Portable Ultrasonic Flaw Detectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438950 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Portable Ultrasonic Flaw Detectors Market Size

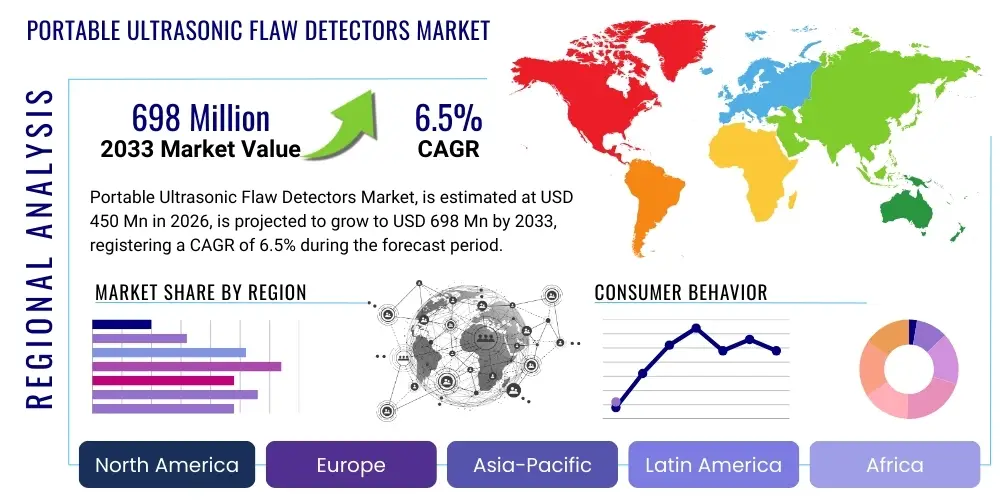

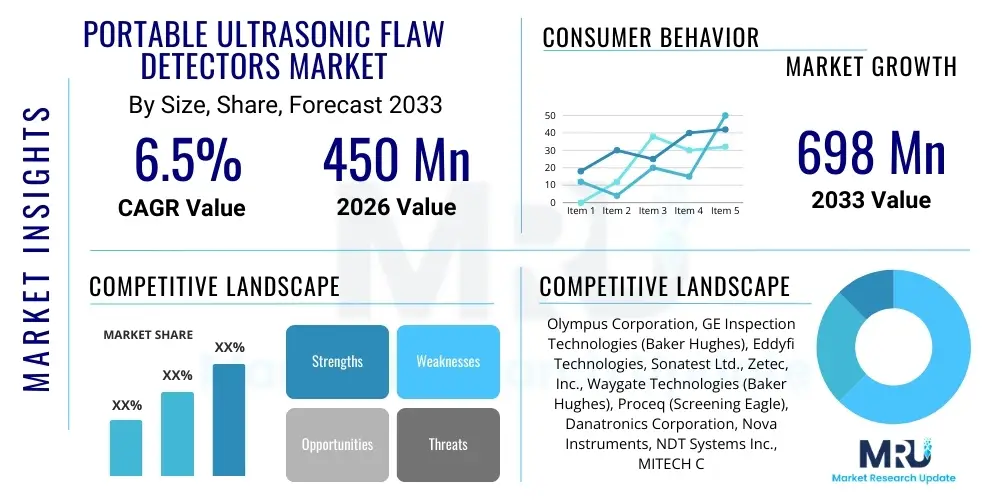

The Portable Ultrasonic Flaw Detectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Portable Ultrasonic Flaw Detectors Market introduction

The Portable Ultrasonic Flaw Detectors (PUFD) Market encompasses devices crucial for Non-Destructive Testing (NDT) across various industrial sectors. These handheld instruments utilize high-frequency sound waves to detect, locate, measure, and evaluate discontinuities, flaws, and defects within materials, without causing damage to the material under inspection. The primary function involves transmitting ultrasonic pulses into a test piece and analyzing the reflected echoes to determine material integrity. This technology is indispensable for ensuring structural reliability and safety in critical applications such as aerospace, oil and gas, manufacturing, and infrastructure.

Key applications of portable ultrasonic flaw detectors include weld inspection, corrosion measurement, forging and casting defect detection, and specialized composite material testing. The lightweight nature, enhanced battery life, and high-resolution displays of modern portable units allow technicians to perform intricate inspections in remote or confined environments, significantly reducing downtime and operational costs associated with traditional inspection methods. The increasing stringency of regulatory standards globally, particularly concerning asset integrity management in high-risk industries, is a foundational factor driving the adoption of these advanced inspection tools.

The principal benefits derived from employing PUFD technology include early detection of material fatigue, precise sizing of internal defects, and enhanced quantitative analysis capabilities through sophisticated software integration. Driving factors for market expansion are the rapid development of phased array ultrasonic testing (PAUT) and full matrix capture (FMC) technologies within portable platforms, coupled with the escalating need for preventative maintenance in aging infrastructure across developed and developing economies. These technological advancements ensure greater accuracy, faster inspection cycles, and improved traceability of inspection data.

Portable Ultrasonic Flaw Detectors Market Executive Summary

The Portable Ultrasonic Flaw Detectors Market is characterized by robust technological innovation focusing on miniaturization, enhanced software analytics, and integration with remote monitoring systems. Business trends indicate a strong shift towards solutions offering advanced capabilities like Phased Array Ultrasonic Testing (PAUT) and Total Focusing Method (TFM) integrated into smaller, more ergonomic devices. Major market players are prioritizing strategic partnerships with NDT service providers and emphasizing training programs to capitalize on the complexity of new generation detectors. Furthermore, subscription-based models for software updates and data analysis platforms are emerging, providing recurring revenue streams and improving customer retention.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing region, primarily fueled by massive infrastructure projects, burgeoning manufacturing sectors in countries like China and India, and increasing investments in oil and gas exploration activities. North America and Europe, while mature, maintain significant market shares due to stringent regulatory environments, high adoption rates of advanced NDT techniques in aerospace and automotive industries, and continuous replacement cycles for outdated equipment. The market in Latin America and the Middle East & Africa (MEA) is experiencing moderate growth, driven by expansion in refinery capacity and petrochemical investments requiring rigorous pipeline integrity monitoring.

Segment trends show the conventional ultrasonic flaw detector segment maintaining a stable base, primarily due to its cost-effectiveness and simplicity for basic testing. However, the phased array segment is projected to exhibit the highest CAGR, reflecting the industry demand for high-speed, comprehensive volumetric inspections and improved defect characterization. Energy and Power remains the dominant application segment, though the Aerospace and Defense sector is increasingly demanding specialized portable units capable of inspecting complex geometries and composite materials with high precision. Overall, the market trajectory is strongly linked to global capital expenditure in infrastructure maintenance and industrial safety regulations.

AI Impact Analysis on Portable Ultrasonic Flaw Detectors Market

User queries regarding AI's influence on Portable Ultrasonic Flaw Detectors center on automation capabilities, data interpretation accuracy, and the eventual role of the human technician. Common questions revolve around: "How will AI automate defect classification?", "Can AI reduce human error in interpreting complex PAUT/TFM data?", and "What are the ethical implications of relying on AI for critical infrastructure safety decisions?". Based on this analysis, the key themes summarize that users expect AI to transition PUFD systems from purely data acquisition tools into intelligent diagnostic platforms. Users anticipate significant improvements in post-processing efficiency, automatic anomaly detection, and historical data comparison, leading to faster, more reliable, and standardized inspection reports, thus reducing reliance on subjective human interpretation while simultaneously elevating the skill requirements for operating and validating AI-driven systems.

- AI algorithms enable automatic defect recognition (ADR), significantly reducing inspection time and improving consistency across different operators.

- Machine learning models enhance signal processing capabilities, effectively filtering out noise and improving the signal-to-noise ratio in complex material inspections.

- Predictive maintenance platforms integrate PUFD data with historical operational metrics, using AI to forecast material degradation and optimal maintenance schedules.

- Deep learning aids in the interpretation of complex imaging methods (e.g., TFM and FMC), offering precise volumetric sizing and three-dimensional visualization of flaws.

- AI integration facilitates data management and reporting, automatically generating audit-ready reports and ensuring compliance with industry standards.

- Autonomous calibration and self-diagnostic features powered by AI minimize downtime and ensure the operational integrity of the portable flaw detector unit itself.

DRO & Impact Forces Of Portable Ultrasonic Flaw Detectors Market

The dynamics of the Portable Ultrasonic Flaw Detectors market are shaped by compelling drivers, operational restraints, significant opportunities, and inherent impact forces. Primary drivers include increasingly strict government regulations mandating NDT in critical sectors, rapid industrialization, particularly in emerging economies, and the necessity to maintain aging infrastructure globally. These factors necessitate the deployment of advanced, reliable, and mobile inspection technologies. Conversely, restraints involve the high initial capital investment required for sophisticated PAUT/FMC systems, the scarcity of highly skilled NDT technicians trained in advanced software operation, and the inherent challenges in testing highly scattering or acoustically challenging materials.

Opportunities for market growth stem from the expansion into new application areas such as additive manufacturing (3D printing), where quality control of complex internal geometries is paramount, and the development of IoT-enabled PUFDs that allow for remote data access and cloud-based analytics. Furthermore, miniaturization efforts aimed at creating drone-deployable ultrasonic inspection payloads present niche market growth potential. The convergence of ultrasonic technology with other NDT methods (e.g., eddy current or radiography) in single portable units also represents a significant avenue for product differentiation and market penetration.

Impact forces governing the market include technological obsolescence driven by rapid innovation in phased array and AI integration, the pricing pressure exerted by regional Asian manufacturers offering highly competitive basic ultrasonic units, and the cyclical nature of capital expenditure in the oil and gas and construction sectors. Geopolitical instability also plays a role, affecting large-scale project execution and, consequently, the demand for inspection equipment. The constant pressure for higher inspection speed without sacrificing accuracy drives research and development efforts, forcing manufacturers to continuously innovate display technology, processing power, and probe design to meet evolving industry expectations.

Segmentation Analysis

The Portable Ultrasonic Flaw Detectors market is rigorously segmented based on technology, measurement method, end-user industry, and geographical region, allowing for targeted strategic planning and product development. Technology segmentation differentiates between conventional UT, Phased Array UT (PAUT), and Advanced Methods like Total Focusing Method (TFM) and Full Matrix Capture (FMC), reflecting the varying levels of complexity and data richness required by specific applications. The PAUT and advanced method segments are experiencing accelerated adoption due to their ability to provide comprehensive, volumetric data and flexibility in probe configuration, making them superior for complex geometries and weld inspections.

End-user segmentation reveals the diverse application landscape, with the Energy (Oil & Gas, Power Generation) and Manufacturing (Automotive, Heavy Machinery) sectors forming the backbone of demand. These industries require continuous, reliable inspection to prevent catastrophic failures and ensure regulatory compliance. The Aerospace & Defense segment, while smaller in volume, demands the highest precision and customization, driving innovation in high-frequency and specialized composite inspection probes. Geographical segmentation highlights disparities in technological maturity and regulatory compliance levels, influencing demand for entry-level versus high-end portable systems.

- By Technology

- Conventional Ultrasonic Testing (UT)

- Phased Array Ultrasonic Testing (PAUT)

- Advanced Ultrasonic Testing (e.g., TFM/FMC)

- By Measurement Method

- Flaw Detection

- Thickness Measurement/Corrosion Mapping

- By End-User Industry

- Oil and Gas

- Aerospace and Defense

- Energy and Power Generation

- Automotive and Transportation

- Manufacturing (Heavy Machinery and Fabrication)

- Infrastructure and Construction

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Portable Ultrasonic Flaw Detectors Market

The value chain for Portable Ultrasonic Flaw Detectors begins with upstream activities focused on raw material sourcing, primarily specialized piezoelectric ceramics, advanced semiconductor components, and high-performance display screens, crucial for probe and device manufacturing. Suppliers of digital signal processing (DSP) chips and custom software components form the critical technological input. Manufacturers then engage in the core process of integrating these components, focusing heavily on miniaturization, ergonomic design, and rigorous quality control testing to ensure the durability and reliability required for field operations. Research and development investment at this stage determines the competitiveness and feature set of the final product, especially concerning PAUT and advanced imaging capabilities.

Downstream analysis involves the distribution and service channels. Distribution primarily occurs through specialized NDT equipment distributors who possess deep technical knowledge and often provide localized calibration and repair services. Direct sales channels are utilized for large, strategic accounts, particularly in the aerospace or nuclear power sectors, where specific customization or long-term training contracts are involved. The distribution channel must manage complex logistics, handle regulatory clearances for shipping sensitive electronic equipment, and provide initial user training to ensure effective deployment of sophisticated portable devices.

The final stage encompasses post-sale support, training, and calibration services, which are critical differentiators. Service contracts often include software updates, remote diagnostics, and preventative maintenance schedules. Potential customers value comprehensive training packages that cover advanced inspection techniques like TFM and array setup. The value chain is increasingly being optimized through digital transformation, where data collected by the detectors feeds into cloud-based analytical platforms, creating a service ecosystem that enhances product utility and fosters long-term customer engagement beyond the initial equipment sale.

Portable Ultrasonic Flaw Detectors Market Potential Customers

The primary customers for Portable Ultrasonic Flaw Detectors are organizations responsible for asset integrity management, quality assurance, and regulatory compliance across high-value industrial sectors. These end-users are broadly categorized into Inspection Service Providers (third-party NDT firms), which purchase equipment to service multiple clients, and In-House Inspection Departments belonging to large industrial corporations (e.g., refineries, power plants, aircraft manufacturers). Service providers represent a significant bulk purchaser segment, driven by the need for versatile, high-throughput equipment capable of meeting diverse client specifications.

Specific buying organizations include pipeline operators in the oil and gas industry who require corrosion mapping and weld integrity checks, power generation companies (nuclear, thermal, hydro) focusing on turbine blade inspection and boiler tube integrity, and major aerospace manufacturers demanding highly precise defect detection in composite structures and critical airframe components. Procurement decisions are heavily influenced by equipment portability, battery life, compliance with standards (e.g., ASME, ASTM), and the ease of generating comprehensive, traceable inspection reports. The trend towards specialized material usage, such as lightweight alloys and composites in automotive manufacturing, is expanding the customer base beyond traditional heavy industries.

The most lucrative potential customers are those undertaking large, long-term capital projects, such as new refinery construction or infrastructure rehabilitation programs, where large fleets of high-performance portable detectors are required. Furthermore, the defense sector, with its stringent requirements for naval vessel hull integrity and specialized military equipment testing, consistently represents a high-value customer segment, often prioritizing proprietary data security and ruggedized equipment design over marginal cost savings. Manufacturers must tailor their sales pitch to highlight total cost of ownership (TCO) benefits, including reduced inspection time and minimized risk of asset failure, to secure procurement contracts from these critical end-user groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, GE Inspection Technologies (Baker Hughes), Eddyfi Technologies, Sonatest Ltd., Zetec, Inc., Waygate Technologies (Baker Hughes), Proceq (Screening Eagle), Danatronics Corporation, Nova Instruments, NDT Systems Inc., MITECH Co., Ltd., YUSHI INSTRUMENTS, SIUI, Pfinder KG, NDT Solutions, Ltd., ModSonic, Srem Technologies, KRAUTKRAMER (GE Sensing & Inspection Technologies), Jireh Industries, Innerspec Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Portable Ultrasonic Flaw Detectors Market Key Technology Landscape

The technological landscape of the Portable Ultrasonic Flaw Detectors market is defined by a continuous push towards higher fidelity imaging, faster data acquisition, and enhanced connectivity. Phased Array Ultrasonic Testing (PAUT) remains the foundational advanced technology, utilizing multiple elements in a single probe to steer and shape the ultrasonic beam electronically. This capability allows technicians to inspect complex geometries and provide volumetric coverage significantly faster than conventional single-probe UT. Market emphasis is now shifting toward optimizing PAUT systems for portability, ensuring high channel count units (e.g., 32:32 or 64:64) can be housed in lightweight, battery-powered field devices, thereby addressing the need for extensive data collection in remote environments.

The emergence and increasing commercial viability of advanced methods, specifically Full Matrix Capture (FMC) and Total Focusing Method (TFM), represent the technological frontier. TFM/FMC provides superior focusing and defect characterization by capturing all possible reflection data points from every element in the array, resulting in geometrically accurate, high-resolution imagery of the inspected volume. While computationally intensive, advances in portable processing power (GPUs and dedicated DSP chips) are making real-time TFM processing a standard feature in high-end portable detectors. These technologies are particularly critical in highly regulated industries like nuclear and aerospace where precise defect sizing is mandatory for fitness-for-service assessments.

Connectivity and software are equally pivotal. Modern portable detectors incorporate wireless communication (Wi-Fi, Bluetooth) for instantaneous data transfer to cloud platforms or central asset management systems. Software sophistication involves specialized modules for coded inspection procedures, automated report generation compliant with standards like API and EN codes, and sophisticated data visualization tools. Furthermore, the ruggedization of hardware—ensuring devices can withstand extreme temperatures, moisture, and vibration—is a constant technological necessity, enabling reliable performance in diverse global operating conditions such as offshore platforms and arctic environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, fueled by massive government investment in infrastructure (high-speed rail, bridges, ports), significant expansion of the manufacturing base, and large-scale greenfield industrial projects, particularly in China, India, and Southeast Asia. The region’s demand spans both cost-effective conventional UT devices for basic industrial use and high-end PAUT systems for complex projects like LNG terminals and nuclear facilities. The burgeoning domestic NDT service sector provides a strong distribution and utilization network.

- North America: North America holds a mature market characterized by high adoption rates of advanced technologies (PAUT, TFM) driven by stringent regulatory enforcement (e.g., DOT pipeline regulations) and high safety standards in the aerospace and defense sectors. Demand is heavily focused on replacing aging infrastructure, notably oil and gas pipelines and civil engineering structures, requiring high-precision corrosion mapping and weld integrity checks. Technological leadership and early adoption of AI integration are hallmarks of this region.

- Europe: The European market is stable and sophisticated, governed by comprehensive EU directives concerning industrial safety and environmental protection. Western European countries, particularly Germany and the UK, drive demand through advanced manufacturing (automotive and precision engineering) and nuclear energy inspection requirements. There is a strong emphasis on standardization (EN codes) and traceability of inspection data, favoring manufacturers who offer integrated software solutions and robust data archiving capabilities.

- Middle East & Africa (MEA): This region exhibits strong demand linked directly to the massive capital expenditure in the oil and gas sector, including refinery construction, expansion of petrochemical facilities, and pipeline network development. The need for continuous integrity monitoring in extremely harsh desert and marine environments drives the preference for ruggedized, high-performance portable detectors used in corrosion monitoring and critical weld inspection for high-pressure vessels.

- Latin America (LATAM): Market growth in LATAM is moderate but steady, largely dependent on the cycles of natural resource extraction and state-owned energy investments. Countries like Brazil and Mexico are primary consumers, driven by mining operations, and oil and gas exploration activities. The adoption of advanced NDT technology is gradually increasing, moving away from conventional methods as regulatory oversight becomes more stringent, particularly concerning export standards compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Portable Ultrasonic Flaw Detectors Market.- Olympus Corporation

- GE Inspection Technologies (Baker Hughes)

- Eddyfi Technologies

- Sonatest Ltd.

- Zetec, Inc.

- Waygate Technologies (Baker Hughes)

- Proceq (Screening Eagle)

- Danatronics Corporation

- Nova Instruments

- NDT Systems Inc.

- MITECH Co., Ltd.

- YUSHI INSTRUMENTS

- SIUI

- Pfinder KG

- NDT Solutions, Ltd.

- ModSonic

- Srem Technologies

- KRAUTKRAMER (GE Sensing & Inspection Technologies)

- Jireh Industries

- Innerspec Technologies

Frequently Asked Questions

Analyze common user questions about the Portable Ultrasonic Flaw Detectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Portable Ultrasonic Flaw Detectors?

The primary driver is the increasing global emphasis on asset integrity management and the enforcement of stringent government and industry safety regulations (e.g., ASME, API) that mandate non-destructive testing for critical infrastructure and high-stress components across the oil and gas, aerospace, and energy sectors.

How is Phased Array UT (PAUT) superior to conventional UT in portable detectors?

PAUT is superior because it uses multiple elements to electronically steer and shape the ultrasonic beam, allowing for faster, more comprehensive inspection coverage, better focusing capabilities, and the ability to detect defects in complex geometries with significantly reduced setup time compared to conventional single-element probes.

Which industry segment represents the largest market share for portable flaw detectors?

The Energy and Power Generation segment, including Oil & Gas, remains the largest market share holder, due to the critical and continuous inspection requirements for pipelines, pressure vessels, boilers, and refinery components where failure carries high economic and safety risks.

What role does Artificial Intelligence play in modern Portable Ultrasonic Flaw Detectors?

AI integrates through Machine Learning algorithms to facilitate automated defect recognition (ADR), enhance signal processing by filtering noise, and streamline the interpretation of complex imaging data (TFM/FMC), thereby improving inspection efficiency and reducing subjective human error in defect classification.

What is the forecast growth rate for the Portable Ultrasonic Flaw Detectors Market between 2026 and 2033?

The Portable Ultrasonic Flaw Detectors Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% throughout the forecast period, driven by technological advancements and mandatory regulatory compliance worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager