Post Etch Residue Removal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440037 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Post Etch Residue Removal Market Size

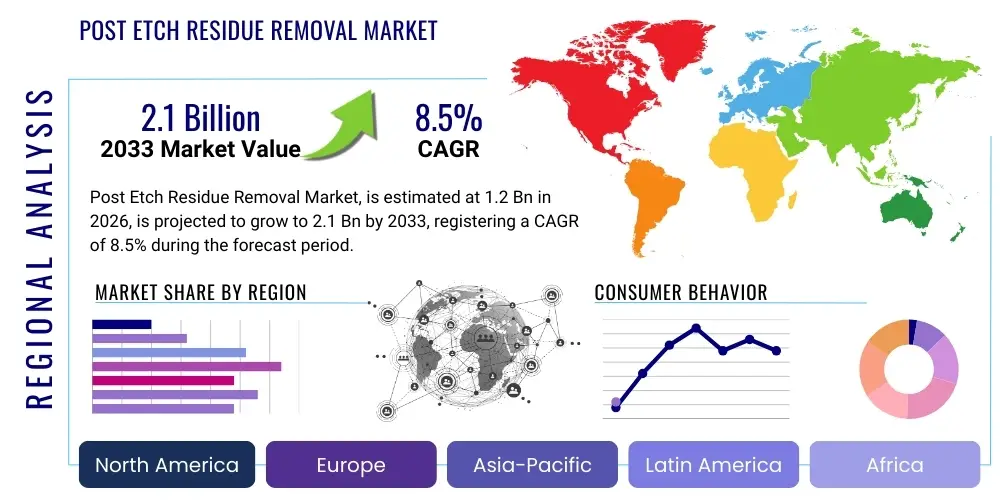

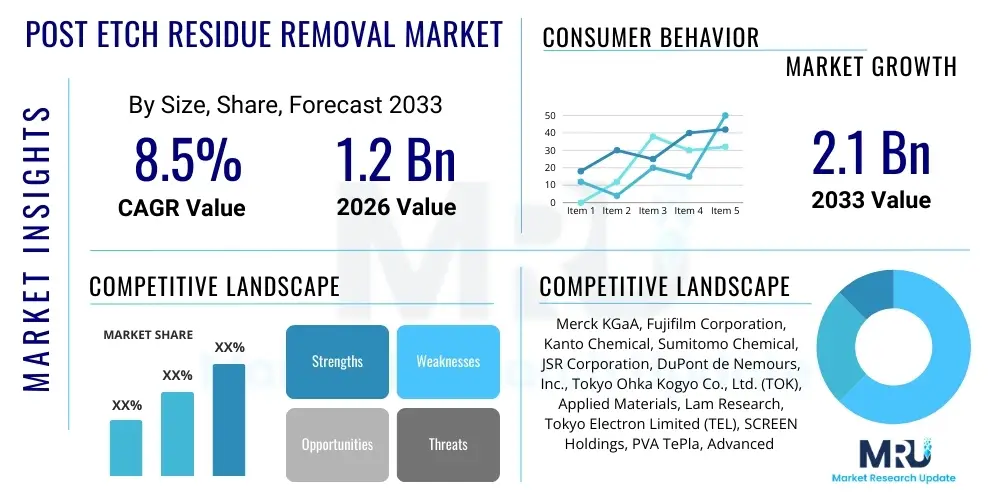

The Post Etch Residue Removal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Post Etch Residue Removal Market introduction

The Post Etch Residue Removal (PERR) market encompasses critical processes and materials essential in semiconductor manufacturing, focusing on eliminating unwanted byproducts left after etching steps. Etching, whether wet or dry, is a fundamental process used to selectively remove material from the semiconductor wafer surface to create intricate circuit patterns. However, this process invariably leaves behind residues, often a complex mix of polymers, metallic compounds, organic contaminants, and halogenated materials, which, if not meticulously removed, can severely compromise device performance, reliability, and yield.

The core products within this market include specialized chemical formulations (solvents, acids, bases, and surfactants), plasma ashing equipment, and advanced cleaning systems tailored for specific residue compositions and substrate materials. These solutions are meticulously developed to be highly selective, removing residues without damaging the underlying circuit features or sensitive device layers. Major applications span across integrated circuit (IC) fabrication for logic and memory devices, Micro-Electro-Mechanical Systems (MEMS), power semiconductors, and advanced packaging technologies, all of which demand pristine surfaces for subsequent processing steps.

The primary benefits derived from effective post etch residue removal include enhanced electrical performance of semiconductor devices by preventing short circuits and leakage currents, improved manufacturing yield by reducing defect rates, and extended device longevity through the elimination of corrosive or insulating contaminants. The market is primarily driven by the relentless pursuit of semiconductor miniaturization, the increasing complexity of 3D device architectures, and the escalating global demand for high-performance electronic devices across various sectors, including artificial intelligence, 5G communications, automotive electronics, and the Internet of Things (IoT).

Post Etch Residue Removal Market Executive Summary

The Post Etch Residue Removal (PERR) market is currently experiencing robust expansion, largely propelled by relentless innovation within the semiconductor industry, particularly the transition to advanced process nodes and the proliferation of sophisticated 3D integration and packaging technologies. Business trends indicate a strong emphasis on developing environmentally friendly chemical solutions, alongside the integration of advanced process control and monitoring systems to enhance efficiency and reduce material waste. Consolidation among specialty chemical and equipment providers is also a notable trend, driven by the need for comprehensive solutions and broader market reach, allowing for greater synergy in R&D efforts and supply chain optimization.

Regionally, the Asia Pacific (APAC) continues its dominance as the epicenter of semiconductor manufacturing, with countries like Taiwan, South Korea, China, and Japan leading in both production capacity and technological advancements. This strong manufacturing base drives significant demand for PERR solutions. North America and Europe, while having a smaller manufacturing footprint, remain crucial for high-end R&D, advanced material development, and specialized applications, fostering innovation in novel residue removal techniques and equipment. Emerging markets in Southeast Asia are also gradually increasing their contribution to the global semiconductor supply chain, presenting new growth avenues.

Segmentation trends highlight a growing demand for dry etch residue removal technologies, particularly plasma ashing, as devices become more sensitive to wet chemical processes and feature sizes shrink. Concurrently, advancements in wet chemical formulations are focusing on improved selectivity, lower material consumption, and enhanced compatibility with new materials like SiC and GaN. The logic and memory device manufacturing segments remain the largest consumers, though MEMS and advanced packaging applications are demonstrating higher growth rates due to their unique structural complexities and increasing market penetration across diverse industries. The evolution towards greener chemistries and sustainable manufacturing practices is also shaping segment development, influencing product innovation and market adoption.

AI Impact Analysis on Post Etch Residue Removal Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) can revolutionize the Post Etch Residue Removal (PERR) process, seeking to understand its potential in improving efficiency, reducing defects, and optimizing material usage. Key themes emerging from these inquiries revolve around the application of AI for real-time process monitoring, predictive maintenance of equipment, advanced defect classification, and the intelligent formulation of new chemical processes. There is a strong expectation that AI can address the increasing complexity and variability inherent in PERR, particularly as semiconductor manufacturing pushes the boundaries of miniaturization and material diversity.

- AI-driven real-time monitoring and process control enhance residue removal efficiency by dynamically adjusting parameters based on in-situ sensor data.

- Predictive analytics enables proactive maintenance of PERR equipment, minimizing downtime and optimizing operational longevity.

- Advanced image recognition algorithms, powered by AI, significantly improve the speed and accuracy of defect detection and classification after cleaning.

- Machine learning assists in the rapid development and optimization of new chemical formulations for PERR, tailoring solutions for novel materials and complex etch schemes.

- AI facilitates the creation of "digital twins" of PERR processes, allowing for virtual experimentation and optimization before physical implementation, reducing R&D cycles.

- Automated decision-making systems using AI can optimize chemical consumption and waste management, contributing to more sustainable manufacturing practices.

DRO & Impact Forces Of Post Etch Residue Removal Market

The Post Etch Residue Removal (PERR) market is significantly shaped by a confluence of driving forces, critical restraints, emerging opportunities, and broader impact forces. Key drivers include the exponential growth of the semiconductor industry itself, fueled by innovations in artificial intelligence, 5G technology, and the Internet of Things, all demanding ever more sophisticated and miniaturized chips. The increasing complexity of 3D device architectures, such as 3D NAND and FinFETs, and the widespread adoption of advanced packaging technologies like System-in-Package (SiP) and Through-Silicon Vias (TSVs), necessitate extremely precise and effective residue removal to ensure device integrity and performance. Furthermore, stringent quality and yield requirements in semiconductor manufacturing push for continuous improvements in PERR processes, as even microscopic residues can lead to catastrophic device failures.

However, the market also faces considerable restraints. The high cost associated with specialized PERR equipment, advanced chemical formulations, and the continuous R&D required to keep pace with evolving semiconductor technologies presents a significant barrier, especially for smaller players. Environmental concerns related to the use and disposal of hazardous chemicals employed in wet cleaning processes are increasing regulatory scrutiny and driving demand for greener alternatives, which are often more complex to develop and implement. The inherent complexity of removing various residue types from diverse materials, often with highly sensitive and delicate underlying structures, demands highly skilled operators and extremely precise process control, adding to operational challenges.

Opportunities within the PERR market are largely driven by technological advancements and sustainability initiatives. The integration of AI and machine learning for predictive maintenance, process optimization, and enhanced defect detection offers substantial potential for efficiency gains and cost reductions. The development of eco-friendly and sustainable residue removal chemistries that minimize environmental impact without compromising performance represents a significant growth area. Furthermore, the emergence of new semiconductor materials, such as Silicon Carbide (SiC) and Gallium Nitride (GaN) for power electronics, and 2D materials for next-generation devices, creates a demand for entirely new and tailored PERR solutions. Broad impact forces, including evolving environmental regulations, geopolitical dynamics influencing global supply chains, and the pace of R&D investments by major industry players and governments, continuously reshape the competitive landscape and technological trajectory of the PERR market.

Segmentation Analysis

The Post Etch Residue Removal (PERR) market is segmented based on various critical attributes, including the type of removal process, specific application areas, the material of the substrate, and the end-user industry. These segmentations provide a granular view of market dynamics, revealing specific growth pockets, technological preferences, and evolving demands across the semiconductor ecosystem. Analyzing these segments helps stakeholders understand where innovation is most impactful, where investment is most active, and how different parts of the market are responding to broader industry trends like miniaturization and advanced material adoption. The distinction between wet and dry processes, for instance, highlights differing technological approaches to tackling residue challenges, each with its own advantages and limitations depending on the specific etching process and device sensitivity.

- By Type:

- Wet Etch Residue Removal: Involves chemical solutions for dissolving or lifting residues.

- Dry Etch Residue Removal (Plasma Ashing): Utilizes plasma to chemically react with and remove residues.

- By Application:

- Logic & Memory Devices: Primary application for high-volume semiconductor manufacturing.

- MEMS & Sensors: Specialized cleaning for micro-electromechanical systems and sensor components.

- Power Devices: Addressing residue challenges in high-voltage and high-current devices.

- LEDs & Optoelectronics: Cleaning processes for light-emitting diodes and other optical components.

- By Material:

- Silicon-based Substrates: Dominant material in semiconductor manufacturing.

- III-V Compound Semiconductors: Including GaN, GaAs, InP, used in high-frequency and optoelectronic devices.

- Advanced Packaging Materials: Solutions for interposers, bump structures, and other packaging components.

- By End-User:

- Integrated Device Manufacturers (IDMs): Companies that design and manufacture their own chips.

- Foundries: Companies that only manufacture chips for other fabless design companies.

- OSAT (Outsourced Semiconductor Assembly and Test): Companies providing assembly, packaging, and testing services.

Value Chain Analysis For Post Etch Residue Removal Market

The value chain for the Post Etch Residue Removal (PERR) market is intricately linked to the broader semiconductor manufacturing ecosystem, beginning with upstream raw material suppliers and extending through to the end-users. The upstream segment primarily involves manufacturers of specialty chemicals, gases, and solvents, which are the fundamental components of wet cleaning solutions. These suppliers provide high-purity materials, often customized for specific residue types and process sensitivities, requiring significant R&D investment and stringent quality control. Additionally, manufacturers of plasma generation equipment, vacuum systems, and other hardware components essential for dry etch residue removal processes also constitute a critical part of the upstream supply, necessitating robust engineering and material science expertise.

Moving downstream, the products and services from upstream suppliers are acquired by equipment manufacturers who integrate these components into sophisticated PERR systems, and by chemical formulators who develop proprietary cleaning solutions. These integrated PERR systems and chemicals are then supplied directly to semiconductor fabrication plants (fabs), including Integrated Device Manufacturers (IDMs), pure-play foundries, and Outsourced Semiconductor Assembly and Test (OSAT) companies. The distribution channel predominantly involves direct sales and technical support from major equipment and chemical suppliers to their large-scale industrial customers due to the highly specialized nature of the products and the need for extensive application engineering and post-sales service.

Indirect distribution may occur through regional distributors or agents, particularly for smaller market segments or in regions where direct presence of major suppliers is limited. However, for critical PERR solutions, direct engagement ensures optimal technical support, rapid problem resolution, and close collaboration on process optimization, which are paramount in the high-stakes semiconductor industry. The effectiveness of this value chain relies heavily on seamless collaboration and continuous innovation at each stage, from raw material purity to the final integration and performance validation within complex semiconductor manufacturing lines.

Post Etch Residue Removal Market Potential Customers

The potential customers for Post Etch Residue Removal (PERR) solutions are exclusively players within the global semiconductor manufacturing and related electronics industries, where precise material removal and surface preparation are paramount. These customers operate highly capital-intensive facilities known as fabrication plants (fabs) and assembly lines, where semiconductor wafers undergo hundreds of intricate processing steps. The increasing complexity and miniaturization of integrated circuits, coupled with the introduction of novel materials and 3D device architectures, mean that virtually every company involved in advanced chip production is a direct buyer or significant influencer of PERR technologies.

Key segments of end-users include Integrated Device Manufacturers (IDMs) such as Intel, Samsung, and Micron, which design, manufacture, and sell their own chips, thus requiring comprehensive in-house PERR capabilities. Pure-play foundries like TSMC, GlobalFoundries, and UMC, which produce chips for numerous fabless design companies, represent another crucial customer base. These foundries handle a wide array of process technologies and diverse customer designs, necessitating flexible and robust PERR solutions to meet varied specifications and stringent yield targets across different product lines. Their reliance on advanced manufacturing processes makes them significant consumers of high-performance PERR equipment and chemicals.

Additionally, Outsourced Semiconductor Assembly and Test (OSAT) companies, including Amkor Technology and ASE Group, are becoming increasingly important customers as advanced packaging techniques introduce new residue challenges at the post-front-end stages. Manufacturers of Micro-Electro-Mechanical Systems (MEMS), power devices, and optoelectronic components (such as LEDs and laser diodes) also represent growing niche markets. These segments often require specialized PERR solutions tailored to their unique material stacks and device geometries, making them high-value targets for suppliers capable of offering customized technologies and processes. The drive for higher yields, improved device performance, and cost efficiency across all these customer types consistently fuels the demand for innovative PERR products and services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Fujifilm Corporation, Kanto Chemical, Sumitomo Chemical, JSR Corporation, DuPont de Nemours, Inc., Tokyo Ohka Kogyo Co., Ltd. (TOK), Applied Materials, Lam Research, Tokyo Electron Limited (TEL), SCREEN Holdings, PVA TePla, Advanced Micro-Fabrication Equipment Inc. (AMEC), Showa Denko Materials (Resonac), Moses Lake Industries (part of Avantor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Post Etch Residue Removal Market Key Technology Landscape

The Post Etch Residue Removal (PERR) market is characterized by a dynamic and evolving technology landscape, continuously adapting to the ever-increasing demands of semiconductor manufacturing for smaller feature sizes, more complex device structures, and novel materials. The primary technologies employed fall into two broad categories: wet chemical cleaning and dry plasma-based processes. Wet chemical cleaning utilizes highly specialized liquid formulations, including acidic, basic, and neutral solutions, often containing surfactants and chelating agents, to dissolve, lift-off, or complex with various organic, inorganic, and metallic residues. These processes require precise control of chemical concentration, temperature, and agitation to achieve high selectivity and avoid damage to underlying device structures, with innovations focusing on greener, less hazardous, and more efficient chemistries.

Dry etch residue removal, primarily through plasma ashing or plasma cleaning, is increasingly vital for delicate structures and when wet processes are unsuitable. This technology employs a reactive plasma, typically generated from oxygen or fluorine-containing gases, to chemically react with and volatilize polymeric or carbonaceous residues. Advantages include anisotropic cleaning capabilities, reduced solvent waste, and suitability for highly aspect-ratio features. Advances in plasma technology are centered on achieving lower damage, higher throughput, and more precise control over radical generation to selectively remove residues without impacting the exposed device layers or introducing new defects.

Beyond these core methods, the technology landscape also includes emerging and supporting techniques. Supercritical CO2 cleaning is being explored as an environmentally friendlier alternative for specific applications, offering excellent penetration into fine structures. Mechanical brushing or scrubbing, though less common for critical front-end processes, finds application in specific advanced packaging or substrate preparation steps. The integration of advanced process control systems, leveraging in-situ metrology and AI/ML algorithms, is a significant technological trend aimed at optimizing process parameters, detecting defects in real-time, and ensuring consistent, high-quality residue removal across increasingly complex manufacturing flows. This continuous push for innovation ensures that PERR technologies remain at the forefront of enabling next-generation semiconductor devices.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Post Etch Residue Removal market, driven by the presence of major semiconductor manufacturing hubs in Taiwan (TSMC), South Korea (Samsung, SK Hynix), China, and Japan. Significant investments in new fabrication plants and advanced packaging facilities fuel the demand for cutting-edge PERR solutions. The region benefits from a robust supply chain and a large pool of skilled labor.

- North America: A significant region for R&D and advanced process development in semiconductor technology. While its manufacturing footprint has seen some shifts, there is a renewed focus on domestic production, particularly for cutting-edge nodes and specialized components. Demand for PERR solutions is strong, driven by innovation, stringent quality standards, and the adoption of new materials.

- Europe: Characterized by niche but high-value semiconductor manufacturing, particularly in automotive, industrial, and specialized sensor applications. The region focuses on advanced R&D and has a strong emphasis on environmental regulations, driving demand for greener and more sustainable PERR chemistries and equipment. Countries like Germany, France, and Ireland play key roles.

- Latin America & Middle East and Africa (MEA): These regions represent emerging markets with nascent but growing semiconductor industries. While their contribution to the global PERR market is currently smaller, increasing investments in electronics manufacturing and assembly facilities, particularly in countries like Mexico, Brazil, and Israel, are expected to drive future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Post Etch Residue Removal Market.- Merck KGaA

- Fujifilm Corporation

- Kanto Chemical Co., Inc.

- Sumitomo Chemical Co., Ltd.

- JSR Corporation

- DuPont de Nemours, Inc.

- Tokyo Ohka Kogyo Co., Ltd. (TOK)

- Applied Materials, Inc.

- Lam Research Corporation

- Tokyo Electron Limited (TEL)

- SCREEN Holdings Co., Ltd.

- PVA TePla AG

- Advanced Micro-Fabrication Equipment Inc. (AMEC)

- Showa Denko Materials Co., Ltd. (now Resonac Corporation)

- Moses Lake Industries (part of Avantor)

- Versum Materials (now part of Merck KGaA)

- Entegris, Inc.

- AZ Electronic Materials (part of Merck KGaA)

Frequently Asked Questions

Analyze common user questions about the Post Etch Residue Removal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is post etch residue removal and why is it important in semiconductor manufacturing?

Post etch residue removal (PERR) is a critical step in semiconductor fabrication that cleans unwanted polymeric, metallic, or organic byproducts left on the wafer surface after etching. It's crucial for preventing electrical defects, ensuring high device performance, improving manufacturing yields, and extending the reliability of integrated circuits by maintaining pristine surfaces for subsequent processing.

What are the primary technologies used for post etch residue removal?

The main technologies are wet chemical cleaning, which uses specialized liquid formulations (acids, bases, solvents) to dissolve or lift residues, and dry etch residue removal, primarily plasma ashing, which employs reactive gases and plasma to chemically remove residues. Both methods are continually being refined for selectivity and efficiency.

How does AI impact post etch residue removal processes in the semiconductor industry?

AI significantly impacts PERR by enabling real-time process monitoring, predictive maintenance for equipment, and advanced defect detection through machine vision. It also aids in optimizing chemical formulations and process parameters, leading to improved efficiency, reduced material waste, and enhanced quality control in complex manufacturing environments.

What are the major challenges faced in the Post Etch Residue Removal market?

Key challenges include the high cost of advanced equipment and specialty chemicals, environmental concerns regarding chemical usage and disposal, and the increasing complexity of removing diverse residues from novel materials and intricate 3D device structures without causing damage. The need for precise process control and highly skilled personnel also poses a challenge.

Which regions are driving the growth of the Post Etch Residue Removal market?

The Asia Pacific (APAC) region, particularly countries like Taiwan, South Korea, China, and Japan, is the dominant growth driver due to its extensive semiconductor manufacturing base. North America and Europe also contribute significantly through R&D and specialized high-value production, while Latin America and MEA represent emerging growth opportunities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager