Portable Foldable Solar Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434754 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Portable Foldable Solar Panels Market Size

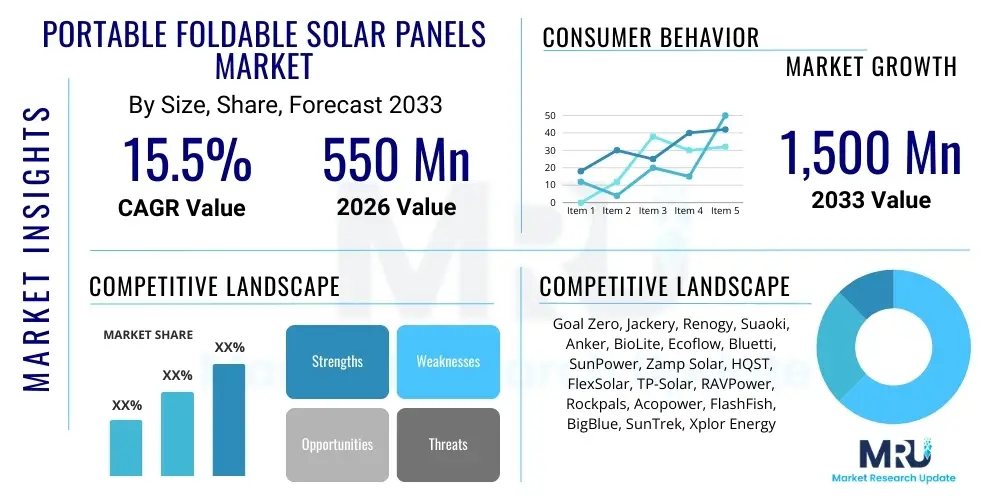

The Portable Foldable Solar Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,500 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for reliable off-grid power solutions, coupled with significant advancements in photovoltaic material science that enhance efficiency and reduce weight, making these units increasingly attractive to a broad consumer base spanning outdoor leisure, emergency preparedness, and remote professional applications.

Portable Foldable Solar Panels Market introduction

The Portable Foldable Solar Panels Market encompasses lightweight, collapsible photovoltaic devices designed to convert sunlight into electricity, primarily serving mobile and off-grid power needs. These panels are distinct from traditional fixed solar installations due to their compact design, ease of transportation, and rapid deployment capabilities. The core product incorporates high-efficiency solar cells, typically housed within durable, weather-resistant fabric casings, and often integrated with USB ports or DC outputs for direct charging of electronic devices or battery banks. Technological refinements are constantly focusing on increasing power output per square meter while simultaneously minimizing the overall form factor and weight, making them indispensable tools for modern portability requirements.

Major applications for portable foldable solar panels span consumer, industrial, and governmental sectors. In the consumer segment, their primary use involves powering devices during outdoor recreational activities such as camping, hiking, boating, and RV travel, where access to grid electricity is unavailable. Industrially, these panels are vital for remote monitoring equipment, temporary communication setups, and mobile workstations in construction or research fields. Furthermore, governmental and humanitarian organizations utilize these units extensively for disaster relief operations, military field deployments, and establishing temporary power sources in regions lacking infrastructure, highlighting their critical role in ensuring operational continuity in challenging environments.

The market growth is primarily driven by the increasing global trend toward sustainable and independent power generation, coupled with the decreasing cost of high-efficiency solar cells. Key benefits include energy independence, environmental sustainability (zero-emission power generation), exceptional versatility, and high durability against varied weather conditions. These factors, alongside substantial technological drivers such as the proliferation of high-density lithium batteries requiring efficient recharge sources, position portable foldable solar panels as a necessary accessory in the expanding outdoor and remote technology ecosystems. The market is also benefiting from robust innovation in materials, including the integration of flexible thin-film technologies that promise even lighter and more durable products.

Portable Foldable Solar Panels Market Executive Summary

The Portable Foldable Solar Panels Market exhibits robust growth, underpinned by powerful intersecting business trends, dynamic regional adoption patterns, and crucial shifts within key market segments. Business trends are characterized by fierce competition centered on power-to-weight ratio and integration features, such as smart charging controllers and direct compatibility with popular power station brands. Strategic partnerships between solar panel manufacturers and outdoor equipment retailers are becoming commonplace, expanding distribution reach and improving market penetration among specific consumer demographics. Furthermore, supply chain optimization, particularly leveraging advancements in flexible cell manufacturing in Asia Pacific, is driving down unit costs and making higher wattage panels more accessible to the mass market.

Regionally, North America remains a dominant force, characterized by high disposable income, a strong culture of outdoor recreation (RVing, camping), and increasing emphasis on emergency preparedness kits, which often mandate reliable backup power sources. Asia Pacific is emerging as the fastest-growing region, propelled by expanding manufacturing capabilities, rapid electrification needs in remote areas (especially in Southeast Asia and India), and growing domestic demand for outdoor lifestyle products. Europe demonstrates stable growth, primarily driven by stringent environmental regulations and a strong consumer preference for sustainable technology, particularly in Germany and Scandinavian countries where off-grid living or temporary installations are common for leisure activities.

Segment trends indicate a decisive shift toward the High Wattage (Above 100W) category, driven by the increasing capacity of portable power stations (PWS) that require rapid recharging capability. Monocrystalline silicon panels continue to dominate due to their superior efficiency, although flexible thin-film technology is rapidly gaining traction in applications where ultra-lightweight and irregular surfaces are prioritized, such as backpacking and aerial drone charging. Distribution channels are increasingly polarized, with online retail commanding the largest market share due to ease of price comparison and direct-to-consumer models, while specialty stores maintain relevance by offering expert advice and bundled solutions tailored for specific outdoor or emergency use cases.

AI Impact Analysis on Portable Foldable Solar Panels Market

User queries regarding AI's influence in the Portable Foldable Solar Panels market often center on whether AI can improve energy harvesting, predict panel degradation, and optimize charging efficiency in dynamic, real-world conditions. Consumers are keenly interested in "smart solar panels" that can self-adjust to maximize output regardless of environmental factors like partial shading or suboptimal angles. Manufacturers, on the other hand, are exploring AI for predictive maintenance in large-scale mobile fleets (like military or construction sites) and for optimizing complex manufacturing processes, particularly in highly sensitive flexible cell production. The overarching theme is the transition from passive energy conversion to intelligent, adaptive power generation tailored precisely to fluctuating user needs and environmental variables.

AI’s primary impact is channeled through integration within the charge controller and power management systems. Machine learning algorithms analyze real-time irradiance data, temperature variations, and the specific charging profile requirements of the connected battery bank to dynamically adjust the Maximum Power Point Tracking (MPPT) frequency. This intelligence allows the panel system to extract 5% to 10% more usable energy under challenging conditions, such as intermittent cloud cover or when the panel angle cannot be optimally adjusted by the user. Furthermore, AI-driven diagnostics are beginning to monitor the performance history of individual cells within the foldable array, alerting users to developing faults or efficiency losses due to minor physical damage, thereby extending the product lifespan and improving user trust in portable power reliability.

Looking ahead, AI is expected to revolutionize the material science and design phase of portable solar panels. Generative design techniques, powered by AI, can simulate millions of structural configurations to identify the optimal balance between durability, weight, and foldability, leading to lighter, stronger panel frames and casings. In manufacturing, AI-powered quality control systems using high-resolution vision checks can instantaneously identify microcracks or defects in the solar cells during the assembly process, significantly reducing waste and increasing the overall yield of high-specification, reliable portable units. This infusion of artificial intelligence elevates the product from a simple power source to a sophisticated, self-optimizing energy management tool.

- AI-enhanced MPPT algorithms maximize energy yield under partial shading and dynamic weather conditions.

- Predictive maintenance analytics monitor cell health and forecast potential degradation, extending product longevity.

- AI integration enables smart load management, prioritizing power distribution among connected devices based on urgency and battery status.

- Generative design optimizes structural integrity and material usage, leading to ultra-lightweight and compact designs.

- Automated manufacturing quality control systems use machine vision for real-time defect identification in flexible cell production.

DRO & Impact Forces Of Portable Foldable Solar Panels Market

The market dynamics are governed by a powerful interplay of drivers, restraints, and opportunities, collectively forming the key impact forces influencing strategic decisions and market trajectories. Primary drivers include the global proliferation of power-hungry electronic devices, the increasing prevalence of outdoor and leisure activities (supported by rising disposable incomes), and the critical need for resilient backup power infrastructure in regions susceptible to natural disasters or grid instability. These factors combine to create a sustained, high-volume demand for compact, reliable energy solutions. However, market expansion is constrained by challenges such as the relatively high initial cost compared to conventional generators, the inherent efficiency limitations of current photovoltaic materials compared to large fixed arrays, and consumer misconceptions regarding the actual power output achievable under non-ideal, real-world conditions, leading to occasional dissatisfaction.

Opportunities for growth are concentrated in emerging economies where grid infrastructure is weak or non-existent, offering a direct path for portable solar solutions to fulfill basic electrification needs in remote communities. Furthermore, ongoing innovation in material science, particularly the maturation of next-generation perovskite solar cells and advanced flexible polymers, promises substantial improvements in power density and durability, potentially overcoming current restraints related to weight and efficiency. The growing trend of vehicle electrification, including electric RVs and vans, also represents a significant opportunity, as these vehicles require highly efficient, integrated portable charging solutions to extend their range during off-grid travel, necessitating higher wattage foldable options specifically designed for vehicular integration.

The impact forces are fundamentally shaping the competitive landscape, pushing manufacturers towards relentless incremental innovation in efficiency and portability while simultaneously striving for cost reduction. The intense competition forces companies to differentiate through ecosystem integration—specifically, ensuring seamless compatibility with proprietary battery storage and power station systems. Regulatory tailwinds promoting renewable energy adoption and providing incentives for sustainable consumer products further amplify the market drivers. Conversely, geopolitical instability affecting key raw material supply chains (such as silicon and specialized polymers) acts as an unpredictable restraint, compelling companies to diversify sourcing and invest heavily in supply chain resilience, thus influencing final product pricing and market stability.

Segmentation Analysis

The Portable Foldable Solar Panels Market is intricately segmented across various dimensions, including the type of solar cell technology used, the panel’s power output (wattage), the primary application area, and the distribution channels utilized. This segmentation allows manufacturers to tailor products precisely to specific end-user requirements, ranging from ultralight backpacking models to high-capacity solutions designed for RVs and emergency home backup. The analysis of these segments reveals that while efficiency-focused segments like Monocrystalline dominate in value, the convenience and low-cost segments, particularly those utilizing flexible thin-film technologies, are rapidly expanding their volume share, driven by increasing adoption in price-sensitive markets and specialized niches requiring extreme flexibility.

- By Technology:

- Monocrystalline Silicon

- Polycrystalline Silicon

- Flexible Thin-Film (Amorphous Silicon, CIGS, Organic PV)

- By Wattage:

- Below 50W

- 50W to 100W

- Above 100W

- By Application:

- Recreational (Camping, Hiking, Backpacking)

- RV and Marine

- Emergency and Disaster Relief

- Military and Defense

- Off-Grid Residential and Remote Work

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Stores (Outdoor Equipment Stores, RV Dealers)

- Direct Sales and Institutional Procurement

Value Chain Analysis For Portable Foldable Solar Panels Market

The value chain for portable foldable solar panels begins upstream with the procurement and processing of critical raw materials, primarily high-purity silicon for crystalline cells, specialized thin-film substrates, conductive polymers, and durable fabrics for the protective casing. Upstream activities are dominated by specialized material suppliers, often geographically concentrated in Asia Pacific, which dictates the fundamental cost and technological characteristics of the final product. Key upstream challenges include maintaining quality consistency of silicon wafers and securing stable pricing for specialized protective materials that must balance flexibility, durability, and UV resistance, demanding intense quality control processes to ensure the longevity required of portable products.

The midstream involves the core manufacturing process, encompassing cell production (laminating, soldering, testing), panel assembly (integrating cells into flexible or foldable substrates), and the critical integration of the charge controller (MPPT or PWM). This stage is characterized by significant investment in automation to achieve high precision and low defect rates, particularly for high-efficiency monocrystalline panels. Downstream activities involve comprehensive testing, packaging, and branding before products enter the distribution channels. Effective downstream management is crucial for portable products, as optimal packaging design minimizes shipping damage and maximizes shelf appeal in competitive retail environments, requiring robust partnerships with specialized logistics providers familiar with handling delicate electronic components.

Distribution channels are broadly categorized into direct and indirect methods. Direct sales typically involve the manufacturer’s own e-commerce platform or institutional contracts (e.g., military tenders), allowing for higher margins and direct customer feedback. Indirect distribution relies heavily on online retail giants, which provide unparalleled market reach, and specialized physical stores such as dedicated RV dealers or high-end outdoor equipment retailers. The increasing prominence of online retail necessitates excellent Answer Engine Optimization (AEO) to ensure visibility during specific buyer journeys, such as searching for "solar panel for RV battery" or "lightweight emergency power." Manufacturers must strategically manage channel conflict, ensuring specialized dealers receive adequate support and pricing structure, while simultaneously leveraging the immense volume potential of mass-market e-commerce platforms.

Portable Foldable Solar Panels Market Potential Customers

The primary customer base for portable foldable solar panels is heterogeneous, encompassing distinct groups unified by the need for reliable, temporary, and mobile power generation outside of conventional grid access. The largest and most visible segment comprises outdoor recreation enthusiasts, including dedicated campers, hikers, backpackers, and the rapidly growing cohort of RV and van life inhabitants. These consumers prioritize weight-to-power ratio, ruggedness, and seamless compatibility with existing portable power stations and batteries. Their purchasing decisions are highly influenced by product reviews, brand reputation within the outdoor community, and the specific wattage requirements necessary to sustain their electronic devices during extended excursions, ranging from basic phone charging to running small appliances.

A second crucial segment consists of professionals and governmental organizations requiring operational resilience. This includes military personnel, disaster relief agencies (NGOs, FEMA equivalents), field researchers, and remote industrial workers (e.g., oil & gas exploration, construction site monitoring). These institutional buyers prioritize durability, standardization (often requiring specific certifications or compliance with military standards like MIL-STD-810G), and rapid deployment capabilities. For these customers, the cost often takes secondary importance to absolute reliability under extreme environmental stress, driving demand for premium, ruggedized panels built with specialized materials and integrated communication interfaces for power reporting.

The third significant segment includes homeowners and individuals focused on emergency preparedness and basic off-grid residential living. While they may own fixed solar systems, portable foldable panels serve as crucial backups during power outages caused by storms or infrastructure failures, or as a primary power source for small, independent structures like sheds or remote cabins. This group looks for panels that can reliably charge high-capacity power banks necessary to run essential medical equipment, communication devices, or refrigeration units for extended periods, necessitating panels typically exceeding 100W in output capacity and often bundled with comprehensive storage solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,500 Million |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Goal Zero, Jackery, Renogy, Suaoki, Anker, BioLite, Ecoflow, Bluetti, SunPower, Zamp Solar, HQST, FlexSolar, TP-Solar, RAVPower, Rockpals, Acopower, FlashFish, BigBlue, SunTrek, Xplor Energy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Foldable Solar Panels Market Key Technology Landscape

The technological landscape of the portable foldable solar panels market is rapidly evolving, driven primarily by the need to maximize energy density (wattage per unit weight) and enhance durability for mobile applications. Current market dominance rests with Monocrystalline PERC (Passivated Emitter and Rear Cell) technology, which offers superior efficiency (often exceeding 22%) compared to traditional polycrystalline cells, making it the preferred choice for high-end, high-wattage foldable panels aimed at RV and emergency markets. Significant development is focused on reducing the thickness of these cells without sacrificing structural integrity, often achieved through advanced lamination processes utilizing robust but lightweight materials like ETFE (Ethylene Tetrafluoroethylene) film, which provides enhanced light transmittance and superior weather resistance compared to traditional EVA encapsulation.

A critical emerging technology is Flexible Thin-Film solar cells, particularly those based on CIGS (Copper Indium Gallium Selenide) or Amorphous Silicon. While currently offering lower efficiencies than Monocrystalline panels, thin-film panels are significantly lighter, truly flexible, and more resistant to power loss from partial shading, a major advantage in dynamic outdoor environments. The innovation here is concentrated on improving the CIGS deposition process to achieve higher conversion rates while maintaining the inherent low-weight characteristic, positioning this technology as ideal for ultra-lightweight backpacking applications or integration into clothing and temporary shelters where stiffness is a constraint. Furthermore, research into Perovskite solar cells, which promise high efficiency and very low manufacturing costs via printing methods, represents a potential disruptive force, though challenges related to long-term stability and moisture degradation remain pivotal hurdles for mass commercialization in portable, ruggedized products.

Beyond the photovoltaic cell itself, smart charging technology represents a major competitive differentiator. The shift from basic PWM (Pulse Width Modulation) controllers to advanced MPPT (Maximum Power Point Tracking) controllers is now standard, optimizing power harvest regardless of battery state or panel temperature. The next wave of innovation includes integrating wireless communication capabilities (Bluetooth/Wi-Fi) into these controllers, allowing users to monitor performance, diagnose issues, and update firmware via smartphone applications. This convergence of efficient power conversion hardware with sophisticated software management is key to providing a seamless, reliable user experience and distinguishing premium portable products in a crowded market where raw wattage is no longer the sole purchasing criterion.

Regional Highlights

North America: North America, comprising the United States and Canada, represents the largest market share holder in the Portable Foldable Solar Panels market, characterized by mature consumer electronics adoption and a deeply ingrained culture of outdoor recreational activities, including extensive RV usage and dispersed wilderness camping. Market growth is robust, largely fueled by strong consumer spending on outdoor gear and an increasing societal focus on disaster preparedness, particularly in regions prone to severe weather events that frequently cause grid failures. The demand here leans heavily towards high-wattage panels (Above 100W) designed to pair with large-capacity portable power stations, reflecting a preference for higher energy independence and the ability to run more substantial domestic appliances or complex electronic setups while off-grid. Competition is intense, with major players focusing heavily on brand reputation, customer service, and strategic retail partnerships across major chains and online platforms, demanding high-quality manufacturing and excellent customer trust.

Europe: The European market demonstrates steady, value-driven growth, propelled by stringent environmental regulations and a high societal appreciation for sustainable energy solutions. Countries such as Germany, the UK, and the Scandinavian nations are key markets, driven by specialized niche applications like marine leisure (yachting) and highly regulated camping standards. While the total market size may be smaller than North America, European consumers often prioritize efficiency, design aesthetics, and adherence to regional certifications, leading to higher average selling prices for premium, well-engineered portable solutions. Innovation in Europe often centers on lightweight, modular systems tailored for urban mobility or highly efficient panels integrated into specialized vehicles or communication equipment, reflecting a nuanced demand structure where portability and sophisticated design are paramount.

Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period, driven by contrasting dynamics: burgeoning consumer outdoor culture in developed nations like Japan and South Korea, and critical electrification needs in developing economies like India, Indonesia, and rural China. The market here is highly fragmented and price-sensitive, with a strong demand for cost-effective, durable solutions that can withstand harsh climatic conditions ranging from intense heat to monsoon rainfall. Furthermore, APAC is the global manufacturing hub for solar cell technology, giving local companies significant competitive advantages in terms of cost control and rapid deployment of new innovations. The application focus in this region is two-fold: supporting large populations transitioning to outdoor leisure, and crucially, powering essential services (lighting, communication) in off-grid villages and remote industrial sites where extending the main power grid is economically unviable.

Latin America and Middle East & Africa (MEA): These regions are emerging markets with vast potential, albeit currently limited by infrastructure and economic volatility. In Latin America, recreational demand is growing, particularly in eco-tourism and remote agricultural applications. The MEA region is characterized by high solar irradiance, making portable solar panels highly effective, particularly for humanitarian aid, military installations, and remote telecommunications infrastructure. Government and institutional procurement drives much of the high-wattage panel demand here, focusing on ruggedness and reliability in extremely high temperatures and dusty environments. While the consumer segment is still developing, the long-term potential for basic electrification and reliable backup power solutions in remote areas provides substantial opportunities for market expansion, requiring tailored products that prioritize robustness and long operational life over complex features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Foldable Solar Panels Market.- Goal Zero

- Jackery

- Renogy

- Suaoki

- Anker

- BioLite

- Ecoflow

- Bluetti

- SunPower

- Zamp Solar

- HQST

- FlexSolar

- TP-Solar

- RAVPower

- Rockpals

- Acopower

- FlashFish

- BigBlue

- SunTrek

- Xplor Energy

Frequently Asked Questions

Analyze common user questions about the Portable Foldable Solar Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most efficient technology used in portable foldable solar panels?

The most efficient technology currently deployed in high-quality portable foldable panels is Monocrystalline Silicon, particularly those utilizing PERC (Passivated Emitter and Rear Cell) architecture. These panels consistently offer conversion efficiencies above 20%, ensuring maximum power harvest relative to the physical size of the folded panel, making them ideal for high-wattage applications like charging large power stations.

How much power (wattage) do I need for RV camping or emergency backup?

For RV camping or comprehensive emergency backup, customers typically require panels in the Above 100W category, often pairing multiple panels to achieve 200W to 400W total output. This range is necessary to quickly recharge high-capacity lithium battery banks and run medium-sized appliances like portable refrigerators or essential communication equipment during extended off-grid periods.

Are flexible thin-film solar panels better than traditional rigid foldable panels?

Flexible thin-film panels are superior in scenarios requiring extreme lightweight characteristics and high resistance to physical stress, such as backpacking or integration into curved surfaces, as they are non-brittle. However, traditional rigid foldable panels, typically utilizing Monocrystalline cells, currently offer significantly higher efficiency (power output per square foot) and a more favorable overall lifespan, making them better for maximizing energy harvest in a fixed deployment location.

What are the primary factors restraining growth in the portable solar panels market?

Key market restraints include the relatively high upfront cost compared to small fossil fuel generators, the inherent limitations in solar conversion efficiency which necessitate larger physical dimensions for high wattage, and the reliance on clear, optimal sunlight conditions, which can be unpredictable and lead to consumer disappointment regarding expected performance.

How does the integration of MPPT technology improve panel performance?

MPPT (Maximum Power Point Tracking) technology is crucial because it continuously monitors and adjusts the electrical load of the panel to match the optimal voltage and current point (the maximum power point), regardless of temperature, shading, or battery voltage. This intelligent regulation can increase power harvest efficiency by 15% to 30% compared to basic controllers, particularly under suboptimal environmental conditions, maximizing the usable energy captured from the portable unit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager