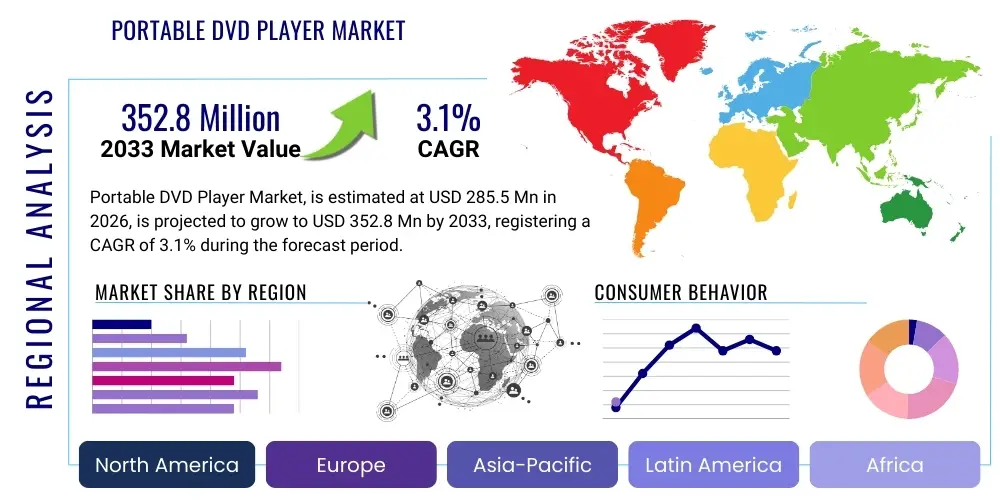

Portable DVD Player Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438832 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Portable DVD Player Market Size

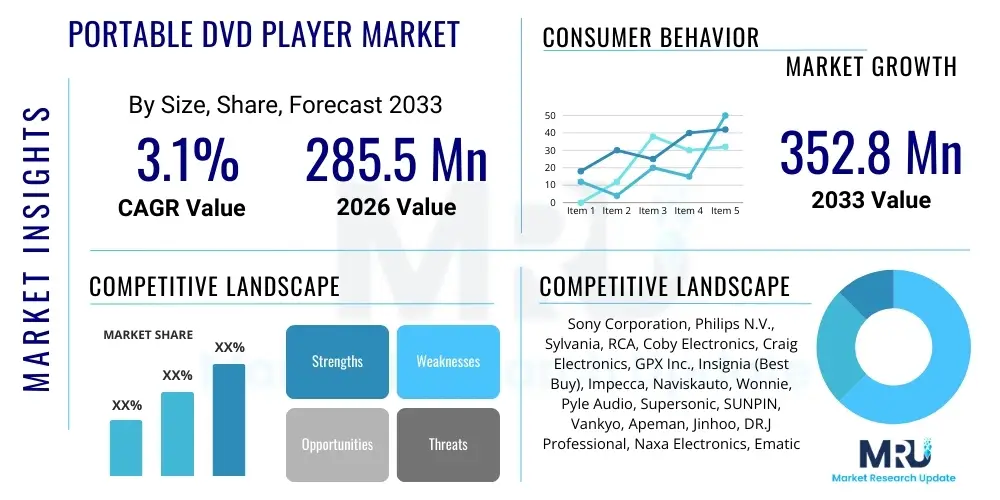

The Portable DVD Player Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.1% between 2026 and 2033. The market is estimated at USD 285.5 million in 2026 and is projected to reach USD 352.8 million by the end of the forecast period in 2033. This growth trajectory, though modest compared to digital media sectors, reflects a stable demand driven by specific niche applications, primarily long-haul travel, automotive entertainment, and utility in regions with limited internet connectivity. The enduring appeal of physical media and the functional robustness of these devices contribute significantly to maintaining market valuation despite intense competition from advanced smart devices.

Portable DVD Player Market introduction

The Portable DVD Player Market encompasses the manufacturing, distribution, and sale of compact electronic devices designed to read and play Digital Versatile Discs (DVDs) and often CDs, offering multimedia entertainment independent of fixed power sources or internet access. These devices typically feature integrated screens, rechargeable batteries, and multiple connectivity options such as USB, SD card slots, and audio-video output ports. Historically a mass consumer electronic staple, the market has transitioned into a mature, stable niche, catering primarily to demographics requiring durable, self-contained entertainment units, notably families with young children, frequent travelers, and users of specialized vehicles like trucks or recreational vehicles (RVs).

Major applications of portable DVD players include in-car entertainment systems, especially for road trips where continuous internet access for streaming is unreliable or cost-prohibitive. They serve as reliable backup entertainment for flights and remote locations where users prioritize physical media playback, robustness, and simplicity of operation. The product’s core benefit lies in its accessibility and operational independence; it does not require recurring subscriptions, complex setup, or dependence on digital rights management (DRM) ecosystems, offering immediate plug-and-play functionality for an existing media library.

Driving factors sustaining this market include the sustained affordability of the units themselves, the large installed base of DVD physical media worldwide, and the specific consumer preference for durable electronics for rugged use environments, such as construction sites or outdoor camping. Furthermore, specific educational or institutional settings sometimes prefer portable DVD players due to their simplicity, resilience, and lack of distracting smart features, ensuring focused media consumption. These factors collectively counterbalance the overwhelming shift towards Video-on-Demand (VOD) services and high-resolution tablet computing.

Portable DVD Player Market Executive Summary

The Portable DVD Player Market executive analysis reveals a transition from a consumer-driven growth phase to a maintenance phase characterized by niche market stabilization and technological refinement focused on improved battery life and display quality rather than revolutionary features. Business trends indicate consolidation among key manufacturers, who are prioritizing cost optimization in component sourcing and focusing marketing efforts on specialized retail channels, such as auto parts stores and big-box retailers emphasizing travel gear. The competitive landscape is intensely price-sensitive, placing immense pressure on operational efficiencies to maintain viable profit margins.

Regionally, Asia Pacific (APAC) continues to dominate the production and supply chain aspects, benefiting from established electronics manufacturing hubs. However, North America and Europe remain the primary revenue generators due to high disposable income and significant adoption within the automotive aftermarket accessory sector. Trends show increased demand in emerging economies where bandwidth limitations still favor offline media consumption. Geographic stability is noted, with marginal shifts driven by fluctuating component costs rather than dramatic changes in consumer behavior.

Segment trends highlight a preference shift toward players with larger screens (10 inches and above) and multi-disc changer functionalities, particularly in the vehicular entertainment category. The accessories segment, including car headrest mounts, power adapters, and carrying cases, is showing above-average growth, indicating that consumers are integrating these players into existing infrastructure more permanently rather than using them as temporary gadgets. Battery technology advancements (longer runtime and faster charging) are the primary drivers of consumer upgrades within this mature market segment.

AI Impact Analysis on Portable DVD Player Market

User queries regarding the intersection of Artificial Intelligence and Portable DVD Players frequently revolve around improving the viewing experience, extending product lifecycle through smart maintenance, and integrating legacy devices into smart home or vehicle ecosystems. Users question whether AI can enhance standard definition content to near high-definition quality (upscaling), how predictive failure analysis might extend battery and optical drive lifespan, and if voice command interfaces could be incorporated without drastically increasing unit cost. The core concern is often whether this traditional hardware can gain minor, modern smart features to remain relevant against fully connected devices.

The practical integration of AI in portable DVD players is highly focused on optimization rather than primary functionality, as the device's main purpose is offline media playback. AI algorithms are currently being deployed in the manufacturing process for enhanced quality control, such as optical alignment calibration and defect detection in display panels, thereby improving final product reliability. From a consumer perspective, AI's future impact lies mainly in sophisticated power management systems that use machine learning to optimize battery usage based on viewing habits, significantly extending playback time—a critical selling point in this category. Furthermore, rudimentary AI could potentially be implemented to analyze media types and automatically adjust display settings (e.g., contrast, brightness) for optimal viewing conditions.

In terms of user experience, while full-fledged smart assistants are not feasible due to connectivity requirements and cost constraints, advanced AI-driven features like intelligent error correction for scratched discs or adaptive sound equalization based on ambient noise could differentiate premium models. The application of AI within the supply chain, facilitating predictive maintenance for distribution networks and optimizing inventory based on localized niche demand, also contributes indirectly to market efficiency and stability. Overall, AI's role is subtle but crucial, helping the Portable DVD Player maintain relevance by improving reliability, longevity, and core performance metrics like battery life and visual fidelity.

- AI optimizes manufacturing quality control, specifically in optical drive alignment and display integrity.

- Machine learning algorithms enhance predictive battery management systems, significantly extending device runtime.

- AI-driven upscaling technology could improve the perceived quality of standard definition DVD content on modern screens.

- Predictive failure analysis leverages AI to monitor component health (laser life, motor wear) for proactive maintenance alerts.

- Supply chain AI models optimize inventory and logistics, ensuring efficient distribution to niche markets.

DRO & Impact Forces Of Portable DVD Player Market

The market dynamics of portable DVD players are defined by a crucial balance between persistent niche demand (Drivers) and powerful external competition (Restraints), leading to strategic market Opportunities. Key drivers include the robustness and simplicity required for specific use cases, such as long-distance trucking and military applications, where internet access is unavailable or prohibited. Furthermore, the extensive global library of owned physical DVDs ensures a steady, replacement-driven demand cycle. The primary restraint is the overwhelming ubiquity and technological superiority of smartphones, tablets, and advanced streaming services, which offer higher resolution and integrated connectivity at comparable price points. These impact forces necessitate innovation primarily in durability and battery efficiency rather than feature proliferation.

A significant driver for market stability is the requirement for dedicated, durable travel entertainment. Families frequently opt for portable DVD players for road trips because they are perceived as more durable and less prone to distraction or breakage than expensive tablets when handled by children. The lower cost of replacing a dedicated DVD player compared to a high-end tablet provides a strong economic incentive for this segment. However, the rapidly declining price of large-capacity solid-state storage and the rising popularity of digital download options present a continuous, profound restraint, reducing the necessity of physical disc media and eroding the long-term potential for market growth.

Opportunities for growth are concentrated in specialized areas, particularly in developing bespoke solutions for the automotive aftermarket, integrating players into headrests seamlessly, and enhancing compatibility with modern audio-visual standards (e.g., HDMI out). Developing players with exceptionally long battery life and ruggedized features (water and shock resistance) targeting outdoor and industrial use also offers profitable avenues. The impact forces emphasize that manufacturers must accept the niche nature of the product and focus on optimizing the core value proposition: reliable, offline, non-internet-dependent entertainment that is accessible and affordable.

Segmentation Analysis

The Portable DVD Player Market is primarily segmented by Screen Size, Application, and Distribution Channel. Screen size is a pivotal factor influencing purchase decisions, ranging from small, highly portable 7-inch models to larger, more immersive 14-inch units preferred for in-car viewing. Application segmentation distinguishes between personal/family use, predominantly travel and home backup, and commercial/institutional use, which includes educational, fleet vehicle, and specialized industrial entertainment. Analyzing these segments helps stakeholders understand where residual market value resides and how marketing strategies should be tailored to address the highly specific needs of different consumer groups, ensuring maximum market penetration despite overall industry maturity.

The segmentation by distribution channel is crucial, reflecting the shift away from broad retail toward specialized and online platforms. Traditional brick-and-mortar sales remain important for impulse purchases and high-touch customer support, but e-commerce platforms offer greater variety, better price comparison, and direct access to niche audiences interested in specific rugged or feature-rich models. The performance of each segment directly correlates with consumer mobility and the prevalent infrastructure for digital media consumption in a given region, requiring continuous adjustment of supply chain and inventory management based on localized demand signals.

Furthermore, segmentation by technology (e.g., standard DVD vs. DVD/Blu-ray combo) influences price points and target demographics. While most consumers are satisfied with standard DVD playback, a small premium segment exists for players that offer backward compatibility with high-definition Blu-ray discs. Understanding the subtle technological demands within these segments allows manufacturers to optimize product portfolios, avoiding over-engineering where simplicity is preferred, and allocating resources to features (like durable construction or superior speakers) that genuinely enhance the core value proposition for niche users.

- Screen Size

- Less than 9 Inches

- 9 Inches to 12 Inches

- Above 12 Inches

- Application

- Automotive Entertainment (In-Car Use)

- Travel and Personal Use

- Institutional and Commercial Use

- Distribution Channel

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Stores, Electronics Outlets, Hypermarkets)

- Technology

- Standard DVD Players

- DVD/Blu-ray Combo Players

Value Chain Analysis For Portable DVD Player Market

The value chain for the Portable DVD Player Market begins with Upstream Analysis, focusing intensely on the sourcing of critical components, specifically optical drive units (ODUs), liquid crystal displays (LCDs) or LEDs, and semiconductor chipsets responsible for decoding and processing video formats. Since this is a mature market, component standardization is high, but price volatility, particularly for displays and memory chips, significantly impacts manufacturing costs. Manufacturers often rely on established, large-scale electronics suppliers in East Asia to leverage economies of scale and maintain competitiveness in the highly price-sensitive final market.

Midstream activities involve the assembly, quality control, and testing of the final products. Given the necessity for precision in aligning the optical drive laser, quality assurance remains a critical step. Manufacturers typically operate large, centralized assembly plants. The Downstream Analysis focuses on efficient logistics and distribution. Due to the varied applications (personal vs. automotive), the distribution channel is multifaceted, incorporating both Direct sales (e.g., OEM supply to car manufacturers for integrated systems) and Indirect sales through a network of distributors, wholesalers, and diverse retail environments.

The indirect channel relies heavily on large-scale e-commerce platforms and mass retailers to reach the fragmented consumer base globally. Direct sales, while smaller in volume, often yield higher margins, particularly in the premium accessories and institutional procurement segments. Effective supply chain management is paramount to minimize inventory holding costs and rapidly respond to short-term spikes in demand, such as those associated with holiday travel seasons. The efficiency of this downstream segment is often the deciding factor in overall profitability due to the low margin nature of the product itself.

Portable DVD Player Market Potential Customers

Potential customers for the Portable DVD Player Market are diverse but share a common need for reliable, offline media consumption, often tied to mobility or specific environmental constraints. The largest and most visible segment consists of families with young children, particularly those engaged in frequent or long-distance car travel, who prioritize physical media for durability and ease of use in confined spaces. These buyers are looking for integrated mounting solutions and multi-screen packages, making the automotive aftermarket a prime target for specialized product bundles.

Another significant customer segment includes professional drivers (e.g., long-haul truckers, commercial fleet operators) and outdoor enthusiasts who require rugged, portable entertainment in environments where connectivity is nonexistent or sporadic. For these users, battery longevity, shock resistance, and simple interfaces are crucial buying factors. Institutions, such as schools, hospitals, and specialized training facilities that utilize physical media for instructional purposes, represent the commercial end-user base, seeking bulk purchasing and highly durable units suitable for repeated institutional handling.

Finally, a niche but loyal customer base includes older demographics and consumers residing in areas with underdeveloped digital infrastructure who prefer the tactile experience and simplicity of physical media. These individuals often seek high-quality display and audio components and reliable, traditional user interfaces. Targeting these diverse end-users requires highly tailored marketing communications emphasizing specific benefits—durability for travelers, simplicity for seniors, and bulk pricing for institutional buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Million |

| Market Forecast in 2033 | USD 352.8 Million |

| Growth Rate | CAGR 3.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Philips N.V., Sylvania, RCA, Coby Electronics, Craig Electronics, GPX Inc., Insignia (Best Buy), Impecca, Naviskauto, Wonnie, Pyle Audio, Supersonic, SUNPIN, Vankyo, Apeman, Jinhoo, DR.J Professional, Naxa Electronics, Ematic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable DVD Player Market Key Technology Landscape

The technology landscape of the Portable DVD Player Market is characterized by incremental improvements aimed at enhancing the core functionalities of viewing and portability, rather than radical innovation. The primary technological focus has shifted towards optimizing display performance and increasing battery endurance. Contemporary models frequently incorporate higher resolution LCD or LED screens, offering wider viewing angles and better color fidelity than legacy TFT displays, essential for multi-person viewing in a car. Furthermore, efficient decoding chipsets are continuously being refined to reduce power consumption while maintaining compatibility with evolving digital audio and video codecs, ensuring the device remains future-proofed for modern media formats, even if the primary input remains the DVD.

Battery technology is the second major area of innovation. Manufacturers are increasingly integrating higher-density lithium-ion polymer batteries, allowing playback times to routinely exceed four to six hours, directly addressing a critical consumer pain point related to long travel durations. Advanced power management systems complement these hardware improvements, ensuring stable performance across varying usage patterns. Connectivity remains essential, with modern players featuring improved USB and SD card support, facilitating the playback of digitally stored media alongside physical discs, expanding their utility beyond just DVD playback.

The structural design and user interface (UI) also represent a key technological focus. Ruggedization techniques, including specialized casing materials and internal shock absorption, are employed to enhance device durability for travel and rough environments. UI development emphasizes simplicity and intuitive operation, often via large physical buttons or simple remote controls, catering to children and older users who prefer straightforward interaction over complex touchscreen menus. While the core optical technology remains largely static, these peripheral improvements in display, power, and durability are vital for maintaining competitive advantage and securing niche market share.

Regional Highlights

- North America is a pivotal region for revenue generation, particularly due to the robust demand within the automotive aftermarket sector. High rates of long-distance road travel and a culture of large vehicle ownership drive sustained demand for integrated and portable in-car entertainment solutions. Consumers here prioritize larger screen sizes and dual-screen configurations.

- Europe demonstrates steady demand, influenced heavily by family holiday travel and regulations regarding in-flight media consumption. The market is segmented, with Western Europe showing preference for slightly higher quality, branded players, while Central and Eastern Europe focus more on affordability and basic functionality.

- Asia Pacific (APAC) is the dominant manufacturing hub, controlling the supply chain for components and assembly. While domestic consumption is significant, driven by emerging economies where offline media remains popular, its primary impact is on global cost efficiency and supply management. Countries like China and Taiwan lead in production capacity and technological refinement of optical drives.

- Latin America exhibits strong, growing demand, primarily constrained by price sensitivity. Portable DVD players serve as an affordable alternative to expensive tablets for in-home and travel entertainment. The market seeks robust, multi-region compatible units.

- Middle East and Africa (MEA) represent a niche but expanding market, particularly in regions with limited broadband penetration or unstable power grids. The emphasis here is heavily on battery life, durability, and robust power input handling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable DVD Player Market.- Sony Corporation

- Philips N.V.

- Sylvania

- RCA

- Coby Electronics

- Craig Electronics

- GPX Inc.

- Insignia (Best Buy)

- Impecca

- Naviskauto

- Wonnie

- Pyle Audio

- Supersonic

- SUNPIN

- Vankyo

- Apeman

- Jinhoo

- DR.J Professional

- Naxa Electronics

- Ematic

Frequently Asked Questions

Analyze common user questions about the Portable DVD Player market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for portable DVD players despite streaming services?

Demand is driven by the need for reliable, offline entertainment, particularly for long road trips and travel where internet access is unavailable or inconsistent. Portability, durability, and the affordability of physical media libraries also appeal strongly to niche segments like families and professional drivers, offering a simple, dedicated media solution.

How is battery life evolving in modern portable DVD players?

Battery technology is a core focus area, with manufacturers increasingly adopting high-density lithium-ion polymer batteries and integrating AI-driven power management systems. This optimization allows most current models to achieve typical playback times of 4 to 6 hours or more on a single charge, catering specifically to long travel demands.

Which screen size segment dominates the Portable DVD Player Market?

The 9 Inches to 12 Inches screen size segment currently holds the largest market share. This size offers an optimal balance between portability for easy packing and sufficient screen immersion for comfortable viewing by multiple passengers, making it the preferred choice for automotive entertainment systems.

What is the key difference between standard portable DVD players and combo players?

Standard players only read DVDs and CDs, offering basic functionality at a lower cost. Combo players, which constitute a smaller premium segment, are equipped to read high-definition Blu-ray discs in addition to standard DVDs, catering to users who require backward compatibility with higher resolution physical media formats.

What role does Asia Pacific play in the global Portable DVD Player Market?

Asia Pacific (APAC) serves as the primary global manufacturing and supply chain center for portable DVD players and their core components, such as optical drives and display panels. While consumer demand is strong, its main significance lies in providing cost-efficient assembly and component sourcing worldwide, thereby regulating overall market pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager