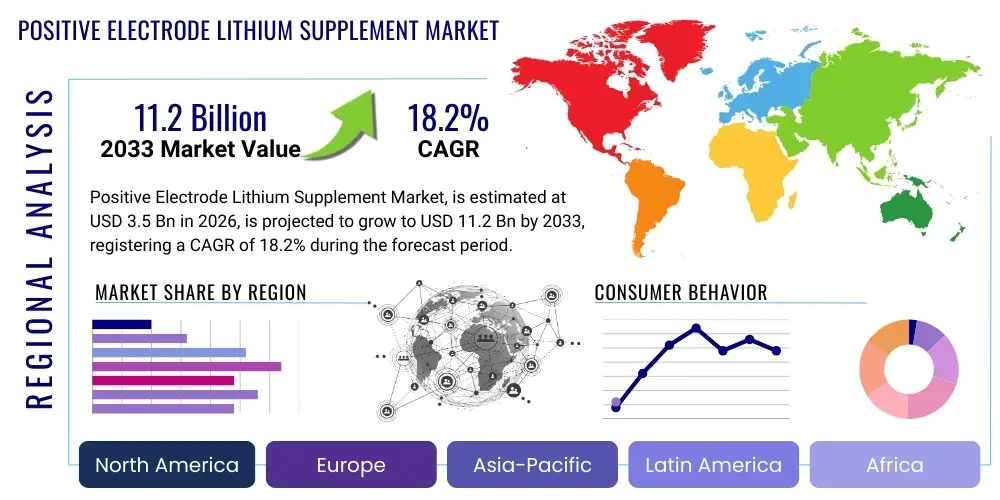

Positive Electrode Lithium Supplement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436617 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Positive Electrode Lithium Supplement Market Size

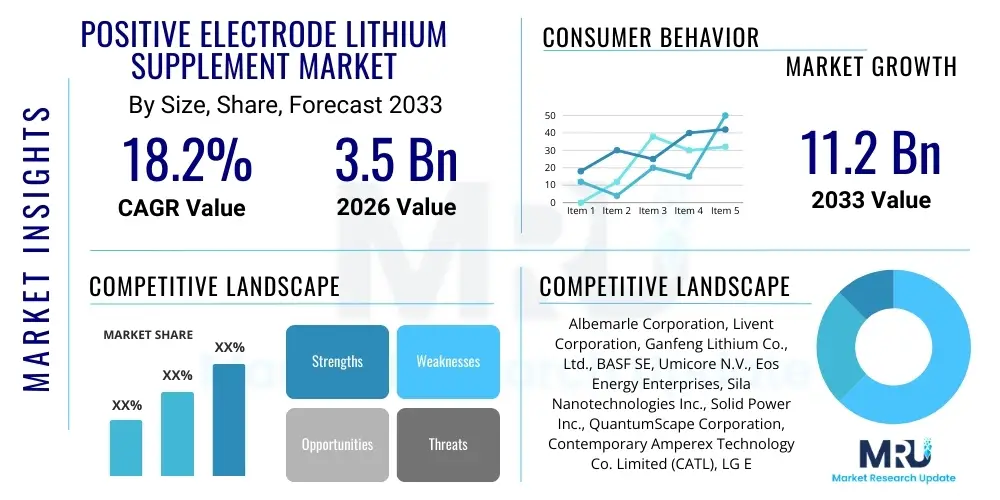

The Positive Electrode Lithium Supplement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.2% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Positive Electrode Lithium Supplement Market introduction

The Positive Electrode Lithium Supplement Market encompasses advanced material additives, often lithium-rich compounds or specialized salts, designed to be incorporated into or onto the cathode material (such as NCA, NMC, or LFP) of lithium-ion batteries. These supplements primarily aim to compensate for the irreversible loss of active lithium during the initial charging cycles (formation cycling), a critical process that significantly determines the battery's long-term capacity retention and overall cycle life. By pre-lithiating the positive electrode, manufacturers can effectively increase the usable lithium inventory, thereby boosting the energy density and ensuring greater stability of the electrode structure under high voltage operation.

Product descriptions within this segment typically include materials like lithium metal powder, stabilized lithium metal particles, or high-purity lithium compounds encapsulated in protective coatings to enhance handling safety and integration efficacy. Major applications are predominantly found in high-performance energy storage systems, especially electric vehicles (EVs), grid-scale energy storage (ESS), and high-end portable electronics where maximizing specific energy and power density is paramount. The increasing global regulatory push toward electrification and the urgent need for longer-lasting, faster-charging batteries are fundamentally driving the uptake of these supplementary technologies.

Key benefits derived from employing positive electrode lithium supplements include improved initial Coulombic efficiency (ICE), reduced capacity fade over hundreds of cycles, and the ability to operate cathodes at higher states of charge without premature degradation. Furthermore, these supplements are crucial for next-generation anode materials, such as silicon or silicon-carbon composites, which inherently consume large amounts of active lithium during operation. Driving factors include aggressive R&D investments in battery material science, governmental subsidies for EV manufacturing, and the continuous industrial demand for energy storage solutions that offer superior volumetric and gravimetric energy densities compared to current commercial benchmarks.

Positive Electrode Lithium Supplement Market Executive Summary

The Positive Electrode Lithium Supplement Market is characterized by robust growth driven by the exponential expansion of the electric vehicle sector and critical advancements in solid-state battery technology requiring high-performance electrode components. Business trends indicate a strong focus on strategic vertical integration by major battery manufacturers (gigafactories) seeking to secure consistent supply and control the intellectual property related to advanced lithium supplements. Technological innovation centers around developing safer, more cost-effective methods for pre-lithiation, particularly addressing issues related to material handling, storage stability, and ensuring homogeneous integration into slurry processes without compromising electrode integrity. Furthermore, sustainability requirements are pushing companies to explore high-efficiency synthesis routes that minimize waste and energy consumption in supplement production.

Regionally, the Asia Pacific (APAC) dominates the market, primarily due to the concentration of leading battery cell manufacturers and the massive production capacity established in China, South Korea, and Japan. Europe and North America are experiencing the fastest growth trajectories, fueled by significant government incentives (such as the Inflation Reduction Act in the US and European Green Deal policies) aimed at establishing resilient domestic battery supply chains. Regional trends highlight intense competition in securing raw material supplies (high-purity lithium sources) necessary for supplement manufacturing, leading to increased investments in resource exploration and refining capacities outside traditional centers.

Segment trends emphasize the rapid adoption of stabilized lithium metal powders and coated lithium compounds, offering superior performance compared to simple salts. The application segment sees Electric Vehicles maintaining the largest market share, though grid storage is emerging as a powerful growth driver due to large-scale renewable energy integration projects globally. There is a perceptible shift towards specialized supplements tailored specifically for high-nickel cathodes (like NMC 811 and higher) where initial capacity loss is a more pronounced challenge, necessitating targeted pre-lithiation strategies to maximize operational life and safety parameters inherent to these advanced material chemistries.

AI Impact Analysis on Positive Electrode Lithium Supplement Market

Common user questions regarding AI's impact typically revolve around how machine learning can accelerate the discovery of novel lithium supplement formulations, optimize complex manufacturing processes (such as particle coating and dispersion), and predict the long-term electrochemical performance of supplemented electrodes. Users are concerned about the ability of AI models to manage the vast datasets generated during high-throughput experimentation (HTE) for screening potential candidates, potentially reducing the time-to-market for next-generation supplements. Key themes emerging from these inquiries include the expectation that AI will standardize quality control, minimize batch-to-batch variation, and enhance the integration predictability of supplements into diverse cathode chemistries, ultimately lowering production costs and improving product consistency across the supply chain, which is critical for mass battery production.

- AI-driven material discovery accelerates the screening and optimization of new lithium supplement chemistries, identifying compounds with superior stability and efficacy.

- Machine learning models optimize complex synthesis parameters (temperature, pressure, precursor ratio) for high-purity supplement production, enhancing yield and consistency.

- Predictive maintenance analytics, powered by AI, monitor large-scale manufacturing equipment used in supplement processing, minimizing downtime and operational variability.

- Data analytics facilitate the correlation between supplement physicochemical properties (particle size, surface area, coating thickness) and resulting battery performance metrics (cycle life, capacity retention).

- AI simulation tools reduce the need for expensive and time-consuming physical prototyping by accurately modeling supplement integration and diffusion behavior within electrode structures.

DRO & Impact Forces Of Positive Electrode Lithium Supplement Market

The market is predominantly driven by the surging global demand for high-energy density batteries, particularly within the automotive sector, where extending EV range is a competitive differentiator. Restraints include the high cost associated with producing ultra-high-purity and stabilized lithium supplements, complex manufacturing challenges related to material stability and safety during handling, and lingering intellectual property hurdles in this specialized materials segment. Opportunities lie in developing cost-effective, non-flammable supplement alternatives and expanding applications beyond EVs into grid storage and aerospace. These market dynamics are heavily influenced by the interplay between stringent performance demands (Drivers) and the technical complexity required for stable integration (Restraints), opening avenues for patented solutions (Opportunities).

Drivers include regulatory mandates promoting zero-emission vehicles, rapid advancements in high-nickel cathode materials (which require pre-lithiation to stabilize performance), and continuous price pressure reduction on lithium-ion batteries necessitating enhanced energy throughput per unit cost. However, the market faces significant restraints from the volatility of raw lithium prices and the extensive regulatory approval processes required for introducing novel chemical additives into commercial battery manufacturing streams. Furthermore, the inherent reactivity of some supplementary materials, particularly pure lithium metal components, poses considerable safety and handling challenges throughout the supply chain, increasing operational risk and insurance costs for manufacturers.

The primary opportunity revolves around integrating these supplements with cutting-edge battery architectures, such as all-solid-state batteries and lithium-sulfur systems, where capacity loss mechanisms are even more pronounced and require robust pre-lithiation solutions. Impact forces are strong and directional, primarily stemming from macro-economic policy shifts (subsidies, trade agreements) and fundamental technological breakthroughs (e.g., successful commercialization of enhanced silicon anodes, which exponentially increases the demand for lithium supplements). These forces dictate investment cycles, prioritizing companies that can offer high-performance, scalable, and safe supplement technologies that adhere to global environmental and ethical sourcing standards, positioning product differentiation based on stability and efficiency rather than just raw material cost.

Segmentation Analysis

The Positive Electrode Lithium Supplement Market is comprehensively segmented based on material type, application, and end-use industry, reflecting the diverse requirements of the advanced battery ecosystem. Material segmentation differentiates between highly reactive stabilized lithium metal powders, various complex coated lithium compounds, and specialized lithium salts, each offering unique performance benefits and integration challenges. The application segmentation focuses on the specific cathode chemistries being supplemented, such as Nickel Manganese Cobalt (NMC), Lithium Iron Phosphate (LFP), and Nickel Cobalt Aluminum (NCA), as supplement requirements vary significantly based on the cathode's inherent stability and lithium consumption profile. Understanding these segments is crucial for manufacturers to tailor product specifications precisely to market needs, maximizing electrochemical compatibility and cost-effectiveness.

The segmentation by end-use industry clearly highlights the dominance of the automotive sector, driven by the massive scale of EV production globally, which necessitates consistent, high-volume supply of reliable battery supplements. The grid energy storage segment, while smaller in volume currently, is exhibiting substantial growth due to global renewable energy targets and the requirement for large-scale, long-duration storage solutions where maximizing cycle life through pre-lithiation is highly valuable. Portable electronics and industrial equipment represent stable but mature segments requiring smaller volumes of highly specialized supplement materials for premium products. This granular segmentation allows market players to focus their research and development efforts on the most lucrative and technically challenging areas, such as developing high-stability supplements for large-format prismatic cells used in heavy-duty commercial vehicles and utility applications.

Further segment refinement involves analyzing the form factor—powder versus slurry or granule—as this dictates the ease of integration into existing gigafactory production lines. Optimized material dispersion and process efficiency are key determinants of market acceptance. Given the high capital expenditure required for pre-lithiation processes, market growth is often concentrated in high-value, high-performance battery sectors where the enhanced cost of the supplement is justified by significant gains in battery lifespan and energy output. Emerging segments include specialized supplements designed to improve fast-charging capabilities, potentially using surface modification techniques that rely heavily on the precise chemistry of the supplementing material to control interfacial reactions and lithium plating kinetics, ensuring safer and more efficient charging protocols are achieved.

- By Material Type:

- Stabilized Lithium Metal Powder (SLMP)

- Coated Lithium Compounds (e.g., Li2O, LiF, Li2CO3 derivatives)

- Lithium Salts and Complex Additives

- Proprietary Polymer Encapsulated Lithium

- By Application (Cathode Chemistry):

- NMC (Nickel Manganese Cobalt)

- NCA (Nickel Cobalt Aluminum)

- LFP (Lithium Iron Phosphate)

- High-Voltage Spinel (e.g., LMO)

- By End-Use Industry:

- Electric Vehicles (EVs, PHEVs, HEVs)

- Grid Energy Storage Systems (ESS)

- Portable Consumer Electronics

- Industrial and Specialized Applications (Aerospace, Medical Devices)

Value Chain Analysis For Positive Electrode Lithium Supplement Market

The value chain for Positive Electrode Lithium Supplements begins with the upstream sourcing of high-purity lithium raw materials, primarily lithium carbonate and lithium hydroxide, which form the base precursors. This upstream stage is characterized by intense geopolitical scrutiny and capital-intensive extraction and refining processes, often involving specialized purification to achieve the stringent quality requirements needed for battery-grade supplements. Specialized chemical synthesis and material engineering companies then take these precursors and transform them through proprietary processes—such as chemical vapor deposition, atomic layer deposition, or mechanical stabilization—into the final supplement products, requiring advanced manufacturing expertise to control particle morphology and surface chemistry for optimal performance and safety.

Midstream activities involve the actual supplement manufacturing, including processes for stabilization, coating, and packaging. Due to the air and moisture sensitivity of many lithium supplements (especially SLMP), specialized inert manufacturing environments and robust packaging solutions are mandatory, significantly increasing operational complexity and capital costs. Following production, the distribution channel plays a crucial role. Distribution is often direct, involving close, technical partnerships between the supplement manufacturers and Tier 1 battery cell producers (e.g., LG Energy Solution, CATL, Panasonic). These direct channels facilitate rapid feedback loops regarding material integration success and performance validation, crucial in the high-stakes environment of battery production.

Downstream activities center on the integration of the supplement during the electrode manufacturing stage at the gigafactories. This involves precise metering and mixing of the supplement into the cathode slurry formulation before coating and calendering. Indirect distribution, though less common for high-volume, performance-critical materials, may involve specialized chemical distributors providing smaller quantities to research institutions, pilot plants, or niche battery manufacturers focusing on specialized applications. The ultimate end-users are the large-scale industrial consumers (EV OEMs and utility companies) who depend on the optimized battery cells enabled by these supplements, highlighting the crucial, though often hidden, role of these specialized materials in determining final product quality and competitiveness.

Positive Electrode Lithium Supplement Market Potential Customers

The primary potential customers and end-users of Positive Electrode Lithium Supplements are the global battery manufacturing giants (gigafactories) responsible for producing Lithium-Ion Cells (LICs) on a mass commercial scale. These manufacturers, including major players in Asia, Europe, and North America, are the direct buyers, integrating the supplements into their proprietary cathode formulation processes. Their procurement decisions are driven not solely by price but primarily by quantifiable performance improvements, such as enhanced cycle life, higher energy density metrics, and documented consistency in material batches. Given the high costs associated with battery material qualification, securing supply contracts with a few major cell producers represents the most significant revenue stream for supplement suppliers.

Secondary but rapidly growing customer segments include specialized battery developers focusing on niche applications, such as high-temperature aerospace batteries, medical device power sources, and small-volume specialty vehicles requiring custom energy storage solutions. Furthermore, major automotive original equipment manufacturers (OEMs), although typically not the direct purchasers of the supplement material itself, exert immense pressure on their battery suppliers to utilize advanced materials, effectively serving as the ultimate demand drivers and setting the performance specifications that necessitate the use of supplements. Their procurement power strongly influences the material choices made upstream by cell manufacturers.

Additionally, independent research institutions, governmental energy labs, and advanced material science universities constitute a consistent, albeit smaller, segment of customers. These entities purchase supplements for R&D purposes, focusing on next-generation battery architectures like all-solid-state or lithium-air batteries, where pre-lithiation techniques are crucial for stabilizing novel components. The future market expansion depends heavily on successfully demonstrating the scalability and cost-effectiveness of these materials to the top 10 global battery producers, ensuring that the performance gains justify the increased material cost and integration complexity within high-throughput manufacturing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 18.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Livent Corporation, Ganfeng Lithium Co., Ltd., BASF SE, Umicore N.V., Eos Energy Enterprises, Sila Nanotechnologies Inc., Solid Power Inc., QuantumScape Corporation, Contemporary Amperex Technology Co. Limited (CATL), LG Energy Solution, Posco Chemical, SK Innovation, BYD Company Limited, Mitsubishi Chemical Corporation, Nippon Chemical Industrial Co., Ltd., Tianqi Lithium Corporation, Milliken & Company, Honjo Chemical Co., Ltd., Targray Technology International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Positive Electrode Lithium Supplement Market Key Technology Landscape

The technological landscape for positive electrode lithium supplements is highly dynamic, focused primarily on achieving maximum performance benefits while ensuring the chemical stability and safe handling of the materials. Key technologies revolve around advanced stabilization techniques, crucial because pure lithium metal is highly reactive. Stabilized Lithium Metal Powder (SLMP) relies on thin, inert coatings (often based on oxides, nitrides, or fluorides) applied through sophisticated techniques such as atomic layer deposition (ALD) or chemical vapor deposition (CVD). These coatings passivate the lithium surface, preventing immediate reaction with air or solvents during electrode processing, thereby allowing for safe integration into slurry-based manufacturing lines without requiring expensive, ultra-dry facilities for the entire process. The precision of these coating technologies dictates the supplement’s shelf life and integration efficiency.

Another crucial technological area is the development of non-metallic or composite lithium supplements, moving away from pure lithium metal powder toward highly reactive lithium compounds (e.g., pre-lithiated silicon oxides or specialized lithium precursors). These compounds aim to deliver the necessary active lithium inventory while offering superior thermal stability and reduced environmental sensitivity. Material engineering focuses on optimizing particle morphology, ensuring the supplement particles are homogeneously dispersed throughout the cathode material without aggregating or interfering negatively with the ionic pathway. High-shear mixing techniques and sophisticated wet-milling processes are employed to achieve the desired dispersion, essential for uniform electrochemical performance across the entire electrode area.

Furthermore, significant R&D efforts are concentrated on integrating these supplements specifically with next-generation high-capacity anodes, such as silicon-rich anodes, which suffer from massive irreversible capacity loss during the initial charge due to the formation of a Solid Electrolyte Interphase (SEI) layer. Effective pre-lithiation technologies must be chemically tailored to work synergistically with both the positive and negative electrode components. Techniques involving in-situ pre-lithiation or controlled charging protocols enabled by specific supplement additives represent the cutting edge, offering potential pathways to significantly boost battery capacity beyond current industry standards while dramatically extending the expected cycle life of advanced battery chemistries used in long-range electric vehicles and high-power applications requiring frequent cycling and rapid charging capabilities, driving the need for continuous investment in specialized manufacturing assets.

Regional Highlights

- Asia Pacific (APAC): APAC is the global hub for battery manufacturing, commanding the largest market share for positive electrode lithium supplements. Countries like China, South Korea, and Japan host the majority of the world's gigafactories, leading to immense demand for high-performance electrode materials. China, in particular, dominates both production and consumption, heavily leveraging governmental policies and strategic investments in raw material procurement and advanced battery research. The region's technological leadership in high-nickel cathodes and rapid deployment of EVs solidify its supremacy in this market segment. South Korea and Japan are key innovators, particularly in developing highly specialized, stable lithium supplements for premium battery applications and export markets.

- North America: North America is poised for the fastest growth, largely driven by the US government's Inflation Reduction Act (IRA) and aggressive corporate strategies aimed at localizing the EV supply chain. Significant investments are pouring into establishing domestic gigafactories and refining capabilities, creating a nascent but rapidly expanding market for locally sourced or produced lithium supplements. Demand is heavily focused on materials compatible with high-performance vehicles and large-scale grid storage projects, emphasizing long-term stability and robust safety profiles mandated by regulatory bodies.

- Europe: The European market is expanding vigorously, supported by the European Green Deal and concerted efforts to achieve battery sovereignty. Countries such as Germany, Poland, and Hungary are becoming key manufacturing centers. European demand emphasizes sustainable sourcing and high environmental compliance, favoring supplement suppliers who can demonstrate low carbon footprints and transparent supply chains. The market here is characterized by strong partnerships between innovative material start-ups and established automotive OEMs, focusing on next-generation battery architectures crucial for achieving stringent EU emission reduction targets and bolstering regional economic resilience in the high-technology sector.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets with distinct drivers. Latin America holds strategic importance due to its vast lithium reserves (the "Lithium Triangle"), positioning countries like Chile and Argentina as potential upstream suppliers of high-purity precursors essential for supplement manufacturing. MEA currently represents a smaller consumer base, but the demand for energy storage, particularly in grid modernization projects and localized EV adoption in specific urban centers, is expected to accelerate, creating opportunities for specialized, robust energy solutions suitable for diverse climatic conditions and requiring maximized operational lifetimes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Positive Electrode Lithium Supplement Market.- Albemarle Corporation

- Livent Corporation

- Ganfeng Lithium Co., Ltd.

- BASF SE

- Umicore N.V.

- Eos Energy Enterprises

- Sila Nanotechnologies Inc.

- Solid Power Inc.

- QuantumScape Corporation

- Contemporary Amperex Technology Co. Limited (CATL)

- LG Energy Solution

- Posco Chemical

- SK Innovation

- BYD Company Limited

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial Co., Ltd.

- Tianqi Lithium Corporation

- Milliken & Company

- Honjo Chemical Co., Ltd.

- Targray Technology International Inc.

Frequently Asked Questions

Analyze common user questions about the Positive Electrode Lithium Supplement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a positive electrode lithium supplement?

The primary function is to compensate for irreversible capacity loss, specifically the active lithium consumed during the initial formation cycle, thereby increasing the battery's initial Coulombic efficiency and extending its overall cycle life.

How do stabilized lithium metal powders (SLMP) differ from traditional lithium salts in supplements?

SLMP utilizes pure metallic lithium encapsulated by a protective coating, offering a higher concentration of active lithium per unit mass, which is critical for maximizing energy density, whereas salts are less reactive but often provide inferior capacity gains.

Which end-use industry is the largest consumer of these lithium supplements?

The Electric Vehicle (EV) segment is the dominant consumer, driven by the intense global demand for long-range batteries that require optimized energy density and lifespan enhancements provided by pre-lithiation technologies.

What are the main technical challenges in integrating lithium supplements into battery manufacturing?

Key challenges include ensuring the stable handling and storage of reactive materials, achieving homogeneous dispersion within the electrode slurry, and precisely controlling the supplement dosage to avoid negative side effects on electrode impedance and safety.

Is the use of these supplements beneficial for silicon-anode based batteries?

Yes, supplements are critically important for silicon-anode batteries. Silicon anodes expand significantly and consume large amounts of active lithium during the first cycle; supplements pre-lithiate the system to mitigate this substantial irreversible capacity loss, enabling viable commercialization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager