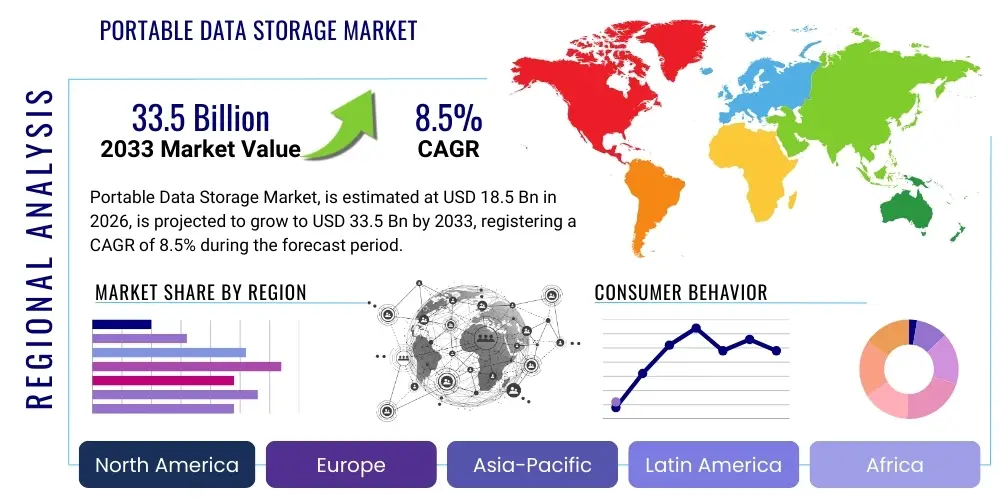

Portable Data Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434205 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Portable Data Storage Market Size

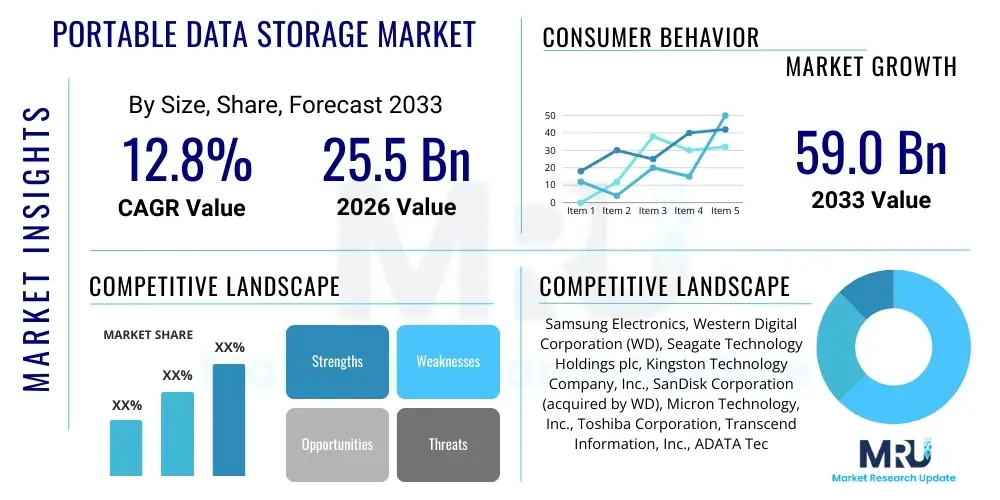

The Portable Data Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $33.5 Billion by the end of the forecast period in 2033.

Portable Data Storage Market introduction

The Portable Data Storage Market encompasses devices designed for the secure and convenient transfer, backup, and archiving of digital data across various platforms and locations. These devices are essential components in the modern digital ecosystem, facilitating mobility for professionals, content creators, and general consumers alike. Products range significantly in form factor, capacity, and speed, including external Hard Disk Drives (HDDs), Solid State Drives (SSDs), USB flash drives, and memory cards, each catering to distinct performance and budget requirements. The core function of these products is to provide a reliable, non-volatile, and accessible extension of primary computing storage, ensuring data integrity and availability outside of fixed infrastructure environments.

Major applications for portable data storage solutions span numerous sectors, driven primarily by the exponential growth of data volumes generated globally. In the consumer segment, key applications include personal data backup, high-definition media storage (4K/8K video), and expansion storage for gaming consoles and laptops. For enterprises and creative professionals, portable drives serve as crucial tools for fieldwork data collection, secure off-site data archival, quick file transfer in production pipelines, and running operating systems or specialized applications directly from external media. The increasing complexity of digital media and the need for immediate data access fuel the demand for high-speed interfaces and high-capacity portable SSDs.

The primary benefits of utilizing portable data storage include enhanced data security through physical control and encryption capabilities, unparalleled flexibility in transferring large files without reliance on network bandwidth, and improved business continuity through localized backup strategies. Driving factors include the proliferation of high-resolution content creation, the continuous decline in the cost-per-gigabyte of NAND flash memory, the rising adoption of mobile computing devices requiring supplementary storage, and global regulatory requirements mandating secure data retention and portability across diverse industries such as healthcare and finance. Technological advancements in interface standards, such as USB 4 and Thunderbolt 4, further enhance the usability and speed performance of these devices, solidifying their role as indispensable tools.

Portable Data Storage Market Executive Summary

The Portable Data Storage Market is characterized by a significant shift from traditional mechanical storage (HDDs) toward Solid State Drives (SSDs), marking a critical business trend driven by performance demands. High-speed, ruggedized portable SSDs are increasingly becoming the standard for professional users and high-end consumers due to their superior read/write speeds, durability, and compact form factors. Furthermore, hybrid storage models are emerging, where portable devices are integrated seamlessly with cloud services, allowing users to leverage both local access speed and cloud scalability. Key market players are intensely focusing on optimizing the power efficiency and physical robustness of their products, incorporating advanced features like hardware-level encryption and biometric security to address growing data privacy concerns, thereby solidifying their competitive positions.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the fastest growth, primarily attributed to robust manufacturing capabilities, rapid digital transformation initiatives in countries like India and China, and a massive, growing base of mobile and technology-savvy consumers. North America and Europe, while being mature markets, continue to dominate in terms of revenue contribution, driven by high adoption rates in enterprise data management, sophisticated content creation industries, and early implementation of cutting-edge interface technologies. Market strategies in these regions often revolve around high-capacity, high-reliability products catering to professional and corporate archival needs, coupled with stringent regulatory compliance requirements influencing product design and security features.

Segment trends reveal that the Portable SSD segment is the primary growth engine, expected to outpace other technologies due to continuous price parity improvements and the escalating requirement for fast data transfer, particularly among gamers and video professionals handling massive files. Capacity segmentation indicates a strong preference shift toward higher storage tiers (1TB and above) across both consumer and enterprise applications, reflecting the accelerating rate of data generation. The application landscape is heavily leaning toward creative professional use cases, where the reliance on portable, high-throughput storage is non-negotiable for efficient workflows, creating premium opportunities for specialized, high-end storage solutions designed for demanding environments and sustained performance.

AI Impact Analysis on Portable Data Storage Market

User queries regarding AI's impact on portable data storage predominantly center on two core themes: the massive data generation fueled by AI model training and inference, and the resulting need for high-speed, edge-based storage solutions. Users are keen to understand how AI applications, such as autonomous vehicles and advanced surveillance systems, drive demand for faster, larger-capacity portable drives at the data source (the edge). There is significant interest in whether AI can enhance storage device management, optimization, and predictive failure analysis. Consumers also expect portable drives to cope with the intensive I/O operations necessitated by local AI inferencing tasks, leading to questions about the necessary performance specifications (IOPS and throughput) that future portable SSDs must offer to remain viable in an AI-dominated ecosystem. The consensus is that AI will be a net positive driver, fundamentally altering performance benchmarks and increasing the overall data volume requiring portable, high-performance storage solutions for transit and immediate processing.

- AI-Driven Data Proliferation: Generates vast datasets (e.g., sensor data, machine learning outputs) requiring portable solutions for immediate collection and transfer to centralized processing centers.

- Edge Computing Demand: AI inference models deployed at the network edge necessitate high-speed portable storage for temporary data caching and localized processing, reducing latency.

- Increased Performance Requirements: AI workloads demand high sustained sequential and random read/write speeds (IOPS), accelerating the shift from HDD to high-performance NVMe portable SSDs.

- AI-Enhanced Storage Management: Integration of AI algorithms for predictive maintenance, intelligent data tiering, and optimizing data placement within portable drives to extend lifespan and improve efficiency.

- Security and Data Integrity: AI models analyzing data often require heightened security protocols, driving the demand for portable drives equipped with robust hardware-level encryption and secure access mechanisms.

- Automation of Backup and Archival: AI tools can automate and optimize portable backup strategies, ensuring critical data generated by intelligent systems is securely stored and transferred.

DRO & Impact Forces Of Portable Data Storage Market

The Portable Data Storage Market is profoundly shaped by dynamic factors encompassing technological advancements, market restraints, and significant untapped opportunities, collectively referred to as the DRO (Drivers, Restraints, Opportunities) framework. Key drivers include the exponential growth in global data volume, often termed the 'Big Data' phenomenon, fueled by social media, IoT devices, and digital streaming, which necessitates readily available external storage for archival and transfer. Furthermore, the increasing mobility of the workforce and the rise of remote work globally mandate flexible and secure portable storage solutions, especially for sensitive corporate information. The rapid expansion of bandwidth-intensive applications, such as 4K/8K video editing and professional gaming, requires high-throughput external drives, reinforcing the shift towards premium SSD products.

Despite robust growth drivers, the market faces several restraining forces that moderate expansion. Primary among these is the persistent and increasing threat of data security breaches and cyberattacks; portable devices are susceptible to loss, theft, and unauthorized access, creating reluctance among highly regulated industries to fully adopt widespread portable solutions without stringent security measures. Additionally, the rapid commoditization and subsequent price volatility of NAND flash memory components introduce complexity in pricing strategies for manufacturers. The continued competition from cloud storage services, which offer scalable, collaborative, and globally accessible alternatives, presents a formidable challenge to the pure-play portable storage market, forcing manufacturers to innovate by integrating cloud backup features and emphasizing local speed advantages.

Significant opportunities exist in the commercialization of high-speed interface technologies, particularly the widespread adoption of Thunderbolt 4 and USB 4, which drastically reduce transfer times and broaden compatibility across device ecosystems. The increasing rollout of 5G networks globally is fostering an environment where large datasets must be captured and moved quickly at the edge, creating new market niches for ruggedized, high-capacity portable drives tailored for remote data acquisition. The integration of advanced security features, such as biometric authentication and self-encrypting drive (SED) capabilities, offers manufacturers a premium differentiation strategy, appealing directly to enterprise and government sectors concerned with compliance and data integrity. These opportunities allow manufacturers to move beyond simple capacity competition toward value-added solutions.

Segmentation Analysis

The Portable Data Storage Market segmentation provides a structural view of the diverse product offerings and application landscapes. The market is primarily segmented based on product type, interface, capacity range, and end-user application, reflecting varying consumer and professional requirements for speed, durability, and cost-effectiveness. The fastest-growing segment remains the Portable SSD market, owing to its superior performance attributes, which are increasingly vital for demanding tasks like 4K video editing and high-fidelity gaming. Geographic segmentation highlights the APAC region's dominance in volume consumption, while North America leads in value due to high enterprise uptake of premium, secure storage solutions. Understanding these granular segments is crucial for strategic market positioning and resource allocation among key industry participants.

- By Product Type:

- Portable Solid State Drives (PSSD)

- Portable Hard Disk Drives (PHDD)

- USB Flash Drives

- Memory Cards (SD, MicroSD, CFexpress)

- By Capacity:

- Less than 500 GB

- 500 GB to 1 TB

- 1 TB to 4 TB

- Above 4 TB

- By Interface:

- USB 3.0/3.1/3.2

- USB 4

- Thunderbolt (3 & 4)

- SATA (External Enclosures)

- By End User:

- Consumer Electronics

- Enterprise (Data Centers & Cloud)

- Media and Entertainment

- IT and Telecommunication

- Healthcare

- Education and Government

Value Chain Analysis For Portable Data Storage Market

The value chain for the Portable Data Storage Market begins with highly concentrated upstream activities, primarily involving the manufacturing of core components. This segment is dominated by a few global technology giants specializing in the production of crucial raw materials, namely NAND flash memory chips (for SSDs and flash drives), magnetic platters and read/write heads (for HDDs), and controller chips. The quality, supply, and pricing stability of these components directly impact the profitability and speed specifications of the final portable product. Technological advancements in this upstream stage, such as the transition from 3D NAND to QLC and PLC architectures, are fundamental drivers of increased capacity and reduced cost-per-gigabyte, influencing the overall market accessibility and competitive intensity at the consumer level.

Midstream activities involve the assembly, integration, testing, branding, and packaging of the portable storage devices. Original Equipment Manufacturers (OEMs) and branded vendors acquire components and integrate them into durable enclosures, ensuring compatibility with high-speed interfaces like USB-C and Thunderbolt. This stage is critical for differentiation, as companies invest heavily in ruggedized designs, thermal management systems for sustained performance, and proprietary software for backup, encryption, and data recovery services. Branding and marketing efforts transform generic components into high-value consumer and professional products, focusing on specific metrics such as sequential transfer speeds and Mean Time Between Failures (MTBF) to capture targeted market segments.

The downstream segment covers the distribution channel, which is highly diversified. Direct distribution involves sales through proprietary e-commerce platforms and B2B contracts, often targeting large enterprises or specialized professional markets requiring customized solutions. Indirect channels, which form the bulk of consumer sales, include large-scale electronics retailers (both online and physical), value-added resellers (VARs), and system integrators. E-commerce platforms, due to their wide reach and logistical efficiency, have become particularly dominant for consumer sales, fostering intense price competition. The efficiency of this downstream network, including logistics and after-sales support, directly impacts customer satisfaction and market penetration, ensuring products reach a global audience rapidly and efficiently.

Portable Data Storage Market Potential Customers

The Portable Data Storage Market serves a broad spectrum of end-users, ranging from individual consumers to large multinational enterprises, each utilizing these devices for distinct purposes. A major segment comprises professional content creators, including photographers, videographers, and graphic designers, who generate massive volumes of high-resolution data daily and require extremely fast, reliable, high-capacity external drives for capturing, editing, and transporting files between workstations and clients. Similarly, the global community of competitive and casual gamers represents a significant customer base, leveraging portable SSDs to expand console storage, reduce game load times, and maintain large game libraries efficiently.

Another crucial customer segment is the Enterprise sector, specifically businesses engaged in IT, data center management, and field operations. These entities utilize portable storage for secure, localized data backup, disaster recovery planning, and regulatory archival purposes. Mobile professionals, such as consultants and salespeople, rely on compact, encrypted portable drives to securely carry confidential corporate data outside the firewall. Furthermore, industries operating under strict data localization laws, such as healthcare and finance, require audited and traceable portable solutions to ensure compliance when data must be moved or transferred physically between different operational sites.

Emerging and consistent demand also originates from the educational and government sectors. Universities and research institutions require robust storage for handling large scientific datasets, research results, and institutional archives. Government agencies frequently procure high-security, ruggedized portable drives compliant with specific federal standards (like FIPS 140-2) for secure data deployment and transfer in sensitive or remote operational environments. General consumers, constituting the largest volume segment, use these products primarily for personal file backup, supplementing the often-limited storage of modern thin laptops and tablets, and ensuring the long-term safety of personal media collections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $33.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, Western Digital (WD), Seagate Technology, SanDisk, Micron Technology (Crucial), Kingston Technology, LaCie, Toshiba, ADATA, Sony Corporation, Lexar, HP, Dell, Transcend Information, PNY Technologies, G-Technology, Verbatim, Buffalo Americas, Silicon Power, Patriot Memory |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Data Storage Market Key Technology Landscape

The technological landscape of the Portable Data Storage Market is defined by continuous innovation aimed at enhancing speed, capacity, and physical durability. The most impactful development is the transition to advanced NAND flash technology, specifically the implementation of QLC (Quad-Level Cell) and emerging PLC (Penta-Level Cell) architectures. These technologies enable manufacturers to stack more bits per cell, drastically increasing storage density and lowering the manufacturing cost per gigabyte, thus making extremely high-capacity portable SSDs economically viable for mass consumer markets. Furthermore, the integration of Non-Volatile Memory Express (NVMe) protocols, originally designed for internal storage, into external portable enclosures via bridges and specialized controllers has dramatically elevated the performance ceiling, allowing portable drives to achieve sequential read/write speeds exceeding 2,000 MB/s, which is critical for real-time 4K/8K video editing workflows and large-scale data migration tasks.

Another defining element is the evolution of external connectivity interfaces. The widespread adoption of USB Type-C physical connectors facilitates universal compatibility and reversibility, but the underlying protocols—USB 4 and Thunderbolt 4—are revolutionizing transfer rates. USB 4 offers up to 40 Gbps bandwidth, effectively doubling the speed of previous generations, while Thunderbolt 4, leveraging the USB-C connector, guarantees high-performance standards, including the mandatory support for 40 Gbps and the ability to drive multiple high-resolution displays. These high-speed interfaces mitigate the bottleneck historically associated with portable storage, ensuring that the external connection can keep pace with the high I/O throughput capabilities of modern NVMe SSDs, thereby making external drives function essentially as fast as internal storage.

In addition to speed and capacity, security and robustness are key technological battlegrounds. Advanced hardware encryption, such as AES 256-bit encryption, is becoming standard in professional-grade portable drives, providing a layer of defense independent of the host system's operating environment. Furthermore, the development of sophisticated thermal management solutions—including passive cooling components and proprietary heat-dissipating enclosures—is crucial for maintaining peak performance during sustained, intensive data transfers, preventing thermal throttling which is common in compact devices. Ruggedization technology, involving ingress protection (IP) ratings against dust and water and enhanced shock absorption mechanisms, also remains a critical differentiator, appealing to users in field environments like construction, military, and outdoor media production, ensuring data reliability under harsh physical conditions.

Regional Highlights

- North America: This region holds a leading position in terms of market revenue, driven by the high concentration of technology giants, vast data centers, and the early adoption of high-speed interface standards (Thunderbolt). The demand is largely corporate-driven, focusing on premium portable SSDs with advanced security features (FIPS compliance) for enterprise backup, data mobility, and media production in Hollywood and Silicon Valley.

- Europe: Characterized by stringent data privacy regulations (e.g., GDPR), the European market shows robust demand for secure, encrypted portable storage solutions. Germany, the UK, and France are key contributors, with high uptake in the finance, government, and professional services sectors where secure transfer and archival of sensitive personal data are paramount.

- Asia Pacific (APAC): Expected to register the highest growth rate during the forecast period. This rapid expansion is fueled by massive consumer populations, accelerating digitalization across emerging economies (India, Southeast Asia), increased smartphone and mobile computing device penetration, and the region's strong position as a global manufacturing hub for NAND flash components, leading to aggressive pricing and high volume sales.

- Latin America (LATAM): Growth is steady, primarily driven by increasing internet penetration, expanding IT infrastructure, and the rising middle class demanding cost-effective data backup solutions. Market focus remains balanced between traditional HDDs for high capacity and budget-friendly flash drives, although SSD adoption is gradually accelerating in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): This region is witnessing growth spurred by government-led smart city projects, investment in IT infrastructure, and diversification away from oil economies. Demand is concentrated in the telecommunications and government sectors, requiring specialized, reliable portable storage for foundational data collection and operational security purposes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Data Storage Market.- Samsung Electronics Co., Ltd.

- Western Digital Corporation (WD, SanDisk, G-Technology)

- Seagate Technology Holdings plc (LaCie)

- Micron Technology, Inc. (Crucial)

- Kingston Technology Company, Inc.

- Toshiba Electronic Devices & Storage Corporation

- ADATA Technology Co., Ltd.

- Sony Corporation

- Lexar International

- HP Inc.

- Dell Technologies Inc.

- Transcend Information, Inc.

- PNY Technologies, Inc.

- Verbatim GmbH

- Buffalo Americas, Inc.

- Silicon Power Computer & Communications Inc.

- Patriot Memory LLC

- Netac Technology Co., Ltd.

- Fuji Photo Film Co., Ltd.

- Maxell Holdings, Ltd.

Frequently Asked Questions

Analyze common user questions about the Portable Data Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Portable SSDs (PSSD) and Portable HDDs (PHDD)?

PSSDs utilize flash memory, offering significantly superior read/write speeds, greater durability (no moving parts), and smaller form factors, making them ideal for high-performance tasks like 4K video editing and gaming. PHDDs use magnetic platters, providing much higher storage capacity per dollar, making them more suitable for cost-effective mass data archiving and general backups where speed is less critical than volume and cost efficiency. The market is steadily shifting toward PSSD technology due to declining flash prices and rising performance demands.

How does the adoption of USB 4 and Thunderbolt 4 affect portable data storage solutions?

USB 4 and Thunderbolt 4 significantly enhance the user experience by delivering theoretical bandwidths up to 40 Gbps, which eliminates speed bottlenecks previously faced by high-performance NVMe portable SSDs. This allows professional users to transfer terabytes of data in minutes rather than hours and run demanding applications directly from the external drive with near-internal performance, accelerating workflows in media, engineering, and data science sectors. These interfaces are mandatory for accessing the highest tiers of portable storage speed.

What are the primary security concerns associated with portable drives, and how are manufacturers addressing them?

The main security concern is data loss or unauthorized access due to the device being physically lost or stolen. Manufacturers are addressing this through the implementation of robust hardware-level security features, notably AES 256-bit encryption (often FIPS 140-2 certified for government use), which encrypts data automatically without reliance on host system software. Furthermore, integrating biometric security, such as fingerprint scanners directly into the drive enclosure, provides a powerful second layer of physical access control, appealing strongly to enterprise and governmental end-users requiring compliance.

Which end-user segment is driving the highest growth demand in the portable data storage market?

The Media and Entertainment segment, encompassing content creators, videographers, and graphic designers, is driving the highest demand for performance-focused portable storage. The exponential increase in the creation of 4K, 6K, and 8K resolution content requires massive, non-negotiable transfer speeds and capacities (1TB to 8TB+), ensuring a high adoption rate for premium, ruggedized NVMe PSSDs. This sector consistently pushes the technological envelope for higher throughput and sustained reliability in the field, making it the most valuable growth segment.

How does the competition from cloud storage services impact the portable data storage market?

Cloud storage poses a major restraint by offering scalability, global accessibility, and superior collaboration features. However, it does not fully replace portable storage. Portable drives maintain a critical competitive advantage in speed (zero latency for local access), cost-effectiveness for bulk archival (no recurring fees), and situations where internet connectivity is limited or unreliable (fieldwork, remote locations). Manufacturers are responding by offering hybrid solutions, integrating software that facilitates seamless local backup and optional cloud synchronization, positioning portable drives as essential local caches for cloud-centric workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager