Porous Prill Ammonium Nitrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432541 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Porous Prill Ammonium Nitrate Market Size

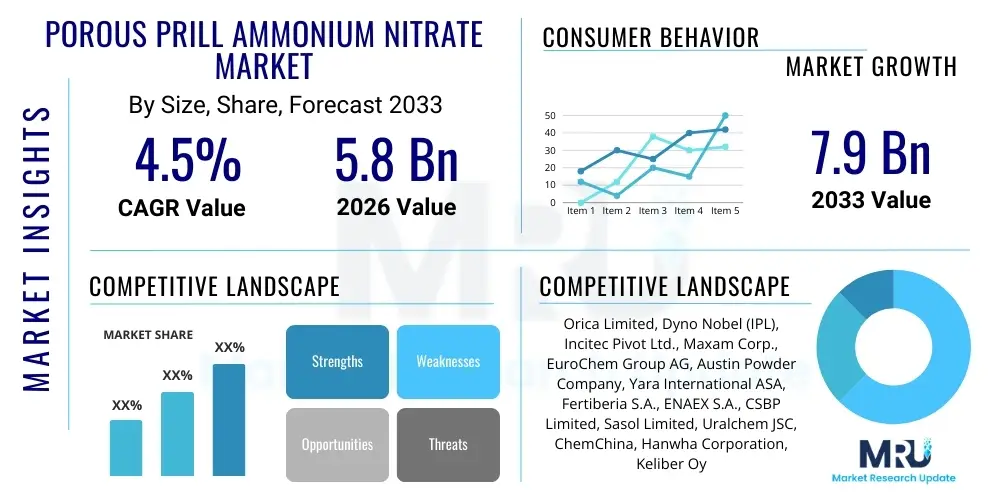

The Porous Prill Ammonium Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Porous Prill Ammonium Nitrate Market introduction

Porous Prill Ammonium Nitrate (PPAN) is a highly specialized chemical compound primarily manufactured for use in explosive compositions, particularly the production of Ammonium Nitrate Fuel Oil (ANFO) and water-in-oil emulsion explosives. PPAN is characterized by its high porosity and low bulk density, features crucial for enabling rapid and efficient absorption of fuel oil, which dictates the explosive performance and sensitivity of the final product. The consistency in prill size and surface texture is paramount for maintaining uniform explosive power and ensuring safety during handling and mixing processes. PPAN manufacturing relies on precise control over crystallization and prilling processes, often utilizing specialized prill towers to achieve the required structural integrity and porosity levels demanded by the mining and construction industries.

The product’s functionality centers on its role as the oxidizer component in explosives used for rock blasting in large-scale operations. Its primary applications span across the extraction sectors, including deep-pit coal mining, hard rock metallic ore extraction (such as copper and gold), and extensive quarrying operations required for aggregate supply in infrastructure projects. The benefits of using PPAN are substantial, encompassing cost-effectiveness relative to high-end packaged explosives, ease of bulk handling, and adaptability for both dry-hole (ANFO) and wet-hole (emulsion) blasting environments when chemically formulated correctly. Furthermore, the inherent stability of PPAN under standard storage conditions, coupled with its reliable detonation characteristics when sensitized, makes it the preferred base material for bulk site-mixed explosive operations globally.

Key driving factors accelerating the demand for Porous Prill Ammonium Nitrate include the persistent global demand for energy resources and base metals, necessitating continued expansion of large-scale mining activities in regions like Asia Pacific and Latin America. Additionally, massive infrastructure development initiatives, particularly in developing economies, fuel the requirement for aggregates and cement, subsequently driving the demand for quarrying and blasting agents. Technological advancements in blasting techniques, such as electronic initiation systems and optimized loading procedures, further enhance the efficiency and economic viability of using PPAN-based explosives, reinforcing its dominant position in the industrial explosives market landscape.

Porous Prill Ammonium Nitrate Market Executive Summary

The Porous Prill Ammonium Nitrate (PPAN) market demonstrates robust expansion, fundamentally underpinned by aggressive growth in the global mining and civil engineering sectors. Business trends indicate a strategic shift among major explosive manufacturers toward establishing localized production facilities, particularly in high-growth resource-rich regions like Australia, Chile, and Western Africa, mitigating complex cross-border logistics and addressing stringent national security regulations governing explosive precursor handling. Supply chain resilience, driven by concerns over geopolitical stability and volatile natural gas pricing (a key feedstock for ammonia production), remains a critical determinant of operational success, pushing companies to integrate vertically and secure long-term ammonia supply contracts to stabilize production costs and ensure continuity of supply to major mining clientele.

Regional trends highlight the Asia Pacific (APAC) region as the undeniable epicenter of market demand and capacity expansion. This dominance is attributed to the confluence of vast coal reserves in India and Indonesia, burgeoning iron ore and bauxite mining in Australia, and intense infrastructure build-out across Southeast Asia and China. While North America and Europe maintain technological superiority in emulsion systems and specialized prill production, their market growth rates are more moderate, focusing primarily on modernization and safety standards compliance. The Latin American market, particularly Brazil and Chile, presents sustained high growth due to continuous heavy metal extraction and reliance on PPAN for large-scale operations in challenging topographical environments, necessitating high-performance, weather-resistant explosive solutions.

Segmentation trends reveal a strong and increasing demand for specialized low-density PPAN suitable for high-energy emulsion explosives, which are gaining preference over traditional ANFO due to superior water resistance and improved energy transfer in difficult blasting conditions. Furthermore, the mining application segment consistently commands the largest market share, driven specifically by open-pit hard rock mining operations where bulk explosives are the standard. Manufacturers are strategically investing in advanced prilling tower technology to ensure uniform particle size distribution and superior porosity consistency, responding directly to end-user requirements for optimized explosive performance and minimization of blast-related environmental impacts such as flyrock and vibration.

AI Impact Analysis on Porous Prill Ammonium Nitrate Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Porous Prill Ammonium Nitrate (PPAN) market commonly center on optimizing the application phase—specifically, how AI algorithms can enhance blast pattern design, loading efficiency, and overall rock fragmentation to reduce cost per ton of extracted material. There is significant interest in AI's role in predictive maintenance for complex chemical manufacturing plants, ensuring stable PPAN production quality (porosity and density) by preemptively identifying equipment failures in prilling towers and coating lines. Furthermore, users frequently question the use of machine learning (ML) models for advanced supply chain forecasting, aiming to stabilize pricing volatility by optimizing the procurement of precursor chemicals, notably ammonia, and managing global logistics for large-volume explosive precursors, thereby improving safety monitoring and reducing inventory risk.

- AI optimizes blast designs using geospatial data and rock mechanics simulation, maximizing fragmentation and reducing PPAN consumption per blast.

- Machine Learning (ML) models enhance predictive maintenance in PPAN manufacturing facilities, minimizing unscheduled downtime of critical prilling and drying equipment.

- AI-driven supply chain analytics improve forecasting for ammonia raw material requirements, mitigating pricing risk and inventory holding costs.

- Integration of computer vision and ML enhances safety protocols in storage and transportation by monitoring compliance with mandated separation distances and handling procedures.

- Natural Language Processing (NLP) aids in analyzing global regulatory changes and automatically updating compliance standards for the storage and use of explosive precursors.

- Optimization algorithms precisely control the prilling process parameters (temperature, flow rate) to ensure consistent porosity and bulk density, key quality metrics for PPAN.

DRO & Impact Forces Of Porous Prill Ammonium Nitrate Market

The Porous Prill Ammonium Nitrate (PPAN) market is governed by a dynamic interplay of market Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive and operational landscape, exerting significant Impact Forces on strategic decision-making. The primary driver is the accelerating pace of global resource extraction, particularly for critical battery metals and essential construction materials, which necessitates high-volume, cost-effective blasting solutions. Counteracting this growth are substantial restraints, most notably the stringent global security regulations imposed on the handling, storage, and transport of high-nitrogen compounds, requiring heavy investments in compliance infrastructure and sophisticated security protocols. Furthermore, volatile input costs, especially the price of natural gas which dictates ammonia production costs, introduce significant instability to the PPAN supply chain, acting as a persistent constraint on profitability margins and requiring complex hedging strategies to mitigate risk.

Opportunities for expansion are primarily concentrated in the realm of specialized product development, focusing on low-density PPAN optimized for advanced water-gel and heavy-emulsion explosives, which offer superior performance in harsh, wet mining environments increasingly common in deep-pit operations. Furthermore, the strategic opportunity to capture market share in developing regions through localized manufacturing facilities provides a pathway to circumvent tariffs, reduce transport costs, and ensure a more stable supply to regional end-users. The rising global focus on environmental, social, and governance (ESG) factors also presents an opportunity for manufacturers who can develop PPAN production processes with lower carbon footprints and minimize waste outputs, differentiating their offerings in a commodity-driven market.

The Impact Forces are heavily weighted towards external macroeconomic and regulatory environments. Geopolitical shifts directly impact ammonia feedstock access and price stability, instantaneously transferring cost pressures downstream. Simultaneously, the force of technological substitution, though currently marginal, poses a long-term threat as mining companies explore non-explosive rock fragmentation techniques, such as mechanical ripping or advanced hydro-blasting, particularly in smaller operations. However, the immediate and most powerful impact force remains the demand pull from the massive, capital-intensive mining sector, whose volume requirements dictate global production capacity and investment cycles. Regulatory scrutiny, specifically concerning anti-terrorism measures related to fertilizer-grade vs. industrial-grade ammonium nitrate, mandates continuous operational adjustments and compliance enforcement throughout the entire value chain.

Segmentation Analysis

The Porous Prill Ammonium Nitrate (PPAN) market is systematically segmented based on product characteristics, primarily density, and critically, by the end-use application where the explosive components are deployed. The density segmentation distinguishes between low-density and high-density prills, influencing the required fuel absorption capacity and the final energy output of the explosive charge. Low-density PPAN is highly valued for its enhanced porosity, making it ideal for standard ANFO mixtures and serving as a critical component in the production of bulk emulsion matrices, which require a consistent, highly reactive oxidizer component. High-density prills, while less common in bulk explosives, find niche applications where lower energy density but greater structural integrity is required, often for specific packaged explosive formats or certain primer charges.

Application segmentation remains the most pivotal factor determining market demand and growth trajectories. The mining segment dominates due to the vast volumes required for extracting base metals (copper, iron ore), precious metals (gold, silver), and coal. Within mining, demand is further broken down by methodology: open-pit operations utilize the majority of bulk PPAN in ANFO or bulk emulsions, while underground mining relies more heavily on specialized, water-resistant emulsion products. The construction and quarrying segment, although smaller in volume, provides a stable demand stream linked directly to global infrastructure investment cycles, covering site preparation, road building, and aggregate extraction for concrete manufacturing. Specialty applications, including seismic exploration and demolition, represent high-value, low-volume requirements demanding highly consistent product quality and specialized logistical handling, further diversifying the market structure.

- By Application:

- Mining (Open-Pit Mining, Underground Mining)

- Quarrying and Construction

- Civil Engineering (Tunnelling, Excavation)

- Seismic Exploration and Demolition

- By Density Type:

- Low Density Porous Prills

- High Density Porous Prills

- By Explosive Type:

- ANFO (Ammonium Nitrate Fuel Oil)

- Heavy ANFO

- Water-in-Oil Emulsions (Bulk and Packaged)

- Blasting Agents

Value Chain Analysis For Porous Prill Ammonium Nitrate Market

The Porous Prill Ammonium Nitrate (PPAN) value chain is characterized by capital intensity at the manufacturing stage and highly specialized logistics management downstream due to the product's classification as an explosive precursor. The upstream segment is dominated by the production of raw materials, primarily ammonia and nitric acid. Ammonia synthesis, typically derived from natural gas (methane), represents the most critical and cost-intensive part of the upstream chain, directly subjecting PPAN manufacturers to the extreme volatility of global energy markets. Companies operating in this space often seek strategic backward integration or long-term supply agreements with major global petrochemical and fertilizer producers to secure stable feedstock at competitive prices, mitigating input cost fluctuations and ensuring reliable chemical purity necessary for high-grade PPAN.

The manufacturing stage involves the reaction of ammonia and nitric acid to form ammonium nitrate solution, followed by the highly engineered process of prilling, which is essential for creating the required high porosity and structural integrity. This stage requires significant investment in specialized equipment, including prilling towers, dryers, and sophisticated coating lines (to prevent caking). Quality control is paramount here, focusing on maintaining precise porosity, particle size distribution, and bulk density—factors directly affecting explosive performance. The distribution channel is heavily regulated; the movement of PPAN often requires specialized licenses, secure warehousing, and tracked transportation systems (direct and indirect). Direct distribution is prevalent when large explosive manufacturers own the PPAN production assets and transport the product directly to their own site-mix facilities at major mining locations. Indirect distribution utilizes specialized chemical distributors that adhere to strict safety and security protocols, servicing smaller quarries or regional construction projects.

The downstream component involves the conversion of PPAN into final explosive products, primarily ANFO and bulk emulsions, often executed by global mining service companies. These companies handle the final blending and delivery of the explosives directly into the blast holes at the mine or construction site. End-users, such as major mining corporations (e.g., Rio Tinto, BHP, Glencore), constitute the ultimate buyers, making procurement decisions based not only on PPAN price but also on the reliability, technical support, safety track record, and logistical capabilities of their chosen explosive supplier. The highly concentrated nature of the global mining industry means that bargaining power is often shifted towards these large downstream buyers, pressuring PPAN manufacturers to maintain operational efficiency and quality consistency throughout the entire value chain.

Porous Prill Ammonium Nitrate Market Potential Customers

The primary cohort of potential customers for the Porous Prill Ammonium Nitrate (PPAN) market consists of industrial consumers requiring large volumes of bulk explosives for rock fragmentation. These end-users are segmented into two major categories: the resource extraction sector and the civil construction industry. Within resource extraction, large integrated mining companies (IMCs) represent the most significant buyers. These corporations operate globally, managing massive open-pit and underground mines for commodities such as iron ore, copper, gold, and metallurgical and thermal coal. IMCs typically contract global explosive manufacturers (such as Orica or Dyno Nobel) to provide full-service blasting solutions, making them indirect, yet pivotal, consumers of PPAN, as the pricing and quality expectations are passed through the supply chain.

The demand profile of these customers is characterized by a need for high-energy, reliable explosives delivered in bulk, often requiring onsite manufacturing or blend plants to meet daily operational demands. Operational continuity and safety are non-negotiable requirements, driving demand for high-quality, consistently produced PPAN that minimizes misfires and ensures predictable blast results. Specific examples include major copper mines in Chile, large-scale iron ore operations in Western Australia, and heavy coal producers in Indonesia. These operations require hundreds of thousands of tons of PPAN annually, positioning them as the backbone of market stability and volume demand. Procurement decisions are often based on multi-year supply contracts that emphasize logistical efficiency and regulatory compliance.

The second major customer group includes regional quarrying operators and construction companies engaged in large-scale infrastructure projects, such as highway construction, railway development, hydroelectric dam building, and large-scale urban tunneling. While their individual consumption volumes are smaller than those of the mega-mines, their collective demand forms a crucial and often more geographically dispersed market segment. These buyers prioritize ease of use, regulatory compliance in densely populated areas, and flexible delivery schedules for packaged or smaller bulk deliveries. Suppliers targeting this segment must excel in local distribution networks and provide technical assistance tailored to specific geological conditions, often dealing with tighter environmental and vibration regulations than those faced by remote mining operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orica Limited, Dyno Nobel (IPL), Incitec Pivot Ltd., Maxam Corp., EuroChem Group AG, Austin Powder Company, Yara International ASA, Fertiberia S.A., ENAEX S.A., CSBP Limited, Sasol Limited, Uralchem JSC, ChemChina, Hanwha Corporation, Keliber Oy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Porous Prill Ammonium Nitrate Market Key Technology Landscape

The technology landscape for the Porous Prill Ammonium Nitrate (PPAN) market is predominantly focused on process engineering enhancements designed to maximize product consistency, stability, and explosion performance, rather than fundamentally changing the core chemistry. A critical area of technological advancement is the refinement of the prilling process, specifically the design and operation of prilling towers. Modern facilities utilize advanced nozzle designs and climate control systems within the towers to achieve precise particle size distribution and highly uniform internal pore structures. This uniformity is essential because inconsistent porosity leads to unpredictable fuel oil absorption and variability in explosive energy, which is unacceptable in large-scale mining operations demanding meticulous blast control. Continuous process monitoring using advanced sensors and computerized feedback loops ensures that specific density and porosity metrics are consistently met across massive production runs, often required for high-grade emulsion production.

Another crucial technological area involves anti-caking and coating agents. Ammonium nitrate is highly hygroscopic, meaning it readily absorbs moisture, which can cause the prills to cake together, rendering them unusable or severely degrading explosive performance. Manufacturers invest significantly in proprietary surface chemistry to develop specialized, hydrophobic coating agents—often based on mineral oils, waxes, or specific polymer combinations—that minimize moisture absorption and enhance flowability, particularly during bulk loading and pneumatic transfer systems at mine sites. These coatings must be inert and not interfere with the subsequent fuel oil absorption or chemical reaction during detonation. Furthermore, the handling and logistical technologies are becoming increasingly specialized, focusing on dust suppression systems and secure, monitored bulk handling equipment to comply with stringent environmental and security regulations globally.

Finally, there is continuous investment in process safety technology, driven by the inherent risks associated with handling large quantities of highly reactive nitrogen compounds. This includes sophisticated distributed control systems (DCS) for continuous monitoring of temperatures, pressures, and concentration levels within the synthesis and drying stages, minimizing the risk of thermal decomposition or unintended detonation. New technologies also extend to the use of advanced analytics and IoT sensors integrated throughout the production line to predict equipment failure and proactively manage maintenance, thereby maximizing operational uptime and ensuring regulatory compliance. The focus is shifting towards 'smart manufacturing' environments where production parameters are dynamically adjusted based on real-time quality control data, ensuring that every batch of PPAN meets the rigorous specifications required for modern high-performance explosives.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Porous Prill Ammonium Nitrate, primarily due to the expansive mining sectors in Australia (iron ore, bauxite), Indonesia (coal), and India (coal, mineral extraction). The immense infrastructure development, particularly in China and Southeast Asian nations, fuels continuous demand for quarrying and construction blasting materials. Australia is a technological leader in bulk explosive usage, driving demand for specialized, high-performance PPAN optimized for large-scale, automated mine sites. Strategic investments in localized manufacturing capacity are highest in this region, driven by lower production costs and proximity to end-users.

- North America: The North American market is mature, characterized by high safety standards and significant consumption driven by copper, gold, and aggregate mining, particularly in the U.S. and Canada. The region focuses heavily on technological sophistication, emphasizing high-quality, consistently pure PPAN used in advanced, highly sensitive emulsion formulations. Growth is stable, supported by sustained demand from the oil and gas industry for seismic exploration and specialized blasting, alongside steady regulatory adherence driving demand for premium products.

- Europe: Demand in Europe is relatively flat compared to APAC, constrained by stricter environmental regulations and the decline of certain legacy mining operations (like coal). The market primarily focuses on quarrying, tunneling, and civil engineering projects. European manufacturers are technological leaders in process efficiency and low-emission production, often focusing on export markets and specialized, high-purity PPAN products compliant with the strictest REACH regulations and security measures.

- Latin America: This region exhibits high growth potential, driven by major metallic ore extraction, especially copper in Chile and iron ore in Brazil. PPAN demand is high due to the necessity for robust explosives capable of performing reliably in diverse and often wet geological conditions. The market relies heavily on bulk imports or localized blending plants managed by international explosive suppliers, making supply chain efficiency and reliability key competitive factors.

- Middle East and Africa (MEA): The MEA market shows promising growth, spurred by extensive resource exploration (phosphate, gold, various minerals in Saudi Arabia, South Africa, and West Africa) and large-scale infrastructural initiatives in the Gulf Cooperation Council (GCC) countries. Supply chains are often complex, requiring specialized logistics to manage security risks and extreme climate conditions. South Africa remains a significant consumer and regional manufacturing hub, serving the demands of deep underground platinum and gold mining.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Porous Prill Ammonium Nitrate Market.- Orica Limited

- Dyno Nobel (Incitec Pivot Ltd.)

- Maxam Corp.

- EuroChem Group AG

- Austin Powder Company

- Yara International ASA

- ENAEX S.A.

- CSBP Limited

- Sasol Limited

- Uralchem JSC

- ChemChina (Sinopec Group)

- Hanwha Corporation

- Keliber Oy

- Fertiberia S.A.

- Qatar Fertiliser Company (QAFCO)

- Borealis AG

- CF Industries Holdings, Inc.

- K+S Aktiengesellschaft

- KuibyshevAzot OJSC

- PJSC Acron

Frequently Asked Questions

Analyze common user questions about the Porous Prill Ammonium Nitrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Porous Prill Ammonium Nitrate (PPAN) and fertilizer-grade Ammonium Nitrate?

PPAN is specifically manufactured with high porosity and low bulk density to maximize the absorption of fuel oil, making it suitable for use as an explosive oxidizer (ANFO). Fertilizer-grade AN is denser, less porous, and often coated to prevent absorption, optimizing it solely for agricultural use.

How do volatile natural gas prices impact the manufacturing cost of PPAN?

Natural gas is the primary feedstock for producing ammonia, which is essential for ammonium nitrate synthesis. Therefore, fluctuations in global natural gas prices directly correlate with and significantly influence the operational expenses and final pricing of PPAN, driving supply chain volatility.

Which application segment accounts for the largest share of PPAN consumption?

The Mining segment, particularly large-scale open-pit operations for the extraction of iron ore, copper, and coal, accounts for the dominant share of global PPAN consumption due to the high-volume requirement for bulk blasting agents like ANFO and heavy emulsions.

What key regulations govern the distribution and handling of PPAN globally?

Global distribution and handling are heavily governed by international agreements and national security laws designed to prevent misuse, focusing on secure transport, specialized storage facilities, stringent tracking (traceability), and strict licensing requirements for all parties in the supply chain.

What technological trends are optimizing PPAN usage in modern mining?

Modern mining utilizes precision blasting techniques, including AI-driven blast design and electronic initiation systems, which necessitate consistent, high-quality PPAN to achieve optimized rock fragmentation and minimize non-compliance issues like flyrock and ground vibration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager