POS Receipt Printers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437655 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

POS Receipt Printers Market Size

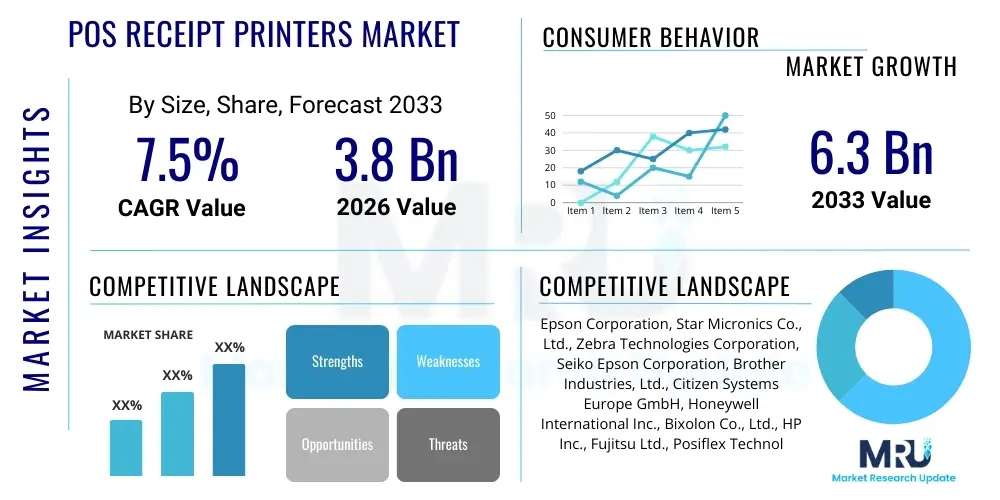

The POS Receipt Printers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

POS Receipt Printers Market introduction

The POS Receipt Printers Market encompasses the manufacturing, distribution, and deployment of specialized printing hardware used to generate transactional receipts at the point of sale (POS). These devices are integral components of modern retail, hospitality, and service infrastructures, providing essential documentation for customers and operational records for businesses. Traditionally dominated by thermal and impact (dot matrix) technologies, the market is undergoing transformation driven by the increasing adoption of mobile POS (mPOS) systems, requiring compact, wireless, and energy-efficient printing solutions. The core product category includes stationary printers used at fixed checkout lanes and portable printers integrated into mobile payment platforms. The consistent demand for quick, reliable, and legible transaction records across diverse industries underpins the market's stability and sustained expansion.

Major applications of these printers span across several critical sectors. Retail, including supermarkets, specialty stores, and department stores, represents the largest end-user segment due to the high volume of daily transactions. The hospitality sector, encompassing restaurants, cafes, and hotels, relies heavily on these systems for order management, kitchen ticketing, and final billing processes, often necessitating specialized features like spill-resistant designs or faster printing speeds. Furthermore, the burgeoning demand from sectors such as healthcare (for billing and prescription receipts), transportation, and entertainment venues further broadens the application landscape. The utility of the receipt printer extends beyond mere customer receipts to include internal operational functions like report generation, shift summaries, and promotional coupon printing, enhancing its value proposition within the broader POS ecosystem.

Driving factors for market growth include the global expansion of organized retail in developing economies, the accelerated digitalization of payment methods, and the continuous necessity for regulatory compliance regarding transaction documentation. Benefits derived from advanced POS receipt printers include enhanced customer satisfaction through faster checkout times, improved operational efficiency by automating transaction recording, and reduced cost of ownership associated with modern thermal printers that eliminate the need for ink cartridges. Additionally, the shift towards printers capable of integrating QR codes or promotional messages on receipts provides businesses with added marketing potential. The increasing preference for cloud-based POS systems that seamlessly integrate with network-enabled printers is also a pivotal trend propelling market innovation.

POS Receipt Printers Market Executive Summary

The POS Receipt Printers Market is characterized by a strong convergence of technological advancements, particularly the shift from traditional wired systems to wireless (Bluetooth/Wi-Fi) solutions compatible with mPOS platforms. Business trends indicate a focus on durability, speed, and energy efficiency, responding to the high-volume requirements of global retail and hospitality giants. Key market players are concentrating on developing compact, mobile thermal printers to capitalize on the rapid growth of small and medium-sized enterprises (SMEs) adopting smartphone or tablet-based POS setups. Furthermore, the market exhibits segmentation driven by end-user demands, where premium brands prioritize robust, high-speed thermal printers for large-scale operations, while lower-cost alternatives meet the needs of smaller merchants. The competitive landscape is intensely focused on connectivity protocols and software integration capabilities.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing region, fueled by rapid urbanization, increasing penetration of digital payment methods, and massive expansion of the retail and quick-service restaurant (QSR) industries, particularly in India, China, and Southeast Asian nations. North America and Europe, while mature, maintain strong market shares driven by frequent technology upgrades, high regulatory standards requiring clear transaction traceability, and the widespread adoption of advanced self-checkout and integrated POS kiosks. The Middle East and Africa (MEA) are emerging regions showing significant potential, driven by infrastructure development and rising disposable incomes leading to growth in organized retail formats. The regulatory environment in each region, concerning data privacy and mandatory receipt issuance, significantly dictates market demand and product specifications.

Segmentation trends reveal that thermal technology dominates the market due to its speed, low noise, and minimal maintenance requirements compared to impact printers. However, impact printers still maintain relevance in specific environments where multi-part forms or long-term archival receipts are necessary, such as specialized banking or logistics applications. Connectivity trends show a clear preference for wireless integration, supporting the flexibility needed for modern business operations. The application segment remains dominated by retail, but hospitality is showing accelerated growth due to the implementation of table-side ordering and mobile payment solutions. Sustainability is also becoming a segment trend, with growing consumer and corporate interest in paper-saving receipt features and energy-efficient hardware design.

AI Impact Analysis on POS Receipt Printers Market

User inquiries regarding AI's influence on POS receipt printers typically revolve around three core themes: the potential obsolescence of physical receipts, how AI optimizes printer maintenance and operations, and the integration of smart receipt data into broader retail analytics. Users are keen to understand if AI-driven personalization and loyalty programs will still necessitate a physical receipt or if the shift to entirely digital receipts will be accelerated. The key expectation is that AI will enhance the "intelligence" of the receipt printing process, moving beyond simple output to providing predictive maintenance alerts, optimizing paper usage through smart layout algorithms, and using aggregated receipt data (via integrated POS systems) to provide real-time inventory and consumer behavior insights back to the retailer, effectively streamlining the downstream value chain. This shift integrates the printer as a data endpoint rather than just an output device.

- AI-driven Predictive Maintenance: Utilizing sensor data from printers (heat, print cycles, cutter use) to forecast hardware failures, minimizing downtime.

- Optimized Paper Consumption: AI algorithms adjust receipt length and layout based on transactional data and regulatory minimums, reducing thermal paper waste.

- Integration with Retail Analytics: Receipt data is instantaneously processed by AI systems for real-time inventory management, personalized offers printed directly onto receipts, and dynamic pricing strategies.

- Enhanced Security Monitoring: AI capabilities monitor printer network traffic to detect anomalies or potential data breaches during transaction processing.

- Intelligent Error Resolution: Automated, AI-guided troubleshooting instructions displayed to staff or relayed to service teams, improving first-time fix rates.

DRO & Impact Forces Of POS Receipt Printers Market

The market dynamics are governed by a complex interplay of growth accelerators, structural limitations, and evolving technological opportunities. Key drivers include the massive expansion of the retail sector, particularly in emerging markets, coupled with the increasing adoption of mPOS systems worldwide, demanding compact, versatile printing solutions. The regulatory necessity for printed proof of transaction in numerous jurisdictions further anchors the demand for these devices. Conversely, the primary restraints center on the environmental concern and high cost associated with thermal paper, pushing businesses toward digital receipt alternatives, which threatens the growth of physical printer usage. Additionally, the proliferation of specialized point-of-sale software solutions requires constant hardware compatibility updates, posing integration challenges for legacy systems. Opportunities lie in developing sustainable, inkless printing technologies and integrating advanced IoT and cloud capabilities for better fleet management and data utilization.

Drivers are specifically focused on operational efficiencies and market expansion. The continuous development and affordability of thermal printing technology have made high-speed receipt issuance commonplace, boosting efficiency in high-traffic environments like QSRs. Furthermore, the global trend of replacing traditional cash registers with sophisticated, integrated POS terminals, which often include dedicated printer interfaces, generates significant replacement and initial purchase demand. The ease of setting up mobile printers using standard Bluetooth or Wi-Fi protocols has substantially lowered the barrier to entry for small businesses adopting digital payment systems, thereby expanding the potential customer base rapidly. The inherent reliability and low maintenance of modern thermal units contribute significantly to their continued widespread appeal across various demanding operational settings.

Restraints are primarily technological and environmental in nature. The most significant long-term restraint is the escalating consumer preference and regulatory push for digital receipts delivered via email or SMS, aiming to reduce paper usage and environmental footprint. This trend, if fully realized, could suppress the demand for physical printers, particularly in developed economies. Another restraint is the commoditization of basic thermal printers, leading to intense price competition and compressed profit margins for manufacturers of standard models. Manufacturers must continuously innovate by adding value-added features, such as advanced data encryption capabilities or built-in receipt scanning functions, to justify premium pricing and maintain profitability against low-cost Asian competitors. Successfully navigating the digital shift while maintaining the critical role of physical receipts remains the central challenge for market stakeholders.

- Drivers (D): Global expansion of organized retail; rapid adoption of mPOS systems; mandatory transactional documentation requirements; advancements in high-speed thermal printing technology.

- Restraints (R): Increasing adoption of digital receipts (e-receipts); environmental concerns related to thermal paper waste; intense price competition and commoditization of basic models.

- Opportunities (O): Integration of IoT and cloud services for remote diagnostics; development of sustainable, eco-friendly receipt alternatives; growth in specialized application areas like healthcare and logistics.

- Impact Forces: Technological substitution (digital receipts vs. physical prints); regulatory compliance and data security mandates; shift towards compact, portable devices.

Segmentation Analysis

The POS Receipt Printers Market is strategically segmented based on core variables including the underlying printing technology, connectivity type, and diverse end-user applications. Understanding these segments is crucial for manufacturers to tailor product development and for businesses to select appropriate systems based on speed, durability, and integration needs. Technology segmentation highlights the clear dominance of thermal printing due to its operational advantages, though impact printers maintain niche relevance. Connectivity segmentation reflects the modernization of POS infrastructure, emphasizing mobility and wireless communication protocols like Bluetooth and Wi-Fi over traditional USB or Serial connections. The application segmentation provides insight into where the highest volume and specific functional requirements originate, allowing targeted marketing efforts.

The segmentation by technology differentiates between thermal and impact (dot matrix) printers. Thermal printers, which utilize heat to produce images on specially coated paper, are preferred globally for their quiet operation, high speed, and lack of reliance on consumables like ink ribbons, making them ideal for high-throughput environments such as retail checkouts and busy QSRs. Conversely, impact printers, while slower and noisier, remain essential in environments requiring multi-ply paper or long-lasting receipts where thermal paper fading is a concern, often found in banking, utility services, or specific back-office operations. The ongoing investment in thermal technology aims at improving resolution, durability, and reducing the environmental impact of the specialized paper.

Application segmentation remains the most pivotal driver of volume and specific product features. The Retail sector is the largest consumer, requiring standardized, reliable, and often high-capacity stationary printers. The Hospitality segment demands specialized features such as compact size for mobile use, spill resistance, and dual functionality for both customer receipts and kitchen order printing (KOTs). The emerging institutional segments, including healthcare and government services, focus more on security features, clear archival quality, and integration with specialized enterprise resource planning (ERP) systems. The varying needs across these applications necessitate a diverse portfolio of printer models, ranging from robust industrial units to sleek, portable Bluetooth devices tailored for specific operational contexts.

- By Technology:

- Thermal Printers

- Impact/Dot Matrix Printers

- By Connectivity:

- Wired (USB, Serial, Ethernet)

- Wireless (Bluetooth, Wi-Fi)

- By End-User Application:

- Retail (Grocery Stores, Supermarkets, Specialty Retail)

- Hospitality (Restaurants, Cafes, Hotels)

- Healthcare and Pharmacy

- Transportation and Logistics

- Others (Banking, Entertainment, Government)

- By Portability:

- Stationary/Desktop

- Mobile/Portable

Value Chain Analysis For POS Receipt Printers Market

The value chain for POS receipt printers begins with raw material suppliers providing electronic components, specialized plastic casings, thermal print heads, and paper-handling mechanisms. Upstream activities are dominated by component sourcing and sophisticated manufacturing processes, focusing on precision engineering and cost-effective assembly, often centralized in Asia Pacific regions to leverage scalable supply chains. Key activities in this stage include R&D for faster print mechanisms and development of specialized connectivity modules. Manufacturers, such as Epson and Star Micronics, then assemble these components, focusing on product reliability, software driver development, and compliance with various regional standards (e.g., electrical safety, wireless certifications). Quality control and inventory management are critical components of the upstream segment, ensuring robust and compliant final products.

The distribution channel forms the crucial link between manufacturers and diverse end-users. Distribution is multifaceted, involving both direct and indirect channels. Direct distribution often targets large enterprise customers (e.g., major retail chains, large hotel groups) through direct sales teams and OEM agreements, ensuring customized solutions and volume pricing. Indirect distribution relies heavily on a network of authorized distributors, specialized Value-Added Resellers (VARs), and System Integrators (SIs). VARs are particularly important as they bundle the printer hardware with POS software, cash drawers, and other peripherals, offering complete, turnkey solutions tailored for SMEs. E-commerce platforms are increasingly serving as a fast, low-cost channel for replacement parts and standardized models, particularly catering to smaller businesses or individual repair needs. This multi-channel approach ensures wide market reach and specialized support tailored to customer scale.

Downstream activities center on deployment, integration, and post-sales support. Successful deployment requires seamless integration with diverse POS software platforms (both local and cloud-based), operating systems (Windows, iOS, Android), and network environments. Service providers and SIs manage the physical installation and initial configuration, often including training for operational staff. Post-sales support, including warranty services, repair, and provision of consumables (thermal paper, ribbons), is essential for customer retention and maintaining system uptime. The continuous feedback loop from end-users back to manufacturers regarding durability, ease of use, and compatibility drives future product improvements and innovations in areas such as remote diagnostics and firmware updates. The efficiency of the downstream support significantly influences brand reputation and overall market share.

POS Receipt Printers Market Potential Customers

Potential customers, or end-users, for POS receipt printers are incredibly diverse, reflecting any organization that handles direct consumer transactions requiring physical documentation. The largest segment remains the retail ecosystem, which includes everyone from small independent boutiques requiring a single mobile printer to multinational supermarket chains deploying thousands of fixed-station thermal printers across hundreds of locations. These retailers seek devices offering high speed and reliability to minimize customer queue times, coupled with robust connectivity options to ensure network stability across vast POS networks. The necessity for quick, reliable hardware is paramount across all sub-segments of the retail industry, driving consistent demand for new and replacement units.

The hospitality sector constitutes the second major customer base, encompassing quick-service restaurants, fine dining establishments, bars, and hotel operations. These customers often have unique requirements, such as dual-interface capabilities for kitchen order printing and customer billing, or highly durable, water-resistant enclosures for use in demanding kitchen or bar environments. The shift towards tableside ordering and mobile payment has significantly increased the demand for compact, long-battery-life mobile thermal printers in this segment. Furthermore, the institutional market, including healthcare facilities (for billing and patient records), logistics companies (for waybills and delivery confirmations), and public sector entities (for ticketing and fee collection), represents a growing segment focusing on specific regulatory compliance and long-term receipt stability.

In addition to large enterprises, the rapidly expanding ecosystem of Small and Medium-sized Enterprises (SMEs) is a critical consumer group. Driven by the accessibility and affordability of modern cloud-based mPOS systems (such as Square or Shopify POS), these businesses are first-time buyers of receipt printers, primarily preferring low-cost, easy-to-configure, wireless thermal printers. Their purchasing decisions are highly influenced by total cost of ownership (TCO), ease of integration with existing tablets or smartphones, and minimal maintenance requirements. Technology providers and resellers focus heavily on this segment by offering bundled solutions that include software, hardware, and ongoing technical support, ensuring that the market penetration continues beyond just the large established enterprise segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epson Corporation, Star Micronics Co., Ltd., Zebra Technologies Corporation, Seiko Epson Corporation, Brother Industries, Ltd., Citizen Systems Europe GmbH, Honeywell International Inc., Bixolon Co., Ltd., HP Inc., Fujitsu Ltd., Posiflex Technology, Inc., NCR Corporation, Custom America, Inc., SATO Holdings Corporation, Oki Data Corporation, Peripage, Xprinter, SNBC, Dascom, Tysso. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

POS Receipt Printers Market Key Technology Landscape

The technological landscape of the POS Receipt Printers market is primarily defined by the evolution of thermal printing and advanced connectivity solutions. Thermal technology remains dominant, offering superior speed, reduced noise, and lower TCO compared to traditional impact printing. Recent advancements focus on improving the lifespan of the thermal print head and enhancing resolution for printing complex graphics, logos, or high-density barcodes/QR codes, which are increasingly utilized for loyalty programs and digital validation. Furthermore, manufacturers are focusing heavily on integrating advanced sensors and diagnostics tools directly into the printers, enabling remote monitoring of paper levels, print head health, and temperature. This integration is crucial for maintaining uptime in large, geographically dispersed retail operations and supports the shift towards IoT-enabled fleet management services.

Connectivity advancements are the second major defining factor, driving the market towards greater flexibility and integration capability. The proliferation of mPOS requires seamless wireless communication, making Bluetooth Low Energy (BLE) and robust dual-band Wi-Fi connectivity standard features. Ethernet connectivity remains essential for fixed stations that require high reliability and network security, particularly in corporate environments. Furthermore, the development of universal printer drivers and standardized APIs (Application Programming Interfaces) ensures easy integration with various proprietary and open-source POS software platforms running on Windows, Android, and iOS. This focus on cross-platform compatibility accelerates deployment times and reduces the complexity associated with system integration for end-users.

Future technology trends point towards sustainability and enhanced data security. Research is ongoing into "inkless" and "paper-saving" technologies, such as reversible thermal printing or alternative marking methods, to address the environmental criticisms of thermal paper. On the data security front, printers are evolving to include built-in encryption and secure booting mechanisms, ensuring that sensitive transaction data, especially when handled over a network in compliance with PCI DSS (Payment Card Industry Data Security Standard), remains protected throughout the printing process. The integration of proximity sensors for automated power management and energy efficiency, along with modular designs that allow for easier repairs and upgrades, also represents a significant trend in improving the overall value proposition of modern POS printing hardware.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, primarily driven by rapid economic growth, burgeoning middle-class populations, and the massive expansion of organized retail chains, supermarkets, and QSRs, especially in China, India, and Southeast Asia. The region is highly sensitive to price, leading to strong demand for cost-effective, high-volume thermal printers and a rapid uptake of mobile solutions in informal retail sectors.

- North America: This region maintains a high market share characterized by early adoption of advanced technologies, high regulatory compliance standards (e.g., specific receipt content requirements), and a significant replacement cycle driven by upgrades to smart POS systems and integrated self-service kiosks. Demand is strong for high-end, network-enabled thermal printers and mobile units supporting modern payment technologies.

- Europe: Europe is a mature market focused on sustainability and sophisticated data privacy compliance (GDPR). The market is driven by technology refreshment cycles and the increasing implementation of sophisticated mPOS solutions in hospitality and boutique retail. Western European countries demonstrate high demand for eco-friendly printing options and devices with integrated digital receipt functionality.

- Latin America (LATAM): Growth in LATAM is strong, fueled by increasing digitalization of economies, rising foreign investment in retail and hospitality sectors, and efforts to formalize business transactions, which mandates physical receipt issuance. Brazil and Mexico are key markets, showing robust demand for both stationary and mobile printers to support widespread deployment of modern POS infrastructure.

- Middle East and Africa (MEA): This region is an emerging market with substantial growth potential, linked directly to large-scale infrastructure projects, urbanization, and the entry of international retail brands. The demand is currently concentrated in urban centers within the GCC countries and South Africa, focusing on robust, durable printers suitable for potentially challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the POS Receipt Printers Market.- Epson Corporation

- Star Micronics Co., Ltd.

- Zebra Technologies Corporation

- Seiko Epson Corporation

- Brother Industries, Ltd.

- Citizen Systems Europe GmbH

- Honeywell International Inc.

- Bixolon Co., Ltd.

- HP Inc.

- Fujitsu Ltd.

- Posiflex Technology, Inc.

- NCR Corporation

- Custom America, Inc.

- SATO Holdings Corporation

- Oki Data Corporation

- Peripage

- Xprinter

- SNBC

- Dascom

- Tysso

Frequently Asked Questions

Analyze common user questions about the POS Receipt Printers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the POS Receipt Printers Market?

The primary driver is the global adoption of mobile Point-of-Sale (mPOS) systems, which necessitates compact, wireless, and efficient thermal printers to support transactions across expanding retail and hospitality sectors worldwide, particularly in emerging economies.

How are environmental concerns impacting the demand for traditional receipt printers?

Environmental concerns regarding thermal paper waste are acting as a restraint, accelerating the shift towards digital receipts (e-receipts) delivered via email or SMS, particularly in environmentally conscious regions like Europe and North America, necessitating manufacturers to invest in paper-saving technologies.

Which type of connectivity is most preferred in modern POS systems?

Wireless connectivity, predominantly Bluetooth and Wi-Fi, is highly preferred due to its compatibility with mobile devices, flexibility in terminal placement, and ease of integration with cloud-based POS software platforms, supporting the modern, flexible retail layout.

What role does AI play in the future development of POS receipt printers?

AI's role focuses on optimizing printer operations through predictive maintenance, monitoring hardware health remotely, reducing paper waste via smart layout algorithms, and enhancing security, positioning the printer as an intelligent data endpoint within the POS ecosystem.

Are thermal printers completely replacing impact (dot matrix) printers?

While thermal printers dominate due to speed and efficiency, impact printers are not fully obsolete; they maintain a necessary niche in applications requiring carbon copies, multi-part forms, or archival-quality receipts where thermal paper fading is unacceptable, such as in banking or logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager