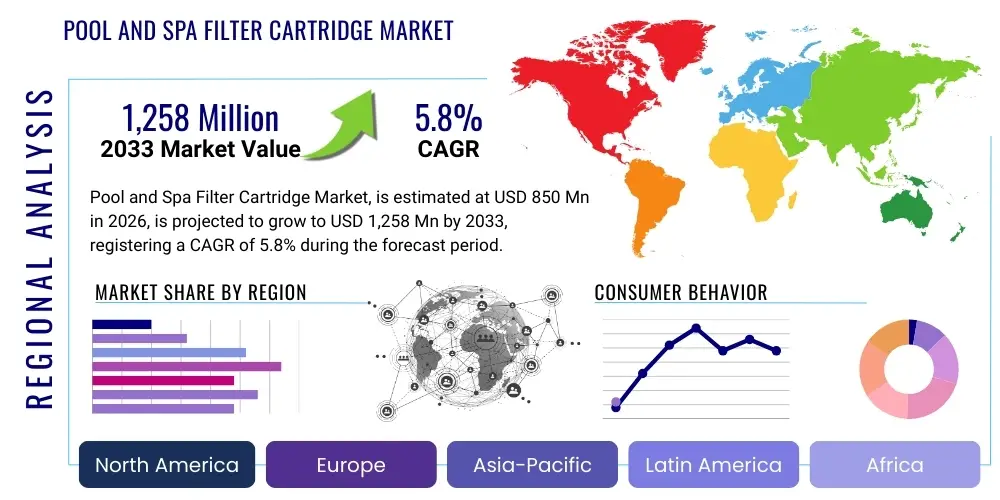

Pool and Spa Filter Cartridge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436579 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pool and Spa Filter Cartridge Market Size

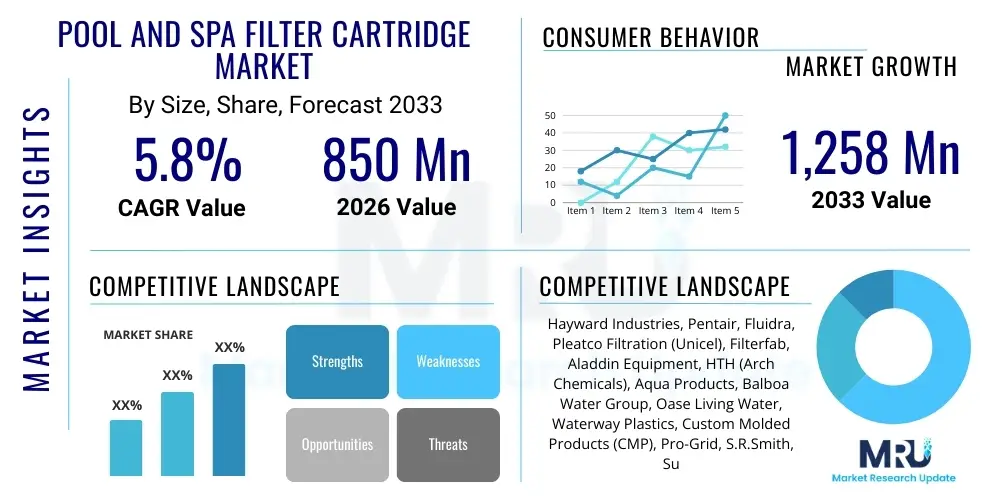

The Pool and Spa Filter Cartridge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,258 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by increasing urbanization, rising disposable incomes leading to higher adoption of residential pools and spas, and stringent public health regulations demanding superior water quality maintenance in commercial installations. The inherent advantages of cartridge filters, such as ease of maintenance and energy efficiency compared to traditional sand or diatomaceous earth (DE) filters, further solidify their market position and drive adoption across various geographical regions.

The valuation reflects robust demand stemming from the aftermarket segment, which constitutes the majority of sales due to the necessity of periodic cartridge replacement. While new pool construction contributes significantly to initial installation demand, the recurring revenue generated by replacement cycles provides stability and resilience to the market. Technological advancements focusing on enhanced filtration media, such as synthetic polyester and specialized cellulose blends offering higher dirt-holding capacity and longer service life, are contributing factors supporting the overall market expansion and the achievement of the projected forecast valuation.

Pool and Spa Filter Cartridge Market introduction

The Pool and Spa Filter Cartridge Market encompasses the manufacturing, distribution, and sale of replaceable filtration units essential for maintaining water clarity and hygiene in swimming pools, hot tubs, and spas. These cartridges, typically constructed from pleated fabric materials like polyester or cellulose, operate by trapping microscopic debris, oils, and particulate matter as water is pumped through the system, ensuring compliance with health standards and enhancing the aesthetic appeal of the water body. The product description centers on high surface area design, which allows for efficient capture of contaminants ranging from large sediments down to micron-sized particles, thus minimizing the use of chemical disinfectants and improving the overall water quality experience for users.

Major applications of these cartridges span both the residential and commercial sectors. Residential applications include backyard swimming pools and personal spas, where ease of maintenance and energy efficiency are key consumer priorities. Commercial applications are diverse, covering hotels, resorts, public swimming complexes, water parks, fitness centers, and therapeutic facilities. In commercial settings, the high flow rates and strict regulatory requirements necessitate reliable, high-performance filtration solutions, making durable, large-format cartridge systems preferred choices. The primary benefit derived from these products is the delivery of clean, sanitized water with reduced operational hassle compared to alternative filtration technologies.

The market is significantly driven by several macroeconomic and behavioral factors. A notable driving force is the global growth in leisure and wellness tourism, directly correlating with increased construction and renovation of hotels and resorts equipped with elaborate pool and spa amenities. Furthermore, heightened public awareness regarding waterborne illnesses and the importance of recreational water hygiene has compelled both homeowners and commercial operators to invest in superior filtration systems. The move towards environmentally sustainable pool management practices, favoring cartridge filters due to their water-saving characteristics (they require less backwashing compared to sand filters), also accelerates market adoption, solidifying the market's positive outlook throughout the forecast period.

Pool and Spa Filter Cartridge Market Executive Summary

The Pool and Spa Filter Cartridge Market is characterized by resilient business trends driven primarily by the aftermarket demand for replacement cartridges, coupled with an increased focus on product innovation aimed at extending filter life and improving filtration efficiency. Key business trends include the vertical integration strategies adopted by major manufacturers to control the supply chain from raw material sourcing (specialized filter media) to final distribution, enhancing quality control and reducing manufacturing costs. A substantial shift is observed towards sustainable manufacturing practices, with companies exploring recyclable or partially biodegradable filter materials, responding to growing consumer and regulatory pressure for eco-friendly products. Furthermore, digital engagement is transforming the business landscape, with e-commerce platforms and direct-to-consumer models capturing a growing share of the replacement market, optimizing inventory management and customer relationship strategies for regional distributors and national brands alike.

Regional trends indicate North America and Europe maintaining their dominance, primarily due to high household pool penetration rates and well-established maintenance cultures; however, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This explosive growth in APAC is attributed to rapid urbanization, increasing middle-class disposable incomes, and substantial investment in residential real estate and large-scale commercial leisure infrastructure, particularly in developing economies such as China, India, and Southeast Asian nations. Latin America and the Middle East and Africa (MEA) also represent burgeoning markets, propelled by favorable climatic conditions necessitating year-round pool maintenance and rising tourism development. These regional disparities dictate targeted marketing and distribution strategies focusing on localized product sizes and material specifications adapted to regional water chemistry and usage patterns.

Segment trends underscore the continued market leadership of pleated polyester cartridges, favored for their excellent balance of dirt-holding capacity, durability, and cost-effectiveness. However, the commercial segment is increasingly demanding higher-performance, specialty cartridges utilizing advanced synthetic media capable of handling heavier usage loads and finer particulate removal, often incorporating antimicrobial treatments. Within end-use sectors, the residential segment remains the largest volume driver, but the commercial segment commands higher average selling prices due to larger filter sizes and complex system requirements. The distribution landscape is seeing significant expansion in the specialized retail and online channels, which offer convenience and price transparency to consumers seeking replacement components, challenging traditional reliance on pool maintenance contractors for supply.

AI Impact Analysis on Pool and Spa Filter Cartridge Market

Common user inquiries concerning Artificial Intelligence (AI) in the pool and spa sector center on leveraging smart technology for predictive maintenance, optimizing filter lifespan, and automating water quality monitoring to reduce operational burden. Users frequently ask how AI can detect filter clogging or deterioration before performance drops significantly, inquiring about smart pool systems that can notify owners or service providers when a cartridge needs cleaning or replacement, thereby maximizing efficiency and minimizing downtime. There is also significant interest in AI-driven inventory management, ensuring distributors and service companies maintain optimal stock levels based on real-time usage data, seasonal variations, and geographical demand patterns, leading to faster service delivery and reduced stock-outs. The core theme summarized from this analysis is the expectation that AI integration will shift pool maintenance from reactive, time-based scheduling to proactive, condition-based servicing, dramatically extending the useful life of filter cartridges and improving overall system energy efficiency.

The implementation of AI algorithms in smart pool sensors and monitoring systems allows for continuous, highly granular analysis of water parameters, pump pressure differentials, and flow rates. These systems collect data that, when processed by machine learning models, can accurately predict the remaining effective life of a filter cartridge based on accumulated debris load, usage intensity, and environmental factors like algae growth potential. This level of predictive analytics is highly valuable for both residential users, who benefit from minimized maintenance surprises, and commercial operators, who must ensure continuous compliance and operational uptime. Furthermore, AI-driven automation minimizes human error in determining ideal replacement timing, ensuring the filter operates within peak efficiency parameters, thereby reducing energy consumption related to the pool pump trying to push water through an overly saturated medium.

For manufacturers and distributors, AI offers profound capabilities in demand forecasting and supply chain optimization. By analyzing historical sales data integrated with seasonal weather patterns, regional pool construction rates, and specific product return rates, AI models can refine production schedules and distribution logistics for filter cartridges. This sophisticated forecasting capability ensures that the right quantity of specific filter models (e.g., high-density commercial filters versus standard residential filters) is available in the correct regional distribution hubs, reducing waste, lowering storage costs, and significantly enhancing customer satisfaction through reliable component availability. Ultimately, AI fosters a more efficient ecosystem for filter cartridge manufacturing and maintenance services.

- AI-enabled Predictive Maintenance: Algorithms analyze pressure differentials and flow to accurately forecast cartridge replacement needs, minimizing unnecessary changes and maximizing service life.

- Optimized Water Quality Management: Machine learning models integrate sensor data to modulate pump cycles and chemical dosing, indirectly reducing strain on the filter system.

- Automated Inventory and Logistics: AI streamlines supply chain operations, predicting regional demand spikes for specific cartridge types, improving distribution efficiency.

- Enhanced Energy Efficiency: Smart pool systems use AI to optimize pump speed relative to filter condition, ensuring energy expenditure is minimized.

- Personalized Consumer Recommendations: AI assists retailers and service providers in recommending the optimal cartridge type and replacement schedule based on individual pool usage patterns.

DRO & Impact Forces Of Pool and Spa Filter Cartridge Market

The dynamics of the Pool and Spa Filter Cartridge Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting as powerful impact forces shaping the industry trajectory. The primary drivers include the consistent global growth in the construction of new pools, particularly in emerging markets, coupled with rising consumer emphasis on health and water sanitation. Technological opportunities, such as the development of long-life, self-cleaning, and specialized antimicrobial filter media, present avenues for premium market growth and differentiation. However, the market faces restraints such as the relatively short lifespan of conventional cartridges compared to permanent media like sand, leading to recurrent purchase costs that some consumers seek to minimize, alongside intense pricing pressure from low-cost generic manufacturers, particularly in the aftermarket segment. Managing these forces requires manufacturers to balance cost-effectiveness with performance innovation.

Key drivers strongly influencing demand include global warming trends, which extend the swimming season in many regions, thereby increasing the operational hours and necessary filtration cycles for pools and spas. Furthermore, stringent regulatory standards implemented by public health organizations regarding water clarity and particulate matter in public facilities necessitate the use of high-efficiency filtration components, often favoring cartridge systems capable of finer micron ratings. The growth of the aftermarket segment is an inherent driver, as every pool or spa installation creates a recurring demand loop for replacement cartridges, providing foundational revenue stability regardless of fluctuations in new construction activity. Moreover, the ease of handling and environmental benefits (reduced water wastage from backwashing) of cartridge filters, compared to alternative media, serve as a strong market impetus for both residential and commercial end-users.

Conversely, the market faces significant restraints. The disposable nature of most cartridges translates into ongoing operational costs for owners, which can be perceived as high compared to the longevity of sand filters, despite the latter's higher water waste and operational complexity. Another restraint is the increasing prevalence of counterfeit or low-quality generic replacement cartridges in online marketplaces, which can erode brand loyalty and compromise the performance of specialized filtration systems, leading to consumer dissatisfaction and potential damage to pool equipment. Addressing market opportunities requires significant investment in Research and Development (RD) to create next-generation filtration materials offering multi-season lifespans or incorporating smart features for real-time performance tracking. Opportunities are particularly pronounced in the development of specialized cartridges designed for saltwater pools and spas, which require media resilient to corrosive environments, offering a high-margin segment for innovation-focused companies.

Segmentation Analysis

The Pool and Spa Filter Cartridge Market is comprehensively segmented across several critical dimensions, including the type of filter media used, the material composition, the specific end-use application, and the channel through which the product is distributed. This segmentation provides a granular view of market dynamics, revealing varying growth rates and consumer preferences across different product categories and user groups. Segmentation by material is particularly vital, separating high-performance synthetic polymers like reinforced polyester from more traditional materials such as cellulose or specialized blends, each offering distinct advantages in terms of filtration effectiveness, durability, and cost profile. Understanding these segments is crucial for manufacturers to tailor their production lines and marketing strategies to specific high-growth niches, ensuring optimal product placement and pricing strategies.

The market structure highlights the significant role of the residential segment as the volume leader, favoring standard-sized, affordable replacement units, whereas the commercial segment, despite lower volume, drives innovation in large-format, high-capacity, and long-lasting filtration systems often incorporating proprietary media technology. Distribution channels are evolving rapidly, with the shift towards online retail simplifying the purchase of standardized replacement cartridges for homeowners, while specialized pool supply stores and professional service providers maintain dominance in the distribution of premium, complex, or customized commercial filters. This clear delineation across segments allows stakeholders to identify potential areas for market penetration and capital investment, particularly in segments showing accelerated adoption rates, such as specialized water treatment applications requiring ultra-fine filtration.

- By Filter Type:

- Pleated Cartridges (Dominant segment due to large surface area)

- Non-Pleated Cartridges (Niche applications)

- By Material:

- Polyester (Most common, durable, and affordable)

- Cellulose (High efficiency, often used in blends)

- Synthetic Blends and Specialty Materials (e.g., micro-fiber, antimicrobial treated)

- By End-Use:

- Residential Pools and Spas

- Commercial Facilities (Hotels, Public Pools, Water Parks, Institutional Facilities)

- By Distribution Channel:

- Offline Channels (Specialized Retail Stores, Pool Contractors, Hardware Stores)

- Online Channels (E-commerce Platforms, Direct Manufacturer Websites)

- By Size/Format:

- Standard Replacement Cartridges (Smaller residential units)

- High-Capacity Commercial Cartridges (Large industrial sizes)

Value Chain Analysis For Pool and Spa Filter Cartridge Market

The value chain for the Pool and Spa Filter Cartridge Market commences with upstream analysis focused on the procurement and processing of critical raw materials, primarily specialized synthetic fibers such as polyester spunbond, polypropylene, and cellulose, along with plastic components for end caps and inner core structures. Key upstream suppliers include petrochemical companies providing polymers and textile manufacturers producing the non-woven filter media. Efficiency at this stage relies heavily on securing stable, high-quality, and cost-effective supplies of polymer resins and ensuring the filter media possesses the correct porosity and tensile strength required for high-pressure pool environments. Innovations in sustainable sourcing, such as recycled plastics for end caps or biodegradable media components, represent a significant area for future upstream development and compliance with evolving environmental standards.

The midstream stage involves the core manufacturing processes: pleating the media to maximize surface area, assembling the cartridge with end caps and central cores, and rigorous quality testing. Manufacturers strive for automation in pleating and assembly to maintain precision and scalability. Downstream analysis focuses on getting the final product to the end-user. This stage is characterized by a multi-faceted distribution channel structure. Direct channels involve manufacturers selling high-volume commercial units directly to large facility managers or major pool builders. Indirect channels, which dominate the replacement market, rely heavily on wholesale distributors, specialized pool and spa retail stores, maintenance service contractors, and increasingly, major e-commerce platforms like Amazon and specialized online pool supply sites, leveraging rapid logistics for timely replacement delivery.

The distribution network complexity necessitates robust inventory management and regional warehousing capabilities, especially given the seasonal nature of pool usage in many markets. Pool service contractors act as crucial intermediaries in the indirect distribution stream, often recommending and installing replacement cartridges for residential clients, capitalizing on their expertise and established trust. The growth of online platforms has significantly empowered the average homeowner, enabling them to easily identify and purchase specific replacement models based on part numbers or dimensions, often bypassing traditional retail markup. This shift requires manufacturers to maintain excellent digital product catalogs and ensure strong brand visibility across digital marketplaces, optimizing product information for search engine relevance (AEO/GEO) to capture the high-volume replacement market efficiently.

Pool and Spa Filter Cartridge Market Potential Customers

Potential customers for pool and spa filter cartridges are broadly categorized into three major groups: residential homeowners, commercial facility managers, and specialized maintenance and repair service providers. Residential homeowners represent the largest volume segment, driven by the sheer number of private swimming pools and hot tubs globally. These buyers prioritize ease of installation, competitive pricing, and generally seek standard polyester pleated cartridges that offer a good balance of performance and affordability. Their purchasing decisions are often influenced by recommendations from pool builders or service technicians, but increasingly, they rely on readily available information and reviews found through online e-commerce channels, making digital accessibility and clear product descriptions paramount for manufacturers targeting this group.

Commercial facility managers, including those overseeing hotels, resorts, public aquatic centers, and institutional pools, constitute the highest value segment. These customers demand large-format, high-capacity cartridges designed for heavy, continuous usage and adherence to strict public health codes. Their purchasing criteria are centered on reliability, maximum dirt-holding capacity, extended lifespan, and the ability to maintain ultra-fine water clarity consistently. Procurement decisions in this sector are typically formalized, involving detailed specifications, vendor qualification, and long-term supply contracts, emphasizing the need for robust product warranties and reliable supply chain support from manufacturers to ensure operational uptime and regulatory compliance, particularly during peak seasons.

Pool maintenance and repair service providers act as crucial intermediaries and direct buyers, purchasing cartridges in bulk for their roster of client accounts. These professionals require a range of cartridge sizes and materials to service diverse equipment types and are keenly focused on stocking reliable products that minimize callbacks and enhance their service reputation. They often rely on specialized pool supply wholesale distributors for efficient inventory management and training on new filtration technologies. Manufacturers must cultivate strong relationships with these service providers, offering technical support and competitive pricing structures, as their endorsements significantly influence product adoption across both the residential and smaller commercial segments, acting as gatekeepers for brand acceptance within localized markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,258 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hayward Industries, Pentair, Fluidra, Pleatco Filtration (Unicel), Filterfab, Aladdin Equipment, HTH (Arch Chemicals), Aqua Products, Balboa Water Group, Oase Living Water, Waterway Plastics, Custom Molded Products (CMP), Pro-Grid, S.R.Smith, Sunbelt Spas, Filbur Manufacturing, Pure N Clean, Quality Pool Products, Septek Filter, Darlly Filtration Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pool and Spa Filter Cartridge Market Key Technology Landscape

The technology landscape within the Pool and Spa Filter Cartridge Market is continually evolving, driven by the imperative to achieve finer particulate filtration, extend service life, and simplify maintenance for the end-user. A key technological focus is the advancement in filter media composition. Modern cartridges increasingly utilize tri-blend or specialty micro-fiber media, moving beyond standard polyester to achieve higher micron ratings (down to 5-10 microns) without significantly sacrificing flow rate or dirt-holding capacity. This specialization often involves blending synthetic fibers with treated cellulose to improve structural rigidity and chemical resistance, particularly crucial in environments utilizing harsh sanitizers like ozone or high concentrations of chlorine. Furthermore, patented pleat geometry and increased pleat count designs are utilized by leading manufacturers to maximize the effective filtration area within standardized cartridge dimensions, ensuring peak performance between cleaning cycles and extending the overall life cycle of the product.

Another significant technological advancement involves the integration of functional additives and coatings. The incorporation of antimicrobial technologies, such as silver ion treatments or specialized surface coatings, is becoming increasingly common. These additives inhibit the growth of bacteria, mold, and mildew on the surface of the cartridge media, which not only improves hygiene but also prevents biofilm formation that can lead to reduced flow and inefficient filtration. This antimicrobial protection is especially critical in high-temperature spa environments and heavily used commercial pools. Additionally, manufacturers are developing specialized end cap materials—often reinforced polymers—that resist warping, chemical corrosion, and UV degradation, which are common failure points, thereby enhancing the structural integrity and durability of the entire cartridge unit under sustained operational pressure.

The market is also witnessing the preliminary integration of IoT (Internet of Things) and smart technology directly linked to the filtration process, creating opportunities for truly proactive pool management. While the cartridges themselves are passive components, the surrounding filter housing and pump systems are becoming "smart." Pressure sensors, flow meters, and conductivity probes communicate data wirelessly to cloud platforms, allowing AI algorithms to monitor filter performance in real-time. This technology enables remote diagnostics, sending alerts when the pressure drop indicates excessive clogging, thereby providing precise, condition-based instructions to the user or service technician to clean or replace the cartridge, optimizing both labor efficiency and cartridge lifespan. This technological synergy between passive media and active monitoring systems represents the future standard for high-end pool and spa filtration.

Regional Highlights

- North America (NA): North America represents the largest and most mature market for pool and spa filter cartridges, characterized by high rates of residential pool ownership, robust maintenance culture, and stringent state-level health regulations governing public pools. The region is a primary consumer of premium, long-life cartridge systems, driven by strong aftermarket demand for replacements. Key market relevance lies in its role as an early adopter of smart pool technologies and high-efficiency filtration media, commanding higher average selling prices compared to other regions. The United States and Canada are the dominant consumers, with high urbanization rates and disposable incomes supporting significant leisure investments.

- Europe: Europe constitutes a stable and sizable market, particularly strong in replacement demand across Southern European countries (Spain, France, Italy) known for their high concentration of tourist resorts and residential pools. The market is highly regulated, particularly by the European Union's REACH and public health directives, which emphasize environmental performance and material safety, driving demand for compliant and sustainable filtration media. Germany and the UK contribute significantly through the thriving spa and wellness sector, which relies on consistent, high-purity water filtration.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid expansion in residential construction, increasing affluence in countries like China, India, and Australia, and massive infrastructure development in tourism and hospitality sectors (e.g., Southeast Asia). While currently lower in terms of absolute market value than NA or Europe, the rapid growth trajectory, driven by new pool installations and the gradual shift away from less efficient traditional filtration methods, makes it the key region for future investment and capacity expansion for cartridge manufacturers.

- Latin America: This region shows steady growth, particularly in Brazil and Mexico, where favorable climate conditions support year-round pool usage. The market is highly sensitive to economic stability but benefits from strong domestic tourism and growing middle-class segments investing in personal leisure amenities. Demand tends to focus on cost-effective, durable replacement solutions that can withstand regional water quality challenges.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) states due to large-scale luxury resort construction (e.g., UAE, Saudi Arabia) and the necessity for effective filtration in high-temperature, dusty environments. The market demands robust, heat-resistant cartridges, with consumption closely tied to the massive expansion of the hospitality and residential leisure sectors driven by government diversification projects aimed at tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pool and Spa Filter Cartridge Market.- Hayward Industries

- Pentair

- Fluidra

- Pleatco Filtration (Unicel)

- Filterfab

- Aladdin Equipment

- HTH (Arch Chemicals)

- Aqua Products

- Balboa Water Group

- Oase Living Water

- Waterway Plastics

- Custom Molded Products (CMP)

- Pro-Grid

- S.R.Smith

- Sunbelt Spas

- Filbur Manufacturing

- Pure N Clean

- Quality Pool Products

- Septek Filter

- Darlly Filtration Equipment

Frequently Asked Questions

Analyze common user questions about the Pool and Spa Filter Cartridge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Pool and Spa Filter Cartridge Market?

The Pool and Spa Filter Cartridge Market is projected to grow at a CAGR of 5.8% between 2026 and 2033, driven by increasing residential pool installations and high replacement demand in the aftermarket.

Which type of filter cartridge material dominates the market segment?

Pleated polyester cartridges currently dominate the market due to their optimal balance of cost-effectiveness, high dirt-holding capacity, durability, and robust performance across both residential and commercial applications.

How does Artificial Intelligence (AI) influence filter cartridge lifespan and maintenance?

AI, integrated through smart pool systems, analyzes real-time pressure and flow data to provide predictive maintenance alerts, accurately forecasting the optimal time for cleaning or replacing a cartridge, thereby maximizing its service life and ensuring energy efficiency.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, primarily fueled by rapid urbanization, substantial growth in the tourism and hospitality sector, and rising disposable incomes leading to increased new pool construction.

What are the primary advantages of cartridge filters over sand or DE filters?

Cartridge filters offer superior water conservation, requiring significantly less backwashing than sand filters, and they provide finer filtration (typically down to 10-20 microns) compared to sand, leading to cleaner water and lower operational water costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager