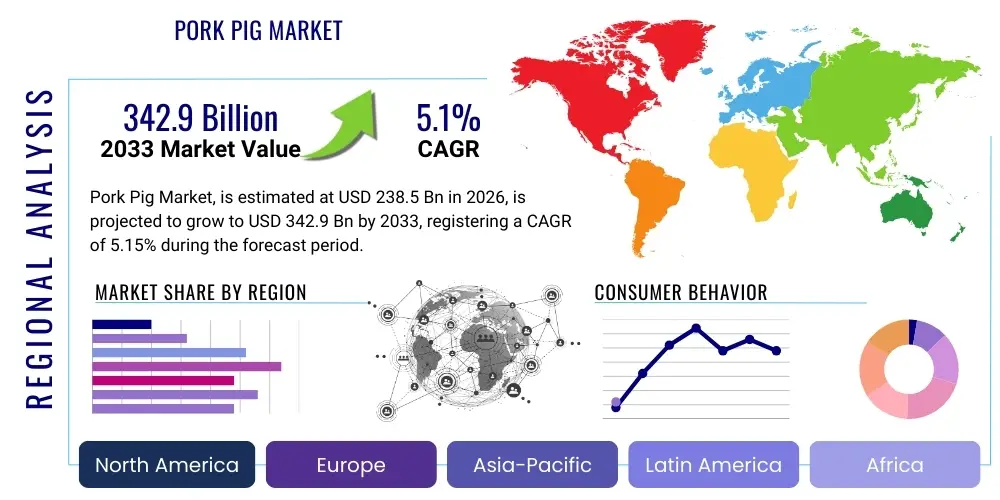

Pork Pig Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438493 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Pork Pig Market Size

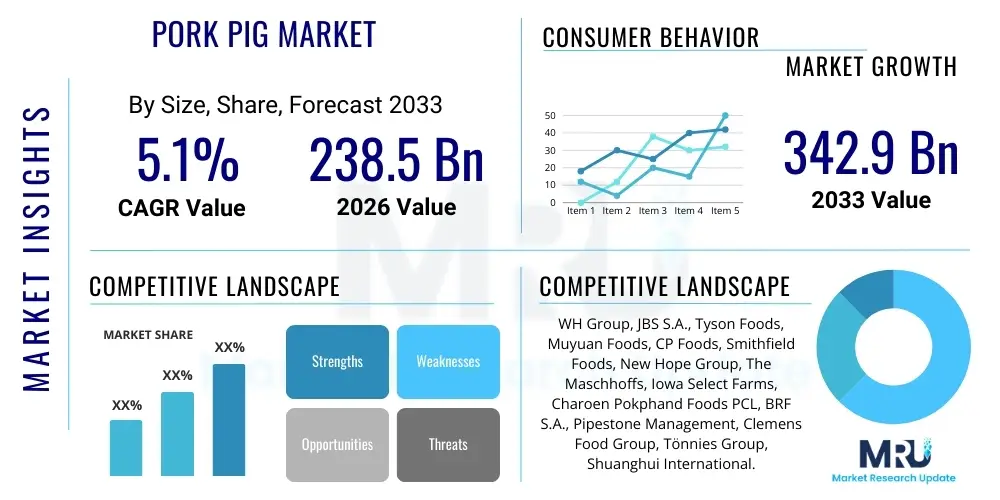

The Pork Pig Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.15% between 2026 and 2033. The market is estimated at USD 238.5 Billion in 2026 and is projected to reach USD 342.9 Billion by the end of the forecast period in 2033.

Pork Pig Market introduction

The Pork Pig Market encompasses the entire commercial ecosystem surrounding the breeding, rearing, feeding, and trading of swine intended for meat production. This market serves as the fundamental supply chain for pork products globally, driven by sustained human consumption preferences and the necessity for scalable, affordable protein sources. The primary product involves live swine categorized by developmental stage—from piglets and feeder pigs to mature slaughter hogs. Key applications span across commercial meat processing, restaurant and food service industries, and retail distribution, forming a complex global network critical for food security and economic vitality in major agricultural nations.

The operational scope of the market includes advanced genetic selection programs aimed at improving feed conversion ratio, disease resistance, and meat quality attributes. This sophistication is complemented by large-scale mechanized farming operations, particularly in regions like Asia Pacific and North America, where demand density necessitates high-efficiency production models. The market's stability relies heavily on the effective management of animal health risks, particularly endemic and epidemic diseases like African Swine Fever (ASF) and Porcine Reproductive and Respiratory Syndrome (PRRS), which can dramatically impact supply and pricing structures.

Major driving factors fueling market expansion include rapid population growth in emerging economies, increasing urbanization leading to higher demand for convenient and processed meat products, and rising disposable incomes allowing consumers to transition toward protein-rich diets. Furthermore, continuous innovation in feed formulations and farming technologies, promoting faster growth and improved sustainability, further cements the pork pig market's position as a dominant segment within the global livestock industry. The inherent versatility of pork as a protein source in various cuisines also contributes significantly to its enduring market prominence.

Pork Pig Market Executive Summary

The global Pork Pig Market is defined by intense consolidation among integrated producers and high volatility driven by geopolitical trade policies and periodic disease outbreaks. Current business trends indicate a strong move toward vertical integration, where major companies control breeding, farming, slaughtering, and processing operations to maximize efficiency and traceability. Sustainability and animal welfare standards are increasingly shaping corporate strategy, influencing investment in climate-controlled housing and waste management systems. Furthermore, technology adoption, including precision feeding and monitoring tools, is boosting operational productivity and lowering the environmental footprint per unit of meat produced, thereby addressing both consumer and regulatory pressures.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, particularly China, both as the largest producer and consumer of pork globally, although its market structure is recovering and consolidating following the severe ASF outbreaks experienced in the late 2010s. North America and Europe remain crucial export hubs, characterized by stringent health standards and advanced biotechnological inputs, focusing heavily on premium and traceable pork products. Latin America, specifically Brazil, is emerging as a critical low-cost production powerhouse, leveraging vast land resources and favorable climatic conditions to compete aggressively in international export markets, particularly targeting Asian consumer bases.

Segmentation trends show a notable shift towards specialized genetics within the Type segment, emphasizing breeding stock engineered for specific market requirements such as high lean meat yield or superior carcass quality. In the Application segment, commercial farming continues to dominate, but there is a growing, albeit niche, market for high-welfare and certified organic pork, reflecting affluent consumer preferences in developed economies. The increasing demand for processed and pre-cooked pork products, driven by lifestyle changes, also underscores segment growth in downstream processing industries, creating sustained demand for specific weights and types of slaughter pigs.

AI Impact Analysis on Pork Pig Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Pork Pig Market frequently center on efficiency gains, disease prevention capabilities, and ethical implications related to monitoring. Users primarily ask how AI can optimize feeding schedules, predict and mitigate disease spread in large herds, automate labor-intensive tasks like sorting and weighing, and enhance overall farm profitability. Key themes reveal concerns about the required infrastructure investment, data privacy standards for livestock monitoring, and the potential displacement of human labor. There is high expectation that AI will deliver superior traceability records and significantly improve the ability of large farms to comply with increasingly strict environmental and welfare regulations by providing real-time operational diagnostics and predictive analytics, moving the industry toward truly precision livestock farming.

AI's role is rapidly transitioning from theoretical potential to practical application within modern hog production facilities. Sophisticated machine vision systems, utilizing deep learning algorithms, are now capable of monitoring individual pig behavior, detecting subtle indicators of distress, illness, or changes in feed intake long before human observation would confirm an issue. This preemptive health management minimizes veterinary costs, reduces antibiotic use, and improves overall herd survival rates. Furthermore, AI-driven climate control and ventilation systems optimize barn environments based on real-time data inputs regarding temperature, humidity, and ammonia levels, directly contributing to superior animal comfort and growth performance. The integration of AI algorithms into farm management software creates a closed-loop system, enabling continuous optimization across the entire production cycle, from gestation to finishing.

The strategic deployment of AI also extends significantly into resource management and supply chain logistics. Predictive models utilize historical market data, weather patterns, and slaughterhouse capacity to optimize transport logistics, ensuring timely delivery and minimizing stress on the animals. On the financial side, AI algorithms provide advanced pricing forecasting, helping producers make informed decisions about market timing and hedging strategies, thereby stabilizing revenue streams against volatile commodity markets. The overall impact is a fundamental shift toward data-driven decision-making, transforming traditional pig farming into a high-tech agricultural enterprise focused on maximizing biological potential while minimizing resource wastage and environmental impact.

- AI-driven sensor technology enables predictive disease detection, reducing mortality and antibiotic usage.

- Machine vision systems automate behavioral monitoring and individual animal identification for precision feeding.

- Optimization of feed conversion ratio (FCR) through AI analysis of environmental and genetic factors.

- Automation of sorting, weighing, and grading processes, improving operational throughput.

- Enhancement of environmental controls (ventilation, temperature) using real-time data analytics.

- Improved traceability and regulatory compliance documentation via distributed ledger technology integrated with AI oversight.

- Advanced market forecasting tools for strategic supply chain management and pricing decisions.

DRO & Impact Forces Of Pork Pig Market

The dynamics of the Pork Pig Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal Impact Forces that shape long-term industry trajectories. Key drivers include accelerating global demand for affordable protein, particularly in emerging markets, coupled with advancements in swine genetics that significantly improve efficiency and yield. However, the market faces severe restraints, notably recurrent outbreaks of highly contagious swine diseases, stringent environmental regulations regarding waste management, and increasing consumer concern over animal welfare practices, which raise production costs substantially. Opportunities lie in leveraging technological innovations such as gene editing for disease resistance, expanding export penetration into developing economies, and capitalizing on the niche market for sustainably and ethically produced pork products.

The primary Impact Forces revolve around global trade mechanisms and public health policy. Trade tariffs and non-tariff barriers, particularly those imposed by large importing nations, create significant market volatility. Furthermore, the global response and control measures against diseases like ASF act as critical, unpredictable forces that instantly reshape regional supply and demand balances. Internal market pressures, derived from the high capital expenditure required for modern, biosecure facilities, favor large, integrated producers, driving consolidation. Conversely, consumer preferences for specific attributes, such as antibiotic-free or organic certification, exert a strong influence, compelling producers to adapt breeding and rearing protocols.

Strategic success in this environment requires producers to navigate the conflict between scale efficiency (driven by technology and consolidation) and public perception (driven by welfare and sustainability concerns). While drivers push for higher volume and lower cost, restraints and external forces necessitate higher investment in resilience and ethical practices. Exploiting opportunities in digital technology and alternative feed sources (e.g., insect protein) provides pathways to mitigate current restraints, ensuring that future growth is both economically viable and socially acceptable. The continual evolution of genetic science acts as an underlying positive force, promising inherent improvements in productivity and robustness against environmental stressors.

Segmentation Analysis

The Pork Pig Market is segmented primarily based on Type (reflecting the developmental stage and purpose of the pig), Application (indicating the farm type or end-use environment), and geographical Region (identifying primary consumption and production hubs). Understanding these segments is crucial for market participants to tailor their strategies, ranging from breeding stock suppliers focusing on specific genetic traits demanded by commercial farms, to feed manufacturers developing specialized nutritional profiles for different growth stages. The segmentation reveals a market structure dominated by large-scale industrialized production but concurrently exhibiting fragmented demand for specialized, high-quality inputs required for smaller, niche production systems targeting premium consumer segments.

The Type segmentation directly influences upstream market activities, including veterinary services and feed supply, as the nutritional and health requirements differ substantially between breeding sows, feeder pigs, and slaughter hogs. The Application segmentation dictates the scale and technology deployed; commercial operations demand automation and efficiency, while backyard farming often relies on traditional methods. Geographic analysis remains paramount, as localized consumer preferences (e.g., demand for specific cuts or fat content), climate conditions, and trade regulations fundamentally alter production economics and market accessibility across continents. The interrelation of these segments defines the overall complexity and targeted investment opportunities within the swine value chain.

- By Type:

- Breeding Pigs (Sows and Boars)

- Feeder Pigs (Weaners and Growers)

- Slaughter Pigs (Finishing Hogs)

- By Application:

- Commercial Farms/Industrial Production

- Backyard Farming/Smallholder Production

- Research and Development (R&D)

- By End-Product Category (Downstream Influence):

- Fresh/Chilled Pork

- Processed Meat Products (Sausages, Bacon, Ham)

- Canned/Preserved Pork

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, Spain, Denmark, Netherlands)

- Asia Pacific (China, Japan, Vietnam, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Pork Pig Market

The value chain of the Pork Pig Market is linear and highly integrated, beginning with upstream activities focused on genetics and feed production, progressing through midstream farming and animal health management, and culminating in downstream processing, distribution, and retail sales. Upstream analysis highlights the critical role of specialized breeding companies that develop genetically superior swine stock, often involving significant biotechnological investment. Concurrently, the feed industry, dealing with massive volumes of corn, soy, and additives, dictates a large portion of the final production cost. Efficiency at the upstream level—such as improving feed conversion ratios and sow productivity—has the most profound effect on overall industry profitability.

Midstream activities involve the actual rearing of the pigs, categorized into farrowing, nursery, and finishing phases. This stage is capital-intensive, requiring advanced housing, ventilation, and biosecurity systems. Distribution channels are varied but generally fall into two categories: direct sales from large, vertically integrated farms to their owned slaughterhouses, or indirect sales through specialized livestock brokers and auction markets, which serve smaller independent producers. The direct model is increasingly prevalent among global market leaders, enabling strict quality control and efficiency from farm gate to consumer.

Downstream analysis focuses on processing and consumer access. Pork processing involves slaughter, cutting, deboning, and manufacturing value-added products (e.g., cured meats). Major supermarket chains, wholesale food service providers, and export channels form the primary end-user distribution points. The complexity of cold chain logistics and the necessity for certified veterinary inspections add layers of cost and regulatory scrutiny to the downstream segment. Ultimately, the integration of genetics, high-quality feed, and modern processing infrastructure determines the competitiveness and profitability of the finished product in the global marketplace.

Pork Pig Market Potential Customers

The primary potential customers and end-users of the Pork Pig Market are varied but largely converge on industrial scale operations that require bulk raw material for subsequent processing. These customers include large multinational meat processors and slaughterhouses, which rely on a continuous, high-volume supply of slaughter pigs meeting strict weight and carcass quality specifications. These processors often engage in long-term contracts with large commercial farms to ensure stability in their supply chain, minimizing exposure to price fluctuations in spot markets. Their demand is driven by global retail consumption and export commitments.

Beyond the primary processing sector, secondary customer bases include independent butcher shops and regional food service distributors who source specific cuts or specialized heritage breeds. Furthermore, pharmaceutical and biotechnology companies represent a growing, niche customer segment, purchasing specific pig tissues or organs for medical research, transplantation studies (xenotransplantation), or vaccine development. The feed industry itself is also a customer of the upstream genetic providers, purchasing breeding stock to test new feed efficacy and performance characteristics.

The ultimate buyers, though not directly purchasing the live pig, are global consumers. However, in terms of direct industry transactions, the largest purchasing power lies with the companies specializing in packaged goods and restaurant supply. As consumer demand for high-welfare or sustainable products increases, specialized retailers and food manufacturers focusing on premium or certified pork products constitute a rapidly growing customer segment, willing to pay a premium for compliance with ethical sourcing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 238.5 Billion |

| Market Forecast in 2033 | USD 342.9 Billion |

| Growth Rate | 5.15% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WH Group, JBS S.A., Tyson Foods, Muyuan Foods, CP Foods, Smithfield Foods, New Hope Group, The Maschhoffs, Iowa Select Farms, Charoen Pokphand Foods PCL, BRF S.A., Pipestone Management, Clemens Food Group, Tönnies Group, Shuanghui International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pork Pig Market Key Technology Landscape

The Pork Pig Market is increasingly relying on sophisticated technology integration to manage large-scale operations, optimize resource utilization, and ensure compliance with biosecurity protocols. A crucial area of technological advancement involves smart barn systems, which utilize IoT (Internet of Things) sensors to continuously monitor environmental conditions such as temperature, air quality, and humidity, dynamically adjusting ventilation and cooling systems to maintain optimal pig health and comfort. Furthermore, automated feeding systems, controlled by specialized software, ensure precise nutritional intake based on the pig’s age, weight, and genetic profile, significantly improving feed conversion efficiency and minimizing waste—a key factor in reducing production costs and environmental impact.

Biotechnology and genetics represent another foundational technology segment. Modern pork production is heavily dependent on advanced genomic selection and gene editing techniques. These technologies allow breeders to rapidly identify and amplify desirable traits, such as increased resistance to common swine diseases (like PRRS), improved reproductive performance in sows, and superior meat quality characteristics. The development of robust, genetically stable breeding stock is critical for market resilience, especially in mitigating the financial damage caused by major disease outbreaks. Concurrently, veterinary diagnostics and vaccine technologies, including rapid on-site testing kits and advanced mRNA-based vaccines, are essential tools for proactive disease management.

Finally, data analytics and traceability platforms are transforming supply chain management. The implementation of blockchain technology, often combined with radio-frequency identification (RFID) tags or biometric identification, enables end-to-end traceability of pork products, from farm to fork. This transparency addresses growing consumer demand for verifiable origin and ethical sourcing, while simultaneously providing producers with invaluable data regarding yield performance, market correlations, and logistical bottlenecks. This digital infrastructure is foundational for enabling precision livestock farming and fulfilling the stringent record-keeping requirements imposed by global regulatory bodies and export markets.

Regional Highlights

The regional analysis of the Pork Pig Market reveals distinct production methods, consumption patterns, and trade dynamics across major geographies. Asia Pacific (APAC) dominates the global market both in terms of production volume and consumption, led overwhelmingly by China. Despite periodic challenges from disease outbreaks, the Chinese market is characterized by massive government investment in consolidation and modernization, favoring large, vertically integrated farming enterprises to stabilize domestic supply. Other APAC nations like Vietnam and the Philippines are also significant consumers, driving continuous expansion in feed manufacturing and processing infrastructure.

North America, particularly the United States and Canada, functions as a highly efficient, export-oriented production hub. This region benefits from cheap grain inputs (corn and soy), sophisticated genetic programs, and advanced automation technologies, allowing producers to achieve some of the lowest costs per pound globally. North American pork often sets the benchmark for quality and biosecurity, making it highly competitive in key import markets like Japan and Mexico. The industry structure here is characterized by large, often contract-based, farming operations feeding into massive slaughter and processing facilities.

Europe presents a varied landscape, constrained by some of the world's most stringent animal welfare and environmental protection standards. Countries like Spain, Germany, and Denmark are major producers and exporters, often specializing in high-welfare or specific regional products (e.g., Iberian ham). The focus in Europe is heavily skewed toward sustainability, reduced antibiotic usage, and adherence to specific geographical indications, adding complexity but also premium value to their products. Latin America, spearheaded by Brazil, represents the emerging powerhouse, utilizing vast resources and favorable climates to become a dominant low-cost exporter, rapidly expanding its market share in Asian and Middle Eastern markets.

- Asia Pacific (APAC): Dominates global production and consumption; recovering from ASF outbreaks via large-scale modernization and vertical integration, particularly in China.

- North America: Highly efficient, export-driven market characterized by technological leadership, low input costs, and integrated supply chains; key exporters include the US and Canada.

- Europe: Focuses heavily on high animal welfare standards, environmental compliance, and specialized/premium pork products; Denmark and Spain are major exporters within the continent and globally.

- Latin America: Emerging global export leader (especially Brazil); leverages large land areas and cost-effective production to compete fiercely in international trade.

- Middle East & Africa (MEA): Smallest regional market for pig production due to cultural and religious factors; characterized by high import dependency for protein needs, particularly from Europe and Latin America.

- China: Single largest market entity; drives global feed and genetics demand; government policies significantly impact global price stability and trade flows.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pork Pig Market.- WH Group (China/USA)

- JBS S.A. (Brazil)

- Tyson Foods, Inc. (USA)

- Muyuan Foods Co., Ltd. (China)

- Charoen Pokphand Foods PCL (CP Foods) (Thailand)

- Smithfield Foods (Subsidiary of WH Group) (USA)

- New Hope Group (China)

- The Maschhoffs (USA)

- Iowa Select Farms (USA)

- BRF S.A. (Brazil)

- Pipestone Management (USA)

- Clemens Food Group (USA)

- Tönnies Group (Germany)

- Betagro Group (Thailand)

- Danish Crown (Denmark)

- Genesus Inc. (Canada – Genetics Focus)

- PIC (Pig Improvement Company) (USA – Genetics Focus)

- Wens Foodstuff Group Co., Ltd. (China)

- Grupo Fuertes (Spain)

- Cherkizovo Group (Russia)

Frequently Asked Questions

Analyze common user questions about the Pork Pig market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current primary driver of growth in the Pork Pig Market?

The primary driver is the accelerating global demand for affordable and scalable animal protein, fueled by population expansion, urbanization, and rising middle-class disposable incomes, particularly across Asia Pacific and Latin America. This demand sustains high volume requirements for slaughter pigs.

How significant is African Swine Fever (ASF) risk to global supply chains?

ASF remains the single most significant biological restraint and volatility factor. While recovery efforts are underway, particularly in Asia, endemic presence necessitates massive investments in biosecurity and structural consolidation, profoundly impacting trade flows, regional production levels, and global pork prices.

What technological innovations are most impacting operational efficiency?

Precision livestock farming technologies, including IoT sensor networks for environmental control, AI-driven automated feeding systems, and advanced genomic selection techniques for disease resistance, are most significantly improving operational efficiency and profitability on modern commercial farms.

Which geographical region holds the largest market share for pork production?

Asia Pacific (APAC), led by China, holds the largest market share in terms of both production volume and consumption value, despite regulatory shifts and past disease challenges. However, North America and Europe remain the leading regions for high-volume exports.

How are environmental sustainability concerns changing pig farming practices?

Environmental concerns are driving mandatory adoption of advanced manure management systems, precision nutrient management (to reduce nitrogen and phosphorus runoff), and investment in anaerobic digestion technology to convert waste into biogas, ensuring regulatory compliance and meeting consumer expectations for lower environmental impact.

What role does vertical integration play among key market players?

Vertical integration allows key market players to control the entire value chain—from genetics and feed milling to slaughter and processing—minimizing external risks, optimizing costs, ensuring product quality consistency, and enhancing traceability, which is critical for accessing premium export markets.

Are there significant differences between conventional and high-welfare pork segments?

Yes, the high-welfare segment, although smaller, commands premium pricing and requires significantly higher capital investment per animal for features like group housing, outdoor access, and enriched environments. Conventional production prioritizes scalability and maximum feed efficiency, often leading to lower retail prices.

How is feed conversion ratio (FCR) addressed in modern pig farming?

FCR is addressed through continuous genetic selection for efficiency, precise dietary formulations tailored to the pig’s growth stage, and the use of sophisticated AI monitoring systems that ensure optimal feed delivery and minimal waste, directly impacting the producer’s profitability margin.

What is the outlook for the Latin American Pork Pig Market?

The outlook is highly positive, driven by abundant natural resources, strong government support for agricultural exports, and strategic positioning to serve growing Asian import markets. Brazil, in particular, is poised for accelerated growth and increased global market influence as a cost-competitive producer.

How do trade agreements influence the global movement of pork products?

Trade agreements significantly reduce tariffs and streamline customs procedures, facilitating the movement of pork products. However, non-tariff barriers related to sanitary and phytosanitary (SPS) measures and specific animal welfare regulations continue to act as major constraints and points of negotiation between trading blocks.

What are the key segments within the slaughter pig category?

Slaughter pigs are segmented primarily by weight (market hogs), intended end-use (fresh meat vs. processing), and specific quality attributes such as lean meat percentage or back fat depth, which dictate their value to the processing industry.

What are the main financial risks facing pork producers?

Main financial risks include extreme volatility in global commodity feed prices (corn/soy), unpredictable revenue due to disease outbreaks causing mass culling, and fluctuations in international pork pricing influenced by cyclical supply surpluses or deficits in major consuming regions.

Is gene editing technology used in swine breeding?

Yes, gene editing, particularly CRISPR technology, is a key area of research aiming to develop swine inherently resistant to devastating viral diseases like PRRS and ASF, promising a long-term solution to major health restraints, although regulatory acceptance is still evolving globally.

What infrastructure is essential for modern biosecure swine facilities?

Essential infrastructure includes strict perimeter fencing, controlled entry points (Danish entry systems), air filtration systems (HEPA filters in some high-value operations), climate-controlled housing, and dedicated mortality disposal systems to prevent pathogen introduction and circulation.

How is the retail distribution of pork products evolving?

Retail distribution is shifting towards greater reliance on chilled and case-ready packaging, increased demand for value-added processed products (pre-marinated, pre-cooked), and enhanced digital traceability information accessible to consumers via QR codes on packaging.

What role does consumer preference play in driving market trends?

Consumer preference dictates shifts towards specific attributes, driving demand for antibiotic-free pork, certified humane production, and distinct regional products (e.g., specific curing processes), compelling producers to diversify their offerings beyond standard commodity pork.

How do feed additives contribute to market performance?

Feed additives, including specific enzymes, probiotics, and amino acids, significantly enhance gut health, improve nutrient absorption, reduce the need for therapeutic antibiotics, and contribute directly to better growth rates and superior feed conversion ratios, maximizing biological potential.

What challenges do smaller independent pork producers face?

Smaller producers struggle with high capital requirements for biosecurity upgrades, difficulties in competing with the cost efficiencies achieved by integrated large farms, and limited access to advanced genetic technologies and centralized processing channels.

In what ways is water management critical in pig farming?

Efficient water management is critical for sustainability and cost control; this includes minimizing water wastage in cooling systems, implementing efficient nipple drinkers, and managing wastewater runoff to prevent environmental pollution and comply with increasingly strict local regulations.

What impact does urbanization have on pork consumption?

Urbanization increases per capita meat consumption due to higher incomes and greater access to formal retail and food service chains. This shift often favors processed and standardized pork products that require high volumes of raw materials from commercial farms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager