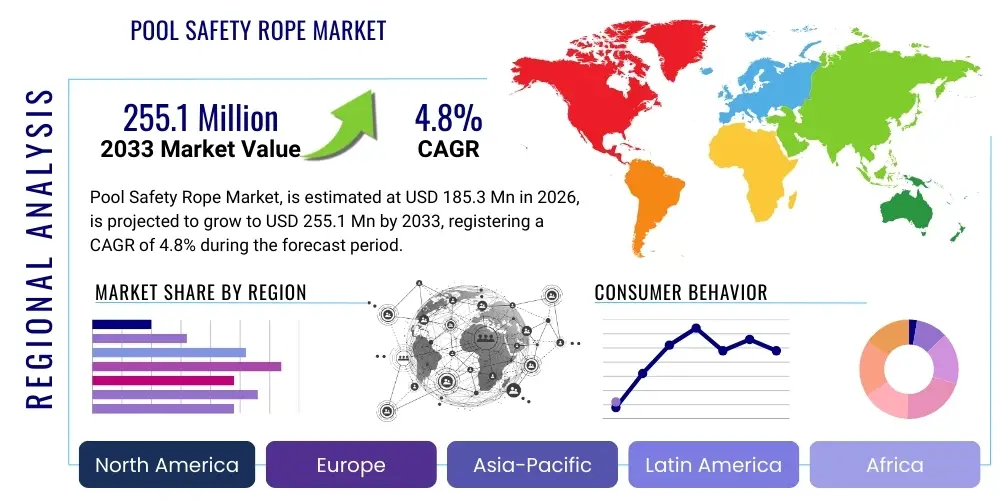

Pool Safety Rope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435375 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pool Safety Rope Market Size

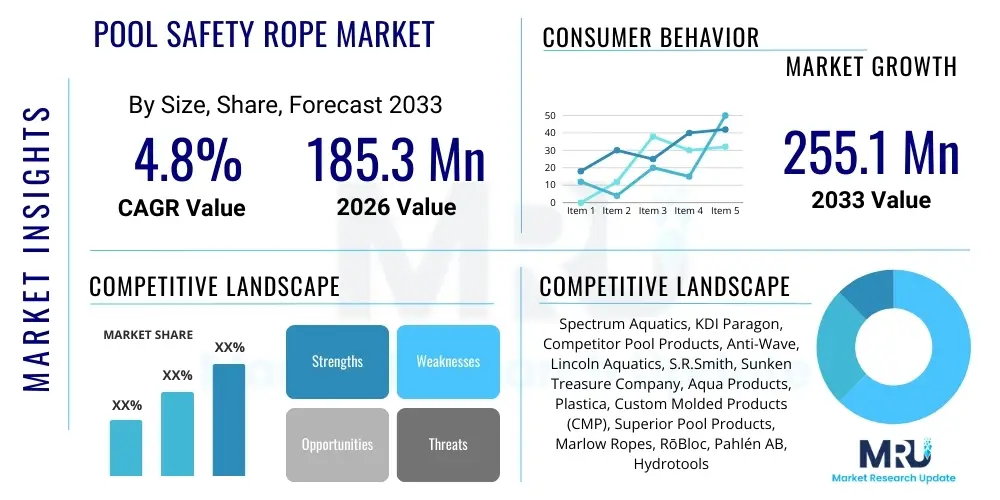

The Pool Safety Rope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 185.3 Million in 2026 and is projected to reach USD 255.1 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by stringent governmental safety regulations concerning public and private swimming facilities worldwide, particularly in developed economies. Increased public awareness regarding water safety, coupled with the rising construction of residential pools, further solidifies the demand trajectory.

Pool Safety Rope Market introduction

The Pool Safety Rope Market encompasses the manufacturing and distribution of specialized flotation devices and demarcation lines designed to enhance safety in aquatic environments. These products serve primarily as crucial visual and physical barriers, designating shallow areas, deep water sections, and rescue zones, thereby preventing accidental drowning and ensuring regulatory compliance. The fundamental product, the pool safety rope, often referred to as a boundary line or demarcation rope, is typically constructed from high-visibility, UV-resistant materials such as polyethylene, polypropylene, and nylon, ensuring durability and longevity under harsh chlorination and sun exposure.

Major applications for pool safety ropes span residential swimming pools, commercial aquatic centers, public municipal pools, hotel and resort leisure facilities, and specialized competitive swimming venues. The immediate benefits derived from the deployment of these ropes include reduced liability risks for facility operators, enhanced organizational flow within crowded pools, and most critically, a significant increase in user safety through clearly defined boundaries. Furthermore, modern safety ropes often incorporate specialized floats that meet specific tensile strength and buoyancy standards mandated by international safety organizations such as the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO).

Key driving factors propelling market growth include escalating global focus on child safety in recreational waters, the continuous enforcement of swimming pool construction codes requiring demarcation, and robust growth in the hospitality sector which necessitates premium safety equipment. The trend towards smart pool technologies, while not directly involving the rope itself, increases the overall market for sophisticated pool infrastructure, creating an ancillary demand for regulatory-compliant safety fixtures. Moreover, the replacement cycle for safety ropes, which deteriorate due to chemical and UV exposure, provides a steady source of recurring revenue for manufacturers.

Pool Safety Rope Market Executive Summary

The global Pool Safety Rope Market exhibits robust business trends characterized by strong regulatory mandates and high consumer emphasis on liability reduction. Key market players are concentrating on product innovation, particularly the development of environmentally friendly and high-strength materials that offer superior chemical resistance and maintain color integrity longer than traditional plastics. Strategic alliances and mergers, along with optimized global supply chain logistics, are prevalent as companies seek to capture larger shares of the fragmented residential and commercial segments. The move towards specialized, compliant ropes for competitive swimming (often incorporating advanced tensioning systems) also represents a profitable niche, demanding precise engineering and certification.

Regional trends indicate North America and Europe maintain dominance, primarily due to well-established regulatory frameworks (e.g., US CPSC guidelines, European EN standards) and a high density of both private and public pools. However, the Asia Pacific region is forecast to experience the highest growth rate, fueled by rapid urbanization, increasing disposable income, and the subsequent construction boom in residential complexes, hotels, and tourist resorts, particularly in developing economies like China, India, and Southeast Asia. These regions are quickly adopting international safety standards, creating significant greenfield opportunities for safety equipment providers.

Segment trends highlight the dominance of the commercial segment (public pools, resorts) in terms of value, driven by bulk purchases of lane lines and heavy-duty safety barriers. Concurrently, the residential segment is growing rapidly, driven by DIY installation kits and increased homeowner responsibility awareness. Material segmentation shows a preference shift towards high-density polyethylene (HDPE) due to its excellent floatation properties and resistance to pool chemicals, though PVC remains cost-effective for standard safety applications. The market structure emphasizes products tailored for specific pool depths and applications, ensuring strict adherence to standardized color coding (red, blue, white) for maximum visibility and safety adherence.

AI Impact Analysis on Pool Safety Rope Market

User queries regarding AI in the Pool Safety Rope Market generally revolve around how technology can enhance the traditional physical barrier system, focusing on automation, predictive maintenance, and integrating safety equipment with smart pool management systems. Common concerns include whether AI can detect rope integrity failures, optimize rope placement based on real-time pool usage density, or if regulatory bodies will mandate AI-driven monitoring alongside physical ropes. The primary user expectation is that AI will move the market beyond passive safety measures toward proactive, intelligent aquatic risk mitigation. While AI does not directly manufacture the rope, it profoundly impacts the peripheral safety ecosystem, influencing decisions on product quality and deployment effectiveness.

The direct impact of AI on the physical Pool Safety Rope product itself is minimal, as the core function relies on material science and physics (buoyancy, tensile strength). However, AI’s influence is transformative in the context of pool management and safety monitoring. Advanced Machine Learning algorithms are increasingly utilized in sensor-based pool safety systems that work in conjunction with safety ropes. These systems use cameras and underwater sensors to monitor swimmer behavior, detect potential drowning incidents, and correlate observed activity patterns with designated safety zones marked by the ropes. This integration validates the strategic placement of ropes and highlights areas where physical barriers might be insufficient, providing valuable feedback for future product design and installation guidelines.

Furthermore, AI-driven predictive maintenance and inventory management systems are streamlining the supply chain for commercial pool operators. Algorithms can analyze the chemical environment, usage rates, and UV exposure data collected by smart pool sensors to accurately predict the degradation rate of safety ropes and floats. This allows facilities to order replacements proactively, minimizing downtime and ensuring continuous regulatory compliance. This shift towards data-driven inventory cycles reduces waste, optimizes logistics, and indirectly favors manufacturers offering high-quality, durable materials compatible with advanced degradation modeling.

- AI enhances manufacturing precision by optimizing plastic extrusion processes for consistent material density.

- Predictive maintenance algorithms anticipate safety rope replacement cycles based on chemical exposure and UV degradation data.

- AI-powered monitoring systems validate the effectiveness and correct positioning of physical safety ropes in real-time.

- Optimized logistics and inventory management for large commercial pool safety equipment deployments.

- Development of smart pool infrastructure that requires highly certified and dimensionally stable safety ropes for sensor placement.

DRO & Impact Forces Of Pool Safety Rope Market

The dynamics of the Pool Safety Rope Market are characterized by a strong interplay between regulatory enforcement (Driver), material cost volatility (Restraint), and the emergence of safety technology integration (Opportunity), all subject to significant influence from safety advocacy and liability concerns (Impact Forces). The most substantial driver remains the globally tightening regulatory environment, compelling both commercial and residential pool owners to install and maintain certified safety demarcations. Conversely, restraints predominantly center on the reliance on petroleum-derived plastics, subjecting manufacturing costs to global commodity price fluctuations. Opportunities abound in developing specialized, quick-release systems and aesthetically pleasing safety solutions for high-end residential markets. The powerful impact force of liability litigation ensures continuous investment in compliant, high-visibility products.

Drivers: The fundamental drivers include stringent governmental regulations and building codes mandating physical barriers and demarcation lines, particularly those enforced after high-profile drowning incidents. The burgeoning tourism and leisure industry, especially in emerging markets, demands international safety standards be met across all new hotel and resort constructions. Growing consumer safety awareness, amplified by organizations focused on water safety, directly translates into increased demand for reliable, certified safety equipment. Furthermore, the mandatory requirement for competitive swimming facilities to use certified lane lines, which fall under the scope of this market, drives product sophistication and high-volume demand.

Restraints: Significant restraints include the inherent durability issue associated with polymers exposed continuously to chlorine, bromine, UV radiation, and physical stress, leading to a mandatory replacement cycle that is often viewed as a recurring expense rather than an investment. Price sensitivity, particularly in the vast residential segment, can lead to the adoption of non-compliant or low-quality alternatives from unregulated sources. Moreover, the cyclical nature of pool construction and renovation, tied closely to economic downturns, can cause temporary dips in market growth. The environmental concern regarding plastic waste is also an increasing constraint, pushing manufacturers toward higher-cost, biodegradable, or recyclable material solutions.

Opportunities: Opportunities lie in developing advanced modular safety rope systems that allow for easy adjustment and quick installation, catering to multi-use pool environments (e.g., pools that switch between recreational and competitive use). There is a growing niche for 'smart ropes' embedded with low-power sensor tags for inventory tracking and potentially real-time tension monitoring in commercial settings. Furthermore, penetrating underserved regional markets, particularly in rapidly developing parts of Asia and Africa where modern safety standards are only now being formalized and adopted, presents substantial long-term growth prospects. Innovation in material science, focusing on superior UV stabilization and chemical resistance, offers a competitive advantage.

Impact Forces: The overarching impact force is the immense risk of legal liability associated with water-related accidents. This force ensures that commercial operators prioritize certified, compliant products over cheaper alternatives, driving demand for premium market segments. Public safety campaigns significantly impact purchasing decisions, making safety ropes a non-negotiable component of pool ownership. The competitive landscape is also shaped by intense rivalry among manufacturers focusing on meeting diverse international standards (Fédération Internationale de Natation (FINA) for competitive pools, ISO for general safety), creating a high barrier to entry for non-certified entities. Regulatory compliance acts as both a driver and an enforcement mechanism, cementing the market’s structure.

Segmentation Analysis

The Pool Safety Rope Market is comprehensively segmented based on the type of application, the material composition of the rope and floats, and the channel through which the product reaches the end-user. Application segmentation distinguishes between the high-volume, durability-focused requirements of commercial facilities and the more cost-sensitive, aesthetics-driven needs of residential users. Material segmentation is crucial, determining the rope's lifespan and performance under chemical stress. Understanding these segments allows manufacturers to tailor product specifications—such as tensile strength, UV resistance, and specific float geometry—to meet the exacting performance expectations of diverse end-users.

Segmentation by material remains critical, with Polypropylene and Polyethylene dominating the market due to their inherent buoyancy and chemical resistance, offering a balance between cost and longevity. The distribution channel analysis is key, reflecting the market structure where direct sales to large commercial buyers and resorts coexist with robust sales through retail channels (big-box stores, dedicated pool supply retailers) serving the individual homeowner segment. This detailed segmentation aids in targeted marketing strategies and ensures product availability aligns with purchasing preferences across different demographics and institutional scales. The market’s segmentation also directly correlates with regulatory requirements, as specialized segments like competitive racing lines must meet specific, rigorous FINA standards, separating them technologically and commercially from standard public safety demarcation lines.

- By Product Type:

- Standard Safety Ropes (Boundary Demarcation)

- Lane Lines (Competitive/Racing)

- Rescue Ropes and Throw Lines

- Winter Cover Ropes and Tie-Downs

- By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Nylon and Polyester Blends

- PVC and Vinyl Floats

- By Application/End-User:

- Commercial Pools (Municipal, Hotels, Resorts, Schools)

- Residential Pools

- Competitive Aquatic Centers

- By Distribution Channel:

- Direct Sales (to Commercial/Government)

- Retail Channels (Pool Supply Stores, Online E-commerce)

- Distributors and Wholesalers

Value Chain Analysis For Pool Safety Rope Market

The value chain for the Pool Safety Rope Market begins with the upstream sourcing of raw petrochemical materials, primarily polypropylene and polyethylene resins, which are essential for the extrusion of both the rope core and the buoyant floats. This upstream phase is highly sensitive to global oil and gas prices, impacting manufacturing costs significantly. Key activities involve material compounding, ensuring the plastic incorporates necessary UV stabilizers, colorants, and anti-chemical agents to meet stringent regulatory standards for pool environments. Suppliers specializing in high-grade, virgin polymer resins hold considerable negotiating power due to the necessity of consistent quality for product certification. Efficiency in this stage is vital, as material integrity directly dictates the final product's performance and lifespan.

The core manufacturing process involves extrusion, molding, and assembly, where the rope line is braided or twisted, and the individual floats are injected and attached, often requiring specialized automated machinery for high-volume production. Midstream activities include quality control checks (tensile strength testing, buoyancy verification) and certification processes essential for market entry, particularly FINA certification for competitive ropes. Downstream, the distribution network is bifurcated: direct channels handle large, recurring commercial orders requiring custom lengths and specifications, while indirect channels leverage wholesalers and specialized pool supply retailers to reach the fragmented residential consumer base. Logistical efficiency in packaging and shipping, especially for long, bulky lane lines, is a key component of the value proposition.

The distribution channel landscape shows a clear distinction between the high-touch, consultative sales approach required for commercial entities—where technical specifications and regulatory compliance are paramount—and the consumer-facing sales through e-commerce and retail. Direct sales provide higher margins but require dedicated sales engineering teams. Indirect channels offer broad market reach but involve margin sharing with intermediaries. The end of the chain involves installation and routine maintenance, frequently performed by pool service contractors, who often influence the purchasing decisions of both residential and smaller commercial customers, acting as important indirect stakeholders in the market's commercial success.

Pool Safety Rope Market Potential Customers

The primary customer base for the Pool Safety Rope Market is highly diverse, spanning governmental bodies responsible for public infrastructure to individual homeowners focused on personal liability and family safety. Commercial aquatic centers, encompassing municipal pools, university recreational facilities, and high-volume fitness centers, represent the largest value segment. These customers require durable, heavy-duty products that meet occupational safety and public health mandates, necessitating frequent replacement due to intensive usage. Purchasing decisions in this segment are typically guided by procurement departments focusing on long-term value, adherence to local building codes, and material certifications.

Another rapidly expanding customer segment includes the global hospitality and resort industry. Large hotel chains and cruise lines operate numerous pools and aquatic features, viewing safety ropes and demarcation lines not just as regulatory requirements but as essential elements of guest safety and service quality. These buyers often demand aesthetic integration, preferring custom colors or branded components, alongside high performance. Furthermore, the specialized market of competitive aquatic sports organizations, including national swimming federations and FINA-certified venues, forms a critical niche, demanding high-precision racing lane lines that meet exact international standards for wave mitigation and dimensional accuracy.

The largest volume segment, however, resides in the residential market. Individual homeowners purchasing or installing pools are driven by regulatory requirements (mandated safety barriers during construction) and personal liability mitigation. These customers typically acquire products through retail stores or specialized online vendors, often prioritizing ease of installation and cost-effectiveness. Finally, pool service contractors and maintenance companies act as indirect but influential buyers, recommending and supplying replacement safety ropes to their client base across both residential and smaller commercial accounts, serving as gatekeepers for brand adoption and quality assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.3 Million |

| Market Forecast in 2033 | USD 255.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectrum Aquatics, KDI Paragon, Competitor Pool Products, Anti-Wave, Lincoln Aquatics, S.R.Smith, Sunken Treasure Company, Aqua Products, Plastica, Custom Molded Products (CMP), Superior Pool Products, Marlow Ropes, RōBloc, Pahlén AB, Hydrotools, Poolmaster, Pool Solutions, Pentair, Fluidra, Certikin International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pool Safety Rope Market Key Technology Landscape

While the Pool Safety Rope Market is intrinsically low-tech concerning the core product, technological advancements primarily focus on material science, manufacturing optimization, and integration with peripheral pool safety systems. The key technological landscape revolves around advanced polymer extrusion techniques that ensure uniform density, maximal UV stability, and enhanced resistance to the aggressive chemical environment of chlorinated water. Manufacturers utilize specialized compounding processes to integrate highly effective hindered amine light stabilizers (HALS) and superior color fastness agents into the base resins (PE/PP), significantly extending the operational lifespan and maintaining the crucial high-visibility required by safety standards. The ability to produce ropes with specific buoyancy characteristics and minimal water absorption is a continuous technological challenge that drives product differentiation.

Another crucial aspect of technology involves the mechanical design of the floats and tensioning systems, particularly for competitive racing lane lines. FINA-certified ropes must incorporate hydrodynamically optimized float designs and high-precision stainless steel or specialized plastic tensioning ratchets. These technologies are crucial for minimizing wave propagation, ensuring optimal swimming conditions, and maintaining consistent line tension across varying pool lengths. Innovation in tensioning mechanisms aims for quick-release functionality and resistance to corrosion, essential for commercial pool environments that require frequent setup and teardown of lane layouts. Furthermore, the standardization and precise calibration of rope lengths and markings rely on advanced laser measuring and automated assembly robotics to meet rigorous competitive and safety specifications.

Emerging technologies include the integration of RFID tags or miniature IoT sensors within the floats of commercial safety ropes. These low-power devices enable facility managers to track inventory, monitor the physical location of removable ropes, and potentially measure the tension status of permanent barriers. This move towards 'smart accessories' allows for digital maintenance logs and better compliance auditing. Although not integral to the rope's primary function, these integrated technologies enhance the overall safety management infrastructure, promoting demand for high-quality ropes that can securely house these electronic components without compromising structural integrity or buoyancy. The continuous pressure from regulatory bodies for verifiable safety standards ensures that manufacturers invest in certified processes and materials.

Regional Highlights

The global Pool Safety Rope Market demonstrates varied maturity levels and growth patterns across key geographic regions, heavily influenced by local regulatory frameworks and economic development related to recreational infrastructure.

- North America: This region holds a dominant market share, driven by a high density of both commercial and residential pools and extremely stringent safety and liability laws, particularly in the United States (governed by CPSC standards and local codes). Demand is stable and replacement-driven, with a strong preference for high-quality, certified products. Key markets include California, Florida, and Texas, where pool ownership is highest.

- Europe: Europe represents a mature market, slightly trailing North America in total value but showing strong demand for durable, standardized products compliant with European Norms (EN) standards. Countries like Germany, France, and Spain, which have extensive public aquatic facilities and strong tourism sectors, are major consumers. Focus is placed on environmentally compliant materials and robust, corrosion-resistant hardware.

- Asia Pacific (APAC): APAC is the fastest-growing market region. Rapid urbanization, increasing disposable income, and massive growth in the hospitality and residential construction sectors (especially in China, India, and Southeast Asia) are fueling explosive demand. While regulatory enforcement is varied, the adoption of international safety standards in new large commercial projects drives significant market opportunity.

- Latin America (LATAM): Growth in LATAM is steady, primarily concentrated in tourist-heavy nations like Mexico and Brazil. The market is often price-sensitive, balancing between compliant products for large resorts and lower-cost options for local usage. Regulatory enforcement is increasing, but standardization remains a challenge, offering substantial long-term market potential as standards solidify.

- Middle East and Africa (MEA): The MEA region is characterized by high demand related to luxury resort development and high-end residential compounds, particularly in the UAE and Saudi Arabia. The extreme heat necessitates materials with superior UV and thermal resistance. Safety standards are rapidly being adopted, aligning closely with international best practices to support the flourishing tourism sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pool Safety Rope Market.- Spectrum Aquatics

- KDI Paragon

- Competitor Pool Products

- Anti-Wave

- S.R.Smith

- Lincoln Aquatics

- Custom Molded Products (CMP)

- Fluidra

- Pentair

- Marlow Ropes

- Plastica

- Pahlén AB

- Sunken Treasure Company

- Aqua Products

- Hydrotools

- Poolmaster

- Water Safety Products, Inc.

- Certikin International

- RōBloc

- Superior Pool Products

Frequently Asked Questions

Analyze common user questions about the Pool Safety Rope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory standards governing pool safety ropes?

Pool safety ropes and demarcation lines must adhere to strict international and national standards, including those set by the American National Standards Institute (ANSI), the Consumer Product Safety Commission (CPSC) in the US, European Norms (EN) in Europe, and specifically, Fédération Internationale de Natation (FINA) standards for competitive racing lane lines. Compliance ensures minimal liability and verified product performance.

How frequently should pool safety ropes be inspected and replaced?

Inspection should occur monthly in commercial settings and seasonally in residential pools, checking for signs of UV damage, chemical corrosion, and abrasion. Replacement frequency depends heavily on material quality and usage intensity, but high-use commercial ropes typically require replacement every 2 to 5 years to maintain mandated tensile strength and visual clarity.

What is the key difference between standard safety ropes and competitive lane lines?

Standard safety ropes primarily serve as simple visual barriers marking depth changes. Competitive lane lines, however, are engineered with specialized, hydrodynamically designed floats (wave-eaters) and advanced tensioning systems designed to absorb and dissipate water turbulence (wave-drag), ensuring optimal, standardized conditions for racing, and require FINA certification.

Which materials offer the best resistance to chlorine and UV degradation?

High-density Polyethylene (HDPE) and certain compounded Polypropylene (PP) resins, when fortified with advanced UV stabilizers (like HALS) and color fastness agents, offer the superior resistance necessary to withstand harsh, long-term exposure to pool chemicals and intense sunlight, minimizing brittleness and discoloration.

How does the distribution channel influence pricing in the pool safety rope market?

Direct sales channels to large commercial and governmental buyers often allow for customized bulk pricing and specialized services. Conversely, the residential market primarily relies on indirect retail and e-commerce channels, where pricing includes distributor and retailer markups, often resulting in slightly higher unit costs for the end consumer but offering convenience and accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager