PoS Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431685 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

PoS Accessories Market Size

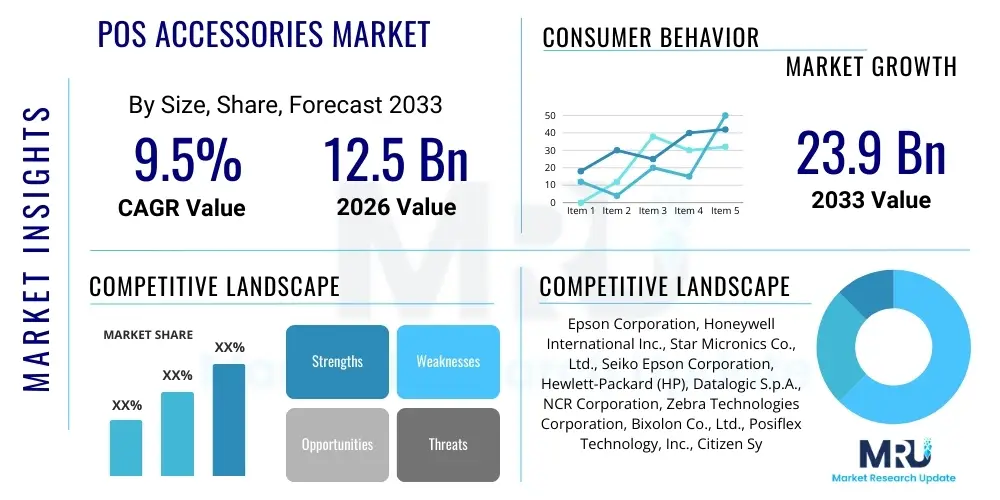

The PoS Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 23.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global digitalization of retail infrastructure, the widespread adoption of mobile Point-of-Sale (mPoS) systems, and the increasing demand for high-speed, secure, and integrated peripheral devices essential for seamless transactional experiences across various commercial sectors.

PoS Accessories Market introduction

The Point-of-Sale (PoS) Accessories Market encompasses a critical array of peripheral devices integral to modern transaction processing systems, ensuring efficiency, accuracy, and customer satisfaction at the point of exchange. These accessories include, but are not limited to, barcode scanners, receipt printers, cash drawers, customer-facing displays, magnetic stripe readers (MSRs), NFC readers, and various mounting solutions designed to support the core PoS terminal. These components transform a basic computer or tablet into a fully functional and compliant transaction station, crucial for managing sales, inventory, and customer data.

The primary applications of PoS accessories span across hypermarkets, specialty retail stores, quick-service restaurants (QSRs), hospitality establishments (hotels and bars), entertainment venues, and small to medium-sized enterprises (SMEs) globally. The recent evolution toward unified commerce and omnichannel retailing has amplified the necessity for advanced accessories that can integrate seamlessly across fixed, mobile, and self-service environments. For instance, high-speed thermal printers are essential for managing order queues in QSRs, while sophisticated 2D barcode scanners are vital for detailed inventory tracking in large retail settings, demonstrating the functional specificity required within the ecosystem.

Major benefits driving the market include enhanced operational speed, reduced manual errors, improved inventory visibility, and compliance with evolving global payment security standards, particularly related to EMV and contactless technologies. Key driving factors include the rapid global transition from traditional cash transactions to digital payments, increasing investments in retail infrastructure modernization across emerging economies, and the continuous innovation in wireless connectivity standards (such as Bluetooth Low Energy and Wi-Fi 6) which facilitate mobile and flexible PoS setups. Furthermore, the push towards better customer engagement is driving the adoption of dual-screen displays and interactive kiosks, positioning accessories as central tools for business optimization.

PoS Accessories Market Executive Summary

The PoS Accessories Market is undergoing a rapid technological transformation, characterized by the shift from wired, proprietary systems to modular, universally compatible, and often wireless accessories that support the growing mPoS trend. Business trends indicate a strong prioritization among retailers for devices offering high durability, energy efficiency, and easy integration with cloud-based PoS software, mitigating high maintenance costs and streamlining setup processes. Furthermore, there is a pronounced move towards integrated peripheral solutions, such as combined scanner/imager modules and multi-functional receipt printers that support both traditional paper and digital receipt options, addressing sustainability concerns and improving data capture capabilities at the transaction level.

Regionally, Asia Pacific (APAC) stands out as the highest-growth market, primarily fueled by massive consumer spending growth, rapid urbanization, and government initiatives promoting digital payment adoption across populous nations like China, India, and Southeast Asian countries. North America and Europe, characterized by established retail infrastructures, exhibit mature demand but are focused on replacement cycles driven by the necessity for upgrading to comply with stricter data security regulations (like GDPR in Europe) and adopting accessories compatible with emerging payment methodologies such as biometric scanning and cryptocurrencies. These regions also show significant uptake in advanced self-checkout solutions, requiring specialized and ruggedized accessories.

Segment trends reveal that the Barcode Scanners and Receipt Printers segments collectively dominate the market share due to their universal application across nearly all retail and hospitality environments. Within the connectivity segment, wireless accessories are experiencing the fastest Compound Annual Growth Rate (CAGR), reflecting the market's pivot towards mobility and flexible store layouts, which is essential for optimizing customer service during peak hours. End-user analysis highlights the Retail segment, particularly large department stores and grocery chains, as the principal consumer base, though the Hospitality sector is rapidly catching up, driven by the demand for mobile ordering and payment processing at tableside.

AI Impact Analysis on PoS Accessories Market

User queries regarding AI's influence on PoS accessories typically revolve around how AI can enhance operational efficiency, minimize hardware failure, personalize customer interactions, and facilitate truly autonomous retail environments. Common concerns include the necessary intelligence level required for peripherals (edge computing vs. cloud), data privacy implications of sophisticated sensor-equipped devices, and the financial feasibility of integrating AI capabilities into existing accessory ecosystems. The consensus expectation is that AI will transform accessories from mere input/output tools into smart, predictive components capable of optimizing business workflows. AI integration fundamentally alters the utility of PoS accessories, moving them beyond transactional tools into essential components of predictive retail operations and personalized customer engagement.

- AI enables predictive maintenance for receipt printers and scanners, forecasting hardware failure before operational downtime occurs, minimizing service interruption costs.

- Smart barcode scanners utilize image recognition AI for rapid, error-free product identification, crucial for self-checkout and rapid inventory auditing.

- AI-driven customer displays personalize advertisements and loyalty offers based on real-time transaction data and historical purchase patterns.

- Integration of machine learning algorithms optimizes cash drawer management by predicting ideal float levels and detecting anomalies indicative of theft or fraud.

- AI assists in optimizing inventory workflows facilitated by handheld scanners and mobile PoS devices, improving stock accuracy and reducing out-of-stock scenarios.

- Voice recognition and natural language processing (NLP) integrated into specialized PoS microphones or customer kiosks streamline order entry in QSR and hospitality settings.

DRO & Impact Forces Of PoS Accessories Market

The PoS Accessories Market is shaped by a powerful confluence of digital transformation drivers, necessary security restraints, and significant opportunities tied to technological convergence. Driving forces include the accelerating global shift towards digital and contactless payments, which necessitates updated hardware (NFC readers, EMV-certified terminals), and the rapid expansion of omnichannel retailing strategies, demanding integrated accessories across all consumer touchpoints. Conversely, major restraints involve the high initial capital investment required for adopting advanced, integrated PoS systems, especially burdensome for small businesses, alongside persistent concerns regarding data security, compliance with stringent regional privacy laws (like CCPA and HIPAA), and the complexities of integrating diverse legacy systems with modern cloud-based peripherals. However, vast opportunities exist in serving the burgeoning Small and Medium Enterprise (SME) sector in emerging markets through affordable mPoS accessory bundles and leveraging the Internet of Things (IoT) to create fully interconnected, self-monitoring retail environments, further cementing the accessories' role as data-gathering nodes rather than simple peripherals. These forces collectively dictate the adoption speed and technological direction of the market, ensuring continuous evolution toward smarter, more secure, and highly connected accessory modules.

Segmentation Analysis

The PoS Accessories Market is extensively segmented based on the type of peripheral device, the connectivity technology employed, and the specific end-user industry served, reflecting the diversity of functional requirements across the commercial landscape. Product type segmentation provides insights into the demand for essential components such as receipt printers (thermal, impact, inkjet), data capture devices (1D, 2D, and biometric scanners), and display units (pole displays, interactive customer screens). Connectivity segmentation analyzes the dominance of traditional wired connections (USB, serial, Ethernet) versus the high-growth trajectory of wireless methods (Bluetooth, Wi-Fi), which support mobile and flexible retail models. End-user categorization distinguishes specific industry needs, recognizing that the demands of a high-volume supermarket differ significantly from those of a fine-dining establishment or a specialized healthcare provider, influencing the required ruggedness and integration capabilities of the accessories utilized.

- By Product Type:

- Receipt Printers (Thermal, Impact, Inkjet)

- Barcode Scanners/Readers (1D/2D Imagers, Handheld, Fixed Mount)

- Cash Drawers

- Customer Displays/Pole Displays

- Magnetic Stripe Readers (MSR) and EMV Card Readers

- Keyboards and PoS Keypads

- Mounts and Stands

- By Connectivity:

- Wired (USB, Serial, Ethernet)

- Wireless (Bluetooth, Wi-Fi, NFC)

- By End-User:

- Retail (Supermarkets, Hypermarkets, Specialty Stores)

- Hospitality (Restaurants, Hotels, QSRs)

- Healthcare

- Entertainment (Cinemas, Gaming Centers)

- Others (Transportation, Government)

Value Chain Analysis For PoS Accessories Market

The value chain for the PoS Accessories Market begins with the Upstream Analysis, which focuses heavily on the procurement and manufacturing of specialized components such as thermal print heads, laser diodes for scanners, durable ABS plastics for casings, specialized microcontrollers, and wireless communication chips (Bluetooth, NFC). Component suppliers, often concentrated in Asia Pacific, hold significant leverage due to their specialized manufacturing capabilities and control over proprietary technologies, influencing the final cost and innovation pace of the accessories. Efficient sourcing and standardization of interfaces are crucial at this stage to maintain competitive pricing and global compatibility for subsequent integration.

The Midstream activities involve the actual design, assembly, and quality assurance of the final PoS accessory products. This stage is dominated by established PoS hardware manufacturers who integrate components, develop proprietary firmware, and ensure compliance with international standards (e.g., electrical safety, EMI/RFI). Crucially, the Midstream must develop robust application programming interfaces (APIs) and drivers that allow the accessories to interface seamlessly with a multitude of operating systems and cloud-based PoS software solutions, which is vital for market acceptance. Downstream activities involve distribution, sales, and post-sale support, where the product reaches the end-user through various channels.

The distribution channel is multifaceted, segmented into Direct and Indirect channels. Direct sales often target large enterprise retailers or hospitality chains requiring customized, high-volume orders and direct system integration support. Indirect channels utilize Value-Added Resellers (VARs), system integrators, regional distributors, and increasingly, e-commerce platforms and payment facilitators (PFs) who bundle accessories with their core software offerings. VARs are especially crucial as they provide localized implementation, installation, and ongoing maintenance services, acting as the primary link between the manufacturer and the SME end-user. This intricate distribution network ensures market penetration across geographies and varying business sizes.

PoS Accessories Market Potential Customers

Potential customers, or end-users/buyers, of PoS accessories are highly diversified but share the common need for reliable, fast, and compliant transactional infrastructure. The largest and most influential customer base comprises multi-national Retail Chains and Hypermarkets, which require extensive fleets of ruggedized scanners, high-speed thermal printers capable of handling large transaction volumes, and self-service kiosks that utilize specialized peripheral modules. These customers often prioritize scalability, centralized management features, and longevity due to their high usage rates and widespread deployment across numerous store locations globally.

The second major group includes the Food and Beverage (F&B) sector, specifically Quick-Service Restaurants (QSRs) and full-service dining establishments. QSRs are major consumers of kitchen display systems (KDS), specialized order printers, and mobile PoS accessories (mPoS card readers) to facilitate curbside pickup and table-side ordering. These buyers look for compact, grease-resistant, and high-connectivity accessories that can withstand demanding, high-temperature, and fast-paced operational environments. The adoption of customer-facing displays in this sector is also growing rapidly to enhance order accuracy and customer transparency.

Furthermore, Small and Medium Enterprises (SMEs) represent a fast-growing customer segment, particularly attracted to cost-effective, plug-and-play mPoS bundles which rely heavily on wireless accessories like Bluetooth receipt printers and small, integrated card readers. Lastly, specialized markets such as Healthcare (pharmacies and patient registration) and Transportation (ticketing and logistics) represent niche buyers seeking accessories that meet specific regulatory requirements, such as specialized labeling printers for patient IDs or ruggedized handheld scanners for warehouse management, prioritizing data security and portability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 23.9 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epson Corporation, Honeywell International Inc., Star Micronics Co., Ltd., Seiko Epson Corporation, Hewlett-Packard (HP), Datalogic S.p.A., NCR Corporation, Zebra Technologies Corporation, Bixolon Co., Ltd., Posiflex Technology, Inc., Citizen Systems Japan Co., Ltd., Fujitsu Ltd., Diebold Nixdorf, Incorporated, Custom SpA, Elo Touch Solutions, Inc., Logic Controls (A Bematech Company), Verifone, Ingenico (Worldline), Toshiba TEC Corporation, and Mettler-Toledo International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PoS Accessories Market Key Technology Landscape

The technology landscape for PoS accessories is predominantly defined by advancements in seamless connectivity, robust data capture, and modular integration capabilities, all vital for supporting modern retail environments. Near Field Communication (NFC) and Radio-Frequency Identification (RFID) technologies are fundamental, driving the expansion of contactless payment readers integrated into PoS terminals and facilitating efficient inventory management via RFID scanners. The increasing reliance on mobile and flexible setups is heavily supported by the widespread adoption of Bluetooth Low Energy (BLE) and enhanced Wi-Fi standards (e.g., Wi-Fi 6), which ensure stable, high-speed, and secure wireless communication between peripherals (like mPoS devices and printers) and the central system without the clutter of excessive cabling.

In data capture, the transition from linear (1D) barcode scanners to 2D imagers is nearly complete, driven by the need to read QR codes, digital coupons, and mobile wallet information, demanding higher processing power and image recognition capabilities within the accessory itself. Furthermore, the architecture of PoS systems is rapidly migrating towards cloud-based solutions, requiring accessories to be designed with native network capabilities (IP connectivity) or simplified drivers for quick setup and remote diagnostics. This shift supports centralized data management and software updates, minimizing physical intervention required at the accessory level.

The design philosophy of modern accessories prioritizes durability, modularity, and environmental efficiency. Manufacturers are employing ruggedized materials to protect components in demanding hospitality or warehouse environments and developing modular accessories that can be easily swapped or upgraded, protecting the retailer's initial hardware investment. Moreover, thermal printing technology continues to advance, focusing on higher resolution, faster print speeds, and mechanisms to reduce paper consumption, while customer display technology evolves to offer touch-sensitive interfaces and high-definition screens for interactive marketing and personalized engagement at the point of sale.

Regional Highlights

The global PoS Accessories Market displays varied growth dynamics influenced by regional economic conditions, technological maturity, and regulatory environments.

- North America (NA): Represents a mature and technologically advanced market characterized by high adoption rates of cutting-edge solutions like self-checkout systems, biometric scanners, and highly secure payment readers. The region leads in retail technology spending, driven by large retail chains and a focus on minimizing friction in the shopping experience. Regulatory compliance (PCI DSS standards) mandates frequent accessory upgrades, ensuring continuous replacement cycles and strong demand for wireless and integrated mPoS solutions, particularly in the rapidly growing e-commerce fulfillment and curbside pickup sectors.

- Europe: This region exhibits stable growth, heavily influenced by stringent data privacy regulations such as GDPR and the high penetration of contactless payments. European retailers prioritize accessories offering robust security features, EMV compliance, and energy efficiency. Western European countries maintain high accessory density, while Eastern Europe presents significant growth potential as smaller retailers modernize their infrastructure, driven by the expansion of multinational retail chains and the standardization of payment systems across the EU bloc.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, APAC's expansion is fueled by massive retail sector growth, rapid digitalization, and increasing disposable income across countries like China, India, and Southeast Asia. The region is seeing rapid deployment of PoS infrastructure in new retail establishments and an aggressive push towards cashless societies, resulting in massive demand for affordable, functional, and mobile-friendly accessories to cater to millions of small and mid-sized merchants entering the digital ecosystem.

- Latin America (LATAM): Growth in LATAM is driven by efforts to combat inflation and formalize the retail sector, leading to increased adoption of digital payment systems and associated accessories, particularly mPoS systems tailored for micro-businesses and mobile vendors. Brazil and Mexico are key markets, where economic stability improvements and consumer confidence are translating into increased investments in modernized transaction infrastructure.

- Middle East and Africa (MEA): This region is characterized by substantial infrastructure investment, particularly in the UAE, Saudi Arabia, and parts of South Africa, focused on developing world-class retail and hospitality sectors. Large-scale modernization projects, often linked to tourism and urban development goals, fuel demand for advanced, integrated PoS accessories. However, market growth is often fragmented, with significant opportunities in mobile banking and payment solutions addressing previously unbanked populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PoS Accessories Market.- Epson Corporation

- Honeywell International Inc.

- Star Micronics Co., Ltd.

- Seiko Epson Corporation

- Hewlett-Packard (HP)

- Datalogic S.p.A.

- NCR Corporation

- Zebra Technologies Corporation

- Bixolon Co., Ltd.

- Posiflex Technology, Inc.

- Citizen Systems Japan Co., Ltd.

- Fujitsu Ltd.

- Diebold Nixdorf, Incorporated

- Custom SpA

- Elo Touch Solutions, Inc.

- Logic Controls (A Bematech Company)

- Verifone

- Ingenico (Worldline)

- Toshiba TEC Corporation

- Mettler-Toledo International Inc.

Frequently Asked Questions

Analyze common user questions about the PoS Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the PoS Accessories Market?

The primary driver is the accelerating global adoption of digital, contactless, and mobile payment solutions, which mandates retailers to upgrade their peripheral hardware (such as NFC readers and mPoS devices) to maintain payment compliance and enhance transaction speed and customer service.

How is the rise of cloud-based PoS systems influencing accessory design?

Cloud-based systems necessitate accessories with simplified plug-and-play installation, universal compatibility, standardized network connectivity (often IP-enabled), and remote management capabilities to facilitate easy deployment and centralized maintenance across multiple locations.

Which accessory type holds the largest market share by revenue?

Receipt Printers and Barcode Scanners typically account for the largest market share by revenue, driven by their universal and mandatory requirement across nearly all retail, hospitality, and logistics operations globally.

What are the key technological advancements shaping the future of PoS accessories?

Key advancements include the integration of artificial intelligence for predictive maintenance and smart scanning, the ubiquity of high-speed wireless connectivity (Bluetooth 5.0 and Wi-Fi 6), and the adoption of modular, ruggedized designs supporting flexible, omnichannel retail environments.

Why is the Asia Pacific (APAC) region experiencing the fastest market growth?

APAC's accelerated growth is due to rapid urbanization, massive consumer base expansion, government initiatives promoting cashless transactions, and widespread infrastructure modernization across developing economies, leading to high-volume deployment of new PoS systems and peripherals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager