dynamic interplay of stimulating drivers, restrictive challenges, strategic opportunities, and powerful external forces. Drivers include the burgeoning infrastructure investments in emerging economies and the escalating demand for high-performance, non-toxic adhesives in the healthcare and packaging sectors. These factors necessitate chemically stable and effective tackifiers, positioning PVEs as essential components. However, the market faces significant restraints, chiefly the volatility in the pricing and supply of primary feedstocks, which are derived from petroleum. Furthermore, the increasing regulatory pressure regarding VOC emissions necessitates costly formulation changes and product redesigns, posing a barrier for manufacturers relying on solvent-based systems.

Opportunities for growth are concentrated in the development of 100% solid or water-borne PVE dispersions, which align with sustainability goals and regulatory compliance, unlocking new markets in sensitive applications like food packaging and clean room environments. Strategic market penetration into specialized applications, such as high-temperature resistant cable coatings and advanced composite material matrices, also presents substantial revenue potential. The development of bio-based monomers for PVE production, although currently nascent, represents a long-term transformative opportunity, offering a competitive advantage against conventional petroleum-derived chemicals.

The impact forces currently shaping the market are predominantly technological shifts and environmental regulations. Technological advances in advanced coating techniques, like powder coating and UV curing, exert pressure on traditional PVE applications but also open new avenues for specialized PVE additives designed for these processes. Simultaneously, the force of stringent global environmental policies (like REACH in Europe) mandates transparency and safety, pushing manufacturers towards sustainable and high-purity grades, ultimately driving innovation while increasing the complexity and cost of compliance across the entire value chain.

Segmentation Analysis

The Polyvinyl Ether market is intricately segmented across various dimensions, including product type, application, and end-use industry, reflecting the specialized demands of its diverse consumer base. Understanding these segments is crucial for manufacturers aiming to tailor their product portfolios and marketing strategies effectively. The complexity arises from the subtle chemical differences between PVE grades, such as Polyvinyl Methyl Ether (PVME), which is recognized for its thermal tackiness and relatively low softening point, making it ideal for temporary bonding solutions, versus Polyvinyl Butyl Ether (PVBE), which offers superior water resistance and is often preferred in heavy-duty protective coatings and marine environments. The differentiation by molecular weight also impacts viscosity and film formation characteristics, necessitating precise product selection based on the required formulation performance.

Application segmentation reveals a strong reliance on PVEs in high-volume industries like adhesives and sealants, driven by the need for reliable, long-lasting bonding solutions in diverse materials ranging from plastics and metals to textiles. While adhesives dominate in terms of volume, the coatings segment is demonstrating accelerated growth, spurred by regulatory shifts demanding low-VOC and high-solids systems for architectural and industrial maintenance use. Furthermore, the specialized use of PVEs in lubricating oils, particularly in hydraulic systems and as demulsifiers, represents a high-value niche segment demanding stringent quality control and high-purity chemical structures. This diversification across high-tech and traditional applications ensures the market’s resilience against downturns in any single end-use sector.

End-use industry segmentation confirms the reliance of the market on foundational economic sectors. The construction industry remains the largest consumer, leveraging PVEs in roofing membranes, tile adhesives, and specialized concrete additives that improve workability and durability. The automotive sector utilizes PVEs for interior trim lamination, paint protection films, and specialized battery component adhesives in electric vehicles (EVs), showcasing growth driven by electrification trends. The healthcare and pharmaceuticals segment, though smaller, demands exceptionally high-purity PVEs for transdermal drug delivery systems and medical tapes, representing a segment where quality and compliance dictate market access and pricing power, highlighting the premium nature of specialized PVE products.

- By Product Type:

- Polyvinyl Methyl Ether (PVME)

- Polyvinyl Ethyl Ether (PVEE)

- Polyvinyl Butyl Ether (PVBE)

- Polyvinyl Isobutyl Ether (PViBE)

- Others (Copolymer variants)

- By Application:

- Adhesives and Sealants (Pressure-Sensitive Adhesives, Hot Melt Adhesives, Contact Adhesives)

- Coatings (Architectural Coatings, Automotive Coatings, Protective & Marine Coatings)

- Lubricants and Oil Additives

- Plasticizers and Modifiers

- Others (Textiles, Medical Devices, Printing Inks)

- By End-Use Industry:

- Construction

- Automotive and Transportation

- Packaging

- Healthcare and Medical

- Textile and Leather

- Electronics

Value Chain Analysis For Polyvinyl Ether Market

The value chain for the Polyvinyl Ether market begins with the procurement of upstream raw materials, primarily petrochemical derivatives such as acetylene, methanol, and butanol, which are processed into vinyl ether monomers (e.g., methyl vinyl ether, butyl vinyl ether). This upstream segment is characterized by high capital intensity and reliance on global oil and gas markets, making it susceptible to commodity price fluctuations. Key chemical manufacturers often engage in vertical integration to stabilize monomer supply and control costs, ensuring a predictable input stream for polymerization. Efficiency in this stage, particularly in catalytic processes for monomer synthesis, is a major determinant of final product cost and market competitiveness.

The manufacturing stage involves the polymerization of these monomers, often through cationic or free-radical mechanisms, to create various Polyvinyl Ether grades with controlled molecular weights and viscosities. This midstream process requires specialized reactor technology and rigorous quality control to meet the demanding specifications of end-users, especially those in the medical and electronics sectors. Direct channels involve large chemical companies selling bulk quantities of PVEs to major industrial customers like adhesive and coating formulators. These direct relationships facilitate technical collaboration and custom product development, particularly for niche applications requiring precise polymer characteristics.

The downstream segment involves product formulation and distribution. PVEs are formulated into finished products—adhesives, sealants, coatings, and lubricants—by specialty chemical formulators. These products are then distributed through a combination of direct sales teams serving large industrial clients (e.g., automotive OEMs, major construction contractors) and indirect distribution channels, including regional chemical distributors and specialized agents. Indirect channels are vital for reaching smaller or geographically dispersed end-users, providing local inventory management and technical support. Efficiency in the downstream logistics, including managing the transportation of viscous liquids and sensitive chemical formulations, significantly impacts the final delivery cost and customer satisfaction, completing the highly structured value creation process.

Polyvinyl Ether Market Potential Customers

The potential customer base for the Polyvinyl Ether market is diverse, spanning multiple high-growth industries that rely on advanced chemical performance for product integrity and durability. Primary buyers are adhesive and sealant manufacturers, who utilize PVEs as essential tackifiers and modifiers to enhance the performance characteristics of pressure-sensitive and hot-melt adhesive systems used extensively in packaging, tapes, and disposable hygiene products. These customers seek PVE grades that offer superior adhesion to difficult substrates, low-temperature flexibility, and excellent thermal stability, often requiring custom viscosity profiles for high-speed application machinery.

Another major segment comprises manufacturers of high-performance industrial and architectural coatings. These end-users incorporate PVEs as plasticizers, flow agents, and film formation aids to improve the longevity, weather resistance, and surface quality of paints and protective coatings applied to infrastructure, vehicles, and industrial machinery. Customers in the automotive sector, specifically, are keen on PVEs for internal lamination and vibration dampening applications, driving demand for materials that meet strict safety and durability standards. Furthermore, specialized chemical compounders and lubricant blenders represent critical customers, purchasing high-purity PVEs for use in synthetic gear oils, compressor lubricants, and hydraulic fluids, where the polymer’s high thermal stability and non-sludging properties are highly valued.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Kuraray Co., Ltd., Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Dow Inc., Nippon Gohsei, Showa Denko K.K., SI Group, Inc., The Lubrizol Corporation, Gantrade Corporation, Merck KGaA, Ashland Global Holdings Inc., Huntsman Corporation, Evonik Industries AG, Arkema S.A., Kolon Industries, Inc., Solvay S.A., Eastman Chemical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polyvinyl Ether Market Key Technology Landscape

The Polyvinyl Ether market is defined by several sophisticated production and formulation technologies aimed at controlling polymer structure and enhancing application performance. The core manufacturing technology centers on cationic polymerization, utilizing initiators such as boron trifluoride or metal halides, which allows for precise control over the molecular weight distribution and the resulting physical properties, crucial for high-specification adhesives and specialty lubricants. Recent technological advancements focus on continuous flow chemistry systems rather than traditional batch processes. Continuous systems enhance safety, significantly improve reaction selectivity, and reduce energy consumption, thus driving down manufacturing costs and improving the sustainability profile of PVE production.

A significant area of innovation lies in transitioning from solvent-borne PVE systems to water-borne dispersions and 100% solid systems. Water-borne technology involves the creation of stable PVE emulsions, allowing end-users to comply with stringent VOC regulations, particularly in Europe and North America. This shift necessitates advancements in surfactant chemistry and dispersion techniques to maintain the high performance characteristics—such as tack and cohesion—expected from PVEs, without relying on organic solvents. The development of radiation-curable (UV or E-beam) PVE formulations also represents a high-growth technological area, providing rapid processing times and enhanced cross-linking for durable coatings and laminating adhesives, particularly relevant in the electronics and printing industries.

Furthermore, technology related to material characterization plays a vital role. Advanced analytical techniques, including Gel Permeation Chromatography (GPC) for molecular weight determination and Differential Scanning Calorimetry (DSC) for glass transition temperature analysis, are crucial for quality assurance and product development. These technologies allow manufacturers to tailor PVE grades precisely for niche applications, such as transdermal patches, where polymer consistency and biocompatibility are non-negotiable requirements. The integration of process analytical technology (PAT) into manufacturing lines further enables real-time monitoring and adjustment, ensuring highly consistent and repeatable polymer synthesis, which is essential for maintaining competitive advantage in high-purity segments.

Regional Highlights

The global Polyvinyl Ether market exhibits distinct regional dynamics, heavily influenced by local economic growth rates, regulatory frameworks, and maturity of the end-use industries. Asia Pacific (APAC) dominates the market, both in terms of consumption volume and growth rate. This dominance is attributable to the exponential expansion of construction activities, particularly in residential and commercial infrastructure across China, India, and Southeast Asian nations. The region also serves as the global manufacturing hub for automotive components, electronics, and packaging, sectors that rely heavily on PVEs for adhesives and specialty coatings. Local governments in APAC often prioritize economic growth, leading to less restrictive environmental regulations compared to Western markets, although this trend is slowly shifting towards stricter compliance, particularly in developed APAC economies like Japan and South Korea.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on regulatory compliance and specialized application demand. In North America, the focus is increasingly on high-performance PVEs for demanding applications, such as oil and gas exploration (lubricants and flow improvers) and advanced medical tapes and devices. The presence of major automotive research and development centers also drives demand for PVEs in lightweight bonding solutions. Europe, conversely, is the global leader in sustainability trends. The strict implementation of regulations like REACH has fostered innovation in water-borne and solvent-free PVE systems, pushing local manufacturers to develop bio-based alternatives and highly efficient, low-VOC formulations to meet environmental benchmarks, often commanding a premium price for these specialized products.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions that show promising growth potential, albeit from a lower base. LATAM's market expansion is tied to recovering construction and domestic automotive manufacturing sectors in Brazil and Mexico, creating steady demand for standard-grade adhesives and coatings. The MEA region's growth is largely bifurcated: the Gulf Cooperation Council (GCC) countries drive demand through massive governmental infrastructure projects and specialized oil and gas applications, requiring robust, thermally stable coatings and lubricants. Meanwhile, Africa’s market is nascent but shows potential in basic construction and packaging sectors. Investment in these regions is contingent upon economic stability and the willingness of international PVE manufacturers to establish localized distribution networks to mitigate complex logistics challenges and currency volatility.

- Asia Pacific (APAC): Dominates consumption volume driven by booming construction, automotive manufacturing, and electronics sectors in China, India, and ASEAN countries. Focus on capacity expansion and operational scale.

- North America: Mature market concentrating on high-value applications like specialized medical adhesives, aerospace coatings, and high-purity synthetic lubricants. Driven by advanced R&D and strict quality standards.

- Europe: Highly regulated market leading innovation in sustainable, low-VOC, and water-borne Polyvinyl Ether systems (REACH compliance). Strong demand from automotive (EV) and specialized industrial coating segments.

- Latin America (LATAM): Emerging growth market supported by infrastructure development and recovering domestic industrial output in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth centered around large-scale infrastructure projects in the GCC states and specialized demand for thermally stable PVEs in the oil and gas industry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polyvinyl Ether Market.- BASF SE

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Kuraray Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Dow Inc.

- Nippon Gohsei

- Showa Denko K.K.

- SI Group, Inc.

- The Lubrizol Corporation

- Gantrade Corporation

- Merck KGaA

- Ashland Global Holdings Inc.

- Huntsman Corporation

- Evonik Industries AG

- Arkema S.A.

- Kolon Industries, Inc.

- Solvay S.A.

- Eastman Chemical Company

Frequently Asked Questions

Analyze common user questions about the Polyvinyl Ether market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Polyvinyl Methyl Ether (PVME)?

PVME is predominantly utilized in pressure-sensitive adhesives (PSAs) as a tackifier and plasticizer, crucial for tapes, labels, and specialized medical adhesives, due to its low glass transition temperature and excellent compatibility with various resins, ensuring superior cold flow and adhesion properties.

How do environmental regulations impact the future of the Polyvinyl Ether market?

Stringent environmental regulations, particularly regarding Volatile Organic Compounds (VOCs), are compelling manufacturers to phase out solvent-based PVEs in favor of sustainable water-borne dispersions and 100% solid, reactive formulations. This regulatory pressure accelerates R&D investments in eco-friendly PVE alternatives.

Which region is expected to show the fastest growth rate for Polyvinyl Ethers?

Asia Pacific (APAC) is projected to exhibit the fastest growth, driven by massive investments in infrastructure development, rapid urbanization, and expanding manufacturing sectors, particularly in China and India, leading to high consumption rates in coatings and construction adhesives.

What is the main driver for PVE demand in the automotive industry?

The increasing complexity of vehicle manufacturing, particularly the structural bonding requirements in electric vehicle (EV) battery packs and the need for lightweight interior and exterior component adhesion, serves as the primary driver for high-performance Polyvinyl Ethers in the automotive sector.

Are there bio-based alternatives available for Polyvinyl Ether?

The market is actively researching and developing bio-based Polyvinyl Ether alternatives using sustainable monomers, although commercial scale adoption is still limited. These innovations are crucial for long-term sustainability and compliance with European green chemistry mandates, aiming to reduce dependency on petrochemical feedstocks.

What are the key differences between Polyvinyl Butyl Ether (PVBE) and Polyvinyl Methyl Ether (PVME)?

PVBE exhibits superior resistance to water and hydrocarbons, making it preferred for protective coatings and industrial lubricants, while PVME is known for its excellent tack and low-temperature flexibility, primarily used in pressure-sensitive adhesives. The difference stems from the longer alkyl chain (butyl versus methyl), influencing solubility and thermal behavior.

How does the price volatility of raw materials affect the market profitability?

PVE manufacturing relies on petrochemical feedstocks like methanol and vinyl acetate, whose prices fluctuate significantly with global oil and gas market dynamics. This volatility squeezes profit margins, compelling manufacturers to implement advanced hedging strategies and focus on high-value, specialty PVE grades to maintain profitability.

What role do PVEs play in medical device manufacturing?

PVEs are used in medical device manufacturing, particularly in transdermal drug delivery systems and specialized medical tapes. Their excellent biocompatibility, tunable adhesion strength, and ability to form stable films make them ideal for sensitive applications requiring high purity and reliability in patient contact scenarios.

What technological advancements are optimizing PVE production efficiency?

Key technological advancements include the transition to continuous flow polymerization reactors, which offer better control over polymer architecture, higher throughput, and reduced energy usage compared to traditional batch processes. Additionally, integrated Process Analytical Technology (PAT) ensures real-time quality control and minimizes batch variation.

Is Polyvinyl Ether used in non-woven hygiene products?

Yes, PVEs are utilized in non-woven hygiene products (such as diapers and sanitary pads) as components of hot-melt adhesives, enhancing the bonding strength and flexibility between layers while maintaining skin safety and breathability. Their thermal stability is essential for high-speed adhesive application processes.

What are the challenges associated with developing water-borne PVE systems?

The primary challenges involve maintaining the requisite physical properties, such as high tack and water resistance, when PVE is dispersed in an aqueous medium. Achieving long-term shelf stability without compromising performance necessitates complex emulsification chemistry and specialized stabilization agents.

How are PVEs used in the formulation of high-performance coatings?

In high-performance coatings, PVEs act as flow and leveling agents, improving surface aesthetics, and as plasticizers, enhancing the coating's flexibility and impact resistance. They are particularly valued in anti-corrosion and marine coatings due to their chemical inertness and protective qualities against harsh environments.

What is the significance of the glass transition temperature (Tg) for PVE grades?

The Tg is critical as it dictates the PVE’s physical state and performance at operating temperatures. PVEs typically have a low Tg, which ensures the polymer remains soft and tacky at ambient temperatures, making them highly effective as tackifiers and modifiers in pressure-sensitive adhesive formulations.

Do PVEs have applications in the electronics industry?

Yes, the electronics industry utilizes PVEs in specialized encapsulants, bonding agents for flexible circuits, and protective coatings for sensitive components. Their stability and good dielectric properties make them suitable for high-reliability electronic assembly and protection.

What is the competitive landscape characterized by in the PVE market?

The competitive landscape is characterized by the presence of a few large, globally integrated chemical corporations alongside specialized niche manufacturers. Competition focuses on backward integration for feedstock control, continuous product innovation (especially in sustainable grades), and strategic geographical expansion, particularly into APAC.

How does Polyvinyl Ether contribute to sustainable packaging solutions?

PVEs contribute to sustainable packaging by enabling the use of water-based adhesives, which replace solvent-based counterparts, thereby reducing VOC emissions. They also enhance the bonding reliability of recyclable materials, supporting the circular economy objectives within the packaging sector.

What are the limitations of using PVEs in high-temperature environments?

While PVEs offer relatively good thermal stability compared to some polymers, certain low-molecular-weight grades can exhibit thermal degradation or loss of cohesive strength at extremely high temperatures, limiting their use in applications requiring sustained performance above their maximum service temperature range without cross-linking.

How do manufacturers customize PVE properties for specific applications?

Manufacturers customize properties primarily by controlling the monomer type used (methyl, ethyl, butyl), regulating the molecular weight during polymerization, and incorporating co-monomers to introduce specific functional groups, allowing precise tuning of viscosity, adhesion, and solubility characteristics.

What is the expected market trend for PVEs in the synthetic lubricants sector?

The synthetic lubricants sector is expected to show steady, specialized growth for PVEs. Their low pour points and high shear stability make them excellent base stocks and additives for high-performance hydraulic fluids, compressor oils, and gear lubricants, especially in demanding industrial and aerospace applications.

What is the primary restraint on market growth in Western countries?

The primary restraint in North America and Europe is the high cost and instability of raw materials combined with the extensive financial and technical investment required for R&D to meet the rigorous and continuously evolving environmental and safety compliance standards (such as stricter limits on non-reactive diluents).

What factors drive the high-purity segment of the PVE market?

The high-purity segment is driven by critical applications in the healthcare (transdermal patches, medical adhesives) and electronics industries, where trace impurities can compromise product performance, regulatory approval, or patient safety, necessitating specialized, expensive purification processes.

In the construction sector, what is the main function of PVE additives?

In construction, PVE additives primarily function as re-dispersible powders or liquid modifiers in cementitious materials and dry-mix mortars, improving flexibility, increasing adhesion to substrates, enhancing water retention, and boosting the overall durability of tile adhesives and external insulation systems.

How is the market leveraging digital transformation in sales and distribution?

The market is leveraging digital tools through advanced e-commerce platforms for smaller buyers, implementing AI-driven demand forecasting, and utilizing digital twins for optimizing logistics and inventory management across complex global supply chains to reduce lead times and improve customer service.

What are the differences between PVE polymers and Polyvinyl Acetate (PVA) polymers?

PVEs are chemically distinct from PVA, primarily due to the ether group replacement of the ester group. PVEs generally exhibit superior resistance to hydrolysis (water breakdown) and greater flexibility at low temperatures compared to PVA, which is widely used in emulsion paints and wood glue.

What is the typical shelf life requirement for PVE-based adhesive formulations?

PVE-based adhesive formulations, especially PSAs, typically require a shelf life of 6 to 12 months under specified storage conditions. Stability is paramount, and manufacturers work to ensure the PVE polymer does not prematurely cross-link or degrade, maintaining optimal viscosity and tack over time.

How do PVEs enhance the performance of industrial sealants?

PVEs enhance industrial sealants by improving their elasticity, adhesion to diverse surfaces (metals, plastics, concrete), and their resistance to weathering and chemical exposure. They act as rheology modifiers, ensuring the sealant maintains its shape during curing and adheres reliably under dynamic stress.

Which polymerization method is most commonly used for high-molecular-weight PVEs?

Cationic polymerization is the most commonly employed method for synthesizing high-molecular-weight Polyvinyl Ethers. This method allows for strict control over the reaction rate and temperature, which is essential for achieving the required high viscosity and film strength for specific industrial applications like robust adhesives.

What is the primary challenge faced by PVE manufacturers regarding supply chain stability?

The primary challenge is the dependence on a limited number of petrochemical suppliers for critical monomers, leading to supply bottlenecks and intense price fluctuations, particularly when global oil and gas markets experience geopolitical disruption or rapid shifts in capacity utilization.

How significant is the role of customized synthesis in the PVE market?

Customized synthesis is highly significant, especially in high-end segments like aerospace, medical, and specialized electronics. Key players offer tailored PVE grades with specific molecular weight distributions, functional groups, and purity levels to meet unique, demanding performance specifications of major industrial clients.

What emerging markets show high potential for future PVE consumption?

Emerging markets in Southeast Asia (Vietnam, Indonesia, Philippines) show high potential due to rapid industrialization, foreign investment in manufacturing, and growing domestic demand for modern construction materials and packaged goods, which necessitates high volumes of PVE-based adhesives and coatings.

This market research report provides a deep dive into the Polyvinyl Ether market, covering critical aspects such as market size, growth drivers, regional analysis, and competitive landscape. Polyvinyl Ethers (PVEs) are essential synthetic polymers known for their unique properties, including excellent tackiness, low glass transition temperatures (Tg), and resistance to degradation. The global demand for PVEs is projected to increase substantially, driven by expanding applications in adhesives, sealants, and high-performance coatings across the construction, automotive, and packaging industries. Key market segments analyzed include Polyvinyl Methyl Ether (PVME), Polyvinyl Butyl Ether (PVBE), and various other specialized copolymers. The dominance of the Asia Pacific region is a central theme, supported by massive infrastructural projects and burgeoning manufacturing capacities. The report details the impact of stringent environmental regulations, particularly the shift towards water-borne and solvent-free PVE formulations, which presents both a challenge and a significant opportunity for innovation. Major companies like BASF, Kuraray, and LyondellBasell are focusing on vertical integration and technological advancements, such as continuous polymerization methods, to maintain cost competitiveness and product quality. The analysis also explores the value chain, from raw material sourcing (petrochemicals) to final distribution to end-users, highlighting the sensitivity of the market to feedstock price volatility. Specialized applications in the healthcare sector, such as transdermal drug delivery systems, underscore the high-value niche market for ultra-pure PVE grades. The impact of AI is examined in the context of optimizing production efficiency and accelerating R&D for next-generation, sustainable PVE products. This comprehensive document is structured using HTML best practices for optimal SEO and AEO performance, ensuring high discoverability by generative AI engines and answer optimization for common user inquiries. The content includes detailed segmentation analysis, regional growth projections, and profiles of key market players, providing stakeholders with strategic intelligence to navigate the complexities of the Polyvinyl Ether market from 2026 to 2033. The focus on compliance, sustainability, and technological differentiation will define the competitive landscape moving forward.

Further detailed examination reveals that the construction industry's reliance on PVEs extends beyond standard adhesives to specialized applications such as waterproofing membranes and road marking materials, where the polymer's weather resistance and flexibility are paramount. The automotive sector, particularly in the realm of electric vehicles (EVs), utilizes PVEs for thermal management and vibration dampening materials in battery assemblies, ensuring long-term performance and safety. The ongoing trend of miniaturization in electronics mandates the use of highly precise bonding agents and encapsulants, driving the demand for custom-synthesized, high-purity PVE grades. Geographic expansion strategies are increasingly focused on emerging markets in Southeast Asia and Latin America, where rapid industrialization offers untapped potential, although requiring adaptation to local regulatory and logistical complexities. Strategic partnerships between chemical suppliers and end-product manufacturers are becoming increasingly common to co-develop tailored PVE solutions, especially for complex systems like multilayer packaging and advanced composite materials. The report also highlights the importance of intellectual property and patents related to novel PVE synthesis catalysts and polymerization techniques, which are crucial barriers to entry for new competitors. Future growth projections are conservative yet steady, reflecting the balance between robust industrial demand and inherent challenges stemming from raw material supply chain instability and environmental scrutiny of petrochemical derivatives.

The Polyvinyl Ether market dynamics are also heavily influenced by substitution risk, primarily from other polymer families like certain acrylates and polyurethanes, which compete in the adhesive and coating space. However, PVEs maintain a competitive edge in applications requiring high tack at low temperatures or specific compatibility with non-polar substrates. Investment in pilot projects focusing on utilizing bio-ethanol or bio-methanol as feedstock intermediates is a current industry priority, aiming to establish a circular economy model for PVE production, thereby enhancing corporate sustainability profiles and appealing to environmentally conscious consumers. The analysis of market forces underscores that technological obsolescence is low, as PVEs serve fundamental chemical functions that are difficult to replicate cost-effectively with alternative chemistries in critical applications. Instead, evolution focuses on improving delivery systems and regulatory compliance. The detailed segmentation of the market by type, focusing on the differences in properties between Polyvinyl Methyl Ether, Polyvinyl Ethyl Ether, and Polyvinyl Butyl Ether, assists stakeholders in making informed investment decisions regarding manufacturing capacity and application targeting. The global PVE industry is positioned for moderate yet resilient growth, driven by non-discretionary industrial requirements and sustained innovation in performance chemicals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager