Post Etch Residue Cleaning Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431744 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Post Etch Residue Cleaning Solutions Market Size

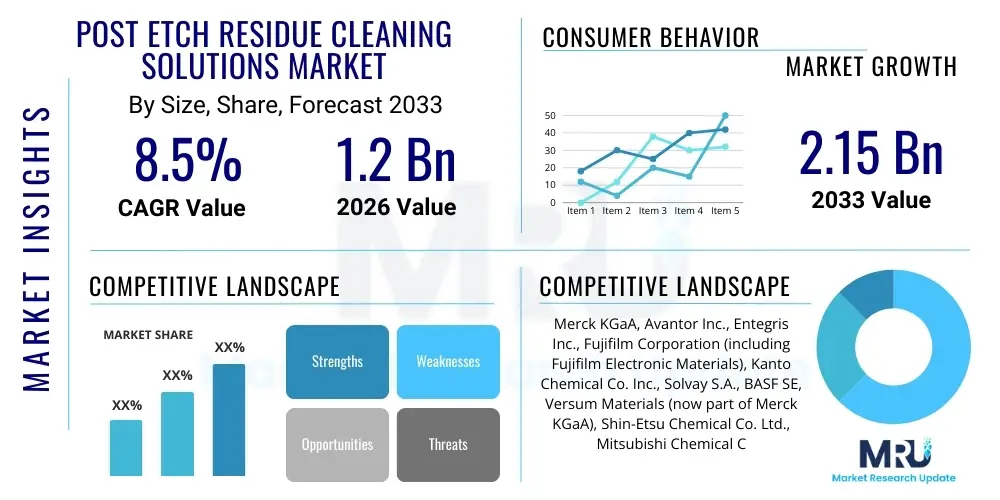

The Post Etch Residue Cleaning Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Post Etch Residue Cleaning Solutions Market introduction

The Post Etch Residue (PER) Cleaning Solutions Market encompasses specialized chemical formulations and processes designed to remove unwanted polymeric and inorganic residues left on semiconductor wafer surfaces following plasma etching steps. These residues, often composed of complex organometallic compounds, photoresist remnants, and damaged dielectric material, severely impact device performance, reliability, and yield if not meticulously removed. As semiconductor fabrication moves toward smaller process nodes (7nm, 5nm, and below) and adopts advanced architectures like FinFETs and Gate-All-Around (GAA) structures, the complexity and tenacity of PER have significantly increased, demanding highly selective and gentler cleaning solutions. The primary applications span across logic chips, memory devices (DRAM, NAND), and advanced packaging components, serving integrated device manufacturers (IDMs) and specialized foundries globally.

The imperative for high-performance cleaning solutions stems directly from the ongoing industry trend of miniaturization and the necessity for extreme selectivity. Modern cleaning chemistries must effectively dissolve or lift complex residues while preserving sensitive underlying materials, particularly ultra-low-k (ULK) dielectrics, without causing structural damage or electrical leakage. Key benefits of effective PER cleaning include maximized transistor functionality, enhanced device longevity, reduced manufacturing defects, and improved overall wafer yield, directly impacting the profitability of semiconductor operations. These solutions are categorized based on their chemical composition, including solvent-based, semi-aqueous, and aqueous formulations, each tailored for specific residue types and materials.

Major driving factors fueling market growth include the escalating global demand for advanced consumer electronics, high-performance computing (HPC), data centers, and automotive electronics requiring cutting-edge semiconductor components. Furthermore, the transition to next-generation lithography techniques, such as Extreme Ultraviolet (EUV) lithography, generates residues that necessitate entirely new chemical formulations capable of precise removal at the atomic scale. Increasing capital expenditure in new fabrication facilities (Fabs) globally, particularly in the Asia-Pacific region, further solidifies the demand trajectory for these critical process chemicals, emphasizing the market's dependence on the cyclical yet structurally growing semiconductor industry.

Post Etch Residue Cleaning Solutions Market Executive Summary

The Post Etch Residue Cleaning Solutions Market is characterized by intense technological evolution driven by the sub-10nm manufacturing landscape and the shift toward heterogeneous integration and advanced packaging technologies. Business trends indicate a strategic focus on developing "green chemistries" that reduce environmental impact, along with customized formulations offering high material compatibility and low corrosion rates, particularly critical for copper interconnects and sensitive dielectric layers. Key industry players are heavily investing in collaborative R&D with leading foundries to co-develop proprietary chemistries optimized for specific process recipes. Furthermore, geopolitical shifts and supply chain vulnerabilities have heightened the focus on regional manufacturing self-sufficiency, compelling IDMs and foundries to secure diverse supply sources for crucial cleaning materials, leading to accelerated expansion and qualification of suppliers outside traditional hubs.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily due to the concentration of major semiconductor manufacturing hubs, particularly in Taiwan, South Korea, China, and Japan. This region exhibits the highest volume consumption and leads in the early adoption of advanced process nodes, making it the central growth engine. North America and Europe, while smaller in volume, are crucial centers for R&D and specialized high-mix, low-volume manufacturing, driving demand for premium, highly specialized cleaning solutions, particularly those involving advanced memory and specialized logic fabrication. Regional trends also reflect a push for localized manufacturing and material sourcing to mitigate long-distance supply risks, influencing shifts in distribution and logistics strategies.

Segment trends reveal a rapid movement away from traditional bulk chemicals towards high-purity, application-specific, and customized formulations, demanding higher average selling prices (ASPs) but delivering superior performance. The Memory segment, particularly advanced NAND and DRAM structures, requires complex cleaning protocols due to their dense, high-aspect ratio features, driving significant demand for solvent-based and fluorine-containing chemistries. Simultaneously, the equipment segment shows a growing preference for single-wafer processing tools over traditional batch cleaning, as single-wafer systems offer superior process control, reduced chemical consumption, and better defect management, directly influencing the required delivery mechanism and packaging of cleaning solutions.

AI Impact Analysis on Post Etch Residue Cleaning Solutions Market

Common user inquiries regarding AI's influence often revolve around how artificial intelligence can accelerate the formulation and qualification process of new cleaning chemistries, optimize real-time usage within high-volume manufacturing (HVM) environments, and predict process deviations caused by residue accumulation. Users are concerned with leveraging AI and machine learning (ML) for predictive defect classification, enabling faster feedback loops for chemical bath regeneration or replacement, and minimizing chemical waste. The key themes summarized across these concerns highlight the expectation that AI will transition PER cleaning from a reactive, empirical process to a highly proactive, data-driven optimization loop, specifically targeting improved selectivity, reduced cycle time, and enhanced cost efficiency in ultra-advanced nodes where material compatibility is paramount.

- AI accelerates R&D by simulating molecular interactions, predicting the solubility and selectivity of novel chemical compounds against complex PER compositions, reducing costly and time-consuming lab experiments.

- Machine Learning algorithms analyze vast amounts of metrology and yield data (SEM, defect inspection) to instantly identify residue types and optimize cleaning recipes (temperature, concentration, time) in real-time within the manufacturing environment.

- Predictive maintenance schedules for chemical supply systems and cleaning equipment are established using AI, forecasting bath life expiration and potential contamination risks before they impact wafer yield.

- AI-driven process control enhances the consistency of chemical delivery in single-wafer cleaning systems, compensating dynamically for minor fluctuations in etch rate or incoming wafer variation, ensuring stable residue removal efficiency.

- Generative AI models assist in developing sustainable "green chemistry" formulations by rapidly filtering chemical libraries based on toxicity, environmental persistence, and material compatibility metrics, driving innovation toward safer solutions.

DRO & Impact Forces Of Post Etch Residue Cleaning Solutions Market

The market dynamics are governed by a complex interplay of technological push and regulatory constraint, encapsulated by the Drivers, Restraints, and Opportunities (DRO). Major drivers include the relentless pursuit of device miniaturization, which inherently generates more challenging residues requiring specialized removal techniques, and the massive capital investments in global foundry expansion. Opportunities primarily arise from the introduction of innovative semiconductor architectures like 3D NAND and High Bandwidth Memory (HBM), alongside the adoption of advanced packaging (e.g., fan-out wafer-level packaging), which creates new high-value applications for customized cleaning solutions. These forces collectively dictate the technological trajectory and commercial viability of new PER cleaning products, forcing manufacturers to innovate constantly to maintain relevance in a highly sensitive manufacturing ecosystem.

Restraints significantly impede market growth and often involve high barriers to entry due to the stringent qualification processes required by major foundries, demanding absolute purity and consistency over long periods. Environmental regulations regarding the use and disposal of highly corrosive or volatile organic compounds (VOCs) place considerable pressure on suppliers to transition towards environmentally benign (green) chemistries, which often require extensive and costly R&D efforts. Furthermore, the concentration of purchasing power among a few large semiconductor manufacturers allows them to exert significant price pressure on cleaning solution suppliers, impacting profit margins despite the high technical complexity of the products.

The fundamental impact forces shaping this market involve technological change, characterized by the shift to EUV and advanced metallization schemes, and material science evolution, where new low-k and high-k materials necessitate new, ultra-selective chemistries. Economic forces, such as the semiconductor market cycles and global trade policies, influence investment in Fabs, thereby impacting demand volume. Regulatory and environmental forces compel innovation toward safer, compliant, and more sustainable processes. These forces compel continuous investment in purity enhancement and process control capabilities to meet the non-negotiable requirements of the most advanced fabrication facilities globally, ensuring that cleaning solutions remain a high-value, high-complexity chemical segment.

Segmentation Analysis

The Post Etch Residue Cleaning Solutions Market is extensively segmented based on the composition of the cleaning solution (Type and Chemistry), the specific semiconductor application, and the cleaning equipment used in the fabrication facility. Segmentation by type broadly differentiates between wet chemistries and dry (plasma) cleaning methods, although the wet chemical segment accounts for the vast majority of specialized PER removal due to its high selectivity and efficacy in complex structures. Segmentation allows chemical manufacturers to tailor their product portfolio precisely to the unique challenges posed by different process nodes, materials, and device architectures, facilitating targeted marketing and regulatory compliance across various end-use sectors.

- By Type:

- Solvent-Based Cleaning Solutions

- Aqueous Cleaning Solutions (Semi-Aqueous and Full Aqueous)

- Gas-Phase/Vapor Cleaning Solutions

- By Chemistry:

- Fluorine-Containing Chemistries (HF/BOE derivatives)

- Amine-Based Chemistries (Traditional Ashing Residue Removal)

- Hydroxylamine-Based Chemistries (Advanced PER Removal)

- Specific Non-Corrosive Solvents (NMP-free formulations)

- By Application:

- Logic Devices (CPUs, GPUs, ASICs)

- Memory Devices (DRAM, NAND Flash, HBM)

- Foundry Services

- MEMS and Sensors

- By Cleaning Equipment:

- Single-Wafer Cleaning Systems

- Batch Wet Cleaning Systems (Spray/Immersion)

Value Chain Analysis For Post Etch Residue Cleaning Solutions Market

The value chain for PER cleaning solutions begins with the upstream sourcing of high-purity, specialty raw materials, including solvents, acids, bases, and proprietary surfactants, often synthesized by specialized fine chemical manufacturers. Maintaining extremely low metal and particulate contamination is crucial at this stage, establishing the foundational quality of the final product. Key upstream activities involve stringent quality control and purification processes to meet the parts-per-trillion (PPT) purity standards mandated by the semiconductor industry. Suppliers must possess robust synthesis capabilities and adhere to specialized handling protocols for hazardous materials, ensuring material integrity before formulation.

The midstream stage involves the highly technical formulation and mixing processes undertaken by the primary PER solution providers. This stage requires significant intellectual property regarding proprietary blends and stabilizing agents to achieve optimal performance, selectivity, and bath life. The complexity of modern semiconductor manufacturing dictates that these formulators work in close partnership with chip designers and process engineers to develop specific cleaning recipes. Packaging and delivery are also critical midstream components, involving specialized inert containers designed to prevent contamination or degradation during transport to the fabrication facility, often requiring just-in-time delivery schedules.

The downstream segment encompasses the direct end-users: Integrated Device Manufacturers (IDMs), pure-play Foundries (e.g., TSMC, UMC), and outsourced semiconductor assembly and test (OSAT) firms. Distribution channels are predominantly direct, characterized by long-term supply agreements and technical support contracts, reflecting the bespoke nature and critical importance of these chemicals to manufacturing yield. Indirect distribution, involving specialized chemical distributors, typically serves smaller fabs or regions where localized stockholding and logistics support are necessary, but direct technical engagement between the formulator and the fab remains the standard practice for high-volume, advanced node applications.

Post Etch Residue Cleaning Solutions Market Potential Customers

The potential customer base for Post Etch Residue Cleaning Solutions is highly concentrated within the global semiconductor manufacturing ecosystem, focusing primarily on entities operating high-volume, advanced wafer fabrication plants (Fabs). These customers are defined by their continuous need for stable, high-purity chemicals essential for high-yield manufacturing of complex microprocessors, advanced memory chips, and application-specific integrated circuits (ASICs). The primary buyers are large-scale foundry operators who manage the manufacturing processes for numerous chip design companies, as well as integrated manufacturers who handle both design and fabrication, driven by the need to manage defectivity rates below one part per million.

The core customer segments include leading logic foundries (e.g., TSMC, Samsung Foundry), major memory producers (e.g., Micron Technology, SK Hynix, Kioxia/Western Digital), and traditional IDMs (e.g., Intel, Texas Instruments) transitioning to advanced process technologies. These corporations require cleaning solutions for processes ranging from shallow trench isolation (STI) cleans to back-end-of-line (BEOL) copper interconnect residue removal. The purchasing decision is heavily influenced by documented performance metrics, including selectivity against low-k materials, low toxicity profiles, extended bath life, and guaranteed chemical purity, making technical qualification a long and rigorous process.

Beyond the core manufacturers, secondary customer segments include companies specializing in advanced packaging (e.g., Amkor, ASE), which increasingly utilize intricate etching steps requiring PER cleaning for interposers and 3D stacking processes. Research institutions and pilot fabrication lines also constitute smaller, but strategically important, potential customers, driving early-stage adoption and qualification of experimental cleaning chemistries before commercial rollout. The customer relationship is characterized by intense technical collaboration and supply chain redundancy planning, given the mission-critical nature of the cleaning process in the entire semiconductor value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., Entegris Inc., Fujifilm Corporation (including Fujifilm Electronic Materials), Kanto Chemical Co. Inc., Solvay S.A., BASF SE, Versum Materials (now part of Merck KGaA), Shin-Etsu Chemical Co. Ltd., Mitsubishi Chemical Corporation, JSR Corporation, DuPont de Nemours Inc., EKC Technology (now part of DuPont), Technic Inc., Chemtrace Corporation, Brewer Science Inc., Hitachi Chemical Co. Ltd. (now Showa Denko Materials), Ashland Global Holdings Inc., ATMI (now part of Entegris), PChem Associates Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Post Etch Residue Cleaning Solutions Market Key Technology Landscape

The technological landscape of PER cleaning solutions is continuously evolving, dictated by the relentless scaling of semiconductor devices and the introduction of delicate new materials. A primary technological focus is on developing highly tailored chemistries that achieve near-perfect selectivity, meaning the cleaning solution must attack the residue (e.g., complex polymeric fences) while completely sparing underlying structures, such as porous ultra-low-k (ULK) dielectrics or sensitive metal interconnects, crucial for signal integrity. This has led to the development of sophisticated multi-component mixtures incorporating chelating agents, corrosion inhibitors, and specialized surfactants, optimized for precise pH and temperature control within the cleaning tool.

Another critical area of innovation involves environmentally conscious or "green" chemistry. Given the high volume of chemicals used in wet processing, there is a significant push toward developing NMP-free (N-Methyl-2-pyrrolidone-free) and non-hazardous solutions, driven by tightening global regulatory standards like REACH in Europe and similar governmental guidelines elsewhere. This involves extensive research into alternative solvent systems, including advanced aqueous-based solutions and specialized organic solvents that offer high performance without the regulatory burden or severe environmental impact associated with traditional chemistries. Furthermore, the integration of megasonic and advanced cavitation techniques within cleaning tools requires cleaning solutions to be optimized for acoustic energy transfer, ensuring efficient removal of nanometer-scale particles and residues from high-aspect ratio features.

The most advanced technological developments are centered around dry or gas-phase cleaning methods and hybrid techniques, specifically targeting the challenges posed by extreme high-aspect ratio features found in 3D NAND and GAA structures, where liquid penetration and subsequent drying can be problematic. Supercritical CO2 (scCO2) cleaning, often combined with small amounts of co-solvents, represents a promising technology that offers excellent penetration and residue removal without the risks associated with surface tension and capillary forces during drying. However, the high capital cost of scCO2 equipment and the complexity of integrating it into existing fabs mean that customized wet chemistries still dominate the high-volume manufacturing segment, necessitating continued investment in high-purity chemical synthesis and delivery infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global semiconductor manufacturing industry, driven by major fabrication bases in Taiwan (TSMC, UMC), South Korea (Samsung, SK Hynix), China (SMIC, YMTC), and Japan (Kioxia, Renesas). This region represents the largest consumer of PER cleaning solutions globally, primarily due to the intense volume of advanced node production for logic and memory (DRAM and 3D NAND). The sustained expansion of mainland Chinese domestic fabrication capacity, fueled by state incentives, ensures APAC remains the fastest-growing market, with high demand for both volume and specialized advanced chemistries.

- North America: North America serves as a major hub for R&D, design, and specialized high-performance manufacturing (Intel, GlobalFoundries). The market here is characterized by high demand for proprietary, premium-priced chemistries used in leading-edge R&D and pilot lines, often focusing on high-mix, specialized products like advanced AI processors and defense applications. Recent legislative incentives (e.g., the CHIPS Act) are driving significant investment in domestic Fab expansion, which is projected to accelerate regional consumption dramatically over the forecast period, enhancing supply chain localization efforts.

- Europe: The European market, while smaller in absolute volume compared to APAC, is crucial for specialized manufacturing, particularly in automotive, industrial, and specialized sensor applications (STMicroelectronics, Infineon). The emphasis in Europe is often on sustainability and compliance with stringent environmental regulations (REACH), driving demand for green, low-VOC cleaning formulations. Investment in new mega-fabs (e.g., Intel in Germany) is set to substantially increase the regional market size and complexity, mirroring the localized production trend seen in North America.

- Latin America & Middle East and Africa (MEA): These regions currently represent nascent markets for PER cleaning solutions, primarily serving assembly, testing, and lower-to-mid-range fabrication activities. Growth is modest but steady, linked to foreign direct investment in semiconductor assembly operations and growing domestic electronics consumption. The primary demand is for established, cost-effective cleaning solutions rather than leading-edge formulations, although MEA, particularly Israel, maintains significant R&D presence impacting global supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Post Etch Residue Cleaning Solutions Market.- Merck KGaA

- Avantor Inc.

- Entegris Inc.

- Fujifilm Corporation (including Fujifilm Electronic Materials)

- Kanto Chemical Co. Inc.

- Solvay S.A.

- BASF SE

- DuPont de Nemours Inc.

- Shin-Etsu Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- JSR Corporation

- Technic Inc.

- ChemTrace Corporation

- Brewer Science Inc.

- Showa Denko Materials (formerly Hitachi Chemical)

- Ashland Global Holdings Inc.

- PChem Associates Inc.

- MicroChemicals GmbH

- Honeywell International Inc.

- Tokyo Ohka Kogyo Co., Ltd. (TOK)

Frequently Asked Questions

Analyze common user questions about the Post Etch Residue Cleaning Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Post Etch Residue (PER) cleaning solutions in semiconductor manufacturing?

The essential function of PER cleaning solutions is to selectively remove complex organic, inorganic, and metallic polymeric residues formed on the wafer surface during dry plasma etching processes. Failure to remove these residues compromises device yield, reliability, and electrical performance, particularly in sub-10nm nodes.

How is the market influenced by the transition to Gate-All-Around (GAA) and EUV lithography?

The shift to GAA and EUV lithography demands entirely new, ultra-selective cleaning chemistries. These advanced processes create extremely dense, high-aspect ratio features and more challenging residues, necessitating solutions with higher penetration capabilities and significantly reduced damage to delicate materials like high-k dielectrics and FinFET/GAA structures.

Which chemical types dominate the Post Etch Residue cleaning segment?

The market is dominated by high-purity wet chemistries, primarily comprising advanced solvent-based formulations (often NMP-free) and specialized aqueous solutions (containing amines, hydroxylamine derivatives, and fluorine compounds). These are preferred due to their high selectivity and ability to handle the complex, multi-layered residues of modern IC fabrication.

What are the key sustainability challenges facing PER cleaning solution manufacturers?

Key challenges include eliminating regulated substances (e.g., high VOC content, specific metal ions), reducing overall chemical consumption (driven by the shift to single-wafer processing), and ensuring the development of effective, non-toxic, and biodegradable "green chemistries" that meet stringent environmental disposal regulations without sacrificing performance.

Which geographical region holds the largest market share for PER cleaning solutions?

The Asia Pacific (APAC) region holds the dominant market share due to its concentration of leading semiconductor foundries (Taiwan, South Korea) and high-volume memory production, which consistently requires the most advanced cleaning solutions for manufacturing at the latest process nodes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager