Potassium Benzoate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436913 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Potassium Benzoate Market Size

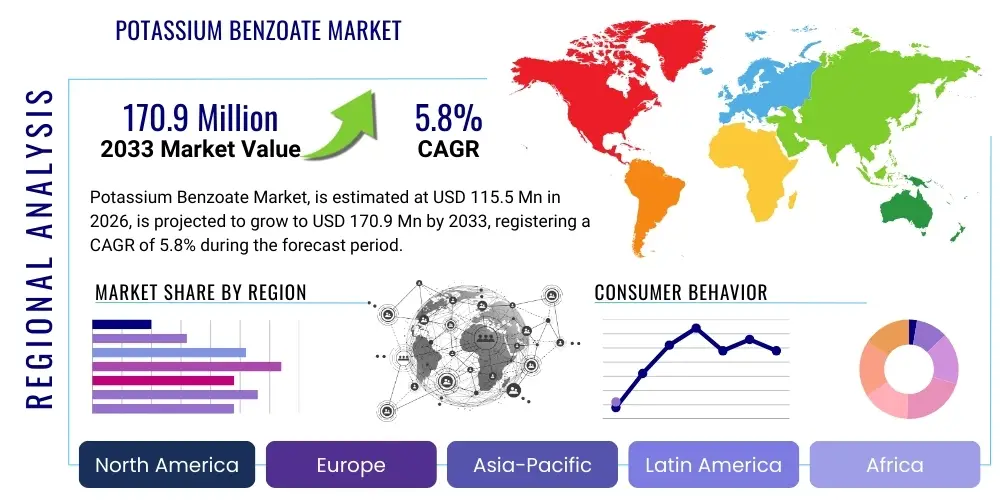

The Potassium Benzoate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 115.5 Million in 2026 and is projected to reach USD 170.9 Million by the end of the forecast period in 2033.

Potassium Benzoate Market introduction

The Potassium Benzoate Market encompasses the production, distribution, and consumption of the potassium salt of benzoic acid, widely known for its efficacy as a food preservative (E212) and fungistatic agent. This chemical compound is essential in preventing the growth of molds, yeasts, and some bacteria, particularly in acidic environments. Its stability, high solubility in water, and lower health impact compared to other preservative alternatives position it as a critical ingredient across multiple high-growth industries. The compound is typically manufactured through the neutralization of benzoic acid with potassium hydroxide or potassium carbonate, ensuring a high-purity product suitable for pharmaceutical and food-grade applications. Demand is strongly correlated with the expansion of the processed food and beverage industry globally, especially the segment focused on high-sugar, low-pH products like carbonated soft drinks, fruit juices, and pickled foods.

A key driver for market expansion is the increasing global consumer reliance on packaged and shelf-stable foods, necessitated by evolving urban lifestyles and busy schedules. Potassium benzoate provides an economical and effective solution for manufacturers seeking to extend product shelf life while maintaining regulatory compliance. Furthermore, beyond its predominant role in preservation, potassium benzoate finds applications in pyrotechnics, where it is used as a fuel component in specialized whistle mixes, and in pharmaceuticals, where it serves as an intermediate or stabilizer. The compound’s versatility allows manufacturers to target diverse revenue streams, although the food and beverage sector remains the primary consumption area, dictating market trends and pricing mechanisms.

However, the market faces intense scrutiny regarding consumer perception of synthetic preservatives and growing interest in clean-label ingredients. Manufacturers are continuously pressured to optimize usage levels to meet stringent regulatory limits set by bodies like the FDA and EFSA, which dictates the quality and concentration requirements for potassium benzoate supplied to end-users. The chemical’s benefits, including its ability to inhibit microbial growth without significantly altering taste profiles when used correctly, outweigh many of the regulatory challenges, underpinning its sustained market growth. Technological advancements in synthesis purity and crystallization processes are also contributing to higher product standards, catering to specialized applications requiring ultra-high purity grades.

Potassium Benzoate Market Executive Summary

The Potassium Benzoate market is experiencing steady expansion, driven primarily by strong business trends in emerging economies and persistent demand from the global beverage industry. Business trends indicate a shift toward specialized, high-purity grades required for pharmaceutical applications and cosmetics, moving beyond standard food preservation grades. Consolidation among major chemical producers and increasing investments in sustainable manufacturing processes, aiming for reduced waste and energy consumption, are notable commercial activities. Supply chain resilience, following recent global disruptions, has become a competitive differentiator, with companies focusing on diversifying raw material sourcing (primarily benzoic acid) to stabilize operational costs and output volumes. The shift towards ready-to-drink functional beverages is further fueling demand, as these products often require effective preservation in complex matrix formulations.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily due to rapid urbanization, increasing disposable incomes, and the consequent growth of the packaged food and processed meat sectors in countries like China and India. North America and Europe, while mature, maintain significant market shares due to strict food safety regulations necessitating robust preservation techniques, especially in fruit preparations, sauces, and low-calorie soft drinks. However, European trends show a stronger regulatory pushback against synthetic preservatives, encouraging the development of blended preservative systems that minimize the use of E212 while maintaining efficacy. The Middle East and Africa (MEA) region is emerging as a potential growth hub, spurred by multinational food manufacturers establishing local production facilities requiring reliable preservative supplies.

Analysis of segment trends reveals that the beverage application segment holds the dominant market share, largely attributed to the high volume production of carbonated beverages and acidic fruit juices where potassium benzoate performs optimally. In terms of grade type, the food-grade segment leads due to sheer volume consumption, but the pharmaceutical-grade segment is exhibiting superior revenue growth rates, driven by stricter quality requirements and premium pricing associated with high purity levels needed for medicinal syrups and excipients. The powder form remains the preferred product type for ease of handling and precise dosing in large-scale manufacturing operations, though granulated forms are gaining traction in certain specific blending applications requiring reduced dusting and improved flowability characteristics.

AI Impact Analysis on Potassium Benzoate Market

User queries regarding AI's impact on the Potassium Benzoate market frequently center on three main themes: optimizing synthesis and process control, enhancing quality assurance and compliance, and improving supply chain resilience and demand forecasting. Users are particularly interested in how Artificial Intelligence (AI) and Machine Learning (ML) can refine the industrial chemical synthesis process to achieve higher yields, reduce impurities, and minimize energy consumption during crystallization, thereby addressing cost pressures and sustainability goals. There is also significant concern regarding the use of AI in rapidly detecting trace contaminants and ensuring that production batches consistently meet strict pharmaceutical or food-grade standards, especially given the global variation in regulatory requirements. Expectations revolve around AI tools providing predictive maintenance for manufacturing equipment and dynamic inventory management for raw materials, ultimately stabilizing the cost structure of this commodity chemical.

In manufacturing, AI is revolutionizing process optimization by analyzing vast datasets generated by sensors within reactors and filtration units. ML algorithms can identify correlations between process parameters (temperature, pH, reaction time) and final product purity and yield. This capability allows manufacturers to dynamically adjust conditions in real-time, moving beyond static batch control and toward continuous improvement. For instance, predictive models can anticipate crystallization irregularities, leading to timely interventions that prevent substandard product formation, resulting in significant savings in raw materials and reprocessing time. This level of precision is becoming essential for meeting the increasingly demanding specifications of key end-users in the beverage and pharmaceutical industries.

The influence of AI extends significantly into quality control and market intelligence. Computer vision systems combined with AI are used for high-throughput screening of physical product characteristics, such as particle size distribution and crystal morphology, which are critical for application performance. Furthermore, AI-driven market analysis helps producers forecast demand fluctuations across different regions by integrating macroeconomic indicators, regulatory changes, and consumer trends. This predictive capability allows companies to optimize production schedules and manage inventory effectively, minimizing the risk of both stockouts and costly overstocking, thus enhancing overall profitability and responsiveness within a competitive market landscape dominated by price sensitivity.

- AI-driven optimization of benzoic acid neutralization process for maximizing yield and purity.

- Machine Learning models deployed for predictive maintenance of synthesis reactors and drying equipment.

- Enhanced quality control through AI-powered spectroscopy analysis for rapid impurity detection (e.g., trace heavy metals).

- Automated compliance monitoring, using AI to cross-reference production data against international food safety standards (FDA, EFSA).

- Improved supply chain logistics and risk assessment through predictive analytics concerning raw material sourcing and volatile energy prices.

DRO & Impact Forces Of Potassium Benzoate Market

The market dynamics of Potassium Benzoate are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of key industry players. The primary driving force remains the inexorable growth of the processed food and non-alcoholic beverage industries globally, particularly in developing economies where consumers are increasingly shifting towards packaged products with extended shelf lives. Coupled with this is the superior solubility and stability of potassium benzoate in low-pH products compared to its sodium counterpart, making it the preferred choice for major soft drink formulators. However, market growth is significantly restrained by stringent regulatory oversight concerning the use of synthetic food additives, amplified by pervasive consumer skepticism regarding artificial ingredients and the rising popularity of 'natural' or 'clean label' alternatives, forcing manufacturers to seek approval for reduced usage levels or explore synergistic natural replacements.

Opportunities for market expansion are largely concentrated in the high-value pharmaceutical sector, where potassium benzoate is utilized as a preservative in liquid medicines and as an active ingredient in treating specific metabolic disorders. The increasing production of over-the-counter liquid formulations and prescription syrups, especially in geriatrics and pediatrics, opens pathways for high-margin sales of ultra-high-purity grades. Furthermore, opportunities exist in leveraging green chemistry principles to develop more sustainable and environmentally friendly manufacturing methods for potassium benzoate, potentially mitigating environmental concerns and appealing to corporate social responsibility (CSR) initiatives of major end-users. Strategic partnerships with key beverage corporations to develop novel, multi-component preservative systems that effectively integrate potassium benzoate at optimized concentrations represent another avenue for sustained growth.

The Impact Forces shaping the market include competitive pressure from alternative preservatives, technological advancements in packaging, and fluctuations in raw material pricing. The force of substitution is strong, exerted by ingredients like potassium sorbate, natamycin, and natural extracts (e.g., rosemary extract). Advancements in barrier packaging technologies and aseptic processing, while reducing the dependence on high levels of chemical preservatives, also act as a constraint. Economically, the market is highly sensitive to the prices of toluene and associated downstream chemicals used in benzoic acid synthesis, creating volatility in operational costs. Compliance with global food safety standards is a non-negotiable force, requiring continuous investment in quality control and process validation, reinforcing the demand for high-grade, reliable suppliers.

Segmentation Analysis

The Potassium Benzoate Market is comprehensively segmented based on its Grade Type, Application, and Physical Form, reflecting the diverse requirements of the end-user industries. This segmentation provides crucial insights into specific market demand vectors, pricing mechanisms, and competitive advantages held by various producers. The Grade Type segmentation, differentiating between Food Grade, Pharmaceutical Grade, and Industrial Grade, is particularly important as it dictates manufacturing complexity, required purity levels, and associated market pricing; Pharmaceutical Grade commands the highest premium due to stringent regulatory demands and low impurity specifications necessary for human consumption in medicinal contexts. The Food Grade segment dominates in volume due to widespread use in processed goods and beverages, underpinning the market's stability.

Analyzing the Application segments reveals that the Beverage Industry constitutes the cornerstone of global demand, particularly for carbonated and non-carbonated soft drinks, fruit concentrates, and electrolyte beverages where its efficacy against mold and yeast at low pH is unrivaled. The Food segment follows closely, encompassing products like pickles, jams, sauces, and condiments. While the Pharmaceutical and Cosmetic segments are smaller in volume, their sustained growth rates and high-value contribution are significant, driven by the increasing demand for stabilized liquid formulations, mouthwashes, and body lotions. This structural diversity allows the market to withstand cyclical downturns in any single end-use sector, providing a balanced demand profile for manufacturers.

Further granularity is provided by segmenting based on Physical Form—Powder, Granules, and Liquid/Aqueous Solutions. Powdered potassium benzoate is the most prevalent form due to its ease of transport, extended shelf life, and standardized use in dry blending operations. However, the Granular form is preferred by certain large-scale manufacturers seeking dust minimization, improved flow characteristics, and uniform dissolution rates. Liquid solutions, though less common, offer advantages in automated dosing systems within specific industrial processes, eliminating the need for dissolution steps. Understanding these nuanced segments is essential for producers to tailor their product offerings and distribution strategies effectively across different geographical regions and industrial buyer preferences, ultimately maximizing penetration and revenue generation.

- By Grade Type:

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

- By Application:

- Beverages (Carbonated, Non-Carbonated, Fruit Juices)

- Food Products (Pickles, Jams, Sauces, Condiments)

- Pharmaceuticals (Syrups, Liquid Medications)

- Cosmetics and Personal Care (Shampoos, Lotions)

- Pyrotechnics and Others

- By Physical Form:

- Powder

- Granules

- Liquid/Aqueous Solution

Value Chain Analysis For Potassium Benzoate Market

The value chain for Potassium Benzoate begins with the upstream sourcing of crucial raw materials, primarily toluene, which is converted into benzoic acid—the immediate precursor. Upstream activities involve complex chemical synthesis and purification processes, dominated by major chemical companies that possess large-scale infrastructure and expertise in managing volatile petrochemical feedstock prices. The efficiency and environmental compliance of these upstream operations directly influence the cost structure and sustainability profile of the final potassium benzoate product. Establishing long-term supply contracts for benzoic acid is critical for potassium benzoate manufacturers to ensure stable production volumes and mitigate exposure to commodity price fluctuations, which is a major risk factor in the highly competitive commodity chemical space.

The central stage of the value chain involves the manufacturing process of potassium benzoate itself, which includes the neutralization of benzoic acid with potassium hydroxide or carbonate, followed by rigorous filtration, crystallization, drying, and final packaging. This stage is characterized by high energy consumption and stringent quality control requirements, especially for pharmaceutical and high-end food grades. Differentiation is achieved through investment in advanced purification technologies and process automation, enabling manufacturers to consistently meet international standards like USP, FCC, and EP. Following manufacturing, the product moves through various distribution channels, which include direct sales to large, multinational end-users (e.g., Coca-Cola, PepsiCo) and indirect sales through specialized chemical distributors who service smaller local food processors and pharmaceutical compounding facilities, offering localized inventory management and technical support.

Downstream analysis focuses on the end-user industries: beverages, processed food, pharmaceuticals, and cosmetics. The primary value addition at this stage is the integration of the preservative into the final product formulation to achieve the desired shelf-life extension and microbial stability. The success of the downstream operation depends heavily on the technical support provided by potassium benzoate suppliers regarding optimal usage levels, pH compatibility, and regulatory guidance across different geographic markets. Direct distribution channels are favored for large-volume, high-frequency customers to ensure cost efficiency, while indirect channels leverage the distributor network's reach for penetrating diverse SME markets globally. The efficacy and safety performance of the preservative in the final consumer product dictates sustained demand and repurchase intent, making downstream performance the ultimate measure of product quality.

Potassium Benzoate Market Potential Customers

The primary potential customers and end-users of Potassium Benzoate span several large industrial sectors focused on stabilizing and extending the life of consumer products. The Beverage Industry, particularly producers of carbonated soft drinks (CSD), bottled iced teas, sports drinks, and fruit juices, represents the largest customer segment by volume. These producers are reliant on potassium benzoate due to the acidic nature of their products, which optimizes the preservative's inhibitory action against yeasts and molds. Major global beverage giants and regional bottling companies constitute high-volume, price-sensitive buyers requiring consistent supply of Food Grade material meeting strict regulatory and internal quality assurance specifications. Their purchasing decisions are driven by cost-in-use, supply chain reliability, and assurance of consistent microbiological protection across different production batches and geographic markets.

The Processed Food Industry constitutes the second major customer base, including manufacturers of acidic condiments, sauces (like ketchup, BBQ sauce), salad dressings, fermented foods (e.g., pickles, sauerkraut), and low-sugar jams and jellies. For these customers, potassium benzoate offers a reliable means of preventing spoilage post-packaging, thereby reducing waste and enabling wide distribution channels. These buyers are often segmented into large commercial entities requiring bulk material and smaller specialty food producers demanding flexible packaging and just-in-time delivery. The critical buying criterion for this segment is the preservative's minimal impact on the organoleptic properties (taste and odor) of the final food product, ensuring consumer acceptance while maximizing shelf life in varied storage conditions.

A high-value, high-growth customer segment includes Pharmaceutical and Personal Care manufacturers. Pharmaceutical customers utilize high-purity, low-impurity grades as excipients or preservatives in liquid oral medications (syrups, suspensions) to prevent microbial contamination throughout the drug's shelf life. Cosmetic manufacturers, including producers of lotions, creams, and specialty mouthwashes, use it to ensure product stability and safety during use. These customers prioritize quality assurance, extensive documentation, and certifications (e.g., cGMP compliance, stringent impurity profiles) over marginal price differences. Their purchasing strategy focuses on vendor qualification, rigorous auditing, and establishing long-term, stable relationships with certified manufacturers capable of delivering compliant Pharmaceutical Grade potassium benzoate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Million |

| Market Forecast in 2033 | USD 170.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerald Kalama Chemical, Tengzhou Aolite Chemical, Fushimi Pharmaceutical, Shandong Hongda Chemical, TCI Chemicals, Novaphene, Hefei TNJ Chemical, Velsicol Chemical, Triveni Interchem, Spectrum Chemical, Shanghai Sino-Ben Chemical, Foodchem International, Changzhou Chemical Research Institute, Merck KGaA, Avantor, Wuxi Yueda Chemical, Hubei Phoenix Chemical, Celanese Corporation, BASF SE, Lanxess AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Potassium Benzoate Market Key Technology Landscape

The technology landscape for the Potassium Benzoate market is centered on enhancing chemical synthesis efficiency, achieving ultra-high purity, and optimizing downstream processing. The fundamental method involves the reaction between benzoic acid and a potassium source. However, modern technological advancements focus on continuous processing rather than traditional batch systems, offering improved scalability, reduced reaction times, and better consistency in quality control. The deployment of advanced reactor designs, such as continuous stirred-tank reactors (CSTRs) and plug flow reactors, is key to maximizing conversion rates and minimizing energy input during the initial neutralization phase. Furthermore, sophisticated process control systems, leveraging IoT sensors and automated feedback loops, are becoming standard to maintain precise temperature and pH levels, which are critical for preventing side reactions and maintaining the integrity of the benzoate structure.

A critical area of technological focus is the purification and crystallization stage, especially for producing Pharmaceutical Grade potassium benzoate. Manufacturers are investing in advanced filtration technologies, including ultrafiltration and nanofiltration membranes, to remove trace metal contaminants and residual organic impurities that cannot be eliminated by standard crystallization. High-efficiency drying techniques, such as fluid-bed drying or vacuum drying, are employed to ensure minimal moisture content and optimal crystal structure, which affects the product's flowability and dissolution characteristics for end-user applications. These purification enhancements are vital for meeting the stringent specifications of global pharmacopeias (e.g., USP and EP), allowing premium pricing and access to regulated high-value markets.

Sustainability and green chemistry principles are increasingly defining the technological roadmap. Innovation is geared toward developing synthesis routes that utilize less hazardous solvents or employ catalytic processes to improve atom economy and reduce waste generation. The adoption of methodologies for recycling potassium salts and optimizing water usage in wash steps are becoming mandatory requirements for leading manufacturers seeking to reduce their environmental footprint. Furthermore, advanced packaging technologies, including modified atmosphere packaging and moisture-barrier containers, are employed to maintain the long-term stability and integrity of the potassium benzoate product, particularly in regions with high humidity, ensuring the delivered quality meets customer expectations regardless of transit distance or storage duration.

Regional Highlights

The regional dynamics of the Potassium Benzoate market show a distinct differentiation between established, mature markets and rapidly expanding emerging economies. Asia Pacific (APAC) currently dominates the market both in terms of consumption volume and growth rate. This exponential growth is underpinned by massive demographic shifts, rapid industrialization, and a burgeoning middle class in countries like China, India, and Southeast Asia, leading to explosive growth in the processed food and beverage industries. China, in particular, is a global manufacturing hub not only for consumption but also for the export of potassium benzoate, benefiting from large-scale production capabilities and competitive pricing. The regulatory framework in APAC is gradually becoming more stringent, aligning with international standards, which simultaneously drives demand for certified, high-quality products.

Europe and North America represent historically significant and technologically advanced markets. While volume growth is slower compared to APAC, these regions are characterized by a high demand for premium, highly certified grades (Pharmaceutical and high-end Food Grade). European manufacturers face strong headwinds from the clean-label movement, prompting innovation towards preservative blends or reduced usage levels. Nevertheless, the strict adherence to food safety and microbiological standards across the EU and the US ensures a stable baseline demand. North America remains a crucial consumer, especially in the CSD and condiment sectors, with regulatory clarity (FDA approval) supporting steady usage, though competition from natural preservatives is intense, requiring suppliers to focus heavily on technical service and cost efficiency.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as critical secondary growth engines. LATAM, driven by population growth and the westernization of dietary habits, shows increasing consumption of soft drinks and packaged snacks, translating directly into demand for potassium benzoate. Brazil and Mexico are the regional leaders in this segment. The MEA region is witnessing structural growth in the food and beverage processing industry, often supported by governmental efforts to improve local manufacturing capacity and reduce reliance on imports. However, market penetration in MEA is often challenged by complex import regulations and logistics constraints. The underlying theme across all regions is the universal requirement for effective, cost-efficient preservation methods to manage large-scale food distribution, solidifying potassium Benzoate's position despite competitive pressures.

- Asia Pacific (APAC): Dominates volume and exhibits the highest CAGR due to rapid urbanization, expanding processed food markets in China and India, and increasing disposable income leading to higher consumption of packaged beverages.

- Europe: Mature market characterized by stringent EU regulations and a strong preference for certified, high-purity grades, balanced by consumer demand for clean-label alternatives. Key consumers include manufacturers of fruit preparations and specialty sauces.

- North America: Stable, high-value market driven by large-scale beverage production; focus on compliance with FDA regulations and efficiency in supply chain management.

- Latin America (LATAM): High growth potential fueled by population expansion and increasing adoption of modern grocery retail channels requiring shelf-stable products, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market with growing local manufacturing capabilities, experiencing increasing demand across pharmaceutical and food preservation sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Potassium Benzoate Market.- Emerald Kalama Chemical (A LANXESS business)

- Tengzhou Aolite Chemical Co., Ltd.

- Fushimi Pharmaceutical Co., Ltd.

- Shandong Hongda Chemical Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Novaphene

- Hefei TNJ Chemical Industry Co., Ltd.

- Velsicol Chemical LLC

- Triveni Interchem Pvt. Ltd.

- Spectrum Chemical Mfg. Corp.

- Shanghai Sino-Ben Chemical Co., Ltd.

- Foodchem International Corporation

- Changzhou Chemical Research Institute Co., Ltd.

- Merck KGaA

- Avantor, Inc.

- Wuxi Yueda Chemical Co., Ltd.

- Hubei Phoenix Chemical Co., Ltd.

- Celanese Corporation

- BASF SE

- Lanxess AG

Frequently Asked Questions

Analyze common user questions about the Potassium Benzoate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Potassium Benzoate in the food and beverage industry?

Potassium Benzoate (E212) serves primarily as an antimicrobial preservative. It is highly effective in inhibiting the growth of yeasts, molds, and certain bacteria, especially in acidic environments (pH 2.5–4.5), thereby extending the shelf life of products such as carbonated soft drinks, fruit juices, pickles, and acidic condiments.

How does the Pharmaceutical Grade segment differ from the Food Grade segment in the market?

Pharmaceutical Grade potassium benzoate requires significantly higher purity levels, often meeting stringent pharmacopeial standards (USP, EP), with extremely low limits on heavy metals and other impurities. This grade is used in medicinal syrups and liquid formulations, commanding a premium price compared to the high-volume Food Grade used in beverages and packaged foods.

Which geographical region exhibits the strongest growth potential for Potassium Benzoate demand?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, shows the strongest growth potential. This is driven by rapid urbanization, increasing consumption of processed and packaged foods, and expanding local manufacturing capabilities for beverages and pharmaceutical liquids requiring preservation.

What are the main competitive restraints facing the Potassium Benzoate Market?

The primary restraints include increasing consumer preference for 'clean label' and natural ingredients, leading to reluctance regarding synthetic additives. Additionally, regulatory limitations on maximum allowable usage levels (e.g., in the EU) and competition from alternative preservatives like potassium sorbate and natural extracts pose significant competitive challenges.

What impact does the price of crude oil and its derivatives have on the cost of Potassium Benzoate?

The cost of Potassium Benzoate is indirectly but substantially influenced by crude oil prices because its key precursor, benzoic acid, is derived from toluene, a petrochemical intermediate. Fluctuations in crude oil and petrochemical markets directly impact the cost of raw materials, leading to volatility in the final manufacturing costs and pricing of potassium benzoate.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager