Porcelain Slabs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437993 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Porcelain Slabs Market Size

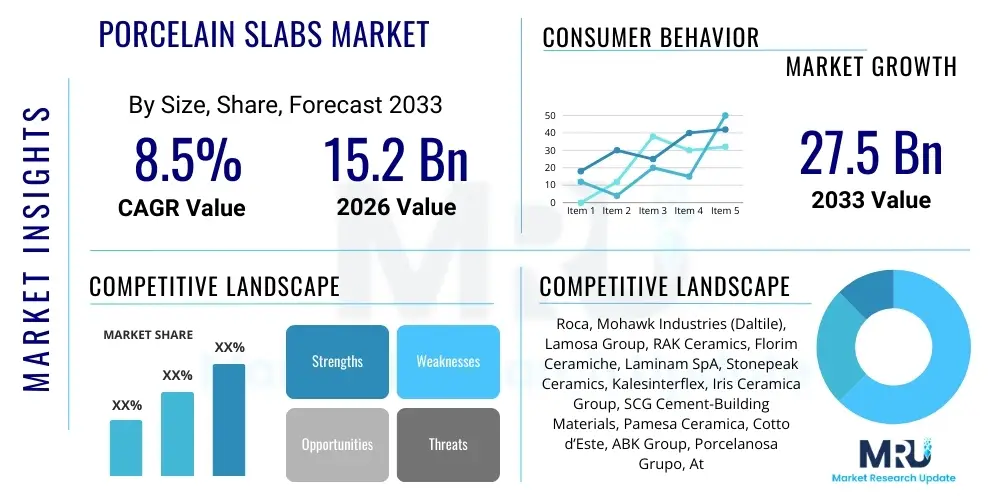

The Porcelain Slabs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Porcelain Slabs Market introduction

The Porcelain Slabs Market encompasses the manufacturing and distribution of large-format ceramic panels, often exceeding dimensions previously achievable by traditional tiles, specifically designed for high-end architectural and interior design applications. These large panels are produced through complex processes involving high-pressure pressing and sintering at extreme temperatures (above 1200°C), resulting in materials that exhibit near-zero porosity (<0.5%) and exceptional mechanical strength. The market is defined by the strategic shift away from small-format tiling towards continuous, seamless surfacing solutions that minimize grout lines, thereby enhancing aesthetic continuity and improving hygiene standards across large surface areas. The aesthetic sophistication is unparalleled, as manufacturers leverage advanced digital printing—specifically high-definition inkjet technology—to faithfully reproduce the intricate veining, color depth, and texture of rare and exotic natural stones, polished concrete, or aged wood, offering design flexibility previously constrained by the scarcity and cost of natural resources. This blend of visual appeal and technical superiority positions porcelain slabs as a disruptive force in the premium surfacing industry.

Major applications of porcelain slabs are expanding rapidly across both the residential and commercial spectra. In residential settings, they are highly sought after for demanding areas such as large kitchen countertops and island cladding, where resistance to heat, scratching, and staining is paramount. They are also favored for bathroom vanities and shower walls due to their hygienic, non-porous nature. Commercially, adoption is robust in high-traffic environments including airports, shopping centers, healthcare facilities, and educational institutions, where their extreme durability and ease of maintenance translate into a lower life-cycle cost compared to materials requiring periodic sealing or special cleaning protocols. A particularly high-growth application is in exterior architecture, where ultra-thin, large slabs are engineered for use in ventilated facade systems, providing necessary thermal insulation and weather protection while contributing significantly to the building’s aesthetic profile and meeting modern energy efficiency standards.

The market expansion is robustly supported by several interconnected driving factors. Globally, there is a sustained surge in construction activity, particularly in residential luxury and high-rise commercial sectors, which intrinsically require large, high-performance materials. Furthermore, there is a significant consumer preference evolution towards sustainable and aesthetically pleasing materials; porcelain slabs, being composed of inert natural raw materials and highly durable, align perfectly with green building principles and long-term investment priorities. Technological innovation, specifically in continuous pressing systems (like Continua+) and advanced polishing equipment, is enabling the production of even thinner (e.g., 6mm), lighter, and larger formats, which reduces installation complexity and material weight, simultaneously broadening the scope of applications and increasing the overall appeal to contractors and developers focused on maximizing efficiency and minimizing installation time. This confluence of performance, aesthetics, and efficiency firmly underpins the market's projected Compound Annual Growth Rate.

Porcelain Slabs Market Executive Summary

The Porcelain Slabs Market is experiencing a paradigm shift characterized by a rapid escalation in demand for premium, customized, and ultra-large formats, which is redefining architectural surfacing norms globally. Key business trends highlight intense competition among global manufacturers focused on optimizing their supply chain for oversized material logistics and investing heavily in digital manufacturing technologies. Manufacturers are shifting production strategies toward 'mass customization,' using AI-driven printing to offer bespoke veining and coloration for individual projects, moving away from standardized batch production. Furthermore, strategic alliances between manufacturers and specialized stone fabricators/installers are becoming critical to ensure successful, breakage-free project execution, which is increasingly viewed as an integral part of the product value proposition and a core differentiator in mature markets like North America and Europe.

Regional dynamics clearly delineate the market landscape, with Asia Pacific driving unparalleled volume growth due to extensive urbanization and infrastructure spending, particularly emphasizing residential and commercial flooring applications. Conversely, North America and Europe dominate the market in terms of value, showcasing higher average selling prices (ASPs) driven by stringent quality requirements, specialized application demand (such as premium kitchen surfaces and technologically advanced facades), and strong regulatory support for sustainable materials. The European market, in particular, leads the charge in thin-format (6mm) innovation and integration into energy-efficient building envelopes. The sustained remodeling boom in the West, coupled with the luxury construction boom in the Middle East, ensures diversified, high-value demand across developed markets, balancing the sheer volume production characteristic of the Eastern hemisphere.

Segmentation analysis reveals that the largest growth occurs within the 1600x3200 mm size category, reflecting the industry's commitment to minimizing joints and achieving monolithic surface appearances in high-end projects. Thickness trends are polarizing; while 12mm remains standard for conventional countertops, 6mm is aggressively penetrating the wall cladding, cabinet facing, and lightweight facade segment, valued for its reduced weight and material efficiency. Application trends confirm that Kitchen Countertops are the market leaders in value, given the high material utilization and premium finishes demanded, closely followed by Exterior Facades, which promise long-term, high-volume contracts due to mandatory green building codes. Overall, the market's trajectory is firmly upward, fueled by technological prowess and a global architectural preference for aesthetically continuous, high-performance surfacing solutions.

AI Impact Analysis on Porcelain Slabs Market

Common user questions regarding AI's influence in the Porcelain Slabs Market frequently revolve around automation in manufacturing (reducing defects, optimizing firing processes), personalization in design (generating unique slab patterns instantly), and efficiency in supply chain management (predictive maintenance, demand forecasting). Users are keenly interested in how AI can streamline the notoriously complex process of replicating natural stone patterns flawlessly and consistently across large batches, ensuring minimal wastage and enhancing product realism. Specifically, queries focus on the use of AI vision systems to map and print intricate vein structures that look non-repeating across multiple slabs, which is a major aesthetic challenge in large-scale production. Furthermore, there is significant inquiry into AI-driven robotics for handling and cutting extremely large and delicate slabs, aiming to reduce labor costs and on-site breakage rates. The overarching theme is the integration of AI to transition from conventional manufacturing paradigms to smart, flexible production lines capable of mass customization and superior material quality control, thus lowering the cost of high-end finishes and accelerating the design-to-market cycle for new aesthetic collections.

- AI-Driven Quality Control: Utilizing sophisticated computer vision and machine learning algorithms installed post-printing and pre-firing to detect minute micro-cracks, surface inconsistencies, and color gradient variations. This proactive detection significantly reduces scrap rates in high-value production runs and ensures superior product consistency across global distribution channels.

- Predictive Maintenance for Kilns: Advanced AI systems analyze real-time sensor data from highly energy-intensive equipment, such as firing kilns and high-tonnage presses. This enables the prediction of potential machinery failures with high accuracy, minimizing unplanned operational downtime—which is crucial in a continuous process industry—and optimizing the maintenance schedule for maximum uptime efficiency.

- Generative Design Systems: Employing deep learning AI to instantaneously create limitless unique slab designs, textures, and three-dimensional surface structures (molding effects) based on predefined stylistic parameters (e.g., depth of veining, color temperature). This capability drastically accelerates the research and development phase, allowing manufacturers to respond to fleeting interior design trends faster than competitors relying on manual graphic design.

- Optimized Logistics and Inventory: Implementing machine learning models for real-time, highly granular demand forecasting, considering seasonal fluctuations, regional construction cycles, and specific project timelines. This optimization ensures that high-demand slab sizes and specialized finishes are accurately inventoried, significantly minimizing warehousing costs and mitigating regional supply chain risks related to importing oversized materials.

- Robotic Handling and Cutting: Integrating AI-powered, sensor-guided robotic arms for the delicate and precise manipulation, movement, and cutting of large, heavy, and extremely fragile unfired or fired porcelain slabs. This not only enhances factory safety and reduces labor dependency but also increases cutting accuracy to sub-millimeter tolerances required for complex architectural specifications.

- Energy Efficiency Optimization: AI systems monitor and dynamically adjust hundreds of process parameters within the high-temperature firing kilns (e.g., temperature curves, heat distribution, air flow). The goal is to minimize overall energy consumption per square meter of slab produced while guaranteeing optimal material vitrification, supporting corporate sustainability objectives and hedging against volatile energy input costs.

- Personalized Customer Visualization: AI-driven augmented reality (AR) tools allow end-users and designers to instantly visualize how different porcelain slab patterns would look in their specific kitchens or facades, accelerating purchasing decisions and reducing reliance on physical samples.

- Defect Classification and Sorting: Automated systems use AI to classify slabs based on minor, acceptable defects or aesthetic variations, allowing manufacturers to create different quality tiers and maximize yield from every production run, optimizing commercial sales strategies.

DRO & Impact Forces Of Porcelain Slabs Market

The strategic expansion of the Porcelain Slabs Market is governed by a potent mixture of enabling factors (Drivers), critical hurdles (Restraints), significant pathways for market growth (Opportunities), and overarching external pressures (Impact Forces). The most pronounced driver is the relentless architectural trend favoring minimalist, joint-free surfaces that deliver a sophisticated aesthetic appearance, directly met by the seamless continuity offered by ultra-large format porcelain slabs. This is compounded by the superior functional characteristics of porcelain—including its unparalleled resistance to chemical etching, UV exposure, thermal shock, and freezing cycles—which fundamentally outperform natural materials and resin-bound composites in demanding commercial and exterior environments, reinforcing porcelain's long-term market position.

However, the market’s growth velocity is constrained by several substantial restraints. Chief among these is the formidable capital investment required to establish state-of-the-art porcelain slab production lines, which must incorporate high-tonnage presses, large continuous kilns, and multi-axis cutting technology, often running into hundreds of millions of USD. This high barrier to entry significantly limits the number of market participants capable of producing competitive, large-format products, leading to market concentration. Furthermore, the handling, transportation, and particularly the installation of these oversized, heavy, yet inherently fragile slabs demand highly specialized labor and dedicated lifting equipment. Breakage during installation is a significant financial risk for contractors, and the scarcity of adequately trained installers, especially in emerging markets, often translates into elevated installation costs and extended project timelines, sometimes offsetting the material’s competitive long-term price.

Nevertheless, lucrative opportunities are emerging, particularly in the diversification of applications beyond traditional flooring and countertops. The rapid growth of the prefabricated and modular construction industries presents a major avenue, as porcelain slabs are ideal for factory-applied finishes due to their precise dimensional stability. Furthermore, utilizing porcelain slabs for customized furniture cladding, internal doors, and high-end cabinetry provides manufacturers with new, high-margin revenue streams. The overarching impact forces include volatile global energy prices, as kiln firing is extremely energy-intensive, directly influencing manufacturing costs and pricing strategies. Regulatory shifts toward stricter fire codes and sustainability mandates (e.g., LEED, BREEAM certifications) act as powerful tailwinds for high-performance, non-combustible porcelain, forcing the adoption of superior materials in large public and commercial construction projects worldwide. Competitive pressure from engineered quartz and natural stone suppliers, who are also innovating their product offerings, necessitates continuous R&D investment in surface finishing and digital reproduction technology to maintain porcelain's edge.

Segmentation Analysis

The Porcelain Slabs Market is meticulously categorized based on critical parameters—Size, Application, and Thickness—which provide a granular view of market demand and consumer preferences across various architectural and design requirements. The segmentation by Size directly reflects the modern aesthetic drive toward monolithic surfaces, with larger formats commanding significant premiums due to the technical complexity of their manufacturing and installation. The Application segmentation dictates the required physical and chemical properties of the slab, such as abrasion resistance for flooring or UV stability for exterior use. This structured analysis is essential for manufacturers to align their R&D investments and marketing strategies with the fastest-growing and most profitable product niches, ensuring resources are optimally allocated to meet sophisticated global demand profiles.

Segmentation by Thickness is particularly insightful as it highlights the technological differentiation within the market. Ultra-thin slabs (6 mm or less) are revolutionary, primarily targeting wall cladding, ventilated facades, and furniture surfacing, where weight reduction is a critical engineering requirement, especially in high-rise buildings and refurbishment projects. Standard thickness (9 mm to 12 mm) remains the workhorse for conventional flooring and robust kitchen countertop applications, balancing strength and manageability. Conversely, the 20 mm segment is specifically tailored for heavy-duty commercial flooring, industrial environments, and demanding outdoor applications, requiring maximum impact resistance and the ability to be directly laid over gravel or grass in landscaping projects. The demand distribution across these thickness categories demonstrates the versatility and broad appeal of porcelain as an engineered surface solution.

Application-based segmentation confirms the market's reliance on the Kitchen Countertops sector for revenue generation due to high material volume and the intrinsic need for a durable, hygienic surface in modern homes. However, Exterior Facades represent the highest future growth potential, driven by regulatory mandates promoting building envelope efficiency, especially in developed markets. The ability of porcelain to function effectively in rainscreen and ventilated systems, often coupled with low thermal expansion coefficients, makes it a preferred choice over materials that degrade or warp under severe weather conditions. Furthermore, the specialized Furniture and Design Elements segment, though smaller, is accelerating rapidly, reflecting a trend where designers use porcelain slabs not just as a covering, but as a structural or feature element in customized interior pieces, capitalizing on the material's aesthetic consistency and scratch resistance.

- By Size:

- 1200 x 2400 mm: Standard large format, widely used in residential flooring and wall cladding, balancing large aesthetics with manageable installation.

- 1600 x 3200 mm: Ultra-large format, dominating premium kitchen countertops and monolithic wall applications in luxury commercial spaces, minimizing visible joints.

- Custom/Other Large Formats (e.g., 1000 x 3000 mm, 1500 x 3000 mm, 1620 x 3240 mm): Specialized formats designed to meet specific architectural constraints or to maximize yield from production processes, catering to bespoke projects.

- By Application:

- Kitchen Countertops: Highest value segment, driven by heat resistance, non-porosity, and superior aesthetic replication of marble and stone.

- Flooring (Residential and Commercial): High volume segment, requiring abrasion resistance (PEI rating), crucial for high-traffic areas like malls and public spaces.

- Wall Cladding and Backsplashes: Key segment for thin (6mm) slabs, valued for reduced weight and ease of application over existing surfaces in remodeling.

- Exterior Facades: Fastest-growing segment, utilizing ventilated systems for thermal efficiency and weather protection, requiring UV stability and frost resistance.

- Furniture and Design Elements: Emerging niche, including tables, cabinets, doors, and custom millwork, leveraging the material's lightness and consistent finish.

- By Thickness:

- 6 mm (Slim/Thin): Ideal for cladding, facades, and overlays; focuses on weight reduction and material efficiency.

- 9 mm to 12 mm (Standard): Versatile thickness, standard for residential flooring and most countertop applications, offering a balance of durability and handling ease.

- 20 mm (Thick/Heavy Duty): Used for outdoor paving, high-impact commercial floors, and robust kitchen islands where substantial perceived thickness is required.

Value Chain Analysis For Porcelain Slabs Market

The porcelain slabs value chain is inherently complex, characterized by high initial investment in fixed assets and deep integration of advanced technological processes, commencing with rigorous upstream raw material procurement. The core raw materials—high-purity clays, feldspars, kaolin, and silica—are sourced globally, and the quality, consistency, and chemical composition of these inputs are paramount, directly dictating the whiteness, final strength, and firing behavior of the resultant slab. Upstream analysis involves establishing robust supply contracts and employing advanced mineral processing techniques (like wet grinding and spray drying) to ensure the homogenization of the mixture prior to pressing. Energy supply contracts are also a crucial upstream element, given that natural gas or electricity consumption during the firing stage is the single largest operating cost component, making supply chain resilience and cost optimization in this area vital for competitiveness.

The central manufacturing stage represents the point of maximum value addition, where raw materials are transformed into finished slabs using multi-million dollar technology suites. This includes advanced preparation systems, followed by high-pressure continuous pressing (Continua technology), which compacts the material uniformly. The subsequent firing in massive roller kilns demands precise temperature control (up to 1250°C) over long cycles to achieve full vitrification. Downstream processing, which includes high-resolution digital printing for aesthetics, large-format polishing, and edge finishing, is highly automated to maintain dimensional accuracy and surface quality. Controlling breakage throughout this manufacturing and subsequent handling process is a key metric, as waste in the form of a large, high-value slab significantly impacts operational efficiency and profitability.

Distribution channels for porcelain slabs are highly specialized, necessitated by the product’s size and fragility. The market utilizes a bifurcated channel strategy: indirect distribution through regional ceramic tile wholesalers and specialized stone distributors provides broad geographical coverage for smaller projects and residential contractors. Direct distribution, involving the manufacturer supplying specialized fabrication centers, architectural firms, and large construction projects, allows for stricter control over service quality, inventory, and crucial cutting/customization services. The crucial role of the fabricator is often underestimated; they act as the final link, transforming the raw slab into a finished countertop or facade panel. Their expertise in handling, cutting, and installing the product without damage directly influences customer satisfaction, making strong partnerships between manufacturers and highly skilled fabricators a strategic necessity for premium market penetration.

Porcelain Slabs Market Potential Customers

The Porcelain Slabs Market targets a sophisticated and diversified customer base spanning the entire built environment, primarily driven by the residential, commercial, and institutional sectors requiring aesthetic excellence combined with technical resilience. Residential customers constitute a foundational segment, predominantly focused on luxury and mid-to-high-end remodeling and new construction. Key buyers within this segment include discerning homeowners and custom home builders seeking premium surfaces for expansive kitchen islands, bespoke bathroom cladding, and large-format interior flooring. Their purchasing decision is heavily influenced by the ability of porcelain slabs to perfectly mimic luxurious materials like rare marble, without the maintenance burden and vulnerability to staining associated with natural stone, positioning the product as a superior, worry-free investment.

The commercial infrastructure sector represents the highest volume potential and includes major developers of hospitality assets (five-star hotels and resorts), large-scale retail complexes (malls and flagship stores), and specialized healthcare facilities. These end-users prioritize porcelain slabs for their superior performance metrics: high resistance to abrasion from continuous heavy foot traffic, non-porosity for infection control and hygiene standards, and non-combustibility for safety regulations in public spaces. The adoption of porcelain facades in large commercial and institutional buildings, where longevity, minimal long-term maintenance costs, and contribution to building energy efficiency are mandated, solidifies this sector as a critical growth engine for the market.

Furthermore, the market relies heavily on Architectural and Design (A&D) professionals, who function as powerful specifiers and key opinion leaders, often dictating the material choices for multi-million dollar projects. A&D firms value the consistency, dimensional stability, and vast aesthetic palette offered by porcelain slabs, enabling them to realize complex design visions, particularly in the creation of seamless internal and external transitions. Finally, specialized end-users, such as modular construction companies, utilize porcelain for factory-prefabricated modules, while custom furniture manufacturers increasingly specify 6mm porcelain for durable, lightweight table tops and cabinet veneers, capitalizing on porcelain's superior scratch resistance compared to engineered wood or standard laminates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roca, Mohawk Industries (Daltile), Lamosa Group, RAK Ceramics, Florim Ceramiche, Laminam SpA, Stonepeak Ceramics, Kalesinterflex, Iris Ceramica Group, SCG Cement-Building Materials, Pamesa Ceramica, Cotto d’Este, ABK Group, Porcelanosa Grupo, Atlas Concorde, Crossville Inc., Gruppo Concorde, Fanal Ceramica, Marazzi Group (S.p.A.), Guangdong Monalisa Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Porcelain Slabs Market Key Technology Landscape

The competitive differentiation within the Porcelain Slabs Market is fundamentally driven by continuous technological superiority in three core areas: pressing, firing, and surface finishing. The most transformative process remains the adoption of continuous pressing systems, specifically the Continua+ generation technology. This non-molding production process allows for unparalleled density and compaction uniformity across vast slab dimensions, up to 1600x3200 mm and beyond, which is crucial for achieving the minimal porosity required for technical porcelain specifications. By eliminating air pockets and ensuring consistent material distribution, this technology reduces the likelihood of internal flaws and stress points, enhancing the material’s structural integrity necessary for complex architectural applications like cantilevered countertops and thin facades.

Aesthetic innovation is entirely reliant on the refinement of high-definition digital inkjet printing (DIP) utilizing ceramic inks. Modern DIP systems employ sophisticated color management and droplet precision to create complex, non-repeating, three-dimensional surface textures and intricate veining patterns that mimic the depth of natural stone with photo-realistic fidelity. Furthermore, advancements in specialized finishing equipment, such as large-format polishing lines, enable manufacturers to achieve extremely high gloss levels while maintaining surface hardness and scratch resistance. New technology also includes the integration of functional coatings, such as anti-microbial treatments embedded during the firing process and photocatalytic coatings that use UV light to break down organic pollutants, expanding the market appeal in hygienic and external environmental applications.

The final significant technological area is the integration of automation and process control, increasingly supported by Artificial Intelligence (AI) and the Industrial Internet of Things (IIoT). Advanced sensors and real-time data analytics are crucial for optimizing the energy-intensive firing cycle, ensuring that massive kilns operate at peak thermal efficiency while maintaining precise temperature uniformity to guarantee vitrification quality. Automation extends to post-production handling, where robotic systems manage the stacking, sorting, and cutting of large, fragile slabs, minimizing human error and reducing costly material breakage. This technological ecosystem ensures high throughput, product consistency, and lowered manufacturing cost per unit, which is vital for competing effectively against traditional surfacing materials.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth

The Asia Pacific region exerts overwhelming influence on the global Porcelain Slabs Market, predominantly defining the volume dynamics through massive manufacturing capacity and accelerating domestic consumption. Economic powerhouses like China, which is both the largest consumer and producer globally, and India, with its rapidly urbanizing Tier I and II cities, are the primary growth drivers. The demand here is largely fueled by extensive large-scale residential housing projects and significant government investment in commercial infrastructure, including transportation hubs and large office complexes. Manufacturers in this region have successfully scaled production, incorporating large-format pressing technology to meet the local architectural preference for highly polished, large-surface flooring that is both durable and aesthetically impressive, often achieving competitive pricing due to efficient supply chains and lower labor costs.

The market environment in APAC is characterized by intense price competition, especially among local producers. However, there is a distinct and growing premium segment driven by multinational hotel chains and luxury residential developers who prioritize imported European slabs for their superior design sophistication and guaranteed technical specifications. The continuous modernization of building standards across Southeast Asia, moving towards materials that offer better durability and fire safety than traditional options, ensures sustained high demand for porcelain slabs. Furthermore, the rising awareness among consumers in South Korea and Japan regarding the long-term benefits of low-maintenance, hygienic surfaces further diversifies the application portfolio within this economically dynamic region.

- North America: Focus on Premiumization and Customization

The North American Porcelain Slabs Market is a high-value sector, distinguished by a mature renovation culture and a strong consumer willingness to invest in premium, performance-driven materials. Demand is heavily concentrated in high-end residential kitchen remodeling, where porcelain slabs are replacing granite and engineered quartz due to their superior heat resistance and ability to resist etching from acidic foods. The aesthetic trend strongly favors monolithic formats (1600x3200 mm) in white marble or dark, textured concrete lookalikes, emphasizing customization and bespoke fabrication services.

A significant regional driver is the stringent building code compliance related to exterior cladding. Porcelain slabs are increasingly specified for rainscreen and ventilated facade systems across commercial and multi-family residential towers in the U.S. and Canada, valued for their seismic resistance, light weight compared to natural stone, and contribution to insulation and weather protection. The market structure relies heavily on specialized distributors who manage the complex logistics and provide essential cutting and fabrication services, minimizing breakage risk for the end-contractor. The presence of major domestic players ensures reliable supply, but European imports continue to dominate the ultra-luxury, high-design segments of the market.

- Europe: Technological Leadership and Sustainability Integration

Europe holds the undisputed leadership position in terms of technological innovation, process quality, and sustainability standards within the global porcelain slab industry. Italian and Spanish manufacturers are the pioneers of ultra-large format pressing and high-definition digital printing, setting global benchmarks for aesthetic fidelity and technical performance. The market growth, while structurally slower than APAC in volume, is high in value, supported by continuous refurbishment programs and a deep commitment to energy-efficient building practices mandated by the European Union directives.

The unique regional characteristics include an exceptionally high demand for ultra-thin (3mm and 6mm) porcelain slabs, which are crucial for lightweight facade construction and interior refurbishment where material weight and quick installation over existing surfaces are priorities. Furthermore, European consumers and architectural specifiers place a high premium on sustainability; manufacturers are responding by prioritizing closed-loop manufacturing, waste reduction, and the development of inert, recycled-content slabs. Countries like Germany, France, and the Nordic nations show strong utilization in public spaces and healthcare, capitalizing on porcelain's hygienic, non-porous surface qualities, cementing Europe's role as the innovation nucleus of the market.

- Latin America (LATAM): Emerging Opportunities and Economic Volatility

The LATAM market, while exhibiting potential, operates under the constraints of periodic economic volatility and currency fluctuations, which impact the cost of imported machinery and premium imported slabs. Nonetheless, key economies like Brazil, Mexico, and Chile are witnessing a substantial transition in construction material preference, moving from cheaper, traditional ceramics to higher-performance porcelain slabs, particularly in high-rise urban centers. This shift is driven by a growing middle and affluent class demanding modern, durable interior finishes comparable to international standards.

Opportunities are concentrated in major urban development projects, where porcelain is specified for large-format flooring in malls and corporate buildings. Local manufacturing capacity is steadily increasing, focusing on adapting production to meet specific regional aesthetic tastes, though specialized technology for the largest formats is often imported. The primary challenge for sustained market expansion in LATAM is the necessity to improve local logistical infrastructure and enhance the availability of skilled labor for large slab installation, which will be essential to reduce material costs and lower project execution risks.

- Middle East and Africa (MEA): Luxury Construction and External Applications

The Middle East market is defined by unparalleled expenditure on luxury real estate, massive tourism infrastructure development, and ambitious "future city" projects, particularly across the Gulf Cooperation Council (GCC) states. Porcelain slabs are essential in this region, especially for exterior applications, due to their unmatched ability to withstand the region’s extreme climatic conditions—intense, unremitting UV exposure, high ambient temperatures, and thermal cycling—without fading or cracking. The aesthetic preference overwhelmingly favors expansive, high-gloss finishes that replicate luxury Italian and Greek marbles on a grand scale.

Consumption is skewed toward the premium segment, often requiring the largest available slab sizes for continuous wall cladding and flooring in opulent hotels and massive public works. While RAK Ceramics represents a major regional manufacturer, many high-specification projects rely on imports from Italy and Spain for specialized quality and design. In the African continent, demand is more localized to South Africa and Egypt, focusing primarily on durable, easy-to-clean commercial flooring, where the focus remains heavily on practical performance and competitive pricing rather than ultra-luxury aesthetics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Porcelain Slabs Market.- Roca

- Mohawk Industries (Daltile)

- Lamosa Group

- RAK Ceramics

- Florim Ceramiche

- Laminam SpA

- Stonepeak Ceramics

- Kalesinterflex

- Iris Ceramica Group

- SCG Cement-Building Materials

- Pamesa Ceramica

- Cotto d’Este

- ABK Group

- Porcelanosa Grupo

- Atlas Concorde

- Crossville Inc.

- Gruppo Concorde

- Fanal Ceramica

- Marazzi Group (S.p.A.)

- Guangdong Monalisa Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Porcelain Slabs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between porcelain slabs and traditional engineered quartz countertops?

Porcelain slabs are manufactured entirely from purified natural minerals (clays, feldspar) fired at over 1200°C, achieving full vitrification (near-zero porosity, <0.5%). This makes them inherently resistant to UV exposure, extreme heat, scratching, and chemical etching, enabling their use both indoors and outdoors. Engineered quartz, however, is a composite material made of ground quartz held together by approximately 10% polymer resin, meaning it lacks resistance to high heat and is susceptible to UV degradation, restricting its application primarily to indoor areas.

Which application segment holds the highest growth potential for porcelain slabs?

The Exterior Facades segment is anticipated to exhibit the highest Compound Annual Growth Rate, especially in Western markets. This accelerated growth is driven by the increasing global emphasis on building envelope performance, energy efficiency regulations, and the need for durable, lightweight, non-combustible cladding materials. Porcelain slabs integrate perfectly into ventilated facade systems, providing superior thermal insulation and aesthetic longevity compared to traditional facade options like heavier stone or metal panels.

How do technological advancements influence the aesthetic variety of porcelain slabs?

Technological leaps in high-definition digital inkjet printing (DIP) have fundamentally transformed aesthetic offerings. Modern DIP utilizes advanced ceramic inks to replicate the complex, non-repeating veining, subtle color gradients, and deep texture of rare natural materials (e.g., highly sought-after Italian marble) with near-perfect realism. This allows for 'mass customization' and rapid introduction of new collections that align immediately with current architectural trends, drastically shortening the product development cycle for manufacturers.

What are the main logistical and labor challenges associated with installing ultra-large format porcelain slabs?

The primary challenges stem from the physical dimensions and inherent fragility of slabs exceeding 1600x3200 mm. Safe handling requires specialized, often vacuum-based, lifting equipment, vertical transport racking, and highly skilled, certified installation teams trained specifically in large-format installation protocols. Any failure in logistics or specialized labor execution significantly increases the risk of costly on-site material breakage and subsequent project delays, necessitating strong integration between manufacturers and highly competent fabricators.

Which geographical region is leading in terms of production innovation and high-value product development?

Europe, anchored by Italy and Spain, leads globally in production innovation and the development of high-value porcelain slabs. This region pioneered continuous pressing and ultra-thin formats (6mm) and is driving advancements in functional surfaces, such as anti-microbial treatments and specialized finishes. European manufacturers focus on sustainability and high technical specifications, setting the premium quality benchmarks adopted by high-end architects and designers worldwide, resulting in the region commanding the highest average selling prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager