Port Crane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437355 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Port Crane Market Size

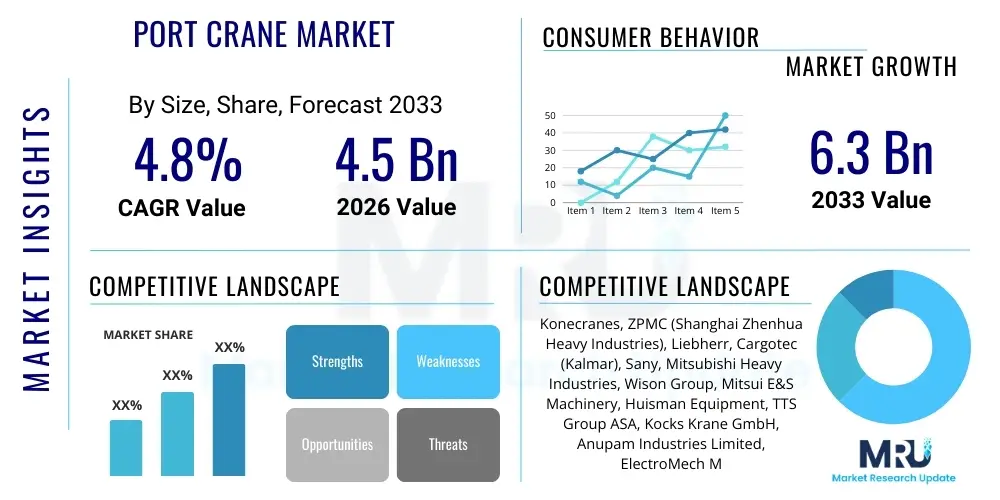

The Port Crane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Port Crane Market introduction

The Port Crane Market encompasses the manufacturing, distribution, and maintenance of heavy lifting equipment essential for handling cargo at maritime ports and terminals globally. These specialized machines, which include Ship-to-Shore (STS) cranes, Rubber-Tired Gantry (RTG) cranes, Rail-Mounted Gantry (RMG) cranes, and Mobile Harbor Cranes (MHCs), are the backbone of modern global trade, facilitating the efficient transfer of containers, bulk materials, and general cargo between ships and shore infrastructure. The market is defined by stringent safety regulations, a critical need for high operational throughput, and increasing technological integration aimed at automation and electrification.

The core product offerings are engineered for durability and precision, crucial for maximizing efficiency in high-volume port environments. Major applications center on container handling, which accounts for the largest share of market revenue, driven by the persistent growth in containerized shipping. Other significant applications involve the handling of dry bulk (like coal and grain) and liquid bulk, though specialized cranes are often utilized for the latter. The market benefits from substantial advancements in digitization, including real-time monitoring and predictive maintenance systems that reduce downtime and improve overall asset utilization.

Key driving factors fueling market expansion include sustained global economic growth leading to increased seaborne trade volumes, particularly in emerging Asian economies. Furthermore, the continuous trend towards ultra-large container vessels (ULCVs) necessitates the upgrading of existing port infrastructure with larger, faster, and more robust STS cranes. Regulatory pressures favoring environmental sustainability are accelerating the adoption of electric and hybrid crane systems, replacing traditional diesel-powered machinery, thereby creating significant replacement and expansion opportunities within the forecast horizon.

Port Crane Market Executive Summary

The Port Crane Market is characterized by a strong push toward automation, digitalization, and sustainability, defining current business trends. Regional disparities exist, with Asia Pacific dominating the demand side due to high volume trade corridors and intensive port development projects, particularly in China and Southeast Asia. North America and Europe, while slower in new construction, lead in retrofitting existing fleets with advanced automation and electrification technologies, focusing on operational resilience and lower carbon footprints. Competitive dynamics are robust, marked by major players investing heavily in robotics and AI-driven predictive maintenance solutions to gain a competitive edge in performance and reliability.

From a regional perspective, investments are concentrated in expanding hub ports to accommodate mega-vessels, driving demand for larger STS cranes and high-density storage solutions facilitated by automated stacking cranes (ASCs) and RMGs. Latin America and the Middle East show potential, driven by infrastructure upgrades tied to key economic development zones and logistics corridors. Government initiatives aimed at improving supply chain resilience and reducing port congestion further underpin regional market growth. The shift toward optimized logistics chains has amplified the need for intermodal connectivity, influencing the design and deployment of rail-based yard handling equipment.

Segmentation trends indicate that the Automated Operation Mode segment is experiencing the fastest growth, although manual operations still hold a significant share, particularly in smaller and less developed ports. STS cranes remain the highest revenue generator, critical for vessel handling, while the yard handling equipment segments (RTG, RMG) are rapidly transitioning toward automation to optimize land use and labor costs. The container handling end-use segment is the primary growth engine, absorbing significant R&D efforts focused on increasing crane speeds and safety features, leveraging technologies like anti-sway systems and optical character recognition (OCR) for precise container tracking.

AI Impact Analysis on Port Crane Market

User inquiries regarding AI in the Port Crane Market predominantly revolve around three key themes: operational efficiency gains through predictive maintenance, the feasibility and scalability of fully autonomous port operations, and the implications for labor force restructuring. Users frequently question how AI algorithms can anticipate equipment failures in real-time (reducing costly unplanned downtime) and whether AI-powered collision avoidance and optimized path planning can significantly boost crane productivity (moves per hour). There is also considerable interest in AI's role in decision support systems, specifically for managing complex yard logistics, optimizing stacking strategies, and orchestrating the movement of hundreds of containers concurrently, transforming ports into self-regulating logistical ecosystems.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from motors, hoists, and spreaders, anticipating mechanical failures before they occur, drastically reducing unexpected downtime and optimizing maintenance schedules.

- Autonomous Operation Optimization: AI systems manage the complex scheduling, path planning, and synchronization of multiple cranes and automated guided vehicles (AGVs), achieving peak operational throughput and minimizing human intervention.

- Enhanced Safety and Collision Avoidance: Deploying deep learning and computer vision for real-time monitoring of the operating area, ensuring precise load handling and preventing accidents involving personnel or infrastructure.

- Optimized Yard Management: AI drives decisions regarding container stacking locations (dynamic allocation) based on anticipated vessel schedules, optimizing retrieval times and maximizing yard density.

- Remote Operation and Digital Twin Integration: AI enhances the remote control capabilities by providing augmented reality overlays and predictive feedback to human operators, supported by digital twin models for simulation and training.

DRO & Impact Forces Of Port Crane Market

The Port Crane Market is primarily driven by relentless growth in global trade and the expansion of maritime container traffic, requiring faster, larger, and more capable cranes. Restraints include the high capital expenditure required for acquiring and installing modern, automated crane systems, along with persistent challenges related to labor resistance against automation, particularly in unionized ports. Significant opportunities exist in the widespread adoption of electrification and hybrid technologies, aligning with global decarbonization goals, and leveraging advanced digital solutions like IoT and AI to retrofit older infrastructure. These factors collectively exert substantial impact forces on market evolution, pushing stakeholders towards technology adoption as a non-negotiable prerequisite for future competitiveness and compliance.

Market Drivers

The foundational driver is the exponential growth of international containerized trade, intrinsically linked to global manufacturing output and consumer demand. As economies worldwide become more interdependent, the reliance on high-volume, efficient container transportation increases. This has led shipping lines to commission Ultra Large Container Vessels (ULCVs) capable of carrying over 24,000 TEUs. Ports are thus compelled to invest in STS cranes with higher outreach, greater lifting capacities, and faster cycle times to effectively service these colossal vessels and maintain quick turnaround times, which are critical metrics in global shipping logistics.

A secondary yet powerful driver is the global trend toward automation to mitigate rising labor costs and address persistent shortages of skilled operators. Automated ports, leveraging automated stacking cranes (ASCs) and fully autonomous STS cranes, offer consistent performance 24/7 with minimal variation due to fatigue or human error. Furthermore, regulatory frameworks increasingly prioritize environmental sustainability. This push mandates the transition from fossil fuel-dependent diesel RTGs and MHCs to zero-emission electric RMGs, e-RTGs, and hybrid solutions, driving a substantial replacement and upgrading cycle across established port infrastructure in developed nations.

Market Restraints

The primary restraint is the extremely high initial investment (CAPEX) associated with procuring advanced crane systems, especially fully automated setups which require significant corresponding civil engineering work and IT integration. The automation transition demands not only expensive hardware but also sophisticated software, systems integration, and cybersecurity measures, which can be prohibitive for smaller ports or those operating in developing economies with limited access to capital financing. This financial burden often delays necessary infrastructure upgrades.

Another significant restraint is the operational complexity and risk associated with integrating new technologies into existing, often decades-old, terminal management systems. The transition period is fraught with potential compatibility issues and requires extensive retraining of maintenance personnel and IT staff, leading to temporary operational disruptions. Furthermore, resistance from port labor unions regarding job displacement due to automation presents a persistent social and political challenge that can significantly slow down or halt automation projects in key operational hubs globally.

Market Opportunities

The greatest opportunity lies in the rapid electrification of existing crane fleets. Many ports are seeking to future-proof their operations by converting diesel RTGs into e-RTGs or battery-powered units, capitalizing on incentives for green infrastructure and utilizing renewable energy sources. This conversion market offers a substantial revenue stream for crane manufacturers and associated technology providers, moving beyond just new equipment sales.

A second major opportunity is the expansion into advanced data services and aftermarket support. As cranes become highly digitized, generating massive amounts of operational data, vendors can offer lucrative service contracts focused on predictive maintenance, remote diagnostics, and performance optimization through SaaS models. This shift transforms crane manufacturers into technology solution providers, ensuring long-term customer engagement and stable recurring revenue streams.

Impact Forces Analysis

The dual impact forces of automation and decarbonization are fundamentally reshaping the market. Automation acts as a force multiplier, significantly boosting port throughput and operational reliability, making it indispensable for handling increasing cargo volumes, particularly in land-constrained ports. Simultaneously, the force of decarbonization, driven by IMO regulations and national environmental mandates, necessitates immediate shifts toward cleaner power sources, creating a replacement cycle that affects virtually all segments of the port crane market, from yard equipment to large STS cranes, cementing technology as the central investment criterion.

Segmentation Analysis

The Port Crane Market is comprehensively segmented by crane type, operation mode, end-use application, and lifting capacity. This segmentation allows for granular analysis of demand patterns, showing that container handling remains the powerhouse sector, fueling high demand for STS and Gantry cranes (RTG/RMG). Geographically, the market complexity dictates specialized equipment needs; for instance, Mobile Harbor Cranes (MHCs) are preferred in ports with lower volume or multi-purpose cargo requirements, while fully automated RMGs dominate high-throughput container terminals, reflecting the strategic investments made based on long-term terminal utilization forecasts and labor market dynamics.

The fastest-growing segment is Automation, driven by the desire to reduce operational costs and maximize efficiency in 24/7 port environments. Within the end-use applications, specialized cranes for renewable energy components (like wind turbine blades) are emerging as a niche but rapidly expanding area, demanding larger lifting capacities and highly specialized rigging equipment. Manufacturers are responding by modularizing crane designs to facilitate easier customization and integrating advanced sensor packages to support remote and autonomous functionality across all primary crane types, ensuring flexibility and maximizing the return on investment for terminal operators.

- By Type: Ship-to-Shore (STS) Cranes, Rubber-Tired Gantry (RTG) Cranes, Rail-Mounted Gantry (RMG) Cranes, Mobile Harbor Cranes (MHCs), Others (Jib Cranes, Deck Cranes).

- By Operation Mode: Manual/Operator-Controlled, Semi-Automated, Fully Automated.

- By End-Use Application: Container Handling, Bulk Handling (Dry Bulk, Liquid Bulk), General Cargo and Project Cargo Handling.

- By Power Source: Diesel/Hydraulic, Electric/Hybrid (E-RTGs, Battery Powered), Others (Fuel Cell).

Value Chain Analysis For Port Crane Market

The Port Crane Market value chain commences with upstream activities involving the sourcing of specialized high-grade steel, complex electrical components (motors, drives), automation software, and heavy-duty mechanical parts. Key suppliers operate in concentrated markets, making robust supply chain management crucial for cost control and timely production. The manufacturing stage is capital-intensive, dominated by a few global engineering giants that specialize in custom-built, large-scale machinery, requiring high levels of precision engineering and compliance with stringent maritime safety standards.

Midstream activities involve sophisticated systems integration, combining hardware with proprietary terminal operating systems (TOS) and software for remote control and diagnostics. Distribution is characterized by direct sales channels, given the customized nature and high value of the assets. Manufacturers maintain a direct relationship with port authorities, terminal operators, and international shipping lines, bypassing traditional indirect distribution networks. This direct engagement ensures precise alignment between product specifications and terminal operational requirements, fostering long-term service agreements.

Downstream activities are dominated by installation, commissioning, and long-term maintenance and servicing. Aftermarket support, including spare parts supply, modernization, and software updates, represents a crucial and increasingly profitable segment of the value chain. The lifecycle of a port crane can exceed 30 years, positioning reliable maintenance and technological retrofitting (e.g., automation upgrades or electrification conversions) as central determinants of lifetime value and customer satisfaction. The efficiency of the distribution channel is thus measured not merely by delivery, but by the comprehensiveness of post-sale support and digital integration services.

Port Crane Market Potential Customers

The primary buyers in the Port Crane Market are international terminal operating companies and global shipping lines that control large fleets of vessels and operate terminals across multiple continents. These entities prioritize equipment reliability, operational speed, and low total cost of ownership (TCO) over the crane's lifespan. Their purchasing decisions are often tied to major infrastructure investment cycles, typically dictated by port expansion projects or the need to upgrade equipment to handle larger vessel sizes, demanding capital financing solutions and long-term partnership commitments.

A secondary customer base includes independent port authorities and regional government bodies responsible for managing public terminals, particularly those handling general cargo or smaller coastal traffic. These customers often prioritize cost-effectiveness and versatility, making Mobile Harbor Cranes (MHCs) or smaller capacity RTGs suitable options. Furthermore, specialized industrial sectors, such as offshore wind development and major construction projects that require handling extremely heavy or oversized components (Project Cargo), also represent potential customers for high-capacity, specialized cranes and heavy lift solutions.

The purchasing cycle is lengthy and highly scrutinized, involving complex technical specifications and regulatory compliance checks. Decisions are increasingly influenced by vendors' capabilities in providing integrated automation packages and sustainability credentials, such as proven success in e-RTG conversions or implementing advanced energy recovery systems, making TIER 1 manufacturers with established global service networks the preferred suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Konecranes, ZPMC (Shanghai Zhenhua Heavy Industries), Liebherr, Cargotec (Kalmar), Sany, Mitsubishi Heavy Industries, Wison Group, Mitsui E&S Machinery, Huisman Equipment, TTS Group ASA, Kocks Krane GmbH, Anupam Industries Limited, ElectroMech Material Handling Systems India Pvt. Ltd., Palfinger AG, Sennebogen Maschinenfabrik GmbH, American Crane & Equipment Corporation, CERRETTI S.p.A., MacGregor (Cargotec), Trelleborg Marine and Infrastructure, KION Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Port Crane Market Key Technology Landscape

The technological landscape of the Port Crane Market is rapidly evolving, driven by the need for increased operational speed, precision, and sustainability. Central to this evolution is the integration of high-precision sensor technology, utilizing LiDAR, advanced cameras, and GPS/RTK systems to facilitate semi- and fully-automated operations. These sensors feed real-time data into sophisticated control systems, enabling critical features such as anti-sway technology, which maintains load stability during rapid movements, and collision avoidance systems, drastically improving operational safety and allowing for high-speed container movements.

A second crucial technological advancement is the widespread adoption of electrification. Traditional diesel-powered cranes are being replaced or retrofitted with electric drives, resulting in the proliferation of e-RTGs and fully electric RMGs. This shift is supported by robust infrastructure components such as advanced battery storage systems and cable reel mechanisms, which are essential for maintaining high duty cycles without interruption. Furthermore, remote monitoring and control through high-bandwidth wireless networks allow operators to manage multiple cranes from centralized control rooms, enhancing labor utilization and improving ergonomic conditions for personnel.

The convergence of Information Technology (IT) and Operational Technology (OT) is defining the next generation of port cranes. Technologies like the Industrial Internet of Things (IIoT) enable constant data harvesting from mechanical components, feeding into AI-powered predictive maintenance platforms. Furthermore, the development of Digital Twin technology allows port operators to simulate complex logistical scenarios and test software updates or operational changes in a virtual environment before deployment. This focus on software-defined functionality and data analytics is transforming cranes from mere heavy machinery into smart, interconnected assets that are integral to the Terminal Operating System (TOS) ecosystem.

Specific technological implementations include: Optical Character Recognition (OCR) systems mounted on spreaders for automated container identification and verification, crucial for inventory accuracy; energy regeneration systems, which capture and store energy generated during braking or lowering operations, enhancing energy efficiency; and advanced crane steering systems that utilize laser guidance to ensure precise gantry travel and stacking alignment in automated yards, maximizing the utilization of tight terminal space. The focus remains on resilient communication infrastructure, often involving 5G or high-performance private wireless networks, essential for the secure and reliable control of remote and autonomous equipment.

The competitive technology race is centered on developing proprietary automation software suites that offer superior path planning algorithms and integration capabilities with different vendors' equipment. Manufacturers are heavily investing in robotic components for automated twistlock handling and remote fault diagnosis tools. The market is witnessing greater standardization efforts to ensure interoperability among different port equipment suppliers and TOS providers, accelerating the adoption curve for new automated solutions. Cybersecurity is also becoming a core technological focus, as connected cranes represent potential vulnerability points within critical national infrastructure, requiring embedded security protocols at the device and network level.

Regional Highlights

- Asia Pacific (APAC): APAC is the undisputed leader in terms of market volume and new installation growth, largely driven by mega-port expansion projects in China, India, and Southeast Asia (e.g., Vietnam, Thailand). The region benefits from robust manufacturing exports and expanding intra-Asian trade lanes. While automation adoption is accelerating, there is still high demand for traditional, manual heavy-duty equipment to handle the vast flow of cargo, complemented by significant investment in high-density automated RMG yards in major hub ports.

- North America: Characterized by mature ports focused on efficiency and decarbonization. The demand is heavily tilted towards retrofitting existing RTG fleets into e-RTGs and adopting sophisticated automation software for yard optimization. Labor agreements and high land costs incentivize high vertical stacking and the adoption of fully automated STS and RMG systems, with significant expenditure on cybersecurity and resilience technologies.

- Europe: Europe exhibits a balanced approach, leading in the adoption of green technology, driven by strict EU emission targets. Ports across Northern Europe (e.g., Rotterdam, Hamburg) are pioneers in fully automated terminal operations, utilizing integrated systems, often featuring sophisticated rail connectivity demanding specialized rail-mounted handling equipment. Demand is high for hybridization and fully electric mobile solutions (MHCs and RTGs).

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in new greenfield ports and logistics hubs (e.g., Jebel Ali, King Abdullah Port) to diversify their economies. These projects often adopt state-of-the-art, fully automated solutions from the outset, aiming for world-record efficiency levels. Africa's market growth is slower but significant, focused primarily on essential infrastructure upgrades and general cargo handling, favoring versatile MHCs.

- Latin America: Growth is steady, driven by capacity constraints at existing ports and modernization efforts aimed at improving global trade competitiveness, particularly in Brazil, Mexico, and Panama. The market exhibits mixed demands, with some terminals adopting automation while others prioritize cost-effective, high-capacity diesel solutions, reflecting diverse economic stability and investment levels across the subcontinent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Port Crane Market.- Konecranes

- ZPMC (Shanghai Zhenhua Heavy Industries)

- Liebherr

- Cargotec (Kalmar)

- Sany

- Mitsubishi Heavy Industries

- Wison Group

- Mitsui E&S Machinery

- Huisman Equipment

- TTS Group ASA

- Kocks Krane GmbH

- Shanghai Port Machinery Company (SPMC)

- Anupam Industries Limited

- ElectroMech Material Handling Systems India Pvt. Ltd.

- Palfinger AG

- Sennebogen Maschinenfabrik GmbH

- American Crane & Equipment Corporation

- CERRETTI S.p.A.

- MacGregor (Cargotec)

- KION Group

Frequently Asked Questions

Analyze common user questions about the Port Crane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of fully automated port cranes?

The primary factor driving the adoption of fully automated port cranes is the critical need to maximize terminal throughput (moves per hour) while simultaneously reducing dependence on costly and potentially scarce manual labor, optimizing land utilization through high-density stacking, and ensuring consistent 24/7 operational reliability.

Which type of port crane segment is expected to experience the highest growth rate?

The Rail-Mounted Gantry (RMG) crane segment, specifically those supporting automated stacking yards (ASCs), is expected to experience one of the highest growth rates, driven by their superior efficiency, high stacking density capabilities, and inherent suitability for electrification, aligning with key trends in high-volume container terminals.

How is the decarbonization trend impacting the Port Crane Market?

Decarbonization significantly impacts the market by compelling ports to transition from diesel-powered equipment (like standard RTGs) to electric, hybrid, or battery-powered alternatives (e-RTGs and electric RMGs), creating a massive market for retrofitting existing fleets and driving demand for new, zero-emission models in compliance with tightening environmental regulations.

What role does Artificial Intelligence play in modern port crane operations?

AI plays a crucial role by enabling predictive maintenance through data analysis, optimizing complex yard logistics and container stacking strategies, improving safety via advanced collision avoidance, and enhancing the accuracy and speed of remote and autonomous crane movements.

Why is the Asia Pacific region the largest market for port cranes?

Asia Pacific is the largest market due to its dominant position in global manufacturing and trade, necessitating continuous expansion and modernization of port infrastructure, driven by massive domestic consumption growth and high-volume transshipment hubs, particularly in China and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Port Crane Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ship to Shore Container Cranes, Mobile Harbour Cranes, Permanently-installed Cranes, Rail Mounted Gantry Cranes), By Application (Container Handling, Stacking, Bulk Handling, Scrap Handling, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Port Crane Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (TEU, STS, RTG), By Application (Container handling, Stacking, Bulk handling, Scrap handling, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager