Porcelain Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433595 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Porcelain Tableware Market Size

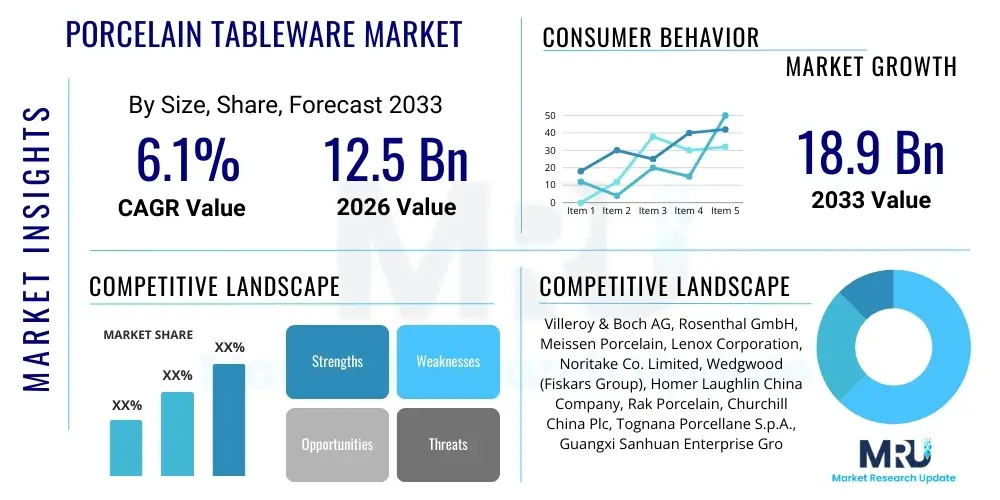

The Porcelain Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.9 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily supported by the expanding hospitality sector globally, coupled with a renewed consumer focus on high-quality, durable, and aesthetically appealing home dining solutions, particularly in rapidly urbanizing economies.

Porcelain Tableware Market introduction

The Porcelain Tableware Market encompasses the manufacturing, distribution, and sale of dining accessories, including plates, bowls, cups, saucers, and serving platters, crafted primarily from fine porcelain clay fired at high temperatures. Porcelain, distinct from earthenware and stoneware due to its vitrified, non-porous nature and characteristic translucency, offers superior mechanical strength, chip resistance, and heat retention properties, making it highly valued in both commercial and residential settings. The market serves a diverse range of end-users, from high-end hotels and Michelin-starred restaurants to mass-market retailers and individual consumers seeking premium kitchenware solutions. The intrinsic qualities of porcelain, such as its hygienic surface and capability to be decorated with complex, durable glazes, maintain its status as a staple material in modern dining culture.

Major applications for porcelain tableware span the entire food service ecosystem. In the hospitality sector, standardized, durable porcelain is essential for efficient operations, brand presentation, and minimizing replacement costs; cruise lines, airlines, and institutional caterers rely heavily on its robust performance features. Conversely, in the residential market, demand is driven by aesthetic trends, seasonal collections, and the cultural significance of formal dining, leading to robust sales of specialized dinnerware sets and artisanal pieces. Key benefits driving market adoption include the material's excellent thermal shock resistance, which allows for safe use in ovens and microwaves, its relative lightweight compared to heavy stoneware, and its ability to maintain a pristine, scratch-resistant finish even after extensive use in commercial dishwashers. These performance attributes solidify porcelain’s competitive advantage over alternative materials like glass, melamine, or standard ceramics.

The market is predominantly driven by increasing disposable incomes in Asia Pacific, leading to higher spending on lifestyle and luxury home goods, and the global resurgence of the tourism and restaurant industries post-pandemic. Furthermore, shifting consumer preferences towards sustainable and health-conscious products favor porcelain, as it is generally non-toxic and environmentally stable compared to certain plastics or lower-quality glazed ceramics. Technological advancements in firing techniques and digital printing allow manufacturers to produce intricate, customized designs at scale, catering to the growing demand for personalized and unique tableware collections. The continuous replacement cycle within the commercial sector and the trend towards "tablescaping" in residential interior design ensure sustained market momentum through the forecast period, positioning porcelain as a resilient and high-growth segment within the broader housewares industry.

Porcelain Tableware Market Executive Summary

The Porcelain Tableware Market is characterized by intense competition driven by product innovation focused on design, durability, and functionality, particularly in the premium segment. Key business trends include the consolidation of manufacturing in Asia Pacific, leveraging cost efficiencies and expertise, while Western companies focus on high-margin, branded, and designer collections marketed through direct-to-consumer (D2C) channels. A significant structural trend is the accelerating shift towards e-commerce platforms, necessitated by changing consumer buying habits and the logistical improvements in shipping fragile goods. Manufacturers are increasingly utilizing advanced material formulations, such as bone china and fine china derivatives, to enhance whiteness and translucency, further differentiating their offerings in a crowded marketplace. The trend of multi-functional tableware and sustainable production methods, including reduced waste processes and recyclable packaging, is gaining traction as corporate social responsibility becomes a core purchasing criterion for commercial buyers and ethical consumers.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by high production capacities, large domestic consumer bases (especially China and India), and the strong cultural tradition of porcelain use. North America and Europe, while representing mature markets, exhibit high spending power, driving demand for premium, luxury, and imported European-style dinnerware. The European market, specifically Germany and the UK, shows a strong preference for heritage brands and specialized artisanal products, often adhering to strict aesthetic and quality standards. Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth regions, spurred by urbanization, rapid expansion of the hotel construction sector, and rising affluence. The infrastructure development supporting large-scale commercial kitchens and tourism projects in regions like the UAE and Saudi Arabia is a key regional trend fueling commercial tableware adoption.

Segment trends reveal that the commercial application segment (HORECA - Hotels, Restaurants, Cafés) accounts for the largest market share, prioritizing durability, stackability, and standardization. However, the residential segment is projected to show a faster CAGR, buoyed by the global shift towards in-home entertaining and increased consumer investment in home aesthetics following global mobility restrictions. Based on product type, dinner sets and specialized serving ware are seeing robust demand, particularly those incorporating innovative, modern designs that complement minimalist or contemporary interior styles. Furthermore, the material segmentation shows a sustained preference for standard porcelain due to its cost-effectiveness, though the premium bone china segment maintains high growth due rates to its exceptional quality and perceived luxury value, heavily influencing the high-end gift and bridal registry market sub-segments.

AI Impact Analysis on Porcelain Tableware Market

User inquiries concerning AI's role in the Porcelain Tableware Market commonly center on efficiency gains, personalized design, and supply chain resilience. Users frequently question how AI can optimize kiln firing processes to minimize energy consumption and defect rates (a critical production cost factor), and whether Generative AI tools can create novel, market-specific patterns and shapes that appeal directly to micro-demographics. Concerns are also raised about AI's potential to automate skilled labor roles in decoration and quality control. The dominant expectation is that AI will primarily serve as an optimization layer, improving inventory forecasting, streamlining complex international logistics, and enhancing customer experience through predictive analytics that inform design choices and pricing strategies based on real-time trend monitoring and consumer feedback.

The immediate and tangible impact of Artificial Intelligence is visible in the manufacturing supply chain optimization. AI algorithms are being deployed to analyze sensor data from firing kilns, predicting optimal temperature curves and timing to ensure consistent vitrification, which directly reduces energy costs and product failures. This precision manufacturing, often coupled with predictive maintenance routines informed by machine learning, drastically increases operational efficiency. Furthermore, in procurement, AI systems analyze volatile raw material prices (clay, feldspar, silica, glaze chemicals) and geopolitical risks, allowing manufacturers to secure favorable contracts and maintain stable production costs, thereby mitigating the impact of external economic shocks on final product pricing.

Beyond the factory floor, AI is transforming the demand side through hyper-personalization and retail optimization. Machine learning models analyze vast datasets of consumer purchasing history, social media trends, and regional cultural preferences to inform new product development, ensuring that design teams create collections that are statistically likely to succeed in target markets. In e-commerce, AI-driven recommendation engines, virtual try-on environments (AR/VR linked), and automated customer service chatbots enhance the online shopping experience for fragile, high-value items, reducing return rates and increasing conversion. This digital transformation is critical for brands looking to scale their global reach without relying solely on traditional brick-and-mortar distribution networks, directly impacting market share and consumer engagement.

- AI-driven Kiln Optimization: Reduction in firing defects and energy consumption through predictive temperature control.

- Generative Design Tools: Creation of personalized patterns and ergonomic shapes based on demographic and trend analysis.

- Predictive Maintenance: Minimizing machinery downtime in production lines (e.g., molding, glazing, and printing equipment).

- Supply Chain Forecasting: Optimized inventory management and logistics planning for fragile goods distribution.

- E-commerce Personalization: Enhanced online recommendation systems and targeted marketing campaigns for luxury segments.

- Automated Quality Control: High-speed, vision-based systems using deep learning to identify subtle surface defects (e.g., bubbles, pinholes, warping).

DRO & Impact Forces Of Porcelain Tableware Market

The dynamics of the Porcelain Tableware Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary impact forces. The dominant driver is the robust growth in the global HORECA sector, specifically the proliferation of fine dining establishments, boutique hotels, and large-scale catering operations that demand durable, high-aesthetic tableware for superior guest experience. Concurrently, the rising consumer appetite for premium home furnishings, particularly in emerging economies where home renovation and lifestyle spending are surging, provides significant market propulsion. These demand-side forces are amplified by continuous technological improvements in material science, leading to the production of lighter, stronger, and more aesthetically diverse porcelain products that command higher price points and increase product differentiation across the competitive landscape.

However, the market faces significant restraints that temper its growth potential. Foremost among these is the volatility and increasing cost of energy, especially natural gas, which is critical for the high-temperature firing required in porcelain manufacturing; this directly impacts profit margins. Environmental regulations regarding kiln emissions and waste disposal also impose higher compliance costs, particularly in developed regions. Furthermore, the inherent fragility of the product, despite improvements in manufacturing, leads to elevated logistical and packaging costs, as well as high replacement rates in commercial settings. Competition from cheaper, alternative materials like tempered glass and specialized plastic resins (particularly in institutional or casual dining settings) continuously pressures prices in the mass-market segment, necessitating constant innovation in quality and design to maintain market relevance.

Opportunities for growth are concentrated around product diversification and sustainable sourcing. There is a strong market opportunity in developing and marketing eco-friendly porcelain lines using recycled materials or low-temperature firing techniques, appealing to environmentally conscious consumers and businesses. The rise of specialized, niche markets, such as custom corporate gifting, personalized wedding registries, and unique artisanal collaborations, offers high-margin avenues for smaller and luxury manufacturers. The expanding digital ecosystem also presents an opportunity to circumvent traditional distributors through D2C sales, allowing manufacturers to control branding, gather direct customer insights, and increase profitability. The overall impact forces are moderately positive, as the inelastic demand from the institutional sector and the continuous drive for premiumization in the residential segment are expected to outweigh cost pressures and competitive substitution risks over the forecast period, leading to stable, incremental market expansion.

Segmentation Analysis

The Porcelain Tableware Market is structurally segmented based on Product Type, Application, Material Type, and Distribution Channel, reflecting the diverse requirements and purchasing behaviors of end-users. The analysis of these segments is crucial for manufacturers to tailor their production, pricing, and marketing strategies effectively. The complexity of the market arises from the fact that design trends, material properties (such as translucency and density), and intended application (e.g., formal dining vs. casual use) significantly dictate product positioning within these categories. Understanding the growth dynamics within each segment, particularly the commercial versus residential split, provides vital insights into resource allocation and investment priorities.

In terms of Product Type, the market is broadly divided into dinnerware (plates, bowls), beverage ware (cups, mugs, teapots), serving ware (platters, tureens), and accessory items (salt shakers, condiment bowls). Dinnerware consistently holds the largest volume share due to its necessity in both residential and commercial settings. However, specialty serving ware, particularly unique, oversized pieces designed for modern, communal dining trends, is experiencing above-average growth, driven by high-end restaurant specifications and aspirational residential purchases. The market based on Application shows the Commercial segment, encompassing HORECA and Institutional use, dominating revenue due to bulk purchasing and regular replacement cycles; this segment demands high performance and durability, often favoring industrial-grade, thick-walled porcelain. Conversely, the Residential segment demands greater aesthetic diversity, focusing on design originality, color palettes, and brand perception.

Further delineation by Material Type highlights the split between Standard Porcelain, Bone China, and Fine China. Standard Porcelain, offering the best balance of cost and durability, maintains the highest volume share and is the preferred choice for mass-market retail and high-volume commercial users. Bone China, recognized for its exceptional whiteness, thinness, and translucency, commands a significant premium and exhibits high growth in luxury retail and high-end hospitality sectors, driven by its perceived value and status symbol association. Distribution Channel segmentation reveals the ongoing transition from traditional channels (retail stores, specialized distributors) to modern formats, with e-commerce showing explosive growth due to improved fulfillment processes and the ability of digital platforms to showcase vast design catalogs to a global audience. The strength of traditional wholesale distributors remains high for serving the highly localized and relationship-driven commercial HORECA sector.

- Product Type:

- Dinnerware (Plates, Bowls, Side Dishes)

- Beverage Ware (Mugs, Cups, Saucers, Teapots)

- Serving Ware (Platters, Trays, Casseroles, Gravy Boats)

- Accessory Items (Condiment Sets, Egg Cups, Specialty Items)

- Application:

- Commercial (HORECA, Institutional Catering, Corporate)

- Residential (Household Use, Gifting)

- Material Type:

- Standard Porcelain

- Bone China

- Fine China

- New Ceramic Composites

- Distribution Channel:

- Offline (Specialty Stores, Department Stores, Wholesale Distributors)

- Online (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Porcelain Tableware Market

The value chain for the Porcelain Tableware Market begins with the highly specialized Upstream activities involving the sourcing and processing of raw materials. These include high-purity kaolin clay, feldspar, quartz, and, in the case of bone china, calcined animal bone ash. The quality and consistent supply of these materials are paramount, as even minor impurities can compromise the structural integrity and aesthetic finish of the final product. Key upstream players include specialized mining companies and mineral processors. Manufacturers often establish long-term contracts or vertical integration strategies to secure raw material stability, which is essential given the high energy consumption involved in the subsequent milling and mixing phases that prepare the raw ‘body’ for molding and firing.

The Midstream segment encompasses core manufacturing processes: forming (casting, jiggering, pressing), high-temperature firing (bisque firing and glost firing), glazing, and decoration (printing, hand painting, decal application). This stage is capital-intensive, requiring advanced kiln technology and precise temperature control. Value creation here is heavily influenced by quality assurance protocols, waste reduction efficiency, and skilled labor for intricate decoration. Downstream activities involve distribution and sales. The distribution channel is bifurcated into direct sales, often utilized by luxury brands via their flagship stores or proprietary e-commerce sites, and indirect sales, which rely on global wholesalers, regional HORECA distributors, and large-scale retailers/department stores. Efficient packaging and logistics, particularly minimizing breakage risk during transport, are critical cost components in the downstream phase.

Direct channels offer higher margin control and brand visibility, proving particularly effective for customizable or high-value sets sold to residential customers or bespoke hospitality projects. Indirect channels, through specialized distributors, dominate the commercial segment, as these partners possess the necessary logistics infrastructure, local relationships, and inventory management capabilities required to service large institutional orders efficiently. The flow of value is optimized when manufacturers employ lean manufacturing principles in the midstream and utilize data analytics (often AI-assisted) in the downstream to forecast demand accurately, thereby reducing inventory holding costs and improving responsiveness to market shifts. The strong performance of the market is contingent on minimizing raw material and energy price volatility through optimized supply contracts throughout the value chain.

Porcelain Tableware Market Potential Customers

The primary customer base for the Porcelain Tableware Market is fundamentally divided into two major end-user groups: the Commercial Sector and the Residential Sector. Within the Commercial Sector, the HORECA industry—Hotels, Restaurants, and Cafés—represents the most significant segment. High-end hotels and resorts require vast quantities of durable, standardized tableware that reflects their brand aesthetics, often necessitating bespoke designs or specific quality grades (e.g., reinforced rolled edges for chip resistance). Restaurants, ranging from casual eateries to fine dining venues, purchase based on menu requirements, aesthetic themes, and operational needs, prioritizing stackability and easy cleaning. Institutional buyers, including hospitals, schools, corporate canteens, and military facilities, represent another high-volume, cost-sensitive sub-segment prioritizing functionality and robustness over intricate design.

The Residential Sector is characterized by highly fragmented purchasing behavior, driven by disposable income, cultural traditions, gifting occasions (like weddings and housewarmings), and prevailing interior design trends. Aspirational consumers in developed and rapidly urbanizing markets represent the fastest-growing segment, seeking luxury or branded tableware as a reflection of personal status and lifestyle. These customers are highly sensitive to marketing, digital influencers, and the narrative associated with heritage brands. They often purchase full dinner sets or curated collections designed for specialized use, such as seasonal entertaining or specific cuisine types, which drives innovation in product aesthetics and packaging. The rise of home-based social gatherings and the cultural emphasis on culinary presentation further solidify this consumer group’s importance.

Furthermore, niche potential customers include corporate gift buyers and specialized retailers focusing on bridal registries or luxury houseware. Corporate clients often purchase customized porcelain items (with logos or bespoke artwork) for promotional purposes or executive gifts, demanding high-quality finishing and reliable delivery schedules. Designers and interior architects also act as influential indirect customers, specifying certain brands and styles for residential projects or large commercial hospitality developments. Targeting these professional specifiers requires a different sales approach, emphasizing technical specifications, durability reports, and the capacity for customization. The overall customer profile demands varying degrees of quality, from the basic utility of institutional ware to the exquisite artistry of high-end bone china, requiring manufacturers to maintain diverse product portfolios and targeted distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Growth Rate | CAGR 6.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Villeroy & Boch AG, Rosenthal GmbH, Meissen Porcelain, Lenox Corporation, Noritake Co. Limited, Wedgwood (Fiskars Group), Homer Laughlin China Company, Rak Porcelain, Churchill China Plc, Tognana Porcellane S.p.A., Guangxi Sanhuan Enterprise Group Holding Co. Ltd., KAHLA Porzellan, Seltmann Weiden, Portmeirion Group PLC, Royal Doulton, Zibo Hantao Ceramics Co., Ltd., WMF Group, Royal Worcester, Steelite International, New Bone China Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Porcelain Tableware Market Key Technology Landscape

The core technology landscape in the Porcelain Tableware Market revolves around advanced ceramics manufacturing, emphasizing process control, automation, and material science innovation. A crucial technological advancement is the deployment of fast-firing kiln technology (roller hearth kilns), which significantly reduces the energy footprint and cycle time compared to traditional tunnel kilns. This technology ensures higher consistency in quality and allows manufacturers to respond quicker to market demands. Furthermore, robotic automation is increasingly utilized in labor-intensive and repetitive tasks such as casting, glazing, and stacking, reducing the reliance on highly skilled human labor while minimizing human error and associated defect rates. These automated processes are fundamental in achieving the scale and precision required by large commercial clients globally, ensuring uniformity across large batch productions.

Material innovation is another cornerstone of the technological landscape. Research efforts are focused on developing high-alumina porcelain formulas (reinforced porcelain) that offer significantly improved mechanical strength and chip resistance, crucial for the highly demanding environment of commercial kitchens. New composite ceramic blends are also being developed to mimic the aesthetic qualities of bone china (whiteness and translucency) while eliminating the use of animal bone ash, catering to ethical consumer preferences and simplifying production logistics. Moreover, advancements in glaze technology are critical, leading to highly durable, non-porous surfaces that resist staining, abrasion from flatware, and chemical etching from commercial detergents, thereby extending the service life of the tableware and reducing replacement costs for institutional buyers.

Digital technologies are driving the innovation in decoration and customization. High-definition digital printing and decal technology now allow for the precise and rapid application of complex, multi-color designs directly onto the porcelain surface before the final firing, offering far greater flexibility and lower setup costs than traditional silkscreen printing or hand-painting. This facilitates mass customization, allowing HORECA businesses to incorporate intricate branding elements economically. Furthermore, the integration of CAD/CAM software and 3D printing in the design and prototyping phase allows for the rapid creation and iteration of complex, ergonomic forms that would be impossible to achieve efficiently using traditional mold-making techniques. This confluence of material science, automation, and digital design capability defines the modern technological edge in porcelain manufacturing, ensuring both high quality and rapid market responsiveness.

Regional Highlights

The global Porcelain Tableware Market exhibits significant regional variations in production capacity, consumer preferences, and growth drivers, making regional analysis pivotal for strategic planning. Asia Pacific (APAC) stands as the undisputed global manufacturing hub, primarily led by China, which boasts extensive raw material reserves, massive production volumes, and cost advantages. Countries like India, Vietnam, and Thailand are also emerging as significant manufacturing centers, capitalizing on favorable government policies and growing domestic consumer demand for mid-range products. The APAC region’s market expansion is fueled by its massive population base, increasing urbanization, rising middle-class disposable incomes, and the rapid expansion of the hospitality and tourism sectors, leading to dual growth in both export-oriented manufacturing and domestic consumption. Specifically, China and India are experiencing a noticeable shift from basic ceramics towards higher-quality porcelain as aspirational spending increases.

Europe represents a mature but high-value market, characterized by deep-rooted traditions in porcelain manufacturing, notably in Germany (Villeroy & Boch, Rosenthal), the UK (Wedgwood), and France (Limoges). This region focuses heavily on luxury, heritage, and premium fine china, where brand reputation, craftsmanship, and bespoke design command high prices. The European market is highly regulated regarding environmental standards and product safety, driving technological investment into sustainable production practices. Although production volumes are lower than in APAC, the high average selling price (ASP) of European-made porcelain ensures substantial revenue generation. The demand here is stable, driven by replacement cycles in established commercial settings and resilient residential demand for high-quality, durable goods.

North America is predominantly a consumer market, heavily reliant on imports, with demand driven by trends in home décor, high residential renovation rates, and a robust commercial sector. The US specifically is a key market for both luxury imports (European and Japanese porcelain) and high-volume, cost-effective products (often sourced from China). Key growth factors include the consistent expansion of the food service industry and the strong influence of lifestyle media and e-commerce, which dictate fast-moving consumer trends in color, style, and functionality. The market shows a high penetration of multi-brand retailers and department stores that leverage diverse global supply chains to offer a wide array of products catering to varying consumer price points and aesthetic tastes, including modern, minimalist, and rustic porcelain styles.

The Latin American (LATAM) and Middle East & Africa (MEA) regions are emerging markets showing accelerated growth. In LATAM, economic stability improvements and expanding middle classes in countries like Brazil and Mexico are leading to increased residential spending on durable goods. In the MEA, growth is almost entirely propelled by massive government investment in tourism infrastructure, including the construction of mega-hotels, luxury residential complexes, and ambitious hospitality projects, particularly in the UAE, Saudi Arabia, and Qatar. These regions demand high-quality, often opulent, and customized commercial tableware, providing lucrative opportunities for global manufacturers specializing in large-scale, luxury contract supplies. Local manufacturing capacity in these regions remains low, making them highly attractive import destinations for global porcelain companies looking for high-margin, large-volume commercial contracts.

- Asia Pacific (APAC): Dominant manufacturing and consumption hub; rapid urbanization and rising middle-class disposable income drive high volume growth. Key markets: China, India, Vietnam.

- Europe: Mature, high-value market focused on luxury, heritage brands, and fine china. Stable demand driven by replacement and premium residential sectors. Key markets: Germany, UK, France.

- North America: Large consumer market, heavily reliant on imports; demand influenced by HORECA expansion and home décor trends. Key market: United States.

- Latin America (LATAM): Emerging market with increasing residential demand due to improving economic conditions. Key markets: Brazil, Mexico.

- Middle East and Africa (MEA): High growth in the commercial sector driven by large-scale tourism and hospitality infrastructure projects. Key markets: UAE, Saudi Arabia, Qatar.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Porcelain Tableware Market.- Villeroy & Boch AG

- Rosenthal GmbH

- Meissen Porcelain

- Lenox Corporation

- Noritake Co. Limited

- Wedgwood (Fiskars Group)

- Homer Laughlin China Company

- Rak Porcelain

- Churchill China Plc

- Tognana Porcellane S.p.A.

- Guangxi Sanhuan Enterprise Group Holding Co. Ltd.

- KAHLA Porzellan

- Seltmann Weiden

- Portmeirion Group PLC

- Royal Doulton

- Zibo Hantao Ceramics Co., Ltd.

- WMF Group

- Royal Worcester

- Steelite International

- New Bone China Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Porcelain Tableware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between bone china and standard porcelain tableware?

Bone china is differentiated by its inclusion of at least 25% bone ash, resulting in superior translucency, whiteness, and lightness compared to standard porcelain. While standard porcelain offers greater durability and cost-effectiveness for commercial use, bone china is generally considered the premium, high-end choice due to its delicate aesthetic and resistance to chipping, making it highly preferred for luxury residential and fine dining applications.

How is the rise of the e-commerce channel impacting the distribution of fragile porcelain items?

E-commerce is revolutionizing distribution by providing direct-to-consumer access and expanded product catalogs. Key impacts include the necessity for advanced logistics solutions, specialized high-impact packaging, and the integration of virtual reality (VR) tools for visual merchandising. This channel shift is driving manufacturers to invest heavily in robust fulfillment infrastructure to minimize breakage rates and maintain consumer trust in the delivery of fragile goods.

Which geographical region holds the largest market share in terms of production volume?

Asia Pacific (APAC), particularly China, holds the largest global market share in terms of production volume. This dominance is attributed to significant access to high-quality raw materials, established large-scale manufacturing infrastructure, lower operational costs compared to Western counterparts, and a vast domestic consumer base driving high demand for mass-produced porcelain tableware.

What are the key drivers for the commercial (HORECA) segment within the market?

The commercial segment is primarily driven by the expansion of the global hospitality sector, the demand for highly durable, reinforced tableware (e.g., alumina-porcelain) that resists chipping and thermal shock, and the necessity for aesthetic standardization across hotel chains. The segment requires high-volume, recurring orders to replace items lost or damaged in high-turnover environments, ensuring stable demand regardless of residential trends.

How do sustainability concerns influence porcelain tableware manufacturing and consumer choice?

Sustainability concerns are pushing manufacturers to innovate in two primary areas: reducing the energy consumption associated with high-temperature firing and developing eco-friendly materials, such as recycled ceramic bodies or glazes free from heavy metals. Consumers, particularly in Europe and North America, increasingly favor brands that demonstrate verifiable commitments to reduced waste, ethical sourcing, and energy-efficient production methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager