Portable Dance Floors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434114 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Portable Dance Floors Market Size

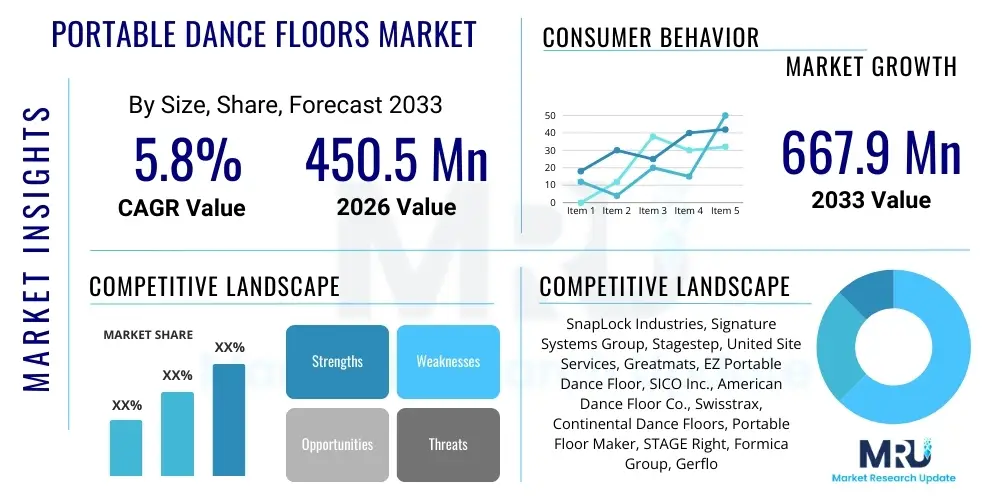

The Portable Dance Floors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 667.9 Million by the end of the forecast period in 2033. This consistent expansion is driven primarily by the escalating demand for temporary and adaptable event spaces across the globe, coupled with rapid urbanization and the proliferation of large-scale cultural festivals and corporate gatherings that necessitate high-quality, durable, and aesthetically pleasing flooring solutions.

Portable Dance Floors Market introduction

The Portable Dance Floors Market encompasses the manufacturing, distribution, and utilization of modular flooring systems specifically designed for temporary installation and easy relocation. These systems provide a stable, safe, and attractive surface for dancing, events, and performance arts, serving as an essential component in the logistics of temporary venues. The core product is typically composed of interlocking panels made from materials such as wood, laminate, vinyl, or specialized polymers, engineered for quick assembly and disassembly, offering unparalleled flexibility to event organizers and venue operators.

Major applications of portable dance floors span a wide array of sectors, including the hospitality industry (hotels, banquet halls), entertainment venues (concerts, theaters), corporate events, and private functions such as weddings and parties. The inherent benefit of these floors lies in their versatility, allowing existing spaces to be rapidly converted into high-traffic performance areas without requiring permanent infrastructure changes. Furthermore, modern portable flooring solutions often incorporate features like slip-resistance, enhanced durability against moisture and impact, and customizable aesthetics, which significantly contribute to their increasing adoption.

The primary driving factors sustaining market growth include the global revival and expansion of the events industry post-pandemic, the rising preference for temporary rental solutions over permanent installations to maximize cost efficiency, and technological advancements focusing on lighter, stronger, and more sustainable flooring materials. The increasing sophistication of event management requires adaptable infrastructure, positioning portable dance floors as a critical and rapidly evolving niche within the broader temporary infrastructure market.

Portable Dance Floors Market Executive Summary

The Portable Dance Floors Market is characterized by robust business trends emphasizing modularity, durability, and specialized customization. Key industry players are focusing on integrating advanced materials, particularly vinyl and high-density laminates, to offer superior performance and ease of maintenance, addressing the stringent requirements of high-volume event rental companies. The proliferation of digital platforms for equipment rental is simplifying access for smaller event organizers, leading to democratized market access and heightened competitive dynamics, while sustainability credentials, such as the use of recycled content and long-lifecycle products, are becoming significant procurement criteria, driving innovation in material science.

Regional trends indicate North America and Europe retaining dominance due to high discretionary spending on leisure and entertainment, and a mature infrastructure for large-scale events and exhibitions. However, the Asia Pacific region is forecast to exhibit the highest growth trajectory, fueled by rapid urbanization, the emergence of a strong middle class, and substantial government investment in tourism and cultural infrastructure, particularly in developing economies like China and India. Latin America and the Middle East are also experiencing accelerated growth, driven by an increase in international sporting events and corporate functions requiring premium event setups.

Segmentation trends highlight the increasing preference for interlocking panel systems over platform systems due to superior stability and easier installation times. Furthermore, the material segment shows a noticeable shift toward vinyl and laminate options, valued for their cost-effectiveness, lightweight nature, and resistance to environmental damage compared to traditional solid wood options. The application segment continues to be dominated by the Hospitality and Events sectors, though the residential and fitness applications are emerging as strong, high-growth niche markets demanding personalized, compact portable solutions.

AI Impact Analysis on Portable Dance Floors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Portable Dance Floors Market primarily revolve around how AI can optimize supply chain logistics, enhance predictive maintenance, and personalize customer experiences in the rental sector. Users are concerned about whether AI can assist in predicting material degradation rates, determining optimal inventory levels based on localized event patterns, and automating the design process for custom flooring layouts. The key expectation is that AI integration, while not directly altering the physical product, will significantly streamline the operational aspects of procurement, rental management, and logistics, leading to reduced turnaround times and improved asset utilization across large fleet operators. Furthermore, inquiries focus on AI-driven visualization tools that allow event planners to accurately model how different flooring options will look and perform within a specific venue space before commitment.

- AI-Powered Inventory Management: Predictive algorithms optimize stock levels based on seasonal demand, geographic event frequency, and specific material requirements.

- Logistics Optimization: AI routes and scheduling systems minimize transportation costs and delivery times for large-scale floor installations and removals.

- Predictive Maintenance: Sensors integrated into premium floors (Smart Floors) coupled with AI analysis predict wear patterns, determining optimal times for refurbishment or replacement, extending product lifespan.

- Automated Design & Quotation: AI assists event planners in rapid, accurate floor layout generation based on venue dimensions, guest capacity, and desired aesthetics, instantly generating customized pricing models.

- Enhanced Customer Service: AI chatbots and virtual assistants handle initial inquiries, scheduling, and product specification matching for rental services, improving responsiveness.

DRO & Impact Forces Of Portable Dance Floors Market

The market dynamics of portable dance floors are governed by a robust interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping the industry's future trajectory. A principal driver is the explosive global growth in organized events, festivals, corporate conventions, and private celebrations, which consistently create demand for temporary yet reliable flooring infrastructure. Additionally, the inherent advantages of portability, quick setup, and lower maintenance costs compared to permanent flooring solutions enhance their appeal to venue operators prioritizing spatial flexibility and operational efficiency. Technological advancements in lightweight, highly durable composite materials are further strengthening the value proposition, allowing for better performance in outdoor and varied climatic conditions.

However, the market faces significant restraints, primarily centered around the high initial capital investment required for acquiring high-quality, durable portable flooring systems, which can be prohibitive for smaller rental firms or limited-budget organizers. Furthermore, variability in quality standards and the potential for regulatory compliance issues, particularly concerning fire safety and accessibility standards (such as ADA requirements in North America), pose challenges to widespread adoption. The storage and maintenance requirements, especially for large inventory fleets, also contribute to operational complexity, which acts as a minor limiting factor, particularly in dense urban areas where storage space is costly.

Opportunities for market growth are abundant, notably through the development of 'smart floors' that incorporate connectivity and lighting elements for enhanced user experience, catering to the sophisticated demands of modern entertainment. Expansion into emerging applications, such as temporary sports courts or specialized fitness training areas, offers diversification potential. Moreover, establishing strong distribution partnerships and implementing leasing models, rather than outright sales, can significantly lower the barrier to entry for customers. The key impact forces driving competitive strategy revolve around material innovation, operational efficiency gains through digitalization, and achieving a balance between high durability and lightweight characteristics to maximize return on investment for rental companies.

Segmentation Analysis

The Portable Dance Floors Market is comprehensively segmented based on product characteristics, material composition, application spectrum, and distribution channels, allowing for detailed analysis of market dynamics and consumer preferences within distinct niches. Segmentation provides essential insights into where innovation is most required and where geographical growth is most pronounced. The diverse range of products, from rugged outdoor floors to polished ballroom systems, necessitates a tailored approach to manufacturing and marketing. Understanding these segments is crucial for stakeholders aiming to optimize their product portfolio and target specific end-user groups, ranging from large international event management companies to small community centers and individual consumers.

- By Type:

- Interlocking Panels

- Platform Systems (Sectional)

- Roll-Out Vinyl Floors (Used for temporary overlays)

- By Material:

- Wood (Hardwood, Plywood, Engineered Wood)

- Vinyl/PVC

- Laminate

- Acrylic/Plexiglass

- Composite Materials

- By Application:

- Events and Rentals (Weddings, Parties, Concerts)

- Hospitality (Hotels, Convention Centers)

- Fitness and Recreation (Yoga, Aerobics, Temporary Studios)

- Residential Use

- Institutional (Schools, Community Centers)

- By Distribution Channel:

- Online Sales (E-commerce platforms, Direct manufacturer sales)

- Offline Sales (Retail Stores, Specialized Distributors, Rental Companies)

Value Chain Analysis For Portable Dance Floors Market

The value chain for the Portable Dance Floors Market starts with upstream activities, involving the sourcing and processing of raw materials such as specialized polymers, high-grade wood materials, adhesives, and finishing layers like vinyl or laminates. Efficiency at this stage is critical, as material quality directly dictates the durability, weight, and price point of the final product. Key upstream partnerships focus on securing stable supplies of sustainable and lightweight composites to maintain competitive pricing and meet increasing ecological demands. Manufacturers then engage in panel fabrication, testing, and system engineering, prioritizing modular design, ease of assembly, and adherence to safety standards.

The downstream segment of the value chain is characterized by complex distribution channels. The primary channel involves specialized rental companies and event equipment providers who purchase large fleets of floors and lease them to end-users. These rental firms manage logistics, installation, maintenance, and storage, adding significant value. Direct sales channels, including manufacturer e-commerce sites, cater primarily to institutional buyers (hotels, schools) or residential users seeking permanent ownership. Indirect distribution relies heavily on regional distributors and specialized retail outlets that provide localized support and smaller inventory access.

The successful operation of the value chain hinges on efficient logistics and inventory management, particularly for large-scale rental operations. The direct channel offers higher profit margins but requires manufacturers to manage extensive after-sales support and installation guidance. Conversely, the indirect channel, leveraging regional distributors and large rental corporations, ensures broader geographical reach and faster market penetration. Optimization throughout the value chain is focused on reducing the material weight without compromising stability, thereby minimizing shipping and setup costs, which are significant expense factors in this industry.

Portable Dance Floors Market Potential Customers

Potential customers for portable dance floors are highly diverse, spanning both commercial enterprises requiring infrastructure flexibility and individual consumers hosting private events. The largest segment remains the Hospitality sector, encompassing hotels, convention centers, and dedicated banquet facilities that rely on these floors to rapidly reconfigure spaces for weddings, conferences, and gala dinners. These customers prioritize professional appearance, quick turnover rates, and high durability to withstand repeated use and rigorous cleaning cycles. Event Management and Rental Companies form another major customer base, viewing portable floors as essential capital assets that must offer versatility and a long operational lifespan to maximize rental yields.

A rapidly growing customer segment includes the Fitness and Recreation industries, particularly pop-up fitness studios, traveling yoga instructors, and temporary sports leagues that require sprung or stable, shock-absorbent flooring for performance and safety. Furthermore, Educational and Institutional buyers, such as schools, universities, and community centers, frequently invest in portable floors for drama performances, school dances, and multi-purpose hall utilization. Residential customers, while smaller in volume, represent a niche market for high-end, custom floors utilized for home parties or private dance practice rooms, demanding aesthetics and simplicity of storage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 667.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SnapLock Industries, Signature Systems Group, Stagestep, United Site Services, Greatmats, EZ Portable Dance Floor, SICO Inc., American Dance Floor Co., Swisstrax, Continental Dance Floors, Portable Floor Maker, STAGE Right, Formica Group, Gerflor, Robbins Sports Surfaces, Alges, DanceDeck, Mobile Dance Floor, Matéflex, Sunbelt Rentals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Dance Floors Market Key Technology Landscape

The Portable Dance Floors Market is undergoing significant technological evolution, moving beyond basic wood or laminate panels toward sophisticated, engineered systems that enhance performance, durability, and user experience. A critical technology involves advanced interlocking mechanisms, such as positive locking systems or magnetic coupling, which ensure seamless, stable surfaces that can be rapidly assembled and disassembled without specialized tools, dramatically reducing labor costs and setup time. Furthermore, the development of lightweight, high-density composite materials, often leveraging recycled plastics and high-impact resins, is enabling the creation of floors that are significantly lighter than traditional options yet maintain superior load-bearing capabilities and moisture resistance, making them ideal for outdoor and temporary installations.

Surface technology also plays a crucial role. Modern portable floors utilize specialized top layers, often high-grade commercial vinyl or durable laminates, treated with anti-slip coatings and anti-microbial finishes. These surface treatments enhance user safety, especially in high-traffic environments, and improve hygiene compliance in the hospitality and fitness sectors. Furthermore, the increasing demand for aesthetic customization has driven innovation in digital printing technologies, allowing manufacturers to embed high-resolution, custom graphics, or realistic wood grain patterns onto vinyl or laminate surfaces, offering visual versatility that stationary floors cannot match.

The emerging technological frontier is the integration of "Smart Floor" technologies. This includes embedding subtle LED lighting elements within the panels for dynamic visual effects, which is particularly popular in the entertainment segment. More advanced smart floors incorporate pressure sensors and RFID tags for inventory tracking and potentially for collecting performance data, such as pressure distribution or dancer movement patterns. This data integration is highly valuable for large rental fleet managers to monitor asset location, utilization rates, and preemptively identify panels requiring maintenance, leveraging IoT principles to enhance operational efficiency.

Regional Highlights

- North America: North America remains the leading market for portable dance floors, characterized by a highly mature events and entertainment industry and high per capita spending on luxury events and large-scale corporate functions. The market here is dominated by large rental equipment companies and benefits from strict safety regulations, driving demand for premium, highly durable, and ADA-compliant modular systems. The United States, in particular, exhibits high adoption of high-end wood and specialized composite floors due to the prevalence of major conventions, exhibitions, and a robust wedding industry.

- Europe: Europe is a substantial and growing market, driven by a strong cultural heritage of music festivals, public celebrations, and the established hospitality sector, especially in countries like Germany, the UK, and France. The emphasis in Europe often leans toward sustainability, favoring manufacturers who utilize recycled or ethically sourced materials. The European market sees strong demand for lightweight, roll-out vinyl floors for temporary arts and theater performances, balancing cost-effectiveness with performance quality.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market segment during the forecast period. This rapid expansion is attributed to fast-paced economic growth, increasing disposable incomes, and substantial governmental investment in MICE (Meetings, Incentives, Conventions, and Exhibitions) infrastructure, particularly in China, India, and Southeast Asian nations. The demand here is highly price-sensitive but rapidly shifting towards higher-quality, moisture-resistant flooring suitable for diverse climatic conditions and large outdoor gatherings.

- Latin America: The market in Latin America is marked by steady growth, driven by increasing tourism, large sporting events, and cultural festivals. Brazil and Mexico are key contributors. Adoption is accelerated by the need for quick, reliable floor setups in areas with limited permanent infrastructure. There is a preference for robust, easy-to-clean materials that can withstand frequent movement and high temperatures.

- Middle East and Africa (MEA): Growth in the MEA region is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant investment in luxury tourism, high-profile corporate events, and cultural exhibitions hosted in cities like Dubai, Riyadh, and Doha. This market demands aesthetically superior, often highly customized flooring systems that complement luxurious venue designs, favoring high-gloss acrylic and specialized laminate finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Dance Floors Market.- SnapLock Industries

- Signature Systems Group

- Stagestep

- United Site Services

- Greatmats

- EZ Portable Dance Floor

- SICO Inc.

- American Dance Floor Co.

- Swisstrax

- Continental Dance Floors

- Portable Floor Maker

- STAGE Right

- Formica Group

- Gerflor

- Robbins Sports Surfaces

- Alges

- DanceDeck

- Mobile Dance Floor

- Matéflex

- Sunbelt Rentals

Frequently Asked Questions

Analyze common user questions about the Portable Dance Floors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used for high-quality portable dance floors?

The most commonly used materials are high-grade engineered wood (laminate), commercial-grade vinyl, and specialized composite plastics (such as polypropylene or high-impact resins). Vinyl and composites are preferred for outdoor use and high durability, while engineered wood remains popular for traditional ballroom and indoor events due to its aesthetic appeal and stability.

How does the type of portable dance floor (Interlocking vs. Platform) impact installation time?

Interlocking panel systems typically offer significantly faster installation times compared to traditional platform or sectional systems. Interlocking floors utilize a simple snap-together mechanism that often requires minimal tools and can be laid by fewer staff, making them ideal for events requiring rapid venue turnover and optimizing labor efficiency.

What are the primary factors driving the adoption of portable dance floors in the hospitality sector?

The primary driver is spatial flexibility and maximizing revenue per square meter. Portable dance floors allow hotels and convention centers to quickly convert large banquet halls into multiple functional spaces (dining, dancing, exhibition areas) and vice versa, minimizing downtime and maximizing the facility's utility for diverse client needs.

Is the Portable Dance Floors Market affected by sustainability and material recycling trends?

Yes, sustainability is a growing market trend. Customers, especially in Europe and North America, increasingly favor manufacturers who utilize recycled content in their composite panels (GEO optimization) and offer products with long lifecycles. Companies are investing in materials that can be fully recycled at the end of their operational life to meet corporate environmental mandates.

Which regional market is showing the highest growth potential for portable dance floor demand?

The Asia Pacific (APAC) region exhibits the highest growth potential (AEO optimization). This is driven by rapid infrastructure development for tourism and MICE, increasing discretionary spending on large public and private events, and urbanization across major economies like China, India, and Southeast Asia, leading to immense demand for temporary event solutions.

The market analysis indicates a strong focus on balancing aesthetic appeal with rugged functionality across all geographical segments. Manufacturers achieving superior engineering in terms of stability, weight reduction, and moisture resistance are gaining a competitive edge, particularly in the highly competitive rental segment where operational costs and maintenance frequency are paramount considerations. The future trajectory involves further integration of digital tools and automation in the supply chain to enhance the speed and accuracy of large-scale event setups.

In addition to traditional market drivers, the post-pandemic resurgence of live entertainment and physical gatherings globally has injected fresh momentum into the portable flooring sector. This rebound is characterized not only by volume increases but also by a demand for premium, specialized floors for niche performances, such as professional ballroom and ballet practice, which require specific sprung qualities to minimize performer injury. This specialization pushes manufacturers towards precision engineering and material stratification to meet diverse performance requirements, broadening the product spectrum available in the market.

The regulatory landscape, specifically concerning adherence to global standards like ISO certifications for load-bearing capacity and national safety codes (e.g., slip resistance testing), is becoming a non-negotiable aspect of market entry. Suppliers who invest in documented compliance and comprehensive product testing are better positioned to secure contracts with governmental bodies and large international event organizers who prioritize risk mitigation. Furthermore, the evolution of modular design allows for the seamless integration of accessibility ramps and edge pieces, ensuring compliance with accessibility mandates such as the Americans with Disabilities Act (ADA), thereby expanding the usability of these systems in public spaces.

Technological advancement is also being applied to the maintenance phase. Specialized cleaning and refurbishment systems are being developed to efficiently process large volumes of floor panels after events, ensuring the longevity and cleanliness of the rental inventory. UV protective coatings and advanced sealing techniques are critical for floors utilized outdoors, preventing material warping, color fading, and premature degradation caused by environmental exposure. This focus on life-cycle management significantly enhances the economic viability of portable flooring assets for rental companies, securing long-term investments in high-quality systems over lower-cost alternatives.

The convergence of event technology, such as dynamic lighting and interactive displays, is increasingly influencing the design of portable dance floors. Floors that can support embedded or surface-mounted LED lighting arrays without compromising structural integrity are commanding premium pricing. This move toward 'experiential flooring' transforms the traditional static dance area into a dynamic canvas, essential for high-end corporate launches, concerts, and modern weddings seeking an immersive atmosphere. This trend pushes material science to provide transparency and structural support simultaneously, often leading to the use of specialized acrylics and reinforced glass panels in high-end portable systems.

The segmentation by Distribution Channel is experiencing a noticeable transformation due to digitalization. While specialized rental companies remain the dominant distribution mechanism, direct-to-consumer online sales are growing rapidly, particularly targeting smaller businesses, residential users, and independent fitness professionals. E-commerce platforms offer detailed specifications, virtual visualization tools, and simplified ordering processes, lowering the purchasing friction for smaller-scale projects. However, the complexity of shipping large, heavy flooring systems still gives traditional, geographically localized distributors and rental firms a strong logistical advantage for major events.

Competition in the Portable Dance Floors Market is multifaceted, involving rivalry based on price, material quality, ease of installation, and breadth of customer service (including technical support and logistical provision). Smaller, specialized manufacturers often compete by offering highly customized or niche products, such as floors designed specifically for specific dance styles (e.g., tap or ballet), while large international players focus on economies of scale, extensive global distribution networks, and securing long-term contracts with major hotel chains and convention centers worldwide. Intellectual property protection around proprietary locking mechanisms and material formulations is a key competitive strategy.

Geographically, while mature markets like North America focus on innovation and replacement cycles, emerging markets are driven by volume and initial penetration. Manufacturers targeting APAC must prioritize floors that are cost-effective, easily transported across developing logistics networks, and highly resistant to humidity and pest issues common in tropical climates. The ability to offer comprehensive logistical and installation support in these regions is often more critical to securing market share than offering the absolute highest-end product specification, reflecting a difference in market maturity and client needs.

The application segment also illustrates divergent trends. The 'Events and Rentals' category demands versatility and quick turnaround, whereas the 'Hospitality' segment prioritizes luxury aesthetics and acoustic dampening. The 'Fitness and Recreation' segment requires specialized sprung floors to protect joints, focusing the demand on high-performance composite and engineered wood systems that offer superior impact absorption and stability, often needing specialized surface finishes compatible with athletic footwear.

Future growth will be significantly influenced by infrastructure investment in rapidly developing economies and the continued global trend toward experiential leisure activities. As events become more sophisticated and venue expectations rise, the demand for portable flooring systems capable of supporting advanced lighting, sound, and staging equipment will intensify, ensuring sustained growth in the value segment of the market. Furthermore, the expansion of pop-up retail and experiential marketing activations represents an untapped opportunity, requiring durable, visually appealing, temporary floor systems to define brand spaces.

Investment in research and development is predominantly directed toward material science. The focus is on creating materials that are both lighter for transport and stronger for load-bearing applications. Specifically, advanced polymer research aims to achieve the stability and feel of real wood floors without the associated weight, susceptibility to moisture damage, or extensive maintenance requirements. The development of self-leveling or micro-adjustable feet technology is another area of innovation, crucial for ensuring a perfectly flat dance surface when installing floors over uneven terrain, a common challenge in outdoor and temporary event locations.

The interdependence of the portable dance floor market with the broader rental and temporary structure industry is high. Economic fluctuations that impact corporate events or tourism directly influence demand. However, the inherent flexibility offered by portable solutions makes them resilient, as they often become the preferred, cost-effective alternative during economic downturns, allowing businesses to avoid the high capital expense of permanent renovations while maintaining functional space capabilities. This resilience contributes to the stable projected CAGR despite underlying macro-economic uncertainties.

Finally, cybersecurity and data protection are becoming relevant, particularly for providers utilizing "Smart Floors." If floors are equipped with IoT sensors for performance monitoring or asset tracking, manufacturers must ensure robust data encryption and compliance with global privacy regulations (like GDPR) to protect client data and proprietary event logistics information. This adds a necessary layer of technological complexity to the product development process, transforming a historically low-tech product into a digitally integrated asset.

The Portable Dance Floors Market is dynamic and structurally robust, driven by the global events ecosystem and technological progression. Success hinges on strategic alliances between material suppliers, manufacturers, and large rental agencies, focusing on creating efficient, reliable, and aesthetically customizable products that meet evolving safety and performance standards worldwide. Long-term market leaders will be those who successfully leverage digital integration for logistics and asset management while continually innovating in sustainable and high-performance material composites, ensuring the market remains buoyant and responsive to end-user demands for flexibility and quality.

The focus on environmental sustainability is transforming procurement practices within the industry. Large corporate clients and governmental organizations are increasingly implementing criteria for 'green purchasing,' favoring floors that are not only durable but also manufactured using low-VOC (Volatile Organic Compound) adhesives and finishes. This shift necessitates significant changes in the manufacturing process, particularly in the production of laminates and vinyls, pushing R&D towards bio-based plastics and sustainably sourced wood components, directly impacting raw material costs and product pricing.

Moreover, the rise of modularity extends beyond just the floor panels themselves to include modular staging, lighting fixtures, and even integrated cable management systems that can be swiftly combined with the portable floor setup. This holistic approach to temporary venue construction simplifies the logistics for event planners, leading to a preference for providers offering comprehensive, integrated system solutions rather than just isolated floor panels. Companies that can provide a full, certified, temporary infrastructure package gain a considerable competitive advantage.

The regulatory aspect of accessibility, particularly ensuring seamless transitions between the installed floor and surrounding permanent flooring, is a specialized challenge. Manufacturers are investing in low-profile edging and ramp components that meet strict slope requirements for wheelchair access, ensuring compliance with global accessibility standards. This product specialization caters to a critical need, expanding the market viability of portable floors in public-facing venues that must accommodate all attendees, regardless of mobility needs.

The market also sees segmentation based on acoustic properties. For high-end performance venues, dance studios, and theaters, demand is strong for floors that incorporate specific acoustic dampening layers to reduce sound transfer or provide the required reverberation for specialized dance styles. This nuanced requirement further drives material innovation, resulting in multi-layered, composite panels that address both structural integrity and auditory performance, pushing pricing into the premium tier.

In terms of distribution, rental companies are increasingly utilizing sophisticated software for digital asset management. This software tracks the location, maintenance history, and utilization rate of every floor panel, maximizing the asset lifespan and ensuring optimal readiness for deployment. This operational efficiency driven by digitalization lowers the overall cost of ownership for fleet operators, reinforcing the dominance of the rental model in the overall market structure.

Finally, the growing popularity of destination weddings and large international exhibitions necessitates portable floors that are highly resistant to extreme temperature variations and environmental factors, such as high humidity or arid conditions. Manufacturers must engineer systems that minimize expansion and contraction, preventing gaps or warping, which are critical safety hazards. This engineering complexity reinforces the value proposition of high-quality, certified portable systems over cheaper, less reliable alternatives, safeguarding the industry's reputation for quality and reliability.

These market nuances ensure that the Portable Dance Floors Market remains a field of continuous innovation, where success is equally dependent on material science breakthroughs, logistical efficiency, and responsiveness to highly specialized end-user performance and safety requirements across diverse global markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager