Portable Sawmills Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439532 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Portable Sawmills Market Size

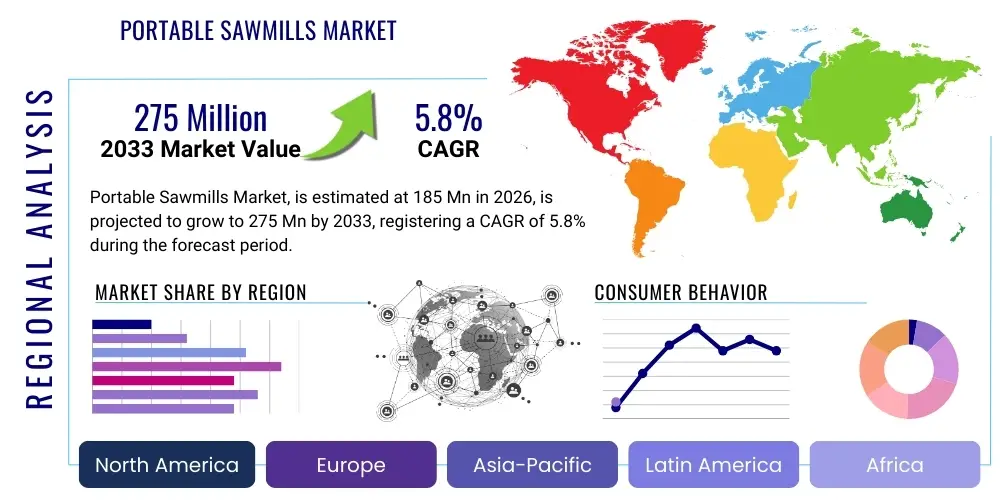

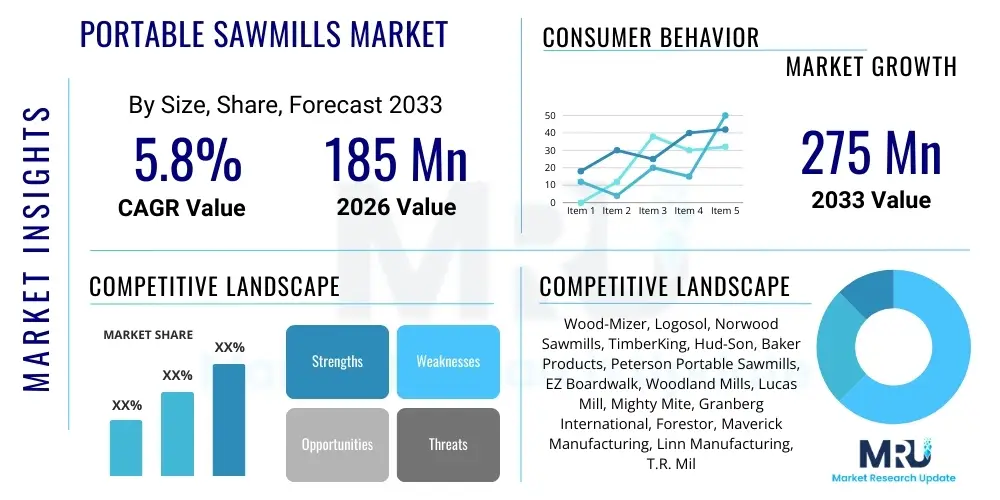

The Portable Sawmills Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $275 Million USD by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global demand for localized timber processing solutions, particularly among small-scale forest owners, DIY enthusiasts, and developing economies seeking sustainable construction materials.

Market expansion is significantly bolstered by technological advancements that enhance the efficiency and mobility of these units. Modern portable sawmills feature sophisticated hydraulic controls, computerized setworks, and advanced thin-kerf blade technology, allowing for higher lumber recovery rates and reduced operational waste. The inherent flexibility of these sawmills, enabling on-site processing, eliminates high transportation costs associated with moving raw logs to centralized lumber mills, making them an economically viable choice for dispersed forestry operations and specialized timber cutting projects.

Furthermore, regulatory shifts favoring sustainable forest management and the growing emphasis on using locally sourced, renewable resources are creating fertile ground for market penetration. The adoption rates are particularly high in regions with extensive private forest ownership, where owners are leveraging portable sawmills to manage their timber assets proactively, generating both income and necessary lumber for personal use or local sales. The shift towards greater self-sufficiency in construction and woodworking further guarantees sustained demand throughout the forecast period.

Portable Sawmills Market introduction

Portable sawmills are specialized pieces of equipment designed to cut raw timber logs into usable lumber, dimensioned materials, or custom beams directly at the felling site. These units, which range from small, manually operated models to large, fully hydraulic trailers, offer an unparalleled combination of mobility and operational capability, transforming remote logs into finished wood products efficiently. The core function involves securely mounting a log and passing a cutting mechanism (typically a band, chain, or circular blade) along its length, adjusting the cutting thickness via precise mechanical or computerized setworks.

Major applications of portable sawmills span across multiple sectors, including small-scale residential construction, agricultural infrastructure projects (barns, fencing), high-value specialty wood processing (cabinetry, furniture making), and general forestry management. For professional logging operations, portable sawmills provide a necessary tool for salvaging blowdown or insect-damaged timber that might otherwise be economically unfeasible to transport. The primary benefits driving adoption include significantly reduced logistics costs, the ability to capitalize on unique or urban timber resources, superior control over lumber dimensions and quality, and minimal environmental impact compared to large stationary mills.

The market is predominantly driven by the surging popularity of the ‘Do-It-Yourself’ (DIY) and small-scale farming movements, where individuals and small enterprises require custom lumber without the expense and lead times associated with commercial lumber yards. Additionally, increasing global construction activity, coupled with fluctuating and often high prices for dimensional lumber, strengthens the business case for investment in portable milling solutions. The ease of setup, relatively low maintenance requirements, and the continued introduction of models with increased power and precision ensure these machines remain a critical component of decentralized wood processing infrastructure worldwide.

Portable Sawmills Market Executive Summary

The Portable Sawmills Market is characterized by robust growth stemming from dynamic business trends centered on decentralization and operational efficiency in forestry and construction. A significant trend involves the integration of advanced digital technologies, such as programmable logic controllers (PLCs) and remote diagnostics, enhancing operational precision and minimizing downtime. Manufacturers are focusing on developing hybrid models (electric/diesel) and optimizing hydraulic systems to improve cutting speed and ease of log handling, catering specifically to the professional segment demanding continuous, high-volume output while maintaining mobility. Furthermore, the market sees heightened activity in mergers, acquisitions, and strategic partnerships aimed at broadening distribution networks and securing technological advantages, particularly in emerging markets where infrastructure development fuels lumber demand.

Regionally, North America maintains its dominance due to a vast private land ownership base, a strong tradition of woodworking, and favorable regulatory frameworks supporting private timber harvesting. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by massive infrastructure projects, rapid urbanization, and government initiatives promoting localized wood processing to meet burgeoning domestic consumption needs. Europe demonstrates mature market behavior, focusing heavily on sustainability, precision engineering, and adherence to stringent environmental certifications, driving the demand for high-efficiency, low-emission sawmill variants. The market globally is observing an increase in localized supply chains as geopolitical risks and shipping volatility incentivize self-reliance in resource procurement.

Segment trends reveal that the hydraulic segment within the operational category commands the largest market share, attributable to its ease of use, ability to handle heavy and large-diameter logs, and reduced physical labor requirements for the operator. By type, band sawmills remain the preferred choice globally due to their thin-kerf blades, which maximize lumber yield and minimize waste, offering substantial economic benefits over traditional chain or circular systems. The end-user segmentation highlights hobbyists and small landowners as the primary demand drivers for entry-level and mid-range manual or semi-hydraulic units, whereas professional loggers and commercial carpenters constitute the core clientele for high-capacity, heavy-duty portable mills, underlining a polarized demand structure requiring diverse product portfolios from market participants.

AI Impact Analysis on Portable Sawmills Market

User queries regarding AI’s influence on the Portable Sawmills Market frequently revolve around three core themes: enhancing operational precision, enabling predictive maintenance, and optimizing raw material utilization. Users are primarily interested in how AI can move beyond simple digital setworks to implement genuine process intelligence, answering questions such as "Can AI automatically adjust cutting paths based on internal log defects?" or "How can machine learning models predict blade wear before failure occurs?" There is a clear expectation that AI will eliminate human error in measuring and setup, significantly increase lumber recovery rates (LBR), and provide real-time feedback on motor efficiency and hydraulic system health. The summarized consensus indicates users anticipate AI integration will transition portable milling from a skilled manual operation to a highly automated, waste-reducing smart process, making small-scale operations competitively viable against large industrial mills.

The application of AI in sawmilling, while currently nascent in the portable sector, focuses intensely on data acquisition and algorithmic decision-making. High-resolution sensors integrated into the sawmill carriage can feed dimensional and density data into machine learning algorithms, which then determine the optimal cutting pattern for maximizing board feet output while accounting for knot placement and inherent log taper. This real-time optimization capability ensures that every log is processed for its maximum potential value, a critical differentiator for small-volume producers dealing with high-value or complex timber species. Such precision minimizes the generation of lower-grade lumber or unusable sawdust waste, fundamentally altering the economics of portable milling.

Furthermore, AI-driven predictive maintenance represents a significant leap forward in reducing the total cost of ownership (TCO) for portable sawmills. By continuously monitoring vibration patterns, temperature fluctuations in hydraulic fluid, and power consumption signatures of the engine or electric motors, AI systems can accurately forecast component degradation. This capability allows operators to schedule maintenance precisely when needed, preventing catastrophic failures, extending the lifespan of expensive parts like setworks components and hydraulic pumps, and critically, maximizing uptime during crucial operating seasons. The integration of AI thus promises enhanced reliability, superior resource management, and a new era of optimized, autonomous portable lumber production.

- Autonomous cutting path optimization using vision systems to detect defects and maximize yield.

- Predictive maintenance analytics monitoring engine health, blade fatigue, and hydraulic fluid anomalies.

- AI-enhanced setworks providing instant, algorithmic adjustments for log taper and uneven loading.

- Integration with timber resource management software for automated inventory tracking and grading.

- Machine learning models improving power efficiency by optimizing cutting speed relative to wood density.

DRO & Impact Forces Of Portable Sawmills Market

The Portable Sawmills Market is shaped by a confluence of driving factors, operational restraints, emerging opportunities, and competitive impact forces. Key drivers include the global increase in custom lumber demand, particularly from the artisanal woodworking and small construction sectors, alongside the undeniable economic advantage of processing timber locally, thereby circumventing rising fuel and transportation costs. Restraints primarily involve the substantial initial capital investment required for high-capacity hydraulic units and the inherent dependence on fluctuating timber availability and stumpage rights regulations, which vary significantly by region. Opportunities lie in the technological refinement of existing products, such as improved automation and battery-powered systems, and penetrating rapidly industrializing regions with limited centralized milling capacity. These forces collectively dictate the market dynamics, emphasizing efficiency and technological adaptation as core competitive necessities.

A primary impact force is the level of competitive intensity, which is moderate to high, characterized by a few global dominant players (e.g., Wood-Mizer, Norwood) and numerous regional niche manufacturers focusing on specialized models or price competition. This intensity drives continuous innovation in areas like blade technology (e.g., specialized carbide-tipped blades for dense or dirty wood) and trailer mobility features. Furthermore, the regulatory environment acts as a significant external impact force; stringent environmental standards related to noise pollution, dust control, and fuel emissions necessitate continuous product design updates, particularly in developed markets like Europe and North America. Economic cycles also exert pressure, as portable sawmill sales are closely tied to discretionary spending on property improvements and small business investment in machinery.

Specific opportunities are emerging from the growing trend of urban logging, where high-value, large-diameter urban trees, often removed due to construction or disease, can be salvaged using mobile equipment. This niche market requires highly versatile and precise portable sawmills capable of handling unique, often metal-embedded logs safely. Additionally, the move towards sustainable and certified lumber (FSC/PEFC) favors small, managed operations often utilizing portable sawmills, as they facilitate traceable, localized production chains. Overcoming the restraint of operator skill requirement, through simplified, automated user interfaces and comprehensive dealer training programs, remains a critical factor for unlocking wider market potential in the hobbyist and novice segment.

Segmentation Analysis

The Portable Sawmills Market is analyzed based on product type, operational mechanism, and end-user application, offering a comprehensive view of demand structure and competitive landscape. Segmentation by Type includes the dominant Band Sawmills, which are favored for their precision and yield, Chain Sawmills, popular for their low initial cost and ruggedness, and Circular Sawmills, known for high speed in specific applications. Operational segmentation delineates the market based on the degree of mechanization, ranging from fully Manual systems, through semi-automated Electric models, to high-efficiency, labor-saving Hydraulic units. The end-user perspective separates demand drivers into distinct categories, reflecting varying requirements for capacity, durability, and technological sophistication across different buyer groups.

The operational mechanism segmentation is critical as it reflects the investment capacity and primary application needs of the buyer. Hydraulic sawmills, while representing a higher investment, dominate the professional segment due to their capability for rapid log handling and cutting of extremely heavy timber, significantly boosting throughput. Conversely, manual and electric models capture the vast DIY and hobbyist segments, where lower cost, simplicity of maintenance, and the ability to operate in noise-sensitive environments are prioritized. These smaller segments are vital for long-term market sustainability as they feed into the professional segment through business expansion and equipment upgrades.

Analysis of the End-User segment provides insights into demand elasticity and feature preference. Farmers and Landowners primarily seek rugged, reliable, and moderately priced mills for on-farm lumber production (fencing, barns), valuing durability over extreme speed. Professional Loggers and Carpenters, however, demand maximum cutting capacity, advanced computerized setworks, and robust dealer support, viewing the sawmill as a core income-generating asset. Understanding these specific requirements allows manufacturers to tailor marketing strategies and product development efforts efficiently, ensuring optimized feature sets for each customer cohort, thereby maximizing market penetration.

- By Type:

- Band Sawmills

- Chain Sawmills

- Circular Sawmills

- By Operation:

- Manual

- Electric

- Hydraulic

- By End-User:

- Hobbyists & Homeowners

- Farmers & Landowners

- Professional Loggers & Carpenters

Value Chain Analysis For Portable Sawmills Market

The value chain for the Portable Sawmills Market begins with the upstream suppliers responsible for sourcing and manufacturing critical components. These inputs include specialized steel for thin-kerf band blades (requiring high tensile strength and wear resistance), high-performance diesel or gasoline engines (meeting stringent emission standards), electric motors, and precision hydraulic system components (pumps, valves, cylinders). Upstream procurement efficiency directly impacts the final product cost and reliability, pushing manufacturers to establish strong, often global, supply relationships to manage fluctuating raw material prices, particularly steel and specialized alloys required for chassis and carriage construction. Quality control at this stage is paramount, as component failure can significantly compromise the portability and operational safety of the final sawmill unit.

Mid-stream activities involve the core manufacturing and assembly processes, including advanced welding, computerized numerical control (CNC) machining of carriages and tracks for extreme precision, and the final assembly of complex hydraulic and electronic setworks systems. Direct sales and robust distribution channels form the crucial downstream segment. Due to the high-value and technical nature of the product, direct distribution via the manufacturer’s own sales force or specialized dealer networks that offer localized service and parts supply is dominant. Indirect distribution, leveraging e-commerce for accessories or lower-cost manual models, is growing but less prevalent for high-end hydraulic units which require installation and training support.

The distribution channel strategy is highly dependent on the product segmentation. High-end, professional-grade sawmills are almost exclusively sold through specialized machinery dealers (indirect) who provide comprehensive pre-sale consultation, financing options, and critical post-sale service support. Smaller, less complex manual or entry-level electric sawmills often utilize direct-to-consumer models, facilitated by strong brand presence and extensive online educational content. Effective inventory management across the dealer network is essential to meet seasonal demand peaks, typically coinciding with summer and autumn logging seasons, thereby optimizing the flow of goods from the manufacturer to the end-user.

Portable Sawmills Market Potential Customers

The potential customer base for the Portable Sawmills Market is highly diverse, spanning individual landowners utilizing the equipment for personal projects to seasoned professionals operating commercial timber businesses. The largest volume segment comprises Hobbyists and Homeowners who typically purchase smaller, manually operated or electric band sawmills. These buyers are motivated by the desire for self-sufficiency in wood sourcing for DIY projects, barn repairs, or specialized furniture making, prioritizing low entry cost, simple operation, and minimal maintenance. Marketing efforts towards this group heavily emphasize ease of use and the economic benefits of converting salvaged or owned timber into valuable construction material, appealing directly to the maker and homesteading movements.

A secondary, high-value customer group consists of Farmers and Landowners, particularly those managing parcels exceeding 40 acres. These individuals often require semi-hydraulic or mid-range portable sawmills to manage their timber assets, clear land, and produce construction-grade lumber for agricultural structures like sheds, fencing, and permanent shelters. Their purchasing decision is driven by ruggedness, reliability, and the ability to process logs of moderate size and volume over long operational periods. These buyers often seek diesel-powered units for durability and require robust features such as remote control for safety and efficiency during solo operation.

The most demanding segment, providing the highest revenue per unit, includes Professional Loggers, Commercial Carpenters, and specialized Mobile Sawmilling Service Providers. These end-users demand heavy-duty, fully hydraulic sawmills equipped with advanced features like computer setworks, high-horsepower engines, and rapid log loading capabilities. Their core need is maximizing throughput and minimizing labor time; hence, speed, precision, and the manufacturer’s warranty/service network are paramount. These professionals often purchase specialized attachments, such as debarkers and log decks, to enhance efficiency, viewing the sawmill as a capital asset central to their specialized service offering in custom cutting or localized timber supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $275 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wood-Mizer, Logosol, Norwood Sawmills, TimberKing, Hud-Son, Baker Products, Peterson Portable Sawmills, EZ Boardwalk, Woodland Mills, Lucas Mill, Mighty Mite, Granberg International, Forestor, Maverick Manufacturing, Linn Manufacturing, T.R. Miles, Dyna-Cut, Kasco Manufacturing, Cook’s Saw. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Sawmills Market Key Technology Landscape

The technological evolution within the Portable Sawmills Market is concentrated on maximizing lumber recovery, improving operator ergonomics, and enhancing mobility. The most critical advancement has been the widespread adoption of thin-kerf band blade technology. Thin-kerf blades minimize the width of the cut (kerf), significantly reducing the amount of wood converted into sawdust, thereby boosting the yield of marketable lumber per log. Modern blades utilize specialized metallurgy and precision grinding techniques to maintain sharpness and durability, even when cutting highly dense hardwoods or logs containing small inclusions. This technology has fundamentally increased the economic viability of portable sawmilling, especially for high-value species where maximizing yield is crucial.

Furthermore, the integration of advanced hydraulic systems and computerized setworks defines the premium end of the market. Hydraulic technology manages all heavy lifting and log manipulation tasks, including loading, turning, clamping, and leveling, drastically reducing manual labor and speeding up the processing cycle. Computerized setworks utilize digital sensors and microprocessors to precisely position the sawhead for the next cut, often within thousandths of an inch accuracy. These systems allow operators to pre-program cut lists, adjust for log taper automatically, and utilize digital scales to monitor board output in real-time, greatly improving consistency and reducing human error, which is critical for meeting stringent dimensional tolerances required in construction.

Power train innovations are also shaping the landscape, with a noticeable shift towards more fuel-efficient Tier 4 compliant diesel engines and robust electric motor alternatives. Electric portable sawmills are gaining traction, particularly among smaller operations and urban loggers, owing to their zero emissions, quieter operation, and lower running costs when consistent three-phase power is available. Additionally, sophisticated trailer suspension systems, quick-setup jacks, and modular track extensions are enhancing the portability and setup speed of these units. These design optimizations ensure that large, high-capacity sawmills can still be rapidly deployed and stabilized on uneven terrain, maintaining the 'portable' advantage over stationary industrial equipment.

Regional Highlights

The regional dynamics of the Portable Sawmills Market reflect diverse economic conditions, forestry practices, and regulatory environments, creating distinct growth profiles across continents. North America, encompassing the United States and Canada, represents the most mature and dominant market globally. This leadership is underpinned by extensive private forest land ownership, a deeply ingrained DIY culture, and a large population of small to medium-sized enterprises (SMEs) engaged in construction and specialty wood manufacturing. Demand here is characterized by a preference for large, fully hydraulic band sawmills capable of high-volume, precision cutting, driven by the need to efficiently process significant annual timber harvests and capitalize on the high market value of diverse hardwood species.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily fueled by rapid infrastructure expansion, urbanization, and a growing middle class requiring affordable housing and furniture. Countries like India, China, and Southeast Asian nations are increasingly adopting portable sawmills to supplement traditional, often outdated, stationary mills and meet localized demand efficiently. The APAC market segment favors cost-effective, durable models—often chain or smaller band sawmills—that can handle tropical hardwoods and operate reliably in challenging, humid environments with limited access to sophisticated maintenance facilities. Government initiatives supporting small agricultural businesses and localized resource processing further stimulate adoption.

Europe presents a highly specific demand landscape focused intensely on environmental performance and engineering quality. European customers prioritize high precision, low noise operation, and adherence to strict emission standards (Euro VI compliance for diesel models). The market predominantly favors high-specification electric and hybrid sawmills, often featuring integrated digital measurement systems and advanced dust collection mechanisms. Regulatory emphasis on sustainable forestry practices (FSC/PEFC certification) drives demand for portable mills among forest management cooperatives and landowners seeking to utilize wood resources responsibly, minimizing waste and maintaining forest health.

- North America: Market leader driven by private forest ownership, strong construction sector, and high demand for advanced, large-capacity hydraulic band sawmills.

- Asia Pacific (APAC): Fastest growth region supported by infrastructure development, urbanization, and a shift towards localized, cost-effective milling solutions.

- Europe: High demand for precision-engineered, eco-friendly models (electric/hybrid) emphasizing low emissions and noise, aligning with strict environmental regulations.

- Latin America: Growing potential supported by agricultural expansion and decentralized timber processing needs in regions like Brazil and Chile.

- Middle East and Africa (MEA): Emerging market driven by necessity for localized construction materials and infrastructure development, favoring rugged, easy-to-maintain diesel units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Sawmills Market.- Wood-Mizer

- Logosol

- Norwood Sawmills

- TimberKing

- Hud-Son Forest Equipment Inc.

- Baker Products

- Peterson Portable Sawmills

- EZ Boardwalk

- Woodland Mills

- Lucas Mill

- Mighty Mite Industries Inc.

- Granberg International

- Forestor

- Maverick Manufacturing

- Linn Manufacturing

- Cook’s Saw Manufacturing

- Kasco Manufacturing

- Dyna-Cut

- T.R. Miles Manufacturing

Frequently Asked Questions

Analyze common user questions about the Portable Sawmills market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market growth for portable sawmills?

The primary driver is the increasing demand for decentralized, custom-sized lumber, coupled with the economic necessity to reduce logging and transportation costs by processing timber directly at the source, maximizing value recovery.

Which type of portable sawmill offers the highest lumber recovery rate (yield)?

Band sawmills offer the highest lumber recovery rate due to their use of thin-kerf blades, which significantly reduce the amount of wood wasted as sawdust compared to traditional circular or chain sawmills.

How are computerized setworks enhancing modern portable sawmill operations?

Computerized setworks provide high-precision, automated control over blade positioning, allowing for pre-programmed cut lists, automated compensation for log taper, and real-time dimension monitoring, drastically improving cutting accuracy and speed.

Which end-user segment utilizes the high-capacity, fully hydraulic portable sawmills?

Professional loggers, commercial carpenters, and mobile custom milling service providers primarily utilize fully hydraulic sawmills, as these segments require maximum efficiency, speed, and reduced manual labor for high-volume operation.

What is the projected growth rate (CAGR) for the Portable Sawmills Market between 2026 and 2033?

The Portable Sawmills Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by global demand for customized, locally sourced timber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager